Markets

How Fed’s Interest Rate Decisions Could Affect Crypto | Video

Mean coins have continued to be the zeitgeist. I don’t think that’s surprising when you look at the fact that we might be in a fiscal driven regime with no one in the driver’s seat. Government spending is out of control, interest payments are out of control. Like when things stop making rational sense, it’s rational to start looking at assets that might be irrational. I know that’s a bit funny. It’s Monday, June 17th and this is market staley a show where we get into the minds of some of the smartest investors, ceo s analysts, economists, professors, people who are looking at strategy and everyone in between. If you have a hot or smart take, you are always invited to the market’s daily show. Welcome back to our daily programming and thank you for tuning in to hearing some of the best market. It’s related discussions we had at consensus 2024 over the past couple of weeks, we are back in action with our daily interviews. Now, now before we get into today’s discussion, let’s take a look at what’s going on in the crypto news this morning. The biggest cryptocurrencies fell during the European morning. Extending the subject mood after the fed trimmed interest rate cut expectations on Wednesday, Bitcoin and Ether both fell around 1% this morning. The largest Cryptocurrency by market cap. Bitcoin has been trading between the $137,000 range for the past month. Meanwhile, coin share says that Bitcoin investment products saw a total of $621 million in outflows last week. And according to JP US listed Bitcoin miners reached a record total market cap of $22.8 billion. Meaning that mining stocks outperformed Bitcoin in the first half of this month. Joining the show now to unpack the crypto markets is intuition, head of strategy and operations. Matthew K. Matthew. Welcome, good morning Jennifer. Thanks for having me. All right, a lot happening in the markets this morning. As you heard, we have been off for the past two weeks listening to some of the great conversations we had at consensus 2024. I just want to get a broad view from you this morning. What are you paying attention to in the markets? Yeah, great question and I guess, welcome back, everybody. Um I’m gonna call this market just continue chop solid summer. Uh We’ve seen very similar sideways price action uh almost every summer in the crypto markets with the exception of uh the COVID-19 summer with so much stimulus and liquidity being pumped into systems. So I’m not necessarily, you know, rush to make moves. But I’m also not necessarily uh panicking here either. I think it’s a very good time to be a patient buyer. Um And of course, you know, Bitcoin has been one of the top performers uh of this cycle, but by no means do I think it’s the only thing to be looking at right now. You know, when we look at some of the trends that have happened in the past this year has been a little different because we had the approval of the spot. Bitcoin ETF, the market has felt different this year. That’s the general consensus I get from folks who I talk about um the markets with here on the show or outside at events. Is there anything different you’re looking at this year because of the events that have happened? Absolutely. There’s been a number of structural changes to Bitcoin that I think go largely unappreciated, at least by the quote, you know, crypto natives who are spending most of their time looking at this asset class. The first being the uh mining Bitcoin China Ban which happened some number of years ago. However, we’ve seen like a large inflow of capital into us based mining companies. So why that’s important is us, miners generally hold their Bitcoin on their balance sheet as they are able to tap public debt networks for capital financing. So they don’t have to sell as much Bitcoin. So the supply side of the Bitcoin market is a bit different. Uh, the ETF of course, is going to be the other side of that equation. The demand side, we now have a large liquidity fire hose, uh, hooked into Bitcoin, that Bitcoin is just quite frankly never seen. Uh, and for those who are paying attention, we know that the Bitcoin ETF listing has been the largest, fastest, most successful ETF listing in history. I think it’s easy for folks, uh who might be a bit too zoomed in to see that as a potential near term headwind thinking that we might have gone up too fast, too soon. Um But I think the fact of the matter remains that we are likely in the set up of that Bitcoin um ETF trade. And what I mean by that is first that infrastructure has to get uh laid approved, et cetera. We’ve seen that happen, then people will front run those flows. We’ve seen that happen as well. But now we sit and wait and we essentially are waiting for uh an extreme macro catalyst and I think that’s going to take the form of a fiscal driven catalyst. Um I think you started the show talking about um the fed uh and not, not changing interest rates, et cetera. And a lot of people are still looking at the fed and interest rates, right. They’re looking at uh monetary driven signals and I believe you will be better off recognizing this period of time as a transition from a monetary driven regime into a fiscally driven regime. Uh And I’m happy to go into that a bit further. I want to talk about that in just a minute, but you brought up mining stocks. I also mentioned that at the beginning of the show, are there any particular mining stocks that you are watching this morning? And I guess on the back of that, are you surprised to hear that mining stocks outperformed Bitcoin itself for the first half of the month. So you really have to peel some layers back to that. Um The reason the mining stocks have done uh or have had multiple surprises I’d say over the past six months. Uh is the initial surprise and this was back in 2023. Was that uh Bitcoin ordinal which was like uh call it J pegs on Bitcoin? Um There are other use cases there as well but not, not to go into detail on those provided a huge boost in Bitcoin miners revenue that was largely off the radar of uh track right off of Wall Street. Similarly, in 2024 some of the Bitcoin processing power is switching over into the world of A I. And that was another surprise for Bitcoin miners is that they’re no longer quote exclusively Bitcoin miners. They’re now also using some of their computation in A I. So I was not surprised that it outperformed was I in that trade? No Um but for those who were hats off to you, I think that was quite, quite smart. All right, let’s get back to our macro discussion. Now. I know that you say that the mon monetary driven regime is not something that we should be watching right now, we should be watching a fiscally driven regime. What do you mean there? Yeah, great question. So essentially from 2008 until today call it, Uh We’ve been paying very close attention to central bank policy. Uh monetary driven policy, essentially how liquidity will increase or decrease uh within the US banking sector and all of the uh subsequent places liquidity flows to from there. Um That’s, that’s been great when the majority of liquidity has been um coming through the banking system, but when a