Markets

Discover the Hottest Top Crypto Market Trends to Watch

Embarking on a quest to uncover the next monumental trend in the crypto market often feels akin to searching for a needle within an expansive haystack. Having meticulously scoured recent studies, including one notable revelation that 38% of cryptocurrency investors were drawn to the market with aspirations of growth, I’ve refined my discoveries into insights poised to steer your forthcoming decisions.

This article promises to arm you with knowledge on burgeoning trends, from buoyant markets to pioneering technological advancements, and how they could sculpt your trading strategies.

Dare to stay ahead?

Key Takeaways

- Bull markets are coming, with ETFs boosting top cryptocurrencies like Bitcoin and Ethereum by May 2024.

- Artificial Intelligence (AI) and Data Availability Layers are new tech making trading smarter and more efficient.

- Decentralised Physical Infrastructure Networks (DePIN) show crypto’s real – world uses, like trading energy between solar panels without middlemen.

- Real – world asset tokenisation opens up investments in property, art, and gold through digital tokens on a blockchain.

- Central Bank Digital Currencies (CBDCs) aim to modernise payments, enhancing speed and security.

Emerging Bull Market

A bull market is on the horizon, and I’m keeping my eyes peeled. With ETFs gaining approval in the bti.live crypto sphere, we’re bracing for a surge that spells good news for investors like me.

Think of it as the dawn after a long night; this change could boost Bitcoin, Ethereum, Dogecoin, and Tether to new heights by May 2024. For someone who trades crypto daily, this anticipation feels like gearing up for a major win.

The moment we’ve waited for is nearing – be ready to embrace the bull market with open arms.

This isn’t just about watching numbers tick upwards on a screen. It’s about understanding where opportunities lie and seizing them. Given that crypto markets recently added $150 billion in a day with Bitcoin leading the pack – thanks to Solana and NEAR too – there’s tangible excitement brewing.

For traders like us, staying informed isn’t just beneficial; it’s crucial to navigate these promising times ahead efficiently.

Key Technological Innovations

New tech is shaping the future of crypto. AI and layers for data are big news now.

Artificial Intelligence (AI)

AI changes how we handle crypto. It’s making trading and investing smarter with tools that predict market trends, giving us an edge. This tech isn’t just about fancy robots; it’s deeply woven into the fabric of cryptocurrency markets now.

Think about bots that can trade 24/7 without a break, or algorithms that sift through massive data piles to find profitable signals.

I see AI as a game-changer in managing risk and spotting opportunities. With AI, I can analyse patterns in Bitcoin, Ethereum, Dogecoin, and Tether much faster than before – all top cryptocurrencies to watch as May 2024 approaches.

The insights gained are invaluable for making swift decisions in a market known for its volatility.

This shift towards digital intelligence means we traders have to stay updated on AI developments to keep our strategies sharp. The future of crypto trading feels exciting with all these advancements at our fingertips.

From predictive analytics to automated trading systems, embracing AI seems like the smart move for anyone serious about their crypto investments.

Data Availability Layers

Moving from the topic of Artificial Intelligence, another trend catching my eye in the crypto space is Data Availability Layers. This innovation isn’t just a buzzword. In my journey exploring blockchain technologies, I’ve noticed how crucial fast and reliable access to data has become for traders like me.

These layers serve as bridges that ensure information flows seamlessly across different blockchains.

I’ve personally seen their impact on trading strategies. With these systems in place, accessing real-time market data or historical transaction records has become much quicker and more reliable.

For a trader focusing on making timely decisions based on accurate data, this development is a game-changer. It’s not just about speed either; it’s also about enhancing security and making sure our trades are based on solid, verifiable information.

The convenience brought by Data Availability Layers transforms how we interact with blockchain platforms daily, making trading smoother and more efficient than ever before.

Decentralised Physical Infrastructure Networks (DePIN)

Decentralised Physical Infrastructure Networks (DePIN) are changing how I think about crypto’s future. These networks take blockchain beyond digital assets, making real-world uses possible.

Imagine solar panels that trade energy with neighbours without a middleman. That’s what DePIN is starting to do.

I’ve seen projects where houses sell excess solar power directly to others in their area using blockchain. This cuts out traditional utility companies and reduces costs. It’s exciting because it shows how crypto can solve real problems, not just in trading but in everyday life.

DePIN could transform every aspect of our physical world, from energy to real estate.

This isn’t just theory; it’s happening now. Companies are building these networks worldwide, showing us a glimpse of a decentralised future where we have more control over our resources and data.

Real-World Asset Tokenisation

Real-world asset tokenisation is changing how I look at investments. This trend lets us turn things like property, art, and gold into digital tokens on a blockchain. It’s exciting because it makes investing in these assets simpler and opens them up to more people around the world.

