Markets

How Crypto Embraced Donald Trump, JD Vance, and Project 2025

When the pandemic hit in 2020, DJ and personal trainer Jonnie King stopped getting booked for gigs and workouts. So he turned to trading cryptocurrencies, which were rapidly rising in value at the time. “I thought, ‘Oh my God, there’s hope for me. I can make money while I’m stuck at home,’” he says.

Four years later, King is a devout believer who keeps most of his assets in cryptocurrencies. And while he voted for Bernie Sanders in 2016—because of the latter’s focus on improving the working class—King is now a staunch supporter of Donald Trump, because of the latter’s recent embrace of cryptocurrencies.

“I can probably say it’s a one-vote question for me because it’s my livelihood,” King told TIME. “Crypto is how I save my wealth, and if [the Democrats] “They’re trying to attack this, it’s literally taking my money. How am I supposed to provide for my family?”

The king embodies a growing faction of the cryptocurrency community that supports Trump with open arms. For years, both during his presidency and after, Trump has expressed his distrust of cryptocurrencies. In 2021, he went so far as to say that Bitcoin it looked like a scamBut as the 2024 election approaches, Trump has reversed course and praised the technology. And over the past week, he’s taken several other major steps to win over the crypto faithful: He announced an appearance at a Bitcoin conference in Nashville on July 27, a Bitcoin conference in New York on July 29, and a cryptocurrency conference in New York on July 30. new NFT project, and chose a staunchly pro-crypto vice presidential candidate in JD Vance.

The crypto world has regained its enthusiasm. Despite the apprehensions they may have towards others elements of Trump’s program Or criminal chargeMany believe he will bring a significant boon to the industry if elected. The crypto community on X, formerly known as Twitter, is filled with pro-Trump sentiments, and cryptocurrency pours into Trump’s campaign. And in the wake of Trump’s shooting, Bitcoin whose price has skyrocketed, apparently based on the belief that the event helped Trump’s chances of being elected.

“Trump has had an incredible and surprisingly positive impact on this industry,” Kristin Smith, CEO of crypto lobbying group The Blockchain Association, told TIME. “That wasn’t on my 2024 bingo card.”

Trump’s U-turn on Cryptocurrencies

Trump hasn’t given many details about his newfound love of crypto after criticizing it for so many years. But he has used the industry as a point of contention, directly contrasting himself with left-wing crypto skeptics like Elizabeth Warren. crypto lobby is well organized and full of money, it offers Trump a lot of potential money.

Trump has attended several fundraisers filled with cryptocurrency industry executives, who have promised to host more fundraisers for him, according to The Washington PostCryptocurrency moguls Tyler and Cameron Winklevoss everyone made a donation $1M in Bitcoin to Trump, criticizing Biden’s ‘war on crypto,’ and Trump discussed crypto policy with pro-crypto entrepreneur Elon Musk, according to Bloomberg. (Musk has since endorsed Trump.) The price to pay to attend a “VIP reception” with Trump at the upcoming Bitcoin conference is a cool $844,600 per person.

When Trump announced that his campaign would accept cryptocurrency donations, a statement on his website said the decision was part of a broader fight against “socialist government control” of U.S. financial markets. (Joe Biden hasn’t spoken much publicly about cryptocurrency, but his administration has.) supported stricter policies made for protect consumers.)

Learn more: Why Donald Trump is betting on cryptocurrency

And earlier this month, The Post reported that a Trump adviser added a passage about cryptography to the Republican Party platform, surprising longtime party members. Part of the passage read: “We will defend the right to mine Bitcoin and ensure that every American has the right to hold their digital assets in their own hands and transact without government oversight or control.” (Government agencies currently use blockchain tracing (to track down cryptocurrency scammers and other criminals.)

Learn more: Inside the Health Crisis of a Bitcoin Town in Texas

Trump’s VP Pick JD Vance Boosts Cryptocurrency Reputation

On Monday, Trump further energized cryptocurrency fans by choosing the Pro-crypto Senator JD Vance as his running mate. While running for Senate in 2021, Vance disclosed that he owned more than $100,000 worth of Bitcoin. That same year, he called the crypto community “one of the few sectors of our economy where conservatives and other free thinkers can operate without the pressure of the social justice mob.” Vance also received significant campaign funding from pro-crypto entrepreneur Peter Thiel.

