Tech

The Latest Tech News in Crypto and Blockchain

Feb. 21: Fuel Labs, creator of the optimistic rollup Fuel v1, announces its evolution into the “Rollup OS, a complete operating system designed to empower Ethereum rollups and unlock their full potential,” according to the team: “Purpose-built to tackle critical limitations in existing rollups architectures, this paves the way for its Q3 2024 mainnet launch. Powered by FuelVM, the Rollup OS brings new capability to Ethereum via parallelization, state minimization, seamless interoperability and VM customisation. By introducing multiple native assets and combating state bloat, Fuel brings a new paradigm to scaling.”

Flare Claims First as ‘Compliant Decentralized Futures Protocol’

Feb. 21: Flare is joining forces with Sindric Solutions to launch XDFi, claiming it’s “the world’s first compliant decentralized futures protocol,” according to the team: “With regulatory uncertainty impeding larger-scale institutional investment in DeFi, XDFi emerges as a promising solution for major investors. The protocol’s third-party Know Your Customer tokenization (KYCT) guarantees 100% confidence in compliant futures contract transactions, ensuring all P2P matches occur between eligible counterparties.”

INIT Capital Secures $3M in Funding to Launch ‘Liquidity Hooks’

Feb. 21: INIT Capital has secured $3 million in seed funding to launch Liquidity Hooks on Feb. 28, targeting DeFi liquidity challenges. According to the team: “With the goal of evolving alongside DeFi’s rapid growth, this innovation is set to address the gap in money market architecture and user composability. With backing from top investors like Electric Capital and Mirana Ventures, INIT’s Liquidity Hooks serve as composable plugins for liquidity, allowing dApps to fully concentrate on catering yield and trading strategies for end-users.”

Protocol Village is a regular feature of The Protocol, our weekly newsletter exploring the tech behind crypto, one block at a time. Sign up here to get it in your inbox every Wednesday. Project teams can submit updates here. For previous versions of Protocol Village, please go here. Also please check out our weekly The Protocol podcast.

ZKM Launches ‘zkVM’ Alpha Testnet

Feb. 20: ZKM is launching its zero-knowledge virtual machine (zkVM) alpha testnet to open up possibilities for both blockchain and non-blockchain applications to harness the potential benefits of zero-knowledge proofs. According to the team: “The primary aim of ZKM is to establish Ethereum as the global settlement layer for secure, verifiable computing via their general purpose zkVM.”

Stellar Starts Phased Rollout of ‘Soroban’ Smart Contracts

Feb. 20: The Stellar blockchain moved forward with its “Protocol 20” upgrade, initiating phased rollout that will see the payments network add Ethereum-style smart contracts under the long-planned Soroban project. The Stellar Development Foundation, which supports the blockchain’s ecosystem, confirmed the “new era for the Stellar smart contracts tech stack” in a blog post on Tuesday, noting that the move came after validators voted for the mainnet upgrade. CoinDesk 20 asset: (XLM)

EOS Introduces Leap 6.0 Upgrade, Including Launch of ‘Savanna’ Consensus Algorithm

Feb. 20: EOS introduced the Leap 6.0 upgrade, “transforming the ecosystem with the Savanna consensus algorithm,” according to the team: “This upgrade delivers instant finality and a 100-fold transaction speed boost. Scheduled for release on July 10, it enhances security, user experience and decentralization. Infrastructure providers and partners should note key dates, with the hard fork set for July 31. Inspired by HotStuff, Savanna elevates scalability and privacy, while introducing the potential for decentralized block producers.”

Pontem Network Unveils Liquidswap, an AMM on Aptos

Feb. 20: Pontem Network, a product development studio building Move and EVM-compatible products to enable a safer, more performant and developer-friendly Web3, is unveiling Liquidswap, “the first automated market maker to offer concentrated liquidity on Aptos,” according to the team: “Since launching in stealth mode, Pontem’s Liquidswap has recorded $320M in trading volume, $32M of TVL and 700K unique addresses,” according to the team. (APT)

Humanity Protocol Emerges From Stealth, Backed by Animoca, Polygon

Feb. 20: Humanity Protocol, launched by Human Institute with Animoca Brands and Polygon Labs, emerged from stealth as a new zkEVM layer-2 blockchain for Web3 identity validation. According to a press release, the project relies on palm recognition tech “as a less invasive identity verification alternative to methods like iris scans.” The protocol was built from the chain-development kit Polygon CDK, with zero-knowledge proofs and a “Proof of Humanity” consensus mechanism. The team wrote in a message: “Founded by Terence Kwok and backed by tech leaders, it aims for an inclusive, user-centric Web3 experience. Utilizing Polygon CDK for scalability, it’s designed for diverse applications, ensuring sybil resistance and data ownership.” CoinDesk 20 asset: (MATIC)

CrossFi, With CoinList, Launches EVM Testnet

Feb. 20: CrossFi, in collaboration with CoinList, has launched its EVM testnet, marking a crucial step towards providing secure and user-friendly cross-border payments, according to the team: “The testnet, running for three months with $8.4M in MPX rewards, aims to validate CrossFi Chain’s functionality, performance and security, paving the way for its mainnet launch and redefining traditional finance with decentralized solutions.”

