Markets

MiCA deadline looming: Cryptocurrency exchanges shake up stablecoins

The European Union’s Markets in Crypto Assets (MiCA) regulation will come into force on June 30, just three days from now. As such, many crypto exchanges offering services in the block are already taking action, primarily by abandoning stablecoin offerings.

“This will be a first step towards entering the new regulatory framework, and will have a significant impact on the stablecoin market in the European Economic Area (EEA),” said Binance, the largest crypto exchange in terms of transaction volume.

Crypto Exchanges Have Abandoned Stablecoins

At least four cryptocurrency exchanges have confirmed that they are limiting access to certain stablecoins to users in the EEA. Bitstamp was the latest to confirm on Wednesday that it would delist the euro-denominated stablecoin, EURT, before the June 30 deadline.

EURT is a euro-pegged stablecoin issued by Tether, the company behind the largest stablecoin in circulation, USDT, with a market cap of over $112.7 billion. Interestingly, Bitstamp became one of the first crypto exchanges to list EURT in November 2021.

“Electronic money tokens (EMT) which are not denominated in euros and are already available on exchanges but are not subject to MiCA regulation, will not be delisted, although their availability to European customers will be limited on certain products .” Stamp-bit wrote in his ad.

“Bitstamp will not list any new EMTs that do not meet MiCA requirements nor will it engage in any commercialization of them.”

Another major name to act before MiCA is Binance. As Finance Magnates reported earlier, The crypto exchange has already blocked access to some servicesincluding copy trading. This will also bring new restrictions, including restricting the purchase of unauthorized stablecoins and limit new borrowing and transfers of unauthorized stablecoins in margin trading.

Uphold, another cryptocurrency exchange linked to Ripple, also confirmed the delisting of six stablecoins, including the popular USDT, for European users. However, it will continue to support USDC, EURC and PYUSD.

Comply with MiCA from June 30

Similar to MiFID, Mica The regulation will bring together cryptocurrency services in the EU under one regulatory umbrella. This regulation will impact the distribution of cryptocurrencies in the Union, meaning that both retail and institutional players will be affected in one way or another.

With the approval of the European Parliament in 2023, the MiCA is expected to be implemented in two phases: Stablecoin rules to come into effect on June 30, 2024 and then broader compliance on exchanges and wallets which will come into effect from December 30, 2024.

Under MiCA, stablecoins backed by fiat currencies on the blockchain would be categorized as “e-money tokens,” while other asset-backed tokens would be “asset-referenced tokens.” In both cases, stablecoin issuers must maintain a 1:1 reserve. This will also place algorithmic stablecoins under liability, requiring them to maintain their value.

The regulation would also limit the daily limit on transactions with non-euro-pegged stablecoins to just $1 million.

“As the world’s oldest cryptocurrency exchange, we have consistently advocated for a proportionate response to regulation that protects consumers while enabling the continued maturation of cryptocurrencies as an asset class” , said James Sullivan, Bitstamp UK Managing Director. “We communicate directly with the small proportion of our clients whose asset mix is affected. »

The exchanges have been preparing for months

A few crypto exchanges were already taking steps to comply with MiCA earlier this year. In March, OKX confirmed the delisting of USDT pairs in the EEA, without mentioning MiCA. “Please note that not all tokens are available on all markets due to regulatory requirements,” noted an email sent by the exchange to its European clients.

Interesting way, Kraken According to a Bloomberg report in March, Kraken also reviewed the USDT pairs it offered in the EU and considered removing them to comply with MiCA. However, following the report, Kraken’s global head of growth and asset management, Mark Greenberg, clarified that the exchange “continues to list USDT in Europe and we have no plans to delist it at this time.”

“We know that our European customers value access to USDT and we continue to explore all options for offering USDT under the upcoming regime,” he added. “We will of course comply with all legal requirements, even those we do not agree with. But the rules are not yet finalized and we continue to do everything we can to continue to offer all relevant stablecoins to our European customers.”

So far, Kraken has not officially announced anything regarding the removal of any stablecoin pairs to comply with MiCA.

Interestingly, a recent report found that only 9% of the 68 cryptocurrency companies surveyed are fully MiCA compliant needs, while 25 percent have yet to begin preparations.

The European Union’s Markets in Crypto Assets (MiCA) regulation will come into force on June 30, just three days from now. As such, many crypto exchanges offering services in the block are already taking action, primarily by abandoning stablecoin offerings.