Earlier this year, Vance circulated a bill that would overhaul cryptocurrency regulation and clarify whether specific crypto tokens should be regulated by the SEC or the CFTC. reported that the proposal appears to be “more industry friendly” than previously introduced bills.

The crypto industry has largely welcomed the idea of a personal Bitcoin holder entering the White House next year. “Senator Vance, an emerging voice for responsive and pro-innovation crypto legislation, is an ideal candidate to lead the Republican Party’s crypto principles,” Kristin Smith wrote in an email to TIME.

Project 2025 also supports the crypto industry

Looming over the election is Project 2025, a sweeping conservative plan led by the Heritage Foundation that lays out policies Trump should implement if elected, including launching mass deportations and combating “anti-white” discrimination. distanced himself of the social truth proposal, dozens of Trump allies and former administration officials are connected to the project.

The crypto industry is excited about the crypto-related language in Draft 2025. The document guest The US president wants to abolish the Federal Reserve (whose monetary policies have long been abhorred by cryptocurrency advocates) and move the US toward a free banking system, in which the dollar is backed by a valuable commodity like gold – or, crypto enthusiasts hope, Bitcoin itself. However, there is no indication that Trump or anyone else in his administration has considered this idea. The document also calls on regulators to clarify the rules around cryptocurrencies, as Vance has advocated, which could pave the way for greater adoption of cryptocurrencies.

Learn more: What is Project 2025?

Questions Remain About Trump’s Commitment to Bitcoin

Despite all this, there are crypto fans who are skeptical Trump’s sudden embrace of Bitcoin will have lasting weight beyond an election-year talking point. Some of Trump’s avowed policy proposals, which have been described as authoritarianseem to counter Bitcoin’s anti-government and libertarian bent. For example, his call for all Bitcoin mining to be located in the United States has angered some crypto idealists, since decentralization and immunity from government pressure are a key part of the ethos of cryptocurrency mining.

Moe Vela, a former Biden adviser and senior advisor to the Unicoin cryptocurrency project, is skeptical of Trump’s intentions. “It wasn’t that long ago that he was critical of cryptocurrencies,” he says. “The crypto community tends to be a little inexperienced when it comes to legislation, policy, and politics — and I encourage them not to fall into the trap of complacency.”

Vela argues that “sound and balanced” cryptocurrency regulation is essential to the industry’s growth. “If we don’t have regulation that weeds out bad actors (and we’ve already seen that we have our share of bad actors), it weakens trust in the industry,” he says.

And Vitalik Buterinlead founder of the Ethereum cryptocurrency, wrote a blog post on June 17 warning crypto enthusiasts against voting based solely on a candidate’s stance on cryptocurrency. “Making decisions in this manner carries a high risk of going against the values that led you to enter the crypto space in the first place,” he wrote.

Some surveys suggest that cryptocurrency is still an extremely niche interest. The Federal Reserve has found that only 7% of American adults would use or hold cryptocurrencies by 2023, and another poll suggested that anti-crypto sentiment Trump’s approval rating remains high. But the crypto industry is convinced that there could be thousands of single-issue voters like Jonnie King who could push Trump forward in the next election.

“Maybe a politician is just a politician who wants to win votes,” King says of Trump’s pro-crypto stance. “I’m not saying a man is perfect. But when Biden is campaigning against crypto, the only system that represents hope for money, I don’t see how to move forward.”

“If Trump can give us a little hope – even if it’s just hope – that’s something.”

Markets

Today’s top crypto gainers and losers

Over the past 24 hours, Jupiter and JasmyCoin emerged as the top gainers among the top 100 crypto assets, while Bittensor and Mantra plunged as the top losers.

Top Winners

Jupiter

Jupiter (JUP) led the charge among the biggest gainers on July 27.

At the time of writing, the crypto asset had surged 12.6% in the past 24 hours and was trading at $1.16. JUP’s daily trading volume was hovering around $282 million, according to data from crypto.news.

JUP Hourly Price Chart, July 26-27 | Source: crypto.news

Additionally, the cryptocurrency’s market cap stood at $1.56 billion, making it the 62nd largest crypto asset, according to CoinGecko. Despite the recent price surge, the token is still down 42.6% from its all-time high of $2 reached on Jan. 31.