fiscally driven regime starts to take over, um the liquidity is coming more so from government spending, I guess the best analogy is if you’re in a car going too fast. Um And in this case, the driver is fiscal. Um and all the fed can do is control the radio. It doesn’t matter how high or low they turn the volume, it doesn’t control the, the gas or brake pedal here. And that’s what we’re seeing in what I would consider this transition into fiscal. The FED can hike more, cut more, but no matter what they do, it’s gonna be stimulative. Um And the reason being is that we are seeing over 250 billion uh in interest payments uh per quarter, um being covered by the US government. Um, that’s pretty much 25 cents on every dollar of tax revenue going to interest expenses and th those are going to treasury holders, right. So, um, people holding treasuries are getting more dollars, that’s going to introduce liquidity if inflation continues to creep up or even stays where it is. Um And the fed decides to hike rates, they are not going to have an influence on the amount of fiscal spending taking place uh at the government level. What they will be doing is increasing uh the amount of interest that treasury holders receive. So they’ll just be introducing more liquidity into the system. Similarly, if they cut rates. And I think this is why they are being quite slow and intentional about cutting is they’ll also have a stimulative effect. They’ll start to free up capital, it will start to become a bit cheaper to borrow again. Um And we’ll just sort of have money coming into the system from lots of directions. Um And that’s why I laid out this, this concept that we’re more so in the beginning of that uh Bitcoin ETF trade because at at a certain point of end time, the knowledge that fiscal is in the driver’s seat, we have pretty much unchecked spending uh and we have way too high interest payments will start to catch on. Um And that’s when people really start to pay attention to the fact that they’re purchasing power when holding dollars uh continues to fall. It’s when people start to realize that um the US dollar as a global reserve currency might fall into question. And we have to understand that uh fiat currencies largely rely on sort of a collective belief that they are valuable. And if that starts to erode, you can have some really scary effects where uh what we have known for our lifetimes to be very stable um currency is to actually start to act like emerging market currencies. Uh And if that starts to really take hold Bitcoin, that Bitcoin ETF is just going to see, I think, tremendous uh tremendous inflows. Well, tell me a little bit more about that. How do you think we should be looking at government spending and given what you’ve said, will the fed have as much of an impact on the economy as it did in previous years? Yeah, great questions. I think the FED is largely in the passenger seat uh with, with the rest of us, there might be some levers that can be pulled along the way, at the very least, they’ll be able to help direct sort of the collective conscious, like the collective belief system. Um And, and for that, you know, that that type of forward guidance that can be, that can have a real impact. Um You know, I don’t want to sound alarmist because I don’t think there’s any reason to be alarmed, but I think it’s important to understand the fiscal regime as something that’s a bit more complex than any one factor. It is decades of policy. It is compounding uh, unintended consequences from term lengths, um, to inability to regulate certain industries, to certain, um, industry or regulatory capture, um, to unchecked spending responsibility. Like there are just so many compounded mistakes that I don’t think there’s really anyone in the driver’s seat for fiscal, there’s no one bad person to point a finger to, there’s no one mistake that can be pointed to, but quite frankly, we found ourselves in a situation. We’re spending more and more money. Those interest payments are going up and up. There’s no uh social desire for austerity. Um So I don’t think we’re gonna see drastic decreases. Um We have certain commitments um in terms of like federal safety nets that I don’t think are going to be going away anytime soon. And then we have uh the Bank of Japan to point to as sort of this smokescreen to say, oh, actually, it can go like this for quite some time. Um No reason to be concerned. So it’s, it’s hard to really try to boil down um where fiscal is going. And I think the best thing you can do is sort of simplify your, your framework. Um Bet that the trend will continue increased fiscal spending um and position yourself accordingly for continued purchasing. Um, the basement. Well, tell me a little bit more about that. If you were allocating funds this morning, what would you be paying attention to? Yeah, I would be sitting on my hands for a little bit longer, quite frankly, but I can tell you, uh what I, what I do like and what I think is interesting. I think anybody paying attention to the general crypto news cycle um is hopefully aware that the E ETF should be listing. It seems at some point this summer um that was explicitly stated by the SEC. It might be as early as end of June. Um The Bitcoin ETF saw tremendous inflows. I do not think the E ETF will come close to those Bitcoin inflows, but I also wouldn’t be surprised if it sees uh some, some healthy allocation. Um But I think that’s much more of a wait and see approach. I don’t think there’s a lot of front running of the Ethereum ETF. So if that E ETF starts to see some strong inflows upon listing, that’s absolutely an asset to buy and hold for some time because it’s quite uh under allocated outside of uh the crypto native world. So that should be uh really good. Similarly, uh you know what we might consider high beta, which should do quite well. Now, on paper that might look like the Ethereum layer twos like arbitra or optimism. Um Those trades haven’t showed much strength optimism definitely shows more strength than arbitra. I think one of the best pair trades of this past 12 months has been short arbitra, uh long optimism and optimism, I think actually has another unlock today or yesterday, roughly 100 million um in us D value unlocking. Um So that’s, that’s another headwind for, for arbitra where things start to get interesting and this might sound childish but it, it shouldn’t be to any objective market participant. Is that mean coins have continued to be the zeitgeist. I don’t think that’s surprising when you look at the fact that we might be in a fiscal driven regime with no one in the driver’s seat. Government spending is out of control. Interest payments are out of control. Like when things stop making rational sense, it’s rational to start looking at assets that might be irrational. I know that’s a bit funny. Meme coins are, are not a childish thing on this show. Matthew, it’s OK. I love them. So maybe I’m just, uh, you know, protecting my own, my own ego. Um But yeah, I think high beta Ethereum mean coins, especially for somebody who’s looking for higher risk and greater outperforms are extremely interesting. Um, the largest for the Ethereum network would be Pepe uh