I can now buy a piece of fine art or real estate with just a few clicks, something that was hard to imagine before.

The best part? These tokens can be bought and sold easily, making the whole process smoother. This isn’t just about making life easier for investors like me; it’s also about creating new opportunities.

For small investors, getting into markets that were out of reach before is now possible. With this technology growing fast, I’m keeping my eyes peeled for how it shapes the future of trading and investment.

Central Bank Digital Currencies (CBDCs)

Central Bank Digital Currencies, or CBDCs, have caught my eye as a crypto trader. These digital forms of money are issued by central banks, making them quite different from the cryptocurrencies we’re used to trading.

My journey into understanding CBDCs began when I realised their potential impact on the future of finance and digital currencies. From what I’ve gathered, these bank-backed digital currencies aim to modernise payments, making them faster and more secure.

I’ve explored various reports and articles highlighting how countries around the globe are experimenting with or actively developing CBDCs. My interest spiked further when I learnt that they could potentially offer quicker settlements and enhance financial accessibility.

Taking this into account has made me rethink my investment strategies and consider how the advent of CBDCs might shape market trends in cryptocurrency and blockchain technology developments moving forward.

Environmental Impact of Crypto

Mining cryptocurrencies like Bitcoin uses a lot of electricity. This can be bad for our planet because it adds to how much carbon gets put into the air, and that makes climate change worse.

I read about this and found out that some places where they mine a lot use power from coal or other sources that aren’t good for the earth. It’s something we need to think seriously about, especially if we care about keeping our planet healthy.

I also learned there are newer types of cryptocurrencies that don’t use as much energy. They do things in a smarter way which doesn’t harm the environment so much. This made me hopeful.

We could make crypto work without hurting our world too much if more people start using these cleaner options.

The future of crypto must consider its impact on the planet.

Looking at what comes next, we have to talk about how rules around crypto are changing fast…

Increasing Regulation and Compliance

I’ve noticed more rules and checks coming into the crypto world. Governments and big groups want to make sure everything is fair and safe. This means we all have to be careful about how we deal with our digital money.

Rules are getting tighter, which helps stop bad actions like money laundering.

These changes also mean that some coins might do better because they follow the new rules well. I keep an eye on these updates to stay ahead in trading. Next up, let’s talk about mergers and acquisitions in the crypto space.

Mergers and Acquisitions in the Crypto Space

In my journey through the crypto market, I’ve observed an intriguing trend: mergers and acquisitions are becoming a big deal. This movement isn’t just about big players getting bigger; it’s reshaping how we think about cryptocurrency investments and technology.

In 2024, experts forecast funding, mergers, and acquisitions in the crypto space to be standout trends. From personal experience, watching companies merge or buy each other out signals a maturing market where stability might soon outweigh volatility.

For instance, seeing how these strategic moves play out reminds me of chess – every move is calculated with precision to gain an advantage or expand influence in this rapidly evolving sector.

It fascinates me that while some fear market consolidation could stifle innovation, others see it as an opportunity for more streamlined services and advanced tech developments. Observing from the sidelines has taught me one thing – staying informed on these trends is crucial for anyone looking to make savvy investment decisions in the world of digital currencies.

The Role of NFTs

Merging and acquisitions in the crypto world have set a fast pace. This brings us to another critical trend, NFTs (Non-Fungible Tokens). I’ve seen firsthand how these digital assets are reshaping art, gaming, and even real estate markets.

Owning an NFT is like having a unique piece of the digital universe. It’s not just about owning; it’s about being part of a community that values exclusivity.

I’ve bought and sold several NFTs over the past year. Each time, I noticed something new. People aren’t just buying art or collectibles; they’re investing in items with potential for future growth within the cryptocurrency market trends.

Some of my friends made substantial returns by selling their NFTs when their value spiked—showing me how volatile yet rewarding this space can be.

This experience taught me that NFTs are more than a fad; they’re here to stay as part of our digital landscape. They symbolise ownership in ways we haven’t seen before – extending beyond mere possession to include access, rights, and participation in exclusive communities.

As someone deeply involved in crypto trading, understanding and engaging with the world of NFTs has become key to spotting opportunities amidst this top crypto market trend.

Integration of Blockchain with Traditional Finance

Moving on from NFTs, let’s talk about how blockchain is changing traditional finance. I see it every day. Banks and big financial companies are starting to use blockchain. They’re doing this because it’s safe and fast for moving money around the world.

Imagine sending cash across borders without waiting days or paying big fees. That’s what blockchain can do.

I’ve noticed more people talking about Bitcoin, Ethereum, Dogecoin, and Tether as real investments now. This means a lot for traders like us. We’re not just looking at cryptocurrencies as something new or different anymore; they’re becoming a part of how the world handles money.

