Markets

‘Elizabeth Warren’s Anti-Crypto Wing Is A Shrinking Iceberg’, Says Former Top Regulator

Former CFTC Chairman Christopher Giancarlo is bullish on crypto’s future in the U.S.

Christ Giancarlo

The Honorable J. Christopher Giancarlo served as the 13th chairman of the U.S. Commodity Futures Trading Commission. He also was a member of the U.S. Financial Stability Oversight Committee, the President’s Working Group on Financial Markets and the Executive Board of the International Organization of Securities Commissions. Giancarlo is also the author of CryptoDad—The Fight for the Future of Money, an account of his oversight of the world’s first regulated market for Bitcoin derivatives and the coming digital network transformation of financial services.

In this discussion we cover the current regulatory landscape in crypto, the outlook for new pieces of crypto legislation, whether the U.S. is falling behind the rest of the world, and how a Trump vs. Biden presidency will impact the industry over the next four years.

Forbes: How would you assess the current state of crypto?

Giancarlo: There’s a lot happening. This evolution is taking place and it’s not just startups and innovators, it’s also the traditional system as well with enterprises like Fnaility in the U.K. tokenizing central bank deposits, and the digital yuan in China, which is already in 260 million wallets. The Atlantic Council figures that there are 138 countries working on central bank digital currencies, whose countries account for 98% of the world’s GDP. The development of privately issued stablecoins, especially dollar-based stablecoins, is accelerating, and if there’s anything going to come out of this Congress, it very well may be stablecoin legislation. I was recently at dinner with Senator Tim Scott (R-SC and Ranking Member of the Senate Banking Committee), and he’s optimistic that a stablecoin bill may get done. So, I believe that stablecoins are continuing to develop. As it’s been announced, I just joined the Paxos board, which is an infrastructure provider for stablecoin development amongst other things. I’m very excited about that evolution. In the area of crypto, notwithstanding spectacular frauds like Sam Bankman-Fried and what seems to be kind of coordinated efforts at suppression by the Biden administration, Bitcoin continues to grow in its durability and its usage. So decentralized tokens, systems of value continue to grow. The current U.S. position of resistance and suppression is an outlier. I think it’s an outlier in global development.

I think it’s an outlier in American historical receptivity to innovation and politics because it seems to be confined not just to one party but a small minority of the Democrat party. And it’s unsustainable. I think if the November elections threaten that wing of the Democrat party, you’re going to see a complete rejection of the policy of the last few years of hostility to crypto innovation.

Forbes: There’s a belief that if Senate Banking Committee Chairman Sherrod Brown (D-OH) is replaced, I guess by Tim Scott, that could clear a pathway for more crypto-friendly legislation. What could that look like?

Giancarlo: I think Tim Scott is quite enthusiastic about the potential of this innovation. He very kindly showed me his copy of my book CryptoDad, in which he had many pages marked up and underlined, which was very flattering. But it also tells me this is someone who’s taken the time to read books like mine to understand crypto. So I think he is someone who could be a real leader in the area.

Forbes: Have you ever spoken with Trump about crypto?

Giancarlo: Earlier this month, I gave a speech at the DC Blockchain Summit, in which I said Trump could justifiably be named America’s first crypto president. And not because of what he said or did in the last two weeks, but because of what happened in the first year of his presidency. That was the launch of Bitcoin futures by the CFTC. Why do I say that? I laid this out very carefully in my speech, but the point I was making is that by the CFTC greenlighting bitcoin futures, we made sure that the world’s first digital commodity was priced in dollars. The reason that’s important is the dollar has many strengths, but one of its key strengths is that most of the world’s industrial natural commodities, oil, gold, iron, as well as soybeans, corn and wheat are priced in dollars. As a result, the world needs to hold dollars to buy those key minerals and agricultural and natural commodities. The pricing of commodities is not set in spot markets, but futures markets; the price of oil is not set at the gas pump. It’s set in the Chicago futures markets and so on. By greenlighting Bitcoin futures, we made sure that the price of bitcoin, the world’s first digital commodity, would be set in dollars. Now, did the Trump administration say, “CFTC, go do this?” No, but did they stop us? No. Did they mount the type of resistance that we’re seeing in the current administration to the development of a healthy, thriving, well-regulated market? No, and as I explained in my book CryptoDad, we kept Treasury Secretary Mnuchin apprised of everything we were doing quite carefully and gave him every opportunity to say, “Look, administration policy is not to create a healthy marketplace, is not to write the heightened scrutiny regulations or principles that you put in place.” They wanted to make sure we handled it right, but they’re quite satisfied, and I think that’s an enduring legacy.

Presidents get blamed if things go badly on their watch, probably to some degree unfairly, but they also get credit when things go right on their watch. I’m not saying the White House has taken a position, but I’m saying that I think they could arguably make the case based on that one step. Now, were there other perhaps missteps? I’ll leave that to others to argue, but I think the development of bitcoin futures, and by the way, there would be no bitcoin ETF right now if we hadn’t done bitcoin futures at the CFTC. I don’t think Trump particularly cares [about crypto]. I think he’s got his issues, and he’s laid them out carefully. You have to deal with immigration, oil, energy usage and other things. So I don’t think he’s wagering his campaign on whether he appeals to crypto or not, but I think history will look back 20 years from now and recognize that bitcoin futures really were an important step.