Jupiter functions as a decentralized exchange aggregator that allows users to trade Solana-based tokens. The platform also offers users the best routes for direct trades between multiple exchanges and liquidity pools.

In addition to being a DEX aggregator, Jupiter has expanded into a “full stack ecosystem” by launching several new projects, including a dedicated pool to support perpetual trading and plans for a stablecoin.

JasmyCoin

JasmyCoin (JASMI) has increased by 12% in the last 24 hours and is trading at $0.0328 at press time. JASMY’s daily trading volume has increased by 10% in the last 24 hours, reaching $146 million.

JASMY Hourly Price Chart, July 26-27 | Source: crypto.news

The asset’s market cap has surpassed the $1.5 billion mark, making it the 60th largest cryptocurrency at the time of reporting. However, the self-proclaimed “Bitcoin of Japan” is still down 99.3% from its all-time high of $4.79 on February 16, 2021.

JASMY is the native token of Jasmy Corporation, a Japanese Internet of Things provider. The platform seeks to merge the decentralization of blockchain technology with IoT, allowing users to convert their digital information into digital assets.

The initiative was launched by Kunitake Ando, former COO of Sony Corporation, along with Kazumasa Sato, former CEO of Sony Style.com Japan Inc., Hiroshi Harada, executive financial analyst at KPMG, and other senior executives from Japan.

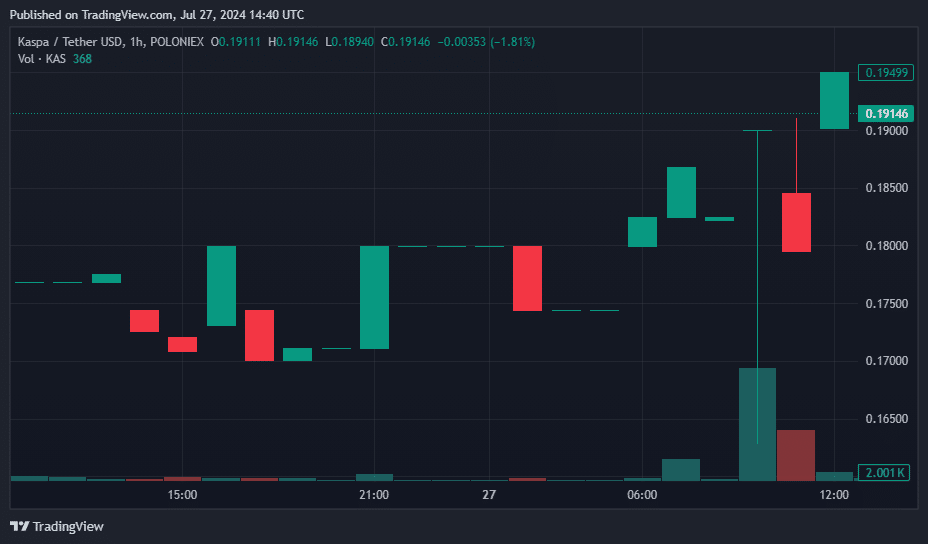

Kaspa

Kaspa (KAS) saw a 100% increase in trading volume and an 8% increase in price over the past 24 hours, trading at $0.19 at the time of publication.

KAS Hourly Price Chart, July 26-27 | Source: crypto.news

According to data from CoinGecko, Kaspa now ranks 27th in the global cryptocurrency list, with a circulating supply of approximately 24.29 billion KAS tokens and a market capitalization of $4.59 billion.

Kaspa is a cryptocurrency designed to deliver a high-performance, scalable, and secure blockchain platform. Its unique Layer-1 protocol includes the GhostDAG protocol, a proof-of-work (PoW) consensus mechanism that enables faster block times and higher transaction throughput compared to standard blockchains.

Unlike Bitcoin, GhostDAG allows multiple blocks to be created simultaneously, speeding up transactions and increasing block rewards for miners.

