Tech

A Timeline and History of Blockchain Technology

Blockchain was officially introduced in 2009 with the release of its first application — the Bitcoin cryptocurrency — but its roots reach back several decades. Many of the technologies that form the basis for blockchain today were in the works long before the emergence of Bitcoin.

Still, blockchain most identifies with Bitcoin — for better or worse. In the wild and raucous years that followed Bitcoin’s debut, blockchain earned a reputation akin to the Wild West. Its decentralized, peer-to-peer (P2P) architecture allowed just about anyone to participate in the process, making it seem too risky for business use. That started to change in 2016 when a burgeoning open source community began developing complete enterprise platforms.

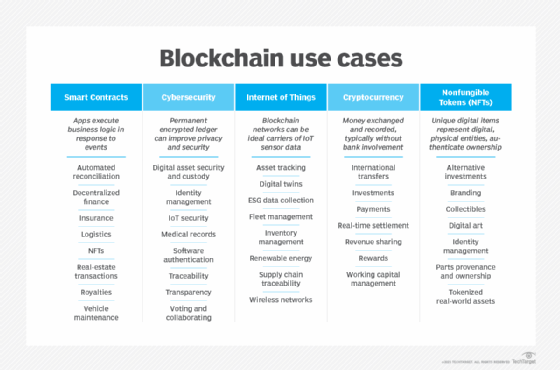

Since then, the technology has taken on a life of its own, with interest coming from many quarters, despite the sometimes scary cryptocurrency headlines of late. Governments, businesses and other organizations are researching and deploying blockchain technology to meet needs that have nothing to do with digital currency. In the face of proliferating cyberthreats and government data privacy regulations, blockchain offers security, immutability, traceability and transparency across a distributed network, making it well suited for use cases that have become difficult to support and protect with traditional infrastructures.

What is blockchain?

Blockchain is a type of database that’s a public ledger for recording transactions without the need for a third party to validate each activity. It’s distributed across a P2P network and consists of data blocks linked together to form a continuous chain of immutable records. Each computer in the network maintains a copy of the ledger to avoid a single point of failure. Blocks are added in sequential order, and they’re permanent and tamperproof.

A blockchain starts with an initial block — often referred to as the Genesis block — that records the first transactions. The block is also assigned an alphanumeric string called a hash, which is based on the block’s timestamp. Blocks are added to the chain sequentially. Each block uses the hash from the previous block to create its own hash, thus linking the blocks together.

Blockchain also uses a computational process called consensus to validate a block’s authenticity before it can be added to the chain. As part of this process, most of the nodes on the blockchain network must agree that the new block’s hash has been calculated correctly. Consensus ensures that all copies of the distributed ledger are in the same state.

Initially, blockchain provided a distributed public ledger to support Bitcoin, so transactions could be recorded without the need for a central authority to establish trust in a trustless environment. Not only were transactions more efficient, but the costs typically associated with third-party verification were eliminated. Blockchain also provided greater transparency, traceability and security than conventional approaches to handling distributed transactions.

Blockchain’s historical building blocks

Although blockchain as an entity has a relatively short history, its influence today is widespread and its applications wide-ranging and growing. Through the decades, blockchain’s development and evolution include some of the following notable developments:

- Pioneers like Merkle and his tree, Chaum and digital cash, Haber and timestamping, Dwork and proof of work (PoW), Black and hashcash, Finney and reusable PoW dotted the early years of the pre-blockchain landscape.

- The presumed pseudonym Satoshi Nakamoto was created to introduce the concept of cryptocurrency and blockchain. Shortly thereafter, cryptocurrency was launched and Nakamoto conducted the first bitcoin transaction, a bitcoin exchange was established and a programmer paid 10,000 bitcoin for two pizzas.

- Bitcoin’s price soared from pennies to tens of thousands of dollars, all the while draped in controversies, shutdowns, crackdowns, bankruptcies, scams, scandals and arrests.

- Blockchain started to somewhat divorce itself from Bitcoin when the decentralized blockchain platform Ethereum eventually became one of the biggest applications of blockchain technology and opened the door to numerous business applications beyond cryptocurrencies.

- And buoyed by AI, IoT, non-fungible tokens (NFTs), decentralized finance (DeFi) and smart contracts, as well as initiatives by the likes of Walmart and Amazon, blockchain has gained legitimacy as a safe, viable alternative to traditional methods of conducting business and individual transactions.

Block-by-block description of blockchain’s inner workings.

1979

One of the early pre-blockchain technologies is the Merkle tree, named after computer scientist and mathematician Ralph Merkle. He described an approach to public key distribution and digital signatures called tree authentication in his Ph.D. thesis for Stanford University. Merkle eventually patented this idea as a method for providing digital signatures. The Merkle tree provides a data structure for verifying individual records.

1982

In his Ph.D. dissertation for the University of California, Berkeley, David Chaum described a vault system for establishing, maintaining and trusting computer systems among mutually suspicious groups. The system embodied many of the elements that comprise a blockchain. Chaum is also credited with inventing digital cash, and in 1989, he founded the company DigiCash.

