Tech

Forbes Blockchain 50 2023

Despite 2022’s crypto market collapse, dozens of enterprises around the world are still investing in blockchain, the distributed-database technology that underpins the entire sector because it helps their businesses operate better, faster or cheaper.

Edited by Nina Bambysheva and Michael del Castillo

Reported by Nina Bambysheva, Michael del Castillo, Steven Ehrlich, Chris Helman, Jeff Kauflin, Maria Gracia Santillana Linares, Emily Mason, Rosemarie Miller, Javier Paz, Jon Ponciano, David Westenhaver

Illustration by Lena Weber for Forbes

Crypto is in the toilet. Even after a January rally that saw prices jump by a third or more, the cryptocurrency market is still down 38% over the last 12 months, wiping out some $630 billion of wealth. Faddish bits of the market, like NFT digital collectibles, have done even worse. Prominent prophets like Sam Bankman-Fried have been exposed as incompetent at best, criminal at worst. Despite it all, dozens of enterprises around the world are still quietly investing in blockchain, the distributed-database technology that underpins the entire sector. These mostly big, mostly smart firms aren’t throwing good money after bad. They’re doing it because blockchain helps their businesses operate better, faster or cheaper.

AI50

Alphabet

Mountain View, California

Through its venture capital arms, Alphabet has invested in blockchain firms like Fireblocks, Dapper Labs and Digital Currency Group. In addition, Google’s Cloud division last January formed a specialized team devoted to helping companies access crypto market data more quickly and launch blockchain-based products. Via Coinbase, Google will soon start accepting cryptocurrency as payment for cloud services.

Key Leaders: Amit Zavery, Google Cloud; Sunita Verma, Labs at Google

Ant Group

Hangzhou, China

Alibaba’s giant fintech affiliate has a proprietary blockchain running more than 50 apps. One of them, called the Treasure Project, helps museums and galleries popularize their collections by creating and distributing copies of ancient Chinese artifacts in the form of digital collectibles that are similar to NFTs. Ant has also developed an engine that it says is 15 times more efficient at storing blockchain data than mainstream providers. Topnod, a digital collectibles platform powered by Ant, is already using it and saves 75% on storage costs.

Key Leaders: Geoff Jiang, Intelligent Technology Business Group

Aon

London

Many organizations test job candidates. In June, the global professional services firm launched a blockchain service that enables job seekers to store and share the results of their assessments (say, an IQ test or a coding exercise) with multiple employers, eliminating the need to take the test more than once. Aon will apply the service to the 30 million assessments it administers annually.

Key Leaders: Greg Case, CEO; Christa Davies, CFO

Apollo

New York

In April, the $500 billion (assets under management) private equity manager hired JPMorgan’s cryptocurrency guru, Christine Moy, who wants to use blockchain to improve visibility into alternative investments like mortgages. In March the firm bought its first mortgage tracked on a blockchain, reducing the weeks-long settlement time to seconds.

Key Leader: Christine Moy, head of digital assets

Christine Moy, head of digital assets at Apollo

Courtesy Christine Moy

“Crypto encompasses many things. We’re focused on the technologies that can be applied and can scale, whether that’s capital raising, securitization, even trading. It’s rooted in real-world use cases that will make our business faster, more efficient, more accessible.”

—Christine Moy

Baidu

Beijing

Baidu’s new blockchain platform XuperAsset helps more than 400 companies issue digital collectibles—essentially Chinese NFTs, but because crypto trading is illegal in China, these nonfungible assets go by a different name there and resale is prohibited. Nearly 1 million copyrighted goods, mostly artwork and videos, have been created, generating around $35 million in fees for Baidu in the last 12 months. Outside of these non-NFT NFTs, more than 30,000 blockchain developers worldwide use Baidu’s open-source code.

Key Leader: Xiao Wei, Baidu Blockchain

BlackRock

New York

Last summer, BlackRock began offering direct investment in bitcoin for clients. It is also the primary manager of stablecoin USDC reserves (see story) .

Key Leaders: Robert Mitchnick, Digital Assets; Adam Salvatori, Digital Assets Lab

Block

San Francisco

In addition to giving away its code to bitcoin developers, Block is working with Coinbase and Circle to build a way to prove one’s identity without middlemen. Think using Facebook’s login for other websites without handing Mark Zuckerberg your private information. It’s part of Jack Dorsey’s big vision to create an open-source “financial substrate” that could lie at the foundation of Square and Cash App (it generated $1.8 billion in bitcoin revenue in Q3).

Key Leader: Jack Dorsey, CEO

Jack Dorsey, CEO of Block

Marco Bello/AFP/Getty Images

“The internet requires a currency native to itself. And in looking at the entire ecosystem of technologies to fill this role, it’s clear that bitcoin is currently the only candidate. It has proven resilience over a decade.”

—Jack Dorsey

BNY Mellon

New York

In addition to providing custody services for crypto assets (see story), it’s also working with the New York Fed on a digital dollar pilot project.

Key Leaders: Roman Regelman, Securities Services and Digital; Caroline Butler, CEO of Digital Assets; Michael Demissie, Head of Innovation and Advanced Solutions

Broadridge

Lake Success, New York

The financial technology company is modernizing the repurchase agreement (repo) market by automating the life cycle of these contracts. Instead of manually booking transfers of collateral across each institution’s systems, asset managers, banks and hedge funds can now transact with one another using a shared ledger. Launched in June 2020, Broadridge’s blockchain platform is now averaging $50 billion in daily trading volume for users like Société Générale.

