Tech

26 Top Blockchain Applications and Use Cases in 2024

When trust meets technology, you get blockchain.

Blockchain technology has been a game changer for transacting, sharing information, and defining trust in the rapidly evolving digital world. Blockchain platforms serve as a digital database or ledger system that fosters transparency and accountability in a business network by recording transactions and tracking assets.

While blockchain applications have been largely associated with cryptocurrency software and bitcoins, the technology has the power to revolutionize several industries by offering secure and decentralized solutions.

What are the top applications of blockchain technology?

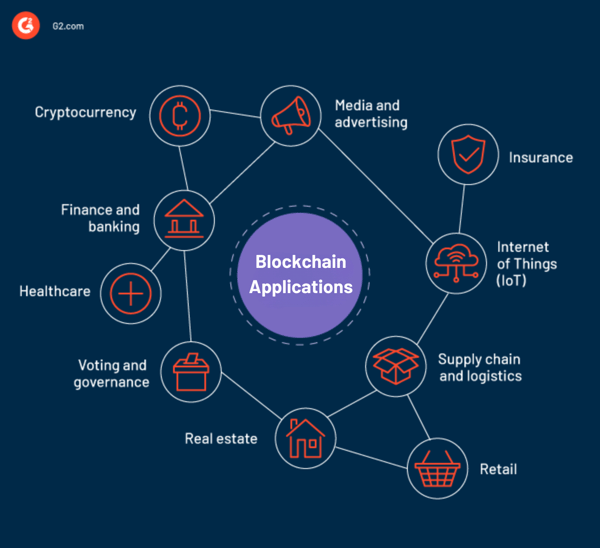

Blockchain technology is being used across almost every industry, including:

- Cryptocurrency

- Healthcare

- Finance and banking

- Real estate

- Retail

- Supply chain and logistics

- Insurance

- Voting and governance

- Internet of Things (IoT)

- Media and advertising

Businesses can build applications of blockchain for any purpose, like digital payments or supply chain, through blockchain platforms, often hosted by blockchain as a service providers. This distributed ledger technology (DLT) redefines how we operate in the digital economy by establishing trust and security for all.

How does blockchain work?

Blockchain is a decentralized digital ledger system that records and verifies transactions and information across a network of computers called nodes. Its core components comprise decentralization, transparency, immutability, and automation.

If we break down the term blockchain, we get block and chain. So to understand how it works, imagine a chain of blocks, where each block represents a data set. These blocks are connected in a distinct order to create a continuous chain.

Each node maintains a copy of the entire blockchain to ensure that the information is consistent and not controlled by a single commodity. This means that once a block is added to the chain, it’s difficult for any single entity to manipulate the stored data without alerting everyone in the blockchain network.

This secure data distribution is possible through a hash, which is generated from a cryptographic hashing algorithm. Hash is a digital fingerprint unique to each block and ensures that any slight change in the block’s data would result in a completely different hash.

Furthermore, to add a new block to the blockchain, its authenticity has to be validated via consensus. Consensus is a mechanism that ensures there are no discrepancies in the state of the distributed ledger. It’s essential in maintaining the integrity of the blockchain. Once consensus validates the block, it’s added permanently to the blockchain. This action is then distributed across all nodes to update their copies.

Now that we’re clear on how blockchain works, let’s dive deep into some of the applications of blockchain technology across different industries and sectors.

Blockchain applications in healthcare

By embracing blockchain solutions, healthcare providers can modernize operations, maintain data integrity, and enhance patient care. Blockchain doesn’t encounter privacy breaches like traditional methods, where the risk of unauthorized access exists. It also enables secure data interoperability in real time, reducing administrative inefficiencies.

Here’s a look into what blockchain applications in healthcare comprise.

1. Secure electronic health records (EHRs)

Medical professionals can’t access complete patient history when patient data gets siloed. To overcome this problem, a blockchain-based system is linked to existing EHR software. The decentralized system stores and manages EHRs securely and provides a single view of a patient’s record. It also gives patients the freedom to approve changes to their EHRs, authorize who can view them, and control how they are shared by healthcare providers.

2. Clinical trial research

Clinical trials and continuous medical research are part of what takes a healthcare system to the next level. However, such initiatives are often burdened with data integrity issues. The blockchain serves as the single source of truth for research and trial data. It improves and secures record keeping and sharing while maintaining patient privacy.

