Markets

7 Altcoins To Consider Buying For The Next Bull Run In 2024 – Forbes Advisor INDIA

A bull run is defined as a period when the majority of investors’ demand outweighs supply, market confidence hits a peak, and prices rise. If you witness prices quickly climbing in a given market, this could be a sign that the majority of investors are becoming “bullish,” which means they are optimistic about the price increasing further. It may also mean that you’re looking at the starting point of a bull market. Bitcoin Halving appears to be fueling the next bull run in 2024.

Investing in the best altcoins can be rewarding as they offer diversification and potentially higher returns. However, it is important to approach the altcoin landscape with caution and do a thorough research. Understanding the development team, technology, community and use case of altcoins are vital factors for making informed decisions.

Additionally, it is essential to be updated on market trends and regulatory changes to navigate the ever-evolving cryptocurrency landscape. Investors can make informed and strategic decisions when evaluating these key factors when considering altcoin investments. Let us see some altcoins to consider buying for the next bull run in 2024.

Featured Partners

Legacy

Over 1 Million Investors Trust Mudrex for Their Crypto Investments

Security

Mudrex is Indian Govt. recognized platform with 100% insured deposits stored in encrypted wallets

Fees

Enjoy zero crypto deposit fees and industry’s best fee rates.

Please invest carefully, your capital is at risk

Best Altcoins for Next Bull Run

Ethereum (ETH)

Market cap: $404.96 billion

Ethereum is one of the biggest altcoins on the crypto market. Of the almost $2.24 trillion that portrays the total market capitalization of the 20,000-plus crypto assets, more than 17% is held in ETH. It is a distributed computing network where users can use the blockchain to run dApps and host smart contracts.

Ethereum critics point to high transaction fees. However, ETH is here to stay, with thousands of apps and other altcoins powered by its blockchain.

Related: How To Buy Ethereum

Solana (SOL)

Market cap: $62.75 billion

Solana gained popularity among crypto investors, helped by its lightning-fast transaction speeds and low fees. It is a blockchain platform that is highly focused on overcoming the challenges of speed and scalability faced by many existing blockchains.

On March 4, 2024, it surged by approximately 7% in 24 hours, surpassing the BNB coin and securing a higher rank among the top five cryptocurrencies. Solana has jumped nearly 16.60% in the last seven days.

On June 27, 2024, it decreased by approximately 0.11% in 24 hours, but BNB coin surpassed and secured a higher rank among the top five cryptocurrencies due to Solana being down by 0.48% in the last seven days.

The surge in SOL brought the digital asset to its highest point in two years, reaching levels last observed in April 2022, three months after the culmination of the bull cycle in 2021. However, it dropped slightly and landed on the fifth slot, with BNB regaining dominance shortly after March 4.

Related: How To Buy Solana

Dogecoin (DOGE)

Market cap: $17.57 billion

Dogecoin is a dog-inspired crypto and the original meme token. True to its fame, it has been one of the most highly volatile yet rewarding investments. As of June 27, 2024, DOGE is down by 2.24% in the last 24 hours and is trading at $0.1212.

Over the years, this meme coin has been criticized for offering a small-scale real-world utility, a centralized holder base, and an unlimited supply. However, it is tricky to debate these criticisms; DOGE has gained ground in network usage over the past year, as it has been up by around 87.62%. On top of that, it’s tough to deny the gigantic community support with the support of industry-notable celebrities such as Elon Musk.

Related: How To Buy Dogecoin

Polygon (MATIC)

Market cap: $5.40 billion

Polygon stands out as a premier layer-2 scaling solution for the ETH blockchain. It was formerly known as Matic Network, and its primary mission is to alleviate Ethereum’s transaction costs and scalability challenges.

Polygon offers a foundation for interconnecting and constructing scalable blockchain networks. As of June 27, it is trading at $0.5501. In the cryptocurrency ranking, it is among the top 20 cryptocurrencies.

Cosmos (ATOM-USD)

Market cap: $2.63 billion

Cosmos (ATOM-USD) is in charge of solving some slow transactions and high-cost problems. It emerged with Tendermint (software) to create an interconnected network of blockchains. ATOM—a native token of Cosmos, is a decentralized network that provides developers with open-source tools to create their own interoperable blockchains. Cosmos is working to become the “internet for blockchain.”

The Cosmos ecosystem permits blockchains to willingly share tokens and data across all the blockchains in the system. One of its essential roles is to secure the Cosmos Hub and regulate the network of the ATOM tokens obtained via a proof-of-stake algorithm.

A recent report by the Cosmos blog focuses on the steadiness of Inter-Blockchain Communication (IBC) volume and close connections that assure high diversity in tokens and, in turn, higher liquidity. The interchain ecosystem is an area where blockchains act as joined blocks that communicate via the IBC protocol, where developers can run their rare chains as different blocks with different practicality.

