News

Fourth of July fight fiasco: How a Jack Dempsey title bout KO’d a tiny Montana town’s finances

If you’re looking for the spot where Jack Dempsey defended the world heavyweight title against Tommy Gibbons in a fight that brought financial ruin upon an entire town on July 4, 1923, the directions are simple.

Head north on I-15. Keep going until the signs start listing the mileage to various cities in Canada. Then exit in Shelby, Montana, and follow Main Street along the railroad tracks.

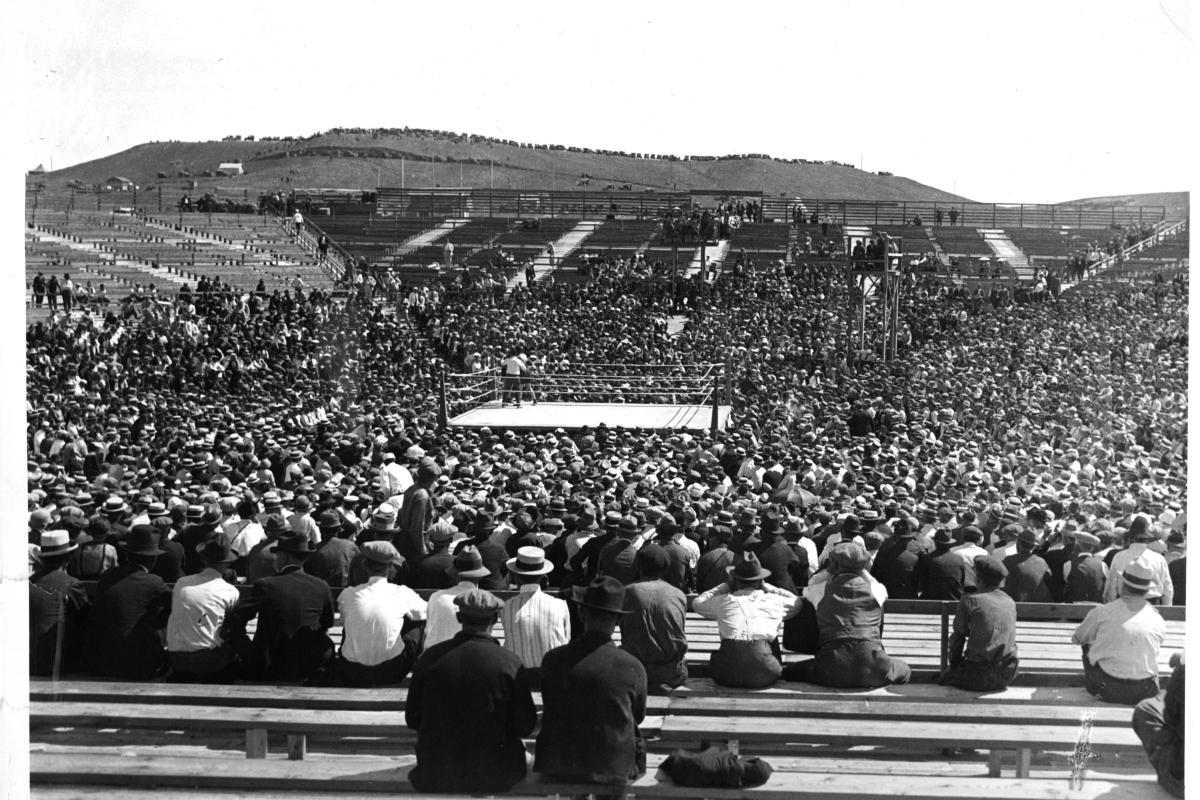

You won’t miss it. There behind the Pizza Hut you’ll see Champions Park with the metal silhouettes of two boxers facing off in the middle. That’s supposed to be them, Dempsey and Gibbons.

On one side stands one of the most famous athletes of the 1920s, a man who would have to literally run out of town by the time the fight was over. On the other side stands a guy who was only promised enough to cover his training expenses in a clash for the heavyweight title.

This park marks the spot where a hastily built arena once stood. The plaques surrounding the two metallic figures tell the story, from “the set up” to “the con,” of how their Fourth of July fight 101 years ago resulted in one of the worst economic disasters in boxing history.

It started almost as a joke. In the early 1920s, oil strikes around this region of central Montana had made the locals overly optimistic about boom times to come. A wildcatter named Gordon Campbell struck oil with the Discovery Well in 1922, and soon people began hailing Montana’s Toole County as “the Tulsa of the West.” Those people were mostly the ones already living in Toole County, with their eyes full of dollar signs at the thought of everything the oil business might soon bring their way.

That oil brought an influx of people to Shelby, the county seat. Oil workers and their families came in waves, and with wages to spend, which translated to opportunity for would-be real estate developer James “Body” Johnson, son of Shelby mayor James A. Johnson.

To the younger Johnson, the combination of Shelby’s nascent oil industry and its location along the railroad line made the town a prime candidate for rapid, profitable growth. All it needed was some positive press to nudge things forward.

So when Johnson read a newspaper story about the city of Montreal offering $100,000 in a bid to host Dempsey’s next heavyweight title defense, he got what he must have thought was a brilliant idea. Johnson wired a message directly to Jack “Doc” Kearns, Dempsey’s manager, offering to double Montreal’s price in order to bring the fight to Shelby.