COTI Blockchain Unveils ‘Garbled Circuits’ as New Encryption Paradigm to Rival FHE

Feb. 20: COTI, a layer-1 blockchain, unveiled a new encryption paradigm with garbled circuits, according to the team: “This is the first time garbled circuits have been successfully deployed on the blockchain, bringing on-chain privacy with a computation speed up to 1,000 times faster than other encryption systems like fully homomorphic encryption (FHE). Garbled circuit technology is a form of multi-party computation (MPC), where specialized cryptographic methods allow a group of parties to collaborate, performing a specific computation that requires their private information, but does so without disclosing the input information to any other party.”

QED, the ‘ZK-Native’ Blockchain, Secures $3M in Funding for DeFi on Bitcoin

Feb. 20: QED, describing itself as “the world’s first ZK-native blockchain protocol,” has secured $3 million in funding, to propel DeFi on Bitcoin. According to the team: “Combining the scalability of zero-knowledge (ZK) proofs with the liquidity and security of BTC, QED supports DeFi at scale, real-time programmable NFTs, secure blockchain bridges and trustless e-commerce marketplaces. DApps built on QED can locally prove transactions, providing unlimited computation for a fixed gas fee. This innovation ensures every user’s public key functions as a custom ZK circuit, featuring ‘smart signatures’ read from state, resembling a smart contract.”

DePIN-Focused Blockchain Minima to Put Nodes on Wicrypt’s ‘Smart WiFi’ Routers

Feb. 20: Minima, a layer-1 blockchain focused on decentralized physical infrastructure network (DePIN) solutions, is partnering with Wicrypt, a smart WiFi network, according to the team. The plan is “to democratize and make internet access cheaper for everyone. Wicrypt will embed Minima nodes into WiFi routers, which will then be able to grant network access to Minima users. By running Minima nodes on Wicrypt routers, each router will become an active node, thus decentralizing and making the network’s infrastructure more secure and resilient.”

ELOOP Plans Tokenization Platform on Peaq Blockchain

Feb. 20: ELOOP, a specialist in “Machine RWAs,” running a project that tokenizes vehicles in a car-sharing Tesla fleet, announced plans for building a tokenization platform on the peaq blockchain, according to the team: “The platform will enable companies and communities to get a stake in the value generated by their machines as on-chain tokens. The tokens will generate rewards for their holders based on the real-world value created by the underlying machines: wind turbines, WiFi hotspots, shared e-scooters. The platform has garnered interest from both Web2 and Web3 projects, including Dabba, a connectivity DePIN.”

Starter Partners With Atlanta Blockchain Center, Revamping Crypto Launchpad

Feb. 20: Starter International Holdings has partnered with Atlanta Blockchain Center, revamping its acclaimed crypto launchpad to champion diversity and innovation. According to the team: “The collaboration introduces Base Chain support, aiming to fill the VC industry’s diversity gap. With a history of over 60 IDOs and $45M raised, Starter is set to bridge blockchains and communities, fostering a more inclusive blockchain ecosystem. Discover how this partnership is redefining blockchain fundraising and empowering minority founders at https://starter.xyz.”

ZKX, Decentralized Perps Exchange on Starknet, Launches ‘Pro Trade’

Feb. 20: ZKX, a decentralized perpetual futures exchange operating on Starknet, has “launched their second product, Pro Trade, a trading exchange offering advanced features, gasless transactions and exclusive $ZKX rewards, enhancing the DeFi experience for experienced traders,” according to the team: “This announcement follows Starknet Foundation’s STRK token distribution plan last week. With a shared objective of bringing more people into DeFi, ZKX is contributing by enriching the ecosystem, driving adoption and showcasing Starknet’s capabilities.”

