News

‘Mission-Driven’ Catholic Credit Unions Offer Members Essential Financial Lifeline

(OSV News) — At the height of the COVID-19 pandemic, Catholic dioceses across America struggled to keep employees on the payroll as offices and schools closed. With churches empty and donations in decline, their best hope for help was the federal government’s Paycheck Protection Program, known as the PPP.

Established by the $2.2 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act in March 2020 — and implemented by the Small Business Administration with support from the Treasury Department — the PPP provided funds for payroll costs, including benefits.

All that was required was to apply through a participating lender.

But that’s where things got tough — some big banks not only didn’t want to help dioceses with loans, they wouldn’t even talk to them.

Robert Kloska — a trustee of Catholic Credit Unions of America and director of partnerships at Notre Dame Federal Credit Union — told OSV News that one California diocese reported, “Our bank won’t even return our phone calls — they’re completely ignoring us.”

That’s when Notre Dame FCU — a Catholic credit union launched in 1941 at the University of Notre Dame in Indiana, with more than 54,000 current members — put nearly $900 million in assets to work for the church. It ultimately arranged $230 million in PPP loans — including to 17 dioceses and 850 Catholic parishes and schools.

“We were one of the top PPP lenders in the country,” Kloska said, “because we didn’t prioritize profitability — we served our mission. And in a bank, if there are more profitable things to do, they can ignore the church. But we didn’t do that.”

In 1960, there were more than 825 credit unions in the U.S. with Catholic affiliation. Now, there are fewer than 100.

Credit unions—not-for-profit financial institutions owned by their members—are, Kloska noted, a unique reflection of Catholic values.

“Credit unions, by structure, instantiate many aspects of Catholic social teaching,” he explained. “The idea of people participating and being empowered in their own financial health — by owning the institution they bank with — takes them from being customers at the whim of the corporation,” Kloska said. “They become stakeholders.”

Brian McCue — president and CEO of Unity Catholic Federal Credit Union, founded in 1942 and serving 9,000 members in the Diocese of Cleveland — agrees.

“We can support our community more closely because we’re in touch with them — we know their needs and we’re more agile in making decisions,” McCue said. Unity Catholic, with $94 million in assets, will lend to someone a bank might not consider, “because we know who they are and we know where they’re coming from,” he said.

Operational priorities, McCue emphasized, are different.

“As credit unions, we’re not beholden to shareholders to make a profit and make money — we’re beholden to our members to help them manage their lives,” he added. “Just as you would be supported in your faith at church,” McCue suggested, “when you come to us, we support you with your finances.”

Popes past and present—including Pope Francis, Pope Benedict XVI, St. John Paul II, St. Paul VI, St. John XXIII, and Pope Pius XII—have advocated credit unions. St. Pius X—as a parish priest—even organized credit unions for his flock.

Canadian-born American priest Monsignor Pierre Hevey — pastor of Sainte-Marie Parish in Manchester, New Hampshire — is credited with founding the first U.S. credit union, La Caisse Populaire, Ste-Marie (The People’s Bank), in 1908.

Intended to serve Monsignor Hevey’s parishioners—predominantly French-American mill workers—it still operates in Manchester. Its website proudly states: “It costs no more to be a member of St. Mary’s Bank now than it did in 1908. For only $5, anyone can become a member by purchasing a share of the capital stock.”

When St. Ann’s Arlington Federal Credit Union opened in 1949, manager Mary Green said, it helped members with mortgages. But by 2024 — with $3 million in assets and the average home listing in Arlington, Va., at $809,000 — its offerings have necessarily changed.

Located in the Diocese of Arlington — a suburb just outside Washington — the bulk of St. Ann’s business now is new and used auto loans and auto title loans, as well as unsecured (signature) loans up to $10,000.

“There are people sitting in the pews next to us at St. Ann Parish in Arlington who don’t know how they’re going to put food on the table,” Green noted. “You don’t know who these people are — because they don’t wear a sign around their neck that says so. But Arlington is a very expensive place to live, and there are people in great need.”

About a dozen large accounts — on a percentage basis — make up the bulk of deposits. Their holders, Green said, keep their money with St. Ann’s because they believe in its ministry.

“People of all income levels will borrow from us,” she shared. “But our ministry is making unsecured loans to people to keep them away from predatory lenders and to keep them out of credit card debt.”