“This will be a first step towards entering the new regulatory framework, and will have a significant impact on the stablecoin market in the European Economic Area (EEA),” said Binance, the largest crypto exchange in terms of transaction volume.

Crypto Exchanges Have Abandoned Stablecoins

At least four cryptocurrency exchanges have confirmed that they are limiting access to certain stablecoins to users in the EEA. Bitstamp was the latest to confirm on Wednesday that it would delist the euro-denominated stablecoin, EURT, before the June 30 deadline.

EURT is a Euro-pegged stablecoin issued by Tether, the company behind the largest stablecoin in circulation, USDT, with a market capitalization of over $112.7 billion. Interestingly, Bitstamp became one of the first crypto exchanges to list EURT in November 2021.

“Electronic money tokens (EMT) which are not denominated in euros and which are already available on the exchange but do not fall under the MiCA regulation, will not be delisted, although their availability to European customers will be limited on certain products”, Bit stamp wrote in his ad.

“Bitstamp will not list any new EMTs that do not meet MiCA requirements and will not engage in any commercialization of them.”

Binance is another big name that will be taking action ahead of MiCA. As Finance Magnates reported earlier, the crypto exchange has already blocked access to certain servicesincluding copy trading. This will also result in other restrictions, including restricting the purchase of Unauthorized stablecoins and limit new borrowing and transfers of unauthorized stablecoins through margin transactions.

Uphold, another crypto exchange linked to Ripple, also confirmed the delisting of six stablecoins, including the popular USDT, for European users. However, it will continue to support USDC, EURC and PYUSD.

Comply with MiCA from June 30

Similar to MiFID, Mica The regulation will bring together cryptocurrency services in the EU under a single regulatory umbrella. This regulation will impact the distribution of cryptocurrencies in the Union, meaning that individual and institutional players will all be affected in one way or another.

With the approval of the European Parliament in 2023, the MiCA is expected to be implemented in two phases: Stablecoin rules to come into effect on June 30, 2024 then broader compliance on exchanges and wallets which will come into force from December 30, 2024.

Under MiCA, stablecoins backed by fiat currencies in the bloc would be categorized as “e-money tokens,” while other asset-backed tokens would be “asset-referenced tokens.” In both cases, stablecoin issuers must maintain a 1:1 reserve. It will also bring algorithmic stablecoins under the purview of the law, requiring them to maintain their value.

The regulations would also limit the daily limit of transactions with non-euro-pegged stablecoins to just $1 million.

“As the world’s oldest cryptocurrency exchange, we have consistently advocated for a proportionate response to regulation that protects consumers while enabling the continued maturation of cryptocurrencies as an asset class,” said said James Sullivan, UK Managing Director of Bitstamp. “We communicate directly with the small proportion of our clients whose asset allocation is affected. »

The exchanges have been preparing for months

A few crypto exchanges were already taking steps to comply with MiCA earlier this year. In March, OKX confirmed the delisting of USDT pairs in the EEA, without mentioning MiCA. “Please note that not all tokens are available on all markets due to regulatory requirements,” noted an email sent by the exchange to its European clients.

Interesting way, Kraken According to a Bloomberg report in March, Kraken also reviewed the USDT pairs it offered in the EU and considered removing them to comply with MiCA. However, following the report, Kraken’s global head of growth and asset management, Mark Greenberg, clarified that the exchange “continues to list USDT in Europe and we have no plans to delist it at this time.”

“We know that our European customers value access to USDT and we continue to review all options to offer USDT under the next regime,” he added. “We will of course comply with all legal requirements, even those with which we do not agree. But the rules are not yet finalized and we continue to do everything possible to continue offering all relevant stablecoins to our European customers.

So far, Kraken has not officially announced anything about removing stablecoin pairs to comply with MiCA.

Interestingly, a recent report found that only 9% of cryptocurrency companies, out of 68 surveyed, are fully MiCA compliant requirements, while another 25% have not yet started preparations.

Markets

Today’s top crypto gainers and losers

Over the past 24 hours, Jupiter and JasmyCoin emerged as the top gainers among the top 100 crypto assets, while Bittensor and Mantra plunged as the top losers.

Top Winners

Jupiter

Jupiter (JUP) led the charge among the biggest gainers on July 27.

At the time of writing, the crypto asset had surged 12.6% in the past 24 hours and was trading at $1.16. JUP’s daily trading volume was hovering around $282 million, according to data from crypto.news.