Kaspa (KAS-USD)

Market cap: $4.18 billion

Kaspa cryptocurrency was launched in 2021 by implementing the GHOSTDAG protocol, working on blockDAG for fast confirmation and high block rates. The Kaspa community projects it as a cryptocurrency that unfolds the blockchain trilemma to stabilize security, speed, and scalability. In 2023, this project encountered transformational developments, including the switch to state-of-the-art ASIC miners.

In addition, Kaspa planned listings on exchanges and launched ideas like the Kaspium mobile wallet and Wrapped Kaspa. It has ambitious plans for the future, including sophisticated smart contract functionalities, Rusy Kaspa Testnet 11 public, and exceeding ten blocks per second.

Stellar (XLM-USD)

Market cap: $2.59 billion

Stellar (XL,-USD) is a decentralized, public blockchain that provides developers with tools to create more likely cash experiences than crypto. Given its accountability for peer-to-peer connectivity to the world’s financial system, it can be a great altcoin to add to your investment portfolio in this bull run.

Stellar’s biggest aim is to make money move easily and quickly. The network is cheaper, faster, and more energy-efficient than most systems based on blockchain. Lumens behave as mediators for transactions and keep a smooth-running system. Its strength is its security. With XLM holders holding the keys, the network is more secure for transactions.

Stellar has lately launched some very amazing features such as Soroban and spread Lumens into positive projects through its Community Fund. Additionally, through the compassionate side of the project via Stellar Aid Assist, it has already helped those in need by sending over $2 million to them.

Note: The market capitalization is taken from CoinMarketCap as of June 27, 2024.

Factors Driving Altcoin’s Growth

Market Demand: Altcoins are initially driven by market demands. Investors are more likely to invest in altcoins with higher growth potential. Consumer sentiments, market trends, and investors’ confidence contribute to the market demand for altcoins.

Regulatory Policy: Regulatory policies can play an important role in the development and growth of altcoins. Regulatory bodies or governments can impose restrictions on cryptocurrency usage, which affects its demand.

Technology: The primary or basic technology behind an altcoin also affects its growth and development. Altcoins with unique features or innovative technology are more likely to gain popularity among others.

Competition: Competition is huge in the cryptocurrency market, and it can also affect the growth and development of altcoins. Altcoins offering similar features might struggle to gain market share.

Economic Conditions: Another factor affecting Altcoin’s growth and development is that in times of economic uncertainty, investors are more likely to invest in altcoins as an economic instability or hedge against inflation.

Featured Partners

Legacy

Over 1 Million Investors Trust Mudrex for Their Crypto Investments

Security

Mudrex is Indian Govt. recognized platform with 100% insured deposits stored in encrypted wallets

Fees

Enjoy zero crypto deposit fees and industry’s best fee rates.

Please invest carefully, your capital is at risk

Altcoin Investment Strategies for the Next Bull Run

Support strategies by avoiding decisions made with emotions involved and creating an effective investment plan that involves target prices for entry and exit. You must stay abreast of market events and news and limit your social media consumption, which often encourages greedy behavior. Let us see Altcoin’s investment strategies for the next bull run.

Risk Management

Risk management is the initial step every trader needs to think about and learn while strategizing their investment plans, but it is generally overlooked until it’s very late. Investors need to manage risk productively by calculating how much is affordable to risk on an all-inclusive investment and then sticking to it by using a stop-loss order to limit losses when the market is not in its favor.

Investment Plan

As we know, the crypto market is highly unpredictable and volatile; it is highly recommended that you steer clear of the temptation to spring into buying at the first sign of a rally with all your savings. Carefully evaluate how much you’re willing to invest in other cryptocurrencies like Bitcoin and Ethereum and also in altcoins.

While investing in altcoins, you may consider industries with high potential and divide your portfolio between them. For example, 30% to Real World Assets, 20% to artificial intelligence, 10% to Layer-2s etc.

In the crypto world, real-world assets refer to the tokenization of tangible assets that only exist in the physical world and are brought on the chain. Layer 2 refers to a secondary framework or protocol built on top of an existing blockchain system.

Then consider rupee-cost averaging into your position to benefit from any dips.

Stick To Profit Targets

One of the major errors in investing is not being aware of when to take profits. This is accurate, especially for crypto, where the market is highly volatile and driven by social media, overnight sensations, emotion, and greed. As prices increase, set realistic targets for gaining profits and cling to them. A well-disciplined approach to profit targets can protect you from unexpected market downturns.

If you do not know where to exit, scaling out is the best strategy. Sell using rupee-cost averaging. For example, sell 25% altcoin at price points 1 and 2 each, etc. This will help ensure you make profits while still benefiting from further upside.