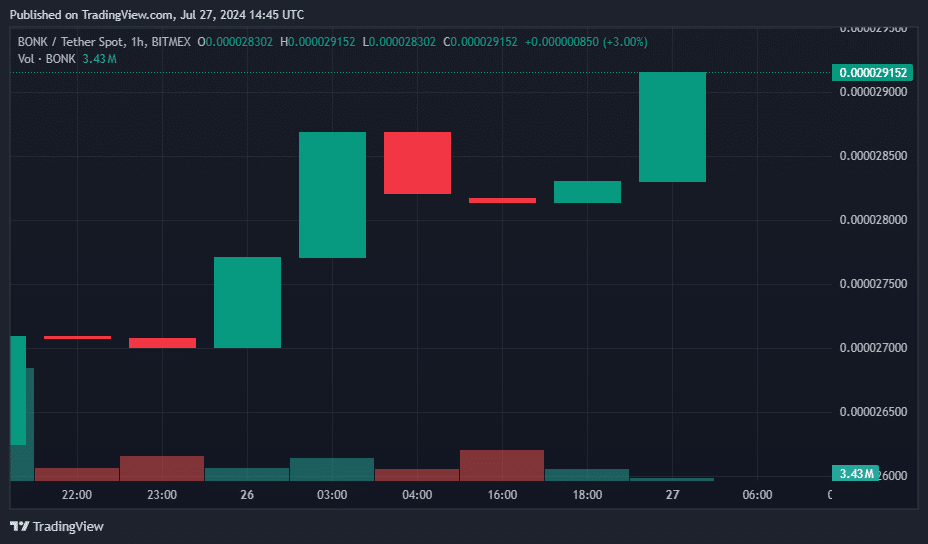

Bonk

Bonk (BONK) is the only one coin meme which made it to this list of biggest gainers and jumped 8.6% in the last 24 hours. Trading at $0.000030, the Solana-based meme coin’s market cap has surpassed $2.1 billion, surpassing Floki (FLOKI), another competing dog-themed coin with a market cap of $1.78 billion.

BONK Hourly Price Chart, July 26-27 | Source: crypto.news

BONK’s daily trading volume hovered around $285 million. However, BONK is still down 33.5% from its all-time high of $0.000045, reached on March 4.

Bonk, a meme coin that rose to prominence in 2023, has contributed significantly to Solana’s value increase amid the meme coin frenzy.

Bonk started out as a simple dog-themed coin. It has since expanded its features to include integration with decentralized finance. The project also partners with cross-chain communication protocols, NFT marketplaces, and various other cryptocurrency ecosystems.

BONK trading pairs are now listed on major exchanges including Binance, Coinbase, OKX, and Bitstamp.