Jumper.Exchange Launches LI.Fuel to Support Expansion of Solana-Based Stablecoin Transfers

Feb. 20: Jumper.Exchange announced that it has added support for Solana-based transfers of USDC and USDT, according to the team: “This enables swaps from any token on the Solana blockchain into USDC. To further support this expansion, Jumper.Exchange has also launched LI.Fuel, which enabled users to convert a portion of their bridged tokens into Solana in order to be able to instantly engage with Solana dApps and platforms. In addition to Solana, Jumper.Exchange currently supports USDC and USDT transfers from various EVM chains, including Ethereum, Arbitrum, Optimism, Base, Polygon, BNB Chain and Avalanche.”

Polybase Announced the Launch of Payy, a New Payment App

Feb. 20: Polybase Labs, which built an Ethereum ZK rollup blockchain with private transactions, announced the launch of Payy, a global payments app. According to the team, it takes fewer than 10 seconds to move $1 or $1B, is free and is end-to-end encrypted. “Polybase is giving away $100K at ETH Denver to celebrate the launch.”

Solana to Use Filecoin to Make Block History More Accessible

Feb. 19: The Solana blockchain has integrated with Filecoin, according to the Filecoin team: “Solana is utilizing Filecoin to make its block history more accessible and usable for infrastructure providers, explorers, indexers, and anyone needing historical access. By leveraging Filecoin’s decentralized storage capabilities, Solana can achieve data redundancy, scalability, and enhanced security while staying true to its decentralized ethos.” CoinDesk 20 assets: (SOL) (FIL)

Trust Wallet Launches ‘SWIFT’ Smart-Contract Wallet With Biconomy

Feb. 19: Trust Wallet, a self-custody wallet, has launched SWIFT, a smart-contract wallet, in collaboration with Biconomy. According to the team, the launch “marks a significant industry shift by redefining Web3 accessibility for 80 million users. SWIFT’s integration of Account Abstraction technology simplifies setup, enhances security with biometric Passkeys, and ensures seamless gas fee management. With features like one-click transactions and support for 200+ tokens, SWIFT sets a new standard for user-centric web3 wallets.” The collaboration “leverages Biconomy’s innovative Paymaster and Bundler infrastructure.”

ZkSync’s ZeroLend to Launch Native Governance Token ZERO

Feb. 19: ZeroLend, the second-largest protocol on zkSync, is set to launch its native governance token ZERO in Q1 2024. This comes on the back of a $3 million seed round. The DeFi protocol has observed 1,000% growth in TVL from $3 million to $40 million in the past few months as users searched for new potential airdrops and interacted with zkSync-based platforms.

AltLayer, Platform for Launching Rollups, Raises $14.4M From Polychain, Hack VC

Feb. 19: AltLayer, an open and decentralized protocol to launch native and restaked rollups with optimistic and ZK stacks, has raised $14.4 million in a strategic fundraising round co-led by Polychain Capital and Hack VC, according to the team: “The company eyes global team expansion amidst the growing number of strategic partnerships and key projects in development, centered around our infrastructure innovation of restaked rollups.”

Y Combinator, Startup Incubator Behind Airbnb, Coinbase, and Stripe, Looks to Invest in Stablecoin Finance

Feb. 19: Y Combinator, the Silicon Valley incubator, has listed stablecoin finance as a category in its new and updated list of areas it would like to deploy funds in, according to its request for startups (RFS) list released last week.

BNB Chain Releases Report on Its History

Feb. 19: BNB Chain released the “BNB Chain & the Web3 Blueprint” brand story report analyzing the “advancements, use cases,and impact across its three community-led blockchains,” according to the team: “It also delves into its history and journey from BSC’s inception in 2017 as Binance Chain, its evolution to Binance Smart Chain and eventual emergence as BNB Smart Chain, one of the most popular layer-1 (L1) ecosystems in the world, averaging in excess of 1M DAU, and opBNB.”

Wormhole Foundation Collaborates With Succinct on ‘ZK Light Client’

Feb. 18: Wormhole Foundation, which supports teams building products for the cross-chain messaging protocol Wormhole, said in a blog post that it’s “collaborating with the team at Succinct to build an Ethereum ZK light client as part of an ongoing effort to further decentralize message verification within the Wormhole platform. Wormhole ZK is being leveraged by developers to minimize trust in the Wormhole platform, improve cross-chain composability and increase network security. Read more about the vision of Wormhole ZK in the recently announced ZK roadmap.”

