News

How one woman’s quest to fix her Harlem housing complex got her busted on campaign finance charges

When the Manhattan district attorney’s office charged six people last summer in a conspiracy to bundle illegal campaign contributions to the Eric Adams mayoral campaign, prosecutors alleged five of them did it to benefit themselves or companies with business before the city.

But the sixth defendant swept up in the so-called “straw donor” case — a 78-year-old retired accountant with no prior record named Millicent Redick — didn’t fit that narrative.

In her first interview, Redick tells the Daily News her motivation arose not from self-interest, but from desperation. Redick said she was hoping to find a way to persuade indifferent city officials to address nightmarish conditions in Esplanade Gardens, the sprawling Mitchell-Lama co-op in Harlem where she has lived since 1968.

“I wrote letters to elected officials, I wrote letters to the city,” Redick said. “I wrote press releases. I contacted code enforcement. I went to the courts. They did nothing. It’s like a Catch-22.”

In April, prosecutors acknowledged in court that Redick neither benefited financially nor was a key player in the alleged scheme. No money she touched actually ended up with the campaign.

In May, at the urging of Judge Althea Drysdale, prosecutors offered her a misdemeanor plea with no fine or jail time. They even mulled allowing her to plead to a noncriminal violation.

But Redick has so far declined, insisting she did nothing wrong.

“She’s a fighter and I admire her,” said Redick’s lawyer Alexei Grosshtern. “Her goal was to bring attention to the dire situation in her housing development. That attracted the attention of politicians like Mr. Adams and that is what roped her into this situation. But her desire was an entirely selfless one.”

Urban renewal turned nightmare

The story of how Redick arrived at this crossroads begins with Esplanade Gardens itself and involves an appearance by the future mayor.

The birth of the six-building complex with roughly 1,800 apartments at W. 147th St. and Adam Clayton Powell Jr. Blvd. was heralded in a 1963 New York Times article titled, “Middle Income Co-Op Planned in Old Transit Yard in Harlem.”

Redick and her now-deceased husband, Lawrence Redick Jr., moved into a 21st-floor apartment at 129 W. 147th St. in 1968, and over five decades, built a life and raised their two kids.

Manhattan DA Alvin Bragg, the man who would charge Redick in 2023, in fact, lived for part of his childhood in the complex. His mom actually taught Redick in a continuing education math class in 1973, Redick says.

Over the years, Redick built close ties to her neighbors and was active in Harlem issues around housing, banking, air pollution and supermarkets. She also served on the co-op board.

In March 2016, Redick’s husband, then 69, died during surgery at New York-Presbyterian Hospital, court records show. She sued the hospital for wrongful death. The case was settled last March for $900,000.

At Esplanade Gardens, as time passed, the physical condition of the complex deteriorated and the co-op had trouble keeping up. A 2012 story in The News quoted residents complaining about broken elevators, leaks and delayed repairs. The complex’s pool where Redick had watched her kids play has been closed for repairs for six years.

In 2020, the board brought in a contractor to begin wholesale repairs. But what followed was a range of problems detailed in dozens of lawsuits and thousands of complaints and violations reviewed by The News. Deafening drilling and widespread disruption stressed an aged population left in their apartments during the height of the pandemic rather than being relocated, according to residents and court papers.

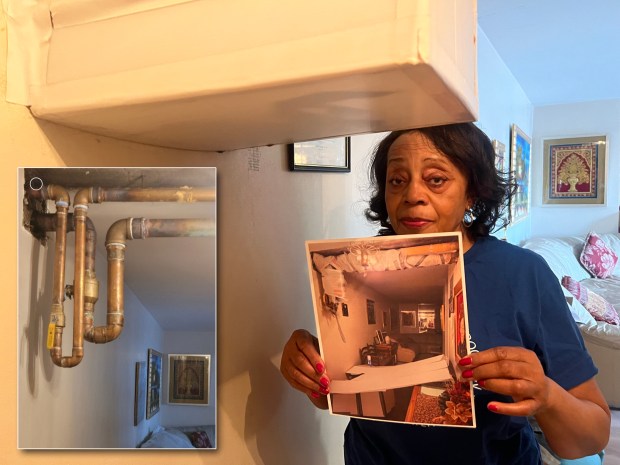

Millicent Redick

Pictures from Millicent Redick’s apartment showing damage in bathroom caused by contractors. (Millicent Redick)

