Markets

10 Best Cryptocurrencies Of July 2024 – Forbes Advisor Australia

Table of Contents

{{ tocState.toggleTocShowMore ? ‘Show more’ : ‘Show less’ }}

Cryptocurrencies offer a mix of opportunity and risk. While the market has matured and larger digital assets like bitcoin and Ethereum are now recognised as legitimate investments by professionals, investing in them remains volatile and complex.

Featured Partners

Invest with a crypto brand trusted by millions

Buy and sell 100+ cryptoassets on a secure, easy-to-use platform

On Independent Reserve’s Secure Website

Trading Fees:

0.50% – 0.02%

Best for:

Sophisticated investors, SMSFs, businesses and trusts

Benefits:

Fast deposits, advanced trading tools and reporting

On bitcoin.com.au’s Secure Website

Best for:

Beginners to crypto and investing

Benefits:

Easy to use, instant deposits using credit card, PayPal and bank transfer

Crypto assets are unregulated & highly speculative. No consumer protection. Capital at risk.

For astute investors, crypto assets can be an interesting addition to a diversified portfolio. However, they require careful research, strong security practices and a strong stomach to weather the volatility they bring. The Australian Government is yet to introduce legislation to Parliament to regulate crypto markets, and until they do, it will remain a haven for scammers.

Nevertheless, Australians are crypto-curious. According to consumer group CHOICE, almost one in five Aussies are either involved in some form of cryptocurrency trading or are interested in getting involved. Those who steer clear from crypto often do so because of the risk of crypto scams. Some 4.6 million Australians own cryptocurrency, and Australia ranks third in the world for crypto uptake.

From bitcoin and Ethereum to Dogecoin and Tether, there are thousands of different cryptocurrencies, each with different strengths, weaknesses and varying degrees of potential.

Below are the top 10 cryptocurrencies based on their market capitalisation or the total value of all the coins currently in circulation. This is not a recommendation of what you should or should not buy; it is merely a list of the largest projects ranked by market capitalisation so you can get a sense of the playing field before you decide whether to roll the dice and invest in crypto.

Invest Smarter with eToro

Invest with a crypto brand trusted by millions. Buy and sell 70+ cryptoassets on a secure, easy-to-use platform

Crypto assets are unregulated & highly speculative. No consumer protection. Capital at risk.

Related: Best Cryptocurrency Exchanges for Australians

What Are Cryptocurrencies?

A cryptocurrency is a digital asset that can circulate without the centralised authority of a bank or government. According to CoinMarketCap, there are more than two million cryptocurrency projects out there that represent the entire $US1.76 trillion crypto market.

1. Bitcoin (BTC)

- Market cap: $US1.315 trillion

Created in 2009 by Satoshi Nakamoto, bitcoin (BTC) is the original cryptocurrency. As with most cryptocurrencies, BTC runs on a decentralised blockchain technology, which is a ledger logging transactions distributed across a network of thousands of computers. Because additions to the distributed ledgers must be verified by solving a cryptographic puzzle, a process called proof of work, bitcoin is kept secure and safe from fraudsters.

Bitcoin’s price has skyrocketed as it’s become a household name. In May 2016, you could buy one bitcoin for about $US500. As of July 20, 2024 (three months after the most recent bitcoin halving event occurred) a single bitcoin’s price was around $US66,667. That’s a growth of more than 13,233%.

Related: How To Buy Bitcoin

2. Ethereum (ETH)

- Market cap: $US420 billion

Both a cryptocurrency and a blockchain platform, Ethereum is a favourite of program developers because of its potential applications, like so-called smart contracts that automatically execute when conditions are met and non-fungible tokens (NFTs).

Ethereum has also experienced tremendous growth. From April 2016 to July 2024, its price went from about $US11 to around $US3,500, increasing 31,718%.

Related: How To Buy Ethereum

3. Tether (USDT)

- Market cap: $US113 billion

Unlike some other forms of cryptocurrency, Tether (USDT) is a stablecoin pegged to the value of US$1. This is achieved by having a 1-1 backing between the token and USD which hypothetically keeps a value equal to one of those denominations because one token should always be able to be redeemed for one dollar. In theory, this means Tether’s value is supposed to be more consistent than other cryptocurrencies, and it’s favoured by investors who are wary of the extreme volatility of other coins.

4. Binance Coin (BNB)

- Market cap: $US87 billion

Binance Coin (BNB) is a form of cryptocurrency that you can use to trade and pay fees on Binance, one of the largest crypto exchanges in the world. Since its launch in 2017, Binance Coin has expanded past merely facilitating trades on Binance’s exchange platform. Now, it can be used for trading, payment processing or even booking travel arrangements. It can also be traded or exchanged for other forms of cryptocurrency, such as Ethereum or Bitcoin.

BNB’s price in 2017 was just $US0.10. By July 20, 2024, its price had risen to around $US590, a gain of approximately 589,900%.