Justin Sun Tweets Tron DAO’s Roadmap for Bitcoin Layer-2

Feb. 16: TRON DAO, the decentralized autonomous organization (DAO) behind the TRON network, with over 210 million user accounts, has unveiled its roadmap for building an innovative Bitcoin layer-2 solution, according to a tweet from Tron founder Justin Sun. “This solution will revolutionize how we think about blockchain interoperability and using stablecoins within the Bitcoin ecosystem,” according to a message from the team. “Let’s make #Bitcoin fun again!” Sun wrote. (TRX)

Silencio, Decentralized Network to Use Smartphones as Noise-Pollution Sensors, Raises $1M

Feb. 16: Silencio, a decentralized network of smartphones working as noise-pollution sensors, has closed a $1M funding round led by Borderless Capital, a leading investor in the DePIN space, according to the team: “Along with Borderless Capital, funding from Moonrock Capital, Master Ventures, and others will be used to expand and enhance its community-driven noise pollution sensor network, improve data integrity for well-being, and support strategic initiatives. This investment marks a significant milestone for Silencio as it sets out to redefine data coverage through the integration of peaq, the layer-1 blockchain for real-world apps.” Silencio selected peaq’s network last year as its layer-1 blockchain.

Subsquid Joins Google BigQuery for Multi-Chain Projects

Feb. 16: Subsquid, a peer-to-peer network to batch query and aggregate data, has joined Google’s BigQuery for multi-chain projects to leverage Subsquid with BigQuery to quickly analyze their usage on different chains and gain insights into fees, operating costs and trends, according to the team: “Subsquid indexing has supported over $11 billion in decentralized applications and L1/L2 value, with 30,000 participants, including tens of thousands of developers, deploying over 40,000 indexers.”

RW3, Blockchain-Focused VC Led by Pete Najarian, Raises $80M

Feb. 15: RW3 Ventures raised $60 million for RW3 Ventures Fund I LP, according to the team: “The fund will target investments in early-stage blockchain and Web3 companies, with an emphasis on teams that seek to utilize blockchain technology to disrupt real-world industries and business models with sizable addressable markets. The round was led by The Raptor Group and Mubadala Capital, the wholly-owned asset management subsidiary of Mubadala Investment Company, a global sovereign investor headquartered in Abu Dhabi. RW3 is led by Pete Najarian and Joe Bruzzesi, two well-known figures in the digital asset space.”

Blueprint Finance Emerges With $7.5M of Funding, Concrete Protocol

Feb. 15: Blueprint Finance announced that it’s emerging from stealth with $7.5 million in funding from crypto-native investors including Tribe Capital, Hashed, Portal Ventures, SALT and others – to solve crypto’s liquidation problem. According to the team: Blueprint’s flagship product is the Concrete Protocol, an appchain purpose-built for on-chain debt and credit. Concrete powers higher yields, liquidation protection, and advanced predictions across all of DeFi, starting with money markets.”

QuickNode Adds Support for ZkSync Hyperchains

Feb. 15: QuickNode, a Web3 development platform, now supports zkSync hyperchains,” enhancing its custom chains offering for clients seeking fast and scalable ZK technology,” according to the team: “Hyperchains, powered by ZK Stack, ensure robust data privacy, ideal for enterprise use cases while maintaining compliance. They run parallel to zkSync mainnet, enabling seamless asset bridging and liquidity flow. With QuickNode handling infrastructure, businesses can focus on creating plug-and-play blockchain applications.”

Lava, Cosmos-Based Appchain, Raises $15M, Plans Mainnet Launch

Feb. 15: Lava, an application-specific proof-of-stake blockchain built using Cosmos SDK, has raised a $15 million seed round, led by Tribe, Jump and Hashkey Capital, according to the team: “Mainnet is launching end of Q1/early Q2. Lava’s vision is to build a modular data access layer for Web3, enabling developers to easily build apps on any chain or rollup. Lava has been uniquely designed for technical and non-technical users to contribute to scaling the network and is launching a points system to reward users.”

Injective Adds Mainnet Support for Solana Domain-Name Bridging With Wormhole

Feb. 15: Injective, a blockchain designed for finance built using Cosmos SDK, now supports “an interoperable domain name service (DNS) on mainnet: Solana domain-name bridging with Wormhole (previously available on testnet). The cross-chain integration further converges the Web3 and Web2 experience by letting users leverage single domain names like on Web2 when conducting transactions, and represents a major achievement in ecosystem collaboration, including Bonfida and Wormhole. More details from Injective and Bonfida. Injective’s infrastructure features a unique two-way cross-chain interaction facilitated by Wormhole. This results in a more efficient and streamlined domain service experience when SNS transactions are initiated. Adoption is simple: users can purchase .sol domains plus use both .sol and .inj domains across Injective dApps, further expanding the cross-chain domain experience.” (INJ)

Helika, Data Analytics Provider for Web3 Gaming, Raises $8M From Pantera, Animoca, Diagram, Sfermion

Feb. 15: Helika, a data analytics and infrastructure provider for traditional and Web3 gaming with customers like Animoca Brands and Yuga Labs, is announcing the completion of an $8 million Series A fundraising from Pantera, Animoca, Diagram and Sfermion. According to the team: “This funding will help Helika advance its AI-powered suite of products and services, which currently aggregates data across multiple chains, social media platforms, and games and synthesizes that data into actionable insights for gaming studios to leverage in user acquisition, retention, and engagement to ultimately drive profits.”

