DeFi

12 Best DeFi 2.0 Projects to Invest in 2024

Last updated:

May 24, 2024 15:43 EDT

| 23 min read

DeFi 2.0 builds on the original decentralized finance ethos – with faster transactions, higher scalability, and cross-chain capabilities. Not to mention lower fees and access to a much broader range of investment markets.

This guide explores the 12 best DeFi 2.0 tokens to buy right now. Read on to discover the leading DeFi 2.0 projects for long-term upside.

Top DeFi 2.0 Tokens to Buy

The best DeFi 2.0 tokens to buy in 2024 are listed below:

- Dogeverse: Top DeFi 2.0 coin to invest in with a staking APY of 50%. Raised more than $15 million in presale.

- WienerAI: Blends the fun of memes with AI, offering high staking APY. Raised over $2.8 million.

- Mega Dice Token: Casino token with $50M in monthly bets and $2.25 million in airdrop rewards.

- 99Bitcoins Token: Learn-to-earn token with a high APY that raised over $1.4 million in presale.

- The Graph: Popular for efficient DeFi operations with blockchain indexing; supports 30,000+ projects.

- Polygon: Top layer 2 solution for scalable, low-fee DeFi 2.0; 210+ projects bridged.

- Hedera: Super-fast transactions at minimal cost. It supports diverse DeFi projects and smart contracts.

- Cosmos: Leading cross-chain platform with Inter-Blockchain Communication; used by 250+ projects.

- Chainlink: Key DeFi 2.0 player with robust smart contract Oracles bridging real and decentralized data.

- RocketPool: Offers a simple and secure Ethereum staking. It is decentralized with low staking minimums.

- OKB: OKX’s Web 3.0 wallet supports DeFi 2.0 and is optimal APYs across 200+ exchanges and yield pools.

- Ethereum Name Service: Converts complex wallet addresses to simple usernames; 700,000+ domains sold.

What is DeFi 2.0?

Decentralized finance, or DeFi, is increasing its capabilities at a rapid pace. This industry allows the average citizen to access core financial services without going through middlemen. This includes banking, remittances, loans, insurance, and investment products.

But what is DeFi 2.0? Put simply, DeFi 2.0 extends the original DeFi landscape through real-world solutions. More specifically, it solves many of the issues found in the DeFi 1.0 arena. For example, many DeFi 1.0 ecosystems suffer from high fees and scalability restrictions. This is largely because most DeFi 1.0 projects are built on the Ethereum framework.

As stated by ETHTPS, those on the ERC20 standard are currently limited to 29 transactions per second. This overloads the network and results in high DeFi fees. The solution here comes from layer 2 solutions like Polygon and Arbitrum. These protocols support thousands of transactions per second, with fees costing a small fraction of a cent.

DeFi 1.0 also faced issues with liquidity, especially when facilitating peer-to-peer trades. This made many DeFi 1.0 exchanges inefficient, resulting in wide spreads and high slippage costs. The DeFi 2.0 frontier solves this through multi-chain bridges that can source liquidity from hundreds of different locations.

Another area that DeFi 1.0 was lacking is cross-chain capabilities. Innovative projects like Cosmos solve this through the Inter-Blockchain Communication protocol. This allows DeFi 2.0 ecosystems to connect with multiple blockchains, enabling consumers to trade cryptocurrencies with different network standards.

The inability of DeFi 1.0 platforms to connect with the real world was another pressing issue. Innovators like Chainlink solve this through decentralized Oracles. These provide DeFi smart contracts with reliable data from the real world. There is no risk of third-party manipulation, considering that Oracles derive from millions of sources.

Overall, DeFi 2.0 is an exciting concept that will take decentralized finance to the next level. People from all walks of life will be able to bank, transact, borrow, and trade in an efficient, fair, and democratic way. DeFi 2.0 also serves as a viable long-term investment. The industry is still in its infancy, so some of the best DeFi 2.0 projects are heavily undervalued.

A Closer Look at the Top DeFi 2.0 Projects

We will now analyze the best DeFi 2.0 coins with the greatest upside potential.

We cover the most important metrics for investors to make informed decisions. This includes the concept being developed and why it has the potential to revolutionize the future of finance.

1. Dogeverse – Top DeFi 2.0 Coin to Invest In with a Staking APY of 50%. Raised $15M+

Dogeverse ($DOGEVERSE) is the #1 DeFi 2.0 coin to buy right now. It offers an industry-leading staking model, where early $DOGEVERSE stakers can earn an APY of over 50% at the time of writing.

The platform aims to redefine the meme coin space with its utility-focused approach. It is unique as it works across six blockchains — making it the first Doge-themed multi-chain meme coin.

Early investors can buy the tokens for only $0.00031 each in its recently launched $DOGEVERSE presale. This price will keep increasing throughout the presale stages and also at the time of exchange listings.

The platform’s presale has witnessed massive investor traction as it raised over $15 million in just a few months of its official launch.

Dogeverse uses a new-age “Portal Bridge” and “Wormhole” technology to connect with blockchains like Ethereum, Solana, Base, Avalanche, Polygon, and Binance. This lets token holders enjoy faster transactions, more liquidity, and better scalability.

It’s worth noting that the platform offers 30 billion of its total token supply of 200 billion tokens in the ongoing presale at discounted prices.

You can join the platform’s Telegram channel and follow Dogeverse on X to get the most recent updates on its presale milestones and token listing dates.

2. WienerAI – Blends the Fun of Memes with AI and Offers high staking APY

The next DeFi 2.0 coin showing high upside potential is WienerAI ($WAI). It’s a trending new meme crypto with a funny theme that offers high utility and staking rewards.

Early $WAI buyers can start staking their tokens during the ongoing presale stage itself. You can earn a staking APY of over 360% at the time of writing.

The ongoing presale offers $WAI for a discounted price of $0.00071. It’s worth noting that this price will keep rising throughout the ongoing presale stage and at the time of the expected exchange listing.

WienerAI is unique because it combines funny meme-style jokes with the high-tech benefits of artificial intelligence (AI).

It is not just a silly-themed coin trying to be popular but offers an AI-powered trading bot that gives users real-time market analysis. The platform also has detailed plans to use AI in ways that could increase $WAI’s utility and demand.

The ongoing presale has already raised over $1.3 million in just a few weeks of launch – showing strong community traction and trust. You can follow WienerAI on X (Twitter) and join its Telegram group to keep up with the project’s updates and get the latest news on the token listing.

3. Mega Dice Token – Casino Token with $50M in Monthly Bets and $2.25 Million Airdrop

Mega Dice Token ($DICE) is a promising new DeFi 2.0 coin that combines the elements of gaming and gambling with DeFi.

$DICE is native to the Mega Dice Casino – which is already a well-established platform with over 10,000 active monthly players and $50M+ monthly betting volume.

Mega Dice recently launched a presale for the $DICE tokens, where early investors can buy these tokens for a relatively low rate of $0.075 at the time of writing.

$DICE is integrated into the Mega Dice Casino to offer high utility and rewards to its holders. Token holders can get cashback from the casino, earn free tokens through airdrops, and unlock special NFT bonuses.

Buyers can earn an impressive 10% referral commission during the presale stage. The platform will reward you 10% of the amount invested by the friends who you’ve referred to.

Mega Dice is similar to other successful gambling tokens, such as Rollbit and TG.Casino, which gave over 10x returns to early buyers at launch.

The platform currently offers 35% of its total 420 million tokens in the ongoing presale phase. You can join the Mega Dice Token Telegram channel and check out its X handle to stay updated on the latest progress.

4. 99Bitcoins Token – Learn-to-Earn Token with a High APY that Raised Over $1.4 Million in Presale

99Bitcoins is a well-known platform that has been teaching people about cryptos for over 10 years. It already has an established community – with over 700K subscribers on YouTube. It’s worth noting that over 2 million users have subscribed to its crypto courses.

The platform recently launched a new learn-to-earn model and a presale for its native 99Bitcoins Token ($99BTC). Their goal is to make learning about crypto more fun by rewarding users for completing lessons and quizzes.

The platform offers a highly rewarding staking model with an APY of over 1000% at the time of writing. However, this rate will fall as more people join the staking pool.

You can buy $99BTC for $0.00106 during the ongoing presale. Please note that the price increases every few days— so buying early gives you the best price before the token officially launches on exchanges.

Once $99BTC launches, the platform has plans to bridge the token to Bitcoin’s new BRC-20 token standard. They also plan to start a service that offers users crypto trading signals, adding even more utility to the $99BTC token.

Interested buyers can follow 99Bitcoins on X (Twitter) and join their Telegram group to stay updated.

