News

S&P 500 e Nasdaq sobem lentamente para dar início a uma semana enorme para os mercados

As ações dos EUA fecharam praticamente estáveis na segunda-feira para dar início a uma grande semana cheia com uma decisão de taxa do Federal Reserve, o relatório de empregos e os lucros das Big Techs.

O Índice Industrial Dow Jones (^IXIC) fechou em queda de 0,1%, saindo de uma aumento de mais de 650 pontos para o índice blue-chip na sexta-feira. O S&P 500 (^GSPC) ganhou quase 0,1%, enquanto o Nasdaq Composite, de alta tecnologia (^IXIC) subiu logo acima da linha plana.

As ações começaram a semana com o pé direito após subirem na sexta-feira, com os investidores a acolherem uma leitura promissora da inflação que consolidou apostas para cortes de juros. Mas depois de uma sequência volátil de sessões e uma grande liquidação de tecnologia, o relógio está aberto para surpresas que podem colocar o frágil rali à prova.

Não se espera nenhuma ação do Federal Reserve no final de sua reunião na quarta-feira, apesar dos sinais de que a economia e a inflação dos EUA atingiram um ponto ideal. Muitos em Wall Street vê outras razões para o banco central esperar até setembro para agir.

Consulte Mais informação: 32 gráficos que contam a história dos mercados e da economia agora

O relatório de folha de pagamento não agrícola de julho, que será divulgado na sexta-feira — que deve mostrar rachaduras no mercado de trabalho — influenciará nos cálculos posteriores sobre o momento e a profundidade dos cortes nas taxas em 2024.

Lucros iminentes desta semana da Microsoft (MSFT), Maçã (AAPL), Amazonas (AMZN) e Meta (META) também deixam os investidores em alerta, dada a eliminação de ações que se seguiu o primeiro par de resultados do “Magnificent Seven”.

Na segunda-feira, as ações da gigante dos veículos elétricos Tesla (TSLA) ganhou mais de 5% após Adam Jonas, do Morgan Stanley designou o estoque como uma ‘escolha principal’.’ McDonald’s (MCD) as ações subiram apesar dos lucros falha em todos os aspectos à medida que os consumidores diminuíram os gastos na rede de fast food.

A COBERTURA AO VIVO ACABOU13 atualizações

- Seg, 29 de julho de 2024 às 22h02 GMT+2

Ações encerram sessão mistas antes de grande semana para os mercados

As ações dos EUA encerraram a sessão mistas na segunda-feira, dando início a uma grande semana em Wall Street em meio à decisão da taxa do Federal Reserve, ao relatório de empregos e aos lucros das grandes empresas de tecnologia.

O Índice Industrial Dow Jones (^IXIC) caiu 0,1% após subindo mais de 650 pontos na sexta-feira. O S&P 500 (^GSPC) ganhou 0,1%, enquanto o Nasdaq Composite, de alta tecnologia (^IXIC) subiu quase 0,1%.

Entre os grandes movimentos de segunda-feira, a Tesla (TSLA) as ações ganharam mais de 5% após uma chamada de alta do Morgan Stanley. McDonald’s (MCD) as ações subiram mais de 3%, apesar dos lucros falha em todos os aspectos à medida que os consumidores diminuíram os gastos na rede de fast food.

Os investidores ouvirão uma série de pesos pesados da Big Tech esta semana, começando pela Microsoft (MSFT) que deve ser divulgado na terça-feira após o fechamento do pregão. Apple (AAPL), Amazonas (AMZN) e Meta (META) divulgará seus resultados trimestrais no final desta semana.

Na quarta-feira à tarde, autoridades do Federal Reserve anunciarão sua decisão sobre a taxa de juros após sua reunião de dois dias. Os investidores esperam amplamente que os bancos centrais preparem o cenário para um corte de taxa em setembro.

O relatório de empregos de julho será divulgado na sexta-feira.

Seg, 29 de julho de 2024 às 21h35 GMT+2

Seg, 29 de julho de 2024 às 21h35 GMT+2

Lamborghini resiste à fraqueza no mercado de luxo com resultados recordes no primeiro semestre

Pras Subramanian do Yahoo Finance relatórios:

A montadora italiana de automóveis de luxo Lamborghini apresentou resultados excelentes no primeiro semestre de 2024, apesar do ambiente de vendas fraco para automóveis de luxo e produtos de luxo em geral.

Lamborghini, parte da Volkswagen (VWAGY) Grupo Audi que inclui Audi, Lamborghini, Ducati e Bentley, receita recorde relatada de 1,6 bilhão de euros (US$ 1,762 bilhão) para os primeiros seis meses de 2024, um salto de 14,1% em relação ao ano passado. O lucro operacional atingiu outro recorde de 458 milhões de euros (US$ 495 milhões).