In Redick’s apartment, leaks from floors above caused by the renovation exposed her to toxic mold and damaged her health. She says workers also left her ceiling with broken and defective plaster in several rooms. Records show Redick filed multiple complaints and city inspectors issued 28 violations in 2020 and 2021. But little was resolved, Redick says.

Fed up, she sued the co-op and its management company in April 2021.

More than three years later, the case is still pending and, Redick says, the mold and leak problems remain.

Obtained by Daily News

Damage from a leak in Millicent Redick’s apartment. (Obtained by Daily News)

In Gloria Lowe’s apartment, workers bizarrely installed a water pipe that protrudes 2 feet below her living room ceiling. Workers broke a hole in a wall. Leaks warped her floors, her kitchen tiles cracked and mold mushroomed in her linen closet, a list of violations included in one of the court files shows.

Lowe, a retired educator, filed suit in September 2022. She has appeared in court at least 15 times. The pipes still jut from her ceiling. She has refused to pay maintenance, and the complex has twice towed her car. She’s spent thousands to fix the problems and says she has slept in hotels at times.

In Gloria Lowe’s apartment, workers bizarrely installed a water pipe that protrudes two feet below her living room ceiling. (Téa Kvetenadze / New York Daily News)

In Gloria Lowe’s apartment, workers bizarrely installed a water pipe that protrudes two feet below her living room ceiling. (Téa Kvetenadze / New York Daily News)

“It’s just been unbelievable. It’s hard for anybody to envision what we went through,” Lowe said.

Tracey Jones, a resident of 2569 Seventh Ave., says her apartment has been afflicted with leaks that led to mold and disgusting odors. Her bathroom tiles were damaged. There were holes in her walls. Jones sued in 2023.

Tracey Jones, a resident of 2569 7th Ave., provided The News with these photos of a neighbor’s apartment with heavy mold problems.

Tracey Jones, a resident of 2569 7th Ave., provided The News with these photos of a neighbor’s apartment with heavy mold problems.

“They’ve been held in contempt of court. They’ve had a $24,000 violation they haven’t paid,” she said, referencing legal action she has taken. “This is my fourth time in civil court.”

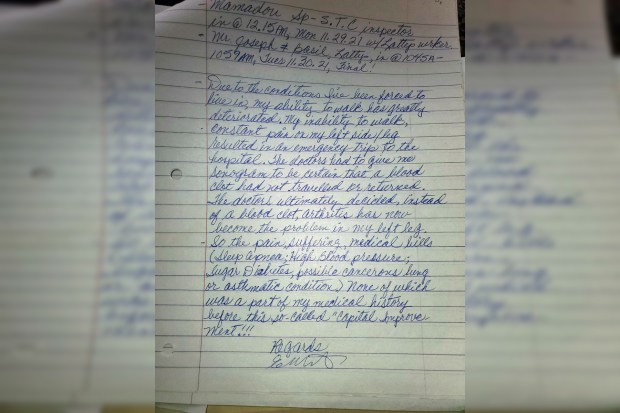

On Dec. 24, 2021, Jones’ 78-year-old aunt Ellen Grant wrote an anguished letter about her own apartment to the board, the contractor and local pols begging for help.

Plastic covered Redick’s possessions for more than a year. (Millicent Redick)

Plastic covered Redick’s possessions for more than a year. (Millicent Redick)

In the letter, penned in perfect script, she wrote she had no access to her bed as a result of the renovation and had to sleep on her sofa with her legs on a stool. She couldn’t use her kitchen or shower and had no ventilation because the windows had to be closed.

