Tech

Exposing the Truth in 2023

Many individuals are unaware of what Blockchain stats and cryptocurrencies entail. But it is one of the latest additions to tech with fast-spreading tentacles. This article will serve as an aid to provide quality insight into Blockchain, highlighting statistics surrounding the industry, market, users, businesses, and general facts.

If you have yet to understand what people mean when discussing Bitcoin, Ethereum, and other blockchains, you will better understand the meanings and crucial data to know with the stats below. Let’s dive in.

Did You Know?

- In 2022, global expenses on Blockchain were predicted to hit $11.7 billion.

- The estimated revenue for the blockchain technology global market is expected to reach $20 billion by 2024.

- By 2029, the blockchain industry will experience a compound annual growth rate (CAGR) of 56.3%, making it worth over $163.83 billion.

- With blockchain implementation, companies in the finance sector can save at least $12 billion annually.

- The blockchain system can reduce 30% of infrastructure costs on banks.

- Total spending in healthcare upon integration of Blockchain will increase to $5.61 billion by 2025.

- The FBI owns 1.5% of the global Bitcoin supply.

- As per the March 2022 data, the number of registered wallets under Blockchain was over 81 million.

- By 2025, 55% of healthcare apps will have commercialized Blockchain.

Up-to-date Statistics in the Blockchain Industry

Let’s quickly look into the trending statistics on the blockchain industry.

1. Blockchain-based Cryptos are Poised to Generate $1 Billion in Revenue for the Banking Sector.

Recent statistics from the blockchain industry indicate a swift integration of blockchain technology into the worldwide financial sector, particularly banking. Numerous banks in countries such as Japan, the United States, Belarus, Switzerland, and others have already begun incorporating cryptocurrency transactions into their operations, and many more are expected to join soon.

(Source: Medium)

2. The Blockchain IoT Market is Anticipated to Achieve a 40% Annual Growth Rate by 2026.

The Internet of Things (IoT) industry has already reached remarkable revenues, amounting to billions of dollars, with billions of IoT devices dispersed worldwide. Blockchain statistics reveal that integrating the technology will bolster the security of data exchange between connected devices and IoT platforms.

Moreover, including automated backup files in the event of a successful breach provides an additional advantage. This is possible by the extensive network of individual nodes within the Blockchain, which facilitates system data storage.

(Source: Mordor Intelligence)

3. The Global Blockchain Market is Expected to Exhibit a CAGR of Over 69% From 2019 to 2025.

The growth rate of blockchain technology has been consistently on the rise, experiencing substantial year-on-year increases. Recent blockchain statistics from 2022 indicate that Blockchain is set to become an integral part of various key industries.

Back in 2017, the growth rate of Blockchain stood at a CAGR of 35.2%. By 2018, this figure had escalated to 41.8%, and projections suggest it will surge to nearly 70% within three years.

(Source: Globe News Wire)

4. The Financial Sector Leads as the Primary Investor in Blockchain Technology With a 46% Market Share.

The financial sector emerges as the dominant investor in blockchain technology, capturing a significant market share of 46%. Other sectors, like the energy and manufacturing sectors, each hold a share of 12%, while healthcare accounts for 11%. Government entities allocate 8% of investments, followed by the retail sector with 4% and the media and entertainment industry with 1%.

On a global scale, approximately 77% of the financial sector is expected to incorporate blockchain-enabled services into their systems and processes, highlighting the widespread adoption of this technology within the industry.

(Source: Compare Camp)

5. More Than 83 Million Blockchain Wallets are Registered Worldwide.

Data on blockchain wallets indicates a significant surge in their numbers. In Q4 2016, the total count stood at a modest 10.98 million. However, as of July 2022, the figure has skyrocketed to 83.4 million. Blockchain technology’s growing importance and popularity in recent years.

(Source: Statista)

6. Mobile Wallets Reign is the Preferred Choice for Blockchain Users.

Out of 4.57 billion internet users worldwide, a staggering 3.5 billion individuals utilize mobile phones. Consequently, it is no surprise that 62% of all blockchain storage options cater to mobile blockchain wallets.

Despite the availability of other types of blockchain wallets, such as hardware, desktop, mobile, and web wallets, most users strongly prefer mobile wallets.

(Source: Compare Camp)

7. January Transaction Rate Reaches 2.87 Transactions Per Second.

Blockchain statistics reveal intriguing insights into pool activity. The lowest recorded number of additions was 1.133 transactions per second on January 27, 2018. Conversely, the highest recorded value reached 7.56 transactions per second on May 2, 2019, followed by 2.58 transactions on June 22, 2021. As of January 28, 2022, the transaction rate settled at 2.87 transactions per second.

(Source: Block Chain)

8. Blockchain Ranked as a Highly Disruptive Technology in 2020.

According to a report from Gartner in 2020, blockchain technology was identified as one of the most disruptive technologies. The technology’s widespread applicability has been observed across various sectors, including manufacturing, agriculture, insurance, banking, and more.

(Source: Gartner)

9. The Healthcare Sector’s Blockchain Integration Spending is Expected to Reach $5.61 Billion by 2025.

$5.61 billion could be spent in this area by 2025. Notably, US blockchain stats show a significant increase in health sector investment as the country allocates 20% of its GDP to healthcare expenditures.

(Source: BIS)

Blockchain Business Statistics 2023

Blockchain technology can have a significant impact on businesses. Using blockchain can help companies gain a competitive advantage in myriad ways.

10. 60% of CIOs are Set to Integrate Blockchain by 2022.

Data suggests a significant shift in blockchain technology adoption among CIOs. Blockchain is expected to be integrated into the infrastructure of 60% of CIOs across different sectors by 2022. This marks a notable departure from previous years, where most CIOs expressed no intention to incorporate blockchain technology.

(Source: MVP)

11. 53% of C-Level Officers Recognize Blockchain’s Significance in Organizational Infrastructure.

In 2020, a substantial 53% of C-level officers, ranging from CEOs to chief financial officers and chief human resource managers, acknowledged the importance of blockchain technology as a crucial component of their organizational infrastructure. They recognized Blockchain’s potential to enhance operational efficiency and drive positive organizational outcomes.

(Source: Deloitte)

12. 90% of Blockchain Enterprise Platforms are Expected to Require Replacement in 2021.

Gartner’s analysis suggests that 90% of blockchain enterprise platforms implemented in 2021 will necessitate Replacement. The evolving nature of the technology, changes in the competitive landscape, and potential early-stage failures contribute to this prediction.

(Source: Gartner)

13. 40% of Top Health Executives Prioritize Blockchain Adoption.

Blockchain technology has gained significant attention in the healthcare industry, with 40% of top health executives identifying it as one of their top five priorities. Implementing Blockchain in healthcare offers benefits such as enhanced interoperability and secure transfer of patient information between healthcare centers, ensuring accurate and reliable data exchange.