Related: Cryptocurrency Glossary Of Terms

Featured Partners

Invest with a crypto brand trusted by millions

Buy and sell 100+ cryptoassets on a secure, easy-to-use platform

On Independent Reserve’s Secure Website

Trading Fees:

0.50% – 0.02%

Best for:

Sophisticated investors, SMSFs, businesses and trusts

Benefits:

Fast deposits, advanced trading tools and reporting

On bitcoin.com.au’s Secure Website

Best for:

Beginners to crypto and investing

Benefits:

Easy to use, instant deposits using credit card, PayPal and bank transfer

Crypto assets are unregulated & highly speculative. No consumer protection. Capital at risk.

5. Solana (SOL)

- Market cap: $US79.5 billion

Solana is a high-performance blockchain platform designed to provide fast and scalable transaction processing. It utilises a unique consensus algorithm called Proof of History, which allows it to process up to 65,000 transactions per second, making it one of the fastest blockchain networks available today. The platform supports smart contracts and decentralised applications (dApps) and is extremely popular for NFT trading.

The native token of the Solana platform is called SOL, and is used for paying transaction fees, staking, and participating in governance decisions on the network. The ICO price for SOL was $US0.22, and as of July 20, 2024, now sits at $US171, an increase of 77,627%.

6. U.S. Dollar Coin (USDC)

- Market cap: $US34 billion

Like Tether, USD Coin (USDC) is a stablecoin, meaning it’s backed by US dollars and aims for a 1 USD to 1 USDC ratio. USDC is available on numerous blockchains, such as Ethereum and Solana, and you can use USD Coin to complete global transactions.

7. XRP (XRP)

- Market cap: $US32.3 billion

Created by some of the same founders as Ripple, a digital technology and payment processing company, XRP can be used on that network to facilitate exchanges of different currency types, including fiat currencies and other major cryptocurrencies.

At the beginning of 2017, the price of XRP was $US0.006. As of July 20 2024, its price reached $US0.58, equal to a rise of 9,566%.

Related: Ethereum 2.0: The Ethereum Merge Explained

8. Toncoin (TON)

- Market cap: $US18.4 billion

Toncoin (TON) is the native token of The Open Network (TON), a decentralised Layer 1 blockchain network originally developed by Telegram but later transferred to the community. TON aims to onboard billions of users and enable quick, inexpensive, and energy-efficient blockchain transactions. The network boasts a flexible architecture, scalability, and support for millions of transactions per second through dynamic sharding and workchains. Toncoin can be used to pay transaction fees, settle payments, or validate transactions using TON’s proof-of-stake (PoS) consensus model.

TON’s unique features, such as ultra-fast transactions, low fees, apps ecosystem, and Telegram integration, have rocketed the coin into the top 10 cryptocurrencies by market capitalisation over the past few months. As of July 20, 2024, its price stands at $7.33, representing an increase of 1,366% from the coin’s ICO price of $0.50 in 2019.

9. Dogecoin (DOGE)

- Market cap: $18.1 billion

Dogecoin was famously started as a joke in 2013 but rapidly evolved into a prominent cryptocurrency thanks to a dedicated community and creative memes. Unlike many other cryptos, there is no limit on the number of Dogecoins that can be created, which leaves the currency susceptible to devaluation as supply increases.

Dogecoin’s price in 2017 was $0.0002. By July 20, 2024, its price sat at $0.1252, up 62,550%.

.

10. Cardano (ADA)

- Market cap: $US15.5 billion

Somewhat later to the crypto scene, Cardano (ADA) is notable for its early embrace of proof-of-stake validation. This method expedites transaction time and decreases energy usage and environmental impact by removing the competitive, problem-solving aspect of transaction verification in platforms like bitcoin. Cardano also works like Ethereum to enable smart contracts and decentralised applications, which ADA, its native coin, powers.

Cardano’s ADA token has had relatively modest growth compared to other major crypto coins. In 2017, ADA’s price was $0.02. As of July 20, 2024, its price was at $0.4366. This is an increase of 2,083%.

*Market caps and pricing sourced from coinmarketcap.com, current as of July 2024

This article is not an endorsement of any particular cryptocurrency, broker or exchange nor does it constitute a recommendation of cryptocurrency or CFDs as an investment class. Cryptocurrency is unregulated in Australia and your capital is at risk. Trading in contracts for difference (CFDs) is riskier than conventional share trading, not suitable for the majority of investors, and includes the potential for partial or total loss of capital. You should always consider whether you can afford to lose your money before deciding to trade in CFDs or cryptocurrency, and seek advice from an authorised financial advisor.

Frequently Asked Questions (FAQs)

What are cryptocurrencies?

Cryptocurrency is a form of currency that exists solely in digital form. Cryptocurrency can be used to make near-instant overseas transfers and pay for purchases online without going through an intermediary, such as a bank, or it can be held as an investment.

Do you have to pay taxes on cryptocurrency?

If you buy and sell coins, paying attention to cryptocurrency tax rules is important. Cryptocurrency is treated as a capital asset, like stocks, rather than cash, which means that you need to pay your marginal tax rates on any capital gains or income earned from crypto when you register your return with the ATO. You can read our guide to crypto and tax in Australia.