The big losers

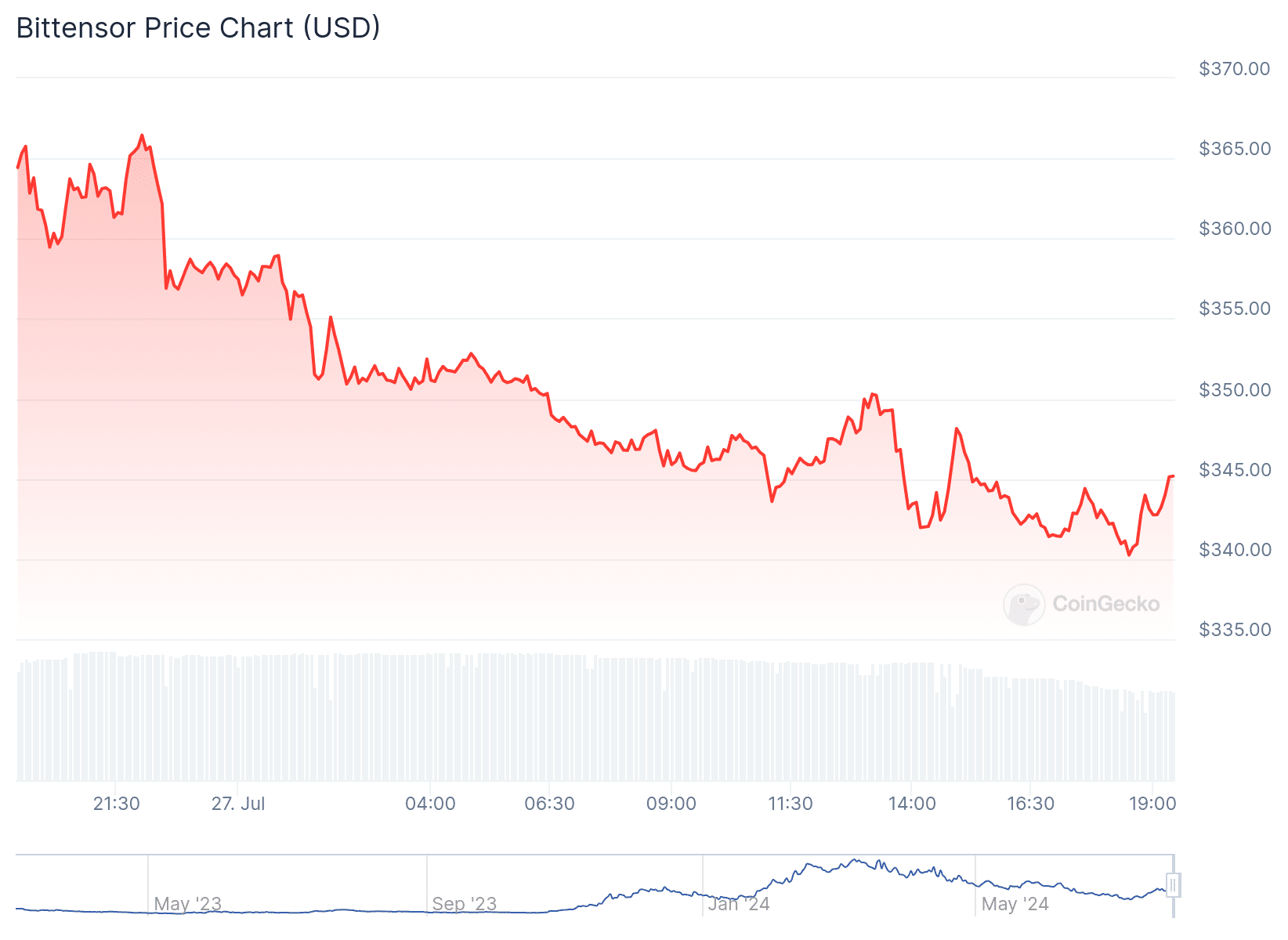

Bittensor

Bittensor (TAO) was the biggest loser among the 100 largest crypto assets, according to data from CoinGecko.

At the time of writing, TAO, the native token of decentralized AI project Bittensor, was down 5%, trading around $344. The crypto asset had a daily trading volume of $59 million and a market cap of $2.43 billion.

TAO 24 Hour Price Chart | Source: CoinGecko

Bittensor, created in 2019 by AI researchers Ala Shaabana and Jacob Steeves, initially operated as a parachain on Polkadot before transitioning to its own layer-1 blockchain in March 2023.

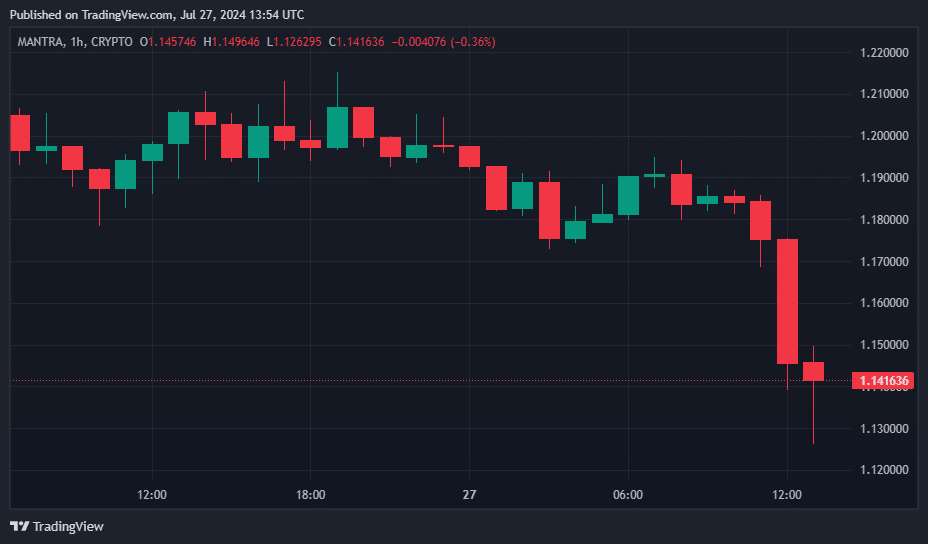

Mantra

Mantra (OM) fell 6%, trading at $1.13 at press time. The digital currency’s market cap fell to $938 million. Additionally, the 82nd largest crypto asset has a daily trading volume of $26 million.

