Tech

A Support Guide for Women

Cryptocurrency has historically been a male-dominated market, but women are becoming increasingly interested in the opportunities available. The number of female investors in cryptocurrency has risen in recent years, and more women have become aware of digital asset opportunities.

If you’re a woman considering investing in cryptocurrency, getting started can feel overwhelming. To support you on your journey, we spoke with several female leaders in the cryptocurrency space to learn about the community resources available for female investors and hone in on the steps you should take when starting to invest in cryptocurrency.

Key Takeaways

- Women make up only about one-third of crypto investors in the U.S., but more than half of crypto-curious individuals.

- Crypto is a male-dominated market due to its connection to the male-dominated finance and technology industries, but women are expressing more interest.

- There are many online cryptocurrency communities dedicated to women, and they can be key in overcoming gender barrier challenges and building confidence.

- Before investing in cryptocurrency, it is important to understand its basics and learn how to purchase and store coins securely.

Overcoming Challenges and Building Confidence

Only about one-third of crypto investors in the United States are women, according to Gemini’s 2022 Global State of Crypto report. That number is largely representative of First World countries, though women in the developing world invest in cryptocurrency at higher rates.

It’s not particularly surprising that women are underrepresented in cryptocurrency. It sits at the intersection of two male-dominated fields: finance and technology.

“Women face the same biases as in tech and financial sectors, such as skepticism about their technical expertise and financial acumen,” says Lisa Carmen Wang, the founder and general partner of Bad Bitch Empire, a community designed to help women build wealth by investing.

Historically, women have been structurally—sometimes even legally—excluded from these industries. Today, they make up a minority of employees in both fields—about 35% of STEM employees in the United States and 46% of financial sector employees (though only 15% of leadership roles).

“There’s a visible lack of female role models and leaders in the cryptocurrency space, which affects confidence and deters women from participating,” says Wang. “Also, cryptocurrency and blockchain technology thrive on community and network effects, and men often have more established networks in these fields, which can be a barrier for women trying to enter the space.”

Understandably, women’s underrepresentation in finance and technology has translated to a lower participation rate in cryptocurrency and blockchain. But that doesn’t mean women have written off cryptocurrency. In fact, Gemini’s State of Crypto report found that more than half of crypto-curious individuals in the United States are women.

The Investopedia and REAL SIMPLE 2024 Her Money Mindset survey found cryptocurrency is the third most popular type of investment among women in the millennial generation or younger. Overall, 8% of invested women said they hold cryptocurrency.

However, while there are barriers in the crypto space, there are also interesting opportunities as well. According to some women, cryptocurrency feels more female-friendly than the traditional world of finance. Its decentralized nature eliminates many of the gatekeepers that have traditionally kept women out of power and wealth.

“Despite these challenges, it’s important to acknowledge that the crypto space is meritocratic,” says Marissa Kim, head of asset management with Abra Capital Management. “Individuals with knowledge and skill are welcomed regardless of gender. Unlike some of the more traditional hierarchical systems, the crypto industry is generally open to newcomers who demonstrate expertise and capability.”

What Are the Benefits of Joining Crypto Communities as a Woman?

The most common theme among the women we spoke with was community. Unlike the world of traditional finance, cryptocurrency has a shorter history and fewer centralized entities. As a result, people are more likely to learn from each other than from official organizations.

At the same time, many of the communities dedicated to cryptocurrency were founded by and are largely populated by men, leaving some women to feel uncomfortable or unwelcome.

Elaine Asher, the founder and chief strategy officer of EVE Wealth, describes first learning about cryptocurrency from her male colleagues in finance and then attending crypto meetups “where I was often the only woman, and the only person not wearing a hoodie.”

For Asher, attending her first community event specifically for women in cryptocurrency was a transformational experience. She describes feeling like she wasn’t alone in the cryptocurrency space for the first time

“Women, more so than men, enjoy learning together, especially when it comes to new and potentially intimidating subjects,” says Asher. “Women don’t want to feel like they are alone on an island trying to figure out something as complex as crypto by themselves…”

Asher continues, “They also enjoy learning with and from their peers in a supportive environment where no question is too basic. Studies show that engaging in a community boosts confidence and problem-solving skills, both of which are important for making investing decisions.”

