Markets

6 Best Short-Term Crypto Trading Platforms

Cryptocurrency trading has taken the financial world by storm, offering opportunities for profit that are both thrilling and potentially lucrative. For short-term traders, the right platform can make all the difference between seizing a profitable opportunity and missing out.

In this blog post, we dive into the six best short-term crypto trading platforms that cater to both novice and seasoned traders. Whether you’re looking for low fees, advanced charting tools, or the fastest execution times, we’ve got you covered.

But with so many options out there, how do you choose the one that fits your trading style perfectly? Stay tuned as we reveal which platforms are worth your time and why one of them might just be the hidden gem you’ve been searching for. Let’s jump into short-term crypto trading and find out which platform will help you maximize your gains and minimize your risks. Ready to uncover the secrets? Let’s get started!

List of our top picks

- BYDFi – Best overall, Available in the USA without VPN, no KYC, lowest fees (0.02%), perpetual futures trading, 200x leverage, stop-loss, trailing stop, short-selling, Regulated by FinCEN, excellent support team, quick registration, and fiat on-ramp.

- Phemex – Best for mobile, KYC-free, accepts US traders with VPN, 100x leverage, futures contracts, stop-loss, trading bots, risk-free demo account, buy crypto with fiat, and VIP programme.

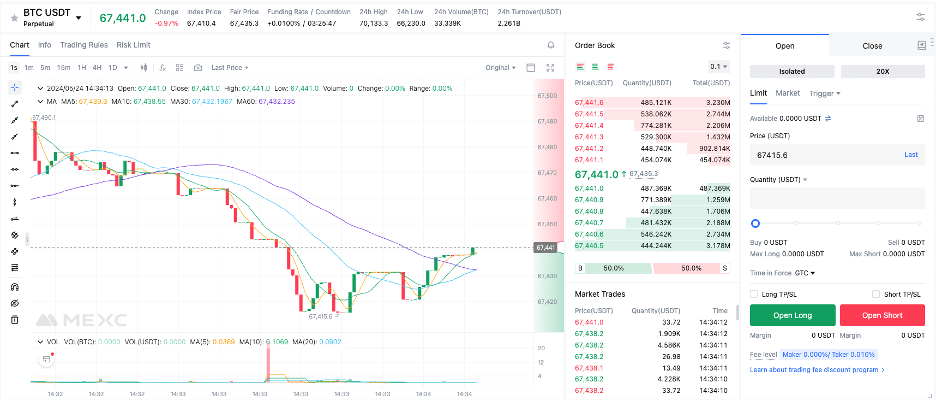

- MEXC – Best for low maker fees (0%), KYC-free, available in the USA with VPN, 200x leverage, daily futures rewards, copy day trading, demo trading, and competitions.

- BTCC – Best for high leverage (225x), No KYC, available in the USA without VPN, deposit crypto or fiat, good educational hub, fast online support, and advanced tools.

- PrimeXBT – Best for Bitcoin trading, Tradingview charts, multi-exchange with other assets, good track record, CFD trading, copy trade, economic calendar, and contests.

- Binance – Biggest exchange by volume, most altcoin pairs (600+), advanced trading tools for scalpers, futures contracts, short-term options, margin trading, and mobile app.

What is the best short-term crypto trading platform?

Before diving into the reviews of each platform, it’s important to understand how we evaluated them. Our team of crypto experts carefully analyzed a range of data points to provide you with the most accurate and helpful information.

Here’s what we looked at:

- User Interface and Experience: How easy and intuitive each platform is to use.

- Fees and Costs: Comparison of trading, withdrawal, and deposit fees.

- Security Features: Security measures like two-factor authentication (2FA) and encryption.

- Trading Tools and Features: Availability of advanced tools like charting and real-time data.

- Liquidity and Volume: Ensuring high liquidity for quick and efficient trading.

- Customer Support: Responsiveness and helpfulness of the support teams.

- Reputation and Reviews: Overall reputation and user feedback.

- Innovation and Technology: Use of AI, blockchain, and trade execution speed.

- Educational Resources: Availability of tutorials, webinars, and community forums.

- Community and Social Features: Social trading, user forums, and interaction with successful traders.

By analyzing these comprehensive data points, we aim to give you a thorough overview of each platform’s strengths and weaknesses. Now, let’s dive into the detailed reviews of the top six short-term crypto trading platforms!

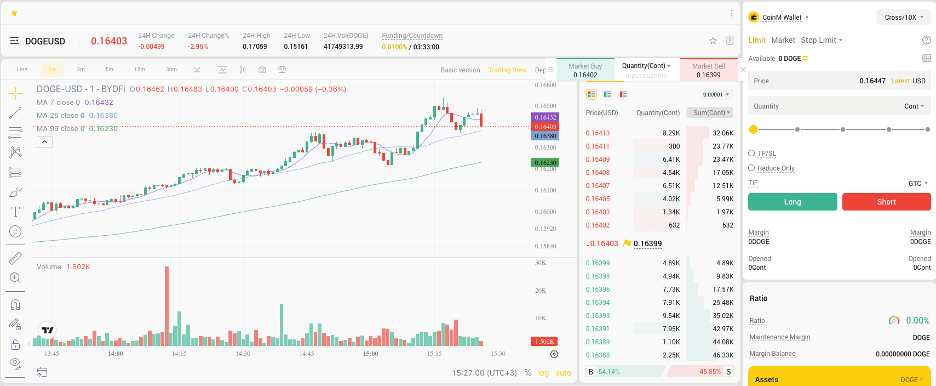

1. BYDFi – Best overall (highest rating)

BYDFi, which used to be called BitYard, has been getting a lot of attention since it launched in 2020. It’s super user-friendly, making it great for both newbies and seasoned traders who are looking to day trade crypto. But what exactly makes BYDFi special, and is it worth using? Let’s break down the features, pros, and cons of BYDFi to help you figure that out.

Main Features of BYDFi

BYDFi is famous for its simple and easy-to-use interface, perfect for beginners. It offers three main tiers for spot trading: Classical, Advanced, and Convert. The Classical tier is for quick buying and selling, the Advanced tier offers detailed trading tools, and the Convert tier lets you easily swap crypto for USDT.

Perpetual Contracts

For more experienced traders, BYDFi offers perpetual contracts with up to 200x leverage. This means you can hold positions as long as you want without worrying about them expiring. But be careful with high leverage—it can lead to big losses if you’re not careful.

Leveraged Tokens

BYDFi also has leveraged tokens, which let you buy large amounts and benefit from small price changes. These tokens have built-in leverage, making it easier to trade without manually setting up leverage.

Security

Security is a big deal at BYDFi. The platform uses two-factor authentication (2FA), email binding, and anti-phishing codes to keep your account safe. They also follow strict KYC (Know Your Customer) and AML (Anti-Money Laundering) standards to prevent fraud.

Customer Support

BYDFi offers great customer support with 24/7 live chat, email support, and a detailed FAQ section. They’re also active on social media and have Telegram groups for community help.

Pros:

- User-Friendly Interface: Super easy to use, great for beginners.