OM Price Hourly Chart, July 26-27 | Source: crypto.news

Mantra is a modular blockchain network comprising two chains, Manta Pacific and Manta Atlantic, specialized in zero-knowledge applications.

Coat

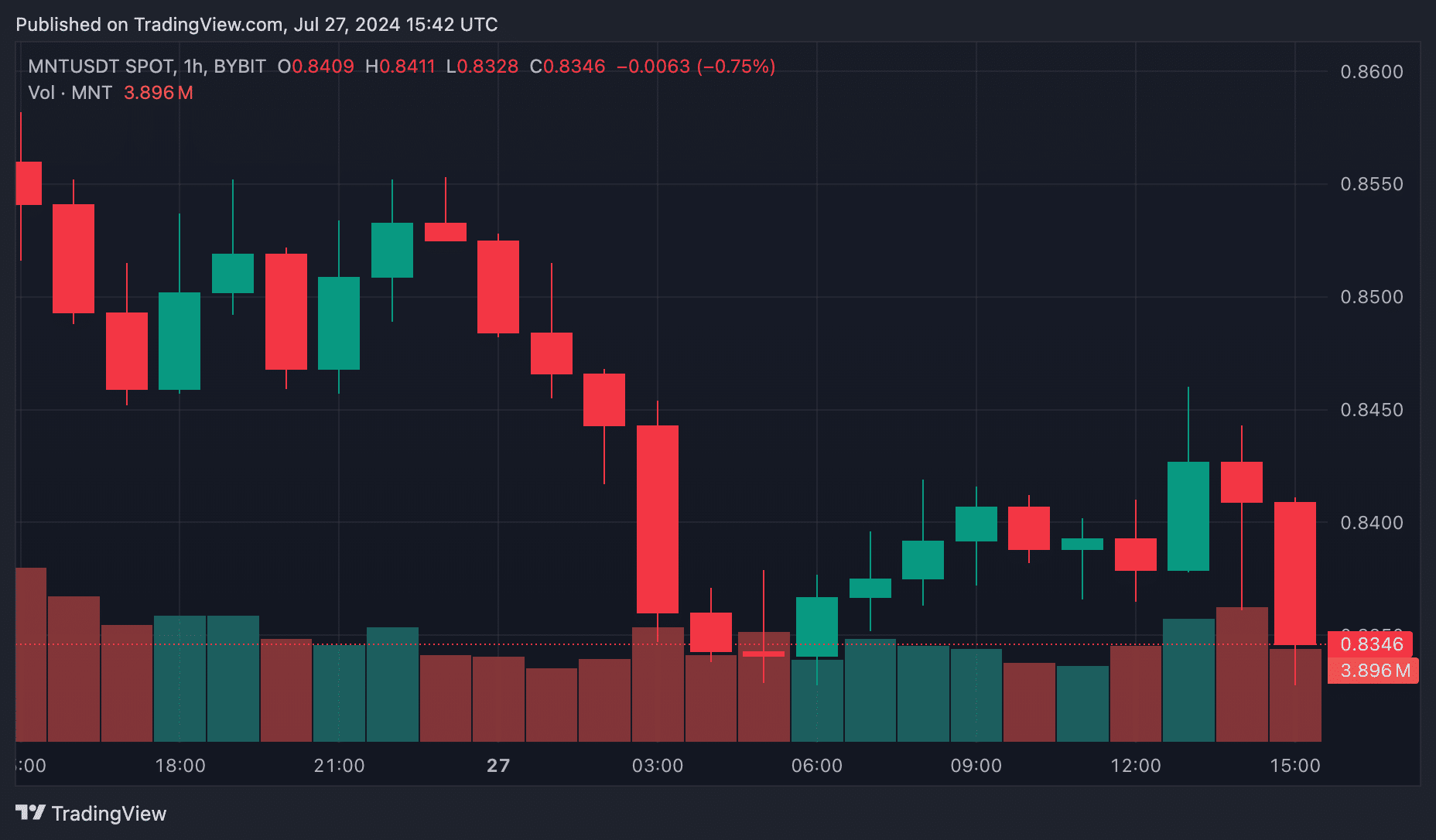

Coat (MNT) also saw a 2.4% drop in price, now trading at $0.8413. Currently, Mantle has a market cap of around $2.75 billion, which ranks 36th in the global cryptocurrency rankings by market cap, according to price data from crypto.news.