Forbes: I think the total stablecoin market cap is around $150 billion now. Tether makes up 80% of it. Then there’s USDC and everybody else. Paxos was a bigger player before BUSD got shut down. I know they provide the backend for PayPal and their own stablecoin, but those are small. How much room is there for additional private stablecoins and do you think that USDT at this point is so dominant that it’s going to be hard to knock them off of that perch?

Giancarlo: The global demand for dollars is extraordinary. The fact of the matter is that from the tip of South America to Africa to Southeast Asia, the demand for dollars remains very strong. I’ve said before that, sadly, in many countries, domestic currencies are not worth the paper they’re printed on. The dollar is still an enormously important hard currency. The problem with the dollar is it’s an analog instrument. It’s hard to assemble dollars in many parts of the world. And so I think global demand for a digital version of the dollar with all the utility and efficiency that would come with that will be tremendous. What we haven’t had to date is a streamlined licensing regime.

I think that passage of stablecoin legislation in the United States will enable well-run, well-compliant stablecoin operators to satisfy global demand. And I think once you’ve got well-regulated U.S. players, the opportunity to take market share from Tether will be significant. So I’m excited. I think Circle does a lot of things well, and I think that PayPal has an enormous distribution network. So I think the opportunities for U.S. companies properly licensed now, hopefully under legislation passed by Congress, will be able to satisfy global demand. I think that’s ultimately good for the United States.

Forbes: What do you think is an equilibrium for stablecoins that are yield-bearing versus non-yield-bearing? I know the current legislation is for non-bearing, but at some point, I would imagine token holders will get tired of giving the money to Tether and letting those guys become billionaires.

Giancarlo: I agree. Again, around the world, if you are in a country like, say, Argentina, with historically high inflation, the demand for a yield-bearing instrument that is dollar-based is going to be tremendous. It’s not just states like Argentina. I think there will be demand. I don’t think the domestic demand is the driving force here. It’s the overseas demand. The dollar is an export product.

Forbes: What is your sense of how or if the stablecoin legislation may pass and go into law this year?

Giancarlo: I’m not an odds maker on Congress. It’s an election year, after all, and we’ve got three or four or five weeks left effectively. Once we hit the 4th of July, nothing will happen or historically speaking, nothing happens in an election year after July 4th in terms of legislation. Unless there’s some crisis or market meltdown as there was in 2008. So, I don’t have high prospects, but I believe that in the long term stablecoin legislation will pass. I think there’s bipartisan support for it. And again, I think once we get past this, what I consider the short-term crypto suppression minority view of certain members of the Senate that dominate White House thinking, I think this will get done. I think the big driver is creating more demand for U.S. Treasury securities. Sadly, one of the big drivers is that we are a nation that lives on our credit card and we need more people to buy our debt, and that’s what stablecoins will provide.

Forbes: The first piece of crypto-specific legislation passed both chambers of Congress, even though it does seem likely that President Biden will veto SAB 121. What are your general thoughts about it and what that says about the legislative climate toward crypto right now?

Giancarlo: I think it says that the Elizabeth Warren wing is a shrinking iceberg. When the Senate majority leader Chuck Schumer signs the rebuke of 121, that’s a pretty good statement. Now, Machiavelli might say he can sign it because he knows the White House will veto it, but I think it’s a pretty good rebuke, and you have to think that the banks are supportive of that as well. Notwithstanding some parts of the banking system that may be resistant to digital asset innovation, forcing them to reserve a hundred percent against their holdings effectively means banks can’t be a player in this innovation. I think the rejection of this is there. So the White House may veto this, but I think it puts them in an increasingly untenable position against the tide of history, against the tide of innovation.

It’s a generational divide as well. I think this view of anti-crypto armies is an octogenarian point of view that the next generation up just doesn’t have to this innovation. One of my favorite authors is Doug Adams, who wrote the Hitchhiker’s Guide to the Galaxy series of books. Adams has a quote, which I’m going to mangle here, but it basically says, that “Anything that’s invented before you turn 35 is super cool, worthy of enormous amounts of time and attention, and might be the vocation for the rest of your life. But anything that comes about after you’re 35 is a dangerous suspect that needs to be suppressed.” I think you’ve got a lot of that generational animosity to crypto for people who grew up in the traditional banking system of paper checks and branch banks, and they just can’t get their head around it and see it as dangerous.

Forbes: What are your thoughts on the FIT for 21st Century Act? When we did an interview three years ago, you mentioned how the CFTC has historically not overseen retail markets. It’s much more of an institutional one. It seems like the CFTC would have that responsibility in this particular act. How might that work?

Giancarlo: My mind has evolved on this as well. Years ago, when I was at the CFTC, one of the things I thought then, and I still think that makes the CFTC both special and actually very capable, is the fact that, for the most part, it oversees wholesale and not retail markets. The reason why it’s mostly a wholesale regulator is because it oversees futures markets, which, for the most part, have professional traders in them. It doesn’t oversee spot markets where you’ve got a lot of retail traders. This act would give CFTC market supervision regulation power over spot markets for crypto and not just the derivative markets. Therefore, the CFTC would find itself, to some degree, engaging in retail marketplace supervision. My mind has evolved on this in part because the CFTC already has certain pockets of retail supervision, and it’s shown itself to be able to handle them very well. Secondly, at the end of the day, we as a nation need to regulate retail crypto markets, and somebody’s got to do the job. The CFTC, by doing bitcoin futures back in 2017, has demonstrated itself as a very capable crypto regulator. I mean, that market today is deep, it’s liquid, it’s transparent, it’s well regulated. I’d go even further to say that the one part of the Sam Bankman-Fried empire that didn’t fail was the piece under CFTC supervision. I think the CFTC has earned its wings in terms of this; I think it can step up to the job now. Congress is going to have to give it resources to do the job. You can’t say we will regulate an area, assign it to a regulator, and not give them additional resources to do it. But with the right resources, I think the CFTC is ready for this job.

