Tech

The Latest Tech News in Crypto and Blockchain

Jan. 10: EOS Network Ventures (ENV) invests $2.4M in NoahArk Tech Group, DeFi for secure decentralized trading, according to the team: “The investment will be used to build a robust DeFi within the EOS ecosystem and focus on decentralized exchange activities. NoahArk aims to drive innovation in the EOS DeFi ecosystem, particularly in decentralized exchange activities. The company plans to develop an interoperable liquidity aggregation protocol in collaboration with leading DeFi teams.” (EOS)

Protocol Village is a regular feature of The Protocol, our weekly newsletter exploring the tech behind crypto, one block at a time. Sign up here to get it in your inbox every Wednesday. Project teams can submit updates here. For previous versions of Protocol Village, please go here. Also please check out our weekly The Protocol podcast.

Jan. 10: Libre, a newly established tokenization platform, is emerging from stealth mode under the leadership of tokenization pioneer Avtar Sehra, constructed using Polygon CDK, the blockchain development kit of the Ethereum-based scaling network. Heavy hitters from the world of institutional cryptocurrency investing like Nomura’s Laser Digital, Brevan Howard’s WebN group and private markets giant Hamilton Lane are foundational partners and the first users, the companies said on Wednesday.

SKALE, Ethereum Layer-2 Network, Now Has Chain Pricing Live on Mainnet

Jan. 10: SKALE Chain Pricing is officially live on mainnet, with first payments due Feb. 1, according to the team: “Instead of adopting an unsustainable model that may eventually lead to increased fees or perpetual subsidies, SKALE opts for a sustainable system with zero gas fees for end-users, financed through chain fees. This approach positions SKALE for mass adoption and long-term economic stability.” The move follows a vote by the community last month. (SKL)

Hedera-Based Tune.FM Raises $20M for Artist-Friendly Web3 Music Platform

Jan. 10: Tune.FM, a Web3 music platform, has received $20 million in capital from alternative investment group LDA Capital to advance its goals of helping musicians earning a greater share of royalties from their work. Using Hedera Hashgraph’s blockchain technology, Tune.FM provides musicians with a platform to receive micropayments for streaming in its native JAM token (JAM) as well as minting non-fungible tokens (NFTs) for digital music assets and collectibles.

DeFi Developer Daniele Sesta Deploys New Project ‘WAGMI’ on Metis With $2M Grant

Jan. 9: Metis, the layer 2 blockchain, in the first official disbursement of their Ecosystem Development Fund (EDF), revealed that DeFi products suite WAGMI will receive a $2 million grant and deployed on Metis on Jan. 8, according to the team: “WAGMI is the latest venture from DeFi magnate Daniele Sesta, and WAGMI will be deploying a decentralized exchange that will allow permissionless pool creation, arbitrage bots that will be a way for market inefficiencies to become users’ returns and GMI strategies that allow users to seamlessly interact with concentrated liquidity pools.”

Elastos Launches ‘Elacity DRM’ for Web3 Rights Management

Jan. 9: Elastos, working to develop a decentralized internet infrastructure, announced the launch of Elacity DRM, Elacity’s first digital rights management (DRM) tool for Web3, focused on video content, according to the team: “Web3 promises to transform the realm of DRM and the scope of digital asset ownership and trading. Based on the Elastos Smart Chain, the Elacity DRM product is EVM compatible and will be available to creators on the Elastos SmartWeb via its marketplace starting January 2024. It fosters interactive Web3 content markets while protecting user data and intellectual property from unauthorized access and misuse.”

Entangle, Messaging Infrastructure for Web3 Liquidity, Enters Alliance With Layer-2 Network Mantle

Jan. 9: Entangle , a customizable messaging infrastructure to “unify Web3 and optimize ecosystem liquidity,” has entered a strategic alliance with Mantle Network, an Ethereum layer-2 network, according to the team: “Entangle, designed to optimize yield asset utility, foster liquidity sharing among decentralized applications (dApps), drive cross-chain interoperability and offer custom data feeds for Mantle Ecosystem, has gained pivotal support, including up to $50K from Mantle Foundation, to facilitate technical integration and marketing efforts. Entangle’s integration addresses liquidity, smart contract communication and scalability, solidifying Mantle’s position as the premier destination for building groundbreaking dApps.”