Champions Park in Shelby, Montana, commemorates the July 4, 1923, heavyweight title fight between Jack Dempsey and Tommy Gibbons. (Ben Fowlkes/Yahoo Sports)

Champions Park in Shelby, Montana, commemorates the July 4, 1923, heavyweight title fight between Jack Dempsey and Tommy Gibbons. (Ben Fowlkes/Yahoo Sports)

Dempsey and ‘Doc’

Johnson, didn’t know it, but from the moment he reached out to Kearns he was in over his head. As he wrote later in a slim volume titled “The Fight That Won’t Stay Dead,” the whole thing was meant to be “nothing but a publicity stunt.”

His hope was that, just as Montreal had made newspaper headlines with its six-figure offer, Shelby would get similar press for doubling it. He didn’t think there was much danger of Dempsey’s manager taking him up on the offer. Shelby was a tiny town in north-central Montana with one hotel, two banks and zero arenas or stadiums in which to hold the fight. Who would possibly agree to bring a world heavyweight title fight there?

But Johnson didn’t fully understand who he was dealing with. Kearns had traveled an interesting and often criminal path en route to getting his hands on boxing’s biggest draw. Before he ever met Dempsey he’d already been either accused or convicted of offenses ranging from fight-fixing, forgery, running crooked gambling operations, embezzlement and all manner of grifting. He was even rumored to have kidnapped sled dogs during a stint in Alaska. Later, his mere involvement in some fight sports enterprises was enough to get the venues raided by police.

As a manager of various small-time boxers, Kearns developed a routine of discarding one fighter for whomever beat him. This is how he found Dempsey, who had spent much of his career to that point as essentially a boxing hobo, drifting between various Western mining towns and fighting whomever he could for whatever money the locals could scrounge up.

A favorite technique of Dempsey’s was to walk into a saloon and loudly declare: “I can’t sing and I can’t dance, but I can lick any son of a bitch in the house.” Then, if anyone could be found who might disagree, a hat was literally passed until it filled up with enough money to make it worthwhile for the two principals to fight over it — winner take all.

Funny story: Jack Dempsey wasn’t even Jack Dempsey at first. He was born William Harrison Dempsey in June of 1895 in Manassa, Colorado. His older brother sometimes fought under the name Jack Dempsey, hoping to draw some attention by conjuring people’s memories of “Nonpareil” Jack Dempsey, the Irish-born middleweight champion of the late 19th century.

But after his brother backed out of a scheduled fight in the Colorado mining town of Cripple Creek, the younger Dempsey stepped in to replace him, fighting under the same name. This didn’t fool people, and the promoter of the fight was displeased, but the skinny kid fighting under the name Jack Dempsey proved out, battering his opponent en route to a referee stoppage, which was uncommon at the time.

“In those days they didn’t stop mining town fights as long as one guy could move,” Dempsey later recalled in one of several autobiographies. (My personal favorite, “Dempsey,” also has the advantage of a fantastic opening line: “I am William Harrison Dempsey, a Jack Mormon, ex-heavyweight champion of the world, rich in friends, richer in loved ones, comfortable in the world’s goods.”)

Dempsey’s early career was marked by furious, frequent brawls and predatory managers. More than once he hopped a train into town, earned a small pile of money with his fists, then woke up the next morning to find that his manager had taken that pile and hopped a train elsewhere without him.

(L-R) Jack Dempsey and his manager, Jack Kearns, in New York on Feb. 10, 1919. (George Rinhart via Getty Images)

(L-R) Jack Dempsey and his manager, Jack Kearns, in New York on Feb. 10, 1919. (George Rinhart via Getty Images)

Kearns was far from an honest manager, but at least Dempsey’s career prospects improved in his care. Dempsey had essentially been run out of Utah after a first-round knockout loss to “Fireman” Jim Flynn resulted in accusations of a fix. Dempsey always denied this, at times suggesting instead that the suspiciously early knockout was the result of Flynn clocking him when he went to touch gloves at the start of the fight. About 40 fights and a little over two years later, Dempsey became the heavyweight champ after beating Jess Willard on July 4, 1919.

It’s those championship years from 1919-26 that people remember best about Dempsey’s career, but they comprised a relatively small slice of it. He fought fewer than 10 bouts after becoming champ, compared with at least 75 fights leading up to it. But with help from Kearns and New York-based promoter Tex Rickard, he became a legitimate sports superstar in the Roaring ’20s, one of the nation’s few instantly recognizable sports figures.

The idea of bidding for the right to host a Dempsey fight began to seem like a good idea after his 1921 title defense against France’s Georges Carpentier (delightfully nicknamed “The Orchid Man”) in Jersey City, New Jersey, broke records with boxing’s first million-dollar gate. Time magazine later put the live gate total of the fight at $1,789,238. (Rickard’s cut of this was said to be around $550,000, equivalent to about $9.6 million today.)

For almost the entirety of his title reign, Dempsey was box office gold. The first five million-dollar gates in boxing were all Dempsey fights. No fight eclipsed $1,000,000 in live gate again until Joe Louis vs. Max Baer in 1935. In fact, from Dempsey’s fight with Carpentier until his retirement in 1927, only one of his fights brought in under seven figures.