What are altcoins?

When we first think of crypto, we usually think of bitcoin first. That’s because bitcoin represents more than 54% of the total cryptocurrency market. So when we talk about any cryptos outside of bitcoin, all of those cryptos are considered altcoins.

Ethereum, for instance, is regarded as the most popular altcoin.

What are the three most popular cryptocurrencies?

Here are the top three cryptocurrencies by market capitalisation as of April 2024:

-

- Bitcoin (BTC): The original cryptocurrency, Bitcoin continues to hold its position as the market leader. Its widespread acceptance and status as digital gold make it a cornerstone of the crypto market.

- Ethereum (ETH): Ethereum has firmly established itself as the second most popular cryptocurrency, thanks to its versatile platform that enables decentralised applications (DApps) and smart contracts.Its ongoing developments and widespread use for DeFi and NFTs contribute to its strong position.

- Tether (USDT): Tether stands out as the most popular stablecoin, pegged to the US dollar to maintain a consistent value of US$1. With a market capitalisation of over US$100 billion, it’s a favourite among investors looking for stability in the often volatile crypto market. Its primary use is to provide a stable currency for trading and hedging in the crypto space.

These cryptocurrencies represent the forefront of the digital asset world, each with unique attributes that cater to different needs and preferences within the market. Whether you’re looking for a store of value, a platform for innovation, or stability, these top three cryptocurrencies offer something for every investor.

Why is bitcoin valuable?

Part of what makes bitcoin so valuable is its scarcity. Bitcoin’s maximum supply is limited to 21 million coins. Currently, there are 19 million coins in circulation.

To create supply, bitcoin rewards crypto miners with a set bitcoin amount. (To be exact, 3.125 BTC is issued when a miner has successfully mined a single block.). To keep the process in check, the rewards given for mining bitcoin are cut in half almost every four years.

Will crypto explode in 2024?

The future performance of cryptocurrencies is uncertain and depends on various factors, including the recent regulatory uncertainty surrounding the crypto space, as well as the unstable economic climate characterised by high levels of inflation and rising interest rates.

While some investors are optimistic about the potential growth of the crypto market despite these challenges, others may be more cautious or sceptical. It’s important to note that the performance of cryptocurrencies is generally volatile and unpredictable, and is often significantly impacted by external factors beyond the digital asset space. It is essential for anyone interested in this space to conduct thorough research and, if necessary, consult with a financial advisor before making any investment decisions.

What are the top 10 cryptocurrencies in the world?

As of July 2024, the top 10 cryptocurrencies by market capitalisation are:

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether (USDT)

- Binance Coin (BNB)

- Solana (SOL)

- U.S. Dollar Coin (USDC)

- XRP

- Toncoin (TON)

- Dogecoin (DOGE)

- Cardano (ADA).

However, it’s important to note that the cryptocurrency market is highly volatile, and rankings can change rapidly. Up to date rankings can be found at CoinMarketCap.

What is the best cheap crypto to buy?

There’s no definitive “best” cheap cryptocurrency to buy, as the potential for growth and risk varies greatly among lower-priced coins. Some investors look at projects with strong fundamentals, active development teams and real-world use cases, even if their current price is low. However, it’s crucial to understand that the price of the coin doesn’t reflect the valuation of the project as a whole, as some cryptocurrencies have a huge number of coins in circulation, giving them a high valuation despite the coins being comparatively cheap.

Instead of focusing solely on price, consider factors such as the project’s technology, adoption rate and long-term viability. Always conduct thorough research and consider consulting with a financial advisor before deciding to invest.

What is the best crypto wallet?

Finding the perfect crypto wallet can be a bit tricky, as the best one for you will depend on your specific needs and preferences. Crypto wallets come in different types, such as hardware and software wallets, each with its own pros and cons. Don’t forget to consider factors like security, ease of use, and compatibility with various cryptocurrencies when selecting a wallet. To help you make an informed decision, we recommend reading our crypto wallet review of the Best Crypto Wallets for Australians.

Markets

Today’s top crypto gainers and losers

Over the past 24 hours, Jupiter and JasmyCoin emerged as the top gainers among the top 100 crypto assets, while Bittensor and Mantra plunged as the top losers.

Top Winners

Jupiter

Jupiter (JUP) led the charge among the biggest gainers on July 27.

At the time of writing, the crypto asset had surged 12.6% in the past 24 hours and was trading at $1.16. JUP’s daily trading volume was hovering around $282 million, according to data from crypto.news.

JUP Hourly Price Chart, July 26-27 | Source: crypto.news

Additionally, the cryptocurrency’s market cap stood at $1.56 billion, making it the 62nd largest crypto asset, according to CoinGecko. Despite the recent price surge, the token is still down 42.6% from its all-time high of $2 reached on Jan. 31.

Jupiter functions as a decentralized exchange aggregator that allows users to trade Solana-based tokens. The platform also offers users the best routes for direct trades between multiple exchanges and liquidity pools.