(Source: Healthcare Weekly)

14. Value Chain, New Business Models, and Enhanced Security Drive Blockchain Adoption.

Based on recent business blockchain statistics, 23% of respondents identified the value chain and new business models as primary drivers for their adoption.

Another 23% highlighted the pursuit of heightened security as a compelling reason. Considering the alarming cybercrime statistics and the need for secure solutions, it is no surprise that organizations are turning to Blockchain to address these concerns.

(Source: Compare Camp)

General Statistics about Blockchain Technology

Since introducing technology about 15 years ago, many people have followed the blockchain trend. Judging by the new projects and the millions of decentralized wallets, the world is interested in this aspect of finance.

Here are general stats surrounding the tech evolution:

15. Satoshi Nakamoto Conceptualized the First Blockchain in 2008.

The creation of Bitcoin and the foundational concept of Blockchain can be attributed to Satoshi Nakamoto. Despite Dorian Nakamoto’s denials of involvement, numerous coincidences have led to speculation that he is the most likely candidate for the creator of Bitcoin.

(Source: The Sun)

16. There are About 5 Ideal Countries for Blockchain and Crypto Startups.

Blockchain and crypto startups have identified five countries as ideal locations for their operations: Gibraltar, Switzerland, Slovenia, Bermuda, and Malta. These countries provide favorable environments and incentives for flourishing blockchain and crypto startups.

(Source: Coinnounce)

17. September 2019: Over 42 Million Blockchain Wallet Users Worldwide.

As of September 2019, the global count of blockchain wallet users surpassed 42 million. These wallets serve as a cryptocurrency storage mechanism, enabling users to buy, sell, and utilize digital currencies for transactions.

In January 2015, the number of individuals worldwide with a blockchain wallet was slightly over 3 million; by June 2018, it exceeded 28.8 million. The continuous increase led to a milestone of 42 million in September 2019.

(Source: Statista)

18. Over 80% of Central Banks are Exploring the Introduction of Their Cryptocurrencies.

According to reports, over 80% of central banks globally are contemplating the implementation of their digital currencies. Countries such as the United States, China, and select nations in the European Union possess the required infrastructure, technology, and resources to support such initiatives.

Encouragingly, other countries are making progress in this domain, with 10% of those planning to launch their cryptocurrencies already conducting pilot projects to explore the feasibility and potential of this technology.

(Source: Decrypt)

19. Coincheck Hack: Over $500 Million Worth of Cryptocurrency was Stolen in 2018.

In 2018, the Japanese cryptocurrency exchange Coincheck experienced one of the largest blockchain hacks in history. Over 58 billion yen, equivalent to $500 million, was illicitly transferred from Coincheck’s wallet to another account.

The stolen cryptocurrency was not widely recognized like Bitcoin or Ethereum but rather a newer digital currency called NEM coin. Each NEM coin had an average value of under a dollar, resulting in the hackers absconding with more than 534 million NEM coins.

(Source: CNBC)

20. The IoT Market is Projected to Reach $1,463.2 Billion by 2027.

The Internet of Things (IoT) is set to flourish, with a projected value of approximately $1,463.2 billion by 2027. The intertwining of Blockchain and IoT has proven beneficial, as both technologies have experienced substantial growth and rely on each other.

Blockchain offers enhanced security for IoT devices, while IoT facilitates the growth and expansion of Blockchain through its widespread adoption. The IoT market is expected to maintain a CAGR of around 25% on its path to reaching the predicted value.

(Source: Globe News Wire)

21. Accenture and Microsoft Collaborate to Provide a Digital ID Network for 1.1 Billion People.

Microsoft and Accenture have joined forces to develop a blockchain-powered digital ID network, aiming to offer legal identification to over 1.1 billion individuals worldwide who lack official government documents. This initiative targets refugees, undocumented immigrants, and others with identity verification challenges.

(Source: Reuters)

22. Blockchain Facilitates Over $270 Billion in Distributed Transactions.

Blockchain technology has facilitated the management and distribution of more than $270 billion of cryptocurrencies. Notably, since 2010, Blockchain has surpassed Western Union in the volume of money transferred annually. While Western Union handles around $5.5 billion in money transfers, Blockchain has emerged to enable significantly larger transaction volumes.

(Source: Nividous)

23. FBI Holds 1.5% of Total Bitcoins in Possession.

Due to its active involvement in combating cybercrimes and investigating fraud cases related to cryptocurrencies, the FBI has acquired a significant amount of Bitcoin. The agency has received over $20 million in funding to prevent and address cybercrimes.

This accumulation of funds has positioned the FBI as one of the largest holders of Bitcoin worldwide, representing over 1.5% of the total supply.

(Source: Forbes)

24. Half a Percent of the World’s Population is Engaged with Blockchain Technology.

Approximately 0.5% of the global population, equivalent to around 40 million individuals, uses blockchain technology. However, even conservative estimates indicate that this figure is projected to quadruple within five years. Furthermore, within the next decade, it is anticipated that as much as 80% of the population will be involved with blockchain technology in some capacity.

(Source: Edureka)

25. Ripple Holds XRP Worth $30 Billion.

A San Francisco-based company, Ripple, has emerged as a significant success story in crypto investing. The founders of Ripple introduced the XRP coin, which rapidly gained popularity and propelled the company’s value to over $30 billion within a few months.

(Source: The New York Times)

26. IBM and Hu-manity Co-launched a Blockchain App Enabling Patients to Sell Anonymized Data to Pharmaceutical Companies.

The pharmaceutical industry requires access to population data to enhance drug development, testing, and customer satisfaction. To address privacy concerns and build trust, IBM and Hu-manity collaborated to develop a blockchain-based app. This application enables patients to sell their anonymized data to pharmaceutical companies directly, ensuring data security and utilizing valuable information for research and development.

(Source: ComputerWorld)

Statistics on Blockchain Market and Revenue

The market is growing, and significant revenues come with its size expansion. We’ll look at some stats that show its upward movements.

27. The Blockchain Technology Market Will Reach $20 Billion in Revenue by 2024.

According to blockchain growth statistics, the global market will generate revenue worth $20 billion by 2024. Comparatively, the revenue generated by Blockchain in 2015 was a mere $315 million.

(Source: Cision)

28. US to Invest $2.6 Billion in Blockchain Solutions.

The United States leads as the largest regional spender on blockchain solutions, with an estimated expenditure of around $2.6 billion. Western Europe follows as the second-largest client, investing approximately $1.6 billion in the technology, while China secures the third position with an investment of $777 million.

Central and Eastern Europe are projected to experience a CAGR of around 50% in the next five years, while China’s CAGR is expected to reach 54.6% over the same period.