That fight, of course, happened in Shelby, Montana.

‘The financial ruin of many Montana citizens’

Johnson had never really intended to pay $200,000 to bring the fight to Shelby. That’s because, for starters, he didn’t have the money. When word of his offer began to circulate, Montana Gov. Joseph Dixon chided him for it, reportedly saying, “Hell, man, there isn’t that much money in the whole state of Montana.”

But after pitching the idea to several area banks and other investors, Johnson managed to gather $100,000. This he gave to Loy Molumby, a lawyer and World War I pilot who also served as the commander of the Montana American Legion, which had agreed to sanction the fight. Molumby traveled to meet with Kearns, and by the time he returned (after supposedly being wined and dined by the famously hard-partying Kearns), the financial commitment to secure the bout had gone up to $300,000.

Kearns and Dempsey had agreed to accept the money in three installments, but the backers in Shelby struggled mightily to come up with even the second payment. With the fight scheduled for July 4, a deadline of June 15 had been set for payment of the second $100,000 sum.

In what was part fundraising tour and part publicity campaign, Johnson hopped in a plane piloted by the former WWI ace Molumby and flew to American Legion posts all over Montana to boost ticket sales and investment in the fight. That plan seemed to be working, but while returning from the town of Livingston in southwest Montana in early June, the plane crashed. Johnson and Molumby were injured but lucky to escape with their lives.

The plane crash stalled the fundraising efforts just prior to the deadline. Dempsey had already set up his training camp for the fight in the nearby city of Great Falls, about 85 miles south of Shelby. When the second payment didn’t arrive on time, Dempsey began considering alternatives.

As he told newspaper reporter Maxwell Stiles years later, he was “already having trouble with Jack Kearns and had made up my mind to retire when this fight came up.” From the start, Dempsey claimed he didn’t believe there could possibly be so much money in a fight held in the middle of Montana. This, he said, was why he insisted on guaranteed payments in advance.

“Despite an oil and real estate boom, no second $100,000 was forthcoming when it was due,” Dempsey said. “So now the promoters brought the American Legion into the thing for a percentage of the profits, though they knew there would not be any profits and so did I. They had no way of handling the people. The town had only one main street and housing for the fans was nonexistent.”

Dempsey reached out to Rickard, who had a 10-year lease of Madison Square Garden. Rickard offered to move the fight to New York and refund the $100,000 payment that Montanans had already provided.

“I told these people Rickard’s proposition,” Dempsey said. “They said no, the fight will be in Montana. Kearns got tough about then and they came up with the second $100,000. But when the final $100,000 came due there just was no more money.”

As the Fourth of July grew near, the missed payments became a bigger story than the fight. Kearns told newspaper reporters that the fight was off, then back on, then off again. The uncertainty killed ticket sales, especially since the financial success of the bout was dependent on fight fans traveling from far away to attend an event in a place that had no other forms of entertainment or even reasonable accommodation to offer.

By this point, a lot had already been invested in making that plan feasible. The Great Northern Railway had laid miles of extra track and booked somewhere in the neighborhood of $500,000 in ticket reservations. Over 200 carpenters had worked frantically to build an enormous open-air arena in Shelby, all in less than two months. As word spread that the fight was in jeopardy, all this work seemed like it might be for nothing.

“Trains had been canceled and I was blamed for this circumstance that contributed to what they called the financial ruin of many Montana citizens,” Dempsey said.

Kearns, on the other hand, was known to brag for years afterward that he’d swindled and ruined multiple Montana banks in the deal. Remorse never seemed able to find the man.