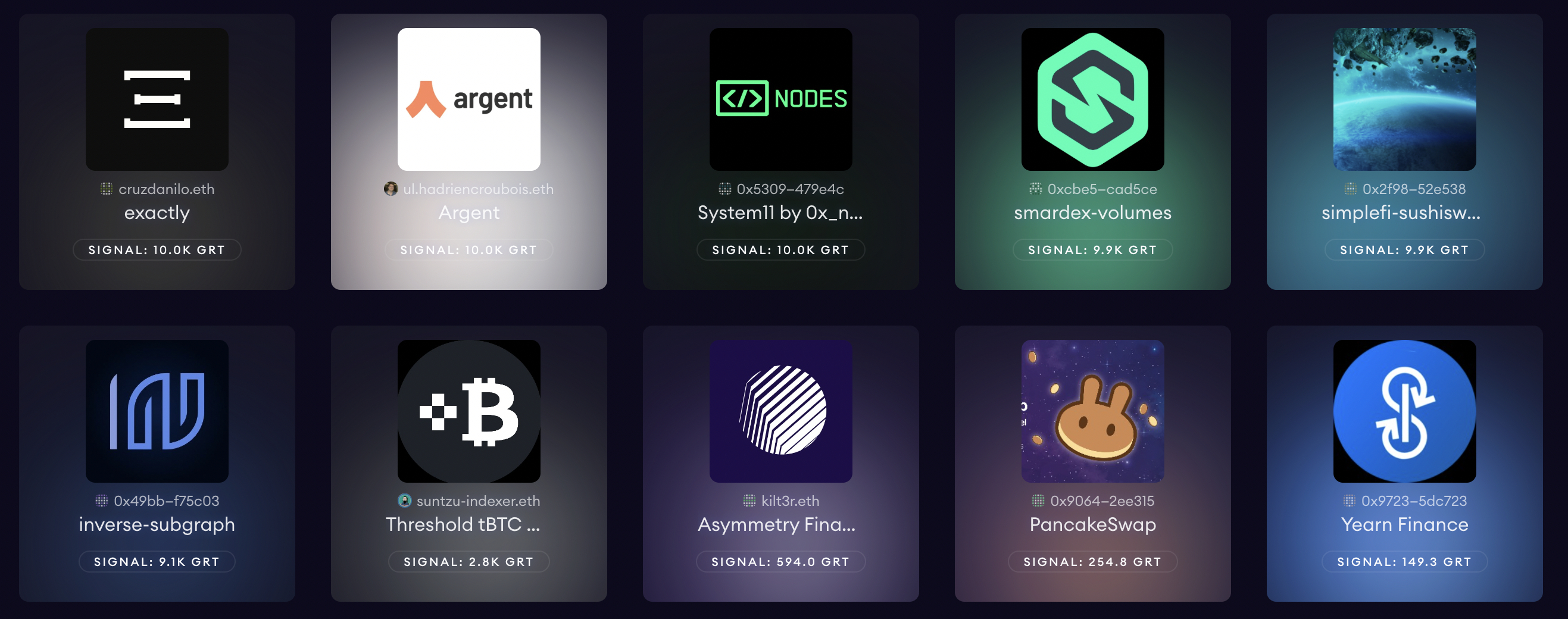

5. The Graph – Decentralized Data Queries Through a Blockchain Indexing Protocol

The Graph is an innovative DeFi 2.0 project that specializes in blockchain indexing. Its decentralized protocol sorts, filters, and manages blockchain data. While this helps blockchain ecosystems operate more efficiently. it also enables developers to query data. This can be achieved without needing to manually sort through millions of transactions.

For example, through the Graph, developers can query DeFi transactions from hundreds of leading platforms. This provides real-time insights into investor trends. The data could then be used to make informed investment decisions. Another use case is aimed at DeFi exchanges like Aave, Compound, and Uniswap.

These projects use the Graph to source real-time data from liquidity pools. For example, how much is being staked and what APYs are available. Crucially, the Graph has many use cases within the DeFi 2.0 landscape. What’s more, the Graph is a self-sufficient project, as it charges fees when making blockchain queries.

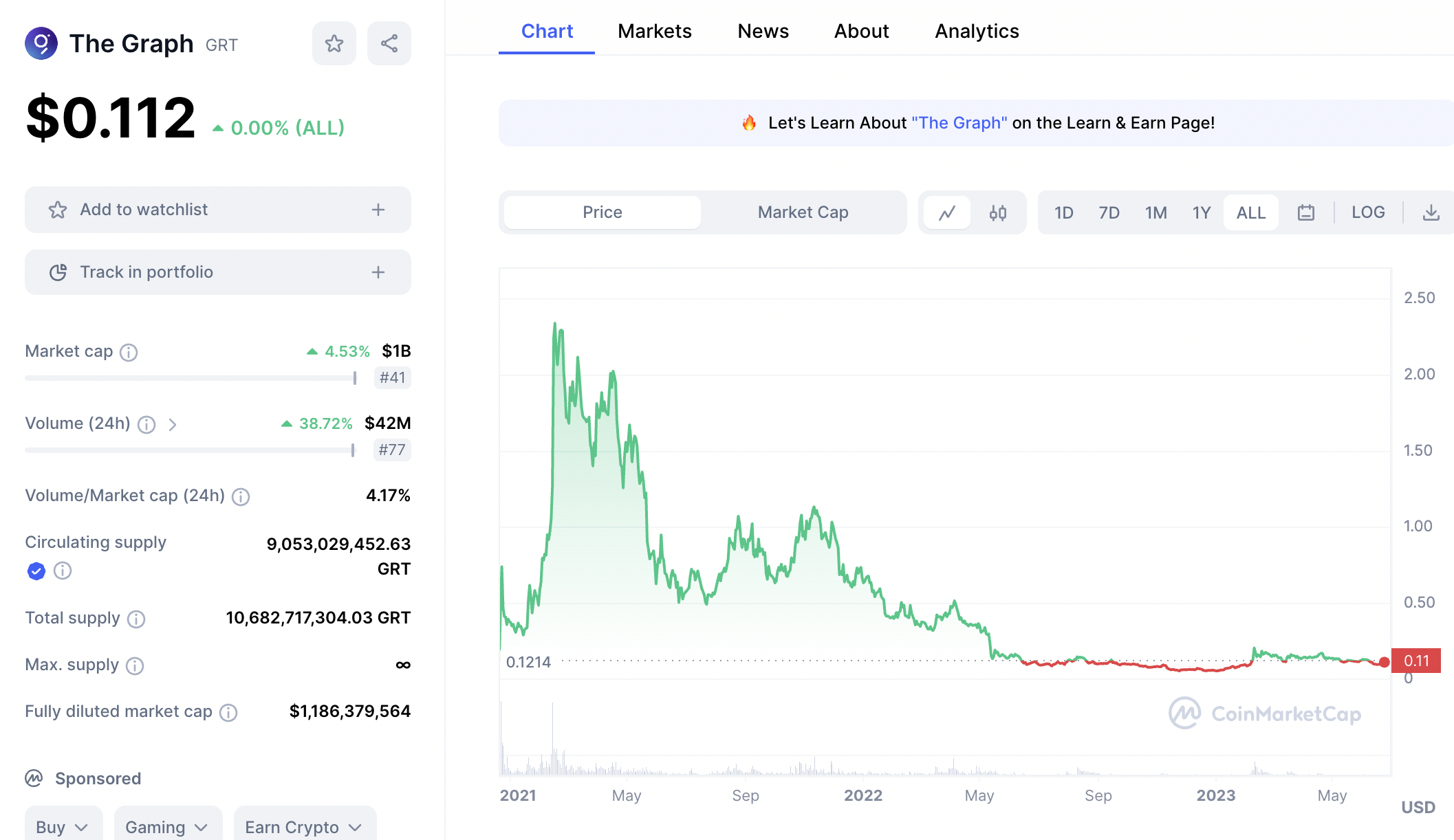

Fees are payable in GRT, the native token of the Graph. According to CoinMarketCap, GRT has a market capitalization of $1 billion. This is just a fraction of its prior peak of over $5.3 billion. GRT tokens currently trade at $0.11. During the bear market, GRT hit highs of over $2.34. Therefore, GRT can be purchased for a significant discount.

6. Polygon – Layer 2 Solution for DeFi 2.0 Projects Seeking Scalable and Fast Transactions

Polygon is one of the best DeFi 2.0 projects for scalability. It enables ERC20 ecosystems, such as Uniswap, SushiSwap, Yearn.finance, and Aave, to offer DeFi services efficiently. Without bridging to the Polygon network (or another layer 2 solution), ERC20 projects face high fees and an inability to increase transaction throughput.

As noted earlier, this is because the Ethereum blockchain is still only able to process 29 transactions per second. This is the case even though Ethereum has completed its proof-of-stake upgrade. In contrast, Polygon can handle up to 65,000 transactions per second. This makes Polygon over 2,000 times more efficient than Ethereum.

Over 200 ERC20 ecosystems have already bridged to Polygon. Not only to increase scalability but to significantly reduce fees. According to Polygon, the average transaction fee is just $0.018. This makes DeFi investing and trading more cost-effective and viable, especially for small amounts. The Polygon network has its own native token, MATIC.