Blockchain also asserts ethical checkpoints to ensure the trial is completed while staying compliant.

3. Pharmaceutical supply chain management

One of the persistent challenges in the healthcare industry is confirming the authenticity of medicines and pharmaceutical products. Blockchain offers visibility into each stage of the supply chain, enabling complete visibility and traceability of medical goods.

In a sector where counterfeit products cause thousands of deaths every year, the implementation of blockchain is one of the most secure and legit solutions to prevent such circumstances.

4. Verification of staff credentials

Similar to blockchain applications in supply chain management, the technology can track the records and credentials of medical professionals to streamline hiring processes. Trusted medical records with staff credentials are accessible to other healthcare organizations as needed. This practice enforces transparency when sharing staff details with patients.

5. Remote patient monitoring

Patient monitoring solutions have created one of the biggest shifts in the medical world. Healthcare practitioners are using advanced sensors to measure patients’ vital signs to provide enhanced preventative and proactive care remotely.

Blockchain supports it by providing encrypted communication and securing such devices from cyberattacks tampering with personal data.

Blockchain applications in finance and banking

Blockchain technology lies at the heart of the digital transformation in banking. It has evolved from crypto to securing loans, digital transactions, and online payments. It has become one of the most widely used technologies in fintech. Blockchain in banking and financial services enables efficient processes, reduced costs, and secure networks.

Check out some of the most common blockchain applications in finance and banking.

6. Smart contracts

Smart contracts software is built on blockchain-based platforms that automate the execution of agreements, reducing the need for intermediaries. They permit trusted transactions and agreements between two parties without a central authority. Smart contracts have several uses, including real estate, trading, healthcare, supply chain, and dispute resolution.

7. Digital currencies

With blockchain enabling and normalizing the use of digital currencies, financial trading, and transactions are much faster and more secure than ever. It has also paved the way for the development of central bank digital currencies (CBDCs).

Furthermore, this new and efficient framework of digital assets exchange has opened the possibility of digital currencies becoming standard in the future.

8. Cross-border payments

By providing real-time tracking and secure payment gateways, blockchain has made cross-border payments faster, safer, and highly cost-effective. By reducing the element of a middleman and transaction fees, blockchain has enabled banks and customers to transact more frequently.

9. Regulatory compliance

Blockchain provides transparent and auditable records of digital transactions, which helps financial institutions meet regulatory requirements. Banks can also intercept suspicious transactions and digital banking activities on time by streamlining the auditing process with blockchain technology.

10. Asset management

There are many ways through which blockchain solutions make asset management more advanced. It digitizes the portfolio and existing holdings for wider market access, liquidity, and ease of transfer. Blockchain also improves investor and stakeholder governance through customizable built-in privacy settings.

Blockchain applications in real estate

Businesses and professionals are becoming increasingly cognizant of blockchain applications in the real estate sector. It can transform property management and sales, optimize payments, and increase investment opportunities.

Here’s a look into the different uses of blockchain in real estate.

11. Fractional ownership and asset tokenization

Through blockchain, the process of real estate investment is repurposed, allowing investors to buy and sell fractional shares instead of pooling all their money to acquire property. Asset tokenization platforms built on blockchain let you create a digital token of ownership for real-world liquid assets. Once assets are tokenized, investors only need a trading app to execute borderless international trading.

12. Loan and mortgage security

Blockchain solves many challenges that come with paper documentation for loans and mortgages. Digitization of such documents provides access to critical information that supports future decisions like ownership rights and loan payment history.

Blockchain payment systems enable the use of smart contracts that automate the collection and distribution of payment along with real-time reporting.

13. Land registration

By letting go of the paper system, blockchain serves as the single resource in the form of an immutable ledger system. It tracks and updates any changes in the database, including land titles, boundaries, and land use planning. The digitization of such processes eliminates any excessive administrative costs and prevents fraudulent transactions.

14. Property management

Large-scale enterprises and startups often lack oversight of their portfolio. Blockchain in real estate secures data sharing and payment processes, providing effective due diligence across the global portfolio. It also simplifies all property management communication between owners, tenants, and service providers.

15. Urban planning

Any form of property development can’t happen without feedback from the community. However, people often feel deprived of the planning process or unable to express their preferences. Through blockchain, platforms can focus on providing educational resources and create an effective feedback loop between stakeholders to establish engagement and communication.