Key Leaders: Germán Soto Sanchez, Corporate Strategy; Prakash Neelakantan, Blockchain Strategy

Chainalysis

New York

At least $3 billion worth of crypto was stolen last year, and Chainalysis specializes in finding it. The 700-person firm scours blockchain transactions and smart contract data for the electronic footprints of hackers and scammers. More than 1,000 firms including Robinhood, Bitfinex and BNY Mellon, plus a slew of three-letter agencies such as the SEC, DEA and FBI, are customers

Key Leaders: Michael Gronager, CEO; Jacob Illum, chief scientist

Coinbase

San Francisco

Coinbase had a dismal 2022, losing 85% of its market value. Still, it remains the U.S.’s largest crypto exchange, holding $101 billion in assets for more than 100 million clients worldwide.

Key Leader: Brian Armstrong, CEO

China Construction Bank

Beijing

The world’s second-largest bank by assets is using blockchain to connect lenders with investors (see story).

Key Leader: Hao Tan, CCB Fintech

CME Group

Chicago

The old-school futures trading exchange trades lots of crypto derivatives in a highly regulated environment. This reliability gives it a leg up over sloppy and bug-prone exchanges and Web3 projects (see story).

Key Leader: Tim McCourt, Equity Index and FX Products

De Beers

London

De Beers, which sources diamonds in Canada, Botswana, Namibia and South Africa, has been using blockchain since 2019 to track the gems as they’re mined, cut, polished and sold, and is now processing more than 100,000 stones a month. Overall, its Tracr blockchain keeps tabs on 600,000 registered diamonds, roughly 15% of the world’s production—a haul of precious stones worth more than $2 billion.

Key Leader: Wesley Tucker, Digital Transformation

Estée Lauder Companies

New York

People care about what they put on their skin, so cosmetics behemoth Estée Lauder Companies is blending blockchain technology with its brands like Aveda to track components such as vanilla extract and pomegranate seed oil, whose supply chains are vulnerable to environmental and labor issues.

Key Leader: Christine Hall, Aveda R&D

ExxonMobil

Irving, Texas

When Exxon contemplates drilling a new oil well with a partner or expanding a joint-venture pipeline, it’s put up for a vote. For the past 100 years this process has involved distributing round after round of paper ballots. Exxon’s pilot project with GuildOne uses Corda blockchain to speed the process, eliminate disputes and save on mailings. Another pilot with the Blockchain for Energy consortium aims to simplify the often complex process of royalty payments to landowners.

Key Leaders: Raj Rapaka, Digital Transformation; Adam Brown, intellectual property counsel

Fidelity

Boston

In November, just as the demise of crypto exchange FTX was panicking investors, solid-as-a-rock mutual fund giant Fidelity, already a digital asset custodian for institutions, announced it would soon let its 36 million retail customers buy and sell bitcoin and ether, commission-free.

Key Leaders: Abigail Johnson, CEO; Tom Jessop, Digital Assets

FIS

Jacksonville, Florida

This large Florida payment processor has been handling debit card transactions for Coinbase customers since 2017. FIS also works with Binance and Kraken, and in 2021 it facilitated $30 billion worth of card-to-crypto transactions (merchants are paid in U.S. dollars out of customers’ crypto balance). In April 2022, it partnered with Circle to let merchants settle with each other using stablecoin USDC, which is pegged one-to-one to the U.S. dollar.

Key Leader: Himal Makwana, Product Strategy and Web3

Franklin Templeton

San Mateo, California

Building on its $100 million Franklin OnChain U.S. Government Money Fund, which is tracked on a blockchain, in April 2022 the $1.4 trillion (assets) asset manager invested an undisclosed sum in Eaglebrook Advisors, a Miami-based startup that creates crypto portfolios (both actively and passively managed) for investment advisors and institutions.

Key Leader: Roger Bayston, Digital Assets

Fujitsu

Tokyo

The electronics powerhouse runs a blockchain innovation lab in Brussels for more than 50 clients including Italian carmaker Iveco and beer giant Anheuser-Busch. In July, it partnered with Tokyo chemical conglomerate Teijin to create a blockchain for manufacturers looking to offset their carbon footprint by using recycled materials. The software verifies the origin of recycled materials and then tracks a firm’s carbon footprint over time—making it difficult to falsify or greenwash data.

Key Leaders: Frederik De Breuck, Enterprise Blockchain Solution Center; Shingo Fujimoto, Fujitsu Research

Genentech

San Francisco

Since 2018, Genentech has been working with blockchain builder Chronicled on MediLedger, a distributed ledger that helps pharma fight counterfeit medicines and increase the speed of drug delivery to patients by enabling manufacturers, distributors and group purchasing organizations quickly process large amounts of product-related data. MediLedger is also being used by companies such as Pfizer, Johnson & Johnson and AstraZeneca.

Key Leader: David Vershure, vice president, channel and contract management

Goldman Sachs

New York

Blockchain is helping the Wall Street titan dramatically speed bond underwriting (see story).