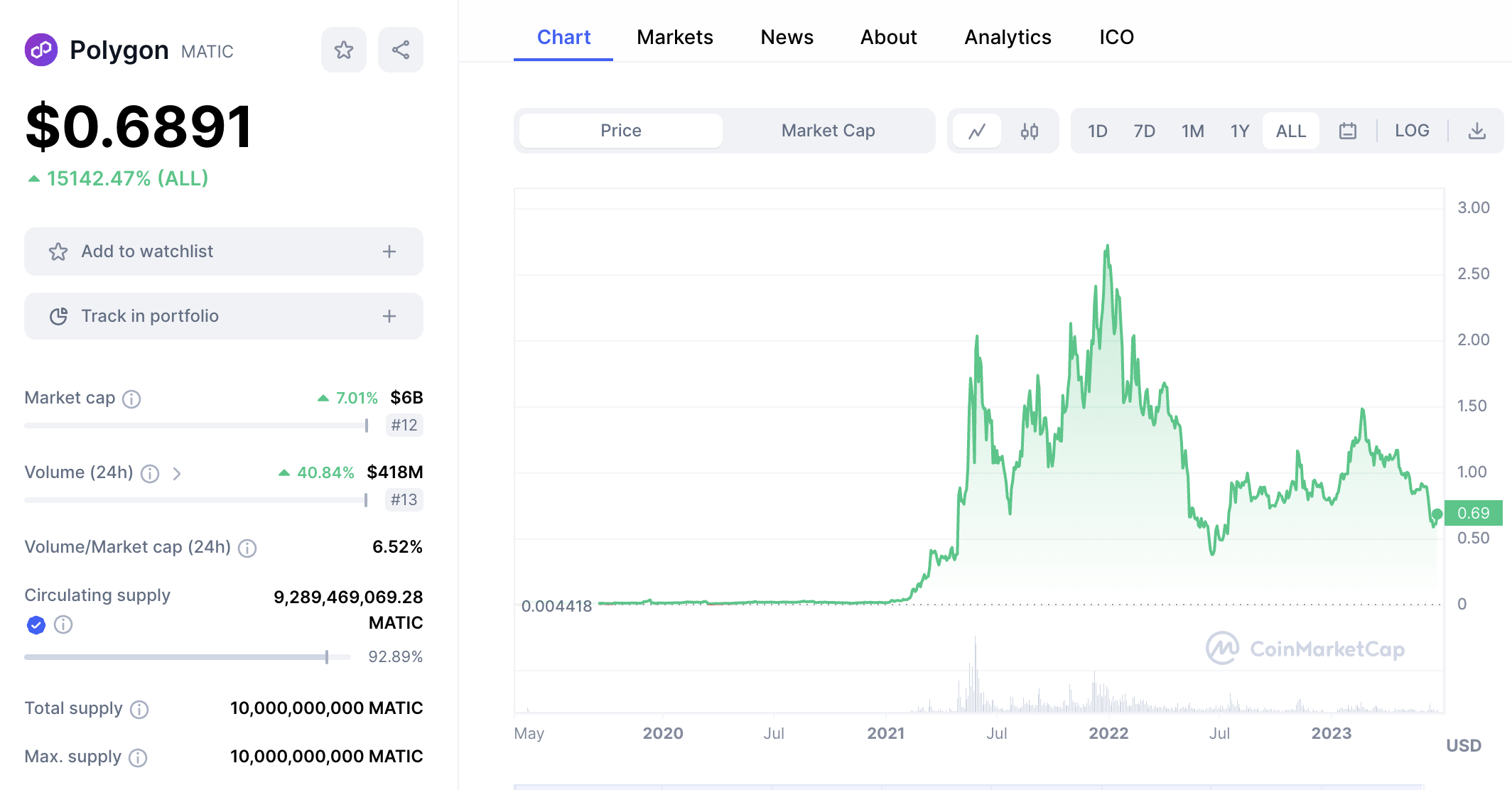

As per CoinMarketCap data, this is a large-cap cryptocurrency currently valued at over $6 billion. But like many of the best DeFi 2.0 cryptos, MATIC is trading at a bear market discount. At its peak, the project was valued at over $19 billion. Currently, MATIC can be purchased at $0.68, a discount of over 75% from its all-time high.

7. Hedera – Layer 2 Solution for DeFi 2.0 Projects Seeking Scalable and Fast Transactions

Hedera is a proprietary blockchain network that uses an asynchronous Byzantine Fault Tolerance (aBFT) hashgraph consensus mechanism. It has developed a high-performance ecosystem that enables projects to facilitate fast and low-cost transactions. According to Hedera, transactions average just 5-6 seconds.

This is at an average cost of $0.001. Hedera is also a sustainable blockchain that requires just 0.000003 kWh per transaction. The Hedera blockchain offers many use cases, including DeFi payments, decentralized trading, and NFT minting. Its network is already being used by multiple DeFi projects, including SaucerSwap, TOKO, Stader Labs, and Pangolin.

It also provides a home for DOVU, Hashport, and HSuite. More than $25 million worth of liquidity is currently locked in the Hedera network, which is small when compared to other ecosystems. That said, the network is active, with over 17,500 smart contracts processed in the prior 24 hours. Hedera has its own governance token, HBAR.

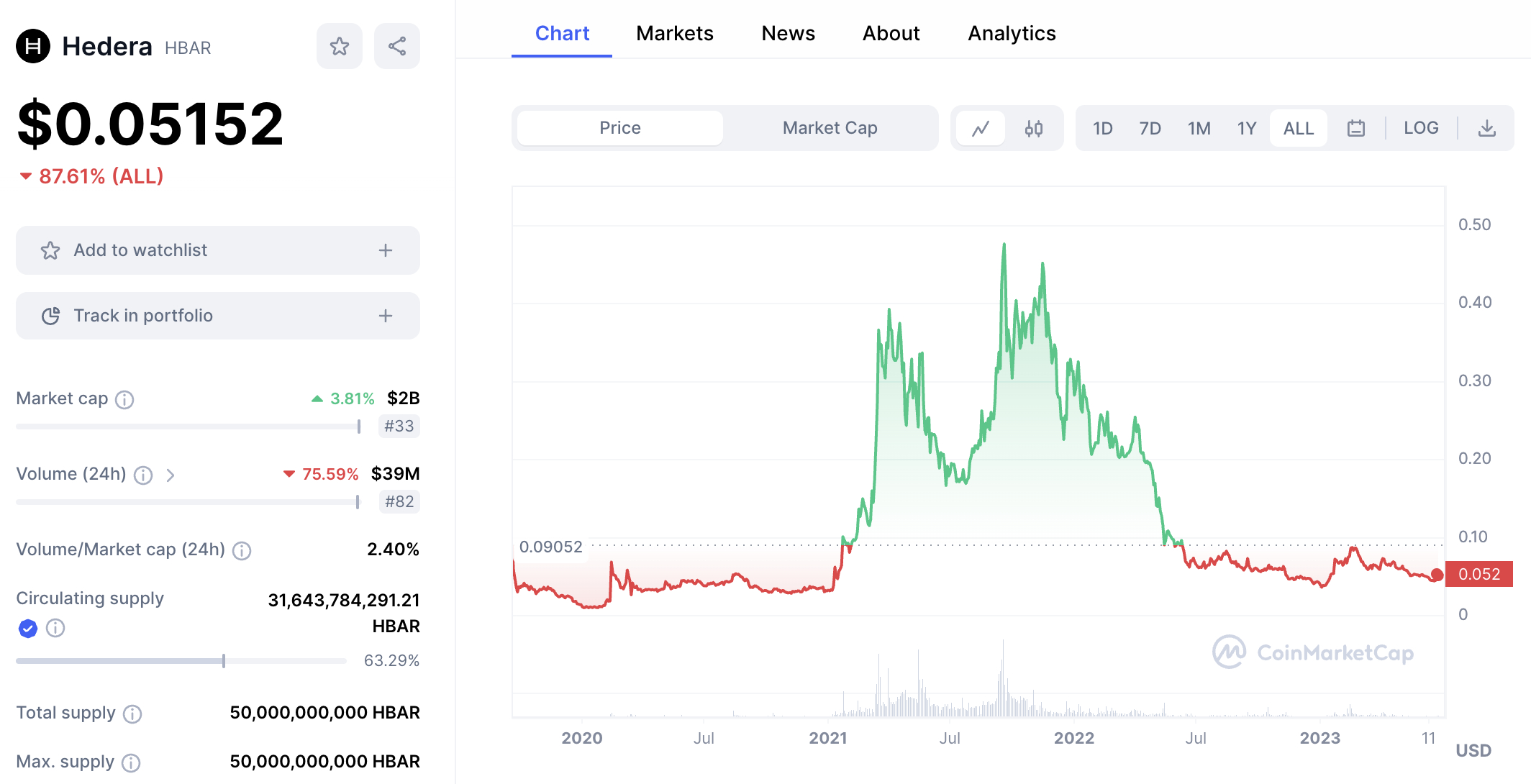

HBAR was launched in late 2019, with CoinMarketCap quoting an initial listing price of 0.09052. Like many DeFi projects, HBAR hit its all-time high in late 2021. While it peaked at $0.47, HBAR is currently trading at just $0.05. That’s a bear market decline of almost 90%. HBAR has a market capitalization of $2 billion, down from its peak of $6.7 billion.

8. Cosmos – Inter-Blockchain Communication Protocol Supporting Cross-Chain Transactions

Cosmos solves one of the biggest issues found in DeFi 1.0 – an inability to transact across two or more blockchains. Put otherwise, DeFi 1.0 would only allow projects to offer services within their respective network ecosystem. Cosmos solves this issue through its native Inter-Blockchain Communication protocol.

In simple terms, this interoperability allows blockchain networks to communicate with one another. For example, consider a DeFi 2.0 exchange that allows people to trade tokens anonymously and cost-effectively. Being compatible with Cosmos means that the exchange can offer cross-chain swaps. This means being able to swap XRP for Litecoin or Solana for Bitcoin.

Without interoperability, the exchange would require users to make the swap via a centralized platform. Additionally, Cosmos is also working on cross-chain liquidity. This will enable DeFi 2.0 projects to source liquidity from a much broader pool of networks. In turn, this will provide DeFi 2.0 investors with more competitive yields.