Tech

Harvard Alumni, Tech Moguls, and Best-Selling Authors Drive Nearly $600 Million in Pre-Order Sales

BlockDAG Network’s history is one of innovation, perseverance, and a vision to push the boundaries of blockchain technology. With Harvard alumni, tech moguls, and best-selling authors at the helm, BlockDAG is rewriting the rules of the cryptocurrency game.

CEO Antony Turner, inspired by the successes and shortcomings of Bitcoin and Ethereum, says, “BlockDAG leverages existing technology to push the boundaries of speed, security, and decentralization.” This powerhouse team has led a staggering 1,600% price increase in 20 pre-sale rounds, raising over $63.9 million. The secret? Unparalleled expertise and a bold vision for the future of blockchain.

Let’s dive into BlockDAG’s success story and find out what the future holds for this cryptocurrency.

The Origin: Why BlockDAG Was Created

In a recent interview, BlockDAG CEO Antony Turner perfectly summed up why the market needs BlockDAG’s ongoing revolution. He said:

“The creation of BlockDAG was inspired by Bitcoin and Ethereum, their successes and their shortcomings.

If you look at almost any new technology, it is very rare that the first movers remain at the forefront forever. Later incumbents have a huge advantage in entering a market where the need has been established and the technology is no longer cutting edge.

BlockDAG has done just that: our innovation is incorporating existing technology to provide a better solution, allowing us to push the boundaries of speed, security, and decentralization.”

The Present: How Far Has BlockDAG Come?

BlockDAG’s presale is setting new benchmarks in the cryptocurrency investment landscape. With a stunning 1600% price increase over 20 presale lots, it has already raised over $63.9 million in capital, having sold over 12.43 billion BDAG coins.

This impressive performance underscores the overwhelming confidence of investors in BlockDAG’s vision and leadership. The presale attracted over 20,000 individual investors, with the BlockDAG community growing exponentially by the hour.

These monumental milestones have been achieved thanks to the unparalleled skills, experience and expertise of BlockDAG’s management team:

Antony Turner – Chief Executive Officer

Antony Turner, CEO of BlockDAG, has over 20 years of experience in the Fintech, EdTech, Travel and Crypto industries. He has held senior roles at SPIRIT Blockchain Capital and co-founded Axona-Analytics and SwissOne. Antony excels in financial modeling, business management and scaling growth companies, with expertise in trading, software, IoT, blockchain and cryptocurrency.

Director of Communications

Youssef Khaoulaj, CSO of BlockDAG, is a Smart Contract Auditor, Metaverse Expert, and Red Team Hacker. He ensures system security and disaster preparedness, and advises senior management on security issues.

advisory Committee

Steven Clarke-Martin, a technologist and consultant, excels in enterprise technology, startups, and blockchain, with a focus on DAOs and smart contracts. Maurice Herlihy, a Harvard and MIT graduate, is an award-winning computer scientist at Brown University, with experience in distributed computing and consulting roles, most notably at Algorand.

The Future: Becoming the Cryptocurrency with the Highest Market Cap in the World

Given its impressive track record and a team of geniuses working tirelessly behind the scenes, BlockDAG is quickly approaching the $600 million pre-sale milestone. This crypto powerhouse will soon enter the top 30 cryptocurrencies by market cap.

Currently trading at $0.017 per coin, BlockDAG is expected to hit $1 million in the coming months, with the potential to hit $30 per coin by 2030. Early investors have already enjoyed a 1600% ROI by batch 21, fueling a huge amount of excitement around BlockDAG’s presale. The platform is seeing significant whale buying, and demand is so high that batch 21 is almost sold out. The upcoming batch is expected to drive prices even higher.

Invest in BlockDAG Pre-Sale Now:

Pre-sale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetwork

Discord: Italian: https://discord.gg/Q7BxghMVyu

No spam, no lies, just insights. You can unsubscribe at any time.

Tech

How Karak’s Latest Tech Integration Could Make Data Breaches Obsolete

- Space and Time uses zero-knowledge proofs to ensure secure and tamper-proof data processing for smart contracts and enterprises.