A Lamborghini entregou 5.558 carros no primeiro semestre, outro recorde histórico, impulsionado pelas vendas do supercarro híbrido Revuelto, do antigo Huracán de dois lugares e do SUV Urus, que agora vem na versão híbrida SE.

Ler mais aqui.

Seg, 29 de julho de 2024 às 21:00 GMT+2

Seg, 29 de julho de 2024 às 21:00 GMT+2

Tesla salta mais de 5% após previsão otimista do Morgan Stanley

Tesla (TSLA) as ações ganharam mais de 5% na segunda-feira após uma chamada de alta de Adam Jonas, do Morgan Stanley.

O analista designou a fabricante de veículos elétricos como uma das principais escolhas, citando o potencial da Tesla de gerar fluxo de caixa positivo após implementar medidas de corte de custos e reestruturação.

As ações da Tesla subiram durante boa parte de junho, mas começaram a mostrar sinais de retração no início deste mês. As ações caíram mais de 12% em uma sessão na semana passada, depois que a empresa postou resultados mistos do segundo trimestre revelando que o crescimento neste ano seria “notavelmente menor” do que o visto em 2023.

Seg, 29 de julho de 2024 às 20h20 GMT+2

Seg, 29 de julho de 2024 às 20h20 GMT+2

A Apple oferece aos desenvolvedores o primeiro gostinho da Apple Intelligence com o beta para desenvolvedores do iOS 18.1

Dan Howley do Yahoo Finance relatórios:

Maçã (AAPL) está dando aos desenvolvedores uma prévia de sua futura plataforma Apple Intelligence AI com o lançamento de seus últimos betas de desenvolvedor para iOS, iPadOS e MacOS na segunda-feira. Os betas, chamados iOS 18.1, iPadOS 18.1 e macOS Sequoia, são os primeiros a incluir o tão aguardado software Apple Intelligence da Apple, que a empresa estreou na Worldwide Developer Conference (WWDC) em junho.

O programa beta para desenvolvedores da Apple dá aos criadores de aplicativos acesso às próximas versões do software da empresa para testá-lo e incorporar seus recursos em seus próprios aplicativos. A Apple também libera betas públicos para usuários regulares experimentarem suas últimas ofertas de software antes de torná-las disponíveis para o público em geral no outono.

Ler mais aqui.

Seg, 29 de julho de 2024 às 19h39 GMT+2

Seg, 29 de julho de 2024 às 19h39 GMT+2

Tickers de tendências segunda-feira

McDonald’s (MCD)

As ações do McDonald’s subiram mais de 4% na segunda-feira, apesar os lucros do segundo trimestre da empresa ficaram aquém à medida que os clientes deixavam de jantar fora.

“Os consumidores estão mais criteriosos com seus gastos”, disse o CEO Chris Kempczinski no comunicado de resultados.

ON Semicondutores (SOBRE)

A empresa de chips relatou lucros do segundo trimestre superou as estimativas dos analistas e sua orientação para o terceiro trimestre está alinhada com as expectativas de Wall Street.

A ON Semiconductor subiu mais de 12% durante a sessão de segunda-feira.

Bitcoin (BTC-USD)

A criptomoeda subiu acima de US$ 69.000 antes de reduzir os ganhos na segunda-feira após o candidato presidencial republicano Donald Trumpcutucar uma conferência de bitcoin em Nashville no final de semana.

Trump prometeu iniciativas pró-criptomoedas, incluindo o estabelecimento de um “estoque nacional estratégico de bitcoins”.

Seg, 29 de julho de 2024 às 18h45 GMT+2

Seg, 29 de julho de 2024 às 18h45 GMT+2

Os investidores estão apostando que o Fed usará sua reunião de julho para preparar o cenário para um corte em setembro

Jennifer Schonberger do Yahoo Finance relatórios:

A maioria dos observadores do Federal Reserve não espera que o banco central alivie a política monetária esta semana em Washington, DC, mas o que eles esperam é que os formuladores de políticas prepare o cenário para um corte na taxa de juros na próxima reunião em setembro.

Autoridades do Fed disseram eles estão chegando mais perto de ter confiança a inflação está caindo sustentavelmente para sua meta de 2%. Eles também disseram que estão prestando mais atenção ao desemprego crescente, outro sinal de que os cortes podem estar se aproximando.

Mas a maioria dos observadores do Fed diz que o banco central ainda precisa de um pouco mais de tempo para ter certeza, ao mesmo tempo em que prepara os mercados para as ações significativas que estão por vir.