(Source: IDC)

29. By 2030, Blockchain’s Business Value is Expected to Surpass $360 Billion by 2026 and $3.1 Trillion.

As blockchain technologies continue to attract investments across various industries, current estimates suggest that the business value added to Blockchain will exceed $360 billion within the next four years. Looking further ahead, by 2030, the projected business value is anticipated to exceed $3.1 trillion.

(Source: IT Web)

30. Blockchain Technology Offers Banks an Annual Savings Potential of $8-12 Billion.

Beyond enhancing transaction security, blockchain technology can potentially deliver substantial cost savings to industries by reducing data transfer and storage expenses.

In the financial sector, adopting blockchain technology could yield remarkable returns on investment (ROI) and enable annual savings of up to $12 billion. Banks can unlock significant cost efficiencies and drive substantial financial benefits by leveraging Blockchain for their transfer and storage requirements.

(Source: Sipotra)

31. Blockchain can Cut Banks’ Infrastructure Costs by 30%.

Banks worldwide allocate a significant portion of their IT budgets to maintain outdated data storage methods, which pose security risks given the presence of personal and sensitive information.

Blockchain presents a secure alternative for storing such data, utilizing encryption and distributed storage across millions of points without containing complete names or account numbers. Besides enhancing security, Blockchain can reduce infrastructure upkeep costs by up to 30%, amounting to $12 billion in savings, as previously mentioned.

(Source: Coin Journal)

32. 71% of Business Leaders Acknowledge Blockchain’s Key Role in Technological Advancement.

Most business leaders, precisely 71% of those actively leveraging blockchain technology, recognize its pivotal role in propelling their progress. Technological advancements in logistics and shipping would be notably slower without blockchain implementation, particularly in ocean shipping.

(Source: SAP)

33. 90% of Government Organizations Intend to Invest in Blockchain Technology.

An impressive 90% of government entities have expressed their plans to invest in Blockchain, highlighting their commitment to exploring and harnessing the benefits of this transformative technology.

(Source: BTC Manager)

34. 52% of Enterprises Prioritize the Permissioned Blockchain Model.

When it comes to blockchain development, organizations can implement either a public or permissioned blockchain model. A permissioned blockchain restricts access to the system of record, granting permission only to authorized participants.

According to the survey, 52% of enterprise respondents stated that their organizations focused on a permissioned blockchain model in 2018. This preference for permissioned models highlights the importance of controlled access and privacy considerations within enterprise blockchain implementations.

(Source: Statista)

35. 74% of Consumer Products & Manufacturing Companies are Progressing in Blockchain Development.

According to the survey, an impressive 74% of respondents from this industry indicated that their companies are actively involved in blockchain development. They reported being in either the experimentation or production phase, demonstrating a solid commitment to leveraging Blockchain for various aspects of their business.

(Source: Statista)

36. 53% of Companies Focus on Supply Chain Use Cases for Blockchain.

Blockchain usage statistics reveal that a significant focus for companies lies in utilizing technology to enhance their logistics and supply chains. More than half of the surveyed executives, approximately 53%, have expressed their intention to leverage Blockchain specifically for this purpose.

(Source: Statista)

37. 36% of Payment Industry Professionals Anticipate Blockchain Impact by 2025.

According to industry professionals in Europe’s payments sector, approximately 36% believe blockchain technology will impact specific niches or payment activities by 2025. These professionals foresee changes that will positively affect their work within the industry. This indicates a growing recognition of the transformative potential of Blockchain in revolutionizing payment processes, fostering greater efficiency, security, and innovation in the payments landscape.

(Source: Statista)

38. 70% of Asia-pacific Executives See a Competitive Advantage in Blockchain Adoption.

A survey of senior executives in the Asia-Pacific region revealed that a significant majority, 70%, believed incorporating blockchain technologies could provide them a competitive edge. This perspective highlights the growing recognition of Blockchain’s potential to enhance business operations, improve efficiency, and drive regional innovation.

(Source: Statista)

39. Coinbase Secured $251 Million in Venture Capital Funding Between 2014 – 2017.

A prominent digital currency exchange, Coinbase, raised over $251 million in venture capital funding between 2014 and 2017. This substantial investment was vital in transforming Coinbase into a leading exchange platform with a global user base comprising millions of individuals.

(Source: Statista)

40. South Korea’s Blockchain Market Value to Surge from $20.1B to $356.2B by 2022.

The blockchain market value in South Korea witnessed exceptional growth, starting at around $20.1 billion in 2016. Within two years, the market expanded by over $150 billion exceeding all expectations.

Further, projections indicate that this remarkable growth trajectory will continue, with the market expected to more than double its current value reaching approximately $356.2 billion in just four years.

(Source: Statista)

41. 44% of Gamers Purchased or Traded Blockchain Game Items.

Gamers have earned a reputation for being open to embracing new internet trends. Therefore, it is not surprising to discover that 44% of gamers have participated in purchasing or trading game-related items on the Blockchain. Among the various methods of transaction, Bitcoin emerges as the most commonly used, followed by Ethereum and XRP.

(Source: Statista)

42. 109 Chinese Blockchain Companies are Empowering the Actual Economy with Applications.

As of the end of March this year, recent data and blockchain adoption statistics reveal the presence of 109 Chinese companies actively offering blockchain applications in the real economy. These companies specialize in providing innovative blockchain solutions that enhance the efficiency and cost-effectiveness of banks and similar financial institutions. Their offerings contribute to streamlining operations and reducing expenses in the sector.

(Source: Statista)

43. 55% of Healthcare Applications to Adopt Blockchain for Commercial Deployment by 2025.

In response to the numerous data breaches experienced in the healthcare industry, it is anticipated that by 2025, 55% of the industry’s administrative requirements will be carried out using blockchain technology. The implementation of Blockchain in healthcare aims to enhance data security and privacy.

(Source: Statista)

44. A Survey Reveals 77% of CIOs Lack Interest or Plans to Deploy Blockchain Technology in 2018.

Based on the survey findings, 77% of Chief Information Officers (CIOs) expressed a lack of interest in blockchain technology and had no immediate plans to integrate it into their business operations for the year. Furthermore, the same survey highlights that only a mere 1% of the interviewed CIOs had already initiated adopting blockchain technology within their organizations.

(Source: Statista)

45. Regulatory Hurdles Impede Investment in Blockchain Technology for 39% of Respondents.

A significant 39% of organizations faced regulatory issues that hindered their ability to increase investments in blockchain technology. Countries with optimized regulations for blockchain technology tend to witness a higher prevalence of blockchain startups.

(Source: Statista)

46. KuCoin Allocates a $3 Million Investment in Bitcoin Australia.

A Singapore-based cryptocurrency trading company, KuCoin, has strategically invested $3 million in Bitcoin Australia. Bitcoin Australia facilitates Bitcoin and Ethereum trading in this specific world region.