- The integration facilitates faster development and deployment of Distributed Secure Services (DSS) on the Karak platform.

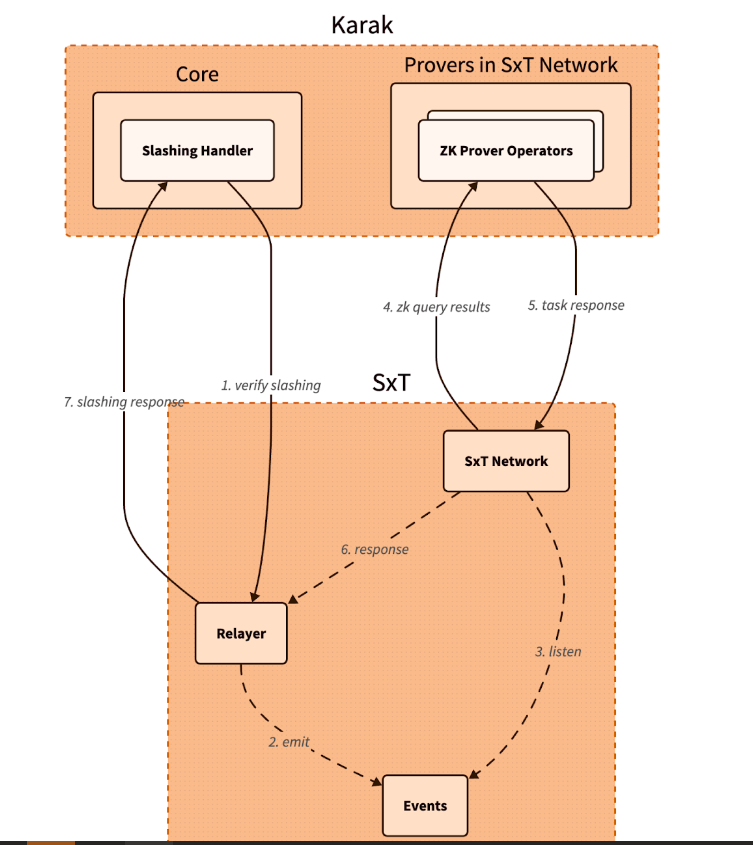

Karak, a platform known for its strong security capabilities, is enhancing its Distributed Secure Services (DSS) by integrating Space and Time as a zero-knowledge (ZK) coprocessor. This move is intended to strengthen trustless operations across its network, especially in slashing and rewards mechanisms.

Space and Time is a verifiable processing layer that uses zero-knowledge proofs to ensure that computations on decentralized data warehouses are secure and untampered with. This system enables smart contracts, large language models (LLMs), and enterprises to process data without integrity concerns.

The integration with Karak will enable the platform to use Proof of SQL, a new ZK-proof approach developed by Space and Time, to confirm that SQL query results are accurate and have not been tampered with.

One of the key features of this integration is the enhancement of DSS on Karak. DSS are decentralized services that use re-staked assets to secure the various operations they provide, from simple utilities to complex marketplaces. The addition of Space and Time technology enables faster development and deployment of these services, especially by simplifying slashing logic, which is critical to maintaining security and trust in decentralized networks.

Additionally, Space and Time is developing its own DSS for blockchain data indexing. This service will allow community members to easily participate in the network by running indexing nodes. This is especially beneficial for applications that require high security and decentralization, such as decentralized data indexing.

The integration architecture follows a detailed and secure flow. When a Karak slashing contract needs to verify a SQL query, it calls the Space and Time relayer contract with the required SQL statement. This contract then emits an event with the query details, which is detected by operators in the Space and Time network.

These operators, responsible for indexing and monitoring DSS activities, validate the event and route the work to a verification operator who runs the query and generates the necessary ZK proof.

The result, along with a cryptographic commitment on the queried data, is sent to the relayer contract, which verifies and returns the data to the Karak cutter contract. This end-to-end process ensures that the data used in decision-making, such as determining penalties within the DSS, is accurate and reliable.

Karak’s mission is to provide universal security, but it also extends the capabilities of Space and Time to support multiple DSSs with their data indexing needs. As these technologies evolve, they are set to redefine the secure, decentralized computing landscape, making it more accessible and efficient for developers and enterprises alike. This integration represents a significant step towards a more secure and verifiable digital infrastructure in the blockchain space.

Website | X (Twitter) | Discord | Telegram

No spam, no lies, just insights. You can unsubscribe at any time.

Tech

Cryptocurrency Payments: Should CFOs Consider This Ferrari-Approved Trend?