- Extensive Trading Options: Supports spot trading, perpetual contracts, and leveraged tokens.

- Copy Trading: Lets beginners follow and learn from experienced traders.

- Strong Security Measures: Includes 2FA, email binding, and anti-phishing codes.

- Responsive Customer Support: 24/7 live chat and email support.

Cons:

- Limited Educational Resources: Not a lot of learning materials for newbies.

- No Staking Options: Doesn’t offer staking or other ways to earn passive income.

- Liquidity Issues: Some less common trading pairs might not have much liquidity.

- Moderate Trust Score: No proof-of-reserves declared, which could worry some users.

Overall, BYDFi is a great pick for short-term traders looking for a simple and secure platform. Currently they offer a great crypto sign up bonus and promotion for new users with up to 2888USDT in rewards.Its user-friendly design,and the variety of trading options make it an attractive choice, especially for those just starting out in the crypto world.

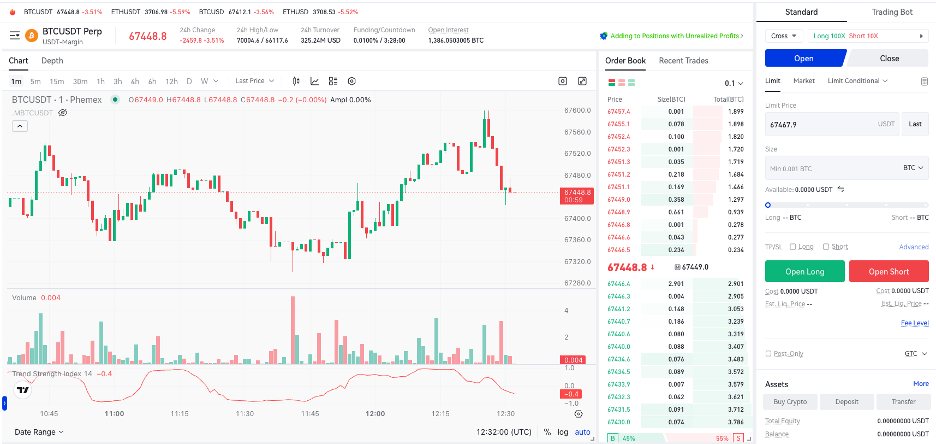

2. Phemex – Best for mobile users

If you’re a short-term crypto trader looking for a fast crypto trading platform that can keep up with your fast-paced trading style, you need to check out Phemex. Since launching in 2019, Phemex has become a top choice for traders who want reliability, speed, and cutting-edge features.

Whether you’re a seasoned pro or just getting started, Phemex has the tools you need to succeed. Let’s dive into why Phemex is perfect for short-term trading!

Main features of Phemex

Phemex isn’t your average trading platform. Founded in Singapore by a team of former Morgan Stanley execs and experienced Bitcoin traders, this exchange has quickly built a strong reputation. Despite being relatively new, Phemex has made significant strides in offering a robust and secure trading environment.

Fee Structure

Phemex charges a flat 0.10% fee for spot trading, which is waived for premium members. Contract trading fees are 0.06% for buyers and 0.01% for sellers which means it is one of the cheapest crypto exchanges. There are no withdrawal fees, just network fees, which are standard in the industry.

Why Phemex is Perfect for Short-Term Trading

Phemex aims to be fast, user-friendly, and comprehensive—everything a short-term trader needs. Here are some of the standout features that make it ideal for quick trades.

Lightning-Fast Trading: Phemex is designed for speed. You can trade over 50 cryptocurrencies with lightning-fast execution times, which is crucial for capitalizing on market movements.

Sub accounts for Better Management: Create and manage multiple sub accounts to organize your trades and strategies better. This feature allows you to separate different trading strategies and manage risk more effectively.

Prediction Market: Bet on real-world events and profit if you’re right. This unique feature can provide additional trading opportunities and diversify your strategies.

Demo Trading: Practice makes perfect! Use the demo trading feature to refine your strategies without risking real money.

Copy Trading: Learn from the pros by copying their trades. This is a fantastic way to see successful strategies in action and adopt them quickly.

Sign-up Bonuses: Earn up to $100 in bonuses for various actions like verifying your identity and making your first deposit.

Competition Mode: Add excitement to your trading with team-based competitions. Compete, win, and boost your earnings while having fun.

Pros:

- Fair Fees: Phemex’s transparent fee structure ensures no hidden costs, maximizing your profits.

- Leverage trading: Phemex offers up to 100x leverage in their perpetual futures market.

- Top-Notch Security: Features like cold storage and two-factor authentication keep your assets safe.

- Collaborative Learning: Educational resources and a supportive community to help you stay ahead of the curve.

- Flexibility: Manage multiple cryptocurrencies and subaccounts with ease, essential for diversified short-term strategies.

- Excellent Customer Support: Responsive support, including direct access to the CEO on Telegram, ensures your issues are quickly resolved.

Cons:

- Limited Altcoin Selection: Fewer altcoin options compared to some other platforms might limit your trading opportunities.

- Limited Fiat Support: Fewer fiat-to-crypto trading pairs can make it harder to move money in and out of the platform quickly.

- Needs More Tutorials: The platform could benefit from more comprehensive guides and tutorials for new users.

User Experience

Phemex’s interface is intuitive and easy to navigate, with customizable features that make trading a breeze. The integration with TradingView is a huge plus, allowing traders to analyze and execute trades seamlessly. The platform supports multiple languages and offers a demo account for practice, making it accessible to users worldwide.

3. MEXC – Best for 1-second chart

The crypto industry is full of exchanges, each with its own perks and downsides. While many stick to top-rated exchanges like Binance and Coinbase, MEXC Global is a hidden gem that offers a ton of features and tools with one standing out in particular, the 1-second chart where you can trade on the smallest time-frame out of all exchanges. Let’s dive into why MEXC might be the best choice for short-term traders.

Why MEXC Stands Out

MEXC Global is gaining popularity with a growing user base. It offers a variety of trading options, making it a great choice for people who like to try different trading methods. But is it really that good for short-term trading? Here’s a closer look at what MEXC offers and what it’s missing.

Top Features for Short-Term Traders

MEXC supports both spot and futures trading. Spot trading is when you buy a cryptocurrency and get it right away. Futures trading involves buying and selling contracts that promise to buy or sell the asset at a set price in the future.

MEXC’s trading dashboards are loaded with features and integrated with TradingView for advanced charting (including the 1-second chart) and analysis, perfect for short-term traders.

MEXC offers a demo trading tool for futures, letting you practice trading with virtual funds. This is awesome for beginners who want to learn the ropes without risking real money.

Copy-Trading: MEXC’s copy-trading feature allows you to mimic the trades of experienced traders. This is a fantastic way to learn and potentially profit by following successful traders. You can see detailed stats and performance metrics for each trader, so you know who to trust.

MEXC offers leveraged ETFs, which let you trade with a multiplier effect, magnifying your profits (or losses). This is available for various cryptocurrencies, including Bitcoin and Ethereum, making it a powerful tool for short-term traders.