And with ETFs getting approved, things are only going to get more interesting in 2024 and beyond. It feels like we’re all watching history happen right now – crypto mixing with regular banking in ways that could change everything about how we think of money.

Impact of Meme Coins

Meme coins caught my eye a while back. These digital currencies, often inspired by jokes or internet culture, can shake up the market in surprising ways. I watched Dogecoin soar, driven not just by its community but also celebrities and social media hype.

This event opened my eyes to how crypto isn’t all serious business; fun plays a huge part too. Markets respond as much to sentiment and trends as they do to tech advancements or economic indicators.

This experience taught me never to underestimate the power of community engagement in crypto assets. When an influential figure tweets about a meme coin, it can skyrocket in price overnight, showing the volatile nature of these investments.

But beyond their unpredictability lies a deeper truth: cryptocurrency markets thrive on innovation, whether from cutting-edge technology or simply clever marketing strategies like those behind meme coins.

Next comes exploring the role of NFTs…

Conclusion

So, we’ve explored the big trends in crypto. From bull markets to tech innovations and everything in between. I’m keen to see how these trends will shape the future. It’s clear; crypto isn’t just a buzzword anymore.

It’s reshaping finance as we know it. Keep an eye on these trends – they’re the key to staying ahead in this fast-paced market.

Disclaimer: The statements, views and opinions expressed in this article are solely those of the content provider and do not necessarily represent those of Crypto Reporter. Crypto Reporter is not responsible for the trustworthiness, quality, accuracy of any materials in this article. This article is provided for educational purposes only. Crypto Reporter is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article. Do your research and invest at your own risk.

Markets

Today’s top crypto gainers and losers

Over the past 24 hours, Jupiter and JasmyCoin emerged as the top gainers among the top 100 crypto assets, while Bittensor and Mantra plunged as the top losers.

Top Winners

Jupiter

Jupiter (JUP) led the charge among the biggest gainers on July 27.

At the time of writing, the crypto asset had surged 12.6% in the past 24 hours and was trading at $1.16. JUP’s daily trading volume was hovering around $282 million, according to data from crypto.news.

JUP Hourly Price Chart, July 26-27 | Source: crypto.news

Additionally, the cryptocurrency’s market cap stood at $1.56 billion, making it the 62nd largest crypto asset, according to CoinGecko. Despite the recent price surge, the token is still down 42.6% from its all-time high of $2 reached on Jan. 31.

Jupiter functions as a decentralized exchange aggregator that allows users to trade Solana-based tokens. The platform also offers users the best routes for direct trades between multiple exchanges and liquidity pools.

In addition to being a DEX aggregator, Jupiter has expanded into a “full stack ecosystem” by launching several new projects, including a dedicated pool to support perpetual trading and plans for a stablecoin.

JasmyCoin

JasmyCoin (JASMI) has increased by 12% in the last 24 hours and is trading at $0.0328 at press time. JASMY’s daily trading volume has increased by 10% in the last 24 hours, reaching $146 million.

JASMY Hourly Price Chart, July 26-27 | Source: crypto.news

The asset’s market cap has surpassed the $1.5 billion mark, making it the 60th largest cryptocurrency at the time of reporting. However, the self-proclaimed “Bitcoin of Japan” is still down 99.3% from its all-time high of $4.79 on February 16, 2021.

JASMY is the native token of Jasmy Corporation, a Japanese Internet of Things provider. The platform seeks to merge the decentralization of blockchain technology with IoT, allowing users to convert their digital information into digital assets.

The initiative was launched by Kunitake Ando, former COO of Sony Corporation, along with Kazumasa Sato, former CEO of Sony Style.com Japan Inc., Hiroshi Harada, executive financial analyst at KPMG, and other senior executives from Japan.