In Virginia — which has some of the weakest consumer protections in the United States — short-term loan and title lenders can charge annual percentage rates in excess of 300%.

“I consider it a victory,” Green said, “when someone who has borrowed from us comes back to me before they make a financial mistake.”

Green also offers credit counseling. The sessions, she said, always start the same way.

“I will say three things: It’s all confidential; there’s no judgment here; and you didn’t get into this situation overnight, and you’re not going to get out of it overnight. But we’re going to try to look at your situation and find solutions,” she explained.

“And I can’t tell you how many times, that’s when someone starts crying,” Green told OSV News. “What they usually say is, ‘I never imagined I could get to a place like this, and someone would do this.’”

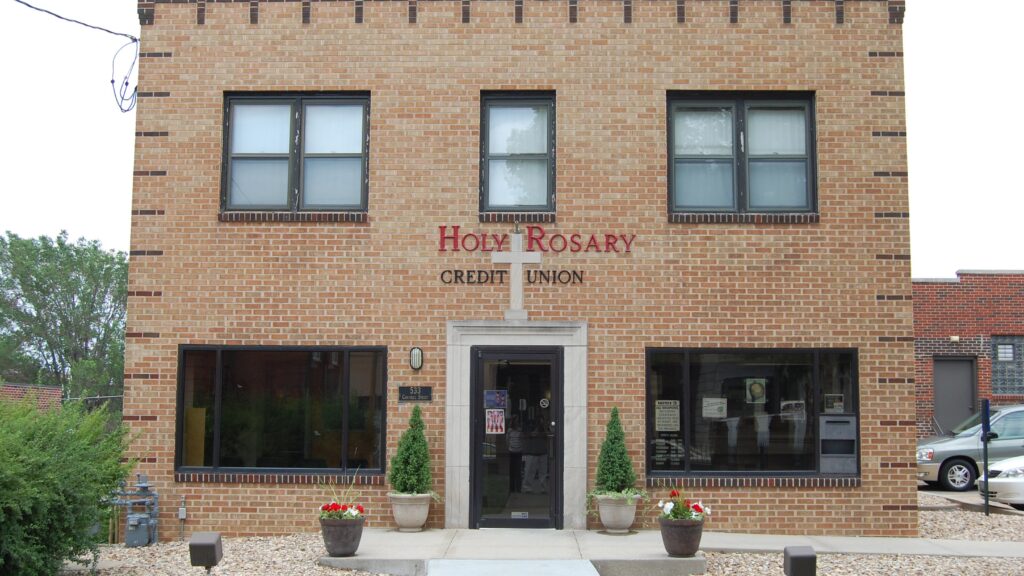

Holy Rosary Credit Union in Kansas City, Missouri — founded in 1943 by Italian immigrants, all parishioners of the city’s Holy Rosary Parish — is also no stranger to the payday lending industry.

“When I came to Holy Rosary, that was my main goal: I was going to fight payday loans,” said President Carole Wight, who diligently crafted a program to combat them.

“But I realized, ‘Carole, that’s not enough. They need to have cars to drive to work.’ And then I realized, ‘Carole, that’s not enough. They need to have decent homes to live in,’” Wight recalled. “And then I thought, ‘Carole, that’s not enough. They need businesses, because immigrants typically gain wealth by starting businesses.’”

And so it is for Wight, who in 16 years has grown Holy Rosary’s assets from $8.9 million to $43 million. Two recent robberies — no one was injured in either incident — were the only such incidents in his era.

Holy Rosary’s Italian immigrant founders “joined this credit union to survive,” Wight explained. “They literally couldn’t borrow a dime anywhere to buy a mattress to lay their heads on.”

Immigrants faced extreme discrimination, Wight noted.

“The chairman of the board — when I arrived — told the story of (how) as an 8-year-old boy, he was walking to see his grandmother, who worked in the garment industry as a seamstress,” Wight said. On the way, he was stopped by police. “He had gone under the bridge into town — he had left the neighborhood,” Wight explained. Put in a police car and taken to the station, he was later brought back to where he was picked up, but with a warning: “‘Never leave your neighborhood again.’ So that was the kind of prejudice they had to face.”

Holy Rosary still largely serves people in poverty — 97 percent of its members struggle financially.