Diversify Your Risk

Many investors look to altcoin for higher risk-reward assets while considering BTC and ETH as blue-chip cryptocurrencies. Given the high risk of altcoins, investors should consider restricting them to a mini portion of their portfolio. The reward opportunity is higher. So, investors still have the potential for fair gains without over-granting and exposing them to excessive downside.

Remember that any gains can be temporary, and many altcoins are unsuitable for long-term buy-and-hold portfolios. Most altcoins usually fall out of favor between market cycles and downturns of 95%.

This means having a logical exit strategy with your targeted price set before you enter the trade is crucial. So, if investors want to consider a portfolio with altcoins, settle it with a mixture of high-cap cryptos and altcoins to ease volatility.

Decision Making

It’s a bad investment decision based on hype or fear of missing out (FOMO). Cryptocurrency is a unique asset class because every transaction is recorded on a chain for public display. It means you have enough information and tools to help you make informed decisions instead of shifting through the tea leaves like in many other markets.

Below are a few free tools you can use:

- AI: Put in any address for a methodical breakdown of transactions, portfolios, and more. Get an analysis of in-depth data for individual blockchains. Layer-2s, dApps, and DeFi with metrics like trade volume and total value locked.

- Fi: It is like an antivirus scanner for detecting harmful or flawed smart contract codes or intentional rug-pulls in cryptocurrency and smart contracts.

- Arkham Intelligence: Arkham is a blockchain observer that helps you understand the relationship between wallets. You can use it to mark shady transfers or prevent a Sybil mistake when airdrop framing.

- Cryto-fundraising.info: This tool tracks investors’ VC funding for new crypto projects, giving them insights into the firms and the amount raised.

Use the above tools to thoroughly research a project’s fundamentals, market position, and team. You can also do this by conducting a strengths, weaknesses, opportunities, and threats (SWOT) analysis. Always challenge your thesis and look for reasons for a project’s crash rather than information confirming your bias.

More Resources in Cryptocurrency

Explore Our Top Cryptocurrency Picks

Crypto Buying Guides

Markets

Today’s top crypto gainers and losers

Over the past 24 hours, Jupiter and JasmyCoin emerged as the top gainers among the top 100 crypto assets, while Bittensor and Mantra plunged as the top losers.

Top Winners

Jupiter

Jupiter (JUP) led the charge among the biggest gainers on July 27.

At the time of writing, the crypto asset had surged 12.6% in the past 24 hours and was trading at $1.16. JUP’s daily trading volume was hovering around $282 million, according to data from crypto.news.

JUP Hourly Price Chart, July 26-27 | Source: crypto.news

Additionally, the cryptocurrency’s market cap stood at $1.56 billion, making it the 62nd largest crypto asset, according to CoinGecko. Despite the recent price surge, the token is still down 42.6% from its all-time high of $2 reached on Jan. 31.

Jupiter functions as a decentralized exchange aggregator that allows users to trade Solana-based tokens. The platform also offers users the best routes for direct trades between multiple exchanges and liquidity pools.

In addition to being a DEX aggregator, Jupiter has expanded into a “full stack ecosystem” by launching several new projects, including a dedicated pool to support perpetual trading and plans for a stablecoin.

JasmyCoin

JasmyCoin (JASMI) has increased by 12% in the last 24 hours and is trading at $0.0328 at press time. JASMY’s daily trading volume has increased by 10% in the last 24 hours, reaching $146 million.

JASMY Hourly Price Chart, July 26-27 | Source: crypto.news

The asset’s market cap has surpassed the $1.5 billion mark, making it the 60th largest cryptocurrency at the time of reporting. However, the self-proclaimed “Bitcoin of Japan” is still down 99.3% from its all-time high of $4.79 on February 16, 2021.

JASMY is the native token of Jasmy Corporation, a Japanese Internet of Things provider. The platform seeks to merge the decentralization of blockchain technology with IoT, allowing users to convert their digital information into digital assets.

The initiative was launched by Kunitake Ando, former COO of Sony Corporation, along with Kazumasa Sato, former CEO of Sony Style.com Japan Inc., Hiroshi Harada, executive financial analyst at KPMG, and other senior executives from Japan.