In addition to being a DEX aggregator, Jupiter has expanded into a “full stack ecosystem” by launching several new projects, including a dedicated pool to support perpetual trading and plans for a stablecoin.

JasmyCoin

JasmyCoin (JASMI) has increased by 12% in the last 24 hours and is trading at $0.0328 at press time. JASMY’s daily trading volume has increased by 10% in the last 24 hours, reaching $146 million.

JASMY Hourly Price Chart, July 26-27 | Source: crypto.news

The asset’s market cap has surpassed the $1.5 billion mark, making it the 60th largest cryptocurrency at the time of reporting. However, the self-proclaimed “Bitcoin of Japan” is still down 99.3% from its all-time high of $4.79 on February 16, 2021.

JASMY is the native token of Jasmy Corporation, a Japanese Internet of Things provider. The platform seeks to merge the decentralization of blockchain technology with IoT, allowing users to convert their digital information into digital assets.

The initiative was launched by Kunitake Ando, former COO of Sony Corporation, along with Kazumasa Sato, former CEO of Sony Style.com Japan Inc., Hiroshi Harada, executive financial analyst at KPMG, and other senior executives from Japan.

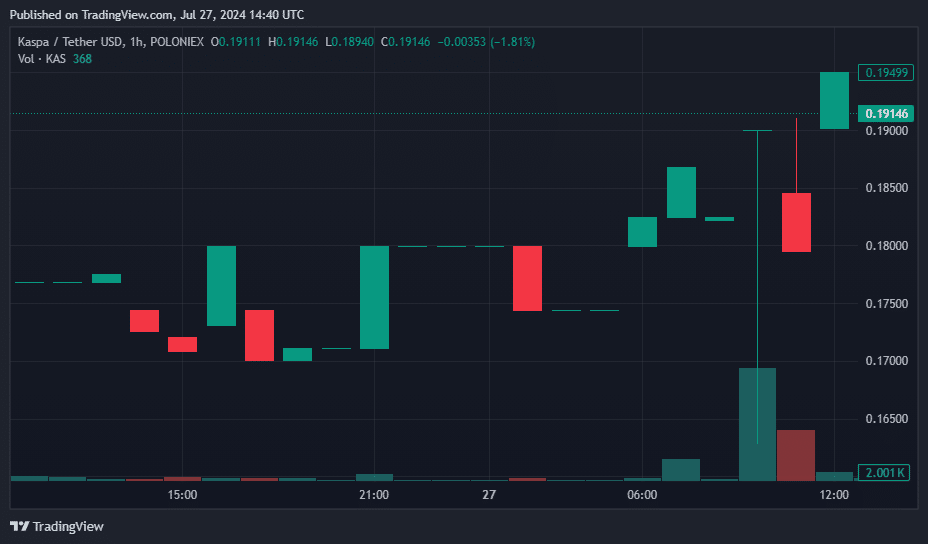

Kaspa

Kaspa (KAS) saw a 100% increase in trading volume and an 8% increase in price over the past 24 hours, trading at $0.19 at the time of publication.

KAS Hourly Price Chart, July 26-27 | Source: crypto.news

According to data from CoinGecko, Kaspa now ranks 27th in the global cryptocurrency list, with a circulating supply of approximately 24.29 billion KAS tokens and a market capitalization of $4.59 billion.

Kaspa is a cryptocurrency designed to deliver a high-performance, scalable, and secure blockchain platform. Its unique Layer-1 protocol includes the GhostDAG protocol, a proof-of-work (PoW) consensus mechanism that enables faster block times and higher transaction throughput compared to standard blockchains.

Unlike Bitcoin, GhostDAG allows multiple blocks to be created simultaneously, speeding up transactions and increasing block rewards for miners.

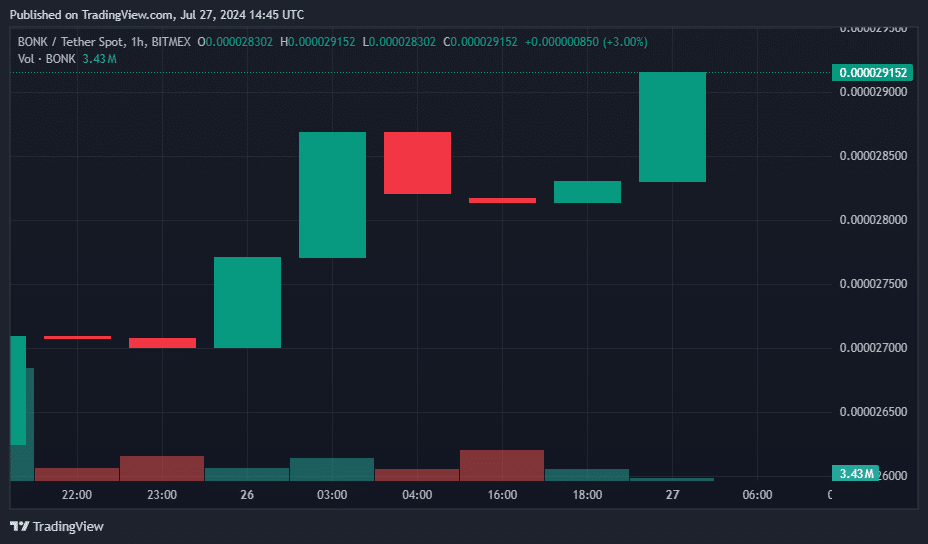

Bonk

Bonk (BONK) is the only one coin meme which made it to this list of biggest gainers and jumped 8.6% in the last 24 hours. Trading at $0.000030, the Solana-based meme coin’s market cap has surpassed $2.1 billion, surpassing Floki (FLOKI), another competing dog-themed coin with a market cap of $1.78 billion.