Compared to the other choices, with great respect to the SEC, they have not been willing to write regulatory standards for crypto regulation. They’re saying the same rules that apply to equities apply to crypto. That’s like saying the same rules apply to railroad and airline transportation. They’re both means of transportation, but they’re very different technologies. The SEC has come up with different rules for municipal bonds, debt and equities. There’s no reason there couldn’t be a bespoke set of rules for crypto. But the SEC hasn’t been willing to write those rules.

Forbes: The Chicago Mercantile Exchange (CME) is evaluating offering spot trading for bitcoin and ether. How do you think such a highly regulated marketplace might impact spot markets and derivatives markets? Was that ever discussed when you were leading the CFTC?

Giancarlo: I don’t want to share a conversation that took place back then other than to say that the CME is a very serious player. They’re not only a commercial training platform but a self-regulated organization. They take compliance very seriously. They demonstrated the ability to build that Bitcoin futures market successfully. Of the players that I think could step into the spot market and build a very confident and successful spot market, I would certainly include them. We have several very strong market operators in the U.S. Nasdaq, Intercontinental Exchange, the owners of the New York Stock Exchange, and others like the CBOE. But I think CME would be a very suitable candidate.

Forbes: One interesting counterargument is that its rival, the CBOE, recently shuttered its spot market. What might that mean for the CME’s prospects?

Giancarlo: I would say that building a new marketplace is a little bit like catching lightning in a bottle. The truth of the matter is probably for every 10 new products launched, maybe one or two last and gain traction. The exchanges are constantly launching new products and markets, and they’re sort of like venture capital funds. Out of every 10, they’re hoping that one or two stick. It’s just about sometimes catching the right timing and getting the parameters of the product right. You hear about them when they’re launched, and then many of them are just quietly shut down three or four months later. They never gained any traction. I haven’t looked at that product from CBOE or spoken to anybody. So I don’t know why it didn’t gain traction.

Forbes: I want to ask you about Bluprynt because disclosures are important, and there’s the whole idea that the SEC is trying to put a square peg into a round hole in making teams try to file disclosure and registration documents that are anathema to crypto. What can you add?

Giancarlo: That’s going to be interesting. I want to stay within the parameters of what Professor Chris Brummer has said and not go outside of that. It’s not for me as an investor to make news on the Bluprynt model.

Forbes: Just in a general sense.

Giancarlo: The need for disclosure is going to be part of the digital asset future. And it’s not just here in the United States. We have our unique approach to disclosure, but other countries like Europe have now implemented MiCA (Markets in Crypto Asset Legislation) that requires disclosure and others will need trusted sources of disclosures. I don’t believe that the U.S. is going to lead as we did in the analog world. I think we’ve already missed the opportunity to lead in developing global standards for crypto disclosure because we’ve been unwilling to write rules for how to trade crypto publicly. I think it might well be Europe, which now has a law in place and an opportunity for disclosure that’s going to design global standards. And I think opportunities for Bluprynt are not limited to the United States.

Forbes: One of the big themes this year outside of bitcoin and bitcoin DeFi is memecoins. What are your thoughts on them?

Giancarlo: I’m not a critic like some who say that memecoin investors are foolish and that these tokens are a waste of everybody’s time and energy. I do think they fit into the current ethos we’re in. And by that ethos, I point to profligate money printing by the United States, putting for many young people the prospect of owning a home out of reach. Combine that with the wholesale promotion of gambling, not just by commercial actors like the NFL, but by states and governments through lotteries and with a little disclaimer that says, got a gambling problem called 1-800-Gambling. But other than that, gamble all you want. And somehow, though, we’re supposed to criticize young people for speculating on meme stocks as if that type of gambling is irresponsible, but betting on football games or betting on the state lottery is a type of responsible gambling? I think the meme stocks and tokens thing is a product of our times.

Forbes: Any concluding thoughts?

Giancarlo: I think the dam is about to break on the U.S. resistance to this innovation. I think it’s going to break regardless of what happens in November. And when the dam breaks or the door becomes ajar, it’s going to swing wide open. I believe this because of my global travels from London to Tokyo, Dubai, Singapore, and Paris. The world is saying, “Let’s build our crypto opportunity now and try to make it take root.” The reason is that all those very smart, savvy regulators in those countries believe the United States is going to turn around in the next 24 months, and the rush is going to be back to Brooklyn, back to Silicon Valley, back to Austin, Texas. They want to ensure that there’s something, some staying power in their jurisdictions. I think they’re right. They’ve seen the U.S. do this before. Winston Churchill famously said that the United States always does the right thing after trying all the alternatives. I think we’ve been trying the alternatives. I think they’re unsustainable, and the United States will be back in this innovation. We’ll have lost some opportunities. I mentioned one of them in terms of developing global standards for disclosure. But I think that ultimately the United States will come back and come back in a strong way.