Wight proudly tells the story of Anna, a homeless mother of three boys. The family was living in their car when they were referred to Holy Rosary by a local social services provider.

“Anna did everything we asked her to do,” Wight shared. “And we closed on her home with a 740 credit score just one year after our first meeting.”

“We meet needs that otherwise would not be met,” Wight emphasized. “We are truly mission-driven. We seek out the people that others don’t want to serve.”

Kimberley Heatherington writes for Virginia’s OSV News.

News

Modiv Industrial to release Q2 2024 financial results on August 6

RENO, Nev., August 1, 2024–(BUSINESS THREAD)–Modiv Industrial, Inc. (“Modiv” or the “Company”) (NYSE:MDV), the only public REIT focused exclusively on the acquisition of industrial real estate properties, today announced that it will release second quarter 2024 financial results for the quarter ended June 30, 2024 before the market opens on Tuesday, August 6, 2024. Management will host a conference call the same day at 7:30 a.m. Pacific Time (10:30 a.m. Eastern Time) to discuss the results.

Live conference call: 1-877-407-0789 or 1-201-689-8562 at 7:30 a.m. Pacific Time Tuesday, August 6.

Internet broadcast: To listen to the webcast, live or archived, use this link https://callme.viavid.com/viavid/?callme=true&passcode=13740174&h=true&info=company&r=true&B=6 or visit the investor relations page of the Modiv website at www.modiv.com.

About Modiv Industrial

Modiv Industrial, Inc. is an internally managed REIT focused on single-tenant net-leased industrial manufacturing real estate. The company actively acquires critical industrial manufacturing properties with long-term leases to tenants that fuel the national economy and strengthen the nation’s supply chains. For more information, visit: www.modiv.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240731628803/en/

Contacts

Investor Inquiries:

management@modiv.com

News

Volta Finance Limited – Director/PDMR Shareholding

Volta Finance Limited

Volta Finance Limited (VTA/VTAS)

Notification of transactions by directors, persons exercising managerial functions

responsibilities and people closely associated with them

NOT FOR DISCLOSURE, DISTRIBUTION OR PUBLICATION, IN WHOLE OR IN PART, IN THE UNITED STATES

*****

Guernsey, 1 August 2024

Pursuant to announcements made on 5 April 2019 and 26 June 2020 relating to changes to the payment of directors’ fees, Volta Finance Limited (the “Company” or “Volta”) purchased 3,380 no par value ordinary shares of the Company (“Ordinary Shares”) at an average price of €5.2 per share.

Each director receives 30% of his or her director’s fee for any year in the form of shares, which he or she is required to hold for a period of not less than one year from the respective date of issue.

The shares will be issued to the Directors, who for the purposes of Regulation (EU) No 596/2014 on Market Abuse (“March“) are “people who exercise managerial responsibilities” (a “PDMR“).

-

Dagmar Kershaw, Chairman and MDMR for purposes of MAR, has acquired an additional 1,040 Common Shares in the Company. Following the settlement of this transaction, Ms. Kershaw will have an interest in 12,838 Common Shares, representing 0.03% of the Company’s issued shares;

-

Stephen Le Page, a Director and a PDMR for MAR purposes, has acquired an additional 728 Ordinary Shares in the Company. Following the settlement of this transaction, Mr. Le Page will have an interest in 50,562 Ordinary Shares, representing 0.14% of the issued shares of the Company;

-

Yedau Ogoundele, Director and a PDMR for the purposes of MAR has acquired an additional 728 Ordinary Shares in the Company. Following the settlement of this transaction, Ms. Ogoundele will have an interest in 6,862 Ordinary Shares, representing 0.02% of the issued shares of the Company; and

-

Joanne Peacegood, Director and PDMR for MAR purposes has acquired an additional 884 Ordinary Shares in the Company. Following the settlement of this transaction, Ms. Peacegood will have an interest in 3,505 Ordinary Shares, representing 0.01% of the issued shares of the Company;