JUP Hourly Price Chart, July 26-27 | Source: crypto.news

Additionally, the cryptocurrency’s market cap stood at $1.56 billion, making it the 62nd largest crypto asset, according to CoinGecko. Despite the recent price surge, the token is still down 42.6% from its all-time high of $2 reached on Jan. 31.

Jupiter functions as a decentralized exchange aggregator that allows users to trade Solana-based tokens. The platform also offers users the best routes for direct trades between multiple exchanges and liquidity pools.

In addition to being a DEX aggregator, Jupiter has expanded into a “full stack ecosystem” by launching several new projects, including a dedicated pool to support perpetual trading and plans for a stablecoin.

JasmyCoin

JasmyCoin (JASMI) has increased by 12% in the last 24 hours and is trading at $0.0328 at press time. JASMY’s daily trading volume has increased by 10% in the last 24 hours, reaching $146 million.

JASMY Hourly Price Chart, July 26-27 | Source: crypto.news

The asset’s market cap has surpassed the $1.5 billion mark, making it the 60th largest cryptocurrency at the time of reporting. However, the self-proclaimed “Bitcoin of Japan” is still down 99.3% from its all-time high of $4.79 on February 16, 2021.

JASMY is the native token of Jasmy Corporation, a Japanese Internet of Things provider. The platform seeks to merge the decentralization of blockchain technology with IoT, allowing users to convert their digital information into digital assets.

The initiative was launched by Kunitake Ando, former COO of Sony Corporation, along with Kazumasa Sato, former CEO of Sony Style.com Japan Inc., Hiroshi Harada, executive financial analyst at KPMG, and other senior executives from Japan.

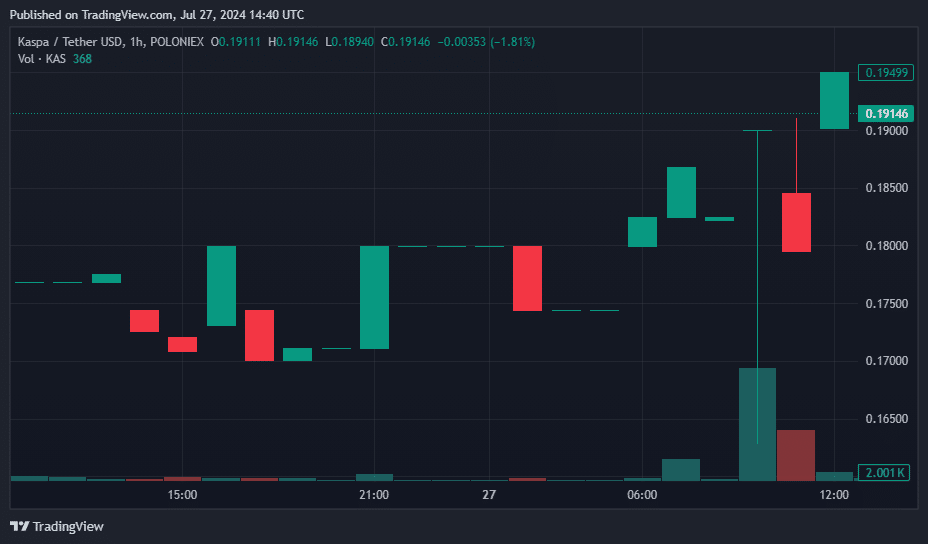

Kaspa

Kaspa (KAS) saw a 100% increase in trading volume and an 8% increase in price over the past 24 hours, trading at $0.19 at the time of publication.

KAS Hourly Price Chart, July 26-27 | Source: crypto.news

According to data from CoinGecko, Kaspa now ranks 27th in the global cryptocurrency list, with a circulating supply of approximately 24.29 billion KAS tokens and a market capitalization of $4.59 billion.

Kaspa is a cryptocurrency designed to deliver a high-performance, scalable, and secure blockchain platform. Its unique Layer-1 protocol includes the GhostDAG protocol, a proof-of-work (PoW) consensus mechanism that enables faster block times and higher transaction throughput compared to standard blockchains.

Unlike Bitcoin, GhostDAG allows multiple blocks to be created simultaneously, speeding up transactions and increasing block rewards for miners.