1991

Stuart Haber and W. Scott Stornetta published an article describing how to timestamp digital documents to prevent users from backdating or forward-dating electronic documents. The goal was to maintain the document’s complete privacy without requiring record-keeping by a timestamping service. Haber and Stornetta updated the design to incorporate Merkle trees, which enabled multiple document certificates to live on a single block.

1993

The beginnings of the PoW concept were published in a paper by Cynthia Dwork and Moni Naor to provide “a computational technique for combatting junk mail, in particular, and controlling access to a shared resource, in general.”

1997

Adam Black introduced hashcash, a PoW algorithm that provided denial-of-service countermeasures.

1999

Markus Jakobsson and Ari Juels published the term proof of work. Also, the P2P network was popularized by the now defunct peer-to-peer file sharing application Napster. Some argued that Napster was not a true P2P network because it used a centralized server. But the service still helped breathe life into the P2P network, making it possible to build a distributed system that could benefit from the compute power and storage capacity of thousands of computers.

2000

Stefan Konst introduced the concept of cryptographically secured chains in his paper “Secure Log Files Based on Cryptographically Concatenated Entries.” His model, which showed that entries in the chain can be traced back from the Genesis block to prove authenticity, was the basis for today’s blockchain models.

2004

Hal Finney introduced reusable PoW, a mechanism for receiving a non-exchangeable — or non-fungible — hashcash token in return for an RSA-signed token. The PoW approach today plays a vital role in Bitcoin mining. Cryptocurrencies like Bitcoin and Litecoin use PoW, and Ethereum shifted to the proof-of-stake protocol to secure a network using a fraction of the energy that PoW uses.

2008

Satoshi Nakamoto, thought to be a pseudonym used by an individual — or group of individuals — published a white paper introducing the concept of cryptocurrency and blockchain and helped develop the first Bitcoin software. Blockchain infrastructure, according to the white paper, would support secure, P2P transactions without the need for trusted third parties such as banks or governments. Nakamoto’s real identity remains a mystery, but there has been no shortage of theories.

The Bitcoin/blockchain architecture was introduced and built on technologies and concepts from the previous three decades. Nakamoto’s design also presented the concept of a “chain of blocks,” making it possible to add blocks without requiring them to be signed by a trusted third party. Nakamoto defined an electronic coin as a “chain of digital signatures,” in which each owner transfers the coin to the next owner by “digitally signing a hash of the previous transaction and the public key of the next owner and adding these to the end of the coin.”

2009

Cryptocurrency was launched during the Great Recession, when the government pumped large amounts of money into the economy. Bitcoin was worth less than a penny then. Nakamoto mined the first Bitcoin block, validating the blockchain concept. The block contained 50 bitcoin and was known as the Genesis block — aka block 0. Nakamoto released Bitcoin v0.1 to the web service SourceForge as open source software. Bitcoin is now on GitHub.

The first Bitcoin transaction took place when Nakamoto sent Hal Finney 10 bitcoin in block 170. The Bitcoin-dev channel was created on the text-based instant messaging system Internet Relay Chat for Bitcoin developers. The first Bitcoin exchange — Bitcoin Market — was established, enabling people to exchange paper money for bitcoin. Nakamoto launched the Bitcoin Talk forum to share Bitcoin-related news and information.

In the spirit of cryptocurrency as money with fixed supply, Nakamoto set up a system to ensure the number of bitcoin mined won’t ever exceed 21 million.

Blockchain’s evolution through the years has been intimately tied to cryptocurrencies, namely Bitcoin.

2010

On May 22, Bitcoin made history when a programmer Laszlo Hanyecz paid 10,000 bitcoin for two delivered Papa John’s pizzas. The two pizzas back then were valued at about $40, a transaction that would balloon to a value of more than $260 million at today’s bitcoin price level.

A short time later that year, programmer Jed McCaleb launched Mt. Gox, a Tokyo-based Bitcoin exchange. Mt. Gox was short for Magic: The Gathering Online eXchange — a carryover from a fantasy card game. At its peak, Mt. Gox handled more than 70% of all Bitcoin transactions. But in August, a hacker exploited a bug in the blockchain code and created more than 184 billion bitcoin in block 74,638, tarnishing Bitcoin’s reputation. Nakamoto published a new version of the Bitcoin software, but by the end of the year, he disappeared from the Bitcoin scene completely.

2011

One-fourth of the 21 million bitcoin had been mined. By early February, the value of a bitcoin was equal to the U.S. dollar. Shortly thereafter, McCaleb sold Mt. Gox to Mark Karpelès. And soon after that, the bitcoin reached parity with the euro and British pound sterling. WikiLeaks started accepting bitcoin donations. However, Mt. Gox was hacked and bitcoin were stolen, causing an artificial drop in value and resulting in suspension of trading. Litecoin was released in October, representing one of the earlier Bitcoin spinoffs and considered the first alternative cryptocurrency.