The notifications below, made in accordance with the requirements of the MAR, provide further details in relation to the above transactions:

|

a) Dagmar Kershaw |

b) Stephen LePage |

c) Yedau Ogoundele |

e) Joanne Pazgood |

|||

|

a. Position/status |

Director |

|||||

|

b. Initial Notification/Amendment |

Initial notification |

|||||

|

||||||

|

a name |

Volta Finance Limited |

|||||

|

b. LAW |

2138004N6QDNAZ2V3W80 |

|||||

|

a. Description of the financial instrument, type of instrument |

Ordinary actions |

|||||

|

b. Identification code |

GG00B1GHHH78 |

|||||

|

c. Nature of the transaction |

Acquisition and Allocation of Common Shares in Relation to Partial Payment of Directors’ Fees for the Quarter Ended July 31, 2024 |

|||||

|

d. Price(s) |

€5.2 per share |

|||||

|

e. Volume(s) |

Total: 3380 |

|||||

|

f. Transaction date |

August 1, 2024 |

|||||

|

g. Location of transaction |

At the Market – London |

|||||

|

The) |

B) |

w) |

It is) |

|||

|

Aggregate Volume: Price: |

Aggregate Volume: Price: |

Aggregate Volume: Price: |

Aggregate Volume: Price: |

|||

CONTACTS

For the investment manager

AXA Investment Managers Paris

Francois Touati

francois.touati@axa-im.com

+33 (0) 1 44 45 80 22

Olivier Pons

Olivier.pons@axa-im.com

+33 (0) 1 44 45 87 30

Company Secretary and Administrator

BNP Paribas SA, Guernsey branch

guernsey.bp2s.volta.cosec@bnpparibas.com

+44 (0) 1481 750 853

Corporate Broker

Cavendish Securities plc

Andre Worn Out

Daniel Balabanoff

+44 (0) 20 7397 8900

*****

ABOUT VOLTA FINANCE LIMITED

Volta Finance Limited is incorporated in Guernsey under the Companies (Guernsey) Law, 2008 (as amended) and listed on Euronext Amsterdam and the Main Market of the London Stock Exchange for listed securities. Volta’s home member state for the purposes of the EU Transparency Directive is the Netherlands. As such, Volta is subject to the regulation and supervision of the AFM, which is the regulator of the financial markets in the Netherlands.

Volta’s investment objectives are to preserve its capital throughout the credit cycle and to provide a stable income stream to its shareholders through dividends that it expects to distribute quarterly. The company currently seeks to achieve its investment objectives by seeking exposure predominantly to CLOs and similar asset classes. A more diversified investment strategy in structured finance assets may be pursued opportunistically. The company has appointed AXA Investment Managers Paris, an investment management firm with a division specializing in structured credit, to manage the investment portfolio of all of its assets.

*****

ABOUT AXA INVESTMENT MANAGERS

AXA Investment Managers (AXA IM) is a multi-specialist asset management firm within the AXA Group, a global leader in financial protection and wealth management. AXA IM is one of the largest European-based asset managers with 2,700 professionals and €844 billion in assets under management at the end of December 2023.

*****

This press release is issued by AXA Investment Managers Paris (“AXA IM”) in its capacity as alternative investment fund manager (within the meaning of Directive 2011/61/EU, the “AIFM Directive”) of Volta Finance Limited (“Volta Finance”), the portfolio of which is managed by AXA IM.

This press release is for information only and does not constitute an invitation or inducement to purchase shares of Volta Finance. Its circulation may be prohibited in certain jurisdictions and no recipient may circulate copies of this document in violation of such limitations or restrictions. This document is not an offer to sell the securities referred to herein in the United States or to persons who are “U.S. persons” for purposes of Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”), or otherwise in circumstances where such an offering would be restricted by applicable law. Such securities may not be sold in the United States absent registration or an exemption from registration under the Securities Act. Volta Finance does not intend to register any part of the offering of such securities in the United States or to conduct a public offering of such securities in the United States.

*****

This communication is being distributed to, and is directed only at, (i) persons who are outside the United Kingdom or (ii) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) or (iii) high net worth companies and other persons to whom it may lawfully be communicated falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as “relevant persons”). The securities referred to herein are available only to, and any invitation, offer or agreement to subscribe for, purchase or otherwise acquire such securities will be made only to, relevant persons. Any person who is not a relevant person should not act on or rely on this document or any of its contents. Past performance should not be relied upon as a guide to future performance.