Blockchain applications in retail

In retail, blockchain acts as a tool for establishing trust between retailers, consumers, supply chain participants, and payment gateways. Blockchain’s ability to amplify the tracking and digitization of processes has been beneficial to the retail industry, especially during the pandemic.

Let’s break down the use of blockchain in retail below.

16. Inventory management

To improve overall efficiency, retailers need to be on top of their inventory management game. Blockchain makes this process more efficient by keeping track of the stock and expiration dates. It also automates the process of identifying product shortage or surplus, depending on consumer needs.

17. Supply chain management

By providing end-to-end visibility in the supply chain, blockchain allows all network participants to look into what’s happening in the system at any given time. It keeps track of everything throughout the product journey, addressing issues of supply chain discrepancies and lack of traceability.

18. Product authentication

Blockchain’s ability to verify product provenance has helped companies combat counterfeiting by identifying its proof of origin. By scanning blockchain-based radio frequency identification (RFID) tags, customers can extract details about the manufacturing process of a product, along with its ingredients and certifications.

19. Protection against cyber attacks

The issue of data privacy is common in every industry, and retail is no exception. Blockchain increases customer data security by storing encrypted data, which prevents unauthorized access or other cybersecurity breaches. This also benefits companies by gaining customer trust, which ultimately adds up to higher revenue.

20. Transparent product reviews

Another aspect of gaining customer trust is blockchain-based review systems. These systems are secured against unauthorized tampering and generate authentic reviews from customers. Trusted customer feedback builds credibility for the brand, resulting in increased customer loyalty and engagement.

Other applications of blockchain

Here are some more examples of blockchain applications across industries.

21. Voting and governance: Blockchain-based voting systems enhance the security and transparency of elections. Each vote is tamper-proof and auditable for easy verification and validation. Therefore, blockchain rids the system of voter fraud and any kind of data manipulation.

22. Intellectual property management: Blockchain supports the registration of intellectual property rights by making the process faster, more accurate, cost-effective, and secure. Non-fungible tokens (NFTs) are built on the ethereum blockchain and add visibility of ownership and ease of trading for digital assets.

23. Energy trading: Blockchain technology combined with IoT devices enables consumers to trade and purchase energy directly from the grid rather than from retailers. It also provides an immutable record of meter readings, energy generation, and consumption data.

24. Insurance: With blockchain, insurance companies streamline all the processes, including claims processing, fraud detection, and underwriting. It also supports customer data protection by storing policy data in a tamper-proof ledger system, which improves accountability and trust.

25. Education: Educational institutions can verify candidate credentials and certifications through blockchain. They can access and share this data securely with authorized personnel, giving them full control. Also, blockchain can develop decentralized e-learning content software for securing educational content ownership.

26. Media and entertainment: While the media and entertainment industry is yet to utilize the full potential of blockchain, the technology helps artists and content creators get their dues, both in terms of revenue and copyrights. It also offers support for tackling piracy and fraud.

Think inside the blocks

Blockchain has immense potential for every industry out there. From cryptocurrencies to voting systems, blockchain has a broad spectrum of use cases that transform the way we have been functioning for years. It’s like a digital superpower that supports every sector and leaves it better than ever by breaking it free from flawed traditional systems.

And this is just the beginning. Blockchain will continue to evolve and transform the digital world, one block at a time. As technologies like artificial intelligence, machine learning, and big data become more efficient over the coming years, technology will converge with human creativity to present countless possibilities.

Make your blockchain ecosystem immune to cyber threats by using the best blockchain security software.

Tech

Harvard Alumni, Tech Moguls, and Best-Selling Authors Drive Nearly $600 Million in Pre-Order Sales

BlockDAG Network’s history is one of innovation, perseverance, and a vision to push the boundaries of blockchain technology. With Harvard alumni, tech moguls, and best-selling authors at the helm, BlockDAG is rewriting the rules of the cryptocurrency game.

CEO Antony Turner, inspired by the successes and shortcomings of Bitcoin and Ethereum, says, “BlockDAG leverages existing technology to push the boundaries of speed, security, and decentralization.” This powerhouse team has led a staggering 1,600% price increase in 20 pre-sale rounds, raising over $63.9 million. The secret? Unparalleled expertise and a bold vision for the future of blockchain.