“Due to the conditions I have been forced to live in, my ability to walk has greatly deteriorated,” she wrote. “Pain, suffering, medical bills — none of which was a part of my medical history before this so-called ‘capital improvement.’ ”

Five months later, on May 24, 2022, Grant was dead. Jones said she found her body on the floor by the sofa surrounded by clutter and construction debris.

Graham Rayman

An anguished letter that Ellen Grant, 78, wrote in December 2021 to city officials. Five months later she was dead. (Tracey Jones)

A snapshot of city inspection records from May 23 show 1,657 complaints filed in the past two years and 2,371 open — or unresolved — violations. Tenants have filed at least 88 lawsuits.

The city Housing Preservation and Development Department has sued the complex at least nine times over conditions since Jan 1, 2023 The Buildings Department had full or partial stop work orders on five of the six towers as of May 23.

Gloria Lowe

Contractors mistakenly drilled a hole in a wall in Gloria Lowe’s apartment through to the outside “big enough to put a football through,” Lowe said. (Gloria Lowe)

The court files are thick with judge’s orders to fix problems, and city inspectors have fined the co-op $11,500 for recent heat and hot water violations, but often there are long delays if the problems are fixed at all.

Meanwhile lawyers for Esplanade Gardens have filed at least 173 suits against tenants for nonpayment of rent. Records show the complex claims tenants owe $6.2 million in back maintenance — a sum that has been growing for many years and includes people who aren’t paying out of protest against the conditions.

Ilana Maier, a spokeswoman for the Housing Preservation and Development Department, described the Esplanade renovation as complicated by the pandemic and aging infrastructure combined with funding struggles — challenges many Mitchell-Lama co-ops are facing.

In legal responses to the lawsuits, Esplanade Gardens denied many of the allegations. The board chairman declined to comment for this story.

Can Eric help?

By 2021, Redick and her longtime friends in the complex were at their wit’s end. They decided to try to arrange a meeting with Adams, who was running for mayor.

“On Sundays in the summer, we would all cook a meal and sit at the pool and have our jazz and watch our kids swim and we would laugh. It was a family affair,” Redick said. “All that was taken from us. So I called the ladies — come on y’all, all of us.”

Redick says she turned to contractor Shamsuddin Riza, a friend of her late husband for whom she provided accounting services.

Riza told The News he contacted retired NYPD Inspector Dwayne Montgomery to set up a meeting for Redick with Adams about Esplanade.

“I said she’s a very good person and what’s happened to the seniors there is a shame,” Riza said. “He said, ‘No problem.’”

Montgomery and Riza were both later charged in the straw donor case. Neither Adams nor his campaign, prosecutors say, was aware of the scheme.

In late May 2021, Adams and David Johnson, then a campaign aide and now a special assistant to the mayor, arrived at Redick’s front door to meet with her and six of her friends. Redick and Lowe say Adams spent about an hour there and listened as they laid out the problems in the complex. Lowe took photos of the group.

“He made general promises,” Redick said. “We hoped he would help us resolve these issues that we have had.”

Obtained by Daily News

In May 2021, candidate Eric Adams spent an hour in Redick’s living room with Redick and six other Esplanade residents. After his election, little has improved, Redick and Gloria Lowe say. (Obtained by Daily News)

After he departed, the women agreed to raise money for his campaign. Redick donated $500 to Adams that August. She says she also collected contributions from residents and turned them into money orders.

Redick says she sent copies of the money orders to Riza but held on to the originals. Once she learned the campaign was no longer accepting donations, she refunded the money orders to the people who donated.

The indictment alleges Riza sent her two checks totaling $3,100 to buy money orders to further the straw donor scheme.

But Redick says the checks from Riza were payment for unrelated bookkeeping work she did for him. Riza backed up Redick’s account to The News.

Campaign fraud Shamsuddin Riza Mayor Eric Adams

Curtis Means / Pool

Shamsuddin Riza is pictured during his arraignment in April. (Curtis Means/Pool)

Adams won the election and took office in January 2022. Redick, Lowe and Jones all say nothing has changed. City government has been no more responsive to their concerns after Adams’ election than before.