2012

The interest in cryptocurrencies solidified. Bitcoin’s price hovered around $5 for most of the year with several fluctuations. Early that year, Mihai Alisie and Ethereum creator Vitalik Buterin launched Bitcoin Magazine and published their first issue in May. A few months later, the Bitcoin Foundation was established to promote Bitcoin and restore public perceptions of cryptocurrency after several scandals. McCaleb and Chris Larsen founded OpenCoin, which led to the development of the Ripple transaction protocol for currency transactions and real-time payments. Coinbase raised more than $600,000 in its crowd-funded seed round on its way to becoming one of the top Bitcoin exchanges.

2013

Bitcoin’s upward trajectory continued. In February, Coinbase reported selling $1 million worth of bitcoin in a single month at more than $22 each. By the end of March, with 11 million bitcoin in circulation, the currency’s total value exceeded $1 billion. And in October, the first reported bitcoin ATM launched in a Vancouver, B.C., coffee shop.

But it wasn’t all good news for digital currency. Both Thailand and China banned cryptocurrencies. The U.S. Federal Court seized Mt. Gox’s funds in the U.S. for transmitting money without a license. And the FBI shut down the dark web marketplace Silk Road, confiscating about 144,000 bitcoin worth more than $1 billion and resulting in a life prison sentence for owner Ross Ulbricht for a litany of crimes, including drug trafficking, computer hacking and money laundering.

2014

Despite setbacks, one of the more important milestones in blockchain’s history occurred when Bitcoin Magazine co-founder Buterin published a white paper proposing a decentralized application platform, leading to the creation of Ethereum and the Ethereum Foundation. Ethereum paved the way for blockchain technology to be used for applications other than cryptocurrency. It introduced smart contracts and provided developers with a platform for building decentralized applications.

Financial institutions and other industries began to recognize and explore blockchain’s potential, shifting their focus from digital currency to the development of blockchain technologies. But Bitcoin stayed in the spotlight — for better and worse. The Mt. Gox Bitcoin exchange filed for bankruptcy. The Bitcoin Foundation vice chairperson was arrested for money laundering. And the U.K. tax authority classified bitcoin as private money. Yet several companies accepted bitcoin by year’s end, including the Chicago Sun-Times, Overstock.com, Microsoft, PayPal and Expedia. Bitcoin’s acceptance only added fuel to blockchain’s fire.

2015

The Ethereum Frontier network launched, enabling developers to write smart contracts and decentralized apps that could be deployed to a live network. Ethereum was on its way to becoming one of the biggest applications of blockchain technology. It drew in an active developer community that continues to this day. In addition, Nasdaq initiated a blockchain trial. The Linux Foundation launched the Hyperledger project. And nine major investment banks joined forces to form the R3 consortium, exploring how blockchain could benefit their operations. Within six months, the consortium grew to more than 40 financial institutions.

2016

The term blockchain gained acceptance as a single word, rather than being treated as two concepts, as they were in Nakamoto’s original paper. The Chamber of Digital Commerce and the Hyperledger project announced a partnership to strengthen industry advocacy and education. A bug in the Ethereum decentralized autonomous organization code was exploited, resulting in a “hard fork” in the Ethereum network. The Bitfinex cryptocurrency exchange was hacked and nearly 120,000 bitcoin were stolen — a bounty worth about $66 million.

2017

Bitcoin hit a record high of nearly $20,000. Japan recognized bitcoin as legal currency. Seven European banks formed the Digital Trade Chain Consortium to develop a trade finance platform based on blockchain. The Block.one software company introduced the EOS blockchain operating system, based on the EOS cryptocurrency and designed to support commercial decentralized applications. About 15% of global banks used blockchain technology in some capacity.

2018

Entering its 10th year, bitcoin’s value continued to drop, ending the year at about $3,800. The online payment firm Stripe stopped accepting bitcoin payments. Google, Twitter and Facebook banned cryptocurrency advertising. South Korea banned anonymous cryptocurrency trading but announced it would invest millions in blockchain initiatives. The European Commission launched the Blockchain Observatory and Forum to accelerate the development of blockchain. Baidu introduced its blockchain-as-a-service platform.

2019

Walmart launched a supply chain system based on the Hyperledger platform. Amazon announced the general availability of its Amazon Managed Blockchain service on AWS to help users build resilient Web 3.0 applications on public and private blockchains. Ethereum network transactions exceeded one million per day. Blockchain research and development took center stage as organizations embraced blockchain technology and decentralized applications for a variety of use cases.

2020

A Deloitte survey revealed that nearly 40% of respondents incorporated blockchain into production, and 55% viewed blockchain as a top strategic priority. Ethereum launched the Beacon Chain in preparation for Ethereum 2.0. Stablecoins, whose value is tied to another asset class, rose significantly because they promised more stability than traditional cybercurrencies. Interest increased in combining blockchain with AI to optimize business processes.