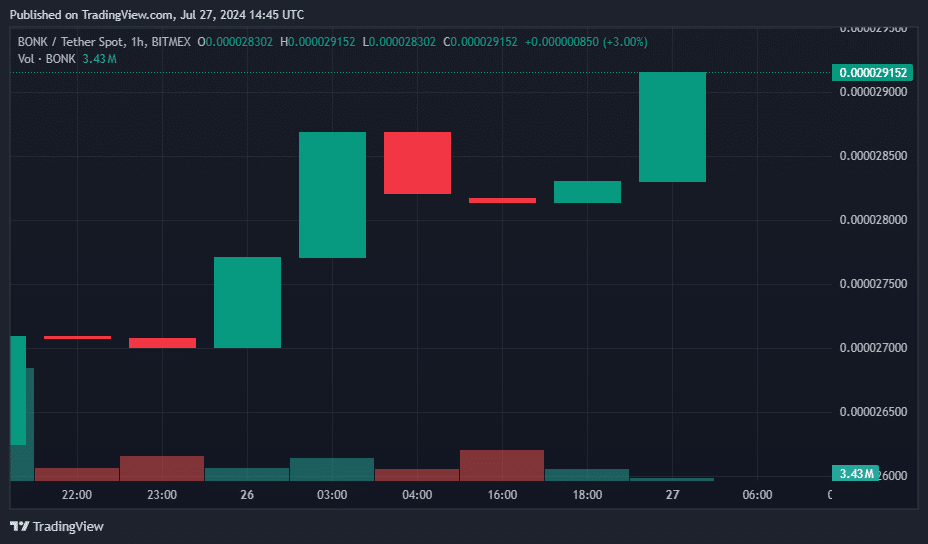

Bonk

Bonk (BONK) is the only one coin meme which made it to this list of biggest gainers and jumped 8.6% in the last 24 hours. Trading at $0.000030, the Solana-based meme coin’s market cap has surpassed $2.1 billion, surpassing Floki (FLOKI), another competing dog-themed coin with a market cap of $1.78 billion.

BONK Hourly Price Chart, July 26-27 | Source: crypto.news

BONK’s daily trading volume hovered around $285 million. However, BONK is still down 33.5% from its all-time high of $0.000045, reached on March 4.

Bonk, a meme coin that rose to prominence in 2023, has contributed significantly to Solana’s value increase amid the meme coin frenzy.

Bonk started out as a simple dog-themed coin. It has since expanded its features to include integration with decentralized finance. The project also partners with cross-chain communication protocols, NFT marketplaces, and various other cryptocurrency ecosystems.

BONK trading pairs are now listed on major exchanges including Binance, Coinbase, OKX, and Bitstamp.