“He could’ve appointed someone who would sincerely monitor the work being done here. Someone with oversight power,” Redick says.

“He could have dealt with the environmental issues, the finances. He could have done a lot of things. He didn’t do any of it.”

William Fowler, a spokesman for the mayor, referred questions on the meeting itself to his campaign, but said Adams has a long record of pushing for legislative reforms to address problems in Mitchell-Lama complexes.

“He has proven time and again his commitment to helping these oft-forgotten New Yorkers —– many of whom are elderly, people of color on fixed incomes,” Fowler said. “The Adams administration has continued to work with Mitchell-Lama boards to make improvements to their buildings while ensuring they remain affordable.”

Adams campaign attorney Vito Pitta did not reply to emails from The News.

Redick cuffed and perp walked

On July 7, 2023, Redick was called to the Manhattan DA’s office, held in handcuffs for four hours, then paraded through a gantlet of TV cameras to her arraignment.

“I didn’t know what was going on,” she said. “I don’t even jaywalk so how did I get here? It’s not funny, but you have to laugh to keep from crying.”

Montgomery, Riza and businessmen Yahya and Shahid Mushtaq and Ronald Peek were accused of pursuing the scheme to advance business with the city.

Curtis Means / Pool

Dwayne Montgomery appears in court on July 7, 2023. (Curtis Means / Pool)

Media reports zeroed in on a quote from a July 2021 wiretapped call in which Montgomery told Riza “[Adams] said he doesn’t want to do anything if he doesn’t get 25 G’s” for his campaign.

Regarding Redick, the indictment alleged Riza enlisted her “to obtain straw donors in Harlem after Montgomery needed 10 more donors to facilitate another contribution.”

For most of last winter, Redick was without heat, She sued over that in Housing Court in February, court records show. The lack of heat forced her to stay with relatives, she said

In addition to dealing with the criminal case, she has had to trudge numerous times to Housing Court. She wins rulings but little changes.

In April, Esplanade Gardens sued her for nonpayment of rent. She says the co-op is now blocking her from using the parking space she has had for decades.

Barry Williams for New York Daily News

Millicent Redick is pictured in Esplanade Gardens in May. (Barry Williams for New York Daily News)

“What upsets me the most is here’s someone who has lived there so long and put so much time into the community to have the city turn their back on her,” Redick’s son Lawrence Redick III, 58, said. “The tenants suffered. The complex is not responsive. The courts don’t really resolve it. Where do you go from there?”

Maier, the Housing Preservation and Development Department spokeswoman, said the complex is seeking a loan from the city and $7 million in city funding is in the pipeline to help complete the renovation.

She said the city doesn’t have the legal authority to manage the day-to-day operations of the complex, but the department closely watches finances, the progress of construction and selection of new tenants.

“Generally speaking, lack of oversight is not the driving force of issues at Esplanade Gardens, it’s the high amount of unfunded capital needs,” she said.

After all the hubbub of the arrests, a year later, the four defendants closest to the scheme have pleaded guilty piecemeal to lesser charges.

Montgomery, the ex-police inspector, was facing prison time, but pleaded to a misdemeanor and received a $500 fine and 200 hours’ community service. Riza, the contractor, also facing prison time, received three years’ probation.

The Mushtaq brothers received 35 hours of community service. Peek’s case is pending.

Redick is due back in court July 16.

News

Modiv Industrial to release Q2 2024 financial results on August 6

RENO, Nev., August 1, 2024–(BUSINESS THREAD)–Modiv Industrial, Inc. (“Modiv” or the “Company”) (NYSE:MDV), the only public REIT focused exclusively on the acquisition of industrial real estate properties, today announced that it will release second quarter 2024 financial results for the quarter ended June 30, 2024 before the market opens on Tuesday, August 6, 2024. Management will host a conference call the same day at 7:30 a.m. Pacific Time (10:30 a.m. Eastern Time) to discuss the results.

Live conference call: 1-877-407-0789 or 1-201-689-8562 at 7:30 a.m. Pacific Time Tuesday, August 6.