and Mog Coin, both of those I think are extremely interesting. Mog actually really stands out in my mind. I don’t know if you’ve seen them. They’re like these Pit Viper sunglasses, they’re reflective Um The reason I think they’re interesting is the term like mog and logging has been um like very viral amongst Gen Z and the Tik Tok generation. The mirrored glasses are like very much in vogue uh all over the world. You can go to like uh Bali or Ibiza or L A, New York, Miami and you’ll see people wearing them. Um So you have, uh and you, you’re actually also seeing them as part of like this moderate to moderate conservative political movement. There is a very famous video that came out from the Mar a lago um former President Trump and event where somebody asked the question about crypto and was wearing the pit vipers. Uh So it’s definitely embedded itself in the political culture, in the online culture, in the physical culture. Um And it’s valued significantly lower than pepe. So in, in terms of the uh Ethereum meme coins, I find that to be extremely interesting, especially if that E ETF is going to see in floats. Um But on the topic of meme coins, which I find so interesting and I can get into that thesis uh in actually a bit more detail because I, I thought, thought it through for a number of years. Um is that while the high data Ethereum based uh meme coins should outperform during that ee ETF inflow period, I think you don’t want to ignore the SOLANA based um or even the uh Ethereum layer two meme coins, either there’s a lot of discussion inside of the crypto space about the base network. So for those who don’t know base is the Ethereum layer two, essentially run by Coinbase. Uh it does not have a token. Um It has a lot of mind share because it will be launching the Coinbase smart wallet. And the coin based smart wallet makes it very easy for uh Coinbase retail investors to move their capital directly on chain. So we saw a very similar dynamic uh a cycle ago with Binance and Binance smart chain where Binance was making it extremely easy for their customers to move money onto bins um Blockchain. And we just saw a ton of speculation taking place on finance smart chain. Uh And for that reason, I think that we could see similar effects in the Coinbase smart wallet to base network um integration. There’s some names that have done quite well. Brett. Brett has been the top performer, although um I think it’s purely a momentum based trade, there’s not much call it culture or community there. Um My investment thesis with, with meme coins is very simple. You sort of bet on cults, you bet on communities who are completely irrelevant to price, you bet on communities who are grounded in some type of basic ideology or some type of basic thesis as to how the future will unfold. Uh My favorite is there’s a coin called uh what they call it a black rock on base. Black rock. Uh and it’s um, ticker is just rock and that’s one of those cults that I find quite interesting, um specifically because their thesis is it’s kind of tongue in cheek, right? There’s no coin um for the base network and there’s no coin for blackrock. And Black Rock’s official custodian is Coinbase and Black Rocks on chain fund is called Biddle. So if you kind of start to connect the dots, maybe you’re somebody who pays attention to like Wall Street bets or maybe you’re somebody who pays attention to like liquidity. If you’re familiar with those social media accounts, I think like the rock meme coin could kind of start to wiggle its way through um the zeitgeist that way. And then last, I’ll touch on the, the solana mean ecosystem because the majority of trading volumes taking place there, the Phantom wallet has uh really performed well in the app store as well. So we know that retail uh enjoys speculating on Solana. Um There, I actually have one meme coin that I think is extremely interesting. Um It’s called Gko and Gko is the oldest cat meme on the internet. Um And actually this will be a beautiful segue into why this is all culturally relevant. Um Gko was born out of Japanese forums in 1998. Uh It became like the de facto meme um uh two chan which was like the most successful for him uh at the time. And what’s remarkable about Kiko is not only does its creative rights already belong to the public commons, but it has multiple decades of content um in English and Japanese and other languages. Um It, it just has an overwhelming amount of games that have been developed. Uh cartoons, comic books, stickers, memes, like the the amount of call it lore um that exists within the eo ecosystem already. It is massive and there’s only really only other two memes that have similar provenance. Um And that would be Pepe, um which I believe became a meme in uh 2008 and dos, which I believe became a meme in 2013. So that’s really amazing company for, for, for geo, right? Like to be 1998 among those peers uh is something quite remarkable and, and I’m happy to go into like the cultural thesis about this. I think it’s actually very important, especially with that backdrop of increased um sort of liquidity, especially from like an irresponsible spending perspective. But I also don’t mean to make this all about uh a means by, by any means I love when it’s all about the memes. Honestly. Matthew. So thank you for bringing that app and I would love to invite you back another time to dig a little bit deeper into the cultural aspect, but we do have to wrap soon. So the last thing I’m going to ask you is, I was reading an article this morning that you were quoted in, you said that we could hit $100,000 for Bitcoin this year. Talk to me a little bit about what went into that prediction and if that still remains true this morning, yeah, it absolutely remains true. I’m definitely uh a very eager buyer of Bitcoin. Uh I think anything under 64,000 is likely an opportunity. I think we’ll see people get reflexively bearish uh if we get down to 60,000. Um So I’m happy to be a buyer there purely because I think government spending is not going to get better. Um And I also like being Long Bitcoin going into the election and I like being Long Bitcoin coming out of the summer um to kind of touch on that quote. Um I think Bitcoin over 100 K this year feels really good and, and I think the question that I’m asking myself is more. So when, and how is Bitcoin trading above 250 K? Right? Is that taking place uh over the next 18 to 24 months? Because things are going to become really irresponsible at the government spending level when people are going to catch on or are we going to have a bit of consolidation, maybe a bit of a pull back in 2025 or 2026. And then that uh next rally that’s really ETF driven takes place I don’t have the answer to that. The the time aspect is a big question mark to me, but I’m much more interested in talking about Bitcoin around those price levels uh and starting to price it against gold as a macro asset than I am asking like, oh, is Bitcoin gonna go up from here over the next six months? Like yeah, probably. It, it looks really good. It’s, it’s about the right time. Matthew. Thanks so much for joining the show this morning. Of course, Jennifer. Thank you for having me.