Let’s dive into BlockDAG’s success story and find out what the future holds for this cryptocurrency.

The Origin: Why BlockDAG Was Created

In a recent interview, BlockDAG CEO Antony Turner perfectly summed up why the market needs BlockDAG’s ongoing revolution. He said:

“The creation of BlockDAG was inspired by Bitcoin and Ethereum, their successes and their shortcomings.

If you look at almost any new technology, it is very rare that the first movers remain at the forefront forever. Later incumbents have a huge advantage in entering a market where the need has been established and the technology is no longer cutting edge.

BlockDAG has done just that: our innovation is incorporating existing technology to provide a better solution, allowing us to push the boundaries of speed, security, and decentralization.”

The Present: How Far Has BlockDAG Come?

BlockDAG’s presale is setting new benchmarks in the cryptocurrency investment landscape. With a stunning 1600% price increase over 20 presale lots, it has already raised over $63.9 million in capital, having sold over 12.43 billion BDAG coins.

This impressive performance underscores the overwhelming confidence of investors in BlockDAG’s vision and leadership. The presale attracted over 20,000 individual investors, with the BlockDAG community growing exponentially by the hour.

These monumental milestones have been achieved thanks to the unparalleled skills, experience and expertise of BlockDAG’s management team:

Antony Turner – Chief Executive Officer

Antony Turner, CEO of BlockDAG, has over 20 years of experience in the Fintech, EdTech, Travel and Crypto industries. He has held senior roles at SPIRIT Blockchain Capital and co-founded Axona-Analytics and SwissOne. Antony excels in financial modeling, business management and scaling growth companies, with expertise in trading, software, IoT, blockchain and cryptocurrency.

Director of Communications

Youssef Khaoulaj, CSO of BlockDAG, is a Smart Contract Auditor, Metaverse Expert, and Red Team Hacker. He ensures system security and disaster preparedness, and advises senior management on security issues.

advisory Committee

Steven Clarke-Martin, a technologist and consultant, excels in enterprise technology, startups, and blockchain, with a focus on DAOs and smart contracts. Maurice Herlihy, a Harvard and MIT graduate, is an award-winning computer scientist at Brown University, with experience in distributed computing and consulting roles, most notably at Algorand.

The Future: Becoming the Cryptocurrency with the Highest Market Cap in the World

Given its impressive track record and a team of geniuses working tirelessly behind the scenes, BlockDAG is quickly approaching the $600 million pre-sale milestone. This crypto powerhouse will soon enter the top 30 cryptocurrencies by market cap.

Currently trading at $0.017 per coin, BlockDAG is expected to hit $1 million in the coming months, with the potential to hit $30 per coin by 2030. Early investors have already enjoyed a 1600% ROI by batch 21, fueling a huge amount of excitement around BlockDAG’s presale. The platform is seeing significant whale buying, and demand is so high that batch 21 is almost sold out. The upcoming batch is expected to drive prices even higher.

Invest in BlockDAG Pre-Sale Now:

Pre-sale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetwork

Discord: Italian: https://discord.gg/Q7BxghMVyu

No spam, no lies, just insights. You can unsubscribe at any time.

Tech

How Karak’s Latest Tech Integration Could Make Data Breaches Obsolete

- Space and Time uses zero-knowledge proofs to ensure secure and tamper-proof data processing for smart contracts and enterprises.

- The integration facilitates faster development and deployment of Distributed Secure Services (DSS) on the Karak platform.