2021

Bitcoin reached an all-time high of $68,789.63 on Nov. 10, 2021. During its bull run, the bitcoin market cap surpassed $3 trillion. Coinbase went public and was acknowledged as the seventh biggest new listing of all time on the U.S. stock exchange. The DeFi market offering services through smart contracts on blockchain grew a whopping 600% from the previous year, reaching a value of $200 billion. And NFT artwork made headlines, selling for more than $69 million in Ethereum at the auction house Christie’s. Well-known entrepreneurs and athletes attempted to capture the meteoric rise in bitcoin’s value, including Elon Musk initially accepting cryptocurrency as payment on new Tesla vehicles and Aaron Rogers taking a portion of his multimillion-dollar NFL salary in bitcoin.

Interest in using blockchain for applications other than cryptocurrency continued as governments and enterprises considered blockchain for a variety of use cases, including voting, real estate, fitness tracking, intellectual rights, IoT and vaccine distribution in the midst of the COVID-19 pandemic. Moreover, multiple cloud providers now offered blockchain as a service, and the demand for qualified blockchain developers was greater than ever. The global blockchain technology market was valued at nearly $6 billion in 2021 and seen surpassing a trillion dollars by 2030, according to market researcher Statista.

Blockchain’s business applications spread far and wide beyond cryptos.

2022

NFTs continued their ascent, eco-friendly blockchain networks emerged and blockchain applications increased among companies. Bitcoin mining crept closer to Nakamoto’s 21 million coin limit, reaching 19 million and leaving less than 10% of bitcoin to be mined.

All-time high prices for bitcoin and other cryptocurrencies plummeted in the spring due to investor concerns about inflation and the new COVID-19 Omicron variant. Some cryptocurrency exchanges went bankrupt. The collapse of the FTX exchange and arrest of its CEO Sam Bankman-Fried amplified fears about cryptocurrency’s riskiness. The open source blockchain platform Terra also collapsed. Speculation of new U.S. government regulation of cryptocurrency added to the uncertainty but at the same time was thought to help legitimize the industry.

Globally, Danish shipping company Maersk announced the shutdown of the blockchain-based TradeLens digital ledger it co-developed with IBM because of a lack of player participation. And the Australian Stock Exchange scrapped a seven-year plan to move its trading platform to blockchain. More than 100 countries were involved in the creation of their own central bank digital currencies, according to Statista. CBDCs are digital versions of real-world fiat money to eventually help speed cross-border retail transactions on blockchain in contrast to the slower speeds and price volatility of cryptocurrency.

Blockchain’s vaunted claims of imperviousness came under attack — and not just figuratively. Blockchain analysis firm Chainalysis identified nearly 200 cryptocurrency or blockchain hacks, resulting in losses of $3.8 billion. The most noteworthy incident occurred when the video game blockchain Ronin Network reported the theft of $625 million worth of Ether and USDC stablecoins. The U.S. Treasury Department blamed a North Korean hacker collective for the attack.

2023

The bad news for cryptocurrency continued as the SEC indicted executives at the Coinbase and Binance exchanges and filed charges against crypto-asset entrepreneur Justin Sun and three of his wholly owned companies for the unregistered offer and sale of crypto-asset securities.

Businesses are still moving ahead with blockchain, but they’re proceeding with greater caution. While blockchain technology has been mostly applicable to finance services and banking, other viable applications include gaming, media and entertainment, real estate, healthcare, cybersecurity, smart contracts, NFTs, IoT, transportation, supply chain management and the government. But the latest iteration of the internet, Web 3.0, with its offer of decentralization and data security, may well be the greatest driver of blockchain technology.

Bitcoin for now has found some relatively solid footing in the $25,000 to $30,000 range. Bitcoin mining should reach Nakamoto’s 21 million limit sometime around 2140.

Beyond 2023

Blockchain’s promise of secure and transparent transactions without the need for intermediaries will potentially change the way enterprises conduct practically every aspect of their daily business operations for decades to come. Technologies like AI, IoT, NFTs and the metaverse will be significantly impacted by blockchain.

Gartner pegs the business value of blockchain at more than $360 billion by 2026 — modest when compared to the research firm’s estimate of $3.1 trillion by 2030. Other estimates place the blockchain market at about $1 trillion by the end of the decade.

Expect several trends to contribute greatly to blockchain’s eventual trillion-dollar-plus valuation, including the following:

- Blockchain as a cloud-based technology is essential to digital transformation initiatives and the migration of data and workloads to distributed cloud environments.

- AI and blockchain will merge as they work synergistically to increase blockchain’s efficiency and produce torrents of new data used in building more reliable machine learning models.

- NFT use cases will substantially increase, opening new avenues of revenue to content producers who tokenize and sell their work without intermediaries.

- Blockchain IoT will make digital transactions faster, more affordable and more secure by preventing tampering and increasing accountability.

- Smart contracts encoded on blockchain will enable simpler, more automated and more wide-ranging transactions.