Forbes: Thank you.

Markets

Today’s top crypto gainers and losers

Over the past 24 hours, Jupiter and JasmyCoin emerged as the top gainers among the top 100 crypto assets, while Bittensor and Mantra plunged as the top losers.

Top Winners

Jupiter

Jupiter (JUP) led the charge among the biggest gainers on July 27.

At the time of writing, the crypto asset had surged 12.6% in the past 24 hours and was trading at $1.16. JUP’s daily trading volume was hovering around $282 million, according to data from crypto.news.

JUP Hourly Price Chart, July 26-27 | Source: crypto.news

Additionally, the cryptocurrency’s market cap stood at $1.56 billion, making it the 62nd largest crypto asset, according to CoinGecko. Despite the recent price surge, the token is still down 42.6% from its all-time high of $2 reached on Jan. 31.

Jupiter functions as a decentralized exchange aggregator that allows users to trade Solana-based tokens. The platform also offers users the best routes for direct trades between multiple exchanges and liquidity pools.

In addition to being a DEX aggregator, Jupiter has expanded into a “full stack ecosystem” by launching several new projects, including a dedicated pool to support perpetual trading and plans for a stablecoin.

JasmyCoin

JasmyCoin (JASMI) has increased by 12% in the last 24 hours and is trading at $0.0328 at press time. JASMY’s daily trading volume has increased by 10% in the last 24 hours, reaching $146 million.

JASMY Hourly Price Chart, July 26-27 | Source: crypto.news

The asset’s market cap has surpassed the $1.5 billion mark, making it the 60th largest cryptocurrency at the time of reporting. However, the self-proclaimed “Bitcoin of Japan” is still down 99.3% from its all-time high of $4.79 on February 16, 2021.

JASMY is the native token of Jasmy Corporation, a Japanese Internet of Things provider. The platform seeks to merge the decentralization of blockchain technology with IoT, allowing users to convert their digital information into digital assets.

The initiative was launched by Kunitake Ando, former COO of Sony Corporation, along with Kazumasa Sato, former CEO of Sony Style.com Japan Inc., Hiroshi Harada, executive financial analyst at KPMG, and other senior executives from Japan.

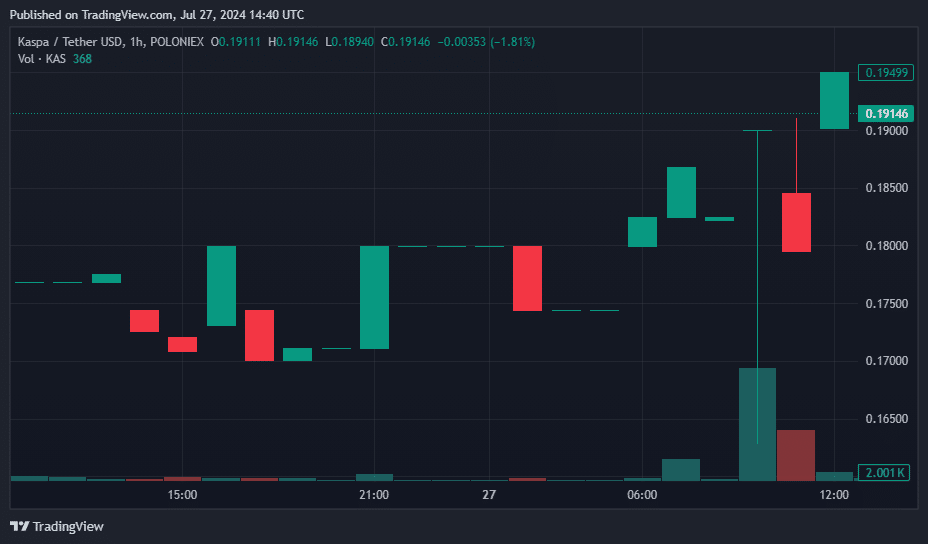

Kaspa

Kaspa (KAS) saw a 100% increase in trading volume and an 8% increase in price over the past 24 hours, trading at $0.19 at the time of publication.

KAS Hourly Price Chart, July 26-27 | Source: crypto.news

According to data from CoinGecko, Kaspa now ranks 27th in the global cryptocurrency list, with a circulating supply of approximately 24.29 billion KAS tokens and a market capitalization of $4.59 billion.

Kaspa is a cryptocurrency designed to deliver a high-performance, scalable, and secure blockchain platform. Its unique Layer-1 protocol includes the GhostDAG protocol, a proof-of-work (PoW) consensus mechanism that enables faster block times and higher transaction throughput compared to standard blockchains.

Unlike Bitcoin, GhostDAG allows multiple blocks to be created simultaneously, speeding up transactions and increasing block rewards for miners.