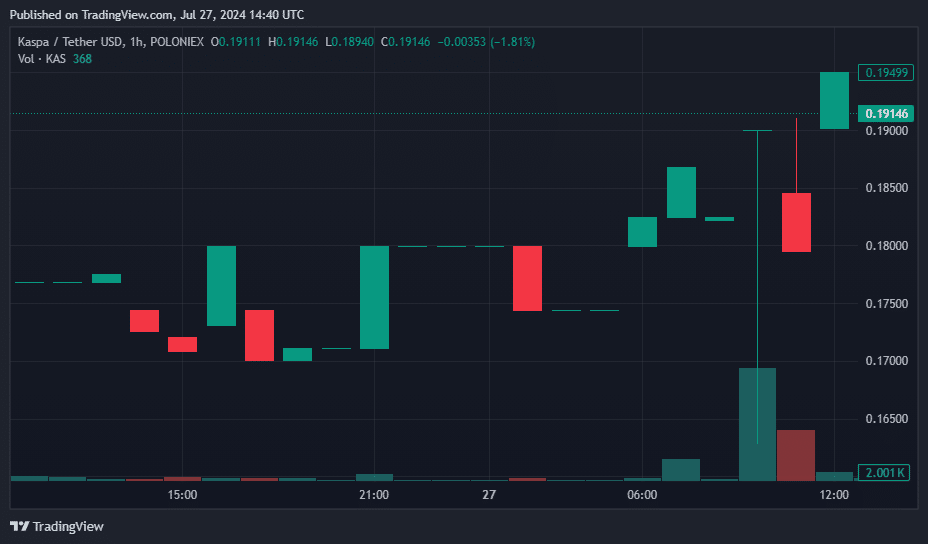

Kaspa

Kaspa (KAS) saw a 100% increase in trading volume and an 8% increase in price over the past 24 hours, trading at $0.19 at the time of publication.

KAS Hourly Price Chart, July 26-27 | Source: crypto.news

According to data from CoinGecko, Kaspa now ranks 27th in the global cryptocurrency list, with a circulating supply of approximately 24.29 billion KAS tokens and a market capitalization of $4.59 billion.

Kaspa is a cryptocurrency designed to deliver a high-performance, scalable, and secure blockchain platform. Its unique Layer-1 protocol includes the GhostDAG protocol, a proof-of-work (PoW) consensus mechanism that enables faster block times and higher transaction throughput compared to standard blockchains.

Unlike Bitcoin, GhostDAG allows multiple blocks to be created simultaneously, speeding up transactions and increasing block rewards for miners.

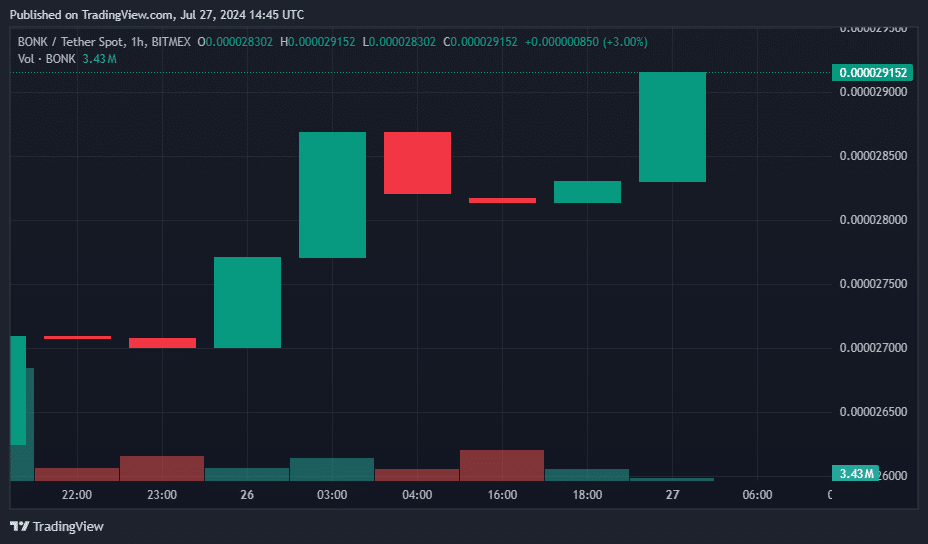

Bonk

Bonk (BONK) is the only one coin meme which made it to this list of biggest gainers and jumped 8.6% in the last 24 hours. Trading at $0.000030, the Solana-based meme coin’s market cap has surpassed $2.1 billion, surpassing Floki (FLOKI), another competing dog-themed coin with a market cap of $1.78 billion.

BONK Hourly Price Chart, July 26-27 | Source: crypto.news

BONK’s daily trading volume hovered around $285 million. However, BONK is still down 33.5% from its all-time high of $0.000045, reached on March 4.

Bonk, a meme coin that rose to prominence in 2023, has contributed significantly to Solana’s value increase amid the meme coin frenzy.

Bonk started out as a simple dog-themed coin. It has since expanded its features to include integration with decentralized finance. The project also partners with cross-chain communication protocols, NFT marketplaces, and various other cryptocurrency ecosystems.

BONK trading pairs are now listed on major exchanges including Binance, Coinbase, OKX, and Bitstamp.