Markets

Today’s top crypto gainers and losers

Over the past 24 hours, Jupiter and JasmyCoin emerged as the top gainers among the top 100 crypto assets, while Bittensor and Mantra plunged as the top losers.

Top Winners

Jupiter

Jupiter (JUP) led the charge among the biggest gainers on July 27.

At the time of writing, the crypto asset had surged 12.6% in the past 24 hours and was trading at $1.16. JUP’s daily trading volume was hovering around $282 million, according to data from crypto.news.

JUP Hourly Price Chart, July 26-27 | Source: crypto.news

Additionally, the cryptocurrency’s market cap stood at $1.56 billion, making it the 62nd largest crypto asset, according to CoinGecko. Despite the recent price surge, the token is still down 42.6% from its all-time high of $2 reached on Jan. 31.

Jupiter functions as a decentralized exchange aggregator that allows users to trade Solana-based tokens. The platform also offers users the best routes for direct trades between multiple exchanges and liquidity pools.

In addition to being a DEX aggregator, Jupiter has expanded into a “full stack ecosystem” by launching several new projects, including a dedicated pool to support perpetual trading and plans for a stablecoin.

JasmyCoin

JasmyCoin (JASMI) has increased by 12% in the last 24 hours and is trading at $0.0328 at press time. JASMY’s daily trading volume has increased by 10% in the last 24 hours, reaching $146 million.

JASMY Hourly Price Chart, July 26-27 | Source: crypto.news

The asset’s market cap has surpassed the $1.5 billion mark, making it the 60th largest cryptocurrency at the time of reporting. However, the self-proclaimed “Bitcoin of Japan” is still down 99.3% from its all-time high of $4.79 on February 16, 2021.

JASMY is the native token of Jasmy Corporation, a Japanese Internet of Things provider. The platform seeks to merge the decentralization of blockchain technology with IoT, allowing users to convert their digital information into digital assets.

The initiative was launched by Kunitake Ando, former COO of Sony Corporation, along with Kazumasa Sato, former CEO of Sony Style.com Japan Inc., Hiroshi Harada, executive financial analyst at KPMG, and other senior executives from Japan.

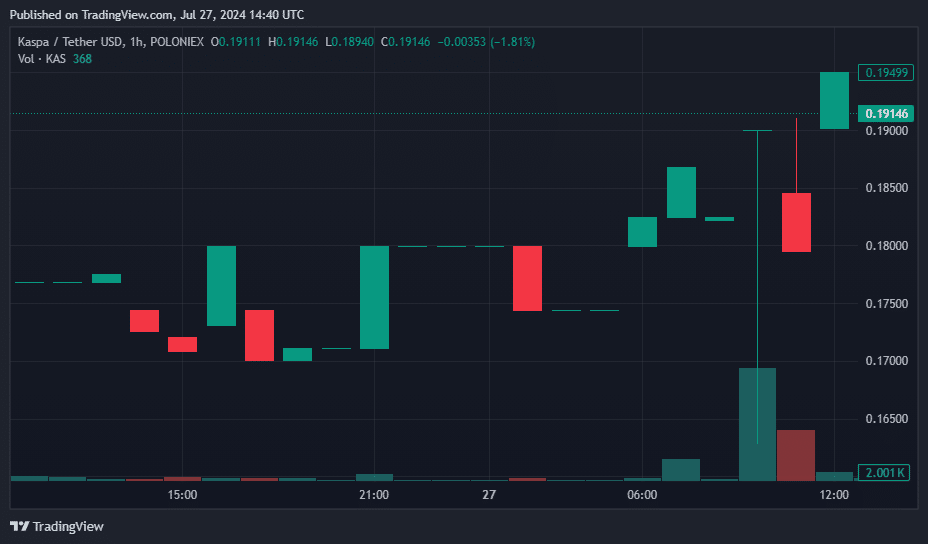

Kaspa

Kaspa (KAS) saw a 100% increase in trading volume and an 8% increase in price over the past 24 hours, trading at $0.19 at the time of publication.

KAS Hourly Price Chart, July 26-27 | Source: crypto.news

According to data from CoinGecko, Kaspa now ranks 27th in the global cryptocurrency list, with a circulating supply of approximately 24.29 billion KAS tokens and a market capitalization of $4.59 billion.

Kaspa is a cryptocurrency designed to deliver a high-performance, scalable, and secure blockchain platform. Its unique Layer-1 protocol includes the GhostDAG protocol, a proof-of-work (PoW) consensus mechanism that enables faster block times and higher transaction throughput compared to standard blockchains.