Key Leader: Mathew McDermott, Digital Assets

HSBC

London

The British bank is using blockchain to increase the efficiency of foreign-exchange flows among its global branches. Since 2019, its FX Everywhere platform, which now also includes Wells Fargo, has settled trades with a nominal value of more than $4.6 trillion. Blockchain technology is also enabling HSBC to reduce bond settlement time from about four days to one.

Key Leader: Mark Williamson, FX Trading and Risk Management

Industrial and Commercial Bank of China

Beijing

The $5 trillion (assets) bank has more than 100 blockchain products either rolled out or in development, but its work on Chinese digital currency—RMB smart contracts—stands out for the way in which it helps protect customers’ funds for digital transactions. For example, a villager in Chengdu received his payment in digital RMB through a smart contract that ensured it came through as soon as he had finished planting his quota of trees.

Key Leader: Chaowei Liu, principal manager

JPMorgan

New York

Last Halloween, Onyx, its business unit that focuses on cutting-edge technologies, ran its first decentralized finance transaction on a public blockchain, using Ethereum to exchange Japanese yen for Singaporean dollars. Settlement time dropped from two days to mere seconds, and the tech enabled participants to prove their identities without needing to reveal them on the public blockchain. Additionally, JPMorgan has used blockchain to execute repurchase agreements (see story) and has transferred $25 billion using the JPM Coin network.

Key Leader: Umar Farooq, CEO of Onyx by JPMorgan

Umar Farooq, CEO of Onyx by JPMorgan

JPMORGAN

“We believe blockchain has the potential to rewire the core infrastructure of financial services.”

—Umar Farooq

Kakao

Jeju, South Korea

Despite a roughly 50% drop in NFT sales for the last six months of 2022 versus the previous year, Kakao’s NFT marketplace has 2 million registered users and is available to anyone who uses Kakao Talk, which is about 90% of South Korea’s 52 million people. Around 60 games are in development on Klaytn, Kakao’s blockchain.

Key Leader: Sangmin Seo, Klaytn Foundation

KKR

New York

In September the storied private equity firm partnered with digital asset securities company Securitize to open one of its funds for sale on the Avalanche blockchain, reducing costs to outside investors (see story).

Key Leader: Dan Parant, U.S. Private Wealth

Line

Tokyo

Japan’s leading messenger app helps create NFTs for 26 big customers including SoftBank, South Korea’s Naver search engine and Visa on a new global NFT platform called Dosi. Despite the NFT bust, more than 100,000 people have registered on Dosi as of November 2022 to collect things like images of K-pop stars since September.

Key Leaders: Youngsu Ko, Line Next; Inkyu Lim, Line Xenesis; Woosuk Kim, Line Tech Plus and Line Next

Mastercard

Purchase, New York

The payments company is all in when it comes to Web3. In 2021 it acquired crypto security firm CipherTrace, which fights fraud by identifying risky cryptocurrency transactions. In 2022, 35 crypto companies, including Binance and Nexo, issued debit cards emblazoned with the Mastercard logo (see story).

Key Leader: Raj Dhamodharan, head of crypto and blockchain

Raj Dhamodharan, global head of crypto and blockchain at Mastercard

Mastercard

“We enable people to spend crypto using their Mastercards and help banks understand crypto transactions through our blockchain analytics. When consumers want to cash out to a bank account, our Mastercard Send network enables this. The trust of our network is paramount.”

—Raj Dhamodharan

McCormick & Company

Hunt Valley, Maryland

The spice and seasoning giant is using QR codes connected to a blockchain to ensure that the vanilla it sources from Madagascar is free of any connection to deforestation. So far, the project is limited to France and Switzerland, but the blockchain-traced vanilla still ends up in more than 3,400 stores.

Key Leaders: Clare Menezes, Global Food Integrity & Risk Management; Iwona German, Western Europe marketing director

Meta

Menlo Park, California

Since its October 2021 rebranding, Meta has spent billions on its Reality Labs division attempting to give the “metaverse” a pulse. By CEO Mark Zuckerberg’s own estimation, losses will continue for years. In the here and now, Meta is giving users the tools to create and share (but not buy and sell) their own NFTs across Facebook and Instagram.

Key Leaders: Mark Zuckerberg, CEO; Andrew Bosworth, CTO

National Basketball Association

New York

The league’s Top Shot platform, a digital collectible marketplace, was one of the great early NFT success stories, banking $1 billion–plus in sales since it launched in 2020. Outside of Top Shot, which has seen its trading volume crater to just $3 million in January, the NBA is working to increase fan engagement by handing out free NFTs to all 9,000 fans attending a July WNBA game in Chicago. It also hosts a free NFT fantasy basketball league created by French startup Sorare.

Key Leaders: Adrienne O’Keeffe, Global Partnerships and Media; Amy Brooks, chief innovation officer

Adrienne O’Keeffe, head of digital consumer products at the NBA

National Basketball Association

“The future of basketball and the NBA will be defined by digital innovation and our ability to reach fans on their preferred device and language. We are truly just scratching the surface with regard to what we can accomplish in the Web3 space.”

—Adrienne O’Keeffe

Nike

Beaverton, Oregon

In December 2021, Nike acquired RTKFT, the virtual clothing startup that helped launch Cryptokicks. Collectors can now own both physical and digital versions and wear them in Nikeland in the Roblox metaverse. The sneaker giant’s Cryptokicks “forges” NFTs to its shoes by fitting each pair with a tiny chip linked to a blockchain. Next up: Swoosh, which will let customers design—and trade—their own digital kicks.