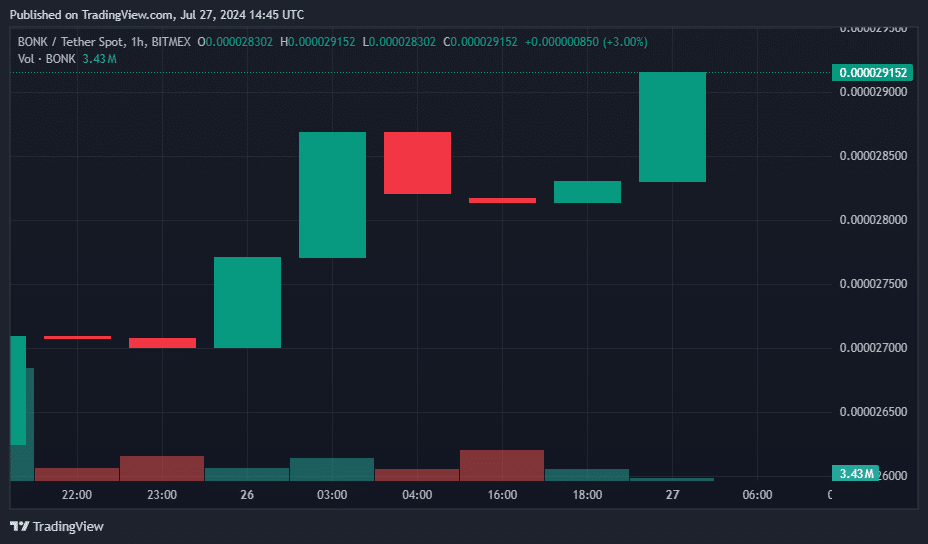

Bonk

Bonk (BONK) is the only one coin meme which made it to this list of biggest gainers and jumped 8.6% in the last 24 hours. Trading at $0.000030, the Solana-based meme coin’s market cap has surpassed $2.1 billion, surpassing Floki (FLOKI), another competing dog-themed coin with a market cap of $1.78 billion.

BONK Hourly Price Chart, July 26-27 | Source: crypto.news

BONK’s daily trading volume hovered around $285 million. However, BONK is still down 33.5% from its all-time high of $0.000045, reached on March 4.

Bonk, a meme coin that rose to prominence in 2023, has contributed significantly to Solana’s value increase amid the meme coin frenzy.

Bonk started out as a simple dog-themed coin. It has since expanded its features to include integration with decentralized finance. The project also partners with cross-chain communication protocols, NFT marketplaces, and various other cryptocurrency ecosystems.

BONK trading pairs are now listed on major exchanges including Binance, Coinbase, OKX, and Bitstamp.