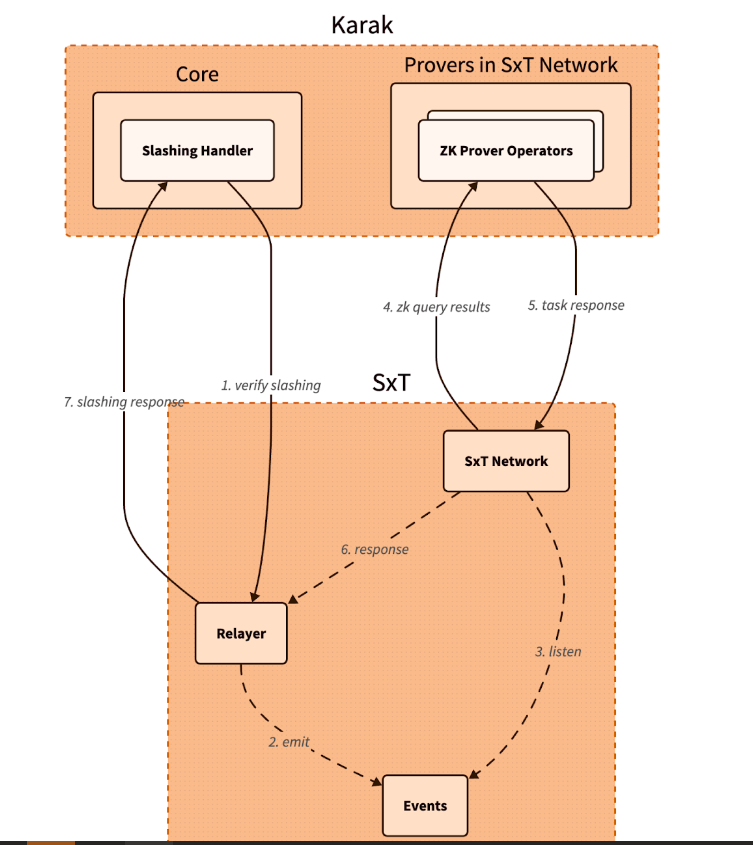

Karak, a platform known for its strong security capabilities, is enhancing its Distributed Secure Services (DSS) by integrating Space and Time as a zero-knowledge (ZK) coprocessor. This move is intended to strengthen trustless operations across its network, especially in slashing and rewards mechanisms.

Space and Time is a verifiable processing layer that uses zero-knowledge proofs to ensure that computations on decentralized data warehouses are secure and untampered with. This system enables smart contracts, large language models (LLMs), and enterprises to process data without integrity concerns.

The integration with Karak will enable the platform to use Proof of SQL, a new ZK-proof approach developed by Space and Time, to confirm that SQL query results are accurate and have not been tampered with.

One of the key features of this integration is the enhancement of DSS on Karak. DSS are decentralized services that use re-staked assets to secure the various operations they provide, from simple utilities to complex marketplaces. The addition of Space and Time technology enables faster development and deployment of these services, especially by simplifying slashing logic, which is critical to maintaining security and trust in decentralized networks.

Additionally, Space and Time is developing its own DSS for blockchain data indexing. This service will allow community members to easily participate in the network by running indexing nodes. This is especially beneficial for applications that require high security and decentralization, such as decentralized data indexing.

The integration architecture follows a detailed and secure flow. When a Karak slashing contract needs to verify a SQL query, it calls the Space and Time relayer contract with the required SQL statement. This contract then emits an event with the query details, which is detected by operators in the Space and Time network.

These operators, responsible for indexing and monitoring DSS activities, validate the event and route the work to a verification operator who runs the query and generates the necessary ZK proof.

The result, along with a cryptographic commitment on the queried data, is sent to the relayer contract, which verifies and returns the data to the Karak cutter contract. This end-to-end process ensures that the data used in decision-making, such as determining penalties within the DSS, is accurate and reliable.

Karak’s mission is to provide universal security, but it also extends the capabilities of Space and Time to support multiple DSSs with their data indexing needs. As these technologies evolve, they are set to redefine the secure, decentralized computing landscape, making it more accessible and efficient for developers and enterprises alike. This integration represents a significant step towards a more secure and verifiable digital infrastructure in the blockchain space.

Website | X (Twitter) | Discord | Telegram

No spam, no lies, just insights. You can unsubscribe at any time.

Tech

Cryptocurrency Payments: Should CFOs Consider This Ferrari-Approved Trend?

Iconic Italian luxury carmaker Ferrari has announced the expansion of its cryptocurrency payment system to its European dealer network.

The move, which follows a successful launch in North America less than a year ago, raises a crucial question for CFOs across industries: Is it time to consider accepting cryptocurrency as a form of payment for your business?

Ferrari’s move isn’t an isolated one. It’s part of a broader trend of companies embracing digital assets. As of 2024, we’re seeing a growing number of companies, from tech giants to traditional retailers, accepting cryptocurrencies.