Internet broadcast: To listen to the webcast, live or archived, use this link https://callme.viavid.com/viavid/?callme=true&passcode=13740174&h=true&info=company&r=true&B=6 or visit the investor relations page of the Modiv website at www.modiv.com.

About Modiv Industrial

Modiv Industrial, Inc. is an internally managed REIT focused on single-tenant net-leased industrial manufacturing real estate. The company actively acquires critical industrial manufacturing properties with long-term leases to tenants that fuel the national economy and strengthen the nation’s supply chains. For more information, visit: www.modiv.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240731628803/en/

Contacts

Investor Inquiries:

management@modiv.com

News

Volta Finance Limited – Director/PDMR Shareholding

Volta Finance Limited

Volta Finance Limited (VTA/VTAS)

Notification of transactions by directors, persons exercising managerial functions

responsibilities and people closely associated with them

NOT FOR DISCLOSURE, DISTRIBUTION OR PUBLICATION, IN WHOLE OR IN PART, IN THE UNITED STATES

*****

Guernsey, 1 August 2024

Pursuant to announcements made on 5 April 2019 and 26 June 2020 relating to changes to the payment of directors’ fees, Volta Finance Limited (the “Company” or “Volta”) purchased 3,380 no par value ordinary shares of the Company (“Ordinary Shares”) at an average price of €5.2 per share.

Each director receives 30% of his or her director’s fee for any year in the form of shares, which he or she is required to hold for a period of not less than one year from the respective date of issue.

The shares will be issued to the Directors, who for the purposes of Regulation (EU) No 596/2014 on Market Abuse (“March“) are “people who exercise managerial responsibilities” (a “PDMR“).

-

Dagmar Kershaw, Chairman and MDMR for purposes of MAR, has acquired an additional 1,040 Common Shares in the Company. Following the settlement of this transaction, Ms. Kershaw will have an interest in 12,838 Common Shares, representing 0.03% of the Company’s issued shares;

-

Stephen Le Page, a Director and a PDMR for MAR purposes, has acquired an additional 728 Ordinary Shares in the Company. Following the settlement of this transaction, Mr. Le Page will have an interest in 50,562 Ordinary Shares, representing 0.14% of the issued shares of the Company;

-

Yedau Ogoundele, Director and a PDMR for the purposes of MAR has acquired an additional 728 Ordinary Shares in the Company. Following the settlement of this transaction, Ms. Ogoundele will have an interest in 6,862 Ordinary Shares, representing 0.02% of the issued shares of the Company; and

-

Joanne Peacegood, Director and PDMR for MAR purposes has acquired an additional 884 Ordinary Shares in the Company. Following the settlement of this transaction, Ms. Peacegood will have an interest in 3,505 Ordinary Shares, representing 0.01% of the issued shares of the Company;

The notifications below, made in accordance with the requirements of the MAR, provide further details in relation to the above transactions:

|

a) Dagmar Kershaw |

b) Stephen LePage |

c) Yedau Ogoundele |

e) Joanne Pazgood |

|||

|

a. Position/status |

Director |

|||||

|

b. Initial Notification/Amendment |

Initial notification |

|||||

|

||||||

|

a name |

Volta Finance Limited |

|||||

|

b. LAW |

2138004N6QDNAZ2V3W80 |

|||||

|

a. Description of the financial instrument, type of instrument |

Ordinary actions |

|||||

|

b. Identification code |

GG00B1GHHH78 |

|||||

|

c. Nature of the transaction |

Acquisition and Allocation of Common Shares in Relation to Partial Payment of Directors’ Fees for the Quarter Ended July 31, 2024 |