BONK Hourly Price Chart, July 26-27 | Source: crypto.news

BONK’s daily trading volume hovered around $285 million. However, BONK is still down 33.5% from its all-time high of $0.000045, reached on March 4.

Bonk, a meme coin that rose to prominence in 2023, has contributed significantly to Solana’s value increase amid the meme coin frenzy.

Bonk started out as a simple dog-themed coin. It has since expanded its features to include integration with decentralized finance. The project also partners with cross-chain communication protocols, NFT marketplaces, and various other cryptocurrency ecosystems.

BONK trading pairs are now listed on major exchanges including Binance, Coinbase, OKX, and Bitstamp.

The big losers

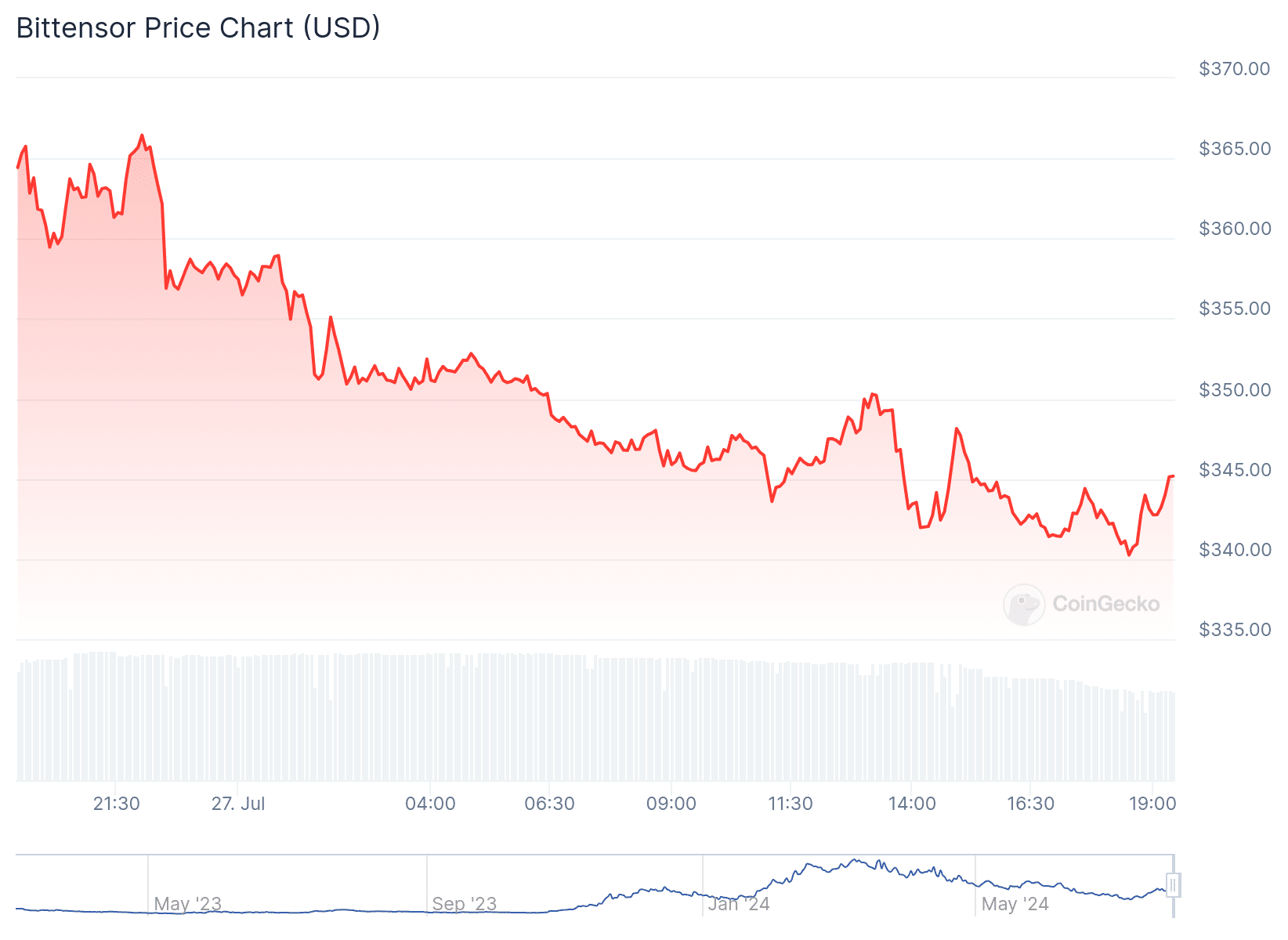

Bittensor

Bittensor (TAO) was the biggest loser among the 100 largest crypto assets, according to data from CoinGecko.