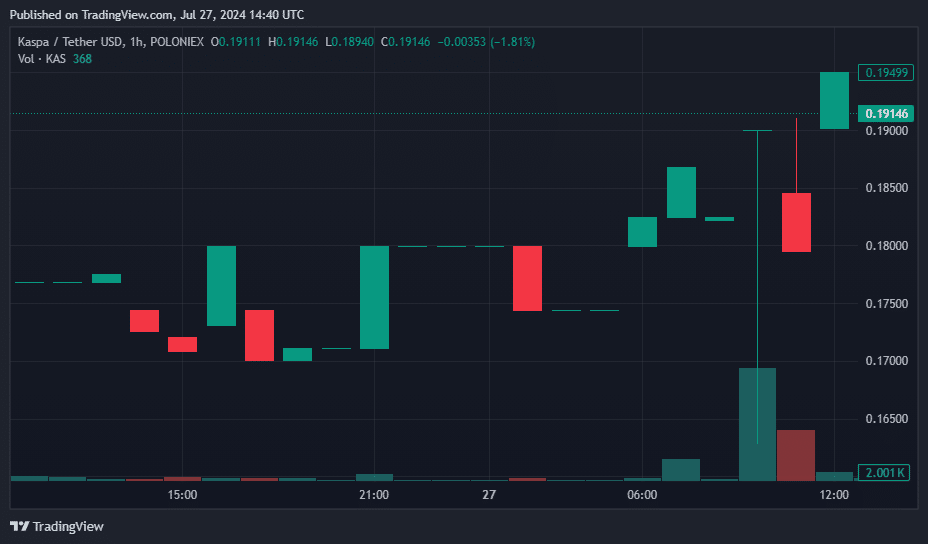

Kaspa

Kaspa (KAS) saw a 100% increase in trading volume and an 8% increase in price over the past 24 hours, trading at $0.19 at the time of publication.

KAS Hourly Price Chart, July 26-27 | Source: crypto.news

According to data from CoinGecko, Kaspa now ranks 27th in the global cryptocurrency list, with a circulating supply of approximately 24.29 billion KAS tokens and a market capitalization of $4.59 billion.

Kaspa is a cryptocurrency designed to deliver a high-performance, scalable, and secure blockchain platform. Its unique Layer-1 protocol includes the GhostDAG protocol, a proof-of-work (PoW) consensus mechanism that enables faster block times and higher transaction throughput compared to standard blockchains.

Unlike Bitcoin, GhostDAG allows multiple blocks to be created simultaneously, speeding up transactions and increasing block rewards for miners.

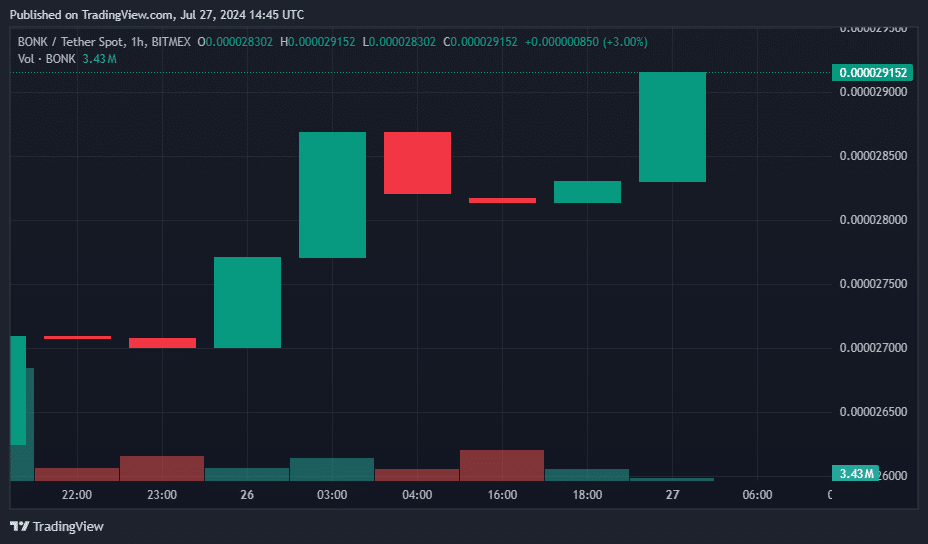

Bonk

Bonk (BONK) is the only one coin meme which made it to this list of biggest gainers and jumped 8.6% in the last 24 hours. Trading at $0.000030, the Solana-based meme coin’s market cap has surpassed $2.1 billion, surpassing Floki (FLOKI), another competing dog-themed coin with a market cap of $1.78 billion.

BONK Hourly Price Chart, July 26-27 | Source: crypto.news

BONK’s daily trading volume hovered around $285 million. However, BONK is still down 33.5% from its all-time high of $0.000045, reached on March 4.

Bonk, a meme coin that rose to prominence in 2023, has contributed significantly to Solana’s value increase amid the meme coin frenzy.

Bonk started out as a simple dog-themed coin. It has since expanded its features to include integration with decentralized finance. The project also partners with cross-chain communication protocols, NFT marketplaces, and various other cryptocurrency ecosystems.

BONK trading pairs are now listed on major exchanges including Binance, Coinbase, OKX, and Bitstamp.