(Source: AFR)

47. Bittrex Recorded Trading Volume Exceeding $86M in 24 Hours.

Bittrex is a prominent blockchain trading hub in Seattle, enabling users to trade cryptocurrencies, including Bitcoin, Ethereum, and nearly 200 others. It caters to a global audience, including individuals from Latin America and the Caribbean. Bittrex closely monitors real-time Bitcoin statistics, allowing users to stay updated.

(Source: LinkedIn)

48. Centra Secured $32M Through an ICO Endorsed by Boxer Floyd Mayweather.

Renowned boxer Floyd Mayweather was among the early endorsers of cryptocurrency. He lent his support to the controversial Centra coin, which initially gained traction and displayed significant potential. Centra raised over $32 million in their Initial Coin Offering (ICO). However, the Securities and Exchange Commission (SEC) swiftly intervened and shut down Centra’s operations due to fraudulent practices, leading to the project’s downfall.

(Source: CNBC)

49. By 2026, Blockchain in the Financial Sector will Achieve a $22.46 Billion Market Size.

In 2018, the market size of blockchain solutions tailored for financial institutions was estimated at $280 million. The banking and finance industry collectively invested over $550 million in blockchain technology during the same year. The market size has reached $2.53 billion, demonstrating substantial growth.

Looking ahead to 2026, predictions suggest that this upward trajectory will persist, with Blockchain in the financial sector anticipated to reach an impressive market size of $22.46 billion.

(Source: Statista)

50. Blockchain in the Manufacturing Market is Expected to Reach $778.05 Million by 2026.

Blockchain in manufacturing is projected to grow remarkably, with a predicted market value of $778.05 million by 2026. The market is currently valued at $85.64 million, exhibiting a robust compound annual growth rate (CAGR) of 73%. This positive trend is expected to continue, with the CAGR further increasing to 73.6% by 2026, indicating significant progress and adoption of blockchain technology within the manufacturing industry.

(Source: The Business Research Company)

51. Manufacturing and Resources Sector Invested $334m in Blockchain Technology in 2018.

The manufacturing and resources sector stands out as another significant investor in blockchain technology. In 2018 alone, this sector allocated over $330 million towards blockchain-based technologies.

(Source: Builtin)

52. Blockchain Technology Market is Projected to Reach $7.59B by 2024.

The market size is projected to surge, reaching an estimated worth of $7.59 billion by 2024. Various sectors, including financial services, media, transportation, consumer products, and healthcare, will drive this growth.

(Source: Cision)

53. Global Blockchain Market will Exceed $60B by 2024.

The global blockchain market will grow exponentially, with projections indicating it will surpass $60 billion by 2024. Despite being in its early stages, blockchain technology is witnessing widespread adoption across various industries.

(Source: Forbes)

54. Global Spending on Blockchain to Approach $20B by 2024.

The global expenditure on blockchain technology is experiencing significant growth, reaching record levels. This upward trajectory will continue in the coming years based on current trends. In the last quarter of 2021, global spending on Blockchain reached $6.6 billion. Furthermore, according to blockchain growth statistics, this spending will surge even further, reaching $19 billion by 2024.

(Source: Statista)

55. 13% of Senior IT Leaders have Firm Plans for Blockchain Implementation.

Blockchain statistics indicate that 13% of senior IT leaders within large companies have established precise and current plans to integrate blockchain technology into their organizations’ day-to-day operations. While the reduced costs associated with data transfer pique the interest of company executives, IT leaders are particularly drawn to the enhanced security aspects that Blockchain offers.

(Source: The Enterprisers Project)

56. IT and Business Services to Contribute 70% of Blockchain Spending in the Next Five Years.

According to predictions and trends, approximately 70% of blockchain spending will originate from IT companies and other businesses over the next five years. The significant investment from IT and business services underscore the recognition of Blockchain’s potential and its increasing integration into everyday business transactions.

(Source: Finder)

57. IBM Invested $200M in Blockchain-powered IoT.

In 2016, IBM invested $200 million in blockchain technology, specifically focusing on its Internet of Things (IoT) application. Recognizing the immense potential and expecting substantial returns on investment, IBM emerged as one of the early adopters and significant supporters of blockchain technology.

(Source: Coindesk)

58. IBM Employs 1,000+ Personnel for Blockchain-powered IoT Projects.

Demonstrating its strong commitment to blockchain technology, IBM established a new office in Germany that houses over 1,000 employees. The primary focus of this Munich-based office is to leverage Blockchain for the development and advancement of IBM’s Internet of Things (IoT) project.

(Source: Law Technology Today)

59. 90% of European and North American Banks Explored Blockchain in 2018.

Recognizing the transformative potential of Blockchain, an overwhelming 90% of banks in Europe and North America were actively exploring how this technology could impact their business operations in 2018.

(Source: Law Technology Today)

60. The United States Boasts Over 36,659 Bitcoin ATMs.

Bitcoin ATMs serve as convenient booths where individuals can purchase cryptocurrencies by exchanging cash. The United States is home to over 36,000 Bitcoin ATMs, which are growing steadily.

(Source: Zippia)

61. Charities and Nonprofits Embrace Cryptocurrency Donations.

Cryptocurrencies have emerged as an accepted transaction means, whether purchasing consumer goods online, settling dinner bills, or making charitable contributions. Data reveals over $69 million worth of donations received in Bitcoin and other cryptocurrencies last year alone.

(Source: Fidelity Charitable)

62. Global Spending on Blockchain will Surpass $11.7B in 2022.

The worldwide expenditure on blockchain technology will reach a staggering $11.7 billion by 2022, indicating significant growth compared to just a year or two ago. IDC states this growth trajectory will continue beyond 2022, maintaining a robust annual growth rate of approximately 73.2%. The past few years have surpassed expectations, doubling Blockchain spending from the previous year.

(Source: ABL Advisor)

63. Significant Companies Worldwide are Exploring Blockchain Technology.

Blockchain has garnered widespread interest across industries with its transformative capabilities.

(Source: Forbes)

64. 77% of Financial Sector Incumbents Aimed to Adopt Blockchain by 2020.

According to PwC, an overwhelming 77% of firms in the financial sector expressed their plans to incorporate Blockchain as part of their systems or processes by the end of 2020.

(Source: PwC)

65. 99% of Russian Financial Service Companies Aimed to Adopt Blockchain by 2020.

In Russia, financial service companies demonstrate a powerful interest and enthusiasm for blockchain technology compared to their global counterparts. Remarkably, 99% of Russian financial service companies agreed to integrate Blockchain into their production systems by the end of 2020.

(Source: Cryptochain Sphere)

66. 45% of Financial Intermediaries Experience Fraud and Cybercrime Annually.