“A pressão está crescendo para eles”, disse a ex-presidente do Fed de Kansas City, Esther George. “Acho que eles vão olhar para setembro muito seriamente. Parece-me que estamos chegando a um momento em que essa decisão é mais importante e é por isso que estou mais confiante.”

Ler mais aqui.

Seg, 29 de julho de 2024 às 18:00 GMT+2

Seg, 29 de julho de 2024 às 18:00 GMT+2

S&P 500 e Nasdaq voltam ao território verde

As ações subiram na segunda-feira após ficarem negativas brevemente durante a sessão.

O Índice Industrial Dow Jones (^DJI) ficou pouco alterado após cair mais de 100 pontos nas negociações da manhã.

O S&P 500 (^GSPC) ganhou 0,2%, enquanto o Nasdaq Composite (^IXIC) voltou ao território verde para aumentar 0,2% após ficar brevemente negativo.

Seg, 29 de julho de 2024 às 17h30 GMT+2

Seg, 29 de julho de 2024 às 17h30 GMT+2

A Starbucks deve relatar vendas fracas à medida que impulsiona pérolas estouradas e jogos de valor

Brooke DiPalma, do Yahoo Finance, relata:

Starbucks (SBUX) os investidores estão cautelosos antes do relatório de lucros de terça-feira.

Suas ações caíram quase 28% em comparação ao ano passado, quando a gigante do café pintou um quadro de uma consumidor resiliente com crescimento de vendas de 10%. Agora, expectativas diferentes estão em pauta.

A receita do Q3 deve crescer 0,37% para US$ 9,20 bilhões, segundo estimativas de consenso da Bloomberg. Os lucros ajustados por ação devem ser de US$ 0,92, em comparação com US$ 1,00 há um ano.

Ler mais aqui.

Seg, 29 de julho de 2024 às 17:27 GMT+2

Seg, 29 de julho de 2024 às 17:27 GMT+2

Ações apagam ganhos da sessão, Nasdaq fica negativo

As ações apagaram os ganhos da sessão anterior e ficaram abaixo da linha plana na segunda-feira.

O Índice Industrial Dow Jones (^DJI) perdeu cerca de 100 pontos após abrir inicialmente mais alto. O S&P 500 (^GSPC) caiu 0,1%, enquanto o Nasdaq Composite (^IXIC) também caiu abaixo da linha plana após ganhar até 0,9%.

Seg, 29 de julho de 2024 às 16h45 GMT+2

Seg, 29 de julho de 2024 às 16h45 GMT+2

Bitcoin paira perto de US$ 69.000 após discurso pró-criptomoedas de Trump

Bitcoin (BTC-USD) foi negociado perto do nível de US$ 69.000 por token na segunda-feira, depois que o ex-presidente Donald Trump promoveu uma agenda pró-criptomoedas em uma conferência sobre bitcoin no fim de semana.

Trump foi o palestrante principal no Bitcoin 2024 no sábado em Nashville O candidato presidencial republicano disse que planeja fazer dos EUA a “capital mundial das criptomoedas” se eleito em novembro. Ele também propôs a criação de um “estoque nacional de bitcoins”.

Ler mais aqui.

Seg, 29 de julho de 2024 às 16:00 GMT+2

Seg, 29 de julho de 2024 às 16:00 GMT+2

Ações do McDonald’s sobem apesar dos lucros abaixo do esperado no segundo trimestre, com consumidores diminuindo suas opções de jantar fora

McDonald’s (MCD) as ações subiram na manhã de segunda-feira, recuperando-se de uma reação negativa inicial na abertura do mercado após os resultados trimestrais da rede de fast food.

Brooke DiPalma do Yahoo Finance relatórios:

Os clientes do McDonald’s estão apertando os cintos novamente no segundo trimestre, enquanto lutam para pagar pelo Big Mac.

Na manhã de segunda-feira, a empresa divulgou lucros do segundo trimestre que ficaram abaixo das estimativas de Wall Street em termos de receita, lucros e vendas nas mesmas lojas, provando que nem mesmo o maior player de fast food dos Estados Unidos está imune às desafiadoras condições macroeconômicas.

Ler mais aqui.

As ações da rede de fast food abriram em baixa inicialmente, mas se recuperaram rapidamente e chegaram a ganhar até 3% no início do pregão.

Seg, 29 de julho de 2024 às 15h30 GMT+2

Seg, 29 de julho de 2024 às 15h30 GMT+2

Ações abrem em alta para dar início a uma grande semana em Wall Street

As ações subiram na segunda-feira para dar início a uma grande semana cheia com uma decisão de taxa do Federal Reserve, o relatório de empregos e os lucros da tecnologia.