Low Fees: One of MEXC’s best features is its low fees. For spot trading, both maker and taker fees are 0%. For futures, maker fees are 0%, and taker fees are 0.01%. Leveraged ETF fees are 0.2% for both makers and takers. Low fees mean more profit stays in your pocket.

Global Availability: MEXC is available in over 170 countries, including the US, UK, India, Canada, and South Korea. This wide reach ensures you have access to a large liquidity pool and that the platform follows various regulatory standards.

Pros:

- Supports spot and futures trading

- Futures demo trading portal

- Copy-trading tools

- Leveraged ETF listings

- Very low fees

- Available globally

Cons:

- Limited fiat withdrawals

- No NFT support

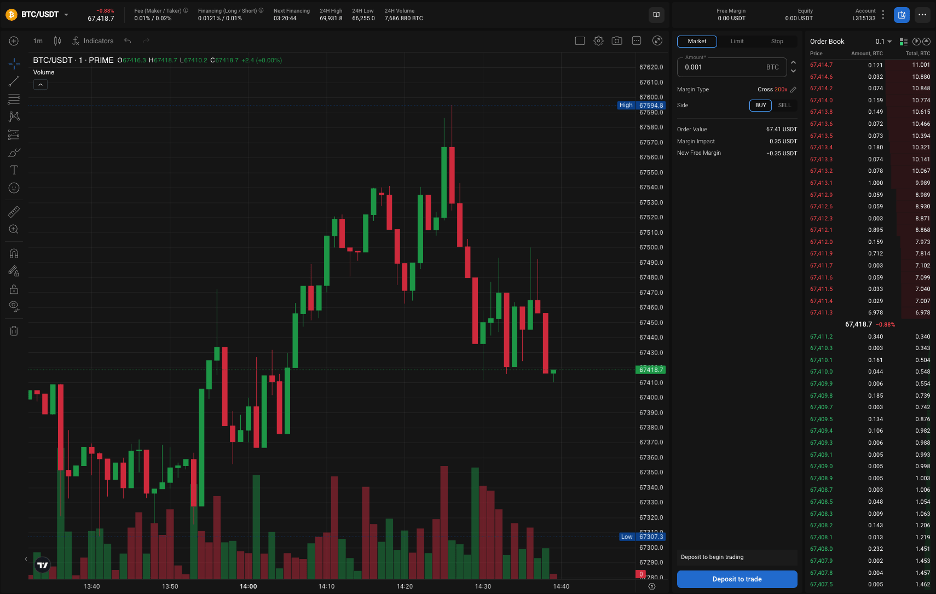

4. BTCC – Best for high leverage

If you’re looking to make quick profits, BTCC is one of the best platforms to consider. Established way back in 2011 in Shanghai, BTCC is one of the oldest and most trusted crypto exchanges globally. It used to be one of the big three Chinese crypto exchanges, along with Huobi and OKCoin.

In 2018, BTCC expanded globally and is now headquartered in the United Kingdom. It’s widely praised for its reliability, security, and high liquidity, which are all essential for successful short-term trading.

Futures Trading

BTCC specializes in futures trading, which is perfect for short-term traders looking to capitalize on market movements. You can trade two types of crypto futures: USDT-margined futures, settled in USDT, and Coin-margined futures, settled in cryptocurrencies.

The platform offers perpetual futures trading on more than 60 trending coins like BTC, ETH, DOGE, XRP, and SOL. This variety ensures you always have exciting trading opportunities.

Tokenized Futures

In 2022, BTCC added commodity and stock tokenized futures to its offerings. This means you can diversify your trading portfolio beyond just cryptocurrencies, all within the same platform. These tokenized futures are also settled in USDT, making it easier to manage your trades and profits.

Trading Fees

BTCC charges a flat fee of 0.06% for both takers and makers, which is way below the industry average. Lower fees mean more profits for you, which is a big deal for short-term traders who make frequent trades. You can also get discounts by upgrading your VIP level.

Deposit Methods and US Investors

BTCC allows deposits through credit cards (Visa/Mastercard) and cryptocurrencies. This flexibility is great for new and experienced traders alike. While BTCC does not explicitly forbid US investors, they should check if there are any legal issues due to their residency.

Demo Trading

BTCC offers a demo trading account with 100,000 USDT in virtual funds for practice. This is awesome for beginners to get a feel for trading without risking real money.

Pros:

- Low trading fees, maximizing your profits

- High liquidity and strong security features

- Extensive range of futures trading options

- Tokenized futures for portfolio diversification

- Demo trading account to practice without risk

- Multiple deposit methods, including credit cards

Cons:

- US investors need to do their own legal checks

- Trading view might take some getting used to for beginners

5. PrimeXBT – Best for Bitcoin trading

PrimeXBT is a top short-term crypto CFD exchange that’s really popular among traders. It lets you trade a bunch of different assets, including cryptocurrencies, stocks, forex, commodities, and indices, all as contracts for difference (CFDs). If you’re looking for a fresh alternative to the usual crypto trading platforms, PrimeXBT’s crypto margin trading feature is a game-changer.

PrimeXBT is all about leveraged trading. You can get up to 200x leverage on crypto pairs and up to 1,000x on some forex and commodity pairs. This high leverage can seriously boost your profits if you’re a short-term trader looking to make quick gains. But remember, trading with margin/leverage can be risky, especially since the crypto market is already pretty volatile.

One of the best things about PrimeXBT is its liquidity. The platform pulls liquidity from over 12 different exchanges, so you’ll always have plenty available for trading. No need to worry about not being able to execute trades due to low liquidity.

PrimeXBT Features

- High Leverage: Up to 200x on crypto pairs and up to 1,000x on some forex pairs.

- Wide Range of Assets: Trade cryptocurrencies, forex, commodities, indices, and more.

- Pooled Liquidity: Aggregates liquidity from over 12 exchanges.

- Strong Security Measures: Extensive cybersecurity practices, including cold storage and multi-signature wallets.

- Anonymous Trading: No KYC requirements for most users.

- User-Friendly Platform: Customizable interface with advanced charting tools.

- Mobile App: Trade on the go with the PrimeXBT mobile app.

Pros:

- High Leverage: Amplify profits quickly with high leverage.

- Variety of Assets: Access to diverse trading markets.

- Strong Security: Extensive security measures to protect user funds.

- User-Friendly Interface: Customizable trading platform with advanced tools.

- No KYC Required: Allows for anonymous trading, great for privacy-conscious traders.

Cons:

- High Risk with Leverage: Can lead to significant losses, especially in volatile markets.

- Unregulated: PrimeXBT isn’t regulated, which might concern some traders.

- No Fiat Withdrawals: Currently, no option to withdraw funds in fiat currency.

- Limited Customer Support Channels: No dedicated phone support, which might be inconvenient for some users.

PrimeXBT Security

Security is super important, and PrimeXBT takes it seriously. Most funds are stored in cold storage, safe from hackers. Only a small amount is kept in hot wallets for daily transactions, protected by multi-signature access to reduce risk. They also use Cloudflare to protect against DDoS attacks and run regular security tests and updates.

PrimeXBT uses full SSL encryption for all communication, so your data is safe. They also use the bcrypt algorithm to store passwords securely, and two-factor authentication (2FA) is available for added account security.