Financial intermediaries face an ongoing challenge in combating fraud and cybercrime, with a significant 45% of these institutions falling victim to such criminal activities each year.

(Source: PwC)

Statistics and Facts on Cryptocurrencies

As usual, the crypto market is always volatile. However, trading volumes in different currencies keep increasing, showing individuals’ daily interest.

Here are some related statistics:

67. There are Over 18 Million Bitcoins in Circulation.

There are approximately 18.3 million bitcoins in circulation. This figure has increased by around 1.4 million coins since September 2018. The number of bitcoins fluctuates every 10 minutes as miners discover new blocks. Each block contributes 6.25 new coins to the ecosystem.

(Source: Buy Bitcoin Worldwide)

68. Bitcoin Price on March 15, 2022, was $39,106.75.

Crypto market prices can be volatile and fluctuate rapidly over short periods. In recent months, the crypto market has witnessed significant price declines, including percentage drops in the value of Bitcoin since November 2021.

However, it is worth mentioning that Bitcoin reached an all-time high of $68,000 during that period. As of March 15, 2022, the price of Bitcoin was $39,106.75, and on July 13, BTC traded at $30,498.29.

(Source: Coin Market Cap)

69. Bitcoin Market Capitalization Dropped by $1.2 Trillion in January 2022.

As of November 2021, Bitcoin’s market capitalization reached an all-time high of nearly $3 trillion. However, in January 2022, the cryptocurrency market experienced a significant downturn, resulting in a drop of $1.2 trillion in Bitcoin’s market capitalization.

(Source: Binance)

70. Binance is the Largest Crypto Exchange Globally.

With an impressive average daily trade volume of 2 billion, Binance is a prominent platform for cryptocurrency trading. Furthermore, Binance processes approximately 1.4 million transactions per second, showcasing its scalability and capability to handle high transaction volumes efficiently.

(Source: Analytics Insight)

71. Size of the Bitcoin Blockchain Reached 420.59GB in August 2022.

As of August 2022, the size of the Bitcoin blockchain expanded significantly, reaching a staggering 420.59GB. Comparatively, back in 2010, the blockchain size was a mere 1 megabyte, highlighting the exponential growth and scalability of the Bitcoin blockchain over the years.

(Source: YCharts)

72. Maximum Bitcoin Supply is Limited to 21 Million.

The maximum supply of Bitcoins that can ever exist is set at 21 million. This limit ensures that there will be a finite number of Bitcoins in circulation, providing scarcity and an inherent value proposition. Presently, over 4 million Bitcoins remain to be rewarded to miners as they continue to secure the blockchain network through the mining process.

(Source: Coin Central)

73. Decentralization and Absence of Central Authority in Blockchain and Cryptocurrencies.

One of the critical advantages of utilizing blockchain technology and cryptocurrencies is their decentralized nature. Blockchain and cryptocurrencies operate without the involvement of a central authority, unlike traditional financial systems facilitated by banks or centralized payment processors like PayPal,

(Source: The Verge)

74. Ethereum is Predicted to Grow by 400% in 2022.

Despite experiencing a significant setback in July 2022, Ethereum’s price has stabilized and even displayed signs of recovery at the time of writing. Experts remain optimistic about Ethereum’s potential for further growth as the year progresses. The initial prediction of a 400% increase in Ethereum’s value for 2022 suggests that more positive developments may be in store for the cryptocurrency in the coming months.

(Source: Marca)

75. Bitcoin Records Over 12,000 Transactions Per Hour Across 96 Countries.

Bitcoin, being a decentralized digital currency, facilitates a significant number of transactions worldwide. Across 96 countries where Bitcoin usage is allowed, over 12,000 transactions occur every hour. Within this timeframe, more than 99,000 BTC (Bitcoin) are sent, with an average transaction value of approximately 0.103 BTC or around $600 per transaction.

(Source: Interxion)

76. There are Over 188,912 Bitcoin Transactions Per Day.

Currently, there are approximately 190K Bitcoin transactions carried out daily. It’s important to note that the number of transactions fluctuates over time, with the peak occurring in December 2017, surpassing 400,000.

(Source: Blockchain)

77. There is More Concentration of Bitnodes in Three Countries.

Based on available information, nearly 50% of bit nodes are concentrated in just three countries. The United States holds the largest share, accounting for 23.6% of bit node concentration. Following closely, Germany represents 18.95% of the total bit nodes, while France contributes 6.82%.

(Source: Bitnode)

78. The Average Confirmation Time for Bitcoin Transactions is 10 Minutes.

According to blockchain statistics, the average time to confirm a Bitcoin transaction is approximately 10 minutes. The duration of a Bitcoin transaction confirmation depends on the availability and creation of blocks by miners. Factors such as network congestion and the fee attached to the transaction can also influence the confirmation time.

(Source: Blockchain)

79. Bitcoin Mining Consumes More Electricity Than 159 Countries.

Bitcoin mining has become a significant consumer of electricity, surpassing the energy consumption of 159 countries. The electricity usage associated with Bitcoin mining exceeds the energy consumption of entire nations, including Ireland, the Balkans, and a significant portion of Africa. Estimates suggest that Bitcoin mining consumes approximately 29 terawatt-hours (TWh) of electricity annually.

(Source: Power Compare)

80. Ethereum Block Time and Ether Circulation.

The block time for Ethereum, the popular cryptocurrency and blockchain platform, is 14 – 15 seconds. Five new Ether (ETH) are added to the circulating supply during this block-creation process. Notably, the circulating supply of Ether crossed 100 million, and new Ether tokens continue to grow.

(Source: Bitrates)

81. 84.02 Million Cryptocurrency Wallets Existed in 2022.

As of 2022, approximately 84.02 million cryptocurrency wallets were available for Bitcoin and various altcoins. The Ledger Nano S stood out as the most widely used among the popular wallets, supporting a staggering 472 digital currencies. The Trezor Wallet ranked second, accommodating 190 coin types, followed by the Unstoppable Wallet, which supported 123 cryptocurrencies.

(Source: Finances Online)

82. Over 30 Million Downloads of Top 10 Cryptocurrency Apps in June 2022.

In June 2022, the combined downloads of the top 10 cryptocurrency apps exceeded 30 million. This data encompasses downloads from popular apps such as Crypto.com, Trust, BRD, Coinbase, Blockchain Wallet, Bitcoin Wallet, Bitcoin Wallet by Bitcoin.com, Binance, Coinbase Wallet, and Luno.

(Source: Statista)

83. Bitcoin Network Boasts Immense Processing Power.

The Bitcoin network possesses an astonishing level of processing power, surpassing the combined power of the top 500 computers in the world by a factor of 100,000. The volume of processed data every second using the Bitcoin blockchain is incredibly vast, to the extent that it takes a supercomputer several decades to analyze it all.