Iconic Italian luxury carmaker Ferrari has announced the expansion of its cryptocurrency payment system to its European dealer network.

The move, which follows a successful launch in North America less than a year ago, raises a crucial question for CFOs across industries: Is it time to consider accepting cryptocurrency as a form of payment for your business?

Ferrari’s move isn’t an isolated one. It’s part of a broader trend of companies embracing digital assets. As of 2024, we’re seeing a growing number of companies, from tech giants to traditional retailers, accepting cryptocurrencies.

This change is determined by several factors:

- Growing mainstream adoption of cryptocurrencies

- Growing demand from tech-savvy and affluent consumers

- Potential for faster and cheaper international transactions

- Desire to project an innovative brand image

Ferrari’s approach is particularly noteworthy. They have partnered with BitPay, a leading cryptocurrency payment processor, to allow customers to purchase vehicles using Bitcoin, Ethereum, and USDC. This satisfies their tech-savvy and affluent customer base, many of whom have large digital asset holdings.

Navigating Opportunities and Challenges

Ferrari’s adoption of cryptocurrency payments illustrates several key opportunities for companies considering this move. First, it opens the door to new customer segments. By accepting cryptocurrency, Ferrari is targeting a younger, tech-savvy demographic—people who have embraced digital assets and see them as a legitimate form of value exchange. This strategy allows the company to connect with a new generation of affluent customers who may prefer to conduct high-value transactions in cryptocurrency.

Second, cryptocurrency adoption increases global reach. International payments, which can be complex and time-consuming with traditional methods, become significantly easier with cryptocurrency transactions. This can be especially beneficial for businesses that operate in multiple countries or deal with international customers, as it potentially reduces friction in cross-border transactions.

Third, accepting cryptocurrency positions a company as innovative and forward-thinking. In today’s fast-paced business environment, being seen as an early adopter of emerging technologies can significantly boost a brand’s image. Ferrari’s move sends a clear message that they are at the forefront of financial innovation, which can appeal to customers who value cutting-edge approaches.

Finally, there is the potential for cost savings. Traditional payment methods, especially for international transactions, often incur substantial fees. Cryptocurrency transactions, on the other hand, can offer lower transaction costs. For high-value purchases, such as luxury cars, these savings could be significant for both the business and the customer.

While the opportunities are enticing, accepting cryptocurrency payments also presents significant challenges that businesses must address. The most notable of these is volatility. Cryptocurrency values can fluctuate dramatically, sometimes within hours, posing potential risk to businesses that accept them as payment. Ferrari addressed this challenge by implementing a system that instantly converts cryptocurrency received into traditional fiat currencies, effectively mitigating the risk of value fluctuations.

Regulatory uncertainty is another major concern. The legal landscape surrounding cryptocurrencies is still evolving in many jurisdictions around the world. This lack of clear and consistent regulations can create compliance challenges for companies, especially those operating internationally. Companies must remain vigilant and adaptable as new laws and regulations emerge, which can be a resource-intensive process.

Implementation costs are also a significant obstacle. Integrating cryptocurrency payment systems often requires substantial investment in new technology infrastructure and extensive staff training. This can be especially challenging for small businesses or those with limited IT resources. The costs are not just financial; a significant investment of time is also required to ensure smooth implementation and operation.

Finally, security concerns loom large in the world of cryptocurrency transactions. While blockchain technology offers some security benefits, cryptocurrency transactions still require robust cybersecurity measures to protect against fraud, hacks, and other malicious activity. Businesses must invest in robust security protocols and stay up-to-date on the latest threats and protections, adding another layer of complexity and potential costs to accepting cryptocurrency payments.

Strategic Considerations for CFOs

If you’re thinking of following in Ferrari’s footsteps, here are the key factors to consider:

- Risk Assessment: Carefully evaluate potential risks to your business, including financial, regulatory, and reputational risks.

- Market Analysis: Evaluate whether your customer base is significantly interested in using cryptocurrencies for payments.

- Technology Infrastructure: Determine the costs and complexities of implementing a cryptographic payment system that integrates with existing financial processes.

- Regulatory Compliance: Ensure that cryptocurrency acceptance is in line with local regulations in all markets you operate in. Ferrari’s gradual rollout demonstrates the importance of this consideration.

- Financial Impact: Analyze how accepting cryptocurrency could impact your cash flow, accounting practices, and financial reporting.

- Partnership Evaluation: Consider partnering with established crypto payment processors to reduce risk and simplify implementation.

- Employee Training: Plan comprehensive training to ensure your team is equipped to handle cryptocurrency transactions and answer customer questions.