- Blockchain will be foundational to Web 3.0 and essential to the development of the metaverse on the latest iteration of the internet.

- DeFi will provide lending, borrowing and investment services on blockchain that are more open, transparent and inclusive.

- Blockchain as a service will enable companies and developers to create, implement and administer blockchain applications without setting up and maintaining their own blockchain networks.

- Proof-of-stake protocol, which selects validators in proportion to their quantity of holdings to avoid the computational cost of PoW schemes, will gain further momentum as a viable alternative.

- Governments will replace traditional paper-based systems with distributed ledger technology.

- In answer to cyber attacks, scams and indictments, expect blockchain to be in the crosshairs of federal, state and local legislative and regulatory efforts.

- Blockchain technology will encourage new cryptocurrencies and cryptocurrency exchanges.

As universities, governments and private corporations continue to research and invest in blockchain, the technology will continue to improve and expand in the areas of security, privacy, scalability and interoperability. And since blockchain isn’t suited to every application, businesses will need to weigh the risks, evaluate the financial costs and be selective with their blockchain deployments.

Editor’s note: This article was updated in July 2024 to improve the reader experience.

Ron Karjian is an industry editor and writer at TechTarget covering business analytics, artificial intelligence, data management, security and enterprise applications.

Robert Sheldon is a technical consultant and freelance technology writer. He has written numerous books, articles and training materials related to Windows, databases, business intelligence and other areas of technology.

Tech

Harvard Alumni, Tech Moguls, and Best-Selling Authors Drive Nearly $600 Million in Pre-Order Sales

BlockDAG Network’s history is one of innovation, perseverance, and a vision to push the boundaries of blockchain technology. With Harvard alumni, tech moguls, and best-selling authors at the helm, BlockDAG is rewriting the rules of the cryptocurrency game.

CEO Antony Turner, inspired by the successes and shortcomings of Bitcoin and Ethereum, says, “BlockDAG leverages existing technology to push the boundaries of speed, security, and decentralization.” This powerhouse team has led a staggering 1,600% price increase in 20 pre-sale rounds, raising over $63.9 million. The secret? Unparalleled expertise and a bold vision for the future of blockchain.

Let’s dive into BlockDAG’s success story and find out what the future holds for this cryptocurrency.

The Origin: Why BlockDAG Was Created

In a recent interview, BlockDAG CEO Antony Turner perfectly summed up why the market needs BlockDAG’s ongoing revolution. He said:

“The creation of BlockDAG was inspired by Bitcoin and Ethereum, their successes and their shortcomings.

If you look at almost any new technology, it is very rare that the first movers remain at the forefront forever. Later incumbents have a huge advantage in entering a market where the need has been established and the technology is no longer cutting edge.

BlockDAG has done just that: our innovation is incorporating existing technology to provide a better solution, allowing us to push the boundaries of speed, security, and decentralization.”

The Present: How Far Has BlockDAG Come?

BlockDAG’s presale is setting new benchmarks in the cryptocurrency investment landscape. With a stunning 1600% price increase over 20 presale lots, it has already raised over $63.9 million in capital, having sold over 12.43 billion BDAG coins.

This impressive performance underscores the overwhelming confidence of investors in BlockDAG’s vision and leadership. The presale attracted over 20,000 individual investors, with the BlockDAG community growing exponentially by the hour.

These monumental milestones have been achieved thanks to the unparalleled skills, experience and expertise of BlockDAG’s management team:

Antony Turner – Chief Executive Officer

Antony Turner, CEO of BlockDAG, has over 20 years of experience in the Fintech, EdTech, Travel and Crypto industries. He has held senior roles at SPIRIT Blockchain Capital and co-founded Axona-Analytics and SwissOne. Antony excels in financial modeling, business management and scaling growth companies, with expertise in trading, software, IoT, blockchain and cryptocurrency.

Director of Communications

Youssef Khaoulaj, CSO of BlockDAG, is a Smart Contract Auditor, Metaverse Expert, and Red Team Hacker. He ensures system security and disaster preparedness, and advises senior management on security issues.

advisory Committee

Steven Clarke-Martin, a technologist and consultant, excels in enterprise technology, startups, and blockchain, with a focus on DAOs and smart contracts. Maurice Herlihy, a Harvard and MIT graduate, is an award-winning computer scientist at Brown University, with experience in distributed computing and consulting roles, most notably at Algorand.

The Future: Becoming the Cryptocurrency with the Highest Market Cap in the World

Given its impressive track record and a team of geniuses working tirelessly behind the scenes, BlockDAG is quickly approaching the $600 million pre-sale milestone. This crypto powerhouse will soon enter the top 30 cryptocurrencies by market cap.

Currently trading at $0.017 per coin, BlockDAG is expected to hit $1 million in the coming months, with the potential to hit $30 per coin by 2030. Early investors have already enjoyed a 1600% ROI by batch 21, fueling a huge amount of excitement around BlockDAG’s presale. The platform is seeing significant whale buying, and demand is so high that batch 21 is almost sold out. The upcoming batch is expected to drive prices even higher.