For withdrawals, PrimeXBT requires mandatory white-labelling of Bitcoin addresses, ensuring funds can only be sent to pre-approved addresses.

PrimeXBT is a solid choice for experienced short-term traders looking to maximize their returns. The high leverage options and variety of tradable assets are great, and the strong security measures are a big plus. But remember, high leverage means higher risk, and the lack of regulation might be a concern for some.

6. Binance – Best for most markets

Looking for the best platform to maximize your short-term crypto trades? Binance might just be what you need. As one of the most popular cryptocurrency exchanges globally, Binance offers a range of features perfect for quick and frequent trading. But before you jump in, let’s dive into why Binance stands out and what you need to watch out for.

When it comes to short-term trading, fees and options matter a lot. Binance excels in both areas:

- Low Fees: One of the biggest advantages of using Binance is its low trading fees. For traders who make lots of transactions, keeping costs down is crucial. With Binance, more of your earnings stay in your pocket.

- Wide Selection of Cryptocurrencies: Binance offers over 150 tradable cryptocurrencies for U.S. customers and even more for international users. This variety means you can always find the best opportunities for quick trades.

- Multiple Trading Options: Binance supports several types of trading, including peer-to-peer, spot, and margin trading (though margin trading isn’t available in the U.S.). It also provides a variety of order types like limit orders, market orders, and stop-limit orders, giving you flexibility in how you trade.

Pros:

- Extensive Cryptocurrency Selection: With a huge range of cryptocurrencies available, you can take advantage of various market movements.

- Low Fees: The low fees make frequent trading more profitable.

- Diverse Trading Options: The range of trading options and order types can help you execute your trading strategies more effectively.

Cons:

- Limited U.S. Version: The U.S. platform has fewer cryptocurrencies and features, which can be limiting.

- Complex Interface: The platform can be intimidating due to its many features, which might overwhelm even seasoned traders.

- No Built-In Digital Wallet: Binance recommends Trust Wallet, but it doesn’t have an integrated wallet of its own, which can complicate things.

- Regulatory Issues: Binance has faced legal challenges in several countries, which might make some traders cautious.

What to Keep in Mind

Binance’s low fees and extensive selection of cryptocurrencies make it an attractive option for short-term traders. However, its complexity and regulatory issues mean you need to be careful and stay informed. The U.S. version’s limitations can be frustrating, but the platform’s powerful tools and options make it worth considering for those who can navigate its interface.

If you’re an experienced trader looking for a platform with low fees and a wide range of cryptocurrencies, Binance could be a solid choice for your short-term trading needs. Just remember to stay updated on its regulatory status and be prepared to deal with a complex interface.

For those who can handle these challenges, Binance offers a wealth of opportunities to enhance your trading strategy and maximize your profits.

What to look for when choosing a platform?

When it comes to picking the perfect crypto trading platform as a short-term trader, there’s a lot to consider. Here are some key things you should look for to make sure you get the best experience possible:

- User-Friendly Design: The platform should be easy to navigate. You don’t want to waste time figuring out complicated menus when you could be trading. Look for a clean, simple layout that’s intuitive to use.

- Low Fees: High fees can eat into your profits quickly. Check how much the platform charges for trades, deposits, and withdrawals. The lower the fees, the more money stays in your pocket.

- Security: Safety first! Make sure the platform has strong security features like two-factor authentication (2FA), encryption, and cold storage. This helps protect your funds from hackers.

- Trading Tools: Good platforms offer tools to help you trade better. Look for things like advanced charts, real-time data, and stop-loss orders. These can help you make smarter decisions.

- Liquidity: You want a platform with high liquidity, meaning lots of people are trading on it. This makes it easier to buy or sell assets quickly without affecting the price too much.

- Customer Support: Problems happen, and when they do, you need help fast. Check if the platform has good customer support that’s easy to reach and quick to respond.

- Reputation: Do some research on what other users are saying. Look for reviews and ratings to see if the platform is trustworthy and reliable. A good reputation can save you from potential headaches.

- Innovative Features: Some platforms offer cool features like AI predictions and blockchain integration. These can give you an edge in your trading.

- Learning Resources: If you’re new to trading, it’s great if the platform offers tutorials, webinars, and forums. These resources can help you learn and improve your skills.

- Community: Look for platforms that have a strong community of traders. Features like social trading and forums can help you connect with others, share tips, and stay updated.

By keeping these factors in mind, you’ll be able to choose a crypto trading platform that suits your needs and helps you trade more effectively.

How we selected these platforms

Choosing these platforms wasn’t simple. We explored each platform’s user interface, trying out the menus and features to see how intuitive they were. Some platforms had confusing layouts, emphasizing the importance of user-friendly design.

We analyzed fees for trades, deposits, and withdrawals, uncovering hidden costs on some platforms. Security was a major focus; we checked for protections like two-factor authentication and encryption.

We tested trading tools, looking for advanced charts and real-time data. Liquidity was crucial; we traded various cryptocurrencies to ensure easy buying and selling. Customer support was also key; we contacted support teams to test their responsiveness.

We considered user reviews and industry ratings, noting red flags like frequent withdrawal issues. Finally, we looked at unique features such as AI trading bots, blockchain integration, and educational resources.

By following these steps, we ensured our list of platforms is reliable, secure, and user-friendly, with the best features for short-term crypto trading.

Is short-term trading risky?

Absolutely, short-term crypto trading can be risky. The market is notorious for wild swings, where prices can soar or crash within minutes, leading to big profits or significant losses. Imagine buying a coin expecting it to rise, only to see it drop due to unexpected news or market sentiment changes.

Short-term trading requires perfect timing and quick decisions, which can lead to emotional trading driven by fear or greed. We’ve seen traders panic sell during small dips, missing out on rebounds. It also demands constant monitoring and staying updated, which can be tiring and stressful. One of our team members missed a crucial price spike just by stepping away for a few minutes.

Technical issues like platform outages, slow execution times, or glitches can add to the risk. No platform is completely immune to these problems.

Additionally, without fully understanding tools and strategies like scalping, swing trading, and using leverage, you could amplify both gains and losses. One of our experts lost more than their initial investment using leverage due to a sudden market drop.

What is the best cryptocurrency to trade short-term?

Picking the right cryptocurrency can make a huge difference in short-term trading. Here are some top choices:

- GMT (STEPN): Known for its “move-to-earn” concept, GMT is highly volatile, offering many opportunities for quick trades.

- Polygon (MATIC): Offers scalability solutions for Ethereum, with fast transaction speeds and low fees, making it ideal for short-term trading. Significant price movements often occur with updates or partnerships.

- Filecoin (FIL): A decentralized storage network with price fluctuations based on demand and tech advancements, providing excellent short-term trading opportunities.

- VeChain (VET): Focuses on supply chain solutions with big partnerships. Frequent updates lead to predictable price spikes, great for catching profitable trades.

- FLOKI: A meme coin influenced by social media trends and celebrity endorsements. Its speculative nature means prices can skyrocket quickly, offering chances for quick gains.