(Source: Quartz)

84. Bitcoin Market Facilitated $1 Billion in Illegal Drug Sales in February 2015.

In February 2015, it was reported that a significant portion of illegal drug sales, valued at around $1 billion, was facilitated through the largest known deep web market. Established in 2011, this market serves as a platform for trading mostly illicit goods and services. However, it is essential to note that illegal activities conducted on the deep web do not represent the entirety of Bitcoin’s use cases or its underlying technology.

(Source: The Guardian)

85. A Hacker Stole $50 Million Worth of Ether in 2016.

In 2016, Ethereum experienced a significant security breach resulting in the theft of $50 million Ether. The hacker specifically targeted a blockchain containing over $150 million worth of Ether, and although efforts were made to recover the stolen funds, the ultimate success of those efforts remains undisclosed.

(Source: PCMag)

86. First Bitcoin Purchase: Two pizzas for 10,000 BTC in May 2010.

On May 22, 2010, Laszlo Hanyecz made history by conducting the first recorded Bitcoin purchase. In exchange for 10,000 Bitcoins, he purchased two pizzas from Papa John’s. At the time, the value of Bitcoin was relatively low, and the transaction seemed inconsequential. However, those two pizzas hold historical significance with the subsequent Bitcoin surge.

(Source: Investopedia)

Wrap Up

Looking at the states, it’s clear that blockchain technology continues to grow and get mass adoption. Many sectors have adopted technology, and more are expected to follow. Blockchain technology is being used by businesses across various sectors, from finance to healthcare to logistics. The technology has quickly become a valuable digital tool. How? All thanks to its decentralized nature, stealth security, and ability to streamline processes and enhance data.

FAQs

How much is the global blockchain market worth by 2023?

The global blockchain market will be worth over $60 billion by 2023.

How many blockchain wallets are there currently?

As of 2023, there are over 83 million registered blockchain wallets.

Which industries are adopting blockchain technology the most?

The financial sector, manufacturing, healthcare, and government are among the industries actively adopting blockchain technology.

Our Editorial Process

Our Editorial Process

The Tech Report editorial policy is centered on providing helpful, accurate content that offers real value to our readers. We only work with experienced writers who have specific knowledge in the topics they cover, including latest developments in technology, online privacy, cryptocurrencies, software, and more. Our editorial policy ensures that each topic is researched and curated by our in-house editors. We maintain rigorous journalistic standards, and every article is 100% written by real authors.

Tech

Harvard Alumni, Tech Moguls, and Best-Selling Authors Drive Nearly $600 Million in Pre-Order Sales

BlockDAG Network’s history is one of innovation, perseverance, and a vision to push the boundaries of blockchain technology. With Harvard alumni, tech moguls, and best-selling authors at the helm, BlockDAG is rewriting the rules of the cryptocurrency game.

CEO Antony Turner, inspired by the successes and shortcomings of Bitcoin and Ethereum, says, “BlockDAG leverages existing technology to push the boundaries of speed, security, and decentralization.” This powerhouse team has led a staggering 1,600% price increase in 20 pre-sale rounds, raising over $63.9 million. The secret? Unparalleled expertise and a bold vision for the future of blockchain.

Let’s dive into BlockDAG’s success story and find out what the future holds for this cryptocurrency.

The Origin: Why BlockDAG Was Created

In a recent interview, BlockDAG CEO Antony Turner perfectly summed up why the market needs BlockDAG’s ongoing revolution. He said:

“The creation of BlockDAG was inspired by Bitcoin and Ethereum, their successes and their shortcomings.

If you look at almost any new technology, it is very rare that the first movers remain at the forefront forever. Later incumbents have a huge advantage in entering a market where the need has been established and the technology is no longer cutting edge.

BlockDAG has done just that: our innovation is incorporating existing technology to provide a better solution, allowing us to push the boundaries of speed, security, and decentralization.”

The Present: How Far Has BlockDAG Come?

BlockDAG’s presale is setting new benchmarks in the cryptocurrency investment landscape. With a stunning 1600% price increase over 20 presale lots, it has already raised over $63.9 million in capital, having sold over 12.43 billion BDAG coins.

This impressive performance underscores the overwhelming confidence of investors in BlockDAG’s vision and leadership. The presale attracted over 20,000 individual investors, with the BlockDAG community growing exponentially by the hour.

These monumental milestones have been achieved thanks to the unparalleled skills, experience and expertise of BlockDAG’s management team:

Antony Turner – Chief Executive Officer

Antony Turner, CEO of BlockDAG, has over 20 years of experience in the Fintech, EdTech, Travel and Crypto industries. He has held senior roles at SPIRIT Blockchain Capital and co-founded Axona-Analytics and SwissOne. Antony excels in financial modeling, business management and scaling growth companies, with expertise in trading, software, IoT, blockchain and cryptocurrency.

Director of Communications

Youssef Khaoulaj, CSO of BlockDAG, is a Smart Contract Auditor, Metaverse Expert, and Red Team Hacker. He ensures system security and disaster preparedness, and advises senior management on security issues.

advisory Committee

Steven Clarke-Martin, a technologist and consultant, excels in enterprise technology, startups, and blockchain, with a focus on DAOs and smart contracts. Maurice Herlihy, a Harvard and MIT graduate, is an award-winning computer scientist at Brown University, with experience in distributed computing and consulting roles, most notably at Algorand.

The Future: Becoming the Cryptocurrency with the Highest Market Cap in the World

Given its impressive track record and a team of geniuses working tirelessly behind the scenes, BlockDAG is quickly approaching the $600 million pre-sale milestone. This crypto powerhouse will soon enter the top 30 cryptocurrencies by market cap.

Currently trading at $0.017 per coin, BlockDAG is expected to hit $1 million in the coming months, with the potential to hit $30 per coin by 2030. Early investors have already enjoyed a 1600% ROI by batch 21, fueling a huge amount of excitement around BlockDAG’s presale. The platform is seeing significant whale buying, and demand is so high that batch 21 is almost sold out. The upcoming batch is expected to drive prices even higher.

Invest in BlockDAG Pre-Sale Now:

Pre-sale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetwork

Discord: Italian: https://discord.gg/Q7BxghMVyu

No spam, no lies, just insights. You can unsubscribe at any time.

Tech

How Karak’s Latest Tech Integration Could Make Data Breaches Obsolete

- Space and Time uses zero-knowledge proofs to ensure secure and tamper-proof data processing for smart contracts and enterprises.

- The integration facilitates faster development and deployment of Distributed Secure Services (DSS) on the Karak platform.