Invest in BlockDAG Pre-Sale Now:

Pre-sale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetwork

Discord: Italian: https://discord.gg/Q7BxghMVyu

No spam, no lies, just insights. You can unsubscribe at any time.

Tech

How Karak’s Latest Tech Integration Could Make Data Breaches Obsolete

- Space and Time uses zero-knowledge proofs to ensure secure and tamper-proof data processing for smart contracts and enterprises.

- The integration facilitates faster development and deployment of Distributed Secure Services (DSS) on the Karak platform.

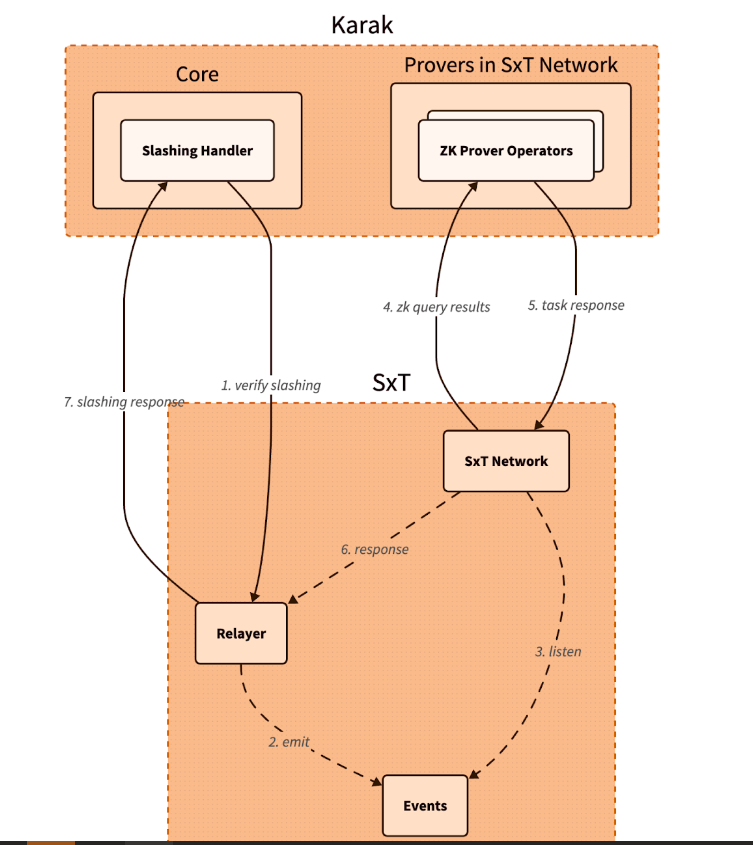

Karak, a platform known for its strong security capabilities, is enhancing its Distributed Secure Services (DSS) by integrating Space and Time as a zero-knowledge (ZK) coprocessor. This move is intended to strengthen trustless operations across its network, especially in slashing and rewards mechanisms.

Space and Time is a verifiable processing layer that uses zero-knowledge proofs to ensure that computations on decentralized data warehouses are secure and untampered with. This system enables smart contracts, large language models (LLMs), and enterprises to process data without integrity concerns.

The integration with Karak will enable the platform to use Proof of SQL, a new ZK-proof approach developed by Space and Time, to confirm that SQL query results are accurate and have not been tampered with.

One of the key features of this integration is the enhancement of DSS on Karak. DSS are decentralized services that use re-staked assets to secure the various operations they provide, from simple utilities to complex marketplaces. The addition of Space and Time technology enables faster development and deployment of these services, especially by simplifying slashing logic, which is critical to maintaining security and trust in decentralized networks.

Additionally, Space and Time is developing its own DSS for blockchain data indexing. This service will allow community members to easily participate in the network by running indexing nodes. This is especially beneficial for applications that require high security and decentralization, such as decentralized data indexing.

The integration architecture follows a detailed and secure flow. When a Karak slashing contract needs to verify a SQL query, it calls the Space and Time relayer contract with the required SQL statement. This contract then emits an event with the query details, which is detected by operators in the Space and Time network.

These operators, responsible for indexing and monitoring DSS activities, validate the event and route the work to a verification operator who runs the query and generates the necessary ZK proof.

The result, along with a cryptographic commitment on the queried data, is sent to the relayer contract, which verifies and returns the data to the Karak cutter contract. This end-to-end process ensures that the data used in decision-making, such as determining penalties within the DSS, is accurate and reliable.

Karak’s mission is to provide universal security, but it also extends the capabilities of Space and Time to support multiple DSSs with their data indexing needs. As these technologies evolve, they are set to redefine the secure, decentralized computing landscape, making it more accessible and efficient for developers and enterprises alike. This integration represents a significant step towards a more secure and verifiable digital infrastructure in the blockchain space.

Website | X (Twitter) | Discord | Telegram

No spam, no lies, just insights. You can unsubscribe at any time.