Key Leaders: Steven Vasilev, Benoit Pagotto and Chris Le, RTFKT cofounders

Steven Vasilev, cofounder of RTFKT

NIKE

“The future will be built by internet/technology native kids. We aim to empower the next generation of creators and democratize access through creation. In the future people will care more about their virtual items than their physical items.”

—Steven Vasilev

NTT

Tokyo

The data and IT consulting subsidiary of Nippon Telephone & Telegraph, NTT Data, helped create an interbank reconciliation tool for Italian lenders called Spunta Banca. Built on the Corda distributed ledger platform and coordinated by ABI Lab, the research and innovation centre of the Italian Banking Association, it has handled 623 million transactions for roughly 100 Italian banks since March 2020, performing real-time checkups to ensure there are no mismatches in bank transfers.

Key Leader: Shinichi Yamashita, Blockchain Strategy

Oracle

Austin, Texas

India’s Delhi University awarded digital degrees to 170,000 students in 2022 and distributed the diplomas on a blockchain to ensure authenticity. Keep Sea Blue, a nonprofit based in Athens, Greece, helps partners verify removed and recycled plastic waste from the Mediterranean via a blockchain. Global Shipping Business Network, a consortium whose members handle one in every three shipping containers in the world, increases the efficiency and visibility of shipments. All used Oracle’s OCI Blockchain Platform.

Key Leader: Wei Hu, High Availability Technologies

PayPal

San Jose, California

The payment giant, which started offering access to crypto in October 2020, charges as little as 49 cents for smaller transactions. Crypto users, according to the company, visit PayPal twice as frequently as other users. It invested in Aptos Labs, parent of fast blockchain Aptos, created by Facebook veterans, last spring.

Key Leader: Dan Schulman, CEO

Repsol

Madrid

Spain’s oil giant is building a platform called VEIA Digitalis, which enables users to store things like driver’s licenses, security badges and passports in a blockchain-based “self-sovereign” wallet. The point is to allow people—mostly Europeans who live in government-intensive societies—to control which parts of their identity they want to share, and with whom. The project began in 2019 through Repsol’s work with the global blockchain consortium Alastria.

Key Leader: Nuria Avalos, digital consortium director

Robinhood

San Francisco

The zero-commission broker offers crypto trading to 23 million accounts, and as of last September, the company was a custodian for $9.4 billion worth of crypto. Robinhood Wallet is its proprietary Web3-friendly self-custody wallet for users who want to have full control of their assets, which more do in the wake of the FTX bankruptcy. More FTX fun: Some 7% of Robinhood stock tied to Sam Bankman-Fried was seized by the Department of Justice in January.

Key Leaders: Vlad Tenev, CEO; Johann Kerbrat, GM of Robinhood Crypto

Samsung Group

Seoul

It’s best known for smartphones and flat screens, but Samsung is also a leader in developing blockchain products and services. For example, AIA, the largest insurance company in the Asia-Pacific region, uses Samsung SDS’s blockchain Nexledger to quickly access clients’ personal information and process consent forms including insurance agents’ electronic signatures, reducing related costs by more than half. More than 150,000 Samsung employees use the in-house blockchain service to store things like product design documents and salary contracts; one big benefit is that they can’t be easily altered or deleted.

Key Leader: Yoensoo Kim, Blockchain Development Team Leader

Signature Bank

New York

Signet, Signature Bank’s Ethereum-based payments network for commercial customers, instantaneously processed $464 billion worth of digital transactions last year. One-fifth of Signet’s 2022 volume came from the logistics industry. Due to market volatility, the bank capped its crypto deposits at 20% of its total assets under management.

Key Leader: Frank Santora, chief payments officer

Société Générale

Paris

The financial giant is helping other institutions use public blockchains to record information about who owns registered bonds. In October it became the first bank in France to receive permission to handle assets issued on a blockchain.

Key Leader: Jonathan Benichou, CFO, SG Forge

Sotheby’s

New York

The NFT market is in a depression, but Sotheby’s still has a dedicated team of 20 focused on digital collectibles. It will soon launch a curated secondary market built on Ethereum and Polygon in which a rotating list of ten handpicked artists will sell their NFTs, with Sotheby’s taking a cut.

Key Leaders: Stefan Pepe, CTO; Sebastian Fahey, Sotheby’s Metaverse

Tech Mahindra

Pune, India

This IT conglomerate has partnered with ten major Indian telecoms—which collectively provide service to 1 billion customers—to use blockchain to fight spam calls and unwanted texts. If one telecom operator receives a complaint, all operators are alerted—and thanks to the magic of blockchain they don’t need to share sensitive customer info.

Key Leader: Rajesh Dhuddu, Blockchain and Metaverse

Rajesh Dhuddu, SVP and global business head, blockchain and metaverse at Tech Mahindra

Tech Mahindra

“We continue to work hard to further empower individual users to not only safeguard their individual data but also have complete control over who accesses it and how it gets democratized and monetized.”

—Rajesh Dhuddu

Tencent

Shenzhen, China

The owner of China’s ubiquitous social platform WeChat is using blockchain tech to help Chinese companies cut costs and speed up business. Using Tencent’s software, thousands of Chinese companies have been able to move their products through customs up to 50% faster. Additionally, about 400 million users in nearly a dozen Chinese cities use Tencent’s blockchain to pay taxes, settle medical bills and even process donations.