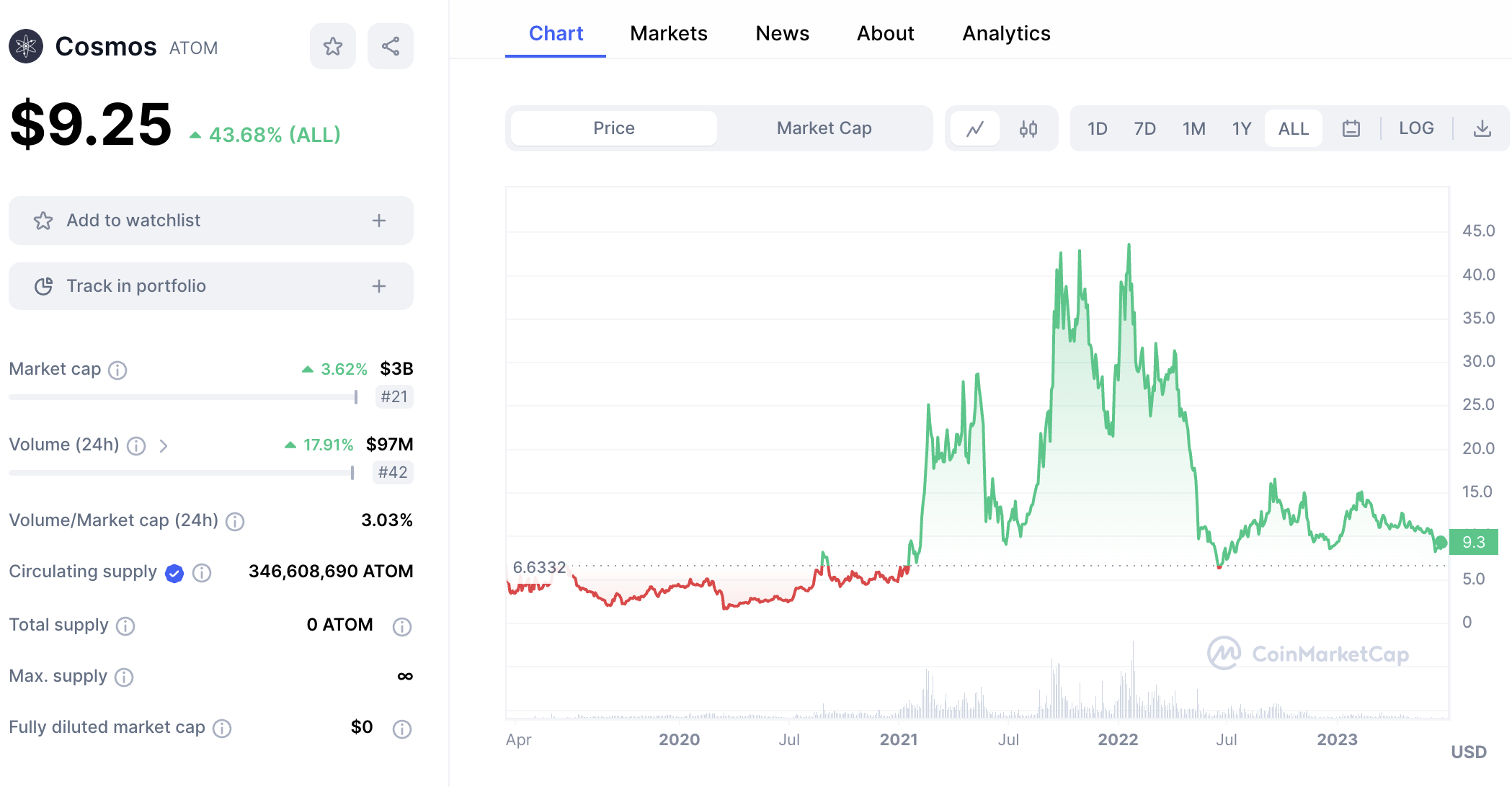

Cosmos, which was launched in 2019, has its own native token, ATOM. According to CoinMarketCap, ATOM is currently trading at just over $9 per token. Rewind to late 2021, and ATOM hit all-time highs of over $43. As such, this is one of the best DeFi 2.0 tokens for bear market discounts. After all, ATOM is trading 80% below its former peak.

9. Chainlink – Real-World Data for DeFi 2.0 Smart Contracts via Oracles

Chainlink will serve the DeFi 2.0 industry by providing real-world data to smart contracts. This solves yet another major shortcoming of the DeFi 1.0 landscape. So how does it work? Put simply, Chainlink uses Oracles to scan real-world data, using millions of sources to ensure information is credible, accurate, and unbiased.

This data is then fed to DeFi 2.0 ecosystems in real-time. The entire process is autonomous, decentralized, and facilitated via smart contracts. The use cases for Chainlink are virtually unlimited. For example, consider a DeFi 2.0 betting site that allows people to wager money on sporting events.

As soon as a sporting event has finished, Chainlink Oracles will provide the results to the platform. In turn, the platform can instantly payout winning bets without needing to manually check results. Another use case is in the insurance market. Consider a consumer that takes out insurance on an upcoming vacation. The premium paid includes flight delays and cancellations.

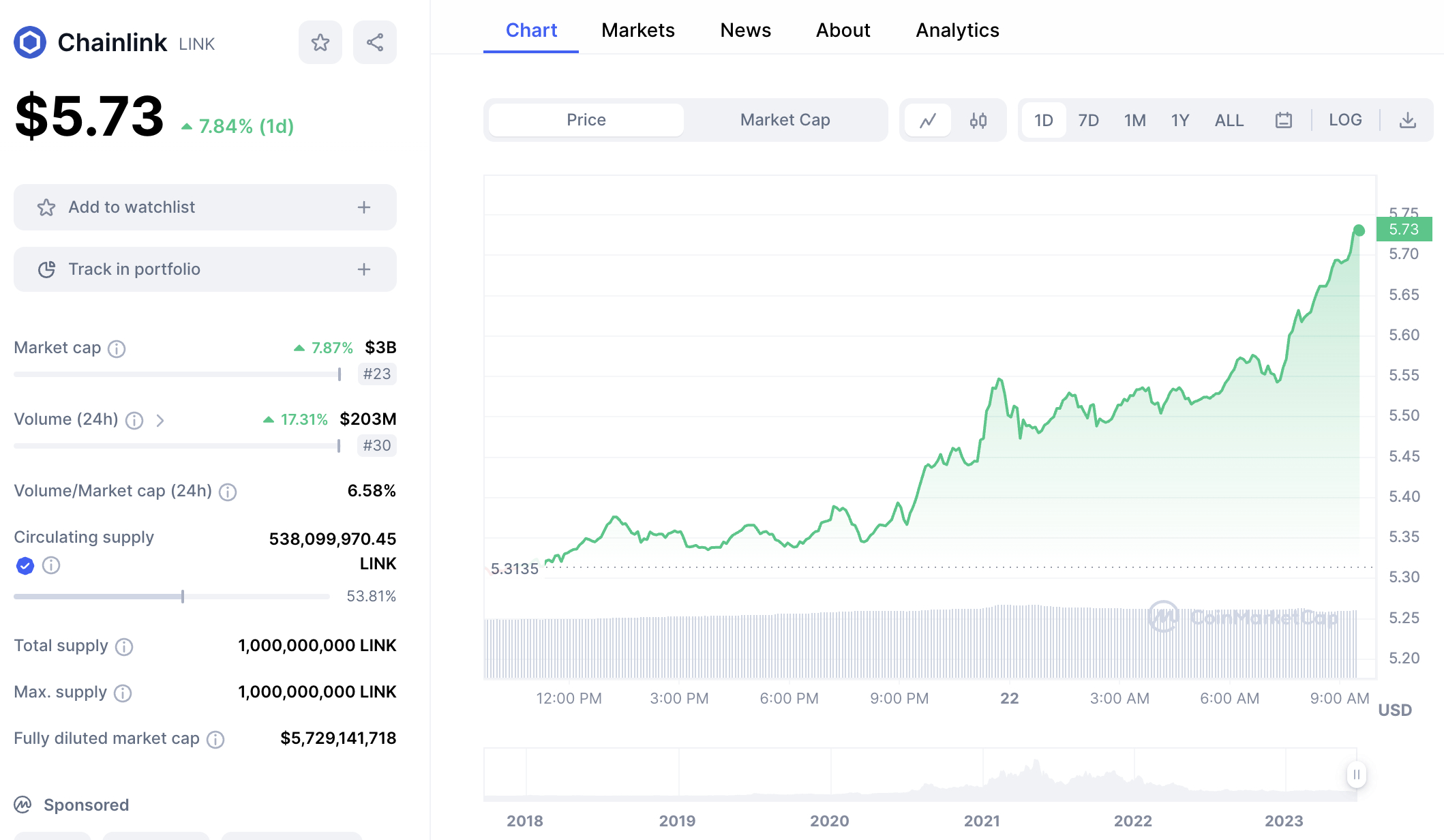

After the flight is canceled by the airline, the Oracle smart contract is executed in real-time. It provides this information to the insurance company, and the consumer is paid out instantly. No forms, and no delays. All Oracle transactions require LINK tokens, which are native to the Chainlink blockchain. Currently, LINK is valued at $3 billion, as per CoinMarketCap.

10. RocketPool – Earn Staking ETH Rewards Without Using a Centralized Platform

RocketPool is one of the best DeFi 2.0 projects for earning passive rewards. It supports Ethereum staking, with RocketPool APYs currently at 3.1%. The reason that RocketPool stands out is that it allows casual investors to stake ETH without needing a large upfront payment. After all, Ethereum requires staking validators to deposit at least 32 ETH.

In contrast, RocketPool offers the same service but with a minimum of just 0.01 ETH. Based on the current ETH price, just $19 worth of tokens is needed. With that being said, RocketPool offers much higher yields to those that deposit 8 ETH or more. Currently, the APY stands at 8.3%. Do note that this includes RPL rewards, the native token of RocketPool.

Nonetheless, RocketPool is considered a much safer way to stake ETH when compared to centralized exchanges. Its staking protocol is open-sourced, regularly audited, and comes with permissionless nodes. RocketPool also offers a bug bounty, rewarding developers that find vulnerabilities in its smart contract.