The big losers

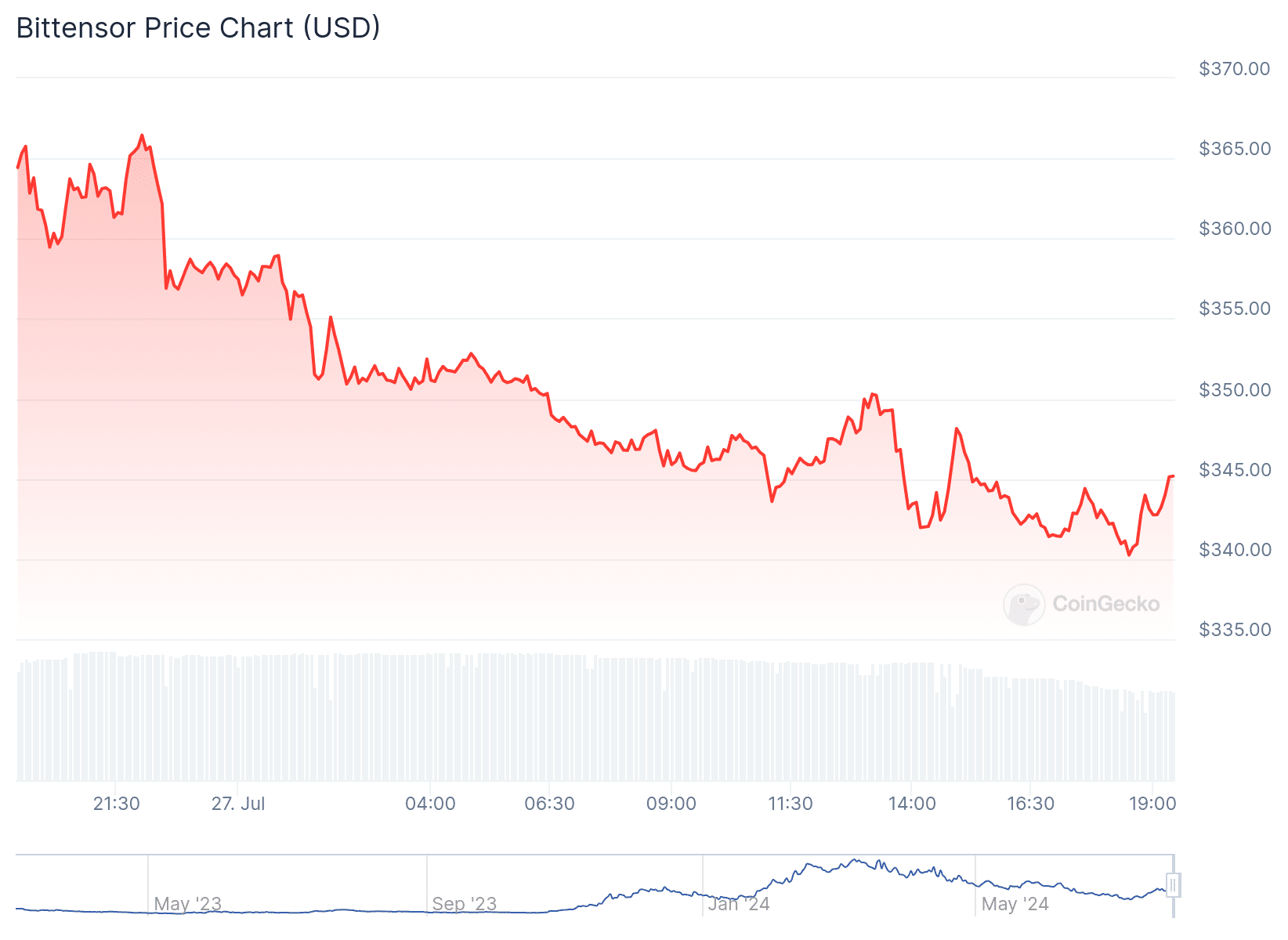

Bittensor

Bittensor (TAO) was the biggest loser among the 100 largest crypto assets, according to data from CoinGecko.

At the time of writing, TAO, the native token of decentralized AI project Bittensor, was down 5%, trading around $344. The crypto asset had a daily trading volume of $59 million and a market cap of $2.43 billion.

TAO 24 Hour Price Chart | Source: CoinGecko

Bittensor, created in 2019 by AI researchers Ala Shaabana and Jacob Steeves, initially operated as a parachain on Polkadot before transitioning to its own layer-1 blockchain in March 2023.