Unlike Bitcoin, GhostDAG allows multiple blocks to be created simultaneously, speeding up transactions and increasing block rewards for miners.

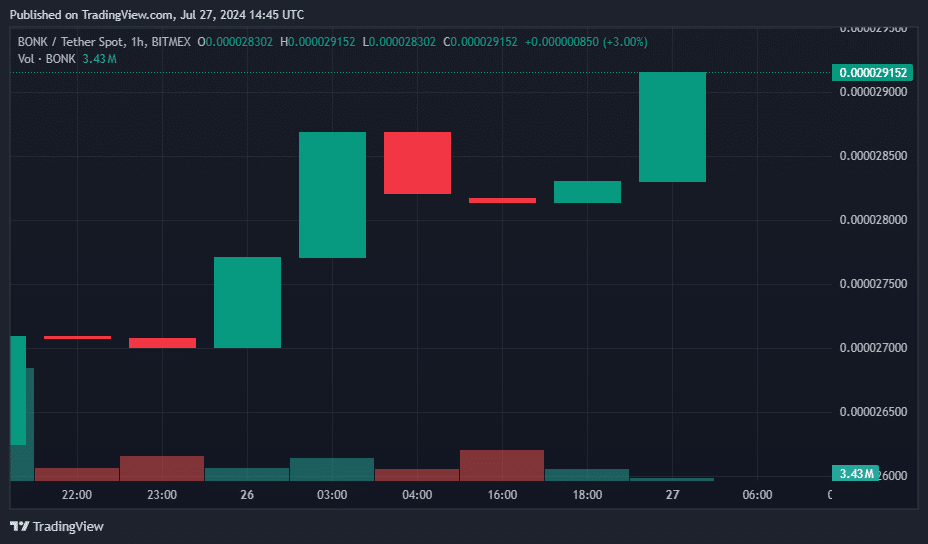

Bonk

Bonk (BONK) is the only one coin meme which made it to this list of biggest gainers and jumped 8.6% in the last 24 hours. Trading at $0.000030, the Solana-based meme coin’s market cap has surpassed $2.1 billion, surpassing Floki (FLOKI), another competing dog-themed coin with a market cap of $1.78 billion.

BONK Hourly Price Chart, July 26-27 | Source: crypto.news

BONK’s daily trading volume hovered around $285 million. However, BONK is still down 33.5% from its all-time high of $0.000045, reached on March 4.

Bonk, a meme coin that rose to prominence in 2023, has contributed significantly to Solana’s value increase amid the meme coin frenzy.

Bonk started out as a simple dog-themed coin. It has since expanded its features to include integration with decentralized finance. The project also partners with cross-chain communication protocols, NFT marketplaces, and various other cryptocurrency ecosystems.

BONK trading pairs are now listed on major exchanges including Binance, Coinbase, OKX, and Bitstamp.