Important

Here are some examples of crypto-focused community platforms for women:

How to Get Started

Here’s a short summary of how to start investing in crypto, regardless of gender:

Understand How Cryptocurrency Works

Cryptocurrency is a digital asset. Though it’s referred to as a digital currency, it’s not in the same category as fiat currency like the U.S. dollar. As a decentralized form of asset, cryptocurrencies aren’t created by, controlled by, or backed by the U.S. government (or any government, for that matter). While a stock’s value is based, at least partially, on the performance of the company—cryptocurrencies’ value is based entirely on what investors are willing to pay for it. Thus, it doesn’t necessarily have any intrinsic value.

Cryptocurrency has several different uses, and as of early 2024, there were more than 9,000 cryptocurrencies on the market, but most have little to no value. The most popular cryptocurrencies by market capitalization are Bitcoin, Ethereum, and Tether USDt.

Choose a Cryptocurrency Exchange

To purchase cryptocurrency, you’ll usually have to set up an account with a cryptocurrency exchange. Think of these exchanges as brokerage accounts for cryptocurrency. Just as you would log into your brokerage account to buy stocks, bonds, and funds, you can log into a crypto exchange to buy a variety of cryptocurrencies.

“First, choose a reputable exchange platform; look for one with robust security measures, positive user reviews, and comprehensive customer support,” says Wang.

The best crypto exchange for you will depend on your goals. There are specific factors to consider when choosing one, so do your research to find out what works best for you.

Prioritize Security

When you’re getting started with cryptocurrency, security should be a top priority. There are several key security risks with cryptocurrency, including online attacks and unstable projects.

“Like creating a website, anyone can make and distribute a cryptocurrency or NFT,” says Shirin Bucknam, the founder of Crypto Witch Club. “Exchanges can be shut down or collapse. Projects can fail. You can click a nefarious link. The best way to protect yourself is to invest in vetted projects that you believe in.”

Set Up Your Wallet

Another important step of investing in cryptocurrency is setting up your crypto wallet. Unlike the physical wallet that holds your cash and credit cards, your crypto wallet doesn’t hold your crypto. Instead, it holds the private key necessary to access the crypto you own. Your private key is your way of proving you own your coins.

“Move your funds from the exchange of purchase to a compatible web3 wallet ASAP,” says Bucknam. “Your crypto should never sit on an exchange (self-custody is 90% of staying safe in crypto). If your crypto is not in a wallet, you do not own it. The exchange it is sitting on has custody.”

Start Small

When you’re ready to start buying cryptocurrency, you don’t have to jump into the deep end—nor should you, in fact. Instead, the experts we spoke with recommend starting small and allocating just a small portion of your portfolio to cryptocurrency.

“I always recommend that new participants start with the basics, such as purchases of Bitcoin and Ethereum, as they are the two largest and most liquid coins by market capitalization,” says Kim.

When you start buying crypto, Asher of EVE Wealth recommends limiting your investments to 1% to 5% of a diversified portfolio. She puts it in a similar category to venture capital or angel investing—the majority of projects fail, so it’s important to dip your toe in, and when you’re ready to start increasing your investments, spread your money out across multiple cryptocurrencies.

Consider Alternative Investment Options

Buying cryptocurrency isn’t the only way to participate in the rise in popularity of these digital assets. You can gain some exposure to crypto without buying it directly.

First, you can invest in cryptocurrency companies. Plenty of major publicly traded companies are involved in cryptocurrency, either through their own investments, partnerships, and more. There are also public crypto companies, including Coinbase, Block Inc., and Riot Platforms.

Finally, you can invest in cryptocurrency funds, including both mutual funds and exchange-traded funds (ETFs). These funds can provide exposure to cryptocurrency companies, cryptocurrency futures, and more.

Advice for Women Investing in Crypto

Even once you have the basics down, there’s still a lot to know and understand about investing in cryptocurrency. As mentioned, finding a crypto community to help you feel supported may be an piece of your journey.

“The key is finding the right community where you can learn and participate alongside these other women,” says Bucknam. “In addition to community, a great way to combat imposter syndrome is to focus on education first and not be afraid to ask questions. Your community should feel like a safe space amongst friends.”