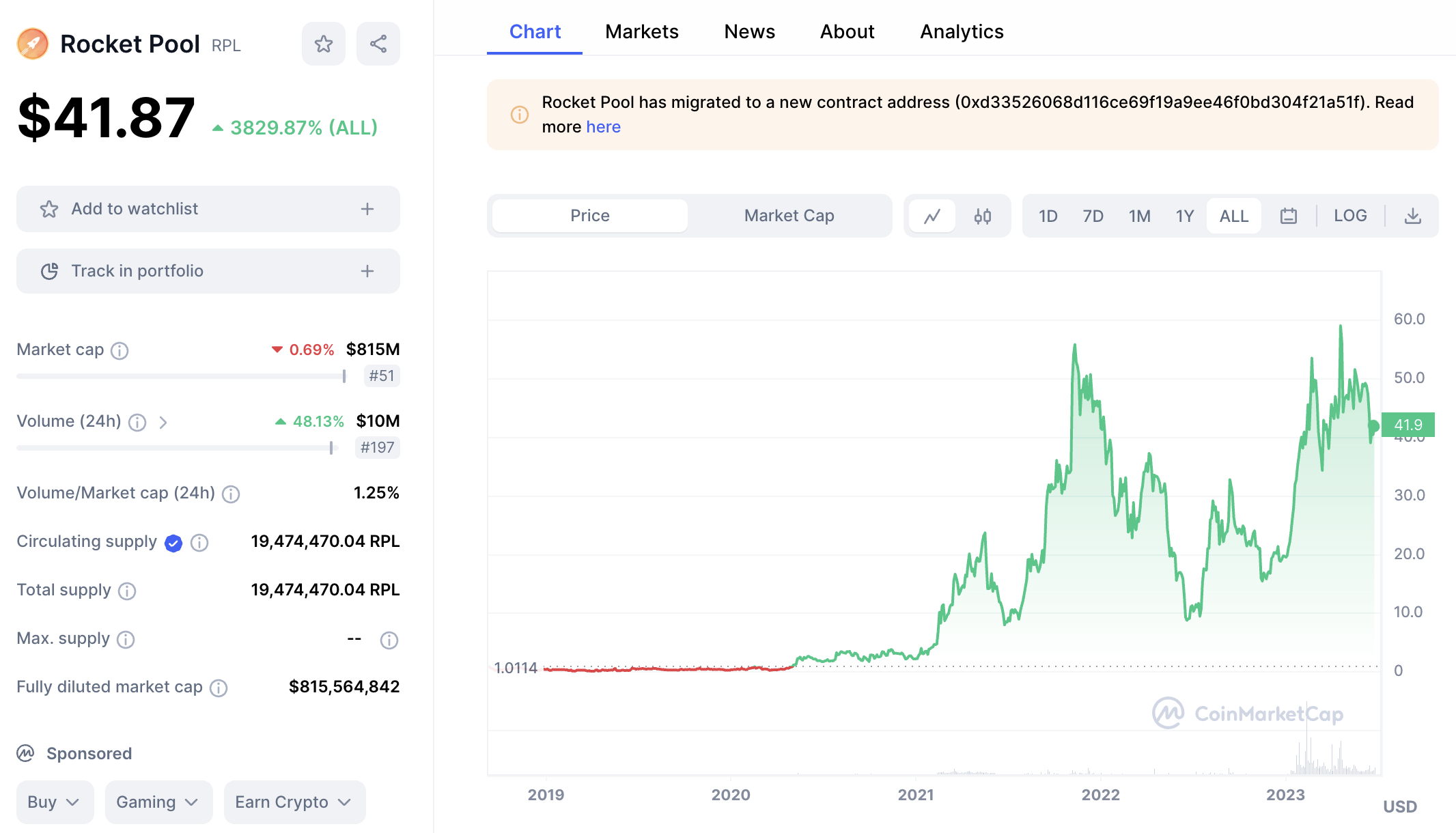

Perhaps the main drawback with RocketPool is that it does not support any other ERC20 tokens. From an investment perspective, RPL tokens continue to outperform the market. For example, while the majority of cryptocurrencies are trading at huge declines, RPL is up 336% over the prior year. Since its inception in late 2018, Rocket Pool has grown by more than 3,800%.

11. OKB – Native DeFi 2.0 Token of the OKX Web 3.0 Ecosystem

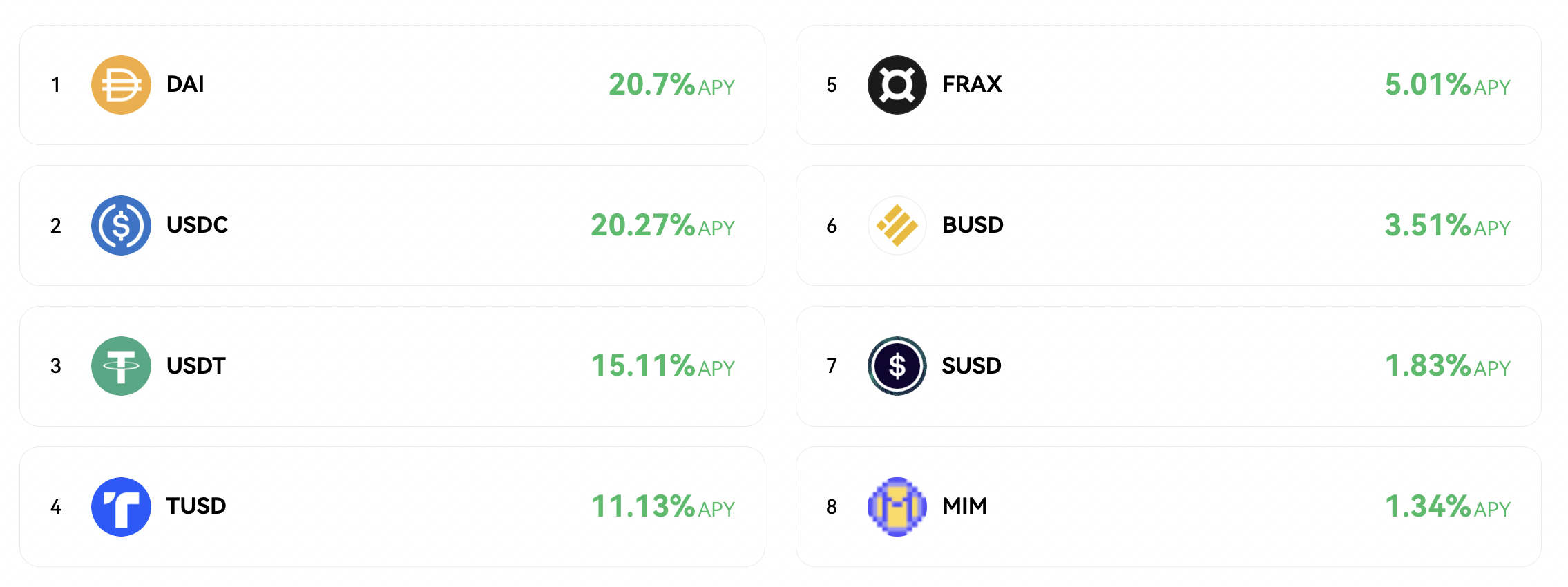

DeFi 2.0 and Web 3.0 operate hand-in-hand, and OKX could be the best ecosystem to bridge the two concepts together. OKX, which is backed by the OKB token, has developed one of the most robust and comprehensive Web 3.0 ecosystems. Connected to a decentralized wallet with MPC security, OKX supports a wide range of DeFi 2.0 products.

This includes anonymous token swaps across more than 50 blockchain networks. Users can trade thousands of tokens instantly and at the best market price. This is because OKX has developed a bridge protocol that aggregates prices from over 200 DeFi platforms. What’s more, DeFi 2.0 investors are fully catered for.

For instance, OKX supports staking, yield farming, and crypto deposit accounts. Its bridge protocol will scan over 200 platforms to find the highest APY for the respective token and product. Users can then complete their DeFi investment without leaving the OKX wallet. It is important to note that the OKX wallet is 100% decentralized.

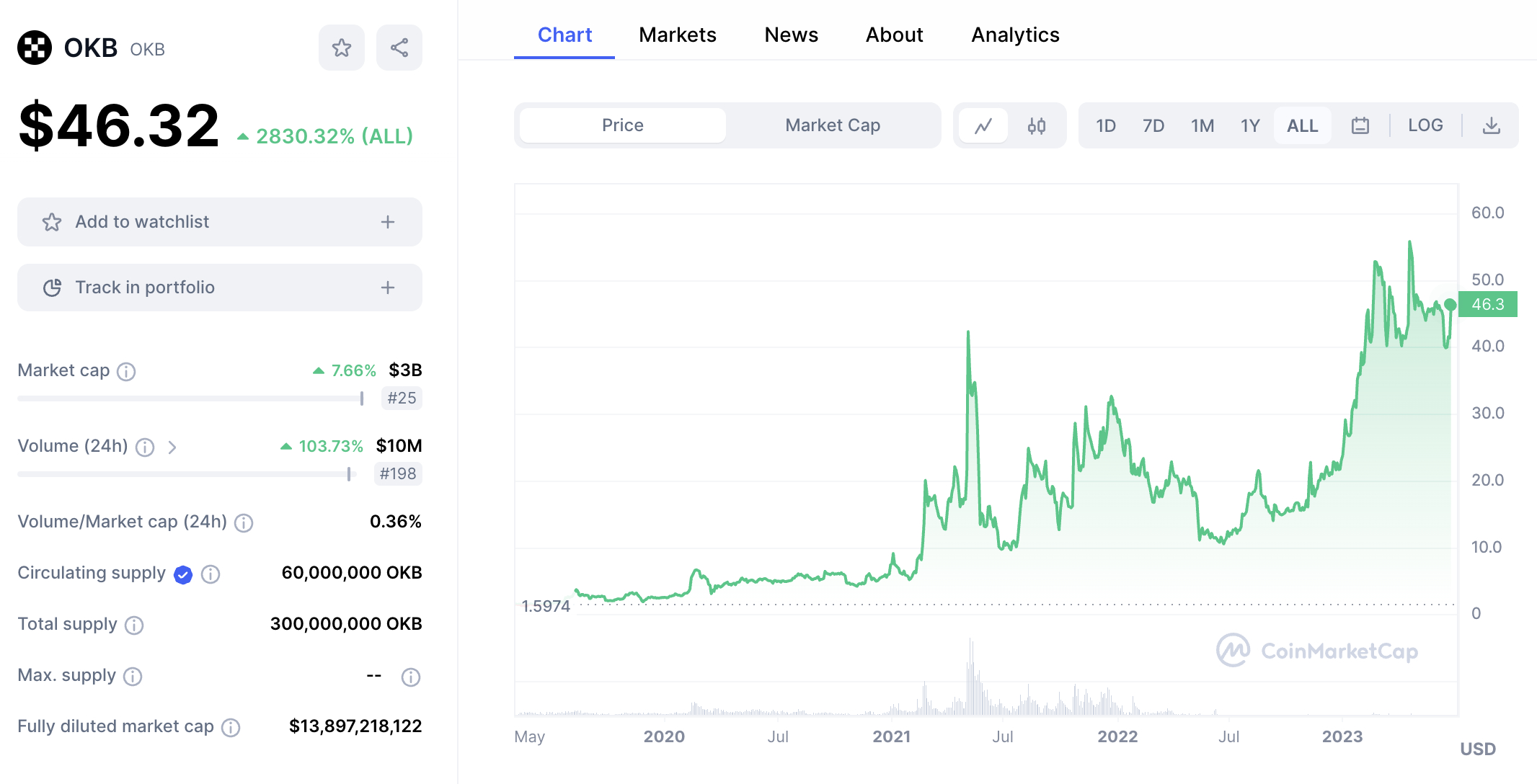

The OKX exchange does not have access to the wallet’s private keys. This allows users to store their DeFi 2.0 investments safely, without using a third-party platform. The best way to invest in the OKX Web 3.0 ecosystem is via OKB tokens. According to CoinMarketCap, OKB has increased in value by over 314% in the prior 12 months. This makes OKB one of the best cryptos to buy.