Key Leader: Powell Li, Tencent Cloud Blockchain

Ticketmaster

Los Angeles

Through its NFL partnership, Ticketmaster is giving football fans who attend games commemorative NFTs—a blockchain option for avid ticket collectors.

Key Leader: Brendan Lynch, Enterprise and Revenue

Visa

San Francisco

Like Mastercard, Visa allows users to pay with their crypto holdings. Some of the cards even offer cash-back or, bitcoin-back deals. It rolled out 10 cards last year, including one for now-bankrupt FTX. Five were from entities outside the U.S., including Ripio and Lemon Cash in Argentina.

Key Leader: Cuy Sheffield, VP Crypto

Walmart

Bentonville, Arkansas

America’s superstore—and largest grocer—uses blockchain to track the farm-to-store journey of 1,500 food products from 70 suppliers, which makes it easier to spot cases of contamination or spoilage. Walmart is also experimenting with blockchain-based invoices, which quicken the process from some three months to near real time.

Key Leaders: Archana Sristy, Blockchain Platforms; Tejas Bhatt, Global Food Safety Innovation

Archana Sristy, senior director II, blockchain platforms, Walmart Global Tech

Walmart

“Customer trust and safety are paramount; that’s why we’re committed to developing industry-leading blockchain platforms that allow us to quickly identify potentially contaminated products at any point of their journey across our entire supply chain ecosystem.”

—Archana Sristy

Warner Music Group

New York

The label behind Lizzo and Chris Stapleton is working with blockchain game developer Splinterlands (1.8 million users) to create arcade-style games that reward players with in-game items and a cryptocurrency called dark energy crystals, which has a market value of some $700 million.

Key Leader: Oana Ruxandra, chief digital officer

WeBank

Shenzhen, China

To process loans, banks typically require customers to produce reams of documents including titles and credit reports. It’s an area of friction in finance. WeBank’s new information verification platform, launched in April and used by roughly 2.5 million people, connects the notary office and borrowers via a single blockchain-based network to speed up and improve the application process. Approval rates for online auto loans requested by car buyers, for one, have gone from 20% to 80%.

Key Leader: Henry Ma, CIO

Wipro

Bengaluru, India

The Indian technology and consulting firm has created a blockchain platform that combats data tampering to help prevent identity fraud. Since September, some 1.6 million people have used it to share information with banks, colleges and other organizations.

Key Leader: Varun Dube, Blockchain

MORE FROM FORBES

ForbesHow Mastercard, Goldman Sachs And Other “TradFi” Titans Are Using Blockchain To Rewire Global FinanceBy Nina BambyshevaForbesOver $3 Billion Stolen In Crypto Heists: Here Are The Eight BiggestBy Nina BambyshevaForbesInside Tether, Crypto’s (So Far) Unbreakable BuckBy Steven EhrlichForbesFallen Unicorns: Startup Billionaires Nearly $100 Billion Poorer Than A Year AgoBy Matt DurotForbesA Quick Remedy Proves Elusive For Lifesaving Pulse Oximeter’s Problems With Darker SkinBy Amy FeldmanForbesThe Only Thing Better Than An Elite Quarterback Is An Inexpensive Elite QuarterbackBy Matt Craig

Tech

Harvard Alumni, Tech Moguls, and Best-Selling Authors Drive Nearly $600 Million in Pre-Order Sales

BlockDAG Network’s history is one of innovation, perseverance, and a vision to push the boundaries of blockchain technology. With Harvard alumni, tech moguls, and best-selling authors at the helm, BlockDAG is rewriting the rules of the cryptocurrency game.

CEO Antony Turner, inspired by the successes and shortcomings of Bitcoin and Ethereum, says, “BlockDAG leverages existing technology to push the boundaries of speed, security, and decentralization.” This powerhouse team has led a staggering 1,600% price increase in 20 pre-sale rounds, raising over $63.9 million. The secret? Unparalleled expertise and a bold vision for the future of blockchain.

Let’s dive into BlockDAG’s success story and find out what the future holds for this cryptocurrency.

The Origin: Why BlockDAG Was Created

In a recent interview, BlockDAG CEO Antony Turner perfectly summed up why the market needs BlockDAG’s ongoing revolution. He said:

“The creation of BlockDAG was inspired by Bitcoin and Ethereum, their successes and their shortcomings.

If you look at almost any new technology, it is very rare that the first movers remain at the forefront forever. Later incumbents have a huge advantage in entering a market where the need has been established and the technology is no longer cutting edge.

BlockDAG has done just that: our innovation is incorporating existing technology to provide a better solution, allowing us to push the boundaries of speed, security, and decentralization.”

The Present: How Far Has BlockDAG Come?

BlockDAG’s presale is setting new benchmarks in the cryptocurrency investment landscape. With a stunning 1600% price increase over 20 presale lots, it has already raised over $63.9 million in capital, having sold over 12.43 billion BDAG coins.

This impressive performance underscores the overwhelming confidence of investors in BlockDAG’s vision and leadership. The presale attracted over 20,000 individual investors, with the BlockDAG community growing exponentially by the hour.