Next, you want to understand the risks. Given that 22% of women surveyed by Investopedia and REAL SIMPLE who were not invested said it was because they don’t trust the market, and 29% are afraid of losing money, this worth noting: Buying crypto means includes signing up for the risks and potential losses, and increased volatility.

Cryptocurrency has gone through major ups and downs throughout its years of existence, and unlike the stock market, it doesn’t have decades of history to help us assess what’s likely to happen after a downturn. However, downturns are an inevitable part of investing, whether it’s in Bitcoin or the S&P 500. Having resilience to weather the storm is key for achieving positive results

“I’ve always advocated thinking of crypto as a long-term investment rather than a short-term trade,” says Kim.

Finally, continually look for more learning opportunities. New coins are regularly hitting the market and new uses for the underlying decentralized finance technology are constantly arising. Along with these advancements come other opportunities to participate in cryptocurrency and blockchain besides just investing in it.

What percentage of women are into crypto?

A 2023 survey from the Pew Research Center found that about 10% of women have invested in cryptocurrency, compared to 17% of the overall population. Women ages 18-29 invest in cryptocurrency at the highest rates—16% of women in that age range have invested in cryptocurrency compared to just 5% of women 50 and older.

What are some common investment strategies for women interested in crypto?

Many of the same investment strategies you would use in your traditional investment portfolio also translate to cryptocurrency. Many experts recommend using a long-term investment strategy rather than actively trading. Additionally, because of cryptocurrency’s risk level, it’s important to only invest with money you can afford to lose.

How can women ensure the security of their crypto assets?

To ensure the security of your crypto assets, be sure to invest in a reputable cryptocurrency exchange and hold your private keys in a secure wallet. When setting up your accounts, make sure to use strong passwords and two-factor authentication. Finally, be on the lookout for scams, as they’re prevalent in the crypto world.

Is there a recommended book or community website to help me get started?

There’s no shortage of online resources and communities to help you learn about cryptocurrency. In addition to the communities we’ve already listed for women in cryptocurrency and blockchain, there are many other books and communities designed for everyone to learn. The most popular cryptocurrency books on the market include The Bitcoin Standard, The Little Bitcoin Book, and Catching Up to Crypto.

The Bottom Line

Cryptocurrency has been one of the most talked-about investments over the past several years, but it’s still a mystery to many investors. It may feel particularly out of reach for women investors who may feel left out of traditional finance or investing spaces.

The good news is thanks to its decentralized nature, cryptocurrency leaves plenty of opportunities for women to get involved. If you’re curious about getting involved with cryptocurrency, consider joining one of the many online communities devoted to women. Look for online educational resources to help you start your cryptocurrency journey. Finally, remember that cryptocurrency is just one piece of the investing puzzle. Consider how it can support and fit into your diversified investment portfolio.

Tech

Harvard Alumni, Tech Moguls, and Best-Selling Authors Drive Nearly $600 Million in Pre-Order Sales

BlockDAG Network’s history is one of innovation, perseverance, and a vision to push the boundaries of blockchain technology. With Harvard alumni, tech moguls, and best-selling authors at the helm, BlockDAG is rewriting the rules of the cryptocurrency game.

CEO Antony Turner, inspired by the successes and shortcomings of Bitcoin and Ethereum, says, “BlockDAG leverages existing technology to push the boundaries of speed, security, and decentralization.” This powerhouse team has led a staggering 1,600% price increase in 20 pre-sale rounds, raising over $63.9 million. The secret? Unparalleled expertise and a bold vision for the future of blockchain.

Let’s dive into BlockDAG’s success story and find out what the future holds for this cryptocurrency.

The Origin: Why BlockDAG Was Created

In a recent interview, BlockDAG CEO Antony Turner perfectly summed up why the market needs BlockDAG’s ongoing revolution. He said:

“The creation of BlockDAG was inspired by Bitcoin and Ethereum, their successes and their shortcomings.

If you look at almost any new technology, it is very rare that the first movers remain at the forefront forever. Later incumbents have a huge advantage in entering a market where the need has been established and the technology is no longer cutting edge.