MNT Hourly Price Chart, July 26-27 | Source: crypto.news

Over the past 24 hours, MNT trading volume also fell by 6%, reaching $240 million.

Mantle, formerly known as BitDAO, is an investment DAO closely associated with Bybit. The MNT token is essential for governance, paying gas fees on the Mantle network, and staking on various platforms.

Built on the Ethereum network, Mantle provides a platform for decentralized application developers to launch their projects. It has become particularly popular for GameFi applications, leading to the formation of an internal Web3 gaming team.

Markets

Bitcoin Price Drops to $67,000 Despite Trump’s Pro-Crypto Comments, Further Correction Ahead?

Pioneer cryptocurrency Bitcoin has registered a 1.13% decline in the past 24 hours to trade at $67,400. Despite a strong pro-crypto stance from US presidential candidate Donald Trump at the Bitcoin 2024 conference, this massive selloff has raised concerns in the market about the asset’s sustainability at a higher price. However, given the recent three-week rally, a slight pullback this weekend is justifiable and necessary to regain the depleted bullish momentum.

Bitcoin Price Flag Formation Hints at Opportunity to Break Beyond $80,000

The medium-term trend Bitcoin Price remains a sideways trend amidst the formation of a bullish flag pattern. This chart pattern is defined by two descending lines that are currently shaping the price trajectory by providing dynamic resistance and support.

On July 5, BTC saw a bullish reversal from the flag pattern at $53,485, increasing its asset by 29.75% to a high of $69,400. This recent spike followed the market’s positive sentiment towards the Donald Trump speech at the Bitcoin 2024 conference in Nashville on Saturday afternoon.

Bitcoin Price | Tradingview

In his speech, Trump outlined several pro-crypto initiatives: he promised to replace SEC Chairman Gary Gensler on his first day in office, to establish a Strategic National Reserve of Bitcoin if elected, to ensure that the U.S. government holds all of its assets. Bitcoin assets and block any attempt to create a central bank digital currency (CBDC) during his presidency.

He also claimed that under his leadership, Bitcoin and cryptocurrencies will skyrocket like never before.

Despite Donald Trump’s optimistic promises, the BTC price failed to reach $70,000 and is currently trading at $67,400. As a result, Bitcoin’s market cap has dipped slightly to hover at $1.335 trillion.

However, this pullback is justified, as Bitcoin price has recently seen significant growth over the past three weeks, which has significantly improved market sentiment. Thus, price action over the weekend could replenish the depleted bullish momentum, potentially strengthening an attempt to break out from the flag pattern at $70,130.

A successful breakout will signal the continuation of the uptrend and extend the Bitcoin price forecast target at $78,000, followed by $84,000.

On the other hand, if the supply pressure on the upper trendline persists, the asset price could trigger further corrections for a few weeks or months.

Technical indicator:

- Pivot levels: The traditional pivot indicator suggests that the price pullback could see immediate support at $64,400, followed by a correction floor at $56,700.

- Moving average convergence-divergence: A bullish crossover state between the MACD (blue) and the signal (orange) ensure that the recovery dynamics are intact.

Related Articles

Frequently Asked Questions

A CBDC is a digital form of fiat currency issued and regulated by a country’s central bank. It aims to provide a digital alternative to traditional banknotes.

The proposal for a strategic national Bitcoin reserve is a major confirmation of Bitcoin’s legitimacy and potential as a reserve asset. Such a move could position Bitcoin in a similar way to gold, potentially stabilizing its price and encouraging other countries to adopt similar strategies.

Conferences like Bitcoin 2024 serve as essential platforms for networking, knowledge sharing, and showcasing new technologies within the cryptocurrency industry.

Markets

Swiss crypto bank Sygnum reports profitability after surge in first-half trading volumes – DL News

- Sygnum says it has reached profitability after increasing transaction volumes.