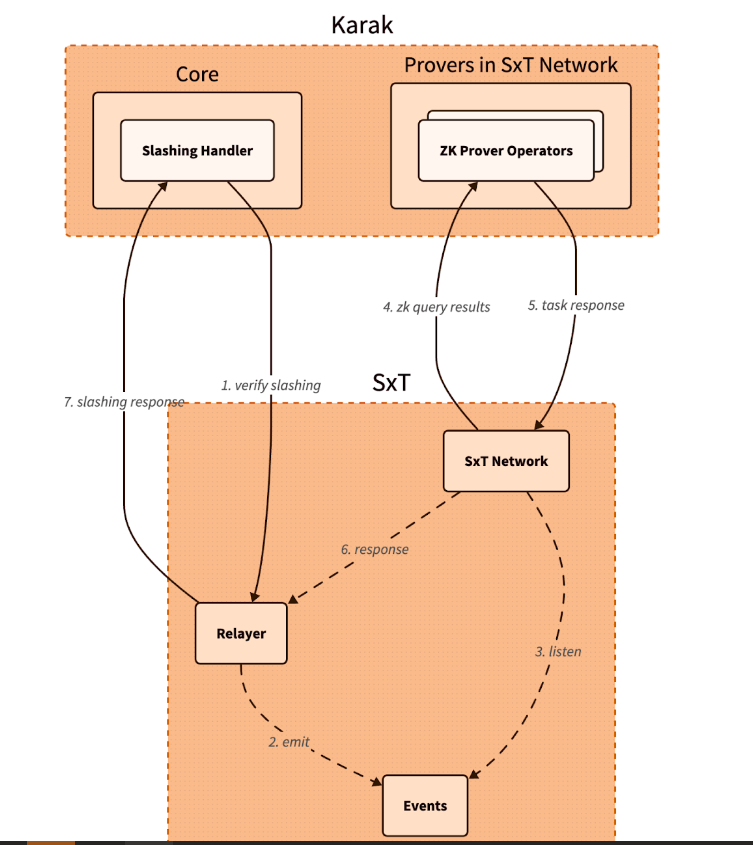

Karak, a platform known for its strong security capabilities, is enhancing its Distributed Secure Services (DSS) by integrating Space and Time as a zero-knowledge (ZK) coprocessor. This move is intended to strengthen trustless operations across its network, especially in slashing and rewards mechanisms.

Space and Time is a verifiable processing layer that uses zero-knowledge proofs to ensure that computations on decentralized data warehouses are secure and untampered with. This system enables smart contracts, large language models (LLMs), and enterprises to process data without integrity concerns.

The integration with Karak will enable the platform to use Proof of SQL, a new ZK-proof approach developed by Space and Time, to confirm that SQL query results are accurate and have not been tampered with.

One of the key features of this integration is the enhancement of DSS on Karak. DSS are decentralized services that use re-staked assets to secure the various operations they provide, from simple utilities to complex marketplaces. The addition of Space and Time technology enables faster development and deployment of these services, especially by simplifying slashing logic, which is critical to maintaining security and trust in decentralized networks.

Additionally, Space and Time is developing its own DSS for blockchain data indexing. This service will allow community members to easily participate in the network by running indexing nodes. This is especially beneficial for applications that require high security and decentralization, such as decentralized data indexing.

The integration architecture follows a detailed and secure flow. When a Karak slashing contract needs to verify a SQL query, it calls the Space and Time relayer contract with the required SQL statement. This contract then emits an event with the query details, which is detected by operators in the Space and Time network.

These operators, responsible for indexing and monitoring DSS activities, validate the event and route the work to a verification operator who runs the query and generates the necessary ZK proof.

The result, along with a cryptographic commitment on the queried data, is sent to the relayer contract, which verifies and returns the data to the Karak cutter contract. This end-to-end process ensures that the data used in decision-making, such as determining penalties within the DSS, is accurate and reliable.

Karak’s mission is to provide universal security, but it also extends the capabilities of Space and Time to support multiple DSSs with their data indexing needs. As these technologies evolve, they are set to redefine the secure, decentralized computing landscape, making it more accessible and efficient for developers and enterprises alike. This integration represents a significant step towards a more secure and verifiable digital infrastructure in the blockchain space.

Website | X (Twitter) | Discord | Telegram

No spam, no lies, just insights. You can unsubscribe at any time.

Tech

Cryptocurrency Payments: Should CFOs Consider This Ferrari-Approved Trend?

Iconic Italian luxury carmaker Ferrari has announced the expansion of its cryptocurrency payment system to its European dealer network.

The move, which follows a successful launch in North America less than a year ago, raises a crucial question for CFOs across industries: Is it time to consider accepting cryptocurrency as a form of payment for your business?

Ferrari’s move isn’t an isolated one. It’s part of a broader trend of companies embracing digital assets. As of 2024, we’re seeing a growing number of companies, from tech giants to traditional retailers, accepting cryptocurrencies.

This change is determined by several factors:

- Growing mainstream adoption of cryptocurrencies

- Growing demand from tech-savvy and affluent consumers

- Potential for faster and cheaper international transactions

- Desire to project an innovative brand image

Ferrari’s approach is particularly noteworthy. They have partnered with BitPay, a leading cryptocurrency payment processor, to allow customers to purchase vehicles using Bitcoin, Ethereum, and USDC. This satisfies their tech-savvy and affluent customer base, many of whom have large digital asset holdings.

Navigating Opportunities and Challenges

Ferrari’s adoption of cryptocurrency payments illustrates several key opportunities for companies considering this move. First, it opens the door to new customer segments. By accepting cryptocurrency, Ferrari is targeting a younger, tech-savvy demographic—people who have embraced digital assets and see them as a legitimate form of value exchange. This strategy allows the company to connect with a new generation of affluent customers who may prefer to conduct high-value transactions in cryptocurrency.

Second, cryptocurrency adoption increases global reach. International payments, which can be complex and time-consuming with traditional methods, become significantly easier with cryptocurrency transactions. This can be especially beneficial for businesses that operate in multiple countries or deal with international customers, as it potentially reduces friction in cross-border transactions.

Third, accepting cryptocurrency positions a company as innovative and forward-thinking. In today’s fast-paced business environment, being seen as an early adopter of emerging technologies can significantly boost a brand’s image. Ferrari’s move sends a clear message that they are at the forefront of financial innovation, which can appeal to customers who value cutting-edge approaches.

Finally, there is the potential for cost savings. Traditional payment methods, especially for international transactions, often incur substantial fees. Cryptocurrency transactions, on the other hand, can offer lower transaction costs. For high-value purchases, such as luxury cars, these savings could be significant for both the business and the customer.