Polkadot Wallet Talisman Releases ‘Sign-In-With-Substrate’

Jan. 9: Polkadot wallet, Talisman, released “Sign-in with Substrate (SIWS) similar to sign-in with Ethereum (SIWE),” according to a blog post: “The goal for SIWS is to allow people to ‘store and access their own data in web2-style apps,’ and to do so with a Web3 sense of decentralization in terms of identity and ownership. This immediately benefits application developers, end users and ecosystems on Polkadot.” (DOT)

ZkLink, Multi-Chain Rollup Platform, Releases 2024 Roadmap, Plans $ZKL Token

Jan. 9: ZkLink, a multi-chain rollup infrastructure based on zero-knowledge technology, revealed its 2024 roadmap on Tuesday, including “what comes next for the protocol and the potential for a native token to ensure streamlined bridging of assets across the ZK rollup ecosystem.” According to the roadmap, “a $ZKL token is coming and we’re getting the engine warm for this train ride.” ALSO: the project’s new whitepaper is here.

QuickNode, Blockchain Infrastructure Provider, Aims to ‘Redefine Industry Partnerships’

Jan. 9: QuickNode, a blockchain infrastructure solutions provider, introduced their new “Preferred Partner Network, aiming to unite top B2B blockchain companies in a bid to redefine industry partnerships,” according to the team: “The business development network, featuring heavyweights like Chainlink and Fireblocks, aims to set new standards by offering tailored opportunities for members to expand their Total Addressable Market, secure more deals and gain valuable referrals.”

C3, Crypto Exchange With ‘Self-Custodial Approach, Launches Public Mainnet

Jan. 8: C3.io, a hybrid crypto exchange, announced the launch of public mainnet. The project’s “self-custodial approach ensures users control their funds, enhancing security while reducing insolvency risks,” according to the team. “Emphasizing security, C3.io passed two Halborn audits and offers up to $100K for vulnerabilities with Immunifi. Collaborating with Pyth Network, it has processed 10 million+ oracle-based transactions. Users can benefit from all CEX functionalities, including instant execution, high throughput, REST APIs, Websocket connectivity, advanced order types and support for all blockchains.” According to the project documentation: “C3’s on-chain component consists of two smart contract applications, the Cross-collateral Clearing Engine and the Health Calculator, which are deployed on the Algorand blockchain and serve as C3’s settlement layer…. To consolidate balances, C3 leverages Wormhole’s cross-chain interoperability protocol to process deposits and withdrawals to and from C3’s on-chain component.”

Solana Foundation Claims 2.5K Monthly Active Developers in Report

Jan. 9: The Solana Foundation released its new report on the State of the Developer Ecosystem, which “outlines the strength of the developer community on Solana in 2023,” according to the team: “The report highlights key metrics for ecosystem health, including monthly active developer figures, retention rates, and overall levels of developer experience. Today, the Solana ecosystem has more than 2,500 monthly active developers on open source repositories, with a three-month retention rate of over 50%.”

Ta-da, AI Marketplace Based on ‘Gamified Web3,’ Raises $3.5M

Jan. 8: Ta-da, an AI data marketplace, completed a $3.5M funding round from investors including Morningstar Ventures, the layer-1 blockchain protocol MultiversX, GBV Capital, XVentures, NxGen and Spark Digital Capital, according to the team: Keying off the model of a “gamified Web3” app, “Ta-da is the brainchild of Vivoka, a successful startup that develops speech recognition solutions.” CEO William Simonin is a serial entrepreneur, according to a spokesperson, while his brother Owen “Hasheur” Simonin, founder of Meria.com and one of the leading Web3 influencers in France, is an investor and serves on the advisory board. “Other members of its advisory board include Luc Julia (creator of Apple’s Siri) and Morningstar Ventures CEO Danilo Carlucci.”

Samson Mow’s AQUA Launches Bitcoin Wallet for Latin American Users, Maxis

Jan. 7: AQUA by JAN3, a Bitcoin and stablecoin wallet headed by former Blockstream Chief Strategy Officer Samson Mow, launched on Jan. 3, according to a press release. Designed for users in Latin America, AQUA claims features that “can also attract die-hard Bitcoin Maximalists, offering them a powerful interface to layer-2 technologies like Lightning and Liquid. By utilizing submarine swaps, AQUA can completely bypass high fee-rate environments, seamlessly moving between Lightning and Liquid. AQUA gives Bitcoiners the ability to batch their Bitcoin transactions in Layer 2 and then swap to mainchain Bitcoin when fees are low.”