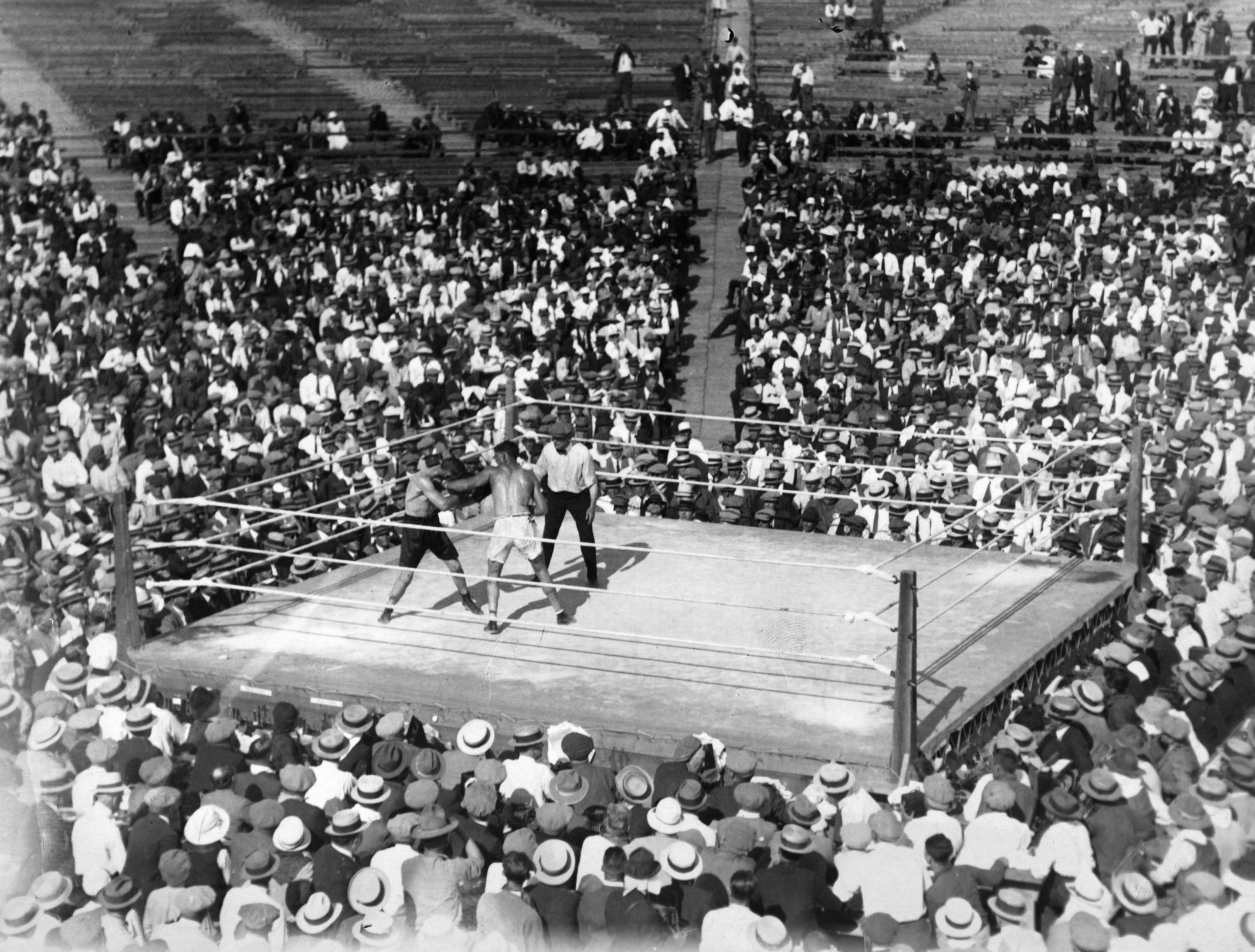

A wide view of the heavyweight title fight between Jack Dempsey (R) and Tommy Gibbons on July 4, 1923, in Shelby, Montana. (The Ring Magazine via Getty Images)

A wide view of the heavyweight title fight between Jack Dempsey (R) and Tommy Gibbons on July 4, 1923, in Shelby, Montana. (The Ring Magazine via Getty Images)

‘If you don’t have the guts to rush the gates, then stay the hell out!’

The Montana backers of the fight tried everything they could think of to keep the fight together, including offering to pay a portion of the guarantee in the form of sheep. Dempsey and Kearns grew increasingly angry at how the event was shaping up. When Dempsey grumbled about it to reporters from his training camp in Great Falls, it did not endear him to fans in Shelby, who came to regard him as a rich, spoiled professional athlete. The enmity was mutual.

“I was mad at the Shelby people for having turned down Rickard’s offer to get them off the hook and for expecting me, after that, to go on with the fight without my money,” Dempsey told newspaper reporters later. “So Kearns and I demanded the final $100,000 and when it was not forthcoming, Kearns called the fight off at 2:30 in the morning. After a couple hours the fight was on again and we agreed to gamble on the gate by taking in the first money to come in toward our third portion of the [$300,000]. When I arrived in Shelby at 10:30 a.m. I was met by a hostile crowd calling me ‘slacker’ and all sorts of names for my having demanded my money.”

The slacker accusation was a sore spot for Dempsey. He’d been accused of avoiding military service during World War I while continuing to box professionally. He was later cleared of any wrongdoing after proving that he’d received a hardship exemption from the U.S. Army, but the slacker claim remained a favorite epithet for Dempsey detractors even years later.

By contrast, Gibbons showed up on fight day as something close to a local hero. Unlike Dempsey, he’d opted to set up his training camp in Shelby, which had proven to be a popular move. Locals felt like they’d gotten to know Gibbons over the weeks leading up to the fight. Many of them had watched him train, paying 50 cents a person to view his sparring sessions. Outside of the money he received to cover his expenses, it was the only profit Gibbons made from the fight.

The arena was built to hold around 40,000 people. The official paid attendance was later listed at 7,202 tickets sold, though the actual number of spectators who saw the fight was estimated to be about three times that. This is because, as anger at Dempsey and Kearns grew, a crowd that could fairly be described as a mob gathered outside the arena, demanding to be let in.

One security guard, apparently overwhelmed by the size of the gathering but also frustrated at being asked to simply stand aside, is said to have shouted: “If you don’t have the guts to rush the gates, then stay the hell out!”

This was all the invitation the crowd needed. As Dempsey put it later, according to a local newspaper report: “When the report came out that I was going to get the gate money, the cowboys threw lariats over the posts and pulled the gates down. Thousands of people got in free.”

The fight itself was tougher for Dempsey than many expected. He’d had a year off after the fight with Carpentier and had trouble getting in shape after toying with the idea of retirement following that blockbuster bout. Gibbons stayed with him for all 15 rounds as Dempsey struggled to land a clean blow.