- Chiliz (CHZ): Powers Socios.com, allowing sports fan engagement through fan tokens. Prices surge during major sports events or new team integrations, providing predictable trading opportunities.

These cryptocurrencies are perfect for short-term trading due to their volatility and quick price movements. Stay updated on news and market trends to capitalize on these fluctuations and make profitable trades. The key is to keep a close eye on the market and act fast!

Final words

Are you ready to boost your short-term crypto trading? Choosing the right platform is your first step to success. In the fast-moving markets of cryptocurrency, the right tools can help you find good opportunities and manage risks better.

Whether you’re new to trading or have lots of experience, there’s a platform for you. BYDFi is great for beginners with its simple design and many trading options. Phemex is perfect for mobile traders who need fast and reliable service.

MEXC’s 1-second chart is ideal for those who want to trade quickly, while BTCC offers high leverage for bigger returns. PrimeXBT has a variety of assets for those looking to diversify, and Binance is a favorite for its many market options and low fees.

Short-term trading can be risky, but the rewards can be worth it. By picking the right platform and keeping up with market trends, you can improve your strategy and increase your profits. Check out these platforms, see which one fits your style, and start your trading journey with confidence.

Markets

Today’s top crypto gainers and losers

Over the past 24 hours, Jupiter and JasmyCoin emerged as the top gainers among the top 100 crypto assets, while Bittensor and Mantra plunged as the top losers.

Top Winners

Jupiter

Jupiter (JUP) led the charge among the biggest gainers on July 27.

At the time of writing, the crypto asset had surged 12.6% in the past 24 hours and was trading at $1.16. JUP’s daily trading volume was hovering around $282 million, according to data from crypto.news.

JUP Hourly Price Chart, July 26-27 | Source: crypto.news

Additionally, the cryptocurrency’s market cap stood at $1.56 billion, making it the 62nd largest crypto asset, according to CoinGecko. Despite the recent price surge, the token is still down 42.6% from its all-time high of $2 reached on Jan. 31.

Jupiter functions as a decentralized exchange aggregator that allows users to trade Solana-based tokens. The platform also offers users the best routes for direct trades between multiple exchanges and liquidity pools.

In addition to being a DEX aggregator, Jupiter has expanded into a “full stack ecosystem” by launching several new projects, including a dedicated pool to support perpetual trading and plans for a stablecoin.

JasmyCoin

JasmyCoin (JASMI) has increased by 12% in the last 24 hours and is trading at $0.0328 at press time. JASMY’s daily trading volume has increased by 10% in the last 24 hours, reaching $146 million.

JASMY Hourly Price Chart, July 26-27 | Source: crypto.news

The asset’s market cap has surpassed the $1.5 billion mark, making it the 60th largest cryptocurrency at the time of reporting. However, the self-proclaimed “Bitcoin of Japan” is still down 99.3% from its all-time high of $4.79 on February 16, 2021.

JASMY is the native token of Jasmy Corporation, a Japanese Internet of Things provider. The platform seeks to merge the decentralization of blockchain technology with IoT, allowing users to convert their digital information into digital assets.

The initiative was launched by Kunitake Ando, former COO of Sony Corporation, along with Kazumasa Sato, former CEO of Sony Style.com Japan Inc., Hiroshi Harada, executive financial analyst at KPMG, and other senior executives from Japan.

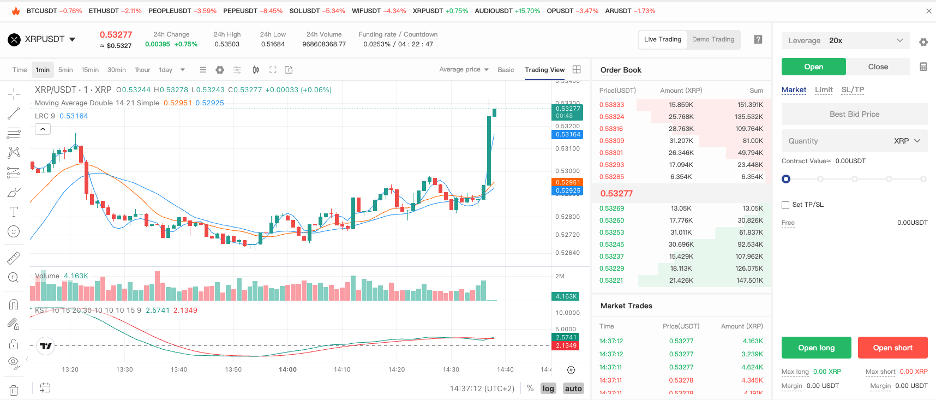

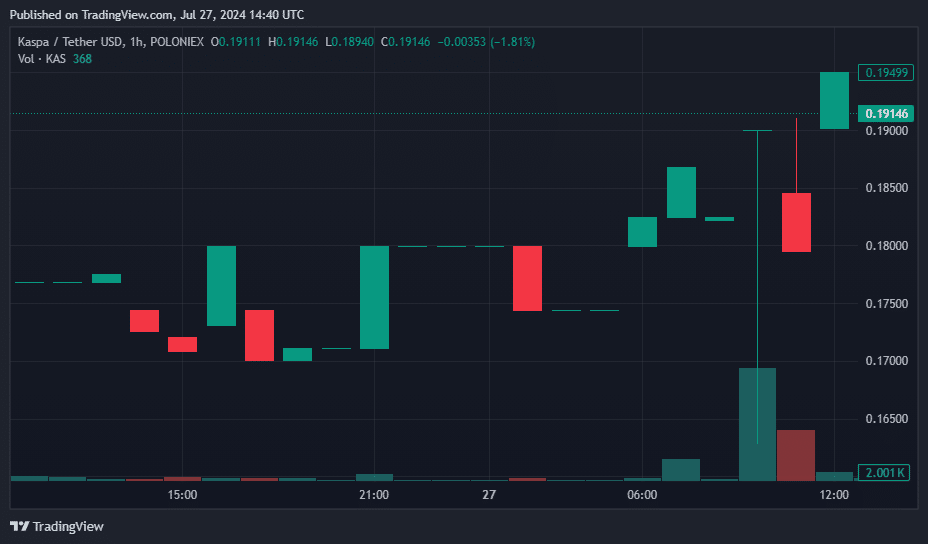

Kaspa

Kaspa (KAS) saw a 100% increase in trading volume and an 8% increase in price over the past 24 hours, trading at $0.19 at the time of publication.

KAS Hourly Price Chart, July 26-27 | Source: crypto.news

According to data from CoinGecko, Kaspa now ranks 27th in the global cryptocurrency list, with a circulating supply of approximately 24.29 billion KAS tokens and a market capitalization of $4.59 billion.

Kaspa is a cryptocurrency designed to deliver a high-performance, scalable, and secure blockchain platform. Its unique Layer-1 protocol includes the GhostDAG protocol, a proof-of-work (PoW) consensus mechanism that enables faster block times and higher transaction throughput compared to standard blockchains.

Unlike Bitcoin, GhostDAG allows multiple blocks to be created simultaneously, speeding up transactions and increasing block rewards for miners.