These monumental milestones have been achieved thanks to the unparalleled skills, experience and expertise of BlockDAG’s management team:

Antony Turner – Chief Executive Officer

Antony Turner, CEO of BlockDAG, has over 20 years of experience in the Fintech, EdTech, Travel and Crypto industries. He has held senior roles at SPIRIT Blockchain Capital and co-founded Axona-Analytics and SwissOne. Antony excels in financial modeling, business management and scaling growth companies, with expertise in trading, software, IoT, blockchain and cryptocurrency.

Director of Communications

Youssef Khaoulaj, CSO of BlockDAG, is a Smart Contract Auditor, Metaverse Expert, and Red Team Hacker. He ensures system security and disaster preparedness, and advises senior management on security issues.

advisory Committee

Steven Clarke-Martin, a technologist and consultant, excels in enterprise technology, startups, and blockchain, with a focus on DAOs and smart contracts. Maurice Herlihy, a Harvard and MIT graduate, is an award-winning computer scientist at Brown University, with experience in distributed computing and consulting roles, most notably at Algorand.

The Future: Becoming the Cryptocurrency with the Highest Market Cap in the World

Given its impressive track record and a team of geniuses working tirelessly behind the scenes, BlockDAG is quickly approaching the $600 million pre-sale milestone. This crypto powerhouse will soon enter the top 30 cryptocurrencies by market cap.

Currently trading at $0.017 per coin, BlockDAG is expected to hit $1 million in the coming months, with the potential to hit $30 per coin by 2030. Early investors have already enjoyed a 1600% ROI by batch 21, fueling a huge amount of excitement around BlockDAG’s presale. The platform is seeing significant whale buying, and demand is so high that batch 21 is almost sold out. The upcoming batch is expected to drive prices even higher.

Invest in BlockDAG Pre-Sale Now:

Pre-sale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetwork

Discord: Italian: https://discord.gg/Q7BxghMVyu

No spam, no lies, just insights. You can unsubscribe at any time.

Tech

How Karak’s Latest Tech Integration Could Make Data Breaches Obsolete

- Space and Time uses zero-knowledge proofs to ensure secure and tamper-proof data processing for smart contracts and enterprises.

- The integration facilitates faster development and deployment of Distributed Secure Services (DSS) on the Karak platform.

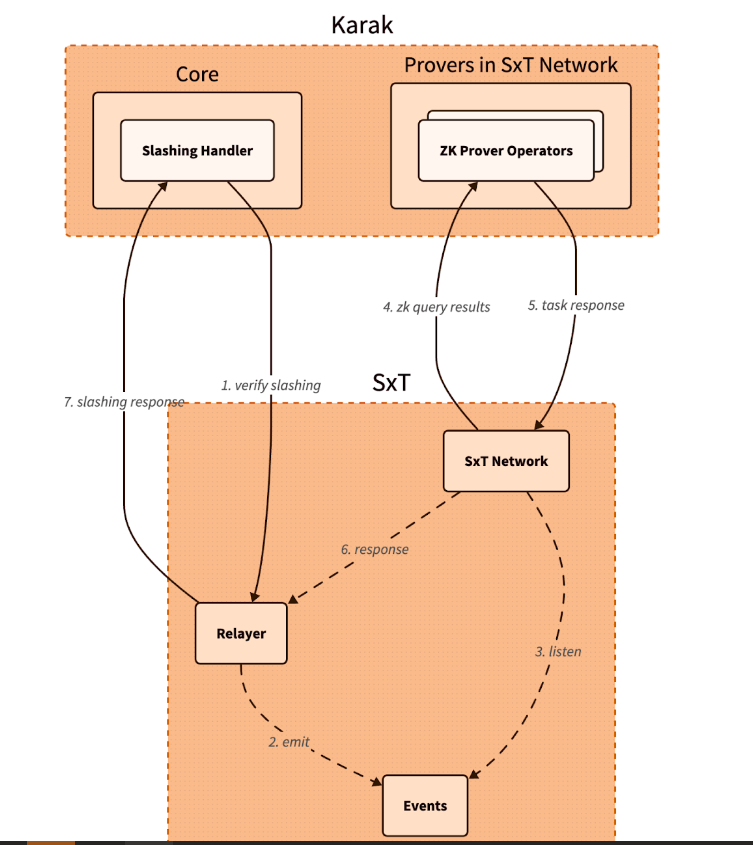

Karak, a platform known for its strong security capabilities, is enhancing its Distributed Secure Services (DSS) by integrating Space and Time as a zero-knowledge (ZK) coprocessor. This move is intended to strengthen trustless operations across its network, especially in slashing and rewards mechanisms.

Space and Time is a verifiable processing layer that uses zero-knowledge proofs to ensure that computations on decentralized data warehouses are secure and untampered with. This system enables smart contracts, large language models (LLMs), and enterprises to process data without integrity concerns.

The integration with Karak will enable the platform to use Proof of SQL, a new ZK-proof approach developed by Space and Time, to confirm that SQL query results are accurate and have not been tampered with.

One of the key features of this integration is the enhancement of DSS on Karak. DSS are decentralized services that use re-staked assets to secure the various operations they provide, from simple utilities to complex marketplaces. The addition of Space and Time technology enables faster development and deployment of these services, especially by simplifying slashing logic, which is critical to maintaining security and trust in decentralized networks.