The big losers

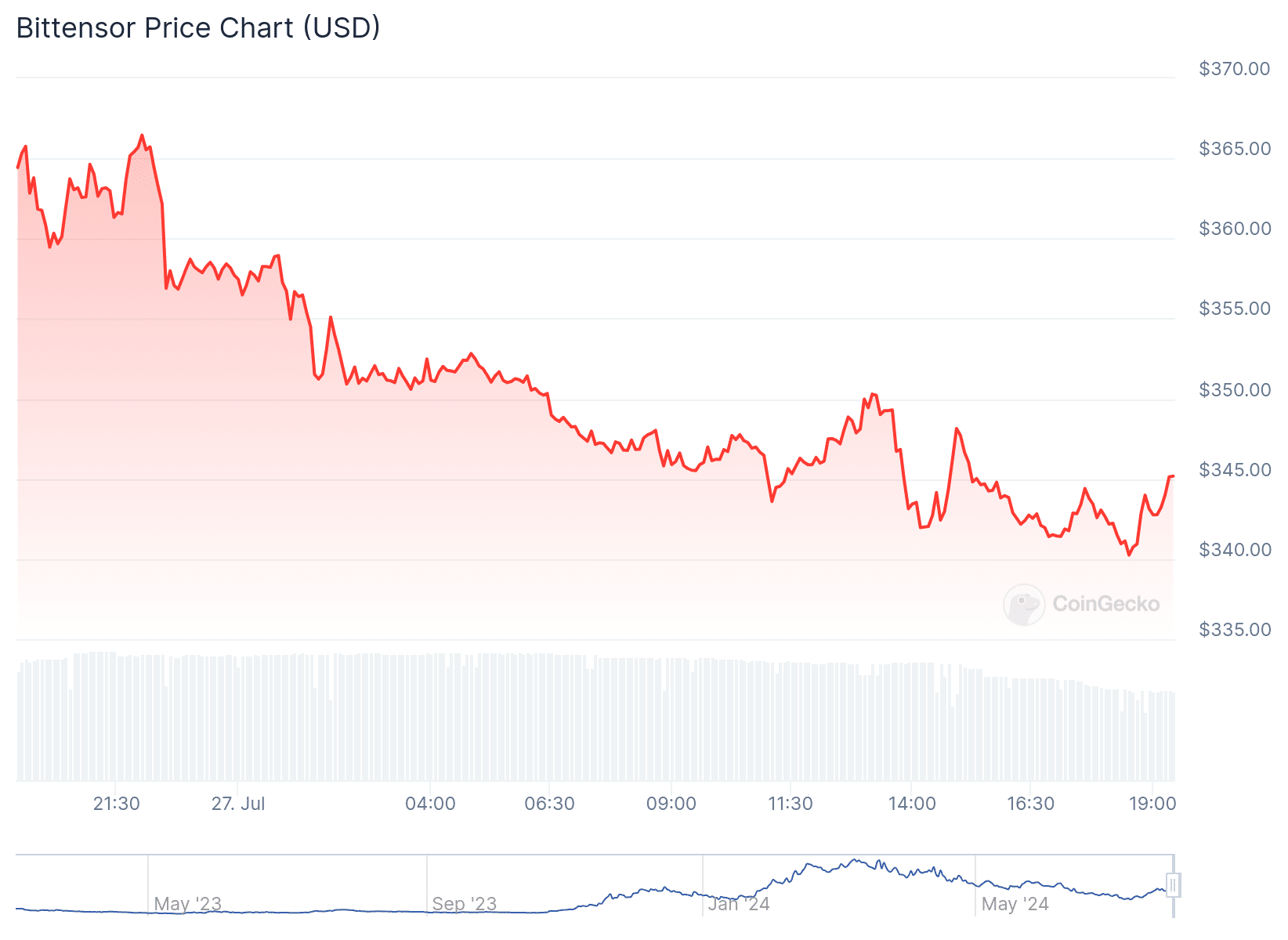

Bittensor

Bittensor (TAO) was the biggest loser among the 100 largest crypto assets, according to data from CoinGecko.

At the time of writing, TAO, the native token of decentralized AI project Bittensor, was down 5%, trading around $344. The crypto asset had a daily trading volume of $59 million and a market cap of $2.43 billion.

TAO 24 Hour Price Chart | Source: CoinGecko

Bittensor, created in 2019 by AI researchers Ala Shaabana and Jacob Steeves, initially operated as a parachain on Polkadot before transitioning to its own layer-1 blockchain in March 2023.