*****

This press release contains statements that are, or may be deemed to be, “forward-looking statements”. These forward-looking statements can be identified by the use of forward-looking terminology, including the words “believes”, “anticipates”, “expects”, “intends”, “is/are expected”, “may”, “will” or “should”. They include statements about the level of the dividend, the current market environment and its impact on the long-term return on Volta Finance’s investments. By their nature, forward-looking statements involve risks and uncertainties and readers are cautioned that such forward-looking statements are not guarantees of future performance. Actual results, portfolio composition and performance of Volta Finance may differ materially from the impression created by the forward-looking statements. AXA IM undertakes no obligation to publicly update or revise forward-looking statements.

Any target information is based on certain assumptions as to future events that may not materialize. Due to the uncertainty surrounding these future events, targets are not intended to be and should not be considered to be profits or earnings or any other type of forecast. There can be no assurance that any of these targets will be achieved. Furthermore, no assurance can be given that the investment objective will be achieved.

Figures provided which relate to past months or years and past performance cannot be considered as a guide to future performance or construed as a reliable indicator as to future performance. Throughout this review, the citation of specific trades or strategies is intended to illustrate some of Volta Finance’s investment methodologies and philosophies as implemented by AXA IM. The historical success or AXA IM’s belief in the future success of any such trade or strategy is not indicative of, and has no bearing on, future results.

The valuation of financial assets may vary significantly from the prices that AXA IM could obtain if it sought to liquidate the positions on Volta Finance’s behalf due to market conditions and the general economic environment. Such valuations do not constitute a fairness or similar opinion and should not be relied upon as such.

Publisher: AXA INVESTMENT MANAGERS PARIS, a company incorporated under the laws of France, with registered office at Tour Majunga, 6, Place de la Pyramide – 92800 Puteaux. AXA IMP is authorized by Autorité des Marchés Financiers under registration number GP92008 as an alternative investment fund manager within the meaning of the AIFM Directive.

*****

News

Apple to report third-quarter earnings as Wall Street eyes China sales

Litter (AAPL) is set to report its fiscal third-quarter earnings after the market closes on Thursday, and unlike the rest of its tech peers, the main story won’t be about the rise of AI.

Instead, analysts and investors will be keeping a close eye on iPhone sales in China and whether Apple has managed to stem the tide of users switching to domestic rivals including Huawei.

For the quarter, analysts expect Apple to report earnings per share (EPS) of $1.35 on revenue of $84.4 billion, according to estimates compiled by Bloomberg. Apple saw EPS of $1.26 on revenue of $81.7 billion in the same period last year.

Apple shares are up about 18.6% year to date despite a rocky start to the year, thanks in part to the impact of the company’s Worldwide Developer Conference (WWDC) in May, where showed off its Apple Intelligence software.

But the big question on investors’ minds is whether iPhone sales have risen or fallen in China. Apple has struggled with slowing phone sales in the region, with the company noting an 8% decline in sales in the second quarter as local rivals including Huawei and Xiaomi gain market share.

Apple CEO Tim Cook delivers remarks at the start of the Apple Worldwide Developers Conference (WWDC). (Photo by Justin Sullivan/Getty Images) (Justin Sullivan via Getty Images)

And while some analysts, such as JPMorgan’s Samik Chatterjee, believe sales in Greater China, which includes mainland China, Hong Kong, Singapore and Taiwan, rose in the third quarter, others, including David Vogt of UBS Global Research, say sales likely fell about 6%.

Analysts surveyed by Bloomberg say Apple will report revenue of $15.2 billion in Greater China, down 3.1% from the same quarter last year, when Apple reported revenue of $15.7 billion in China. Overall iPhone sales are expected to reach $38.9 billion, down 1.8% year over year from the $39.6 billion Apple saw in the third quarter of 2023.

But Apple is expected to make up for those declines in other areas, including Services and iPad sales. Services revenue is expected to reach $23.9 billion in the quarter, up from $21.2 billion in the third quarter of 2023, while iPad sales are expected to reach $6.6 billion, up from the $5.7 billion the segment brought in in the same period last year. Those iPad sales projections come after Apple launched its latest iPad models this year, including a new iPad Pro lineup powered by the company’s M4 chip.

Mac revenue is also expected to grow modestly in the quarter, versus a 7.3% decline last year. Sales of wearables, which include the Apple Watch and AirPods, however, are expected to decline 5.9% year over year.