The big losers

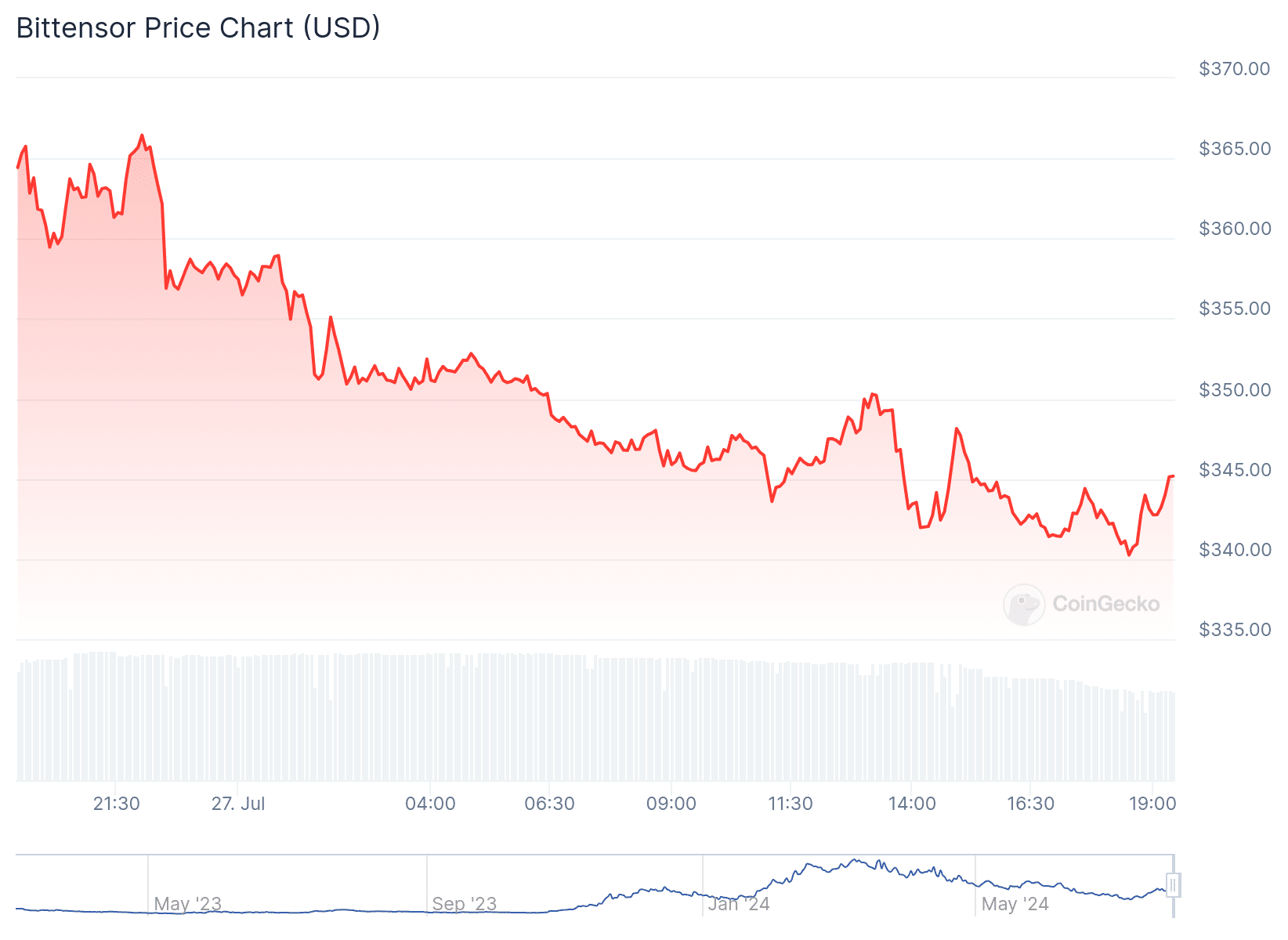

Bittensor

Bittensor (TAO) was the biggest loser among the 100 largest crypto assets, according to data from CoinGecko.

At the time of writing, TAO, the native token of decentralized AI project Bittensor, was down 5%, trading around $344. The crypto asset had a daily trading volume of $59 million and a market cap of $2.43 billion.

TAO 24 Hour Price Chart | Source: CoinGecko

Bittensor, created in 2019 by AI researchers Ala Shaabana and Jacob Steeves, initially operated as a parachain on Polkadot before transitioning to its own layer-1 blockchain in March 2023.

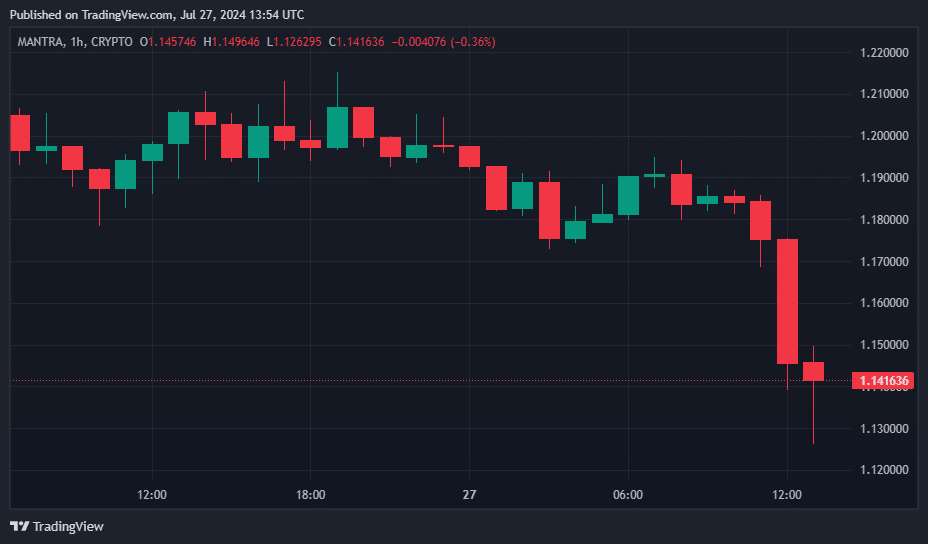

Mantra

Mantra (OM) fell 6%, trading at $1.13 at press time. The digital currency’s market cap fell to $938 million. Additionally, the 82nd largest crypto asset has a daily trading volume of $26 million.

OM Price Hourly Chart, July 26-27 | Source: crypto.news

Mantra is a modular blockchain network comprising two chains, Manta Pacific and Manta Atlantic, specialized in zero-knowledge applications.