At the time of writing, TAO, the native token of decentralized AI project Bittensor, was down 5%, trading around $344. The crypto asset had a daily trading volume of $59 million and a market cap of $2.43 billion.

TAO 24 Hour Price Chart | Source: CoinGecko

Bittensor, created in 2019 by AI researchers Ala Shaabana and Jacob Steeves, initially operated as a parachain on Polkadot before transitioning to its own layer-1 blockchain in March 2023.

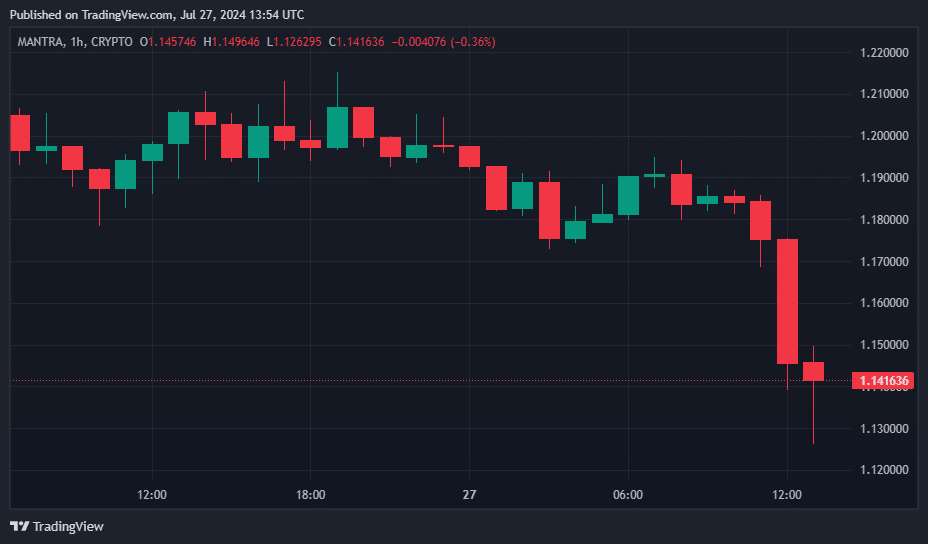

Mantra

Mantra (OM) fell 6%, trading at $1.13 at press time. The digital currency’s market cap fell to $938 million. Additionally, the 82nd largest crypto asset has a daily trading volume of $26 million.

OM Price Hourly Chart, July 26-27 | Source: crypto.news

Mantra is a modular blockchain network comprising two chains, Manta Pacific and Manta Atlantic, specialized in zero-knowledge applications.