12. Ethereum Name Service – Simplifying DeFi 2.0 Transactions and Wallet Addresses

Ethereum Name Service solves an ongoing issue, not only in the DeFi space but the broader blockchain economy. In a nutshell, the project allows Ethereum and ERC20 investors to purchase their own .eth domain. The chosen .eth domain can be used for various purposes, including receiving transactions.

For example, suppose somebody buys the ‘John.eth’ domain. In doing so, the user can receive ETH tokens to this domain, meaning there is no requirement to use long and complex wallet addresses. This simplifies the world of DeFi 2.0, as .eth domains are a lot more user-friendly and suitable for beginners.

What’s more, .eth domains are backed by unique NFTs on the Ethereum network. This enables users to transfer ownership of their domain to another person, potentially for a profit. In total, there are 2.73 million .eth domains for sale, and about 25% have been purchased so far. Another benefit is that .eth domains can be uploaded to IPFS.

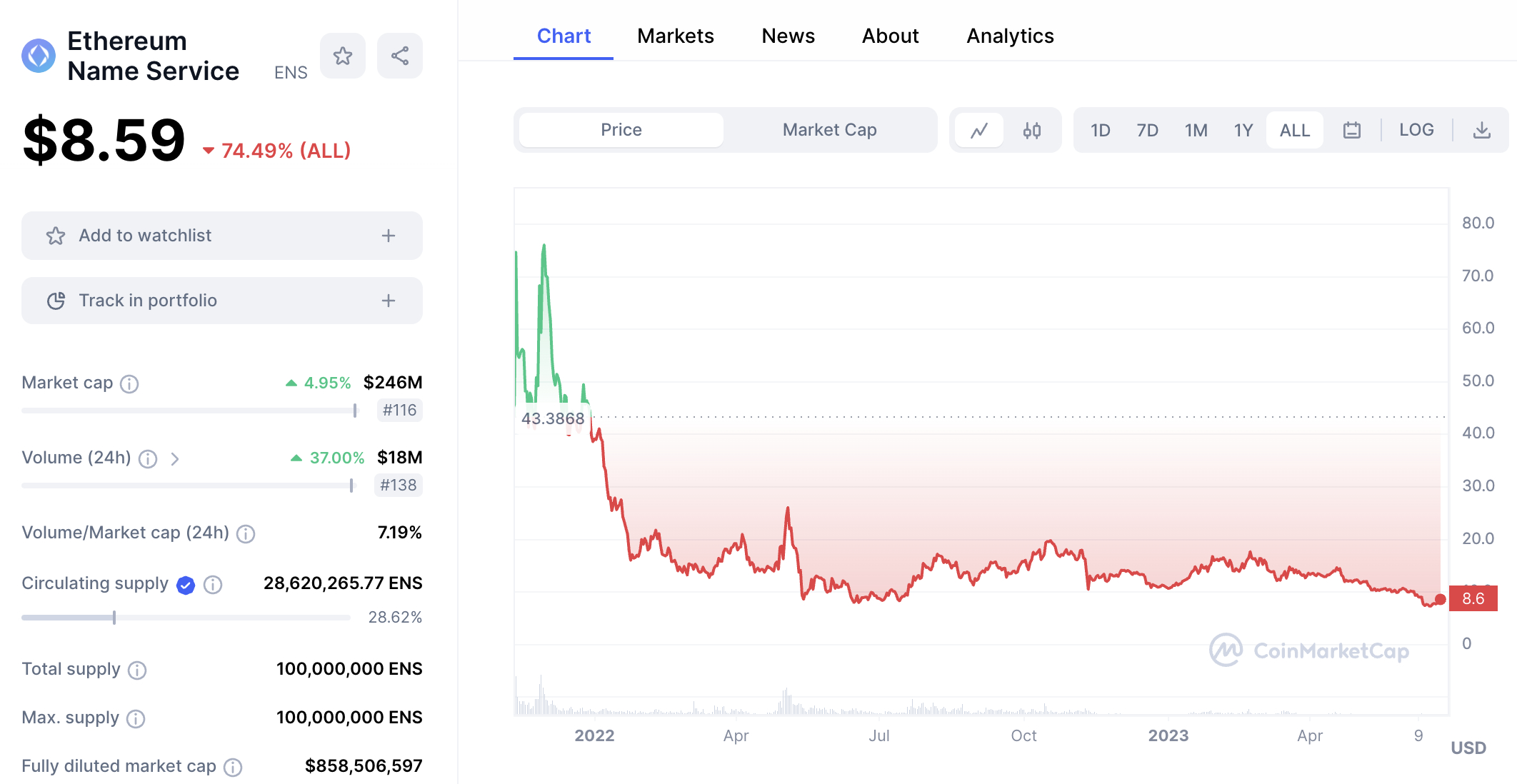

The domain owner can then use their domain to create a censorship-free website. Many DeFi 2.0 projects have incorporated support for .eth domains. This includes everything from Rainbow, Trust Wallet, and Enjin to MetaMask, Steakwallet, and Keystone. Ethereum Name Service is backed by ENS tokens. As per CoinMarketCap data, ENS has a market capitalization of just $246 million.

How we Picked the Best DeFi 2.0 Coins

Picking the best DeFi 2.0 coins is a complex task, considering how many options there are in the market.

For this guide, we ranked the best DeFi 2.0 projects by the following criteria:

Contribution to the DeFi 2.0 Economy

Investors should assess how the project contributes to the DeFi 2.0 economy. More specifically, the chosen project should offer a concept that is unique. This will give the project the best chance possible of becoming mainstream.

For instance, we like that the Graph allows DeFi 2.0 ecosystems to index their blockchain data. This removes unnecessary clutter and manages data into easily filtered blocks. In other words, the Graph allows DeFi 2.0 projects to operate efficiently.

Polygon is another example of how a project can revolutionize the DeFi 2.0 arena. This is a layer 2 solution that supports ERC20 ecosystems. By bridging to Polygon, these ecosystems benefit from much lower fees and higher transaction throughputs.

Put simply, the best DeFi 2.0 coins solve issues that are prevalent in DeFi 1.0.

Token Use Case

The best DeFi 2.0 projects have a native token that serves a specific purpose. This ensures that people have a reason to buy the token, other than just for speculative reasons.

ATOM – the native token of Cosmos, is required to use its blockchain interoperability protocol. Blockchains pay fees in ATOM, giving it a real-world use case.

Upside Potential

Making money from a DeFi 2.0 investment is the primary objective. As such, investors should consider the future potential of their chosen project. A good starting point is to assess the market capitalization.

The market capitalization refers to the value of the DeFi 2.0 project. It is calculated by multiplying the number of tokens in circulation by the current price.

- For example, suppose a DeFi 2.0 token is trading at $1.

- If there are 100 million tokens in circulation, the DeFi 2.0 project has a market capitalization of $100 million.

So why does this matter? Well, for the greatest upside, investors should consider focusing on lower-cap projects. This is because the project has more room to grow. This is especially the case with new cryptocurrencies.

That said, DeFi 2.0 projects with a lower market capitalization will also witness increased volatility. This is the trade-off that needs to be considered when choosing the best DeFi 2.0 coins.

Current Price vs All-Time High

The crypto industry has been in a bear market since it peaked in late 2021. This is just the nature of the markets, which go through bull and bear cycles. While nobody wants to see their portfolios decline, the current bear market offers plenty of opportunities.

This is because some of the best DeFi 2.0 cryptos can be purchased at a fraction of their bull market highs.

For example:

- At its peak, GRT hit an all-time high of over $2.34

- Currently, GRT is trading at $0.11

- This means those buying GRT today will secure a discount of over 95%

It’s not just GRT trading at such sizable lows. This is the case with most cryptocurrencies in the market.

Ultimately, buying DeFi 2.0 tokens at bear market prices can pay off once the next bull cycle arrives.

Why Invest in DeFi 2.0 Crypto Tokens?

Those unsure of DeFi 2.0’s potential should read on. We will now explain why DeFi 2.0 projects could witness unprecedented growth in the coming years.

Huge Market Potential

The DeFi market has the potential to become a multi-trillion-dollar sector. After all, decentralized finance covers a vast range of traditional financial services. This includes everything from banking and insurance to interest accounts and trading.