O Índice Industrial Dow Jones (^DJI) subiu ligeiramente, saindo de um aumento recente de mais de 650 pontos. O S&P 500 (^GSPC) adicionou cerca de 0,3%, enquanto o Nasdaq Composite (^IXIC) subiu 0,5%.

O Federal Open Market Committee realizará sua reunião programada de dois dias esta semana, sem nenhuma movimentação de taxa esperada pelos oficiais do Federal Reserve na quarta-feira. A maioria dos investidores vê os formuladores de políticas esperando até setembro para cortar as taxas de juros.

Os lucros das grandes empresas de tecnologia devem ser divulgados esta semana, incluindo os da Apple (AAPL), Microsoft (MSFT), Amazonas (AMZN) e Meta (META).

Seg, 29 de julho de 2024 às 11:49 GMT+2

Seg, 29 de julho de 2024 às 11:49 GMT+2

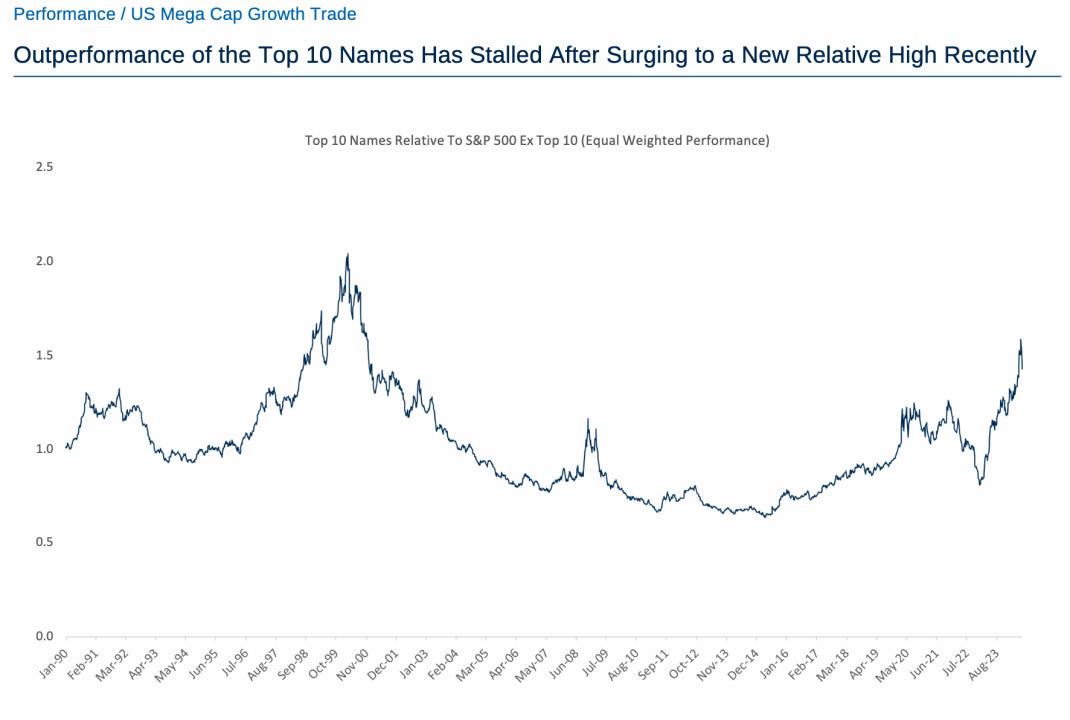

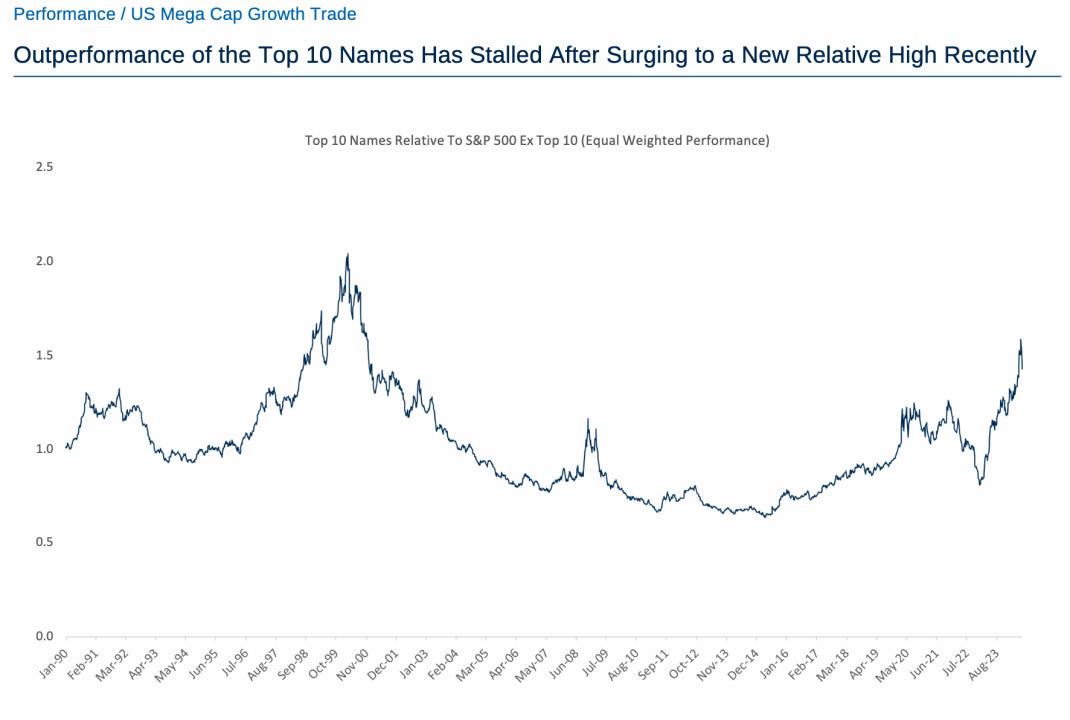

Um gráfico matinal para deixar você pensando

E assim começa uma semana extremamente movimentada para os investidores.

Os investidores começam a semana machucados pela liquidação surpresa do setor de tecnologia na semana passada, que pode estar apenas começando, relata Seana Smith do Yahoo Finanças.

A estrategista do RBC, Lori Calvasina, contextualiza abaixo a paralisação do setor tecnológico.

As ações mais quentes começam a estagnar em julho. (RBC)

News

Modiv Industrial to release Q2 2024 financial results on August 6

RENO, Nev., August 1, 2024–(BUSINESS THREAD)–Modiv Industrial, Inc. (“Modiv” or the “Company”) (NYSE:MDV), the only public REIT focused exclusively on the acquisition of industrial real estate properties, today announced that it will release second quarter 2024 financial results for the quarter ended June 30, 2024 before the market opens on Tuesday, August 6, 2024. Management will host a conference call the same day at 7:30 a.m. Pacific Time (10:30 a.m. Eastern Time) to discuss the results.