Coat

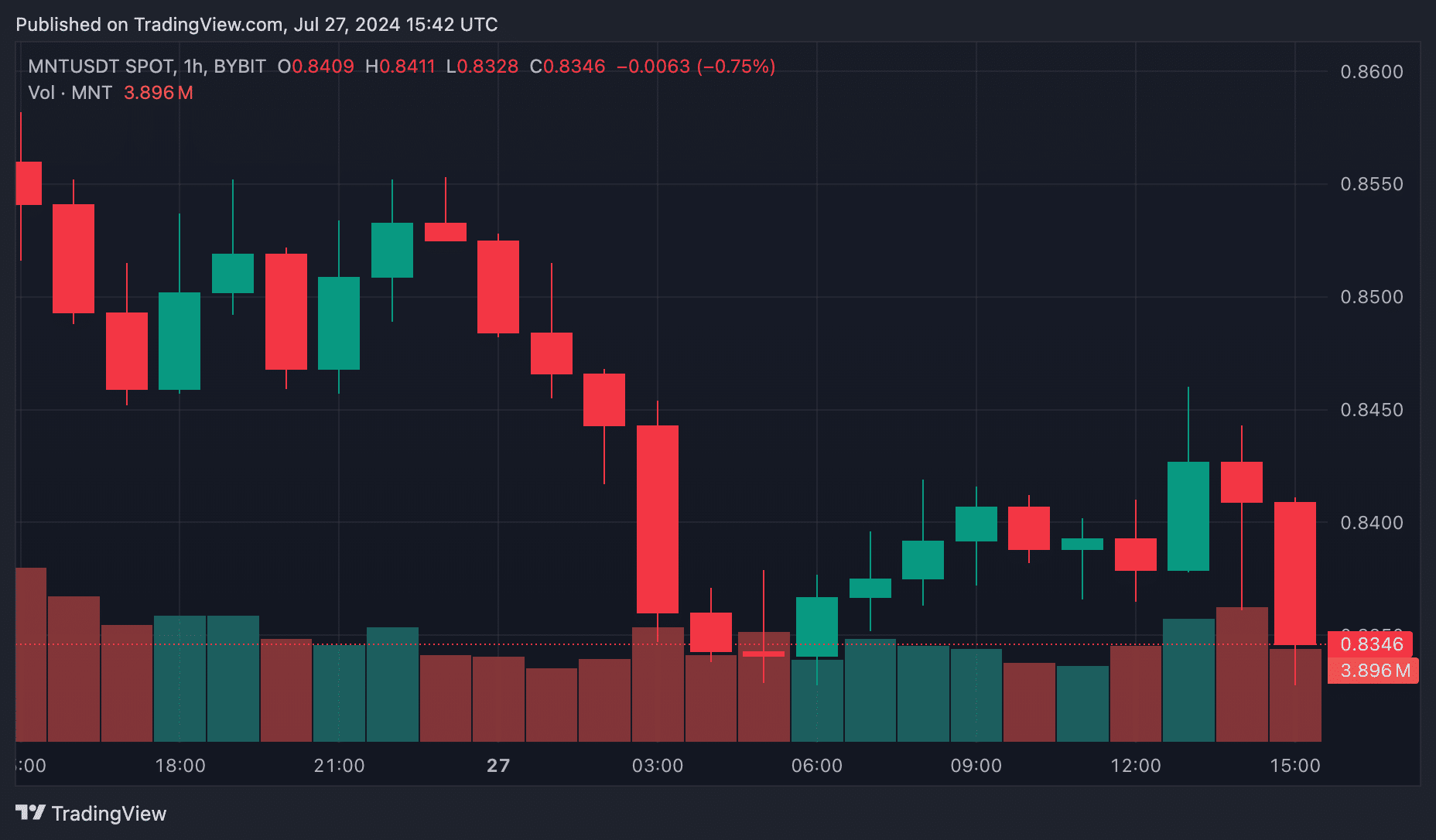

Coat (MNT) also saw a 2.4% drop in price, now trading at $0.8413. Currently, Mantle has a market cap of around $2.75 billion, which ranks 36th in the global cryptocurrency rankings by market cap, according to price data from crypto.news.

MNT Hourly Price Chart, July 26-27 | Source: crypto.news

Over the past 24 hours, MNT trading volume also fell by 6%, reaching $240 million.

Mantle, formerly known as BitDAO, is an investment DAO closely associated with Bybit. The MNT token is essential for governance, paying gas fees on the Mantle network, and staking on various platforms.

Built on the Ethereum network, Mantle provides a platform for decentralized application developers to launch their projects. It has become particularly popular for GameFi applications, leading to the formation of an internal Web3 gaming team.

Markets

Bitcoin Price Drops to $67,000 Despite Trump’s Pro-Crypto Comments, Further Correction Ahead?

Pioneer cryptocurrency Bitcoin has registered a 1.13% decline in the past 24 hours to trade at $67,400. Despite a strong pro-crypto stance from US presidential candidate Donald Trump at the Bitcoin 2024 conference, this massive selloff has raised concerns in the market about the asset’s sustainability at a higher price. However, given the recent three-week rally, a slight pullback this weekend is justifiable and necessary to regain the depleted bullish momentum.

Bitcoin Price Flag Formation Hints at Opportunity to Break Beyond $80,000

The medium-term trend Bitcoin Price remains a sideways trend amidst the formation of a bullish flag pattern. This chart pattern is defined by two descending lines that are currently shaping the price trajectory by providing dynamic resistance and support.

On July 5, BTC saw a bullish reversal from the flag pattern at $53,485, increasing its asset by 29.75% to a high of $69,400. This recent spike followed the market’s positive sentiment towards the Donald Trump speech at the Bitcoin 2024 conference in Nashville on Saturday afternoon.

Bitcoin Price | Tradingview

In his speech, Trump outlined several pro-crypto initiatives: he promised to replace SEC Chairman Gary Gensler on his first day in office, to establish a Strategic National Reserve of Bitcoin if elected, to ensure that the U.S. government holds all of its assets. Bitcoin assets and block any attempt to create a central bank digital currency (CBDC) during his presidency.

He also claimed that under his leadership, Bitcoin and cryptocurrencies will skyrocket like never before.

Despite Donald Trump’s optimistic promises, the BTC price failed to reach $70,000 and is currently trading at $67,400. As a result, Bitcoin’s market cap has dipped slightly to hover at $1.335 trillion.

However, this pullback is justified, as Bitcoin price has recently seen significant growth over the past three weeks, which has significantly improved market sentiment. Thus, price action over the weekend could replenish the depleted bullish momentum, potentially strengthening an attempt to break out from the flag pattern at $70,130.

A successful breakout will signal the continuation of the uptrend and extend the Bitcoin price forecast target at $78,000, followed by $84,000.

On the other hand, if the supply pressure on the upper trendline persists, the asset price could trigger further corrections for a few weeks or months.