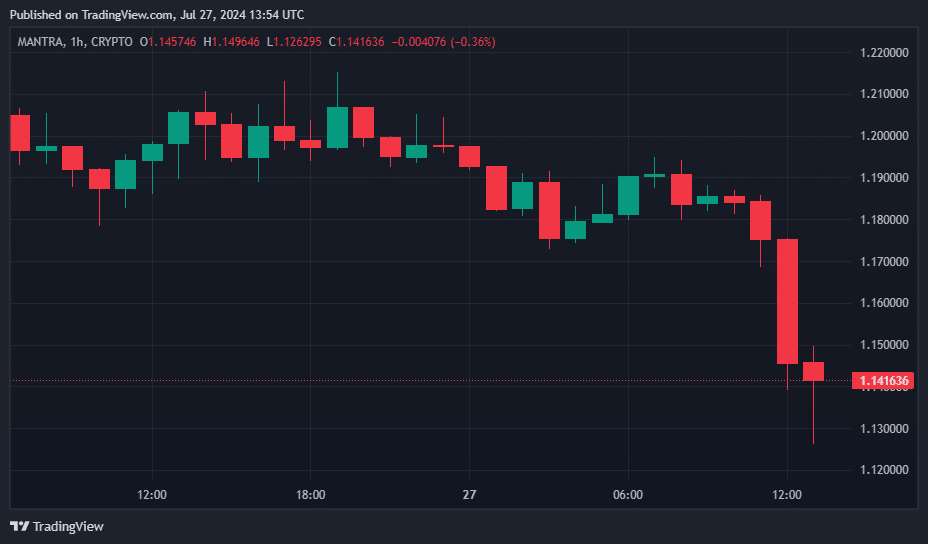

Mantra

Mantra (OM) fell 6%, trading at $1.13 at press time. The digital currency’s market cap fell to $938 million. Additionally, the 82nd largest crypto asset has a daily trading volume of $26 million.

OM Price Hourly Chart, July 26-27 | Source: crypto.news

Mantra is a modular blockchain network comprising two chains, Manta Pacific and Manta Atlantic, specialized in zero-knowledge applications.