Live conference call: 1-877-407-0789 or 1-201-689-8562 at 7:30 a.m. Pacific Time Tuesday, August 6.

Internet broadcast: To listen to the webcast, live or archived, use this link https://callme.viavid.com/viavid/?callme=true&passcode=13740174&h=true&info=company&r=true&B=6 or visit the investor relations page of the Modiv website at www.modiv.com.

About Modiv Industrial

Modiv Industrial, Inc. is an internally managed REIT focused on single-tenant net-leased industrial manufacturing real estate. The company actively acquires critical industrial manufacturing properties with long-term leases to tenants that fuel the national economy and strengthen the nation’s supply chains. For more information, visit: www.modiv.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240731628803/en/

Contacts

Investor Inquiries:

management@modiv.com

News

Volta Finance Limited – Director/PDMR Shareholding

Volta Finance Limited

Volta Finance Limited (VTA/VTAS)

Notification of transactions by directors, persons exercising managerial functions

responsibilities and people closely associated with them

NOT FOR DISCLOSURE, DISTRIBUTION OR PUBLICATION, IN WHOLE OR IN PART, IN THE UNITED STATES

*****

Guernsey, 1 August 2024

Pursuant to announcements made on 5 April 2019 and 26 June 2020 relating to changes to the payment of directors’ fees, Volta Finance Limited (the “Company” or “Volta”) purchased 3,380 no par value ordinary shares of the Company (“Ordinary Shares”) at an average price of €5.2 per share.

Each director receives 30% of his or her director’s fee for any year in the form of shares, which he or she is required to hold for a period of not less than one year from the respective date of issue.

The shares will be issued to the Directors, who for the purposes of Regulation (EU) No 596/2014 on Market Abuse (“March“) are “people who exercise managerial responsibilities” (a “PDMR“).