Coat

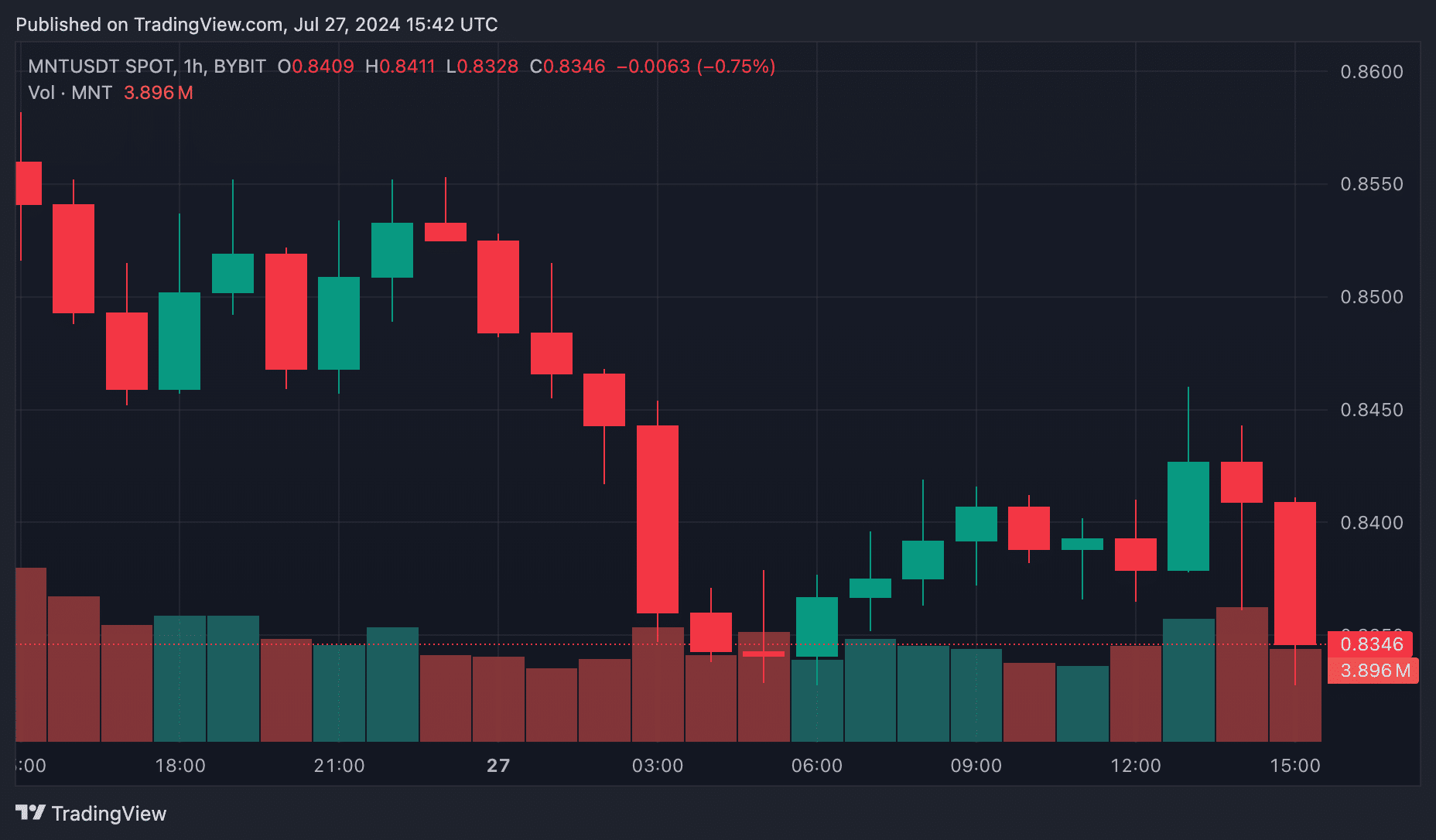

Coat (MNT) also saw a 2.4% drop in price, now trading at $0.8413. Currently, Mantle has a market cap of around $2.75 billion, which ranks 36th in the global cryptocurrency rankings by market cap, according to price data from crypto.news.

MNT Hourly Price Chart, July 26-27 | Source: crypto.news

Over the past 24 hours, MNT trading volume also fell by 6%, reaching $240 million.

Mantle, formerly known as BitDAO, is an investment DAO closely associated with Bybit. The MNT token is essential for governance, paying gas fees on the Mantle network, and staking on various platforms.

Built on the Ethereum network, Mantle provides a platform for decentralized application developers to launch their projects. It has become particularly popular for GameFi applications, leading to the formation of an internal Web3 gaming team.

Markets

Bitcoin Price Drops to $67,000 Despite Trump’s Pro-Crypto Comments, Further Correction Ahead?

Pioneer cryptocurrency Bitcoin has registered a 1.13% decline in the past 24 hours to trade at $67,400. Despite a strong pro-crypto stance from US presidential candidate Donald Trump at the Bitcoin 2024 conference, this massive selloff has raised concerns in the market about the asset’s sustainability at a higher price. However, given the recent three-week rally, a slight pullback this weekend is justifiable and necessary to regain the depleted bullish momentum.

Bitcoin Price Flag Formation Hints at Opportunity to Break Beyond $80,000

The medium-term trend Bitcoin Price remains a sideways trend amidst the formation of a bullish flag pattern. This chart pattern is defined by two descending lines that are currently shaping the price trajectory by providing dynamic resistance and support.

On July 5, BTC saw a bullish reversal from the flag pattern at $53,485, increasing its asset by 29.75% to a high of $69,400. This recent spike followed the market’s positive sentiment towards the Donald Trump speech at the Bitcoin 2024 conference in Nashville on Saturday afternoon.

Bitcoin Price | Tradingview

In his speech, Trump outlined several pro-crypto initiatives: he promised to replace SEC Chairman Gary Gensler on his first day in office, to establish a Strategic National Reserve of Bitcoin if elected, to ensure that the U.S. government holds all of its assets. Bitcoin assets and block any attempt to create a central bank digital currency (CBDC) during his presidency.

He also claimed that under his leadership, Bitcoin and cryptocurrencies will skyrocket like never before.

Despite Donald Trump’s optimistic promises, the BTC price failed to reach $70,000 and is currently trading at $67,400. As a result, Bitcoin’s market cap has dipped slightly to hover at $1.335 trillion.

However, this pullback is justified, as Bitcoin price has recently seen significant growth over the past three weeks, which has significantly improved market sentiment. Thus, price action over the weekend could replenish the depleted bullish momentum, potentially strengthening an attempt to break out from the flag pattern at $70,130.

A successful breakout will signal the continuation of the uptrend and extend the Bitcoin price forecast target at $78,000, followed by $84,000.

On the other hand, if the supply pressure on the upper trendline persists, the asset price could trigger further corrections for a few weeks or months.

Technical indicator:

- Pivot levels: The traditional pivot indicator suggests that the price pullback could see immediate support at $64,400, followed by a correction floor at $56,700.

- Moving average convergence-divergence: A bullish crossover state between the MACD (blue) and the signal (orange) ensure that the recovery dynamics are intact.