Coat

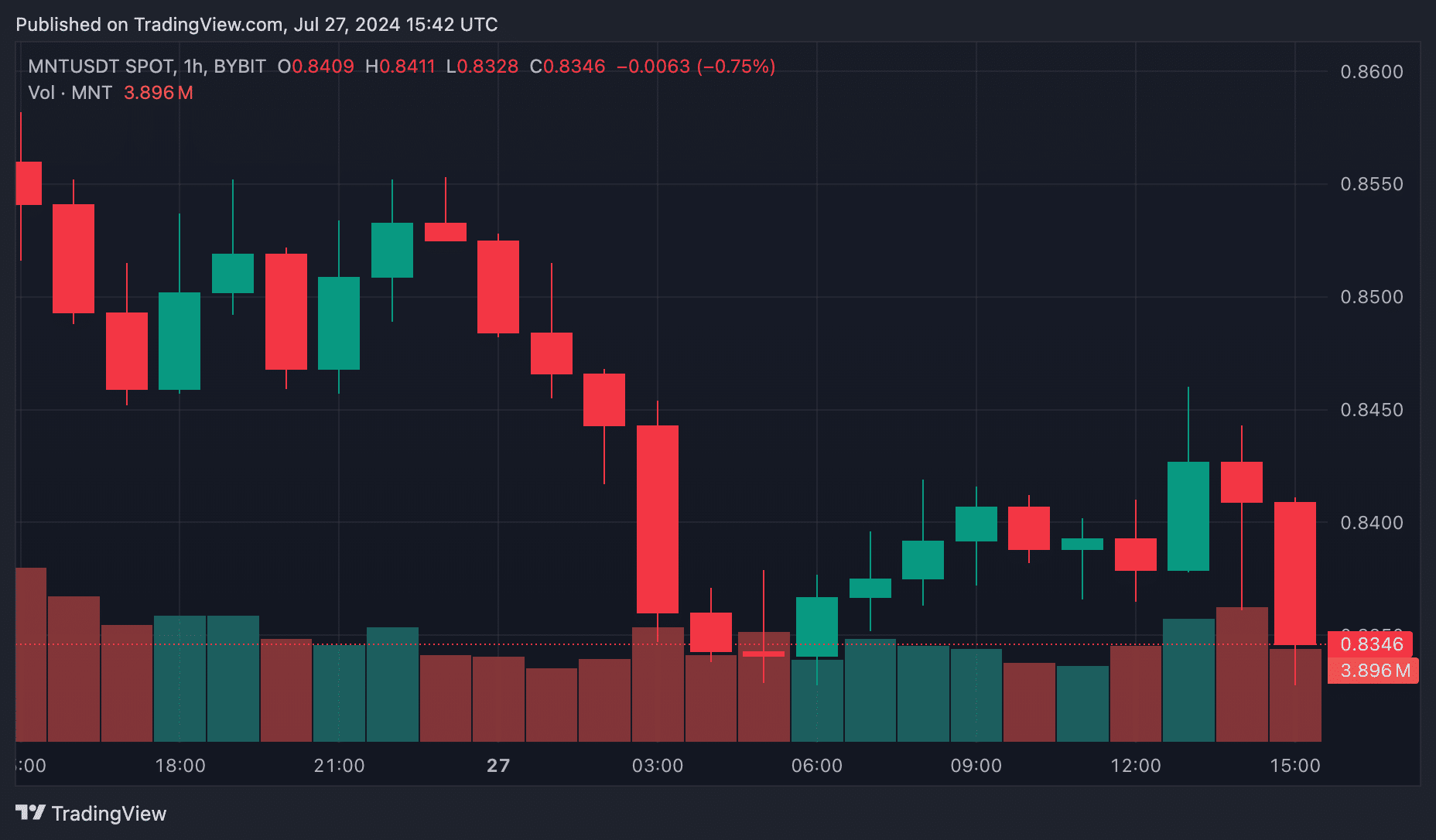

Coat (MNT) also saw a 2.4% drop in price, now trading at $0.8413. Currently, Mantle has a market cap of around $2.75 billion, which ranks 36th in the global cryptocurrency rankings by market cap, according to price data from crypto.news.

MNT Hourly Price Chart, July 26-27 | Source: crypto.news

Over the past 24 hours, MNT trading volume also fell by 6%, reaching $240 million.

Mantle, formerly known as BitDAO, is an investment DAO closely associated with Bybit. The MNT token is essential for governance, paying gas fees on the Mantle network, and staking on various platforms.

Built on the Ethereum network, Mantle provides a platform for decentralized application developers to launch their projects. It has become particularly popular for GameFi applications, leading to the formation of an internal Web3 gaming team.

Markets

Bitcoin Price Drops to $67,000 Despite Trump’s Pro-Crypto Comments, Further Correction Ahead?

Pioneer cryptocurrency Bitcoin has registered a 1.13% decline in the past 24 hours to trade at $67,400. Despite a strong pro-crypto stance from US presidential candidate Donald Trump at the Bitcoin 2024 conference, this massive selloff has raised concerns in the market about the asset’s sustainability at a higher price. However, given the recent three-week rally, a slight pullback this weekend is justifiable and necessary to regain the depleted bullish momentum.

Bitcoin Price Flag Formation Hints at Opportunity to Break Beyond $80,000

The medium-term trend Bitcoin Price remains a sideways trend amidst the formation of a bullish flag pattern. This chart pattern is defined by two descending lines that are currently shaping the price trajectory by providing dynamic resistance and support.

On July 5, BTC saw a bullish reversal from the flag pattern at $53,485, increasing its asset by 29.75% to a high of $69,400. This recent spike followed the market’s positive sentiment towards the Donald Trump speech at the Bitcoin 2024 conference in Nashville on Saturday afternoon.

Bitcoin Price | Tradingview

In his speech, Trump outlined several pro-crypto initiatives: he promised to replace SEC Chairman Gary Gensler on his first day in office, to establish a Strategic National Reserve of Bitcoin if elected, to ensure that the U.S. government holds all of its assets. Bitcoin assets and block any attempt to create a central bank digital currency (CBDC) during his presidency.

He also claimed that under his leadership, Bitcoin and cryptocurrencies will skyrocket like never before.

Despite Donald Trump’s optimistic promises, the BTC price failed to reach $70,000 and is currently trading at $67,400. As a result, Bitcoin’s market cap has dipped slightly to hover at $1.335 trillion.

However, this pullback is justified, as Bitcoin price has recently seen significant growth over the past three weeks, which has significantly improved market sentiment. Thus, price action over the weekend could replenish the depleted bullish momentum, potentially strengthening an attempt to break out from the flag pattern at $70,130.

A successful breakout will signal the continuation of the uptrend and extend the Bitcoin price forecast target at $78,000, followed by $84,000.

On the other hand, if the supply pressure on the upper trendline persists, the asset price could trigger further corrections for a few weeks or months.

Technical indicator:

- Pivot levels: The traditional pivot indicator suggests that the price pullback could see immediate support at $64,400, followed by a correction floor at $56,700.

- Moving average convergence-divergence: A bullish crossover state between the MACD (blue) and the signal (orange) ensure that the recovery dynamics are intact.

Related Articles

Frequently Asked Questions

A CBDC is a digital form of fiat currency issued and regulated by a country’s central bank. It aims to provide a digital alternative to traditional banknotes.

The proposal for a strategic national Bitcoin reserve is a major confirmation of Bitcoin’s legitimacy and potential as a reserve asset. Such a move could position Bitcoin in a similar way to gold, potentially stabilizing its price and encouraging other countries to adopt similar strategies.