While Ferrari’s adoption of cryptocurrency payments is exciting, it’s important to consider this trend carefully.

A CFO’s decision to adopt cryptocurrency as a means of payment should be based on a thorough analysis of your company’s specific needs, risk tolerance, and strategic goals. Cryptocurrency payments may not be right for every business, but for some, they could provide a competitive advantage in an increasingly digital marketplace.

Remember that the landscape is rapidly evolving. Stay informed about regulatory changes, technological advancements, and changing consumer preferences. Whether you decide to accelerate your crypto engines now or wait in the pit, keeping this payment option on your radar is critical to navigating the future of business transactions.

Was this article helpful?

Yes No

Sign up to receive your daily business insights

Tech

Bitcoin Tumbles as Crypto Market Selloff Mirrors Tech Stocks’ Plunge

The world’s largest cryptocurrency, Bitcoin (BTC), suffered a significant price decline on Wednesday, falling below $65,000. The decline coincides with a broader market sell-off that has hit technology stocks hard.

Cryptocurrency Liquidations Hit Hard

CoinGlass data reveals a surge in long liquidations in the cryptocurrency market over the past 24 hours. These liquidations, totaling $220.7 million, represent forced selling of positions that had bet on price increases. Bitcoin itself accounted for $14.8 million in long liquidations.

Ethereum leads the decline

Ethereal (ETH), the second-largest cryptocurrency, has seen a steeper decline than Bitcoin, falling nearly 8% to trade around $3,177. This decline mirrors Bitcoin’s price action, suggesting a broader market correction.

Cryptocurrency market crash mirrors tech sector crash

The cryptocurrency market decline appears to be linked to the significant losses seen in the U.S. stock market on Wednesday. Stock market listing The index, heavily weighted toward technology stocks, posted its sharpest decline since October 2022, falling 3.65%.

Analysts cite multiple factors

Several factors may have contributed to the cryptocurrency market crash:

- Tech earnings are underwhelming: Earnings reports from tech giants like Alphabet are disappointing (Google(the parent company of), on Tuesday, triggered a sell-off in technology stocks with higher-than-expected capital expenditures that could have repercussions on the cryptocurrency market.

- Changing Political Landscape: The potential impact of the upcoming US elections and changes in Washington’s policy stance towards cryptocurrencies could influence investor sentiment.

- Ethereal ETF Hopes on the line: While bullish sentiment around a potential U.S. Ethereum ETF initially boosted the market, delays or rejections could dampen enthusiasm.

Analysts’ opinions differ

Despite the short-term losses, some analysts remain optimistic about Bitcoin’s long-term prospects. Singapore-based cryptocurrency trading firm QCP Capital believes Bitcoin could follow a similar trajectory to its post-ETF launch all-time high, with Ethereum potentially converging with its previous highs on sustained institutional interest.

Rich Dad Poor Dad Author’s Prediction

Robert Kiyosaki, author of the best-selling Rich Dad Poor Dad, predicts a potential surge in the price of Bitcoin if Donald Trump is re-elected as US president. He predicts a surge to $105,000 per coin by August 2025, fueled by a weaker dollar that is set to boost US exports.

BTC/USD Technical Outlook

Bitcoin price is currently trading below key support levels, including the $65,500 level and the 100 hourly moving average. A break below the $64,000 level could lead to further declines towards the $63,200 support zone. However, a recovery above the $65,500 level could trigger another increase in the coming sessions.

-

News10 months ago

News10 months agoVolta Finance Limited – Director/PDMR Shareholding

-

News10 months ago

News10 months agoModiv Industrial to release Q2 2024 financial results on August 6

-

News10 months ago

News10 months agoApple to report third-quarter earnings as Wall Street eyes China sales

-

News10 months ago

News10 months agoNumber of Americans filing for unemployment benefits hits highest level in a year

-

News1 year ago

News1 year agoInventiva reports 2024 First Quarter Financial Information¹ and provides a corporate update

-

News1 year ago

News1 year agoLeeds hospitals trust says finances are “critical” amid £110m deficit

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Tech1 year ago

Tech1 year agoBitcoin’s Correlation With Tech Stocks Is At Its Highest Since August 2023: Bloomberg ⋆ ZyCrypto

-

Tech1 year ago

Tech1 year agoEverything you need to know

-

Markets12 months ago

Markets12 months ago20 Top Crypto Trading Platforms to Know

-

News10 months ago

News10 months agoStocks wobble as Fed delivers and Meta bounces

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Hit $100 Billion in 2024, Fueling Insane Investor Optimism ⋆ ZyCrypto