“Nailing him was like trying to thread a needle in a high wind,” Dempsey said later.

Fans — even the ones who hadn’t paid to get in — were disappointed at having sat so long under a burning July sun to see such a lackluster fight. Many accused Dempsey of carrying Gibbons. They’d been promised a heavyweight knockout artist and felt they were getting less than his full effort due to his complaints about money. When Dempsey was announced the winner via decision, empty bottles and other refuse came sailing into the ring.

“When it was over I just wanted to get out of town,” Dempsey said. “I ran all the way to the train, a distance of about one mile.”

Kearns stuck around in Great Falls slightly longer, hoping to collect the last of any money that might still trickle in. The mood around him, however, grew uncomfortably hostile. One report claimed that Dempsey and Kearns had only agreed to go on with the fight when “Montanans let it be known they had boxes of a certain size and dimension all fixed up for anyone trying to cross the border with $200,000 for a fight that was never held.”

Now that the fight had been held and the dissatisfied local populace began to feel themselves slighted and swindled by the whole affair, Dempsey and Kearns decided that a swift exit from the state with a notable history of frontier vigilantism was in their best interests.

The gloves worn by Tommy Gibbons in his July 4, 1923, fight against Jack Dempsey on display at the Marias Art and History Museum in Shelby, Montana. (Ben Fowlkes/Yahoo Sports)

‘The fight that won’t die’

Kearns and Dempsey parted ways a few years later, then later took turns suing each other. At one point Dempsey claimed Kearns had handled at least $5 million of his earnings, yet always found a way to avoid providing any written accounting of it.

Kearns later wrote an autobiography to be published posthumously. In it, he claimed that he’d helped Dempsey pack his gloves with plaster of paris to defeat Willard for the title, an accusation that was leveled at Dempsey at the time but never proven. Dempsey successfully sued to keep that claim out of the book, but seemed to almost marvel at this twist of the knife from beyond the grave.

“Jack Kearns had managed to give me one more good swift kick in the butt,” Dempsey wrote later. “The man was not to be believed.”

Kearns later wrote of himself that he was a byproduct of the hardscrabble American West in the early 20th century, “when it was every man for himself.”

“In those times you got away with everything possible,” Kearns wrote. Those times, he went on to suggest, had never truly ended.

Within a month of the fight, Shelby’s two banks closed. Another in Great Falls and a fourth in nearby Joplin also shut down due to financial losses related to the fight. To the extent that Shelby was known at all outside Montana, it was as the town bankrupted by an ill-conceived boxing match.

For decades after, many Shelby residents preferred to forget the ordeal. The rest of the 20th century passed without even a marker to mention that the space where the Pizza Hut now stands had once hosted a heavyweight title fight featuring one of boxing’s all-time greats. Champions Park, with its metal silhouettes and extensive history lesson collected on the surrounding plaques, wasn’t constructed until nearly a century after the fight.

Today you can find an impressive collection of artifacts relating to the fight at the Marias Museum of History and Art, just up the street from the site of the bout. From the outside, it looks like any normal home. Inside, you can find everything from 100-year-old fight programs and tickets to the actual gloves worn by Gibbons that day.

Original flags commemorating the fight also adorn several of downtown Shelby’s few bars. The bell from the fight ended up at The Tap Room bar, where it was presented to the owner in lieu of payment for an extensive bar tab that one of Dempsey’s trainers had racked up during his brief time in Shelby. There are those around town who claim to have actual seats from the deconstructed arena, passed down through generations, now collecting dust in their homes.

These days, this community of about 3,200 people is primarily a railroad town. While people here have slowly embraced Shelby’s place in boxing history, there are still those who see it as a chapter best forgotten — and aren’t especially eager to talk about it with reporters even now, with all the participants long since dead.

“They call it the fight that won’t die,” one local told me over a drink at the Mint Bar on Shelby’s Main Street. “Well, maybe it would die if you’d let it.”

This sentiment was shared by many of those who lived through the event. The fight wrecked the local economy for a time, and even bankrupted individual residents. The stain of it followed “Body” Johnson for the rest of his life, even after he left Montana for good.

As he put it years later, looking back on his life: “I was glad to have nothing to do with the fight business again.”

News

Modiv Industrial to release Q2 2024 financial results on August 6

RENO, Nev., August 1, 2024–(BUSINESS THREAD)–Modiv Industrial, Inc. (“Modiv” or the “Company”) (NYSE:MDV), the only public REIT focused exclusively on the acquisition of industrial real estate properties, today announced that it will release second quarter 2024 financial results for the quarter ended June 30, 2024 before the market opens on Tuesday, August 6, 2024. Management will host a conference call the same day at 7:30 a.m. Pacific Time (10:30 a.m. Eastern Time) to discuss the results.

Live conference call: 1-877-407-0789 or 1-201-689-8562 at 7:30 a.m. Pacific Time Tuesday, August 6.

Internet broadcast: To listen to the webcast, live or archived, use this link https://callme.viavid.com/viavid/?callme=true&passcode=13740174&h=true&info=company&r=true&B=6 or visit the investor relations page of the Modiv website at www.modiv.com.