The big losers

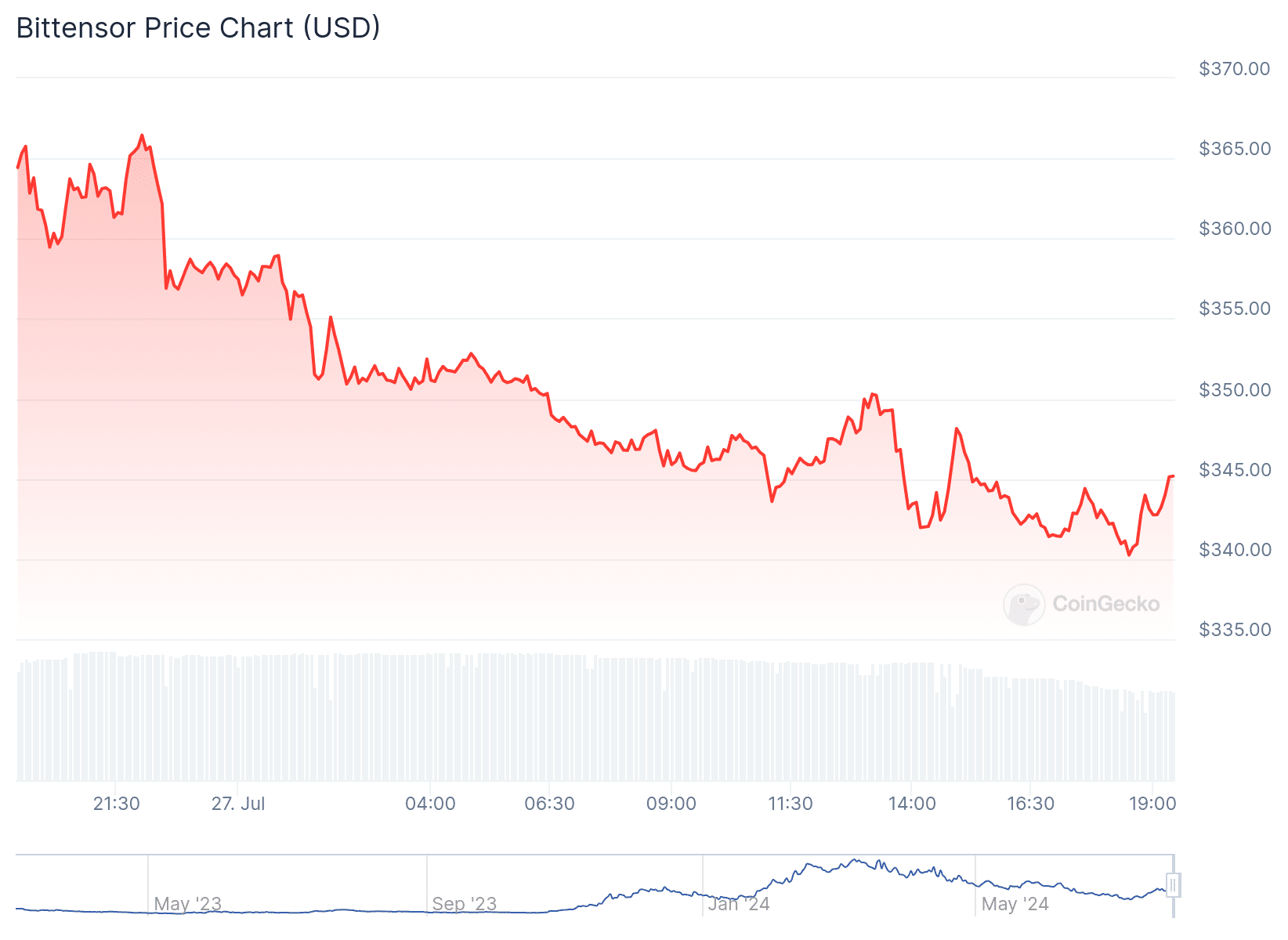

Bittensor

Bittensor (TAO) was the biggest loser among the 100 largest crypto assets, according to data from CoinGecko.

At the time of writing, TAO, the native token of decentralized AI project Bittensor, was down 5%, trading around $344. The crypto asset had a daily trading volume of $59 million and a market cap of $2.43 billion.

TAO 24 Hour Price Chart | Source: CoinGecko

Bittensor, created in 2019 by AI researchers Ala Shaabana and Jacob Steeves, initially operated as a parachain on Polkadot before transitioning to its own layer-1 blockchain in March 2023.

Mantra

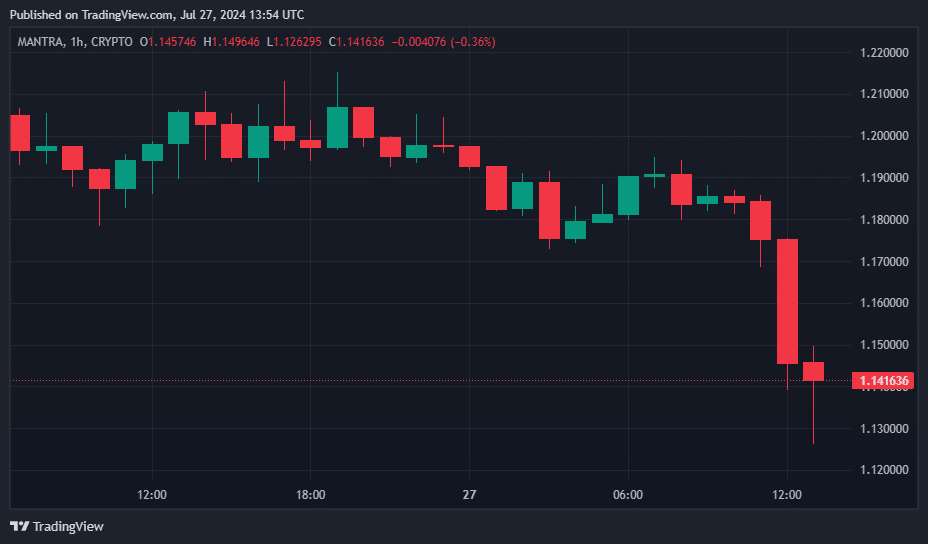

Mantra (OM) fell 6%, trading at $1.13 at press time. The digital currency’s market cap fell to $938 million. Additionally, the 82nd largest crypto asset has a daily trading volume of $26 million.

OM Price Hourly Chart, July 26-27 | Source: crypto.news

Mantra is a modular blockchain network comprising two chains, Manta Pacific and Manta Atlantic, specialized in zero-knowledge applications.