Conferences like Bitcoin 2024 serve as essential platforms for networking, knowledge sharing, and showcasing new technologies within the cryptocurrency industry.

Markets

Swiss crypto bank Sygnum reports profitability after surge in first-half trading volumes – DL News

- Sygnum says it has reached profitability after increasing transaction volumes.

- The Swiss crypto bank does not disclose specific profit figures.

Sygnum, a Swiss global crypto banking group with approximately $4.5 billion in client assets, announced that it has achieved profitability after a strong first half, with key metrics showing year-to-date growth.

The company said in a Press release Compared to the same period last year, cryptocurrency spot trading volumes doubled, cryptocurrency derivatives trading increased by 500%, and lending volumes increased by 360%. The exact figures for the first half of the year were not disclosed.

Sygnum said its staking service has also grown, with the percentage of Ethereum staked by customers increasing to 42%. For institutional clients, staking Ethereum has a benefit that goes beyond the limitations of the ETF framework, which excludes staking returns, Sygnum noted.

“The approval and launch of Bitcoin and Ethereum ETFs was a turning point for the crypto industry this year, leading to a major increase in demand for trusted, regulated exposure to digital assets,” said Martin Burgherr, Chief Client Officer of Sygnum.

He added: “This is also reflected in Sygnum’s own growth, with our core business segments recording significant year-to-date growth in the first half of the year.”

Sygnum, which has also been licensed in Luxembourg since 2022, plans to expand into European and Asian markets, the statement said.

Markets

Former White House official Anthony Scaramucci says cryptocurrency bull market could be sparked by regulatory clarity

Anthony Scaramucci, founder of Skybridge Capital, says the next cryptocurrency bull market could be sparked by a new wave of clear cryptocurrency regulations.

In a new interview On CNBC’s Squawk Box, the former White House communications director said he and two other prominent industry figures traveled to Washington, D.C. to speak to officials about the dangers of Sen. Elizabeth Warren and U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler’s hardline approach to cryptocurrency regulation.

“Mark Cuban, myself, and Michael Novogratz were in Washington a few weeks ago to speak with White House officials and explain the dangers of Gary Gensler and Elizabeth Warren’s anti-crypto approach. I hope that message gets through…

“Overall, if we can get regulatory policy around Bitcoin and crypto assets in sync, we will have a bull market next year for these assets.”

Scaramucci then compares crypto assets to ride-hailing company Uber, saying regulators were initially wary of the service but eventually decided to adopt clear guidelines due to public demand.

“Remember Uber: Nobody wanted Uber. A lot of regulators didn’t want it. Mayors and deputy mayors didn’t want it, but citizens wanted Uber and eventually accepted the idea of regulating it fairly. I think we’re there now.”

The CEO also says young Democratic voters believe their leaders are making the wrong choices when it comes to digital assets.

“I think President Trump’s move toward Bitcoin and crypto assets has shaken Democrats to their core, and I think very smart, younger Democrats are recognizing that they are completely off base with their positions, completely off base with these SEC lawsuits and regulation by law enforcement, and now they need to get back to the center.”

Don’t miss a thing – Subscribe to receive email alerts directly to your inbox

Check Price action

follow us on X, Facebook And Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed on The Daily Hodl are not investment advice. Investors should do their own due diligence before making any high-risk investments in Bitcoin, cryptocurrencies or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Image generated: Midjourney

-

Videos1 month ago

Videos1 month agoAbsolutely massive: the next higher Bitcoin leg will shatter all expectations – Tom Lee

-

News12 months ago

News12 months agoVolta Finance Limited – Director/PDMR Shareholding

-

News12 months ago

News12 months agoModiv Industrial to release Q2 2024 financial results on August 6

-

News12 months ago

News12 months agoApple to report third-quarter earnings as Wall Street eyes China sales

-

News12 months ago

News12 months agoNumber of Americans filing for unemployment benefits hits highest level in a year

-

News1 year ago

News1 year agoInventiva reports 2024 First Quarter Financial Information¹ and provides a corporate update

-

News1 year ago

News1 year agoLeeds hospitals trust says finances are “critical” amid £110m deficit

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Hit $100 Billion in 2024, Fueling Insane Investor Optimism ⋆ ZyCrypto

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Videos1 year ago

Videos1 year ago$1,000,000 worth of BTC in 2025! Get ready for an UNPRECEDENTED PRICE EXPLOSION – Jack Mallers

-

Videos1 year ago

Videos1 year agoABSOLUTELY HUGE: Bitcoin is poised for unabated exponential growth – Mark Yusko and Willy Woo

-

Tech1 year ago

Tech1 year agoBlockDAG ⭐⭐⭐⭐⭐ Review: Is It the Next Big Thing in Cryptocurrency? 5 questions answered