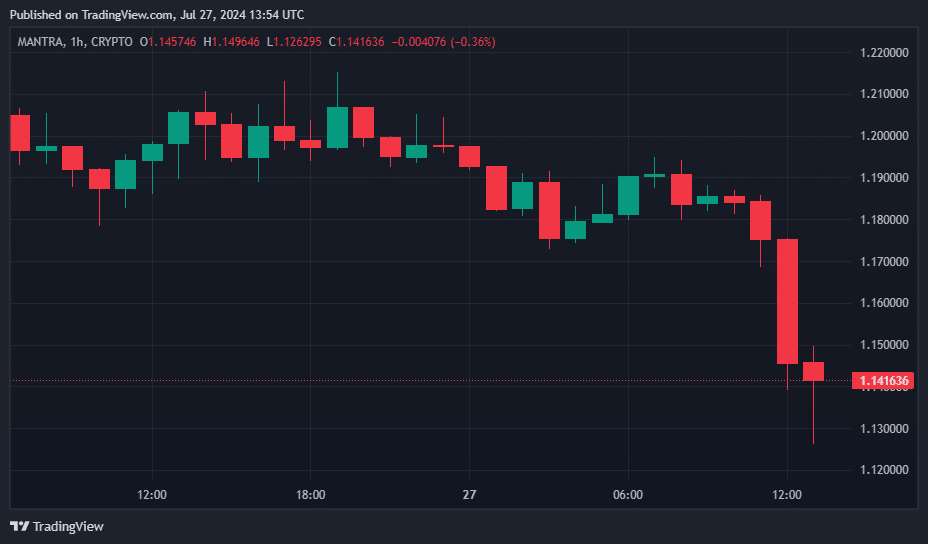

Mantra

Mantra (OM) fell 6%, trading at $1.13 at press time. The digital currency’s market cap fell to $938 million. Additionally, the 82nd largest crypto asset has a daily trading volume of $26 million.

OM Price Hourly Chart, July 26-27 | Source: crypto.news

Mantra is a modular blockchain network comprising two chains, Manta Pacific and Manta Atlantic, specialized in zero-knowledge applications.