-

Dagmar Kershaw, Chairman and MDMR for purposes of MAR, has acquired an additional 1,040 Common Shares in the Company. Following the settlement of this transaction, Ms. Kershaw will have an interest in 12,838 Common Shares, representing 0.03% of the Company’s issued shares;

-

Stephen Le Page, a Director and a PDMR for MAR purposes, has acquired an additional 728 Ordinary Shares in the Company. Following the settlement of this transaction, Mr. Le Page will have an interest in 50,562 Ordinary Shares, representing 0.14% of the issued shares of the Company;

-

Yedau Ogoundele, Director and a PDMR for the purposes of MAR has acquired an additional 728 Ordinary Shares in the Company. Following the settlement of this transaction, Ms. Ogoundele will have an interest in 6,862 Ordinary Shares, representing 0.02% of the issued shares of the Company; and

-

Joanne Peacegood, Director and PDMR for MAR purposes has acquired an additional 884 Ordinary Shares in the Company. Following the settlement of this transaction, Ms. Peacegood will have an interest in 3,505 Ordinary Shares, representing 0.01% of the issued shares of the Company;

The notifications below, made in accordance with the requirements of the MAR, provide further details in relation to the above transactions:

|

a) Dagmar Kershaw |

b) Stephen LePage |

c) Yedau Ogoundele |

e) Joanne Pazgood |

|||

|

a. Position/status |

Director |

|||||

|

b. Initial Notification/Amendment |

Initial notification |

|||||

|

||||||

|

a name |

Volta Finance Limited |

|||||

|

b. LAW |

2138004N6QDNAZ2V3W80 |

|||||

|

a. Description of the financial instrument, type of instrument |

Ordinary actions |

|||||

|

b. Identification code |

GG00B1GHHH78 |

|||||

|

c. Nature of the transaction |

Acquisition and Allocation of Common Shares in Relation to Partial Payment of Directors’ Fees for the Quarter Ended July 31, 2024 |

|||||

|

d. Price(s) |

€5.2 per share |

|||||

|

e. Volume(s) |

Total: 3380 |

|||||

|

f. Transaction date |

August 1, 2024 |

|||||

|

g. Location of transaction |

At the Market – London |

|||||

|

The) |

B) |

w) |

It is) |

|||

|

Aggregate Volume: Price: |

Aggregate Volume: Price: |

Aggregate Volume: Price: |

Aggregate Volume: Price: |

|||

CONTACTS

For the investment manager

AXA Investment Managers Paris

Francois Touati

francois.touati@axa-im.com

+33 (0) 1 44 45 80 22

Olivier Pons

Olivier.pons@axa-im.com

+33 (0) 1 44 45 87 30

Company Secretary and Administrator

BNP Paribas SA, Guernsey branch

guernsey.bp2s.volta.cosec@bnpparibas.com

+44 (0) 1481 750 853

Corporate Broker

Cavendish Securities plc

Andre Worn Out

Daniel Balabanoff

+44 (0) 20 7397 8900

*****

ABOUT VOLTA FINANCE LIMITED

Volta Finance Limited is incorporated in Guernsey under the Companies (Guernsey) Law, 2008 (as amended) and listed on Euronext Amsterdam and the Main Market of the London Stock Exchange for listed securities. Volta’s home member state for the purposes of the EU Transparency Directive is the Netherlands. As such, Volta is subject to the regulation and supervision of the AFM, which is the regulator of the financial markets in the Netherlands.

Volta’s investment objectives are to preserve its capital throughout the credit cycle and to provide a stable income stream to its shareholders through dividends that it expects to distribute quarterly. The company currently seeks to achieve its investment objectives by seeking exposure predominantly to CLOs and similar asset classes. A more diversified investment strategy in structured finance assets may be pursued opportunistically. The company has appointed AXA Investment Managers Paris, an investment management firm with a division specializing in structured credit, to manage the investment portfolio of all of its assets.

*****

ABOUT AXA INVESTMENT MANAGERS

AXA Investment Managers (AXA IM) is a multi-specialist asset management firm within the AXA Group, a global leader in financial protection and wealth management. AXA IM is one of the largest European-based asset managers with 2,700 professionals and €844 billion in assets under management at the end of December 2023.

*****

This press release is issued by AXA Investment Managers Paris (“AXA IM”) in its capacity as alternative investment fund manager (within the meaning of Directive 2011/61/EU, the “AIFM Directive”) of Volta Finance Limited (“Volta Finance”), the portfolio of which is managed by AXA IM.

This press release is for information only and does not constitute an invitation or inducement to purchase shares of Volta Finance. Its circulation may be prohibited in certain jurisdictions and no recipient may circulate copies of this document in violation of such limitations or restrictions. This document is not an offer to sell the securities referred to herein in the United States or to persons who are “U.S. persons” for purposes of Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”), or otherwise in circumstances where such an offering would be restricted by applicable law. Such securities may not be sold in the United States absent registration or an exemption from registration under the Securities Act. Volta Finance does not intend to register any part of the offering of such securities in the United States or to conduct a public offering of such securities in the United States.