Additionally, Space and Time is developing its own DSS for blockchain data indexing. This service will allow community members to easily participate in the network by running indexing nodes. This is especially beneficial for applications that require high security and decentralization, such as decentralized data indexing.

The integration architecture follows a detailed and secure flow. When a Karak slashing contract needs to verify a SQL query, it calls the Space and Time relayer contract with the required SQL statement. This contract then emits an event with the query details, which is detected by operators in the Space and Time network.

These operators, responsible for indexing and monitoring DSS activities, validate the event and route the work to a verification operator who runs the query and generates the necessary ZK proof.

The result, along with a cryptographic commitment on the queried data, is sent to the relayer contract, which verifies and returns the data to the Karak cutter contract. This end-to-end process ensures that the data used in decision-making, such as determining penalties within the DSS, is accurate and reliable.

Karak’s mission is to provide universal security, but it also extends the capabilities of Space and Time to support multiple DSSs with their data indexing needs. As these technologies evolve, they are set to redefine the secure, decentralized computing landscape, making it more accessible and efficient for developers and enterprises alike. This integration represents a significant step towards a more secure and verifiable digital infrastructure in the blockchain space.

Website | X (Twitter) | Discord | Telegram

No spam, no lies, just insights. You can unsubscribe at any time.

Tech

Cryptocurrency Payments: Should CFOs Consider This Ferrari-Approved Trend?

Iconic Italian luxury carmaker Ferrari has announced the expansion of its cryptocurrency payment system to its European dealer network.

The move, which follows a successful launch in North America less than a year ago, raises a crucial question for CFOs across industries: Is it time to consider accepting cryptocurrency as a form of payment for your business?

Ferrari’s move isn’t an isolated one. It’s part of a broader trend of companies embracing digital assets. As of 2024, we’re seeing a growing number of companies, from tech giants to traditional retailers, accepting cryptocurrencies.

This change is determined by several factors:

- Growing mainstream adoption of cryptocurrencies

- Growing demand from tech-savvy and affluent consumers

- Potential for faster and cheaper international transactions

- Desire to project an innovative brand image

Ferrari’s approach is particularly noteworthy. They have partnered with BitPay, a leading cryptocurrency payment processor, to allow customers to purchase vehicles using Bitcoin, Ethereum, and USDC. This satisfies their tech-savvy and affluent customer base, many of whom have large digital asset holdings.

Navigating Opportunities and Challenges

Ferrari’s adoption of cryptocurrency payments illustrates several key opportunities for companies considering this move. First, it opens the door to new customer segments. By accepting cryptocurrency, Ferrari is targeting a younger, tech-savvy demographic—people who have embraced digital assets and see them as a legitimate form of value exchange. This strategy allows the company to connect with a new generation of affluent customers who may prefer to conduct high-value transactions in cryptocurrency.

Second, cryptocurrency adoption increases global reach. International payments, which can be complex and time-consuming with traditional methods, become significantly easier with cryptocurrency transactions. This can be especially beneficial for businesses that operate in multiple countries or deal with international customers, as it potentially reduces friction in cross-border transactions.

Third, accepting cryptocurrency positions a company as innovative and forward-thinking. In today’s fast-paced business environment, being seen as an early adopter of emerging technologies can significantly boost a brand’s image. Ferrari’s move sends a clear message that they are at the forefront of financial innovation, which can appeal to customers who value cutting-edge approaches.

Finally, there is the potential for cost savings. Traditional payment methods, especially for international transactions, often incur substantial fees. Cryptocurrency transactions, on the other hand, can offer lower transaction costs. For high-value purchases, such as luxury cars, these savings could be significant for both the business and the customer.

While the opportunities are enticing, accepting cryptocurrency payments also presents significant challenges that businesses must address. The most notable of these is volatility. Cryptocurrency values can fluctuate dramatically, sometimes within hours, posing potential risk to businesses that accept them as payment. Ferrari addressed this challenge by implementing a system that instantly converts cryptocurrency received into traditional fiat currencies, effectively mitigating the risk of value fluctuations.

Regulatory uncertainty is another major concern. The legal landscape surrounding cryptocurrencies is still evolving in many jurisdictions around the world. This lack of clear and consistent regulations can create compliance challenges for companies, especially those operating internationally. Companies must remain vigilant and adaptable as new laws and regulations emerge, which can be a resource-intensive process.

Implementation costs are also a significant obstacle. Integrating cryptocurrency payment systems often requires substantial investment in new technology infrastructure and extensive staff training. This can be especially challenging for small businesses or those with limited IT resources. The costs are not just financial; a significant investment of time is also required to ensure smooth implementation and operation.

Finally, security concerns loom large in the world of cryptocurrency transactions. While blockchain technology offers some security benefits, cryptocurrency transactions still require robust cybersecurity measures to protect against fraud, hacks, and other malicious activity. Businesses must invest in robust security protocols and stay up-to-date on the latest threats and protections, adding another layer of complexity and potential costs to accepting cryptocurrency payments.

Strategic Considerations for CFOs

If you’re thinking of following in Ferrari’s footsteps, here are the key factors to consider:

- Risk Assessment: Carefully evaluate potential risks to your business, including financial, regulatory, and reputational risks.

- Market Analysis: Evaluate whether your customer base is significantly interested in using cryptocurrencies for payments.

- Technology Infrastructure: Determine the costs and complexities of implementing a cryptographic payment system that integrates with existing financial processes.