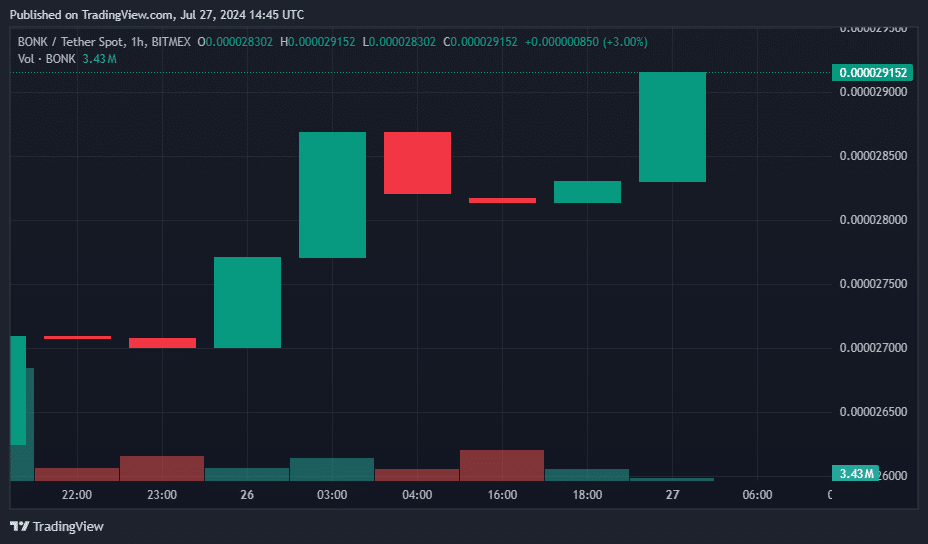

Bonk

Bonk (BONK) is the only one coin meme which made it to this list of biggest gainers and jumped 8.6% in the last 24 hours. Trading at $0.000030, the Solana-based meme coin’s market cap has surpassed $2.1 billion, surpassing Floki (FLOKI), another competing dog-themed coin with a market cap of $1.78 billion.

BONK Hourly Price Chart, July 26-27 | Source: crypto.news

BONK’s daily trading volume hovered around $285 million. However, BONK is still down 33.5% from its all-time high of $0.000045, reached on March 4.

Bonk, a meme coin that rose to prominence in 2023, has contributed significantly to Solana’s value increase amid the meme coin frenzy.

Bonk started out as a simple dog-themed coin. It has since expanded its features to include integration with decentralized finance. The project also partners with cross-chain communication protocols, NFT marketplaces, and various other cryptocurrency ecosystems.

BONK trading pairs are now listed on major exchanges including Binance, Coinbase, OKX, and Bitstamp.

The big losers

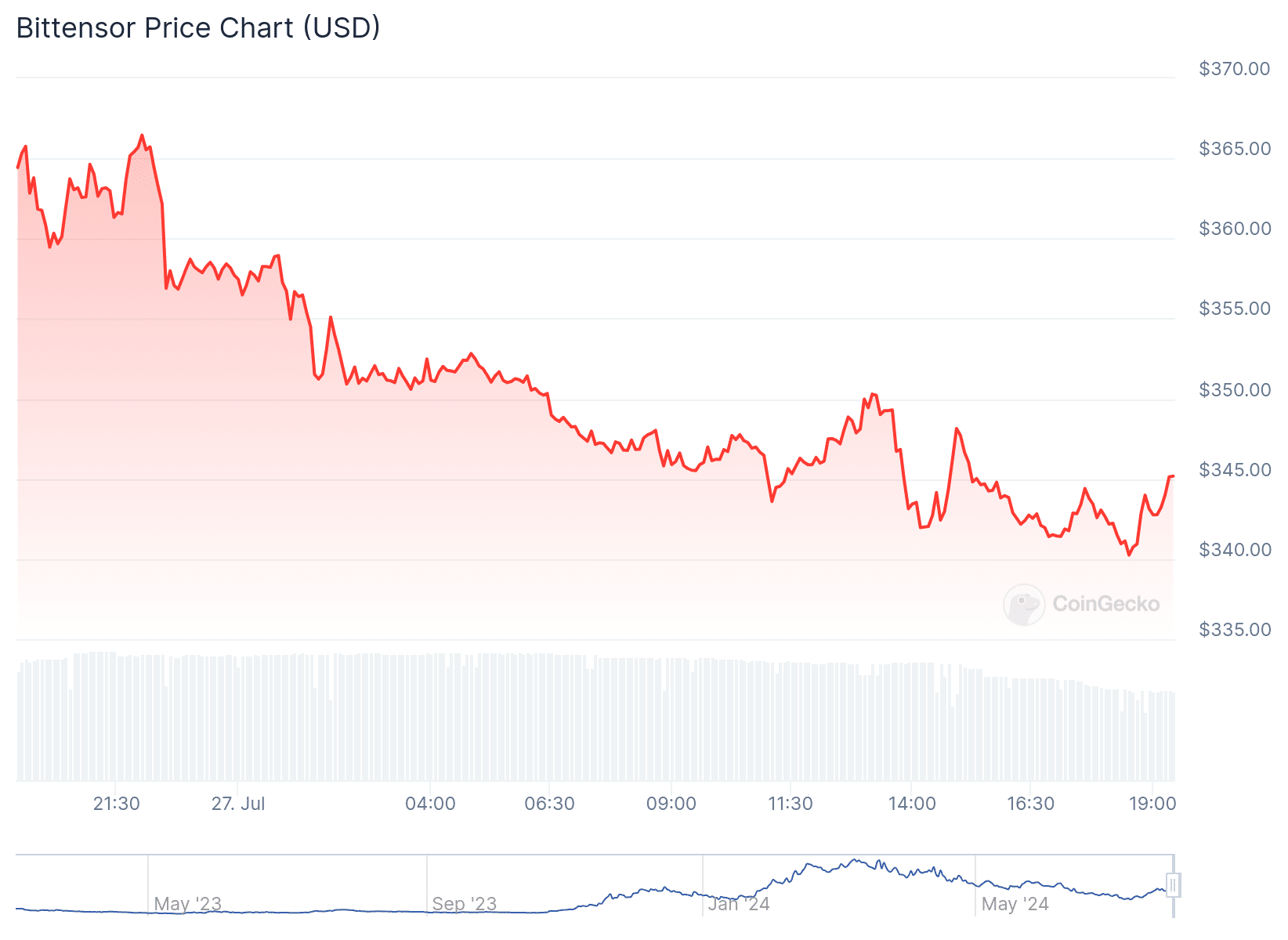

Bittensor

Bittensor (TAO) was the biggest loser among the 100 largest crypto assets, according to data from CoinGecko.

At the time of writing, TAO, the native token of decentralized AI project Bittensor, was down 5%, trading around $344. The crypto asset had a daily trading volume of $59 million and a market cap of $2.43 billion.

TAO 24 Hour Price Chart | Source: CoinGecko

Bittensor, created in 2019 by AI researchers Ala Shaabana and Jacob Steeves, initially operated as a parachain on Polkadot before transitioning to its own layer-1 blockchain in March 2023.