About Modiv Industrial

Modiv Industrial, Inc. is an internally managed REIT focused on single-tenant net-leased industrial manufacturing real estate. The company actively acquires critical industrial manufacturing properties with long-term leases to tenants that fuel the national economy and strengthen the nation’s supply chains. For more information, visit: www.modiv.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240731628803/en/

Contacts

Investor Inquiries:

management@modiv.com

News

Volta Finance Limited – Director/PDMR Shareholding

Volta Finance Limited

Volta Finance Limited (VTA/VTAS)

Notification of transactions by directors, persons exercising managerial functions

responsibilities and people closely associated with them

NOT FOR DISCLOSURE, DISTRIBUTION OR PUBLICATION, IN WHOLE OR IN PART, IN THE UNITED STATES

*****

Guernsey, 1 August 2024

Pursuant to announcements made on 5 April 2019 and 26 June 2020 relating to changes to the payment of directors’ fees, Volta Finance Limited (the “Company” or “Volta”) purchased 3,380 no par value ordinary shares of the Company (“Ordinary Shares”) at an average price of €5.2 per share.

Each director receives 30% of his or her director’s fee for any year in the form of shares, which he or she is required to hold for a period of not less than one year from the respective date of issue.

The shares will be issued to the Directors, who for the purposes of Regulation (EU) No 596/2014 on Market Abuse (“March“) are “people who exercise managerial responsibilities” (a “PDMR“).

-

Dagmar Kershaw, Chairman and MDMR for purposes of MAR, has acquired an additional 1,040 Common Shares in the Company. Following the settlement of this transaction, Ms. Kershaw will have an interest in 12,838 Common Shares, representing 0.03% of the Company’s issued shares;

-

Stephen Le Page, a Director and a PDMR for MAR purposes, has acquired an additional 728 Ordinary Shares in the Company. Following the settlement of this transaction, Mr. Le Page will have an interest in 50,562 Ordinary Shares, representing 0.14% of the issued shares of the Company;

-

Yedau Ogoundele, Director and a PDMR for the purposes of MAR has acquired an additional 728 Ordinary Shares in the Company. Following the settlement of this transaction, Ms. Ogoundele will have an interest in 6,862 Ordinary Shares, representing 0.02% of the issued shares of the Company; and

-

Joanne Peacegood, Director and PDMR for MAR purposes has acquired an additional 884 Ordinary Shares in the Company. Following the settlement of this transaction, Ms. Peacegood will have an interest in 3,505 Ordinary Shares, representing 0.01% of the issued shares of the Company;

The notifications below, made in accordance with the requirements of the MAR, provide further details in relation to the above transactions:

|

a) Dagmar Kershaw |

b) Stephen LePage |

c) Yedau Ogoundele |

e) Joanne Pazgood |

|||

|

a. Position/status |

Director |

|||||

|

b. Initial Notification/Amendment |

Initial notification |

|||||

|

||||||

|

a name |

Volta Finance Limited |

|||||

|

b. LAW |

2138004N6QDNAZ2V3W80 |

|||||

|

a. Description of the financial instrument, type of instrument |

Ordinary actions |

|||||

|

b. Identification code |

GG00B1GHHH78 |

|||||

|

c. Nature of the transaction |

Acquisition and Allocation of Common Shares in Relation to Partial Payment of Directors’ Fees for the Quarter Ended July 31, 2024 |

|||||

|

d. Price(s) |

€5.2 per share |

|||||

|

e. Volume(s) |

Total: 3380 |

|||||

|

f. Transaction date |

August 1, 2024 |

|||||

|

g. Location of transaction |

At the Market – London |

|||||

|

The) |

B) |

w) |

It is) |

|||

|

Aggregate Volume: Price: |

Aggregate Volume: Price: |

Aggregate Volume: Price: |

Aggregate Volume: Price: |

|||

CONTACTS

For the investment manager

AXA Investment Managers Paris

Francois Touati

francois.touati@axa-im.com

+33 (0) 1 44 45 80 22

Olivier Pons

Olivier.pons@axa-im.com

+33 (0) 1 44 45 87 30

Company Secretary and Administrator

BNP Paribas SA, Guernsey branch

guernsey.bp2s.volta.cosec@bnpparibas.com

+44 (0) 1481 750 853

Corporate Broker

Cavendish Securities plc

Andre Worn Out

Daniel Balabanoff

+44 (0) 20 7397 8900

*****

ABOUT VOLTA FINANCE LIMITED

Volta Finance Limited is incorporated in Guernsey under the Companies (Guernsey) Law, 2008 (as amended) and listed on Euronext Amsterdam and the Main Market of the London Stock Exchange for listed securities. Volta’s home member state for the purposes of the EU Transparency Directive is the Netherlands. As such, Volta is subject to the regulation and supervision of the AFM, which is the regulator of the financial markets in the Netherlands.

Volta’s investment objectives are to preserve its capital throughout the credit cycle and to provide a stable income stream to its shareholders through dividends that it expects to distribute quarterly. The company currently seeks to achieve its investment objectives by seeking exposure predominantly to CLOs and similar asset classes. A more diversified investment strategy in structured finance assets may be pursued opportunistically. The company has appointed AXA Investment Managers Paris, an investment management firm with a division specializing in structured credit, to manage the investment portfolio of all of its assets.