*****

This communication is being distributed to, and is directed only at, (i) persons who are outside the United Kingdom or (ii) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) or (iii) high net worth companies and other persons to whom it may lawfully be communicated falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as “relevant persons”). The securities referred to herein are available only to, and any invitation, offer or agreement to subscribe for, purchase or otherwise acquire such securities will be made only to, relevant persons. Any person who is not a relevant person should not act on or rely on this document or any of its contents. Past performance should not be relied upon as a guide to future performance.

*****

This press release contains statements that are, or may be deemed to be, “forward-looking statements”. These forward-looking statements can be identified by the use of forward-looking terminology, including the words “believes”, “anticipates”, “expects”, “intends”, “is/are expected”, “may”, “will” or “should”. They include statements about the level of the dividend, the current market environment and its impact on the long-term return on Volta Finance’s investments. By their nature, forward-looking statements involve risks and uncertainties and readers are cautioned that such forward-looking statements are not guarantees of future performance. Actual results, portfolio composition and performance of Volta Finance may differ materially from the impression created by the forward-looking statements. AXA IM undertakes no obligation to publicly update or revise forward-looking statements.

Any target information is based on certain assumptions as to future events that may not materialize. Due to the uncertainty surrounding these future events, targets are not intended to be and should not be considered to be profits or earnings or any other type of forecast. There can be no assurance that any of these targets will be achieved. Furthermore, no assurance can be given that the investment objective will be achieved.

Figures provided which relate to past months or years and past performance cannot be considered as a guide to future performance or construed as a reliable indicator as to future performance. Throughout this review, the citation of specific trades or strategies is intended to illustrate some of Volta Finance’s investment methodologies and philosophies as implemented by AXA IM. The historical success or AXA IM’s belief in the future success of any such trade or strategy is not indicative of, and has no bearing on, future results.

The valuation of financial assets may vary significantly from the prices that AXA IM could obtain if it sought to liquidate the positions on Volta Finance’s behalf due to market conditions and the general economic environment. Such valuations do not constitute a fairness or similar opinion and should not be relied upon as such.

Publisher: AXA INVESTMENT MANAGERS PARIS, a company incorporated under the laws of France, with registered office at Tour Majunga, 6, Place de la Pyramide – 92800 Puteaux. AXA IMP is authorized by Autorité des Marchés Financiers under registration number GP92008 as an alternative investment fund manager within the meaning of the AIFM Directive.

*****

News

Apple to report third-quarter earnings as Wall Street eyes China sales

Litter (AAPL) is set to report its fiscal third-quarter earnings after the market closes on Thursday, and unlike the rest of its tech peers, the main story won’t be about the rise of AI.

Instead, analysts and investors will be keeping a close eye on iPhone sales in China and whether Apple has managed to stem the tide of users switching to domestic rivals including Huawei.

For the quarter, analysts expect Apple to report earnings per share (EPS) of $1.35 on revenue of $84.4 billion, according to estimates compiled by Bloomberg. Apple saw EPS of $1.26 on revenue of $81.7 billion in the same period last year.

Apple shares are up about 18.6% year to date despite a rocky start to the year, thanks in part to the impact of the company’s Worldwide Developer Conference (WWDC) in May, where showed off its Apple Intelligence software.

But the big question on investors’ minds is whether iPhone sales have risen or fallen in China. Apple has struggled with slowing phone sales in the region, with the company noting an 8% decline in sales in the second quarter as local rivals including Huawei and Xiaomi gain market share.

Apple CEO Tim Cook delivers remarks at the start of the Apple Worldwide Developers Conference (WWDC). (Photo by Justin Sullivan/Getty Images) (Justin Sullivan via Getty Images)

And while some analysts, such as JPMorgan’s Samik Chatterjee, believe sales in Greater China, which includes mainland China, Hong Kong, Singapore and Taiwan, rose in the third quarter, others, including David Vogt of UBS Global Research, say sales likely fell about 6%.

Analysts surveyed by Bloomberg say Apple will report revenue of $15.2 billion in Greater China, down 3.1% from the same quarter last year, when Apple reported revenue of $15.7 billion in China. Overall iPhone sales are expected to reach $38.9 billion, down 1.8% year over year from the $39.6 billion Apple saw in the third quarter of 2023.

But Apple is expected to make up for those declines in other areas, including Services and iPad sales. Services revenue is expected to reach $23.9 billion in the quarter, up from $21.2 billion in the third quarter of 2023, while iPad sales are expected to reach $6.6 billion, up from the $5.7 billion the segment brought in in the same period last year. Those iPad sales projections come after Apple launched its latest iPad models this year, including a new iPad Pro lineup powered by the company’s M4 chip.