While the opportunities are enticing, accepting cryptocurrency payments also presents significant challenges that businesses must address. The most notable of these is volatility. Cryptocurrency values can fluctuate dramatically, sometimes within hours, posing potential risk to businesses that accept them as payment. Ferrari addressed this challenge by implementing a system that instantly converts cryptocurrency received into traditional fiat currencies, effectively mitigating the risk of value fluctuations.

Regulatory uncertainty is another major concern. The legal landscape surrounding cryptocurrencies is still evolving in many jurisdictions around the world. This lack of clear and consistent regulations can create compliance challenges for companies, especially those operating internationally. Companies must remain vigilant and adaptable as new laws and regulations emerge, which can be a resource-intensive process.

Implementation costs are also a significant obstacle. Integrating cryptocurrency payment systems often requires substantial investment in new technology infrastructure and extensive staff training. This can be especially challenging for small businesses or those with limited IT resources. The costs are not just financial; a significant investment of time is also required to ensure smooth implementation and operation.

Finally, security concerns loom large in the world of cryptocurrency transactions. While blockchain technology offers some security benefits, cryptocurrency transactions still require robust cybersecurity measures to protect against fraud, hacks, and other malicious activity. Businesses must invest in robust security protocols and stay up-to-date on the latest threats and protections, adding another layer of complexity and potential costs to accepting cryptocurrency payments.

Strategic Considerations for CFOs

If you’re thinking of following in Ferrari’s footsteps, here are the key factors to consider:

- Risk Assessment: Carefully evaluate potential risks to your business, including financial, regulatory, and reputational risks.

- Market Analysis: Evaluate whether your customer base is significantly interested in using cryptocurrencies for payments.

- Technology Infrastructure: Determine the costs and complexities of implementing a cryptographic payment system that integrates with existing financial processes.

- Regulatory Compliance: Ensure that cryptocurrency acceptance is in line with local regulations in all markets you operate in. Ferrari’s gradual rollout demonstrates the importance of this consideration.

- Financial Impact: Analyze how accepting cryptocurrency could impact your cash flow, accounting practices, and financial reporting.

- Partnership Evaluation: Consider partnering with established crypto payment processors to reduce risk and simplify implementation.

- Employee Training: Plan comprehensive training to ensure your team is equipped to handle cryptocurrency transactions and answer customer questions.

While Ferrari’s adoption of cryptocurrency payments is exciting, it’s important to consider this trend carefully.

A CFO’s decision to adopt cryptocurrency as a means of payment should be based on a thorough analysis of your company’s specific needs, risk tolerance, and strategic goals. Cryptocurrency payments may not be right for every business, but for some, they could provide a competitive advantage in an increasingly digital marketplace.

Remember that the landscape is rapidly evolving. Stay informed about regulatory changes, technological advancements, and changing consumer preferences. Whether you decide to accelerate your crypto engines now or wait in the pit, keeping this payment option on your radar is critical to navigating the future of business transactions.

Was this article helpful?

Yes No

Sign up to receive your daily business insights

Tech

Bitcoin Tumbles as Crypto Market Selloff Mirrors Tech Stocks’ Plunge

The world’s largest cryptocurrency, Bitcoin (BTC), suffered a significant price decline on Wednesday, falling below $65,000. The decline coincides with a broader market sell-off that has hit technology stocks hard.

Cryptocurrency Liquidations Hit Hard

CoinGlass data reveals a surge in long liquidations in the cryptocurrency market over the past 24 hours. These liquidations, totaling $220.7 million, represent forced selling of positions that had bet on price increases. Bitcoin itself accounted for $14.8 million in long liquidations.

Ethereum leads the decline

Ethereal (ETH), the second-largest cryptocurrency, has seen a steeper decline than Bitcoin, falling nearly 8% to trade around $3,177. This decline mirrors Bitcoin’s price action, suggesting a broader market correction.

Cryptocurrency market crash mirrors tech sector crash

The cryptocurrency market decline appears to be linked to the significant losses seen in the U.S. stock market on Wednesday. Stock market listing The index, heavily weighted toward technology stocks, posted its sharpest decline since October 2022, falling 3.65%.

Analysts cite multiple factors

Several factors may have contributed to the cryptocurrency market crash:

- Tech earnings are underwhelming: Earnings reports from tech giants like Alphabet are disappointing (Google(the parent company of), on Tuesday, triggered a sell-off in technology stocks with higher-than-expected capital expenditures that could have repercussions on the cryptocurrency market.

- Changing Political Landscape: The potential impact of the upcoming US elections and changes in Washington’s policy stance towards cryptocurrencies could influence investor sentiment.

- Ethereal ETF Hopes on the line: While bullish sentiment around a potential U.S. Ethereum ETF initially boosted the market, delays or rejections could dampen enthusiasm.

Analysts’ opinions differ

Despite the short-term losses, some analysts remain optimistic about Bitcoin’s long-term prospects. Singapore-based cryptocurrency trading firm QCP Capital believes Bitcoin could follow a similar trajectory to its post-ETF launch all-time high, with Ethereum potentially converging with its previous highs on sustained institutional interest.

Rich Dad Poor Dad Author’s Prediction

Robert Kiyosaki, author of the best-selling Rich Dad Poor Dad, predicts a potential surge in the price of Bitcoin if Donald Trump is re-elected as US president. He predicts a surge to $105,000 per coin by August 2025, fueled by a weaker dollar that is set to boost US exports.

BTC/USD Technical Outlook

Bitcoin price is currently trading below key support levels, including the $65,500 level and the 100 hourly moving average. A break below the $64,000 level could lead to further declines towards the $63,200 support zone. However, a recovery above the $65,500 level could trigger another increase in the coming sessions.

-

News11 months ago

News11 months agoVolta Finance Limited – Director/PDMR Shareholding

-

News11 months ago

News11 months agoModiv Industrial to release Q2 2024 financial results on August 6

-

News11 months ago

News11 months agoApple to report third-quarter earnings as Wall Street eyes China sales

-

News11 months ago

News11 months agoNumber of Americans filing for unemployment benefits hits highest level in a year

-

News1 year ago

News1 year agoInventiva reports 2024 First Quarter Financial Information¹ and provides a corporate update

-

News1 year ago

News1 year agoLeeds hospitals trust says finances are “critical” amid £110m deficit

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Hit $100 Billion in 2024, Fueling Insane Investor Optimism ⋆ ZyCrypto

-

Tech1 year ago

Tech1 year agoBitcoin’s Correlation With Tech Stocks Is At Its Highest Since August 2023: Bloomberg ⋆ ZyCrypto

-

Tech1 year ago

Tech1 year agoEverything you need to know

-

News11 months ago

News11 months agoStocks wobble as Fed delivers and Meta bounces

-

Markets1 year ago

Markets1 year agoCrazy $3 Trillion XRP Market Cap Course Charted as Ripple CEO Calls XRP ETF “Inevitable” ⋆ ZyCrypto