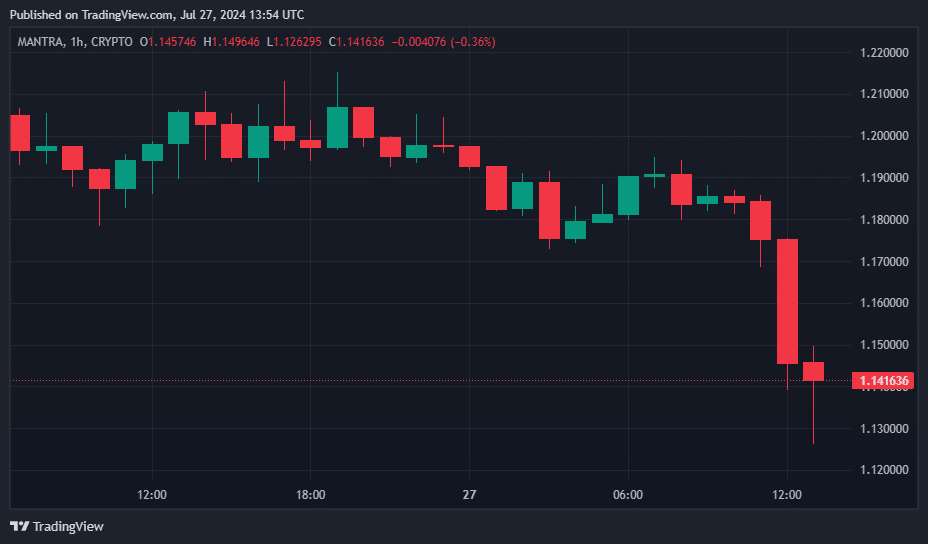

Mantra

Mantra (OM) fell 6%, trading at $1.13 at press time. The digital currency’s market cap fell to $938 million. Additionally, the 82nd largest crypto asset has a daily trading volume of $26 million.

OM Price Hourly Chart, July 26-27 | Source: crypto.news

Mantra is a modular blockchain network comprising two chains, Manta Pacific and Manta Atlantic, specialized in zero-knowledge applications.

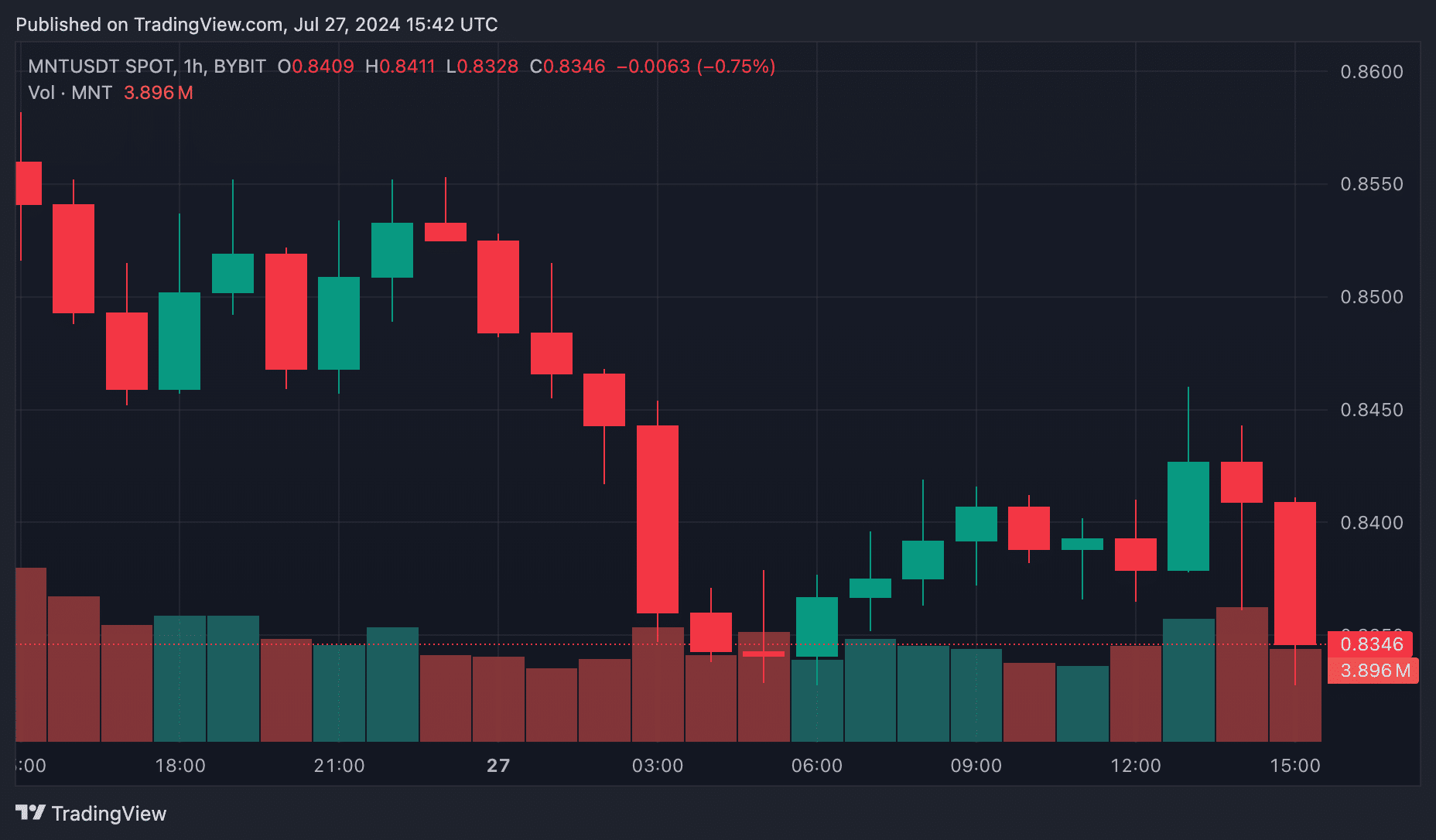

Coat

Coat (MNT) also saw a 2.4% drop in price, now trading at $0.8413. Currently, Mantle has a market cap of around $2.75 billion, which ranks 36th in the global cryptocurrency rankings by market cap, according to price data from crypto.news.

MNT Hourly Price Chart, July 26-27 | Source: crypto.news

Over the past 24 hours, MNT trading volume also fell by 6%, reaching $240 million.

Mantle, formerly known as BitDAO, is an investment DAO closely associated with Bybit. The MNT token is essential for governance, paying gas fees on the Mantle network, and staking on various platforms.

Built on the Ethereum network, Mantle provides a platform for decentralized application developers to launch their projects. It has become particularly popular for GameFi applications, leading to the formation of an internal Web3 gaming team.

Markets

Bitcoin Price Drops to $67,000 Despite Trump’s Pro-Crypto Comments, Further Correction Ahead?

Pioneer cryptocurrency Bitcoin has registered a 1.13% decline in the past 24 hours to trade at $67,400. Despite a strong pro-crypto stance from US presidential candidate Donald Trump at the Bitcoin 2024 conference, this massive selloff has raised concerns in the market about the asset’s sustainability at a higher price. However, given the recent three-week rally, a slight pullback this weekend is justifiable and necessary to regain the depleted bullish momentum.