Parallel Claims to be First Arbitrum Orbit L2 Live on Mainnet

Jan. 7: Parallel Network has officially launched on mainnet and is open to developers, according to the team, claiming to be the first layer-2 network on Arbitrum Orbit to go live. “It is also the first non-custodial omni-chain margin protocol, which allows liquidity to be pooled across multiple chains and makes it immediately available on the Parallel Network.”

John Lilic Joins Telos Foundation as Executive Director

Jan. 5: Telos Foundation, which supports the delegated proof-of-stake (DPOS) layer-1 blockchain Telos, named former Consensys and Polygon contributor John Lilic as executive director. According to the team: “Lilic will spearhead Telos’s evolution into a layer-0 network underpinned by ZK technology aimed at attracting developers and users worldwide. Lilic was an early volunteer at the Bitcoin Center NYC in 2014, before joining Consensys in 2015 and Polygon as a key advisor in 2020. Lilic is also a Top 50 Web3 Angel Investor. Lilic will donate the headline sponsorship for ETHCC 2024 to Telos, plus an additional sponsorship at ETH Belgrade 2024. Lilic will also work to establish an external advisory board made up of world class talent in 2024.”

Bracket, DeFi Structured Products Platform, Raises $2M from Binance Labs, NGC

Jan. 5: Bracket Labs, a provider of leveraged structured products for non-custodial DeFi users, raised $2 million in a pre-seed round led by Binance Labs and NGC Ventures for their “Passage” volatility trading product on the BracketX platform, according to the team: “Passage, built on Arbitrum, simplifies on-chain long and short volatility trading with a user-friendly experience, offering features like 200% leverage, a limit order book and a liquidity-improving vault. Bracket Labs plans to enhance Passage by introducing liquid-staked tokens and deploying on BNB Chain in 2024.”

KuCoin Invests in Solana-Based Mixed-Reality Project DeMR

Jan. 4: KuCoin Labs, the investment and incubation program of Seychelles-based crypto exchange KuCoin, has made a strategic investment in DeMR, a “decentralized mixed reality (MR)” infrastructure network (MR-DePIN) built on the Solana blockchain, according to a press release. The project solves key problems associated with creating 3D maps, according to a whitepaper, by employing “a decentralized network and automated AI map reconstruction pipeline, which can collect and reconstruct global full-scene 3D high-definition map data at lower cost with higher efficiency, and provide open spatial interaction services for massive MR applications. The ownership and revenue of the data are shared by global contributors, and the revenue will be continuously obtained in subsequent applications according to the evaluation of contribution volume.”

EOS-Focused VC Invests in EZSwap for Gaming and ‘Smart Inscriptions’

Jan. 4: EOS Network Ventures (ENV) “just invested $500K in EZ Swap, a multi-chain NFT DEX protocol and inscription marketplace, during its successful second fundraising round in December 2023, totaling $1 million,” according to the team. “Led by ENV with support from major investors like IOBC Capital and Momentum Capital, this investment is set to significantly boost EZ Swap’s gaming asset and smart inscription protocol landscape.” ENV is a venture capital fund set up to make strategic equity and token-based investments into Web3 startups deploying on the EOS Network. According to the EOS Network Foundation, the EOS Network is a “third-generation blockchain platform powered by the EOS VM, a low-latency, highly performant and extensible WebAssembly engine for deterministic execution of near feeless transactions.” (EOS)

Tech

Harvard Alumni, Tech Moguls, and Best-Selling Authors Drive Nearly $600 Million in Pre-Order Sales

BlockDAG Network’s history is one of innovation, perseverance, and a vision to push the boundaries of blockchain technology. With Harvard alumni, tech moguls, and best-selling authors at the helm, BlockDAG is rewriting the rules of the cryptocurrency game.

CEO Antony Turner, inspired by the successes and shortcomings of Bitcoin and Ethereum, says, “BlockDAG leverages existing technology to push the boundaries of speed, security, and decentralization.” This powerhouse team has led a staggering 1,600% price increase in 20 pre-sale rounds, raising over $63.9 million. The secret? Unparalleled expertise and a bold vision for the future of blockchain.