Coat

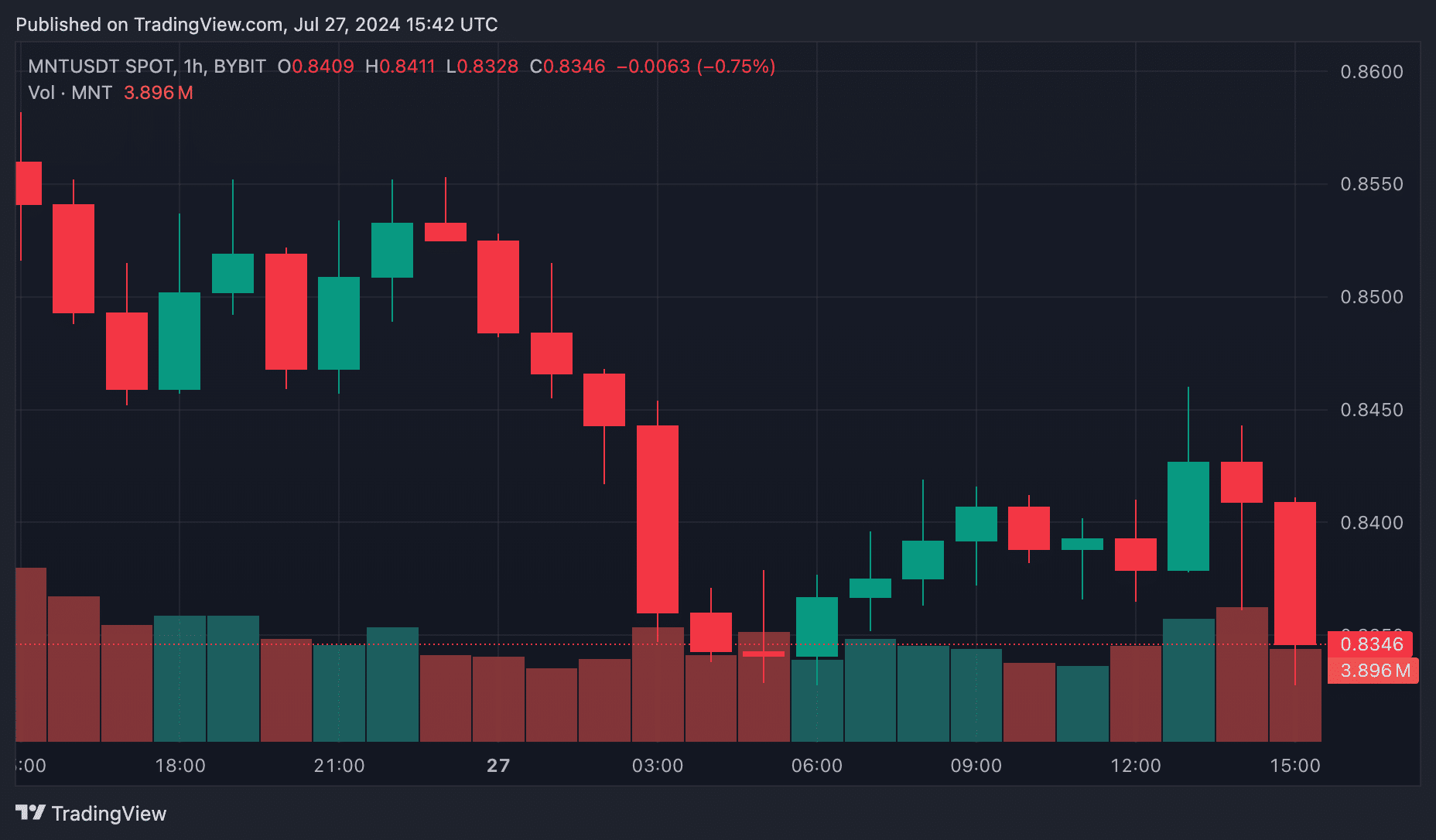

Coat (MNT) also saw a 2.4% drop in price, now trading at $0.8413. Currently, Mantle has a market cap of around $2.75 billion, which ranks 36th in the global cryptocurrency rankings by market cap, according to price data from crypto.news.

MNT Hourly Price Chart, July 26-27 | Source: crypto.news

Over the past 24 hours, MNT trading volume also fell by 6%, reaching $240 million.

Mantle, formerly known as BitDAO, is an investment DAO closely associated with Bybit. The MNT token is essential for governance, paying gas fees on the Mantle network, and staking on various platforms.

Built on the Ethereum network, Mantle provides a platform for decentralized application developers to launch their projects. It has become particularly popular for GameFi applications, leading to the formation of an internal Web3 gaming team.

Markets

Bitcoin Price Drops to $67,000 Despite Trump’s Pro-Crypto Comments, Further Correction Ahead?

Pioneer cryptocurrency Bitcoin has registered a 1.13% decline in the past 24 hours to trade at $67,400. Despite a strong pro-crypto stance from US presidential candidate Donald Trump at the Bitcoin 2024 conference, this massive selloff has raised concerns in the market about the asset’s sustainability at a higher price. However, given the recent three-week rally, a slight pullback this weekend is justifiable and necessary to regain the depleted bullish momentum.

Bitcoin Price Flag Formation Hints at Opportunity to Break Beyond $80,000

The medium-term trend Bitcoin Price remains a sideways trend amidst the formation of a bullish flag pattern. This chart pattern is defined by two descending lines that are currently shaping the price trajectory by providing dynamic resistance and support.

On July 5, BTC saw a bullish reversal from the flag pattern at $53,485, increasing its asset by 29.75% to a high of $69,400. This recent spike followed the market’s positive sentiment towards the Donald Trump speech at the Bitcoin 2024 conference in Nashville on Saturday afternoon.

Bitcoin Price | Tradingview

In his speech, Trump outlined several pro-crypto initiatives: he promised to replace SEC Chairman Gary Gensler on his first day in office, to establish a Strategic National Reserve of Bitcoin if elected, to ensure that the U.S. government holds all of its assets. Bitcoin assets and block any attempt to create a central bank digital currency (CBDC) during his presidency.

He also claimed that under his leadership, Bitcoin and cryptocurrencies will skyrocket like never before.

Despite Donald Trump’s optimistic promises, the BTC price failed to reach $70,000 and is currently trading at $67,400. As a result, Bitcoin’s market cap has dipped slightly to hover at $1.335 trillion.

However, this pullback is justified, as Bitcoin price has recently seen significant growth over the past three weeks, which has significantly improved market sentiment. Thus, price action over the weekend could replenish the depleted bullish momentum, potentially strengthening an attempt to break out from the flag pattern at $70,130.

A successful breakout will signal the continuation of the uptrend and extend the Bitcoin price forecast target at $78,000, followed by $84,000.

On the other hand, if the supply pressure on the upper trendline persists, the asset price could trigger further corrections for a few weeks or months.

Technical indicator:

- Pivot levels: The traditional pivot indicator suggests that the price pullback could see immediate support at $64,400, followed by a correction floor at $56,700.