- Regulatory Compliance: Ensure that cryptocurrency acceptance is in line with local regulations in all markets you operate in. Ferrari’s gradual rollout demonstrates the importance of this consideration.

- Financial Impact: Analyze how accepting cryptocurrency could impact your cash flow, accounting practices, and financial reporting.

- Partnership Evaluation: Consider partnering with established crypto payment processors to reduce risk and simplify implementation.

- Employee Training: Plan comprehensive training to ensure your team is equipped to handle cryptocurrency transactions and answer customer questions.

While Ferrari’s adoption of cryptocurrency payments is exciting, it’s important to consider this trend carefully.

A CFO’s decision to adopt cryptocurrency as a means of payment should be based on a thorough analysis of your company’s specific needs, risk tolerance, and strategic goals. Cryptocurrency payments may not be right for every business, but for some, they could provide a competitive advantage in an increasingly digital marketplace.

Remember that the landscape is rapidly evolving. Stay informed about regulatory changes, technological advancements, and changing consumer preferences. Whether you decide to accelerate your crypto engines now or wait in the pit, keeping this payment option on your radar is critical to navigating the future of business transactions.

Was this article helpful?

Yes No

Sign up to receive your daily business insights

Tech

Bitcoin Tumbles as Crypto Market Selloff Mirrors Tech Stocks’ Plunge

The world’s largest cryptocurrency, Bitcoin (BTC), suffered a significant price decline on Wednesday, falling below $65,000. The decline coincides with a broader market sell-off that has hit technology stocks hard.

Cryptocurrency Liquidations Hit Hard

CoinGlass data reveals a surge in long liquidations in the cryptocurrency market over the past 24 hours. These liquidations, totaling $220.7 million, represent forced selling of positions that had bet on price increases. Bitcoin itself accounted for $14.8 million in long liquidations.

Ethereum leads the decline

Ethereal (ETH), the second-largest cryptocurrency, has seen a steeper decline than Bitcoin, falling nearly 8% to trade around $3,177. This decline mirrors Bitcoin’s price action, suggesting a broader market correction.

Cryptocurrency market crash mirrors tech sector crash

The cryptocurrency market decline appears to be linked to the significant losses seen in the U.S. stock market on Wednesday. Stock market listing The index, heavily weighted toward technology stocks, posted its sharpest decline since October 2022, falling 3.65%.

Analysts cite multiple factors

Several factors may have contributed to the cryptocurrency market crash:

- Tech earnings are underwhelming: Earnings reports from tech giants like Alphabet are disappointing (Google(the parent company of), on Tuesday, triggered a sell-off in technology stocks with higher-than-expected capital expenditures that could have repercussions on the cryptocurrency market.

- Changing Political Landscape: The potential impact of the upcoming US elections and changes in Washington’s policy stance towards cryptocurrencies could influence investor sentiment.

- Ethereal ETF Hopes on the line: While bullish sentiment around a potential U.S. Ethereum ETF initially boosted the market, delays or rejections could dampen enthusiasm.

Analysts’ opinions differ

Despite the short-term losses, some analysts remain optimistic about Bitcoin’s long-term prospects. Singapore-based cryptocurrency trading firm QCP Capital believes Bitcoin could follow a similar trajectory to its post-ETF launch all-time high, with Ethereum potentially converging with its previous highs on sustained institutional interest.

Rich Dad Poor Dad Author’s Prediction

Robert Kiyosaki, author of the best-selling Rich Dad Poor Dad, predicts a potential surge in the price of Bitcoin if Donald Trump is re-elected as US president. He predicts a surge to $105,000 per coin by August 2025, fueled by a weaker dollar that is set to boost US exports.

BTC/USD Technical Outlook

Bitcoin price is currently trading below key support levels, including the $65,500 level and the 100 hourly moving average. A break below the $64,000 level could lead to further declines towards the $63,200 support zone. However, a recovery above the $65,500 level could trigger another increase in the coming sessions.

-

Videos4 weeks ago

Videos4 weeks agoAbsolutely massive: the next higher Bitcoin leg will shatter all expectations – Tom Lee

-

News12 months ago

News12 months agoVolta Finance Limited – Director/PDMR Shareholding

-

News12 months ago

News12 months agoModiv Industrial to release Q2 2024 financial results on August 6

-

News12 months ago

News12 months agoApple to report third-quarter earnings as Wall Street eyes China sales

-

News12 months ago

News12 months agoNumber of Americans filing for unemployment benefits hits highest level in a year

-

News1 year ago

News1 year agoInventiva reports 2024 First Quarter Financial Information¹ and provides a corporate update

-

News1 year ago

News1 year agoLeeds hospitals trust says finances are “critical” amid £110m deficit

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Hit $100 Billion in 2024, Fueling Insane Investor Optimism ⋆ ZyCrypto

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Videos1 year ago

Videos1 year ago$1,000,000 worth of BTC in 2025! Get ready for an UNPRECEDENTED PRICE EXPLOSION – Jack Mallers

-

Videos1 year ago

Videos1 year agoABSOLUTELY HUGE: Bitcoin is poised for unabated exponential growth – Mark Yusko and Willy Woo

-

Tech1 year ago

Tech1 year agoBlockDAG ⭐⭐⭐⭐⭐ Review: Is It the Next Big Thing in Cryptocurrency? 5 questions answered