Let’s dive into BlockDAG’s success story and find out what the future holds for this cryptocurrency.

The Origin: Why BlockDAG Was Created

In a recent interview, BlockDAG CEO Antony Turner perfectly summed up why the market needs BlockDAG’s ongoing revolution. He said:

“The creation of BlockDAG was inspired by Bitcoin and Ethereum, their successes and their shortcomings.

If you look at almost any new technology, it is very rare that the first movers remain at the forefront forever. Later incumbents have a huge advantage in entering a market where the need has been established and the technology is no longer cutting edge.

BlockDAG has done just that: our innovation is incorporating existing technology to provide a better solution, allowing us to push the boundaries of speed, security, and decentralization.”

The Present: How Far Has BlockDAG Come?

BlockDAG’s presale is setting new benchmarks in the cryptocurrency investment landscape. With a stunning 1600% price increase over 20 presale lots, it has already raised over $63.9 million in capital, having sold over 12.43 billion BDAG coins.

This impressive performance underscores the overwhelming confidence of investors in BlockDAG’s vision and leadership. The presale attracted over 20,000 individual investors, with the BlockDAG community growing exponentially by the hour.

These monumental milestones have been achieved thanks to the unparalleled skills, experience and expertise of BlockDAG’s management team:

Antony Turner – Chief Executive Officer

Antony Turner, CEO of BlockDAG, has over 20 years of experience in the Fintech, EdTech, Travel and Crypto industries. He has held senior roles at SPIRIT Blockchain Capital and co-founded Axona-Analytics and SwissOne. Antony excels in financial modeling, business management and scaling growth companies, with expertise in trading, software, IoT, blockchain and cryptocurrency.

Director of Communications

Youssef Khaoulaj, CSO of BlockDAG, is a Smart Contract Auditor, Metaverse Expert, and Red Team Hacker. He ensures system security and disaster preparedness, and advises senior management on security issues.

advisory Committee

Steven Clarke-Martin, a technologist and consultant, excels in enterprise technology, startups, and blockchain, with a focus on DAOs and smart contracts. Maurice Herlihy, a Harvard and MIT graduate, is an award-winning computer scientist at Brown University, with experience in distributed computing and consulting roles, most notably at Algorand.

The Future: Becoming the Cryptocurrency with the Highest Market Cap in the World

Given its impressive track record and a team of geniuses working tirelessly behind the scenes, BlockDAG is quickly approaching the $600 million pre-sale milestone. This crypto powerhouse will soon enter the top 30 cryptocurrencies by market cap.

Currently trading at $0.017 per coin, BlockDAG is expected to hit $1 million in the coming months, with the potential to hit $30 per coin by 2030. Early investors have already enjoyed a 1600% ROI by batch 21, fueling a huge amount of excitement around BlockDAG’s presale. The platform is seeing significant whale buying, and demand is so high that batch 21 is almost sold out. The upcoming batch is expected to drive prices even higher.

Invest in BlockDAG Pre-Sale Now:

Pre-sale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetwork

Discord: Italian: https://discord.gg/Q7BxghMVyu

No spam, no lies, just insights. You can unsubscribe at any time.

Tech

How Karak’s Latest Tech Integration Could Make Data Breaches Obsolete

- Space and Time uses zero-knowledge proofs to ensure secure and tamper-proof data processing for smart contracts and enterprises.

- The integration facilitates faster development and deployment of Distributed Secure Services (DSS) on the Karak platform.