BlockDAG has done just that: our innovation is incorporating existing technology to provide a better solution, allowing us to push the boundaries of speed, security, and decentralization.”

The Present: How Far Has BlockDAG Come?

BlockDAG’s presale is setting new benchmarks in the cryptocurrency investment landscape. With a stunning 1600% price increase over 20 presale lots, it has already raised over $63.9 million in capital, having sold over 12.43 billion BDAG coins.

This impressive performance underscores the overwhelming confidence of investors in BlockDAG’s vision and leadership. The presale attracted over 20,000 individual investors, with the BlockDAG community growing exponentially by the hour.

These monumental milestones have been achieved thanks to the unparalleled skills, experience and expertise of BlockDAG’s management team:

Antony Turner – Chief Executive Officer

Antony Turner, CEO of BlockDAG, has over 20 years of experience in the Fintech, EdTech, Travel and Crypto industries. He has held senior roles at SPIRIT Blockchain Capital and co-founded Axona-Analytics and SwissOne. Antony excels in financial modeling, business management and scaling growth companies, with expertise in trading, software, IoT, blockchain and cryptocurrency.

Director of Communications

Youssef Khaoulaj, CSO of BlockDAG, is a Smart Contract Auditor, Metaverse Expert, and Red Team Hacker. He ensures system security and disaster preparedness, and advises senior management on security issues.

advisory Committee

Steven Clarke-Martin, a technologist and consultant, excels in enterprise technology, startups, and blockchain, with a focus on DAOs and smart contracts. Maurice Herlihy, a Harvard and MIT graduate, is an award-winning computer scientist at Brown University, with experience in distributed computing and consulting roles, most notably at Algorand.

The Future: Becoming the Cryptocurrency with the Highest Market Cap in the World

Given its impressive track record and a team of geniuses working tirelessly behind the scenes, BlockDAG is quickly approaching the $600 million pre-sale milestone. This crypto powerhouse will soon enter the top 30 cryptocurrencies by market cap.

Currently trading at $0.017 per coin, BlockDAG is expected to hit $1 million in the coming months, with the potential to hit $30 per coin by 2030. Early investors have already enjoyed a 1600% ROI by batch 21, fueling a huge amount of excitement around BlockDAG’s presale. The platform is seeing significant whale buying, and demand is so high that batch 21 is almost sold out. The upcoming batch is expected to drive prices even higher.

Invest in BlockDAG Pre-Sale Now:

Pre-sale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetwork

Discord: Italian: https://discord.gg/Q7BxghMVyu

No spam, no lies, just insights. You can unsubscribe at any time.

Tech

How Karak’s Latest Tech Integration Could Make Data Breaches Obsolete

- Space and Time uses zero-knowledge proofs to ensure secure and tamper-proof data processing for smart contracts and enterprises.

- The integration facilitates faster development and deployment of Distributed Secure Services (DSS) on the Karak platform.