This change is determined by several factors:

- Growing mainstream adoption of cryptocurrencies

- Growing demand from tech-savvy and affluent consumers

- Potential for faster and cheaper international transactions

- Desire to project an innovative brand image

Ferrari’s approach is particularly noteworthy. They have partnered with BitPay, a leading cryptocurrency payment processor, to allow customers to purchase vehicles using Bitcoin, Ethereum, and USDC. This satisfies their tech-savvy and affluent customer base, many of whom have large digital asset holdings.

Navigating Opportunities and Challenges

Ferrari’s adoption of cryptocurrency payments illustrates several key opportunities for companies considering this move. First, it opens the door to new customer segments. By accepting cryptocurrency, Ferrari is targeting a younger, tech-savvy demographic—people who have embraced digital assets and see them as a legitimate form of value exchange. This strategy allows the company to connect with a new generation of affluent customers who may prefer to conduct high-value transactions in cryptocurrency.

Second, cryptocurrency adoption increases global reach. International payments, which can be complex and time-consuming with traditional methods, become significantly easier with cryptocurrency transactions. This can be especially beneficial for businesses that operate in multiple countries or deal with international customers, as it potentially reduces friction in cross-border transactions.

Third, accepting cryptocurrency positions a company as innovative and forward-thinking. In today’s fast-paced business environment, being seen as an early adopter of emerging technologies can significantly boost a brand’s image. Ferrari’s move sends a clear message that they are at the forefront of financial innovation, which can appeal to customers who value cutting-edge approaches.

Finally, there is the potential for cost savings. Traditional payment methods, especially for international transactions, often incur substantial fees. Cryptocurrency transactions, on the other hand, can offer lower transaction costs. For high-value purchases, such as luxury cars, these savings could be significant for both the business and the customer.

While the opportunities are enticing, accepting cryptocurrency payments also presents significant challenges that businesses must address. The most notable of these is volatility. Cryptocurrency values can fluctuate dramatically, sometimes within hours, posing potential risk to businesses that accept them as payment. Ferrari addressed this challenge by implementing a system that instantly converts cryptocurrency received into traditional fiat currencies, effectively mitigating the risk of value fluctuations.

Regulatory uncertainty is another major concern. The legal landscape surrounding cryptocurrencies is still evolving in many jurisdictions around the world. This lack of clear and consistent regulations can create compliance challenges for companies, especially those operating internationally. Companies must remain vigilant and adaptable as new laws and regulations emerge, which can be a resource-intensive process.

Implementation costs are also a significant obstacle. Integrating cryptocurrency payment systems often requires substantial investment in new technology infrastructure and extensive staff training. This can be especially challenging for small businesses or those with limited IT resources. The costs are not just financial; a significant investment of time is also required to ensure smooth implementation and operation.

Finally, security concerns loom large in the world of cryptocurrency transactions. While blockchain technology offers some security benefits, cryptocurrency transactions still require robust cybersecurity measures to protect against fraud, hacks, and other malicious activity. Businesses must invest in robust security protocols and stay up-to-date on the latest threats and protections, adding another layer of complexity and potential costs to accepting cryptocurrency payments.

Strategic Considerations for CFOs

If you’re thinking of following in Ferrari’s footsteps, here are the key factors to consider:

- Risk Assessment: Carefully evaluate potential risks to your business, including financial, regulatory, and reputational risks.

- Market Analysis: Evaluate whether your customer base is significantly interested in using cryptocurrencies for payments.

- Technology Infrastructure: Determine the costs and complexities of implementing a cryptographic payment system that integrates with existing financial processes.

- Regulatory Compliance: Ensure that cryptocurrency acceptance is in line with local regulations in all markets you operate in. Ferrari’s gradual rollout demonstrates the importance of this consideration.

- Financial Impact: Analyze how accepting cryptocurrency could impact your cash flow, accounting practices, and financial reporting.

- Partnership Evaluation: Consider partnering with established crypto payment processors to reduce risk and simplify implementation.

- Employee Training: Plan comprehensive training to ensure your team is equipped to handle cryptocurrency transactions and answer customer questions.

While Ferrari’s adoption of cryptocurrency payments is exciting, it’s important to consider this trend carefully.

A CFO’s decision to adopt cryptocurrency as a means of payment should be based on a thorough analysis of your company’s specific needs, risk tolerance, and strategic goals. Cryptocurrency payments may not be right for every business, but for some, they could provide a competitive advantage in an increasingly digital marketplace.