*****

ABOUT AXA INVESTMENT MANAGERS

AXA Investment Managers (AXA IM) is a multi-specialist asset management firm within the AXA Group, a global leader in financial protection and wealth management. AXA IM is one of the largest European-based asset managers with 2,700 professionals and €844 billion in assets under management at the end of December 2023.

*****

This press release is issued by AXA Investment Managers Paris (“AXA IM”) in its capacity as alternative investment fund manager (within the meaning of Directive 2011/61/EU, the “AIFM Directive”) of Volta Finance Limited (“Volta Finance”), the portfolio of which is managed by AXA IM.

This press release is for information only and does not constitute an invitation or inducement to purchase shares of Volta Finance. Its circulation may be prohibited in certain jurisdictions and no recipient may circulate copies of this document in violation of such limitations or restrictions. This document is not an offer to sell the securities referred to herein in the United States or to persons who are “U.S. persons” for purposes of Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”), or otherwise in circumstances where such an offering would be restricted by applicable law. Such securities may not be sold in the United States absent registration or an exemption from registration under the Securities Act. Volta Finance does not intend to register any part of the offering of such securities in the United States or to conduct a public offering of such securities in the United States.

*****

This communication is being distributed to, and is directed only at, (i) persons who are outside the United Kingdom or (ii) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) or (iii) high net worth companies and other persons to whom it may lawfully be communicated falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as “relevant persons”). The securities referred to herein are available only to, and any invitation, offer or agreement to subscribe for, purchase or otherwise acquire such securities will be made only to, relevant persons. Any person who is not a relevant person should not act on or rely on this document or any of its contents. Past performance should not be relied upon as a guide to future performance.

*****

This press release contains statements that are, or may be deemed to be, “forward-looking statements”. These forward-looking statements can be identified by the use of forward-looking terminology, including the words “believes”, “anticipates”, “expects”, “intends”, “is/are expected”, “may”, “will” or “should”. They include statements about the level of the dividend, the current market environment and its impact on the long-term return on Volta Finance’s investments. By their nature, forward-looking statements involve risks and uncertainties and readers are cautioned that such forward-looking statements are not guarantees of future performance. Actual results, portfolio composition and performance of Volta Finance may differ materially from the impression created by the forward-looking statements. AXA IM undertakes no obligation to publicly update or revise forward-looking statements.

Any target information is based on certain assumptions as to future events that may not materialize. Due to the uncertainty surrounding these future events, targets are not intended to be and should not be considered to be profits or earnings or any other type of forecast. There can be no assurance that any of these targets will be achieved. Furthermore, no assurance can be given that the investment objective will be achieved.

Figures provided which relate to past months or years and past performance cannot be considered as a guide to future performance or construed as a reliable indicator as to future performance. Throughout this review, the citation of specific trades or strategies is intended to illustrate some of Volta Finance’s investment methodologies and philosophies as implemented by AXA IM. The historical success or AXA IM’s belief in the future success of any such trade or strategy is not indicative of, and has no bearing on, future results.

The valuation of financial assets may vary significantly from the prices that AXA IM could obtain if it sought to liquidate the positions on Volta Finance’s behalf due to market conditions and the general economic environment. Such valuations do not constitute a fairness or similar opinion and should not be relied upon as such.

Publisher: AXA INVESTMENT MANAGERS PARIS, a company incorporated under the laws of France, with registered office at Tour Majunga, 6, Place de la Pyramide – 92800 Puteaux. AXA IMP is authorized by Autorité des Marchés Financiers under registration number GP92008 as an alternative investment fund manager within the meaning of the AIFM Directive.

*****

News

Apple to report third-quarter earnings as Wall Street eyes China sales

Litter (AAPL) is set to report its fiscal third-quarter earnings after the market closes on Thursday, and unlike the rest of its tech peers, the main story won’t be about the rise of AI.

Instead, analysts and investors will be keeping a close eye on iPhone sales in China and whether Apple has managed to stem the tide of users switching to domestic rivals including Huawei.

For the quarter, analysts expect Apple to report earnings per share (EPS) of $1.35 on revenue of $84.4 billion, according to estimates compiled by Bloomberg. Apple saw EPS of $1.26 on revenue of $81.7 billion in the same period last year.

Apple shares are up about 18.6% year to date despite a rocky start to the year, thanks in part to the impact of the company’s Worldwide Developer Conference (WWDC) in May, where showed off its Apple Intelligence software.

But the big question on investors’ minds is whether iPhone sales have risen or fallen in China. Apple has struggled with slowing phone sales in the region, with the company noting an 8% decline in sales in the second quarter as local rivals including Huawei and Xiaomi gain market share.

Apple CEO Tim Cook delivers remarks at the start of the Apple Worldwide Developers Conference (WWDC). (Photo by Justin Sullivan/Getty Images) (Justin Sullivan via Getty Images)

And while some analysts, such as JPMorgan’s Samik Chatterjee, believe sales in Greater China, which includes mainland China, Hong Kong, Singapore and Taiwan, rose in the third quarter, others, including David Vogt of UBS Global Research, say sales likely fell about 6%.