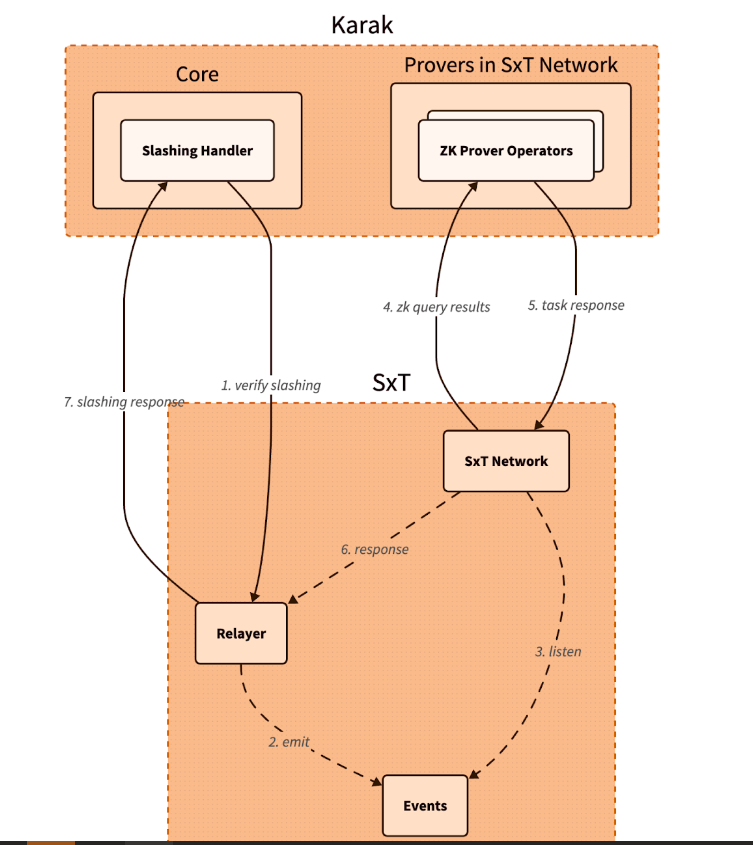

Karak, a platform known for its strong security capabilities, is enhancing its Distributed Secure Services (DSS) by integrating Space and Time as a zero-knowledge (ZK) coprocessor. This move is intended to strengthen trustless operations across its network, especially in slashing and rewards mechanisms.

Space and Time is a verifiable processing layer that uses zero-knowledge proofs to ensure that computations on decentralized data warehouses are secure and untampered with. This system enables smart contracts, large language models (LLMs), and enterprises to process data without integrity concerns.

The integration with Karak will enable the platform to use Proof of SQL, a new ZK-proof approach developed by Space and Time, to confirm that SQL query results are accurate and have not been tampered with.

One of the key features of this integration is the enhancement of DSS on Karak. DSS are decentralized services that use re-staked assets to secure the various operations they provide, from simple utilities to complex marketplaces. The addition of Space and Time technology enables faster development and deployment of these services, especially by simplifying slashing logic, which is critical to maintaining security and trust in decentralized networks.

Additionally, Space and Time is developing its own DSS for blockchain data indexing. This service will allow community members to easily participate in the network by running indexing nodes. This is especially beneficial for applications that require high security and decentralization, such as decentralized data indexing.

The integration architecture follows a detailed and secure flow. When a Karak slashing contract needs to verify a SQL query, it calls the Space and Time relayer contract with the required SQL statement. This contract then emits an event with the query details, which is detected by operators in the Space and Time network.

These operators, responsible for indexing and monitoring DSS activities, validate the event and route the work to a verification operator who runs the query and generates the necessary ZK proof.

The result, along with a cryptographic commitment on the queried data, is sent to the relayer contract, which verifies and returns the data to the Karak cutter contract. This end-to-end process ensures that the data used in decision-making, such as determining penalties within the DSS, is accurate and reliable.

Karak’s mission is to provide universal security, but it also extends the capabilities of Space and Time to support multiple DSSs with their data indexing needs. As these technologies evolve, they are set to redefine the secure, decentralized computing landscape, making it more accessible and efficient for developers and enterprises alike. This integration represents a significant step towards a more secure and verifiable digital infrastructure in the blockchain space.

Website | X (Twitter) | Discord | Telegram

No spam, no lies, just insights. You can unsubscribe at any time.

Tech

Cryptocurrency Payments: Should CFOs Consider This Ferrari-Approved Trend?

Iconic Italian luxury carmaker Ferrari has announced the expansion of its cryptocurrency payment system to its European dealer network.

The move, which follows a successful launch in North America less than a year ago, raises a crucial question for CFOs across industries: Is it time to consider accepting cryptocurrency as a form of payment for your business?

Ferrari’s move isn’t an isolated one. It’s part of a broader trend of companies embracing digital assets. As of 2024, we’re seeing a growing number of companies, from tech giants to traditional retailers, accepting cryptocurrencies.

This change is determined by several factors:

- Growing mainstream adoption of cryptocurrencies

- Growing demand from tech-savvy and affluent consumers

- Potential for faster and cheaper international transactions

- Desire to project an innovative brand image

Ferrari’s approach is particularly noteworthy. They have partnered with BitPay, a leading cryptocurrency payment processor, to allow customers to purchase vehicles using Bitcoin, Ethereum, and USDC. This satisfies their tech-savvy and affluent customer base, many of whom have large digital asset holdings.