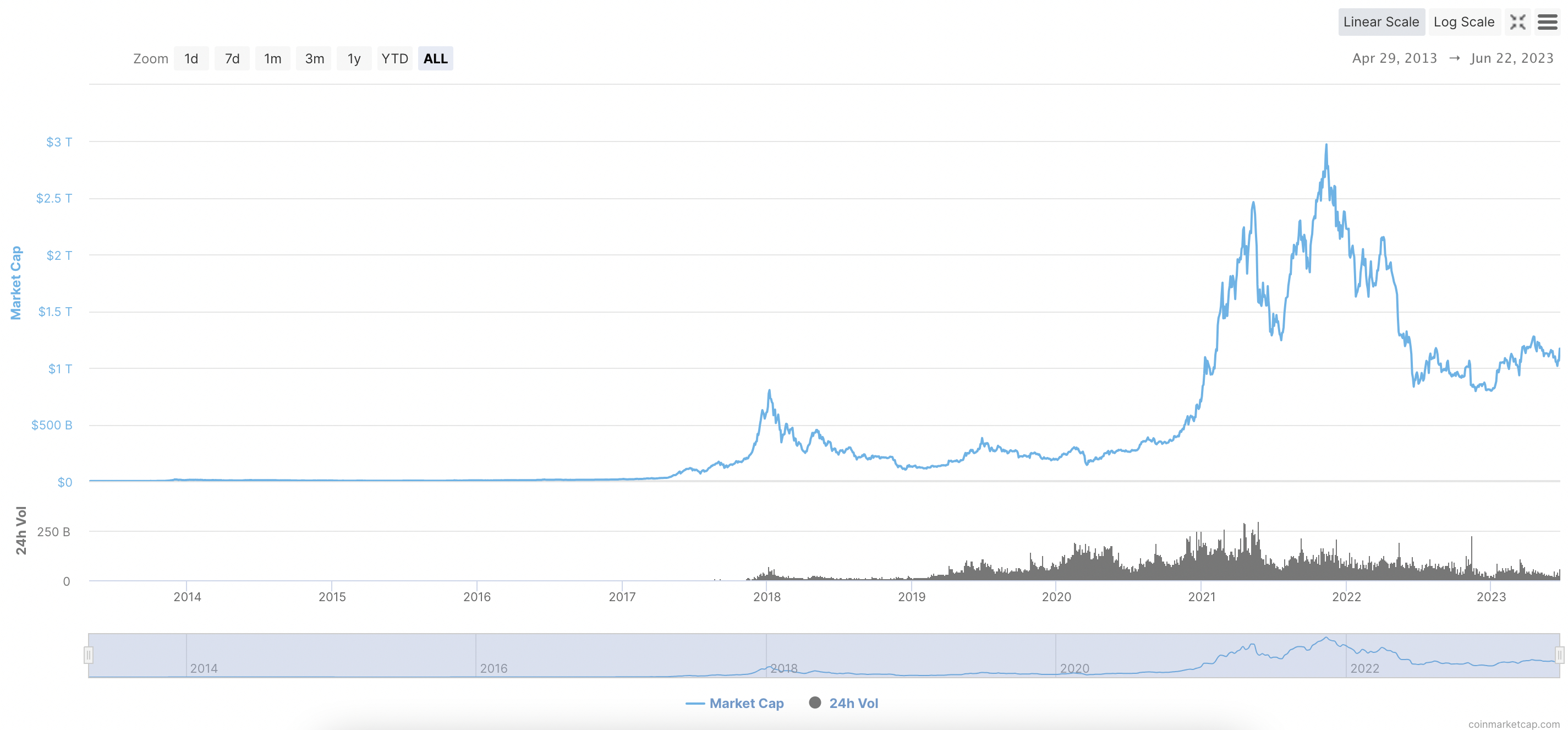

According to CoinMarketCap, the total DeFi market is worth over $41 billion. This is the case even though many DeFi projects are trading over 70% below their all-time highs. Some have declined by 90% and more.

The key point is that based on current valuations, the upside potential of DeFi 2.0 could be sizable. And never has there been a better time to gain exposure, considering the discounts available.

Simple to Diversify

Another benefit of investing in DeFi 2.0 is that it offers plenty of opportunities to diversify. This is because there are many niches within the DeFi 2.0 space.

For example, one segment of the portfolio could focus on DeFi 2.0 projects with increased scalability. The importance of this should not be understated, considering how many DeFi transactions occur.

Polygon is a notable option here, with the layer 2.0 solution capable of 65,000 transactions per second. Polygon also facilitates cost-effective transactions.

Another area of the portfolio could focus on DeFi 2.0 trading. dYdX is worth considering for its decentralized trading suite. This not only supports leveraged crypto derivatives but anonymous accounts and near-instant payouts. These are features that will not be found in the traditional trading industry,

Crucially, a diversified portfolio allows DeFi 2.0 investors to mitigate their risks. It also reduces the impact should an investment fail to take off.

Inclusivity

One of the core pillars of DeFi 2.0 is that traditional finance should be more inclusive. This means ‘banking the unbanked.’

- For example, according to the World Bank, more than 1.4 billion people still do not have access to a bank account.

- This also means a lack of everyday financial services, such as transferring funds, buying products online, or taking out loans.

DeFi 2.0 already solves many of these issues.

For instance, there are various platforms that support crypto loans. There is no requirement for borrowers to provide personal information – let alone a credit report.

Similarly, many DeFi 2.0 platforms support high-yield savings accounts. OKX, for example, sources interest rates from over 200 platforms. This offers a simple and transparent way to maximize savings.

DeFi 1.0 vs DeFi 2.0

Before investing in DeFi 2.0, it is important to understand why this niche market is needed. Similar to how we have Web 1, 2, and 3.0 – the DeFi landscape is constantly evolving and improving.

DeFi 2.0 is the latest version of decentralized finance, and it improves on the shortcomings of DeFi 1.0. For example, DeFi 2.0 allows platforms to offer cross-chain services. This means that transactions can take place between two or more blockchains.

Known as interoperability, this wasn’t possible in DeFi 1.0. As an example, DeFi 2.0 interoperability allows people to trade cryptocurrencies on two different networks. This is without using a centralized exchange. For instance, swapping Solana for Cardano or BNB for Bitcoin.

DeFi 1.0 also had major liquidity issues. There was no way for platforms to source liquidity from external providers while remaining decentralized. DeFi 2.0 solves this through bridge aggregators.

Put simply, a DeFi 2.0 platform can bridge multiple blockchains without using third parties. This is how OKX is able to support token swaps and yields across over 50 networks. Additionally, the majority of DeFi 1.0 was built on the Ethereum blockchain.

While Ethereum is a trusted framework with unparalleled security, it is also slow, expensive, and unable to scale past 29 transactions per second. Polygon, Arbitrum, and other layer 2 solutions solve this issue. This allows DeFi 2.0 projects to bridge to their networks for increased efficiency.

Conclusion

DeFi 2.0 is one of the biggest trends in the blockchain space right now. Many projects are building real-world solutions to DeFi 1.0 shortcomings, including Polygon, the Graph, and OKX.

From an investment perspective, Dogeverse stands out for us. This meme coin project – having already raised $15 million, could be one of the fastest-growing cryptocurrencies this year.

Those looking to secure a discount before the presale concludes can visit the Dogeverse website.

References

FAQs

What does DeFi 2.0 mean?

DeFi 2.0 is the second generation of decentralized finance, providing the industry with cross-chain functionality, faster and more cost-effective transactions, and increased liquidity.

What are some DeFi 2.0 projects?

Examples of DeFi 2.0 projects include Hedera, Polygon, the Graph, RocketPool, and Chainlink.

What is the most promising DeFi 2.0 project?

The most promising DeFi 2.0 project is Dogeverse, a meme coin community that has raised over $15 million in presale funding.

Is DeFi 2.0 sustainable?

One of the core improvements made by DeFi 2.0 is that it is now sustainable and environmentally friendly, with projects using more efficient networks and layer 2 solutions.

Which DeFi project is best on Solana?

Some of the top DeFi projects in the Solana ecosystem include Mango, Orca, Drift Protocol, and Raydium.

About the Author

Kane Pepi is a financial, gambling and cryptocurrency writer with over 2,000 published works, including on platforms like InsideBitcoins and Motley Fool. He specializes in cryptocurrency guides, exchange and wallet reviews, and covers new crypto projects for Cryptonews.com. His expertise includes asset valuation, portfolio management, and financial crime prevention. Pepi holds a Bachelor’s in Finance, a Master’s in Financial Crime, and is pursuing a Doctorate in money laundering in crypto and blockchain. Connect with Kane on LinkedIn.

About Cryptonews

At Cryptonews, we aim to provide a comprehensive and objective perspective on the cryptocurrency market, empowering our readers to make informed decisions in this ever-evolving landscape.

Our editorial team, comprised of more than 20 professionals in the crypto space, works diligently to uphold the highest standards of journalism and ethics. We follow strict editorial guidelines to ensure the integrity and credibility of our content.

Whether you’re seeking breaking news, expert opinions, educational resources, or market insights, Cryptonews.com is your go-to destination for all things crypto since 2017.

DeFi

Pump.Fun is revolutionizing the Ethereum blockchain in terms of daily revenue

The memecoin launchpad saw the largest daily revenue in all of DeFi over the past 24 hours.

Memecoin launchpad Pump.Fun has recorded the highest gross revenue in all of decentralized finance (DeFi) in the last 24 hours, surpassing even Ethereum.

The platform has raised $867,429 in the past 24 hours, compared to $844,276 for Ethereum, according to DeFiLlama. Solana-based Telegram trading bot Trojan was the third-highest revenue generator of the day, as memecoin infrastructure continues to dominate in DeFi.

Pump.Fun generates $315 million in annualized revenue according to DeFiLlama, and has averaged $906,160 per day over the past week.

Income Ranking – Source: DeFiLlama

The memecoin frenzy of the past few months is behind Pump.fun’s dominance. Solana-based memecoins have been the main drug of choice for on-chain degenerates.

The app allows non-technical users to launch their own tokens in minutes. Users can spend as little as $2 to launch their token and are not required to provide liquidity up front. Pump.Fun allows new tokens to trade along a bonding curve until they reach a set market cap of around $75,000, after which the bonding curve will then be burned on Raydium to create a safe liquidity pool.

Pump.Fun generates revenue through accrued fees. The platform charges a 1% fee on transactions that take place on the platform. Once a token is bonded and burned on Raydium, Pump.fun is no longer able to charge the 1% fee.

Ethereum is the blockchain of the second-largest cryptocurrency, Ether, with a market cap of $395 billion. It powers hundreds of applications and thousands of digital assets, and backs over $60 billion in value in smart contracts.

Ethereum generates revenue when users pay fees, called gas and denominated in ETH, to execute transactions and smart contracts.

DeFi

DeFi technologies will improve trading desk with zero-knowledge proofs

DeFi Technologies, a Canadian company financial technology companyis set to enhance its trading infrastructure through a new partnership with Zero Computing, according to a July 30 statement shared with CryptoSlate.