Remember that the landscape is rapidly evolving. Stay informed about regulatory changes, technological advancements, and changing consumer preferences. Whether you decide to accelerate your crypto engines now or wait in the pit, keeping this payment option on your radar is critical to navigating the future of business transactions.

Was this article helpful?

Yes No

Sign up to receive your daily business insights

Tech

Bitcoin Tumbles as Crypto Market Selloff Mirrors Tech Stocks’ Plunge

The world’s largest cryptocurrency, Bitcoin (BTC), suffered a significant price decline on Wednesday, falling below $65,000. The decline coincides with a broader market sell-off that has hit technology stocks hard.

Cryptocurrency Liquidations Hit Hard

CoinGlass data reveals a surge in long liquidations in the cryptocurrency market over the past 24 hours. These liquidations, totaling $220.7 million, represent forced selling of positions that had bet on price increases. Bitcoin itself accounted for $14.8 million in long liquidations.

Ethereum leads the decline

Ethereal (ETH), the second-largest cryptocurrency, has seen a steeper decline than Bitcoin, falling nearly 8% to trade around $3,177. This decline mirrors Bitcoin’s price action, suggesting a broader market correction.

Cryptocurrency market crash mirrors tech sector crash

The cryptocurrency market decline appears to be linked to the significant losses seen in the U.S. stock market on Wednesday. Stock market listing The index, heavily weighted toward technology stocks, posted its sharpest decline since October 2022, falling 3.65%.

Analysts cite multiple factors

Several factors may have contributed to the cryptocurrency market crash:

- Tech earnings are underwhelming: Earnings reports from tech giants like Alphabet are disappointing (Google(the parent company of), on Tuesday, triggered a sell-off in technology stocks with higher-than-expected capital expenditures that could have repercussions on the cryptocurrency market.

- Changing Political Landscape: The potential impact of the upcoming US elections and changes in Washington’s policy stance towards cryptocurrencies could influence investor sentiment.

- Ethereal ETF Hopes on the line: While bullish sentiment around a potential U.S. Ethereum ETF initially boosted the market, delays or rejections could dampen enthusiasm.

Analysts’ opinions differ

Despite the short-term losses, some analysts remain optimistic about Bitcoin’s long-term prospects. Singapore-based cryptocurrency trading firm QCP Capital believes Bitcoin could follow a similar trajectory to its post-ETF launch all-time high, with Ethereum potentially converging with its previous highs on sustained institutional interest.

Rich Dad Poor Dad Author’s Prediction

Robert Kiyosaki, author of the best-selling Rich Dad Poor Dad, predicts a potential surge in the price of Bitcoin if Donald Trump is re-elected as US president. He predicts a surge to $105,000 per coin by August 2025, fueled by a weaker dollar that is set to boost US exports.

BTC/USD Technical Outlook

Bitcoin price is currently trading below key support levels, including the $65,500 level and the 100 hourly moving average. A break below the $64,000 level could lead to further declines towards the $63,200 support zone. However, a recovery above the $65,500 level could trigger another increase in the coming sessions.

-

Videos7 days ago

Videos7 days agoAbsolutely massive: the next higher Bitcoin leg will shatter all expectations – Tom Lee

-

News11 months ago

News11 months agoVolta Finance Limited – Director/PDMR Shareholding

-

News11 months ago

News11 months agoModiv Industrial to release Q2 2024 financial results on August 6

-

News11 months ago

News11 months agoApple to report third-quarter earnings as Wall Street eyes China sales

-

News11 months ago

News11 months agoNumber of Americans filing for unemployment benefits hits highest level in a year

-

News1 year ago

News1 year agoInventiva reports 2024 First Quarter Financial Information¹ and provides a corporate update

-

News1 year ago

News1 year agoLeeds hospitals trust says finances are “critical” amid £110m deficit

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Hit $100 Billion in 2024, Fueling Insane Investor Optimism ⋆ ZyCrypto

-

Tech1 year ago

Tech1 year agoBitcoin’s Correlation With Tech Stocks Is At Its Highest Since August 2023: Bloomberg ⋆ ZyCrypto

-

Tech1 year ago

Tech1 year agoEverything you need to know

-

News11 months ago

News11 months agoStocks wobble as Fed delivers and Meta bounces