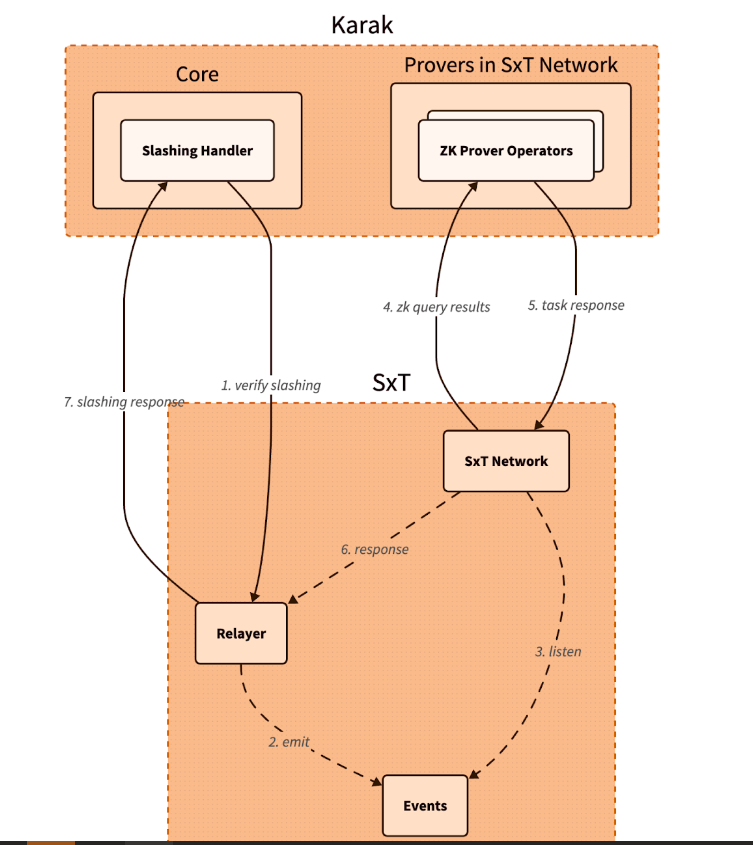

Karak, a platform known for its strong security capabilities, is enhancing its Distributed Secure Services (DSS) by integrating Space and Time as a zero-knowledge (ZK) coprocessor. This move is intended to strengthen trustless operations across its network, especially in slashing and rewards mechanisms.

Space and Time is a verifiable processing layer that uses zero-knowledge proofs to ensure that computations on decentralized data warehouses are secure and untampered with. This system enables smart contracts, large language models (LLMs), and enterprises to process data without integrity concerns.

The integration with Karak will enable the platform to use Proof of SQL, a new ZK-proof approach developed by Space and Time, to confirm that SQL query results are accurate and have not been tampered with.

One of the key features of this integration is the enhancement of DSS on Karak. DSS are decentralized services that use re-staked assets to secure the various operations they provide, from simple utilities to complex marketplaces. The addition of Space and Time technology enables faster development and deployment of these services, especially by simplifying slashing logic, which is critical to maintaining security and trust in decentralized networks.

Additionally, Space and Time is developing its own DSS for blockchain data indexing. This service will allow community members to easily participate in the network by running indexing nodes. This is especially beneficial for applications that require high security and decentralization, such as decentralized data indexing.

The integration architecture follows a detailed and secure flow. When a Karak slashing contract needs to verify a SQL query, it calls the Space and Time relayer contract with the required SQL statement. This contract then emits an event with the query details, which is detected by operators in the Space and Time network.

These operators, responsible for indexing and monitoring DSS activities, validate the event and route the work to a verification operator who runs the query and generates the necessary ZK proof.

The result, along with a cryptographic commitment on the queried data, is sent to the relayer contract, which verifies and returns the data to the Karak cutter contract. This end-to-end process ensures that the data used in decision-making, such as determining penalties within the DSS, is accurate and reliable.

Karak’s mission is to provide universal security, but it also extends the capabilities of Space and Time to support multiple DSSs with their data indexing needs. As these technologies evolve, they are set to redefine the secure, decentralized computing landscape, making it more accessible and efficient for developers and enterprises alike. This integration represents a significant step towards a more secure and verifiable digital infrastructure in the blockchain space.

Website | X (Twitter) | Discord | Telegram

No spam, no lies, just insights. You can unsubscribe at any time.

Tech

Cryptocurrency Payments: Should CFOs Consider This Ferrari-Approved Trend?

Iconic Italian luxury carmaker Ferrari has announced the expansion of its cryptocurrency payment system to its European dealer network.

The move, which follows a successful launch in North America less than a year ago, raises a crucial question for CFOs across industries: Is it time to consider accepting cryptocurrency as a form of payment for your business?

Ferrari’s move isn’t an isolated one. It’s part of a broader trend of companies embracing digital assets. As of 2024, we’re seeing a growing number of companies, from tech giants to traditional retailers, accepting cryptocurrencies.