Bitcoin Price Flag Formation Hints at Opportunity to Break Beyond $80,000

The medium-term trend Bitcoin Price remains a sideways trend amidst the formation of a bullish flag pattern. This chart pattern is defined by two descending lines that are currently shaping the price trajectory by providing dynamic resistance and support.

On July 5, BTC saw a bullish reversal from the flag pattern at $53,485, increasing its asset by 29.75% to a high of $69,400. This recent spike followed the market’s positive sentiment towards the Donald Trump speech at the Bitcoin 2024 conference in Nashville on Saturday afternoon.

Bitcoin Price | Tradingview

In his speech, Trump outlined several pro-crypto initiatives: he promised to replace SEC Chairman Gary Gensler on his first day in office, to establish a Strategic National Reserve of Bitcoin if elected, to ensure that the U.S. government holds all of its assets. Bitcoin assets and block any attempt to create a central bank digital currency (CBDC) during his presidency.

He also claimed that under his leadership, Bitcoin and cryptocurrencies will skyrocket like never before.

Despite Donald Trump’s optimistic promises, the BTC price failed to reach $70,000 and is currently trading at $67,400. As a result, Bitcoin’s market cap has dipped slightly to hover at $1.335 trillion.

However, this pullback is justified, as Bitcoin price has recently seen significant growth over the past three weeks, which has significantly improved market sentiment. Thus, price action over the weekend could replenish the depleted bullish momentum, potentially strengthening an attempt to break out from the flag pattern at $70,130.

A successful breakout will signal the continuation of the uptrend and extend the Bitcoin price forecast target at $78,000, followed by $84,000.

On the other hand, if the supply pressure on the upper trendline persists, the asset price could trigger further corrections for a few weeks or months.

Technical indicator:

- Pivot levels: The traditional pivot indicator suggests that the price pullback could see immediate support at $64,400, followed by a correction floor at $56,700.

- Moving average convergence-divergence: A bullish crossover state between the MACD (blue) and the signal (orange) ensure that the recovery dynamics are intact.

Related Articles

Frequently Asked Questions

A CBDC is a digital form of fiat currency issued and regulated by a country’s central bank. It aims to provide a digital alternative to traditional banknotes.

The proposal for a strategic national Bitcoin reserve is a major confirmation of Bitcoin’s legitimacy and potential as a reserve asset. Such a move could position Bitcoin in a similar way to gold, potentially stabilizing its price and encouraging other countries to adopt similar strategies.

Conferences like Bitcoin 2024 serve as essential platforms for networking, knowledge sharing, and showcasing new technologies within the cryptocurrency industry.

Markets

Swiss crypto bank Sygnum reports profitability after surge in first-half trading volumes – DL News

- Sygnum says it has reached profitability after increasing transaction volumes.

- The Swiss crypto bank does not disclose specific profit figures.

Sygnum, a Swiss global crypto banking group with approximately $4.5 billion in client assets, announced that it has achieved profitability after a strong first half, with key metrics showing year-to-date growth.

The company said in a Press release Compared to the same period last year, cryptocurrency spot trading volumes doubled, cryptocurrency derivatives trading increased by 500%, and lending volumes increased by 360%. The exact figures for the first half of the year were not disclosed.

Sygnum said its staking service has also grown, with the percentage of Ethereum staked by customers increasing to 42%. For institutional clients, staking Ethereum has a benefit that goes beyond the limitations of the ETF framework, which excludes staking returns, Sygnum noted.

“The approval and launch of Bitcoin and Ethereum ETFs was a turning point for the crypto industry this year, leading to a major increase in demand for trusted, regulated exposure to digital assets,” said Martin Burgherr, Chief Client Officer of Sygnum.

He added: “This is also reflected in Sygnum’s own growth, with our core business segments recording significant year-to-date growth in the first half of the year.”

Sygnum, which has also been licensed in Luxembourg since 2022, plans to expand into European and Asian markets, the statement said.

Markets

Former White House official Anthony Scaramucci says cryptocurrency bull market could be sparked by regulatory clarity

Anthony Scaramucci, founder of Skybridge Capital, says the next cryptocurrency bull market could be sparked by a new wave of clear cryptocurrency regulations.

In a new interview On CNBC’s Squawk Box, the former White House communications director said he and two other prominent industry figures traveled to Washington, D.C. to speak to officials about the dangers of Sen. Elizabeth Warren and U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler’s hardline approach to cryptocurrency regulation.

“Mark Cuban, myself, and Michael Novogratz were in Washington a few weeks ago to speak with White House officials and explain the dangers of Gary Gensler and Elizabeth Warren’s anti-crypto approach. I hope that message gets through…

“Overall, if we can get regulatory policy around Bitcoin and crypto assets in sync, we will have a bull market next year for these assets.”

Scaramucci then compares crypto assets to ride-hailing company Uber, saying regulators were initially wary of the service but eventually decided to adopt clear guidelines due to public demand.

“Remember Uber: Nobody wanted Uber. A lot of regulators didn’t want it. Mayors and deputy mayors didn’t want it, but citizens wanted Uber and eventually accepted the idea of regulating it fairly. I think we’re there now.”

The CEO also says young Democratic voters believe their leaders are making the wrong choices when it comes to digital assets.

“I think President Trump’s move toward Bitcoin and crypto assets has shaken Democrats to their core, and I think very smart, younger Democrats are recognizing that they are completely off base with their positions, completely off base with these SEC lawsuits and regulation by law enforcement, and now they need to get back to the center.”

Don’t miss a thing – Subscribe to receive email alerts directly to your inbox

Check Price action

follow us on X, Facebook And Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed on The Daily Hodl are not investment advice. Investors should do their own due diligence before making any high-risk investments in Bitcoin, cryptocurrencies or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Image generated: Midjourney

-

News11 months ago

News11 months agoVolta Finance Limited – Director/PDMR Shareholding

-

News11 months ago

News11 months agoModiv Industrial to release Q2 2024 financial results on August 6

-

News11 months ago

News11 months agoApple to report third-quarter earnings as Wall Street eyes China sales

-

News11 months ago

News11 months agoNumber of Americans filing for unemployment benefits hits highest level in a year

-

News1 year ago

News1 year agoInventiva reports 2024 First Quarter Financial Information¹ and provides a corporate update

-

News1 year ago

News1 year agoLeeds hospitals trust says finances are “critical” amid £110m deficit

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Tech1 year ago

Tech1 year agoBitcoin’s Correlation With Tech Stocks Is At Its Highest Since August 2023: Bloomberg ⋆ ZyCrypto

-

Tech1 year ago

Tech1 year agoEverything you need to know

-

News11 months ago

News11 months agoStocks wobble as Fed delivers and Meta bounces

-

Markets1 year ago

Markets1 year ago20 Top Crypto Trading Platforms to Know

-

News11 months ago

News11 months agoHutchinson House and Senate Candidates Report Finances Ahead of Election