In addition to Apple’s revenue numbers, analysts and investors will be listening closely for any commentary on the company’s software launches. Apple Intelligence beta for developers earlier this week.

The story continues

The software, which is powered by Apple’s generative AI technology, is expected to arrive on iPhones, iPads and Macs later this fall, though according to Bloomberg’s Marc GurmanIt won’t arrive alongside the new iPhone in September. Instead, it’s expected to arrive on Apple devices sometime in October.

Analysts are divided on the potential impact of Apple Intelligence on iPhone sales next year, with some saying the software will kick off a new iPhone sales supercycle and others offering more pessimistic expectations about the technology’s effect on Apple’s profits.

It’s important to note that Apple Intelligence is only compatible with the iPhone 15 Pro and newer phones, ensuring that all users desperate to get their hands on the tech will have to upgrade to a newer, more powerful phone as soon as it is available.

Either way, if Apple wants to make Apple Intelligence a success, it will need to ensure it has the features that will make customers excited to take advantage of the offering.

Subscribe to the Yahoo Finance Tech Newsletter. (Yahoo Finance)

Email Daniel Howley at dhowley@yahoofinance.com. Follow him on Twitter at @DanielHowley.

Read the latest financial and business news from Yahoo Finance

News

Number of Americans filing for unemployment benefits hits highest level in a year

The number of Americans filing for unemployment benefits hit its highest level in a year last week, even as the job market remains surprisingly healthy in an era of high interest rates.

Jobless claims for the week ending July 27 rose 14,000 to 249,000 from 235,000 the previous week, the Labor Department said Thursday. It’s the highest number since the first week of August last year and the 10th straight week that claims have been above 220,000. Before that period, claims had remained below that level in all but three weeks this year.

Weekly jobless claims are widely considered representative of layoffs, and while they have been slightly higher in recent months, they remain at historically healthy levels.

Strong consumer demand and a resilient labor market helped avert a recession that many economists predicted during the Federal Reserve’s prolonged wave of rate hikes that began in March 2022.

As inflation continues to declinethe Fed’s goal of a soft landing — reducing inflation without causing a recession and mass layoffs — appears to be within reach.

On Wednesday, the Fed left your reference rate aloneBut officials have strongly suggested a cut could come in September if the data stays on its recent trajectory. And recent labor market data suggests some weakening.

The unemployment rate rose to 4.1% in June, despite the fact that American employers added 206,000 jobs. U.S. job openings also fell slightly last month. Add that to the rise in layoffs, and the Fed could be poised to cut interest rates next month, as most analysts expect.

The four-week average of claims, which smooths out some of the weekly ups and downs, rose by 2,500 to 238,000.

The total number of Americans receiving unemployment benefits in the week of July 20 jumped by 33,000 to 1.88 million. The four-week average for continuing claims rose to 1,857,000, the highest since December 2021.

Continuing claims have been rising in recent months, suggesting that some Americans receiving unemployment benefits are finding it harder to get jobs.

There have been job cuts across a range of sectors this year, from agricultural manufacturing Deerefor media such as CNNIt is in another place.

-

News11 months ago

News11 months agoVolta Finance Limited – Director/PDMR Shareholding

-

News11 months ago

News11 months agoModiv Industrial to release Q2 2024 financial results on August 6

-

News11 months ago

News11 months agoApple to report third-quarter earnings as Wall Street eyes China sales

-

News11 months ago

News11 months agoNumber of Americans filing for unemployment benefits hits highest level in a year

-

News1 year ago

News1 year agoInventiva reports 2024 First Quarter Financial Information¹ and provides a corporate update

-

News1 year ago

News1 year agoLeeds hospitals trust says finances are “critical” amid £110m deficit

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Hit $100 Billion in 2024, Fueling Insane Investor Optimism ⋆ ZyCrypto

-

Tech1 year ago

Tech1 year agoBitcoin’s Correlation With Tech Stocks Is At Its Highest Since August 2023: Bloomberg ⋆ ZyCrypto

-

Tech1 year ago

Tech1 year agoEverything you need to know

-

News11 months ago

News11 months agoStocks wobble as Fed delivers and Meta bounces

-

Markets1 year ago

Markets1 year agoCrazy $3 Trillion XRP Market Cap Course Charted as Ripple CEO Calls XRP ETF “Inevitable” ⋆ ZyCrypto