Related Articles

Frequently Asked Questions

A CBDC is a digital form of fiat currency issued and regulated by a country’s central bank. It aims to provide a digital alternative to traditional banknotes.

The proposal for a strategic national Bitcoin reserve is a major confirmation of Bitcoin’s legitimacy and potential as a reserve asset. Such a move could position Bitcoin in a similar way to gold, potentially stabilizing its price and encouraging other countries to adopt similar strategies.

Conferences like Bitcoin 2024 serve as essential platforms for networking, knowledge sharing, and showcasing new technologies within the cryptocurrency industry.

Markets

Swiss crypto bank Sygnum reports profitability after surge in first-half trading volumes – DL News

- Sygnum says it has reached profitability after increasing transaction volumes.

- The Swiss crypto bank does not disclose specific profit figures.

Sygnum, a Swiss global crypto banking group with approximately $4.5 billion in client assets, announced that it has achieved profitability after a strong first half, with key metrics showing year-to-date growth.

The company said in a Press release Compared to the same period last year, cryptocurrency spot trading volumes doubled, cryptocurrency derivatives trading increased by 500%, and lending volumes increased by 360%. The exact figures for the first half of the year were not disclosed.

Sygnum said its staking service has also grown, with the percentage of Ethereum staked by customers increasing to 42%. For institutional clients, staking Ethereum has a benefit that goes beyond the limitations of the ETF framework, which excludes staking returns, Sygnum noted.

“The approval and launch of Bitcoin and Ethereum ETFs was a turning point for the crypto industry this year, leading to a major increase in demand for trusted, regulated exposure to digital assets,” said Martin Burgherr, Chief Client Officer of Sygnum.

He added: “This is also reflected in Sygnum’s own growth, with our core business segments recording significant year-to-date growth in the first half of the year.”

Sygnum, which has also been licensed in Luxembourg since 2022, plans to expand into European and Asian markets, the statement said.

Markets

Former White House official Anthony Scaramucci says cryptocurrency bull market could be sparked by regulatory clarity

Anthony Scaramucci, founder of Skybridge Capital, says the next cryptocurrency bull market could be sparked by a new wave of clear cryptocurrency regulations.

In a new interview On CNBC’s Squawk Box, the former White House communications director said he and two other prominent industry figures traveled to Washington, D.C. to speak to officials about the dangers of Sen. Elizabeth Warren and U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler’s hardline approach to cryptocurrency regulation.

“Mark Cuban, myself, and Michael Novogratz were in Washington a few weeks ago to speak with White House officials and explain the dangers of Gary Gensler and Elizabeth Warren’s anti-crypto approach. I hope that message gets through…

“Overall, if we can get regulatory policy around Bitcoin and crypto assets in sync, we will have a bull market next year for these assets.”

Scaramucci then compares crypto assets to ride-hailing company Uber, saying regulators were initially wary of the service but eventually decided to adopt clear guidelines due to public demand.

“Remember Uber: Nobody wanted Uber. A lot of regulators didn’t want it. Mayors and deputy mayors didn’t want it, but citizens wanted Uber and eventually accepted the idea of regulating it fairly. I think we’re there now.”

The CEO also says young Democratic voters believe their leaders are making the wrong choices when it comes to digital assets.

“I think President Trump’s move toward Bitcoin and crypto assets has shaken Democrats to their core, and I think very smart, younger Democrats are recognizing that they are completely off base with their positions, completely off base with these SEC lawsuits and regulation by law enforcement, and now they need to get back to the center.”

Don’t miss a thing – Subscribe to receive email alerts directly to your inbox

Check Price action

follow us on X, Facebook And Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed on The Daily Hodl are not investment advice. Investors should do their own due diligence before making any high-risk investments in Bitcoin, cryptocurrencies or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Image generated: Midjourney

-

News11 months ago

News11 months agoVolta Finance Limited – Director/PDMR Shareholding

-

News11 months ago

News11 months agoModiv Industrial to release Q2 2024 financial results on August 6

-

News11 months ago

News11 months agoApple to report third-quarter earnings as Wall Street eyes China sales

-

News11 months ago

News11 months agoNumber of Americans filing for unemployment benefits hits highest level in a year

-

News1 year ago

News1 year agoInventiva reports 2024 First Quarter Financial Information¹ and provides a corporate update

-

News1 year ago

News1 year agoLeeds hospitals trust says finances are “critical” amid £110m deficit

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Hit $100 Billion in 2024, Fueling Insane Investor Optimism ⋆ ZyCrypto

-

Tech1 year ago

Tech1 year agoBitcoin’s Correlation With Tech Stocks Is At Its Highest Since August 2023: Bloomberg ⋆ ZyCrypto

-

Tech1 year ago

Tech1 year agoEverything you need to know

-

News11 months ago

News11 months agoStocks wobble as Fed delivers and Meta bounces

-

Markets1 year ago

Markets1 year agoCrazy $3 Trillion XRP Market Cap Course Charted as Ripple CEO Calls XRP ETF “Inevitable” ⋆ ZyCrypto