Tech

Cryptocurrency Payments: Should CFOs Consider This Ferrari-Approved Trend?

Iconic Italian luxury carmaker Ferrari has announced the expansion of its cryptocurrency payment system to its European dealer network.

The move, which follows a successful launch in North America less than a year ago, raises a crucial question for CFOs across industries: Is it time to consider accepting cryptocurrency as a form of payment for your business?

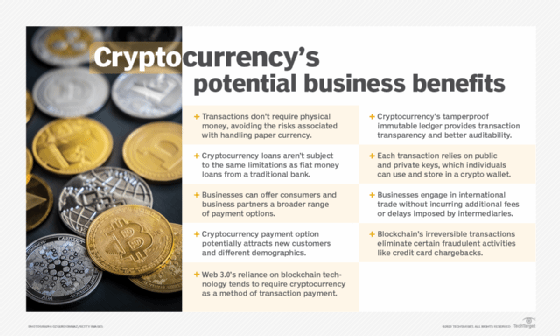

Ferrari’s move isn’t an isolated one. It’s part of a broader trend of companies embracing digital assets. As of 2024, we’re seeing a growing number of companies, from tech giants to traditional retailers, accepting cryptocurrencies.

This change is determined by several factors:

- Growing mainstream adoption of cryptocurrencies

- Growing demand from tech-savvy and affluent consumers

- Potential for faster and cheaper international transactions

- Desire to project an innovative brand image

Ferrari’s approach is particularly noteworthy. They have partnered with BitPay, a leading cryptocurrency payment processor, to allow customers to purchase vehicles using Bitcoin, Ethereum, and USDC. This satisfies their tech-savvy and affluent customer base, many of whom have large digital asset holdings.

Navigating Opportunities and Challenges

Ferrari’s adoption of cryptocurrency payments illustrates several key opportunities for companies considering this move. First, it opens the door to new customer segments. By accepting cryptocurrency, Ferrari is targeting a younger, tech-savvy demographic—people who have embraced digital assets and see them as a legitimate form of value exchange. This strategy allows the company to connect with a new generation of affluent customers who may prefer to conduct high-value transactions in cryptocurrency.

Second, cryptocurrency adoption increases global reach. International payments, which can be complex and time-consuming with traditional methods, become significantly easier with cryptocurrency transactions. This can be especially beneficial for businesses that operate in multiple countries or deal with international customers, as it potentially reduces friction in cross-border transactions.

Third, accepting cryptocurrency positions a company as innovative and forward-thinking. In today’s fast-paced business environment, being seen as an early adopter of emerging technologies can significantly boost a brand’s image. Ferrari’s move sends a clear message that they are at the forefront of financial innovation, which can appeal to customers who value cutting-edge approaches.

Finally, there is the potential for cost savings. Traditional payment methods, especially for international transactions, often incur substantial fees. Cryptocurrency transactions, on the other hand, can offer lower transaction costs. For high-value purchases, such as luxury cars, these savings could be significant for both the business and the customer.

While the opportunities are enticing, accepting cryptocurrency payments also presents significant challenges that businesses must address. The most notable of these is volatility. Cryptocurrency values can fluctuate dramatically, sometimes within hours, posing potential risk to businesses that accept them as payment. Ferrari addressed this challenge by implementing a system that instantly converts cryptocurrency received into traditional fiat currencies, effectively mitigating the risk of value fluctuations.

Regulatory uncertainty is another major concern. The legal landscape surrounding cryptocurrencies is still evolving in many jurisdictions around the world. This lack of clear and consistent regulations can create compliance challenges for companies, especially those operating internationally. Companies must remain vigilant and adaptable as new laws and regulations emerge, which can be a resource-intensive process.

Implementation costs are also a significant obstacle. Integrating cryptocurrency payment systems often requires substantial investment in new technology infrastructure and extensive staff training. This can be especially challenging for small businesses or those with limited IT resources. The costs are not just financial; a significant investment of time is also required to ensure smooth implementation and operation.

Finally, security concerns loom large in the world of cryptocurrency transactions. While blockchain technology offers some security benefits, cryptocurrency transactions still require robust cybersecurity measures to protect against fraud, hacks, and other malicious activity. Businesses must invest in robust security protocols and stay up-to-date on the latest threats and protections, adding another layer of complexity and potential costs to accepting cryptocurrency payments.

Strategic Considerations for CFOs

If you’re thinking of following in Ferrari’s footsteps, here are the key factors to consider:

- Risk Assessment: Carefully evaluate potential risks to your business, including financial, regulatory, and reputational risks.

- Market Analysis: Evaluate whether your customer base is significantly interested in using cryptocurrencies for payments.

- Technology Infrastructure: Determine the costs and complexities of implementing a cryptographic payment system that integrates with existing financial processes.

- Regulatory Compliance: Ensure that cryptocurrency acceptance is in line with local regulations in all markets you operate in. Ferrari’s gradual rollout demonstrates the importance of this consideration.