Coat

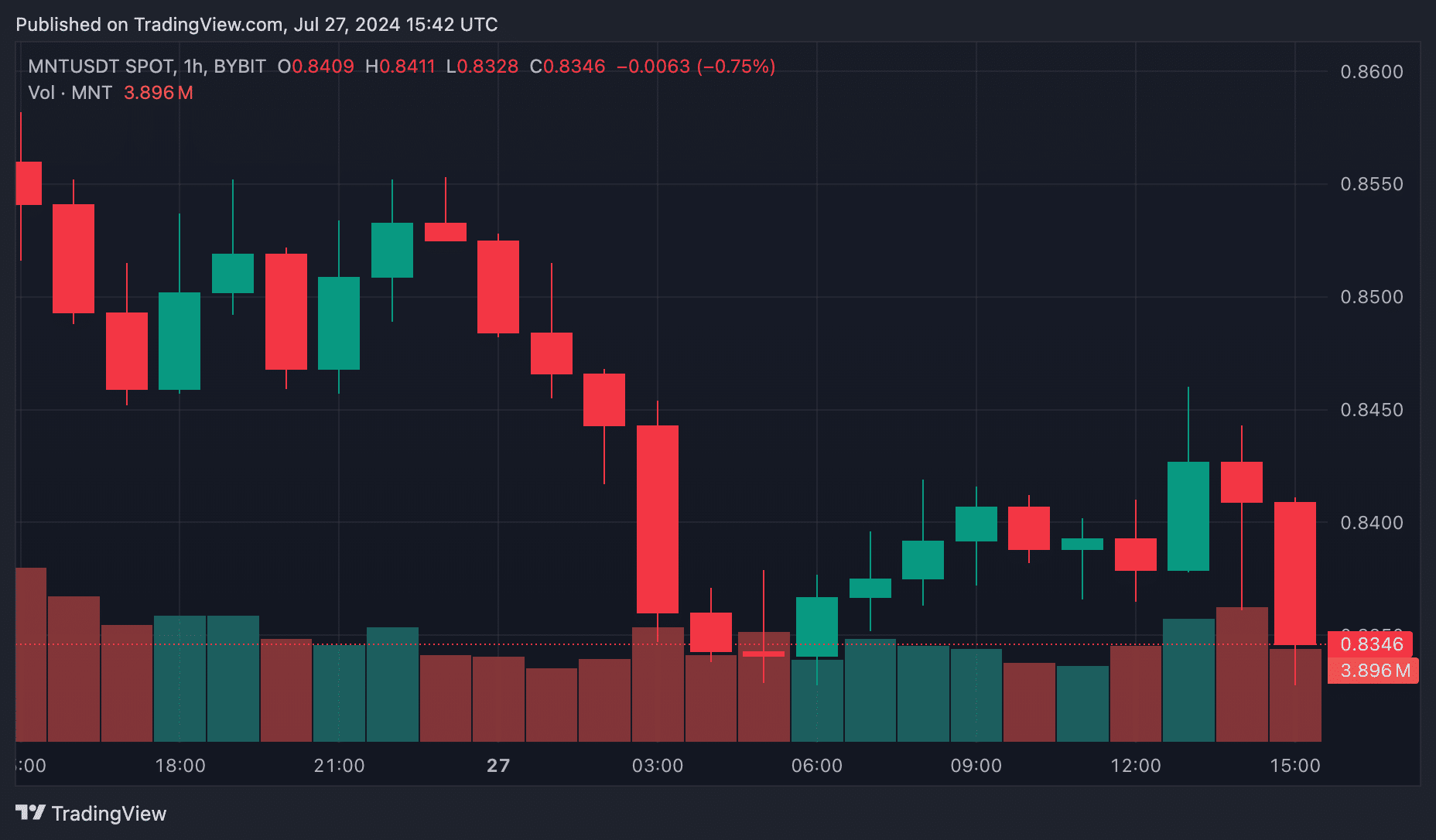

Coat (MNT) also saw a 2.4% drop in price, now trading at $0.8413. Currently, Mantle has a market cap of around $2.75 billion, which ranks 36th in the global cryptocurrency rankings by market cap, according to price data from crypto.news.

MNT Hourly Price Chart, July 26-27 | Source: crypto.news

Over the past 24 hours, MNT trading volume also fell by 6%, reaching $240 million.

Mantle, formerly known as BitDAO, is an investment DAO closely associated with Bybit. The MNT token is essential for governance, paying gas fees on the Mantle network, and staking on various platforms.

Built on the Ethereum network, Mantle provides a platform for decentralized application developers to launch their projects. It has become particularly popular for GameFi applications, leading to the formation of an internal Web3 gaming team.

Markets

Bitcoin Price Drops to $67,000 Despite Trump’s Pro-Crypto Comments, Further Correction Ahead?

Pioneer cryptocurrency Bitcoin has registered a 1.13% decline in the past 24 hours to trade at $67,400. Despite a strong pro-crypto stance from US presidential candidate Donald Trump at the Bitcoin 2024 conference, this massive selloff has raised concerns in the market about the asset’s sustainability at a higher price. However, given the recent three-week rally, a slight pullback this weekend is justifiable and necessary to regain the depleted bullish momentum.

Bitcoin Price Flag Formation Hints at Opportunity to Break Beyond $80,000

The medium-term trend Bitcoin Price remains a sideways trend amidst the formation of a bullish flag pattern. This chart pattern is defined by two descending lines that are currently shaping the price trajectory by providing dynamic resistance and support.

On July 5, BTC saw a bullish reversal from the flag pattern at $53,485, increasing its asset by 29.75% to a high of $69,400. This recent spike followed the market’s positive sentiment towards the Donald Trump speech at the Bitcoin 2024 conference in Nashville on Saturday afternoon.

Bitcoin Price | Tradingview

In his speech, Trump outlined several pro-crypto initiatives: he promised to replace SEC Chairman Gary Gensler on his first day in office, to establish a Strategic National Reserve of Bitcoin if elected, to ensure that the U.S. government holds all of its assets. Bitcoin assets and block any attempt to create a central bank digital currency (CBDC) during his presidency.

He also claimed that under his leadership, Bitcoin and cryptocurrencies will skyrocket like never before.

Despite Donald Trump’s optimistic promises, the BTC price failed to reach $70,000 and is currently trading at $67,400. As a result, Bitcoin’s market cap has dipped slightly to hover at $1.335 trillion.

However, this pullback is justified, as Bitcoin price has recently seen significant growth over the past three weeks, which has significantly improved market sentiment. Thus, price action over the weekend could replenish the depleted bullish momentum, potentially strengthening an attempt to break out from the flag pattern at $70,130.

A successful breakout will signal the continuation of the uptrend and extend the Bitcoin price forecast target at $78,000, followed by $84,000.

On the other hand, if the supply pressure on the upper trendline persists, the asset price could trigger further corrections for a few weeks or months.

Technical indicator:

- Pivot levels: The traditional pivot indicator suggests that the price pullback could see immediate support at $64,400, followed by a correction floor at $56,700.

- Moving average convergence-divergence: A bullish crossover state between the MACD (blue) and the signal (orange) ensure that the recovery dynamics are intact.

Related Articles

Frequently Asked Questions

A CBDC is a digital form of fiat currency issued and regulated by a country’s central bank. It aims to provide a digital alternative to traditional banknotes.

The proposal for a strategic national Bitcoin reserve is a major confirmation of Bitcoin’s legitimacy and potential as a reserve asset. Such a move could position Bitcoin in a similar way to gold, potentially stabilizing its price and encouraging other countries to adopt similar strategies.