- Moving average convergence-divergence: A bullish crossover state between the MACD (blue) and the signal (orange) ensure that the recovery dynamics are intact.

Related Articles

Frequently Asked Questions

A CBDC is a digital form of fiat currency issued and regulated by a country’s central bank. It aims to provide a digital alternative to traditional banknotes.

The proposal for a strategic national Bitcoin reserve is a major confirmation of Bitcoin’s legitimacy and potential as a reserve asset. Such a move could position Bitcoin in a similar way to gold, potentially stabilizing its price and encouraging other countries to adopt similar strategies.

Conferences like Bitcoin 2024 serve as essential platforms for networking, knowledge sharing, and showcasing new technologies within the cryptocurrency industry.

Markets

Swiss crypto bank Sygnum reports profitability after surge in first-half trading volumes – DL News

- Sygnum says it has reached profitability after increasing transaction volumes.

- The Swiss crypto bank does not disclose specific profit figures.

Sygnum, a Swiss global crypto banking group with approximately $4.5 billion in client assets, announced that it has achieved profitability after a strong first half, with key metrics showing year-to-date growth.

The company said in a Press release Compared to the same period last year, cryptocurrency spot trading volumes doubled, cryptocurrency derivatives trading increased by 500%, and lending volumes increased by 360%. The exact figures for the first half of the year were not disclosed.

Sygnum said its staking service has also grown, with the percentage of Ethereum staked by customers increasing to 42%. For institutional clients, staking Ethereum has a benefit that goes beyond the limitations of the ETF framework, which excludes staking returns, Sygnum noted.

“The approval and launch of Bitcoin and Ethereum ETFs was a turning point for the crypto industry this year, leading to a major increase in demand for trusted, regulated exposure to digital assets,” said Martin Burgherr, Chief Client Officer of Sygnum.

He added: “This is also reflected in Sygnum’s own growth, with our core business segments recording significant year-to-date growth in the first half of the year.”

Sygnum, which has also been licensed in Luxembourg since 2022, plans to expand into European and Asian markets, the statement said.

Markets

Former White House official Anthony Scaramucci says cryptocurrency bull market could be sparked by regulatory clarity

Anthony Scaramucci, founder of Skybridge Capital, says the next cryptocurrency bull market could be sparked by a new wave of clear cryptocurrency regulations.

In a new interview On CNBC’s Squawk Box, the former White House communications director said he and two other prominent industry figures traveled to Washington, D.C. to speak to officials about the dangers of Sen. Elizabeth Warren and U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler’s hardline approach to cryptocurrency regulation.

“Mark Cuban, myself, and Michael Novogratz were in Washington a few weeks ago to speak with White House officials and explain the dangers of Gary Gensler and Elizabeth Warren’s anti-crypto approach. I hope that message gets through…

“Overall, if we can get regulatory policy around Bitcoin and crypto assets in sync, we will have a bull market next year for these assets.”

Scaramucci then compares crypto assets to ride-hailing company Uber, saying regulators were initially wary of the service but eventually decided to adopt clear guidelines due to public demand.

“Remember Uber: Nobody wanted Uber. A lot of regulators didn’t want it. Mayors and deputy mayors didn’t want it, but citizens wanted Uber and eventually accepted the idea of regulating it fairly. I think we’re there now.”

The CEO also says young Democratic voters believe their leaders are making the wrong choices when it comes to digital assets.

“I think President Trump’s move toward Bitcoin and crypto assets has shaken Democrats to their core, and I think very smart, younger Democrats are recognizing that they are completely off base with their positions, completely off base with these SEC lawsuits and regulation by law enforcement, and now they need to get back to the center.”

Don’t miss a thing – Subscribe to receive email alerts directly to your inbox

Check Price action

follow us on X, Facebook And Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed on The Daily Hodl are not investment advice. Investors should do their own due diligence before making any high-risk investments in Bitcoin, cryptocurrencies or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Image generated: Midjourney

-

News9 months ago

News9 months agoVolta Finance Limited – Director/PDMR Shareholding

-

News9 months ago

News9 months agoModiv Industrial to release Q2 2024 financial results on August 6

-

News9 months ago

News9 months agoApple to report third-quarter earnings as Wall Street eyes China sales

-

News11 months ago

News11 months agoLeeds hospitals trust says finances are “critical” amid £110m deficit

-

News11 months ago

News11 months agoInventiva reports 2024 First Quarter Financial Information¹ and provides a corporate update

-

News9 months ago

News9 months agoNumber of Americans filing for unemployment benefits hits highest level in a year

-

DeFi11 months ago

DeFi11 months ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Tech11 months ago

Tech11 months agoBitcoin’s Correlation With Tech Stocks Is At Its Highest Since August 2023: Bloomberg ⋆ ZyCrypto

-

Tech11 months ago

Tech11 months agoEverything you need to know

-

Videos11 months ago

Videos11 months ago“We will enter the ‘banana zone’ in 2 WEEKS! Cryptocurrency prices will quadruple!” – Raoul Pal

-

Markets11 months ago

Markets11 months agoWhale Investments in Bitcoin Hit $100 Billion in 2024, Fueling Insane Investor Optimism ⋆ ZyCrypto

-

Markets11 months ago

Markets11 months agoCrazy $3 Trillion XRP Market Cap Course Charted as Ripple CEO Calls XRP ETF “Inevitable” ⋆ ZyCrypto