This change is determined by several factors:

- Growing mainstream adoption of cryptocurrencies

- Growing demand from tech-savvy and affluent consumers

- Potential for faster and cheaper international transactions

- Desire to project an innovative brand image

Ferrari’s approach is particularly noteworthy. They have partnered with BitPay, a leading cryptocurrency payment processor, to allow customers to purchase vehicles using Bitcoin, Ethereum, and USDC. This satisfies their tech-savvy and affluent customer base, many of whom have large digital asset holdings.

Navigating Opportunities and Challenges

Ferrari’s adoption of cryptocurrency payments illustrates several key opportunities for companies considering this move. First, it opens the door to new customer segments. By accepting cryptocurrency, Ferrari is targeting a younger, tech-savvy demographic—people who have embraced digital assets and see them as a legitimate form of value exchange. This strategy allows the company to connect with a new generation of affluent customers who may prefer to conduct high-value transactions in cryptocurrency.

Second, cryptocurrency adoption increases global reach. International payments, which can be complex and time-consuming with traditional methods, become significantly easier with cryptocurrency transactions. This can be especially beneficial for businesses that operate in multiple countries or deal with international customers, as it potentially reduces friction in cross-border transactions.

Third, accepting cryptocurrency positions a company as innovative and forward-thinking. In today’s fast-paced business environment, being seen as an early adopter of emerging technologies can significantly boost a brand’s image. Ferrari’s move sends a clear message that they are at the forefront of financial innovation, which can appeal to customers who value cutting-edge approaches.

Finally, there is the potential for cost savings. Traditional payment methods, especially for international transactions, often incur substantial fees. Cryptocurrency transactions, on the other hand, can offer lower transaction costs. For high-value purchases, such as luxury cars, these savings could be significant for both the business and the customer.

While the opportunities are enticing, accepting cryptocurrency payments also presents significant challenges that businesses must address. The most notable of these is volatility. Cryptocurrency values can fluctuate dramatically, sometimes within hours, posing potential risk to businesses that accept them as payment. Ferrari addressed this challenge by implementing a system that instantly converts cryptocurrency received into traditional fiat currencies, effectively mitigating the risk of value fluctuations.

Regulatory uncertainty is another major concern. The legal landscape surrounding cryptocurrencies is still evolving in many jurisdictions around the world. This lack of clear and consistent regulations can create compliance challenges for companies, especially those operating internationally. Companies must remain vigilant and adaptable as new laws and regulations emerge, which can be a resource-intensive process.

Implementation costs are also a significant obstacle. Integrating cryptocurrency payment systems often requires substantial investment in new technology infrastructure and extensive staff training. This can be especially challenging for small businesses or those with limited IT resources. The costs are not just financial; a significant investment of time is also required to ensure smooth implementation and operation.

Finally, security concerns loom large in the world of cryptocurrency transactions. While blockchain technology offers some security benefits, cryptocurrency transactions still require robust cybersecurity measures to protect against fraud, hacks, and other malicious activity. Businesses must invest in robust security protocols and stay up-to-date on the latest threats and protections, adding another layer of complexity and potential costs to accepting cryptocurrency payments.

Strategic Considerations for CFOs

If you’re thinking of following in Ferrari’s footsteps, here are the key factors to consider:

- Risk Assessment: Carefully evaluate potential risks to your business, including financial, regulatory, and reputational risks.

- Market Analysis: Evaluate whether your customer base is significantly interested in using cryptocurrencies for payments.

- Technology Infrastructure: Determine the costs and complexities of implementing a cryptographic payment system that integrates with existing financial processes.

- Regulatory Compliance: Ensure that cryptocurrency acceptance is in line with local regulations in all markets you operate in. Ferrari’s gradual rollout demonstrates the importance of this consideration.

- Financial Impact: Analyze how accepting cryptocurrency could impact your cash flow, accounting practices, and financial reporting.

- Partnership Evaluation: Consider partnering with established crypto payment processors to reduce risk and simplify implementation.

- Employee Training: Plan comprehensive training to ensure your team is equipped to handle cryptocurrency transactions and answer customer questions.

While Ferrari’s adoption of cryptocurrency payments is exciting, it’s important to consider this trend carefully.

A CFO’s decision to adopt cryptocurrency as a means of payment should be based on a thorough analysis of your company’s specific needs, risk tolerance, and strategic goals. Cryptocurrency payments may not be right for every business, but for some, they could provide a competitive advantage in an increasingly digital marketplace.