Analysts surveyed by Bloomberg say Apple will report revenue of $15.2 billion in Greater China, down 3.1% from the same quarter last year, when Apple reported revenue of $15.7 billion in China. Overall iPhone sales are expected to reach $38.9 billion, down 1.8% year over year from the $39.6 billion Apple saw in the third quarter of 2023.

But Apple is expected to make up for those declines in other areas, including Services and iPad sales. Services revenue is expected to reach $23.9 billion in the quarter, up from $21.2 billion in the third quarter of 2023, while iPad sales are expected to reach $6.6 billion, up from the $5.7 billion the segment brought in in the same period last year. Those iPad sales projections come after Apple launched its latest iPad models this year, including a new iPad Pro lineup powered by the company’s M4 chip.

Mac revenue is also expected to grow modestly in the quarter, versus a 7.3% decline last year. Sales of wearables, which include the Apple Watch and AirPods, however, are expected to decline 5.9% year over year.

In addition to Apple’s revenue numbers, analysts and investors will be listening closely for any commentary on the company’s software launches. Apple Intelligence beta for developers earlier this week.

The story continues

The software, which is powered by Apple’s generative AI technology, is expected to arrive on iPhones, iPads and Macs later this fall, though according to Bloomberg’s Marc GurmanIt won’t arrive alongside the new iPhone in September. Instead, it’s expected to arrive on Apple devices sometime in October.

Analysts are divided on the potential impact of Apple Intelligence on iPhone sales next year, with some saying the software will kick off a new iPhone sales supercycle and others offering more pessimistic expectations about the technology’s effect on Apple’s profits.

It’s important to note that Apple Intelligence is only compatible with the iPhone 15 Pro and newer phones, ensuring that all users desperate to get their hands on the tech will have to upgrade to a newer, more powerful phone as soon as it is available.

Either way, if Apple wants to make Apple Intelligence a success, it will need to ensure it has the features that will make customers excited to take advantage of the offering.

Subscribe to the Yahoo Finance Tech Newsletter. (Yahoo Finance)

Email Daniel Howley at dhowley@yahoofinance.com. Follow him on Twitter at @DanielHowley.

Read the latest financial and business news from Yahoo Finance

News

Number of Americans filing for unemployment benefits hits highest level in a year

The number of Americans filing for unemployment benefits hit its highest level in a year last week, even as the job market remains surprisingly healthy in an era of high interest rates.

Jobless claims for the week ending July 27 rose 14,000 to 249,000 from 235,000 the previous week, the Labor Department said Thursday. It’s the highest number since the first week of August last year and the 10th straight week that claims have been above 220,000. Before that period, claims had remained below that level in all but three weeks this year.

Weekly jobless claims are widely considered representative of layoffs, and while they have been slightly higher in recent months, they remain at historically healthy levels.

Strong consumer demand and a resilient labor market helped avert a recession that many economists predicted during the Federal Reserve’s prolonged wave of rate hikes that began in March 2022.

As inflation continues to declinethe Fed’s goal of a soft landing — reducing inflation without causing a recession and mass layoffs — appears to be within reach.

On Wednesday, the Fed left your reference rate aloneBut officials have strongly suggested a cut could come in September if the data stays on its recent trajectory. And recent labor market data suggests some weakening.

The unemployment rate rose to 4.1% in June, despite the fact that American employers added 206,000 jobs. U.S. job openings also fell slightly last month. Add that to the rise in layoffs, and the Fed could be poised to cut interest rates next month, as most analysts expect.

The four-week average of claims, which smooths out some of the weekly ups and downs, rose by 2,500 to 238,000.

The total number of Americans receiving unemployment benefits in the week of July 20 jumped by 33,000 to 1.88 million. The four-week average for continuing claims rose to 1,857,000, the highest since December 2021.

Continuing claims have been rising in recent months, suggesting that some Americans receiving unemployment benefits are finding it harder to get jobs.

There have been job cuts across a range of sectors this year, from agricultural manufacturing Deerefor media such as CNNIt is in another place.

-

Videos1 week ago

Videos1 week agoAbsolutely massive: the next higher Bitcoin leg will shatter all expectations – Tom Lee

-

News11 months ago

News11 months agoVolta Finance Limited – Director/PDMR Shareholding

-

News11 months ago

News11 months agoModiv Industrial to release Q2 2024 financial results on August 6

-

News11 months ago

News11 months agoApple to report third-quarter earnings as Wall Street eyes China sales

-

News11 months ago

News11 months agoNumber of Americans filing for unemployment benefits hits highest level in a year

-

News1 year ago

News1 year agoInventiva reports 2024 First Quarter Financial Information¹ and provides a corporate update

-

News1 year ago

News1 year agoLeeds hospitals trust says finances are “critical” amid £110m deficit

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Hit $100 Billion in 2024, Fueling Insane Investor Optimism ⋆ ZyCrypto

-

Tech1 year ago

Tech1 year agoBitcoin’s Correlation With Tech Stocks Is At Its Highest Since August 2023: Bloomberg ⋆ ZyCrypto

-

Tech1 year ago

Tech1 year agoEverything you need to know

-

News11 months ago

News11 months agoStocks wobble as Fed delivers and Meta bounces