The collaboration aims to integrate zero-knowledge proof tools to boost operations on the Solana And Ethereum blockchains by optimizing its ability to identify and execute arbitrage opportunities.

Additionally, it will improve the performance of its DeFi Alpha trading desk by enhancing its use of ZK-enabled maximum extractable value (MEV Strategies).

Zero knowledge Proof of concept (ZKP) technology provides an additional layer of encryption to ensure transaction confidentiality and has recently been widely adopted in cryptographic applications.

Optimization of trading strategies

DeFi Technologies plans to use these tools to refine DeFi Alpha’s ability to spot low-risk arbitrage opportunities. The trading desk has already generated nearly $100 million in revenue this year, and this new partnership is expected to further enhance its algorithmic strategies and market analysis capabilities.

Zero Computing technology will integrate ZKP’s advanced features into DeFi Alpha’s infrastructure. This upgrade will streamline trading processes, improve transaction privacy, and increase operational efficiency.

According to DeFi Technologies, these improvements will increase the security and sophistication of DeFi Alpha’s trading strategies.

The collaboration will also advance commercial approaches for ZK-enabled MEVs, a new concept in Motor vehicles which focuses on maximizing value through transaction fees and arbitrage opportunities within block production.

Additionally, DeFi Technologies plans to leverage Zero Computing technology to develop new financial products, such as zero-knowledge index exchange-traded products (ETPs).

Olivier Roussy Newton, CEO of DeFi Technologies, said:

“By integrating their cutting-edge zero-knowledge technology, we not only improve the efficiency and privacy of our transactions, but we also pave the way for innovative trading strategies.”

Extending Verifiable Computing to Solana

According to the release, Zero Computing has created a versatile, chain-agnostic platform for generating zero-knowledge proofs. The platform currently supports Ethereum and Solana, and the company plans to expand compatibility with other blockchains in the future.

The company added that it is at the forefront of introducing verifiable computation to the Solana blockchain, enabling complex computations to be executed off-chain with on-chain verification. This development represents a significant step in the expansion of ZKPs across various blockchain ecosystems.

Mentioned in this article

Latest Alpha Market Report

DeFi

Elastos’ BeL2 Secures Starknet Grant to Advance Native Bitcoin Lending and DeFi Solutions

Singapore, Asia, July 29, 2024, Chainwire

- Elastos BeL2 to Partner with StarkWare to Integrate Starknet’s ZKPs and Cairo Programming Language with BeL2 for Native DeFi Applications

- Starknet integration allows BeL2 to provide smart contracts and dapps without moving Bitcoin assets off the mainnet

- Starknet Exchange Validates the Strength of BeL2’s Innovation and Leadership in the Native Bitcoin Ecosystem

Elastos BeL2 (Bitcoin Elastos Layer2) has secured a $25,000 grant from Starknet, a technology leader in the field of zero-knowledge proofs (ZKPs). This significant approval highlights the Elastos BeL2 infrastructure and its critical role in advancing Bitcoin-native DeFi, particularly Bitcoin-native lending. By integrating Starknet’s ZKPs and the Cairo programming language, Elastos’ BeL2 will enhance its ability to deliver smart contracts and decentralized applications (dapps) without moving Bitcoin (BTC) assets off the mainnet. This strategic partnership with Starknet demonstrates the growing acceptance and maturity of the BeL2 infrastructure, reinforcing Elastos’ commitment to market leadership in the evolving Bitcoin DeFi market.

Starknet, developed by StarkWare, is known for its advancements in ZKP technology, which improves the privacy and security of blockchain transactions. ZKPs allow one party to prove to another that a statement is true without revealing any information beyond the validity of the statement itself. This technology is fundamental to the evolution of blockchain networks, which will improve BeL2’s ability to integrate complex smart contracts while preserving the integrity and security of Bitcoin.

“We are thrilled to receive this grant from Starknet and announce our partnership to build tighter integrations with its ZKP technology and the Cairo programming language,” said Sasha Mitchell, Head of Bitcoin Layer 2 at Elastos. “This is a major milestone for BeL2 and a true recognition of the maturity and capabilities of our core technology. This support will allow us to further develop our innovation in native Bitcoin lending as we look to capitalize on the growing acceptance of Bitcoin as a viable alternative financial system.”

A closer integration with Cairo will allow BeL2 to leverage this powerful programming language to enhance Bitcoin’s capabilities and deliver secure, efficient, and scalable decentralized finance (DeFi) applications. Specifically, the relationship with Cairo reinforces BeL2’s core technical innovations, including:

- ZKPs ensure secure and private verification of transactions

- Decentralized Arbitrage Using Collateralized Nodes to Supervise and Enforce Fairness in Native Bitcoin DeFi

- BTC Oracle (NYSE:) facilitates cross-chain interactions where information, not assets, is exchanged while Bitcoin remains on the main infrastructure

BeL2’s vision goes beyond technical innovation and aims to innovate by creating a new financial system. The goal is to build a Bitcoin-backed Bretton Woods system, address global debt crises, and strengthen Bitcoin’s role as a global hard currency. This new system will be anchored in the integrity and security of Bitcoin, providing a stable foundation for decentralized financial applications.

As integration with Starknet and the Cairo programming language continues, BeL2 will deliver further advancements in smart contract capabilities, decentralized arbitration, and innovative financial products. At Token 2049, BeL2 will showcase further innovations in its core technologies, including arbitrators, that will underscore Elastos’ vision for a fairer decentralized financial system rooted in Bitcoin.

About Elastos

Elastos is a public blockchain project that integrates blockchain technology with a suite of redesigned platform components to produce a modern Internet infrastructure that provides intrinsic privacy and ownership protection for digital assets. The mission is to create open source services that are accessible to the world, so developers can create an Internet where individuals own and control their data.

The Elastos SmartWeb platform enables organizations to recalibrate how the Internet operates to better control their own data.

https://www.linkedin.com/company/elastosinfo/

ContactPublic Relations ManagerRoger DarashahElastosroger.darashah@elastoselavation.org

DeFi

Compound Agrees to Distribute 30% of Reserves to COMP Shareholders to End Alleged Attack on Its Governance

Compound will introduce the staking program in exchange for Humpy, a notorious whale accused of launching a governance attack on the protocol, negating a recently adopted governance proposal.

Compound is launching a new staking program for COMP holders as a compromise with Humpy, a notorious DeFi whale accused of launching a governance attack against the veteran DeFi protocol.

On July 29, Bryan Colligan, head of business development at Compound, published a governance proposal outlining plans for a new compound participation product that would pay 30% of the project’s current and future reserves to COMP participants.

Colligan noted that the program was requested by Humpy in exchange for his agreement Proposition 289 — which sought to invest 499,000 COMP worth approximately $24 million into a DeFi vault controlled by Humpy, and which appears to have been forced by Humpy and his associates over the weekend.

“We propose the following staking product that meets Humpy’s stated interests as a recent new delegate and holder of COMP in exchange for the repeal of Proposition 289 due to the governance risks it poses to the protocol,” Colligan said. “The Compound Growth Program…will execute the above commitments, given the immediate repeal of Proposition 289.”

Colligan added that the proposal would expire at 11:59 p.m. EST on July 29. Had Humpy not rescinded Proposition 289, Compound would move forward with it. Proposition 290 — block Humpy using the Compound team’s multi-sig to deploy a new governor contract removing the delegate’s governance power behind Proposition 289.

Hunchback tweeted that Proposition 289 had been repealed a few hours ago. “Glad to have brought Compound Finance back into the spotlight,” they said. added. “StakedComp… finally becomes a yield-generating asset!

Markets reacted favorably to the resolution, with the price of COMP increasing by 6.2% over the past 24 hours, according to CoinGecko.

Attack on governance

Proposition 289 proposed investing 499,000 COMP from the Compound treasury into goldCOMP, a yield-generating vault of the Humpy-linked Golden Boys team.

The proposal passed with nearly 52 percent of the vote on July 28, despite two previous iterations of the proposal being defeated by strong opposition. Can And JulyThe proposals notably asked for only 92,000 COMP, with security researchers warning that any deposit of tokens into the goldCOMP vault would cede their governance power.

In May, Michael Lewellen of Web3 security firm OpenZeppelin, note The first proposal was submitted by a new governance delegate who was suddenly awarded 228,000 COMP by five wallets that got their tokens from the Bybit exchange. Combined with his own tokens, the delegate got 325,333 COMP, which is over 81% of the 400,000 tokens required for a governance proposal to reach quorum.

“We have been alerting the community to the risk that these delegates could support a potential attack on governance,” Lewellen said. “The timing of the new proposal and these recent delegations are suspect.”

Read more: Compound community accuses famous whale of attacking engineering governance

-

Videos4 weeks ago

Videos4 weeks agoAbsolutely massive: the next higher Bitcoin leg will shatter all expectations – Tom Lee

-

News12 months ago

News12 months agoVolta Finance Limited – Director/PDMR Shareholding

-

News12 months ago

News12 months agoModiv Industrial to release Q2 2024 financial results on August 6

-

News12 months ago

News12 months agoApple to report third-quarter earnings as Wall Street eyes China sales

-

News12 months ago

News12 months agoNumber of Americans filing for unemployment benefits hits highest level in a year

-

News1 year ago

News1 year agoInventiva reports 2024 First Quarter Financial Information¹ and provides a corporate update

-

News1 year ago

News1 year agoLeeds hospitals trust says finances are “critical” amid £110m deficit

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Hit $100 Billion in 2024, Fueling Insane Investor Optimism ⋆ ZyCrypto

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Videos1 year ago

Videos1 year ago$1,000,000 worth of BTC in 2025! Get ready for an UNPRECEDENTED PRICE EXPLOSION – Jack Mallers

-

Videos1 year ago

Videos1 year agoABSOLUTELY HUGE: Bitcoin is poised for unabated exponential growth – Mark Yusko and Willy Woo

-

Tech1 year ago

Tech1 year agoBlockDAG ⭐⭐⭐⭐⭐ Review: Is It the Next Big Thing in Cryptocurrency? 5 questions answered