Remember that the landscape is rapidly evolving. Stay informed about regulatory changes, technological advancements, and changing consumer preferences. Whether you decide to accelerate your crypto engines now or wait in the pit, keeping this payment option on your radar is critical to navigating the future of business transactions.

Was this article helpful?

Yes No

Sign up to receive your daily business insights

Tech

Bitcoin Tumbles as Crypto Market Selloff Mirrors Tech Stocks’ Plunge

The world’s largest cryptocurrency, Bitcoin (BTC), suffered a significant price decline on Wednesday, falling below $65,000. The decline coincides with a broader market sell-off that has hit technology stocks hard.

Cryptocurrency Liquidations Hit Hard

CoinGlass data reveals a surge in long liquidations in the cryptocurrency market over the past 24 hours. These liquidations, totaling $220.7 million, represent forced selling of positions that had bet on price increases. Bitcoin itself accounted for $14.8 million in long liquidations.

Ethereum leads the decline

Ethereal (ETH), the second-largest cryptocurrency, has seen a steeper decline than Bitcoin, falling nearly 8% to trade around $3,177. This decline mirrors Bitcoin’s price action, suggesting a broader market correction.

Cryptocurrency market crash mirrors tech sector crash

The cryptocurrency market decline appears to be linked to the significant losses seen in the U.S. stock market on Wednesday. Stock market listing The index, heavily weighted toward technology stocks, posted its sharpest decline since October 2022, falling 3.65%.

Analysts cite multiple factors

Several factors may have contributed to the cryptocurrency market crash:

- Tech earnings are underwhelming: Earnings reports from tech giants like Alphabet are disappointing (Google(the parent company of), on Tuesday, triggered a sell-off in technology stocks with higher-than-expected capital expenditures that could have repercussions on the cryptocurrency market.

- Changing Political Landscape: The potential impact of the upcoming US elections and changes in Washington’s policy stance towards cryptocurrencies could influence investor sentiment.

- Ethereal ETF Hopes on the line: While bullish sentiment around a potential U.S. Ethereum ETF initially boosted the market, delays or rejections could dampen enthusiasm.

Analysts’ opinions differ

Despite the short-term losses, some analysts remain optimistic about Bitcoin’s long-term prospects. Singapore-based cryptocurrency trading firm QCP Capital believes Bitcoin could follow a similar trajectory to its post-ETF launch all-time high, with Ethereum potentially converging with its previous highs on sustained institutional interest.

Rich Dad Poor Dad Author’s Prediction

Robert Kiyosaki, author of the best-selling Rich Dad Poor Dad, predicts a potential surge in the price of Bitcoin if Donald Trump is re-elected as US president. He predicts a surge to $105,000 per coin by August 2025, fueled by a weaker dollar that is set to boost US exports.

BTC/USD Technical Outlook

Bitcoin price is currently trading below key support levels, including the $65,500 level and the 100 hourly moving average. A break below the $64,000 level could lead to further declines towards the $63,200 support zone. However, a recovery above the $65,500 level could trigger another increase in the coming sessions.

-

News10 months ago

News10 months agoVolta Finance Limited – Director/PDMR Shareholding

-

News10 months ago

News10 months agoModiv Industrial to release Q2 2024 financial results on August 6

-

News10 months ago

News10 months agoApple to report third-quarter earnings as Wall Street eyes China sales

-

News10 months ago

News10 months agoNumber of Americans filing for unemployment benefits hits highest level in a year

-

News1 year ago

News1 year agoInventiva reports 2024 First Quarter Financial Information¹ and provides a corporate update

-

News1 year ago

News1 year agoLeeds hospitals trust says finances are “critical” amid £110m deficit

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Tech1 year ago

Tech1 year agoBitcoin’s Correlation With Tech Stocks Is At Its Highest Since August 2023: Bloomberg ⋆ ZyCrypto

-

Tech1 year ago

Tech1 year agoEverything you need to know

-

Markets12 months ago

Markets12 months ago20 Top Crypto Trading Platforms to Know

-

News10 months ago

News10 months agoStocks wobble as Fed delivers and Meta bounces

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Hit $100 Billion in 2024, Fueling Insane Investor Optimism ⋆ ZyCrypto