|||||

|

d. Price(s) |

€5.2 per share |

|||||

|

e. Volume(s) |

Total: 3380 |

|||||

|

f. Transaction date |

August 1, 2024 |

|||||

|

g. Location of transaction |

At the Market – London |

|||||

|

The) |

B) |

w) |

It is) |

|||

|

Aggregate Volume: Price: |

Aggregate Volume: Price: |

Aggregate Volume: Price: |

Aggregate Volume: Price: |

|||

CONTACTS

For the investment manager

AXA Investment Managers Paris

Francois Touati

francois.touati@axa-im.com

+33 (0) 1 44 45 80 22

Olivier Pons

Olivier.pons@axa-im.com

+33 (0) 1 44 45 87 30

Company Secretary and Administrator

BNP Paribas SA, Guernsey branch

guernsey.bp2s.volta.cosec@bnpparibas.com

+44 (0) 1481 750 853

Corporate Broker

Cavendish Securities plc

Andre Worn Out

Daniel Balabanoff

+44 (0) 20 7397 8900

*****

ABOUT VOLTA FINANCE LIMITED

Volta Finance Limited is incorporated in Guernsey under the Companies (Guernsey) Law, 2008 (as amended) and listed on Euronext Amsterdam and the Main Market of the London Stock Exchange for listed securities. Volta’s home member state for the purposes of the EU Transparency Directive is the Netherlands. As such, Volta is subject to the regulation and supervision of the AFM, which is the regulator of the financial markets in the Netherlands.

Volta’s investment objectives are to preserve its capital throughout the credit cycle and to provide a stable income stream to its shareholders through dividends that it expects to distribute quarterly. The company currently seeks to achieve its investment objectives by seeking exposure predominantly to CLOs and similar asset classes. A more diversified investment strategy in structured finance assets may be pursued opportunistically. The company has appointed AXA Investment Managers Paris, an investment management firm with a division specializing in structured credit, to manage the investment portfolio of all of its assets.

*****

ABOUT AXA INVESTMENT MANAGERS

AXA Investment Managers (AXA IM) is a multi-specialist asset management firm within the AXA Group, a global leader in financial protection and wealth management. AXA IM is one of the largest European-based asset managers with 2,700 professionals and €844 billion in assets under management at the end of December 2023.

*****

This press release is issued by AXA Investment Managers Paris (“AXA IM”) in its capacity as alternative investment fund manager (within the meaning of Directive 2011/61/EU, the “AIFM Directive”) of Volta Finance Limited (“Volta Finance”), the portfolio of which is managed by AXA IM.

This press release is for information only and does not constitute an invitation or inducement to purchase shares of Volta Finance. Its circulation may be prohibited in certain jurisdictions and no recipient may circulate copies of this document in violation of such limitations or restrictions. This document is not an offer to sell the securities referred to herein in the United States or to persons who are “U.S. persons” for purposes of Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”), or otherwise in circumstances where such an offering would be restricted by applicable law. Such securities may not be sold in the United States absent registration or an exemption from registration under the Securities Act. Volta Finance does not intend to register any part of the offering of such securities in the United States or to conduct a public offering of such securities in the United States.

*****

This communication is being distributed to, and is directed only at, (i) persons who are outside the United Kingdom or (ii) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) or (iii) high net worth companies and other persons to whom it may lawfully be communicated falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as “relevant persons”). The securities referred to herein are available only to, and any invitation, offer or agreement to subscribe for, purchase or otherwise acquire such securities will be made only to, relevant persons. Any person who is not a relevant person should not act on or rely on this document or any of its contents. Past performance should not be relied upon as a guide to future performance.

*****

This press release contains statements that are, or may be deemed to be, “forward-looking statements”. These forward-looking statements can be identified by the use of forward-looking terminology, including the words “believes”, “anticipates”, “expects”, “intends”, “is/are expected”, “may”, “will” or “should”. They include statements about the level of the dividend, the current market environment and its impact on the long-term return on Volta Finance’s investments. By their nature, forward-looking statements involve risks and uncertainties and readers are cautioned that such forward-looking statements are not guarantees of future performance. Actual results, portfolio composition and performance of Volta Finance may differ materially from the impression created by the forward-looking statements. AXA IM undertakes no obligation to publicly update or revise forward-looking statements.

Any target information is based on certain assumptions as to future events that may not materialize. Due to the uncertainty surrounding these future events, targets are not intended to be and should not be considered to be profits or earnings or any other type of forecast. There can be no assurance that any of these targets will be achieved. Furthermore, no assurance can be given that the investment objective will be achieved.