- The Swiss crypto bank does not disclose specific profit figures.

Sygnum, a Swiss global crypto banking group with approximately $4.5 billion in client assets, announced that it has achieved profitability after a strong first half, with key metrics showing year-to-date growth.

The company said in a Press release Compared to the same period last year, cryptocurrency spot trading volumes doubled, cryptocurrency derivatives trading increased by 500%, and lending volumes increased by 360%. The exact figures for the first half of the year were not disclosed.

Sygnum said its staking service has also grown, with the percentage of Ethereum staked by customers increasing to 42%. For institutional clients, staking Ethereum has a benefit that goes beyond the limitations of the ETF framework, which excludes staking returns, Sygnum noted.

“The approval and launch of Bitcoin and Ethereum ETFs was a turning point for the crypto industry this year, leading to a major increase in demand for trusted, regulated exposure to digital assets,” said Martin Burgherr, Chief Client Officer of Sygnum.

He added: “This is also reflected in Sygnum’s own growth, with our core business segments recording significant year-to-date growth in the first half of the year.”

Sygnum, which has also been licensed in Luxembourg since 2022, plans to expand into European and Asian markets, the statement said.

Markets

Former White House official Anthony Scaramucci says cryptocurrency bull market could be sparked by regulatory clarity

Anthony Scaramucci, founder of Skybridge Capital, says the next cryptocurrency bull market could be sparked by a new wave of clear cryptocurrency regulations.

In a new interview On CNBC’s Squawk Box, the former White House communications director said he and two other prominent industry figures traveled to Washington, D.C. to speak to officials about the dangers of Sen. Elizabeth Warren and U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler’s hardline approach to cryptocurrency regulation.

“Mark Cuban, myself, and Michael Novogratz were in Washington a few weeks ago to speak with White House officials and explain the dangers of Gary Gensler and Elizabeth Warren’s anti-crypto approach. I hope that message gets through…

“Overall, if we can get regulatory policy around Bitcoin and crypto assets in sync, we will have a bull market next year for these assets.”

Scaramucci then compares crypto assets to ride-hailing company Uber, saying regulators were initially wary of the service but eventually decided to adopt clear guidelines due to public demand.

“Remember Uber: Nobody wanted Uber. A lot of regulators didn’t want it. Mayors and deputy mayors didn’t want it, but citizens wanted Uber and eventually accepted the idea of regulating it fairly. I think we’re there now.”

The CEO also says young Democratic voters believe their leaders are making the wrong choices when it comes to digital assets.

“I think President Trump’s move toward Bitcoin and crypto assets has shaken Democrats to their core, and I think very smart, younger Democrats are recognizing that they are completely off base with their positions, completely off base with these SEC lawsuits and regulation by law enforcement, and now they need to get back to the center.”

Don’t miss a thing – Subscribe to receive email alerts directly to your inbox

Check Price action

follow us on X, Facebook And Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed on The Daily Hodl are not investment advice. Investors should do their own due diligence before making any high-risk investments in Bitcoin, cryptocurrencies or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Image generated: Midjourney

-

News11 months ago

News11 months agoVolta Finance Limited – Director/PDMR Shareholding

-

News11 months ago

News11 months agoModiv Industrial to release Q2 2024 financial results on August 6

-

News11 months ago

News11 months agoApple to report third-quarter earnings as Wall Street eyes China sales

-

News11 months ago

News11 months agoNumber of Americans filing for unemployment benefits hits highest level in a year

-

News1 year ago

News1 year agoInventiva reports 2024 First Quarter Financial Information¹ and provides a corporate update

-

News1 year ago

News1 year agoLeeds hospitals trust says finances are “critical” amid £110m deficit

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Tech1 year ago

Tech1 year agoBitcoin’s Correlation With Tech Stocks Is At Its Highest Since August 2023: Bloomberg ⋆ ZyCrypto

-

Tech1 year ago

Tech1 year agoEverything you need to know

-

News11 months ago

News11 months agoStocks wobble as Fed delivers and Meta bounces

-

Markets1 year ago

Markets1 year ago20 Top Crypto Trading Platforms to Know

-

News11 months ago

News11 months agoHutchinson House and Senate Candidates Report Finances Ahead of Election