Navigating Opportunities and Challenges

Ferrari’s adoption of cryptocurrency payments illustrates several key opportunities for companies considering this move. First, it opens the door to new customer segments. By accepting cryptocurrency, Ferrari is targeting a younger, tech-savvy demographic—people who have embraced digital assets and see them as a legitimate form of value exchange. This strategy allows the company to connect with a new generation of affluent customers who may prefer to conduct high-value transactions in cryptocurrency.

Second, cryptocurrency adoption increases global reach. International payments, which can be complex and time-consuming with traditional methods, become significantly easier with cryptocurrency transactions. This can be especially beneficial for businesses that operate in multiple countries or deal with international customers, as it potentially reduces friction in cross-border transactions.

Third, accepting cryptocurrency positions a company as innovative and forward-thinking. In today’s fast-paced business environment, being seen as an early adopter of emerging technologies can significantly boost a brand’s image. Ferrari’s move sends a clear message that they are at the forefront of financial innovation, which can appeal to customers who value cutting-edge approaches.

Finally, there is the potential for cost savings. Traditional payment methods, especially for international transactions, often incur substantial fees. Cryptocurrency transactions, on the other hand, can offer lower transaction costs. For high-value purchases, such as luxury cars, these savings could be significant for both the business and the customer.

While the opportunities are enticing, accepting cryptocurrency payments also presents significant challenges that businesses must address. The most notable of these is volatility. Cryptocurrency values can fluctuate dramatically, sometimes within hours, posing potential risk to businesses that accept them as payment. Ferrari addressed this challenge by implementing a system that instantly converts cryptocurrency received into traditional fiat currencies, effectively mitigating the risk of value fluctuations.

Regulatory uncertainty is another major concern. The legal landscape surrounding cryptocurrencies is still evolving in many jurisdictions around the world. This lack of clear and consistent regulations can create compliance challenges for companies, especially those operating internationally. Companies must remain vigilant and adaptable as new laws and regulations emerge, which can be a resource-intensive process.

Implementation costs are also a significant obstacle. Integrating cryptocurrency payment systems often requires substantial investment in new technology infrastructure and extensive staff training. This can be especially challenging for small businesses or those with limited IT resources. The costs are not just financial; a significant investment of time is also required to ensure smooth implementation and operation.

Finally, security concerns loom large in the world of cryptocurrency transactions. While blockchain technology offers some security benefits, cryptocurrency transactions still require robust cybersecurity measures to protect against fraud, hacks, and other malicious activity. Businesses must invest in robust security protocols and stay up-to-date on the latest threats and protections, adding another layer of complexity and potential costs to accepting cryptocurrency payments.

Strategic Considerations for CFOs

If you’re thinking of following in Ferrari’s footsteps, here are the key factors to consider:

- Risk Assessment: Carefully evaluate potential risks to your business, including financial, regulatory, and reputational risks.

- Market Analysis: Evaluate whether your customer base is significantly interested in using cryptocurrencies for payments.

- Technology Infrastructure: Determine the costs and complexities of implementing a cryptographic payment system that integrates with existing financial processes.

- Regulatory Compliance: Ensure that cryptocurrency acceptance is in line with local regulations in all markets you operate in. Ferrari’s gradual rollout demonstrates the importance of this consideration.

- Financial Impact: Analyze how accepting cryptocurrency could impact your cash flow, accounting practices, and financial reporting.

- Partnership Evaluation: Consider partnering with established crypto payment processors to reduce risk and simplify implementation.

- Employee Training: Plan comprehensive training to ensure your team is equipped to handle cryptocurrency transactions and answer customer questions.

While Ferrari’s adoption of cryptocurrency payments is exciting, it’s important to consider this trend carefully.

A CFO’s decision to adopt cryptocurrency as a means of payment should be based on a thorough analysis of your company’s specific needs, risk tolerance, and strategic goals. Cryptocurrency payments may not be right for every business, but for some, they could provide a competitive advantage in an increasingly digital marketplace.

Remember that the landscape is rapidly evolving. Stay informed about regulatory changes, technological advancements, and changing consumer preferences. Whether you decide to accelerate your crypto engines now or wait in the pit, keeping this payment option on your radar is critical to navigating the future of business transactions.

Was this article helpful?