Figures provided which relate to past months or years and past performance cannot be considered as a guide to future performance or construed as a reliable indicator as to future performance. Throughout this review, the citation of specific trades or strategies is intended to illustrate some of Volta Finance’s investment methodologies and philosophies as implemented by AXA IM. The historical success or AXA IM’s belief in the future success of any such trade or strategy is not indicative of, and has no bearing on, future results.

The valuation of financial assets may vary significantly from the prices that AXA IM could obtain if it sought to liquidate the positions on Volta Finance’s behalf due to market conditions and the general economic environment. Such valuations do not constitute a fairness or similar opinion and should not be relied upon as such.

Publisher: AXA INVESTMENT MANAGERS PARIS, a company incorporated under the laws of France, with registered office at Tour Majunga, 6, Place de la Pyramide – 92800 Puteaux. AXA IMP is authorized by Autorité des Marchés Financiers under registration number GP92008 as an alternative investment fund manager within the meaning of the AIFM Directive.

*****

News

Apple to report third-quarter earnings as Wall Street eyes China sales

Litter (AAPL) is set to report its fiscal third-quarter earnings after the market closes on Thursday, and unlike the rest of its tech peers, the main story won’t be about the rise of AI.

Instead, analysts and investors will be keeping a close eye on iPhone sales in China and whether Apple has managed to stem the tide of users switching to domestic rivals including Huawei.

For the quarter, analysts expect Apple to report earnings per share (EPS) of $1.35 on revenue of $84.4 billion, according to estimates compiled by Bloomberg. Apple saw EPS of $1.26 on revenue of $81.7 billion in the same period last year.

Apple shares are up about 18.6% year to date despite a rocky start to the year, thanks in part to the impact of the company’s Worldwide Developer Conference (WWDC) in May, where showed off its Apple Intelligence software.

But the big question on investors’ minds is whether iPhone sales have risen or fallen in China. Apple has struggled with slowing phone sales in the region, with the company noting an 8% decline in sales in the second quarter as local rivals including Huawei and Xiaomi gain market share.

Apple CEO Tim Cook delivers remarks at the start of the Apple Worldwide Developers Conference (WWDC). (Photo by Justin Sullivan/Getty Images) (Justin Sullivan via Getty Images)

And while some analysts, such as JPMorgan’s Samik Chatterjee, believe sales in Greater China, which includes mainland China, Hong Kong, Singapore and Taiwan, rose in the third quarter, others, including David Vogt of UBS Global Research, say sales likely fell about 6%.

Analysts surveyed by Bloomberg say Apple will report revenue of $15.2 billion in Greater China, down 3.1% from the same quarter last year, when Apple reported revenue of $15.7 billion in China. Overall iPhone sales are expected to reach $38.9 billion, down 1.8% year over year from the $39.6 billion Apple saw in the third quarter of 2023.

But Apple is expected to make up for those declines in other areas, including Services and iPad sales. Services revenue is expected to reach $23.9 billion in the quarter, up from $21.2 billion in the third quarter of 2023, while iPad sales are expected to reach $6.6 billion, up from the $5.7 billion the segment brought in in the same period last year. Those iPad sales projections come after Apple launched its latest iPad models this year, including a new iPad Pro lineup powered by the company’s M4 chip.

Mac revenue is also expected to grow modestly in the quarter, versus a 7.3% decline last year. Sales of wearables, which include the Apple Watch and AirPods, however, are expected to decline 5.9% year over year.

In addition to Apple’s revenue numbers, analysts and investors will be listening closely for any commentary on the company’s software launches. Apple Intelligence beta for developers earlier this week.

The story continues

The software, which is powered by Apple’s generative AI technology, is expected to arrive on iPhones, iPads and Macs later this fall, though according to Bloomberg’s Marc GurmanIt won’t arrive alongside the new iPhone in September. Instead, it’s expected to arrive on Apple devices sometime in October.