Mac revenue is also expected to grow modestly in the quarter, versus a 7.3% decline last year. Sales of wearables, which include the Apple Watch and AirPods, however, are expected to decline 5.9% year over year.

In addition to Apple’s revenue numbers, analysts and investors will be listening closely for any commentary on the company’s software launches. Apple Intelligence beta for developers earlier this week.

The story continues

The software, which is powered by Apple’s generative AI technology, is expected to arrive on iPhones, iPads and Macs later this fall, though according to Bloomberg’s Marc GurmanIt won’t arrive alongside the new iPhone in September. Instead, it’s expected to arrive on Apple devices sometime in October.

Analysts are divided on the potential impact of Apple Intelligence on iPhone sales next year, with some saying the software will kick off a new iPhone sales supercycle and others offering more pessimistic expectations about the technology’s effect on Apple’s profits.

It’s important to note that Apple Intelligence is only compatible with the iPhone 15 Pro and newer phones, ensuring that all users desperate to get their hands on the tech will have to upgrade to a newer, more powerful phone as soon as it is available.

Either way, if Apple wants to make Apple Intelligence a success, it will need to ensure it has the features that will make customers excited to take advantage of the offering.

Subscribe to the Yahoo Finance Tech Newsletter. (Yahoo Finance)

Email Daniel Howley at dhowley@yahoofinance.com. Follow him on Twitter at @DanielHowley.

Read the latest financial and business news from Yahoo Finance

News

Number of Americans filing for unemployment benefits hits highest level in a year

The number of Americans filing for unemployment benefits hit its highest level in a year last week, even as the job market remains surprisingly healthy in an era of high interest rates.

Jobless claims for the week ending July 27 rose 14,000 to 249,000 from 235,000 the previous week, the Labor Department said Thursday. It’s the highest number since the first week of August last year and the 10th straight week that claims have been above 220,000. Before that period, claims had remained below that level in all but three weeks this year.

Weekly jobless claims are widely considered representative of layoffs, and while they have been slightly higher in recent months, they remain at historically healthy levels.

Strong consumer demand and a resilient labor market helped avert a recession that many economists predicted during the Federal Reserve’s prolonged wave of rate hikes that began in March 2022.

As inflation continues to declinethe Fed’s goal of a soft landing — reducing inflation without causing a recession and mass layoffs — appears to be within reach.

On Wednesday, the Fed left your reference rate aloneBut officials have strongly suggested a cut could come in September if the data stays on its recent trajectory. And recent labor market data suggests some weakening.

The unemployment rate rose to 4.1% in June, despite the fact that American employers added 206,000 jobs. U.S. job openings also fell slightly last month. Add that to the rise in layoffs, and the Fed could be poised to cut interest rates next month, as most analysts expect.

The four-week average of claims, which smooths out some of the weekly ups and downs, rose by 2,500 to 238,000.

The total number of Americans receiving unemployment benefits in the week of July 20 jumped by 33,000 to 1.88 million. The four-week average for continuing claims rose to 1,857,000, the highest since December 2021.

Continuing claims have been rising in recent months, suggesting that some Americans receiving unemployment benefits are finding it harder to get jobs.

There have been job cuts across a range of sectors this year, from agricultural manufacturing Deerefor media such as CNNIt is in another place.

-

Videos4 weeks ago

Videos4 weeks agoAbsolutely massive: the next higher Bitcoin leg will shatter all expectations – Tom Lee

-

News12 months ago

News12 months agoVolta Finance Limited – Director/PDMR Shareholding

-

News12 months ago

News12 months agoModiv Industrial to release Q2 2024 financial results on August 6

-

News12 months ago

News12 months agoApple to report third-quarter earnings as Wall Street eyes China sales

-

News12 months ago

News12 months agoNumber of Americans filing for unemployment benefits hits highest level in a year

-

News1 year ago

News1 year agoInventiva reports 2024 First Quarter Financial Information¹ and provides a corporate update

-

News1 year ago

News1 year agoLeeds hospitals trust says finances are “critical” amid £110m deficit

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Hit $100 Billion in 2024, Fueling Insane Investor Optimism ⋆ ZyCrypto

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Videos1 year ago

Videos1 year ago$1,000,000 worth of BTC in 2025! Get ready for an UNPRECEDENTED PRICE EXPLOSION – Jack Mallers

-

Videos1 year ago

Videos1 year agoABSOLUTELY HUGE: Bitcoin is poised for unabated exponential growth – Mark Yusko and Willy Woo

-

Tech1 year ago

Tech1 year agoBlockDAG ⭐⭐⭐⭐⭐ Review: Is It the Next Big Thing in Cryptocurrency? 5 questions answered