Conferences like Bitcoin 2024 serve as essential platforms for networking, knowledge sharing, and showcasing new technologies within the cryptocurrency industry.

Markets

Swiss crypto bank Sygnum reports profitability after surge in first-half trading volumes – DL News

- Sygnum says it has reached profitability after increasing transaction volumes.

- The Swiss crypto bank does not disclose specific profit figures.

Sygnum, a Swiss global crypto banking group with approximately $4.5 billion in client assets, announced that it has achieved profitability after a strong first half, with key metrics showing year-to-date growth.

The company said in a Press release Compared to the same period last year, cryptocurrency spot trading volumes doubled, cryptocurrency derivatives trading increased by 500%, and lending volumes increased by 360%. The exact figures for the first half of the year were not disclosed.

Sygnum said its staking service has also grown, with the percentage of Ethereum staked by customers increasing to 42%. For institutional clients, staking Ethereum has a benefit that goes beyond the limitations of the ETF framework, which excludes staking returns, Sygnum noted.

“The approval and launch of Bitcoin and Ethereum ETFs was a turning point for the crypto industry this year, leading to a major increase in demand for trusted, regulated exposure to digital assets,” said Martin Burgherr, Chief Client Officer of Sygnum.

He added: “This is also reflected in Sygnum’s own growth, with our core business segments recording significant year-to-date growth in the first half of the year.”

Sygnum, which has also been licensed in Luxembourg since 2022, plans to expand into European and Asian markets, the statement said.

Markets

Former White House official Anthony Scaramucci says cryptocurrency bull market could be sparked by regulatory clarity

Anthony Scaramucci, founder of Skybridge Capital, says the next cryptocurrency bull market could be sparked by a new wave of clear cryptocurrency regulations.

In a new interview On CNBC’s Squawk Box, the former White House communications director said he and two other prominent industry figures traveled to Washington, D.C. to speak to officials about the dangers of Sen. Elizabeth Warren and U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler’s hardline approach to cryptocurrency regulation.

“Mark Cuban, myself, and Michael Novogratz were in Washington a few weeks ago to speak with White House officials and explain the dangers of Gary Gensler and Elizabeth Warren’s anti-crypto approach. I hope that message gets through…

“Overall, if we can get regulatory policy around Bitcoin and crypto assets in sync, we will have a bull market next year for these assets.”

Scaramucci then compares crypto assets to ride-hailing company Uber, saying regulators were initially wary of the service but eventually decided to adopt clear guidelines due to public demand.

“Remember Uber: Nobody wanted Uber. A lot of regulators didn’t want it. Mayors and deputy mayors didn’t want it, but citizens wanted Uber and eventually accepted the idea of regulating it fairly. I think we’re there now.”

The CEO also says young Democratic voters believe their leaders are making the wrong choices when it comes to digital assets.

“I think President Trump’s move toward Bitcoin and crypto assets has shaken Democrats to their core, and I think very smart, younger Democrats are recognizing that they are completely off base with their positions, completely off base with these SEC lawsuits and regulation by law enforcement, and now they need to get back to the center.”

Don’t miss a thing – Subscribe to receive email alerts directly to your inbox

Check Price action

follow us on X, Facebook And Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed on The Daily Hodl are not investment advice. Investors should do their own due diligence before making any high-risk investments in Bitcoin, cryptocurrencies or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Image generated: Midjourney

-

Videos4 weeks ago

Videos4 weeks agoAbsolutely massive: the next higher Bitcoin leg will shatter all expectations – Tom Lee

-

News12 months ago

News12 months agoVolta Finance Limited – Director/PDMR Shareholding

-

News12 months ago

News12 months agoModiv Industrial to release Q2 2024 financial results on August 6

-

News12 months ago

News12 months agoApple to report third-quarter earnings as Wall Street eyes China sales

-

News12 months ago

News12 months agoNumber of Americans filing for unemployment benefits hits highest level in a year

-

News1 year ago

News1 year agoInventiva reports 2024 First Quarter Financial Information¹ and provides a corporate update

-

News1 year ago

News1 year agoLeeds hospitals trust says finances are “critical” amid £110m deficit

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Hit $100 Billion in 2024, Fueling Insane Investor Optimism ⋆ ZyCrypto

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Videos1 year ago

Videos1 year ago$1,000,000 worth of BTC in 2025! Get ready for an UNPRECEDENTED PRICE EXPLOSION – Jack Mallers

-

Videos1 year ago

Videos1 year agoABSOLUTELY HUGE: Bitcoin is poised for unabated exponential growth – Mark Yusko and Willy Woo

-

Tech1 year ago

Tech1 year agoBlockDAG ⭐⭐⭐⭐⭐ Review: Is It the Next Big Thing in Cryptocurrency? 5 questions answered