Analysts are divided on the potential impact of Apple Intelligence on iPhone sales next year, with some saying the software will kick off a new iPhone sales supercycle and others offering more pessimistic expectations about the technology’s effect on Apple’s profits.

It’s important to note that Apple Intelligence is only compatible with the iPhone 15 Pro and newer phones, ensuring that all users desperate to get their hands on the tech will have to upgrade to a newer, more powerful phone as soon as it is available.

Either way, if Apple wants to make Apple Intelligence a success, it will need to ensure it has the features that will make customers excited to take advantage of the offering.

Subscribe to the Yahoo Finance Tech Newsletter. (Yahoo Finance)

Email Daniel Howley at dhowley@yahoofinance.com. Follow him on Twitter at @DanielHowley.

Read the latest financial and business news from Yahoo Finance

News

Number of Americans filing for unemployment benefits hits highest level in a year

The number of Americans filing for unemployment benefits hit its highest level in a year last week, even as the job market remains surprisingly healthy in an era of high interest rates.

Jobless claims for the week ending July 27 rose 14,000 to 249,000 from 235,000 the previous week, the Labor Department said Thursday. It’s the highest number since the first week of August last year and the 10th straight week that claims have been above 220,000. Before that period, claims had remained below that level in all but three weeks this year.

Weekly jobless claims are widely considered representative of layoffs, and while they have been slightly higher in recent months, they remain at historically healthy levels.

Strong consumer demand and a resilient labor market helped avert a recession that many economists predicted during the Federal Reserve’s prolonged wave of rate hikes that began in March 2022.

As inflation continues to declinethe Fed’s goal of a soft landing — reducing inflation without causing a recession and mass layoffs — appears to be within reach.

On Wednesday, the Fed left your reference rate aloneBut officials have strongly suggested a cut could come in September if the data stays on its recent trajectory. And recent labor market data suggests some weakening.

The unemployment rate rose to 4.1% in June, despite the fact that American employers added 206,000 jobs. U.S. job openings also fell slightly last month. Add that to the rise in layoffs, and the Fed could be poised to cut interest rates next month, as most analysts expect.

The four-week average of claims, which smooths out some of the weekly ups and downs, rose by 2,500 to 238,000.

The total number of Americans receiving unemployment benefits in the week of July 20 jumped by 33,000 to 1.88 million. The four-week average for continuing claims rose to 1,857,000, the highest since December 2021.

Continuing claims have been rising in recent months, suggesting that some Americans receiving unemployment benefits are finding it harder to get jobs.

There have been job cuts across a range of sectors this year, from agricultural manufacturing Deerefor media such as CNNIt is in another place.

-

Videos4 weeks ago

Videos4 weeks agoAbsolutely massive: the next higher Bitcoin leg will shatter all expectations – Tom Lee

-

News12 months ago

News12 months agoVolta Finance Limited – Director/PDMR Shareholding

-

News12 months ago

News12 months agoModiv Industrial to release Q2 2024 financial results on August 6

-

News12 months ago

News12 months agoApple to report third-quarter earnings as Wall Street eyes China sales

-

News12 months ago

News12 months agoNumber of Americans filing for unemployment benefits hits highest level in a year

-

News1 year ago

News1 year agoInventiva reports 2024 First Quarter Financial Information¹ and provides a corporate update

-

News1 year ago

News1 year agoLeeds hospitals trust says finances are “critical” amid £110m deficit

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Hit $100 Billion in 2024, Fueling Insane Investor Optimism ⋆ ZyCrypto

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Videos1 year ago

Videos1 year ago$1,000,000 worth of BTC in 2025! Get ready for an UNPRECEDENTED PRICE EXPLOSION – Jack Mallers

-

Videos1 year ago

Videos1 year agoABSOLUTELY HUGE: Bitcoin is poised for unabated exponential growth – Mark Yusko and Willy Woo

-

Tech1 year ago

Tech1 year agoBlockDAG ⭐⭐⭐⭐⭐ Review: Is It the Next Big Thing in Cryptocurrency? 5 questions answered