- Financial Impact: Analyze how accepting cryptocurrency could impact your cash flow, accounting practices, and financial reporting.

- Partnership Evaluation: Consider partnering with established crypto payment processors to reduce risk and simplify implementation.

- Employee Training: Plan comprehensive training to ensure your team is equipped to handle cryptocurrency transactions and answer customer questions.

While Ferrari’s adoption of cryptocurrency payments is exciting, it’s important to consider this trend carefully.

A CFO’s decision to adopt cryptocurrency as a means of payment should be based on a thorough analysis of your company’s specific needs, risk tolerance, and strategic goals. Cryptocurrency payments may not be right for every business, but for some, they could provide a competitive advantage in an increasingly digital marketplace.

Remember that the landscape is rapidly evolving. Stay informed about regulatory changes, technological advancements, and changing consumer preferences. Whether you decide to accelerate your crypto engines now or wait in the pit, keeping this payment option on your radar is critical to navigating the future of business transactions.

Was this article helpful?

Yes No

Sign up to receive your daily business insights

Tech

Bitcoin Tumbles as Crypto Market Selloff Mirrors Tech Stocks’ Plunge

The world’s largest cryptocurrency, Bitcoin (BTC), suffered a significant price decline on Wednesday, falling below $65,000. The decline coincides with a broader market sell-off that has hit technology stocks hard.

Cryptocurrency Liquidations Hit Hard

CoinGlass data reveals a surge in long liquidations in the cryptocurrency market over the past 24 hours. These liquidations, totaling $220.7 million, represent forced selling of positions that had bet on price increases. Bitcoin itself accounted for $14.8 million in long liquidations.

Ethereum leads the decline

Ethereal (ETH), the second-largest cryptocurrency, has seen a steeper decline than Bitcoin, falling nearly 8% to trade around $3,177. This decline mirrors Bitcoin’s price action, suggesting a broader market correction.

Cryptocurrency market crash mirrors tech sector crash

The cryptocurrency market decline appears to be linked to the significant losses seen in the U.S. stock market on Wednesday. Stock market listing The index, heavily weighted toward technology stocks, posted its sharpest decline since October 2022, falling 3.65%.

Analysts cite multiple factors

Several factors may have contributed to the cryptocurrency market crash:

- Tech earnings are underwhelming: Earnings reports from tech giants like Alphabet are disappointing (Google(the parent company of), on Tuesday, triggered a sell-off in technology stocks with higher-than-expected capital expenditures that could have repercussions on the cryptocurrency market.

- Changing Political Landscape: The potential impact of the upcoming US elections and changes in Washington’s policy stance towards cryptocurrencies could influence investor sentiment.

- Ethereal ETF Hopes on the line: While bullish sentiment around a potential U.S. Ethereum ETF initially boosted the market, delays or rejections could dampen enthusiasm.

Analysts’ opinions differ

Despite the short-term losses, some analysts remain optimistic about Bitcoin’s long-term prospects. Singapore-based cryptocurrency trading firm QCP Capital believes Bitcoin could follow a similar trajectory to its post-ETF launch all-time high, with Ethereum potentially converging with its previous highs on sustained institutional interest.

Rich Dad Poor Dad Author’s Prediction

Robert Kiyosaki, author of the best-selling Rich Dad Poor Dad, predicts a potential surge in the price of Bitcoin if Donald Trump is re-elected as US president. He predicts a surge to $105,000 per coin by August 2025, fueled by a weaker dollar that is set to boost US exports.

BTC/USD Technical Outlook

Bitcoin price is currently trading below key support levels, including the $65,500 level and the 100 hourly moving average. A break below the $64,000 level could lead to further declines towards the $63,200 support zone. However, a recovery above the $65,500 level could trigger another increase in the coming sessions.

-

News11 months ago

News11 months agoVolta Finance Limited – Director/PDMR Shareholding

-

News11 months ago

News11 months agoModiv Industrial to release Q2 2024 financial results on August 6

-

News11 months ago

News11 months agoApple to report third-quarter earnings as Wall Street eyes China sales

-

News11 months ago

News11 months agoNumber of Americans filing for unemployment benefits hits highest level in a year

-

News1 year ago

News1 year agoInventiva reports 2024 First Quarter Financial Information¹ and provides a corporate update

-

News1 year ago

News1 year agoLeeds hospitals trust says finances are “critical” amid £110m deficit

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Tech1 year ago

Tech1 year agoBitcoin’s Correlation With Tech Stocks Is At Its Highest Since August 2023: Bloomberg ⋆ ZyCrypto

-

Tech1 year ago

Tech1 year agoEverything you need to know

-

News11 months ago

News11 months agoStocks wobble as Fed delivers and Meta bounces

-

News11 months ago

News11 months agoHutchinson House and Senate Candidates Report Finances Ahead of Election

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Hit $100 Billion in 2024, Fueling Insane Investor Optimism ⋆ ZyCrypto