Yes No

Sign up to receive your daily business insights

Tech

Bitcoin Tumbles as Crypto Market Selloff Mirrors Tech Stocks’ Plunge

The world’s largest cryptocurrency, Bitcoin (BTC), suffered a significant price decline on Wednesday, falling below $65,000. The decline coincides with a broader market sell-off that has hit technology stocks hard.

Cryptocurrency Liquidations Hit Hard

CoinGlass data reveals a surge in long liquidations in the cryptocurrency market over the past 24 hours. These liquidations, totaling $220.7 million, represent forced selling of positions that had bet on price increases. Bitcoin itself accounted for $14.8 million in long liquidations.

Ethereum leads the decline

Ethereal (ETH), the second-largest cryptocurrency, has seen a steeper decline than Bitcoin, falling nearly 8% to trade around $3,177. This decline mirrors Bitcoin’s price action, suggesting a broader market correction.

Cryptocurrency market crash mirrors tech sector crash

The cryptocurrency market decline appears to be linked to the significant losses seen in the U.S. stock market on Wednesday. Stock market listing The index, heavily weighted toward technology stocks, posted its sharpest decline since October 2022, falling 3.65%.

Analysts cite multiple factors

Several factors may have contributed to the cryptocurrency market crash:

- Tech earnings are underwhelming: Earnings reports from tech giants like Alphabet are disappointing (Google(the parent company of), on Tuesday, triggered a sell-off in technology stocks with higher-than-expected capital expenditures that could have repercussions on the cryptocurrency market.

- Changing Political Landscape: The potential impact of the upcoming US elections and changes in Washington’s policy stance towards cryptocurrencies could influence investor sentiment.

- Ethereal ETF Hopes on the line: While bullish sentiment around a potential U.S. Ethereum ETF initially boosted the market, delays or rejections could dampen enthusiasm.

Analysts’ opinions differ

Despite the short-term losses, some analysts remain optimistic about Bitcoin’s long-term prospects. Singapore-based cryptocurrency trading firm QCP Capital believes Bitcoin could follow a similar trajectory to its post-ETF launch all-time high, with Ethereum potentially converging with its previous highs on sustained institutional interest.

Rich Dad Poor Dad Author’s Prediction

Robert Kiyosaki, author of the best-selling Rich Dad Poor Dad, predicts a potential surge in the price of Bitcoin if Donald Trump is re-elected as US president. He predicts a surge to $105,000 per coin by August 2025, fueled by a weaker dollar that is set to boost US exports.

BTC/USD Technical Outlook

Bitcoin price is currently trading below key support levels, including the $65,500 level and the 100 hourly moving average. A break below the $64,000 level could lead to further declines towards the $63,200 support zone. However, a recovery above the $65,500 level could trigger another increase in the coming sessions.

-

Videos3 weeks ago

Videos3 weeks agoAbsolutely massive: the next higher Bitcoin leg will shatter all expectations – Tom Lee

-

News12 months ago

News12 months agoVolta Finance Limited – Director/PDMR Shareholding

-

News12 months ago

News12 months agoModiv Industrial to release Q2 2024 financial results on August 6

-

News12 months ago

News12 months agoApple to report third-quarter earnings as Wall Street eyes China sales

-

News12 months ago

News12 months agoNumber of Americans filing for unemployment benefits hits highest level in a year

-

News1 year ago

News1 year agoInventiva reports 2024 First Quarter Financial Information¹ and provides a corporate update

-

News1 year ago

News1 year agoLeeds hospitals trust says finances are “critical” amid £110m deficit

-

DeFi1 year ago

DeFi1 year agoPump.Fun operated by Insider Exploit

-

Videos1 year ago

Videos1 year ago$1,000,000 worth of BTC in 2025! Get ready for an UNPRECEDENTED PRICE EXPLOSION – Jack Mallers

-

Videos1 year ago

Videos1 year agoABSOLUTELY HUGE: Bitcoin is poised for unabated exponential growth – Mark Yusko and Willy Woo

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Hit $100 Billion in 2024, Fueling Insane Investor Optimism ⋆ ZyCrypto

-

DeFi1 year ago

DeFi1 year agoActive Users on Arbitrum Overtake Solana Despite ARB Token Value Drop – DL News