Technical indicator:

- Pivot levels: The traditional pivot indicator suggests that the price pullback could see immediate support at $64,400, followed by a correction floor at $56,700.

- Moving average convergence-divergence: A bullish crossover state between the MACD (blue) and the signal (orange) ensure that the recovery dynamics are intact.

Related Articles

Frequently Asked Questions

A CBDC is a digital form of fiat currency issued and regulated by a country’s central bank. It aims to provide a digital alternative to traditional banknotes.

The proposal for a strategic national Bitcoin reserve is a major confirmation of Bitcoin’s legitimacy and potential as a reserve asset. Such a move could position Bitcoin in a similar way to gold, potentially stabilizing its price and encouraging other countries to adopt similar strategies.

Conferences like Bitcoin 2024 serve as essential platforms for networking, knowledge sharing, and showcasing new technologies within the cryptocurrency industry.

Markets

Swiss crypto bank Sygnum reports profitability after surge in first-half trading volumes – DL News

- Sygnum says it has reached profitability after increasing transaction volumes.

- The Swiss crypto bank does not disclose specific profit figures.

Sygnum, a Swiss global crypto banking group with approximately $4.5 billion in client assets, announced that it has achieved profitability after a strong first half, with key metrics showing year-to-date growth.

The company said in a Press release Compared to the same period last year, cryptocurrency spot trading volumes doubled, cryptocurrency derivatives trading increased by 500%, and lending volumes increased by 360%. The exact figures for the first half of the year were not disclosed.

Sygnum said its staking service has also grown, with the percentage of Ethereum staked by customers increasing to 42%. For institutional clients, staking Ethereum has a benefit that goes beyond the limitations of the ETF framework, which excludes staking returns, Sygnum noted.

“The approval and launch of Bitcoin and Ethereum ETFs was a turning point for the crypto industry this year, leading to a major increase in demand for trusted, regulated exposure to digital assets,” said Martin Burgherr, Chief Client Officer of Sygnum.

He added: “This is also reflected in Sygnum’s own growth, with our core business segments recording significant year-to-date growth in the first half of the year.”

Sygnum, which has also been licensed in Luxembourg since 2022, plans to expand into European and Asian markets, the statement said.

Markets

Former White House official Anthony Scaramucci says cryptocurrency bull market could be sparked by regulatory clarity

Anthony Scaramucci, founder of Skybridge Capital, says the next cryptocurrency bull market could be sparked by a new wave of clear cryptocurrency regulations.

In a new interview On CNBC’s Squawk Box, the former White House communications director said he and two other prominent industry figures traveled to Washington, D.C. to speak to officials about the dangers of Sen. Elizabeth Warren and U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler’s hardline approach to cryptocurrency regulation.

“Mark Cuban, myself, and Michael Novogratz were in Washington a few weeks ago to speak with White House officials and explain the dangers of Gary Gensler and Elizabeth Warren’s anti-crypto approach. I hope that message gets through…

“Overall, if we can get regulatory policy around Bitcoin and crypto assets in sync, we will have a bull market next year for these assets.”

Scaramucci then compares crypto assets to ride-hailing company Uber, saying regulators were initially wary of the service but eventually decided to adopt clear guidelines due to public demand.

“Remember Uber: Nobody wanted Uber. A lot of regulators didn’t want it. Mayors and deputy mayors didn’t want it, but citizens wanted Uber and eventually accepted the idea of regulating it fairly. I think we’re there now.”

The CEO also says young Democratic voters believe their leaders are making the wrong choices when it comes to digital assets.

“I think President Trump’s move toward Bitcoin and crypto assets has shaken Democrats to their core, and I think very smart, younger Democrats are recognizing that they are completely off base with their positions, completely off base with these SEC lawsuits and regulation by law enforcement, and now they need to get back to the center.”

Don’t miss a thing – Subscribe to receive email alerts directly to your inbox

Check Price action

follow us on X, Facebook And Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed on The Daily Hodl are not investment advice. Investors should do their own due diligence before making any high-risk investments in Bitcoin, cryptocurrencies or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Image generated: Midjourney

-

Videos3 weeks ago

Videos3 weeks agoAbsolutely massive: the next higher Bitcoin leg will shatter all expectations – Tom Lee

-

News12 months ago

News12 months agoVolta Finance Limited – Director/PDMR Shareholding

-

News12 months ago

News12 months agoModiv Industrial to release Q2 2024 financial results on August 6

-

News12 months ago

News12 months agoApple to report third-quarter earnings as Wall Street eyes China sales

-

News12 months ago

News12 months agoNumber of Americans filing for unemployment benefits hits highest level in a year

-

News1 year ago

News1 year agoInventiva reports 2024 First Quarter Financial Information¹ and provides a corporate update

-

News1 year ago

News1 year agoLeeds hospitals trust says finances are “critical” amid £110m deficit

-

DeFi1 year ago

DeFi1 year agoPump.Fun operated by Insider Exploit

-

Videos1 year ago

Videos1 year ago$1,000,000 worth of BTC in 2025! Get ready for an UNPRECEDENTED PRICE EXPLOSION – Jack Mallers

-

Videos1 year ago

Videos1 year agoABSOLUTELY HUGE: Bitcoin is poised for unabated exponential growth – Mark Yusko and Willy Woo

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Hit $100 Billion in 2024, Fueling Insane Investor Optimism ⋆ ZyCrypto

-

DeFi1 year ago

DeFi1 year agoActive Users on Arbitrum Overtake Solana Despite ARB Token Value Drop – DL News