The big losers

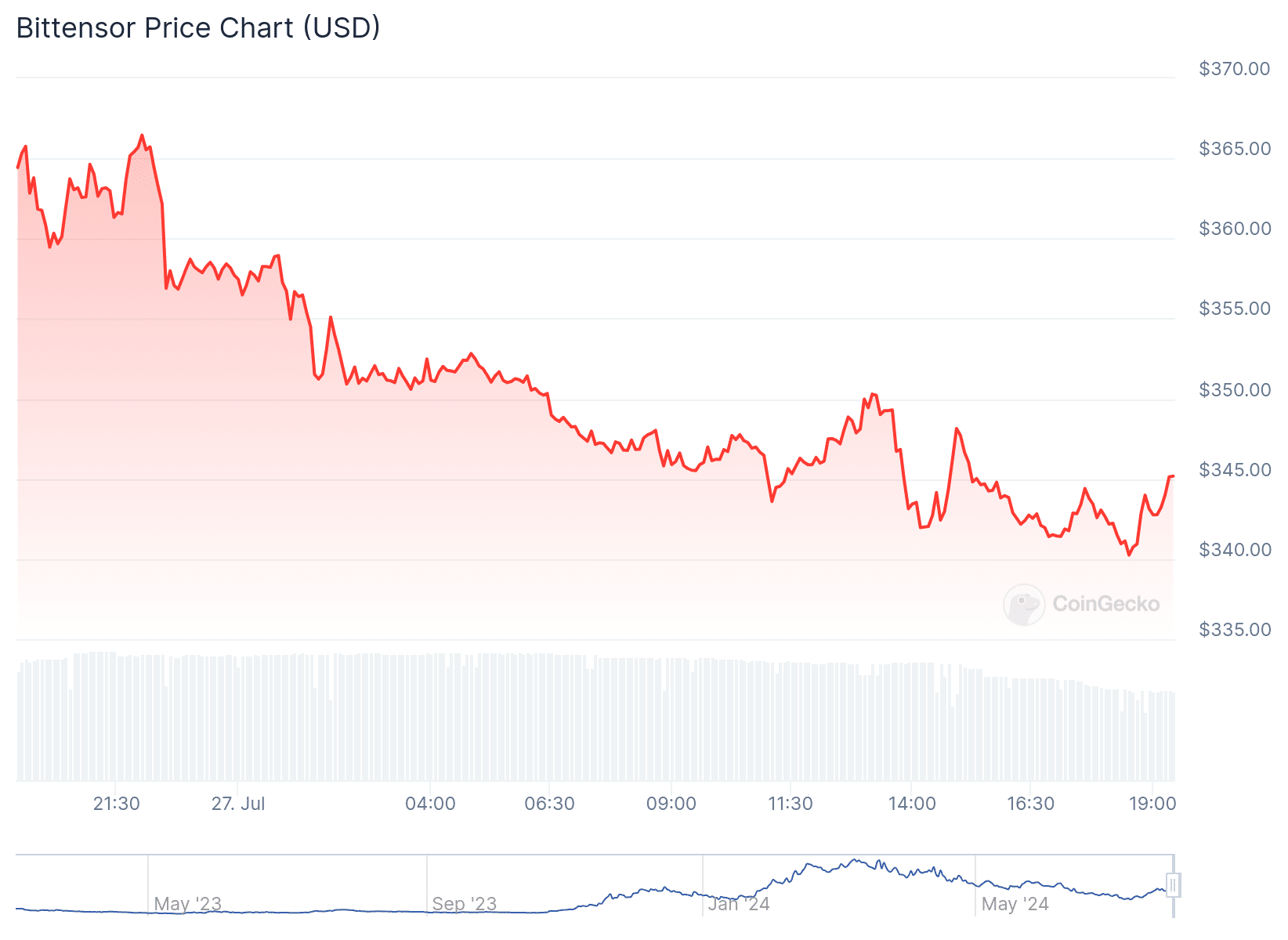

Bittensor

Bittensor (TAO) was the biggest loser among the 100 largest crypto assets, according to data from CoinGecko.

At the time of writing, TAO, the native token of decentralized AI project Bittensor, was down 5%, trading around $344. The crypto asset had a daily trading volume of $59 million and a market cap of $2.43 billion.

TAO 24 Hour Price Chart | Source: CoinGecko

Bittensor, created in 2019 by AI researchers Ala Shaabana and Jacob Steeves, initially operated as a parachain on Polkadot before transitioning to its own layer-1 blockchain in March 2023.

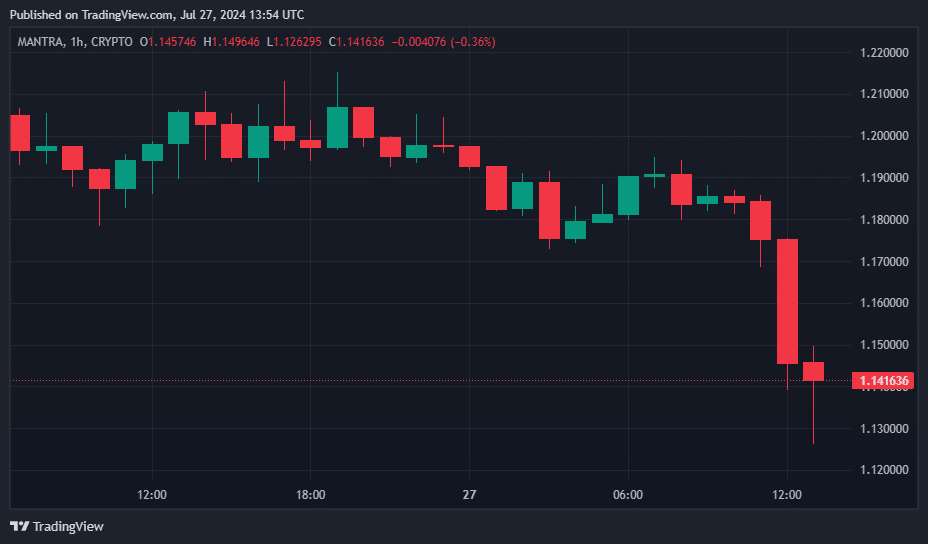

Mantra

Mantra (OM) fell 6%, trading at $1.13 at press time. The digital currency’s market cap fell to $938 million. Additionally, the 82nd largest crypto asset has a daily trading volume of $26 million.

OM Price Hourly Chart, July 26-27 | Source: crypto.news

Mantra is a modular blockchain network comprising two chains, Manta Pacific and Manta Atlantic, specialized in zero-knowledge applications.

Coat

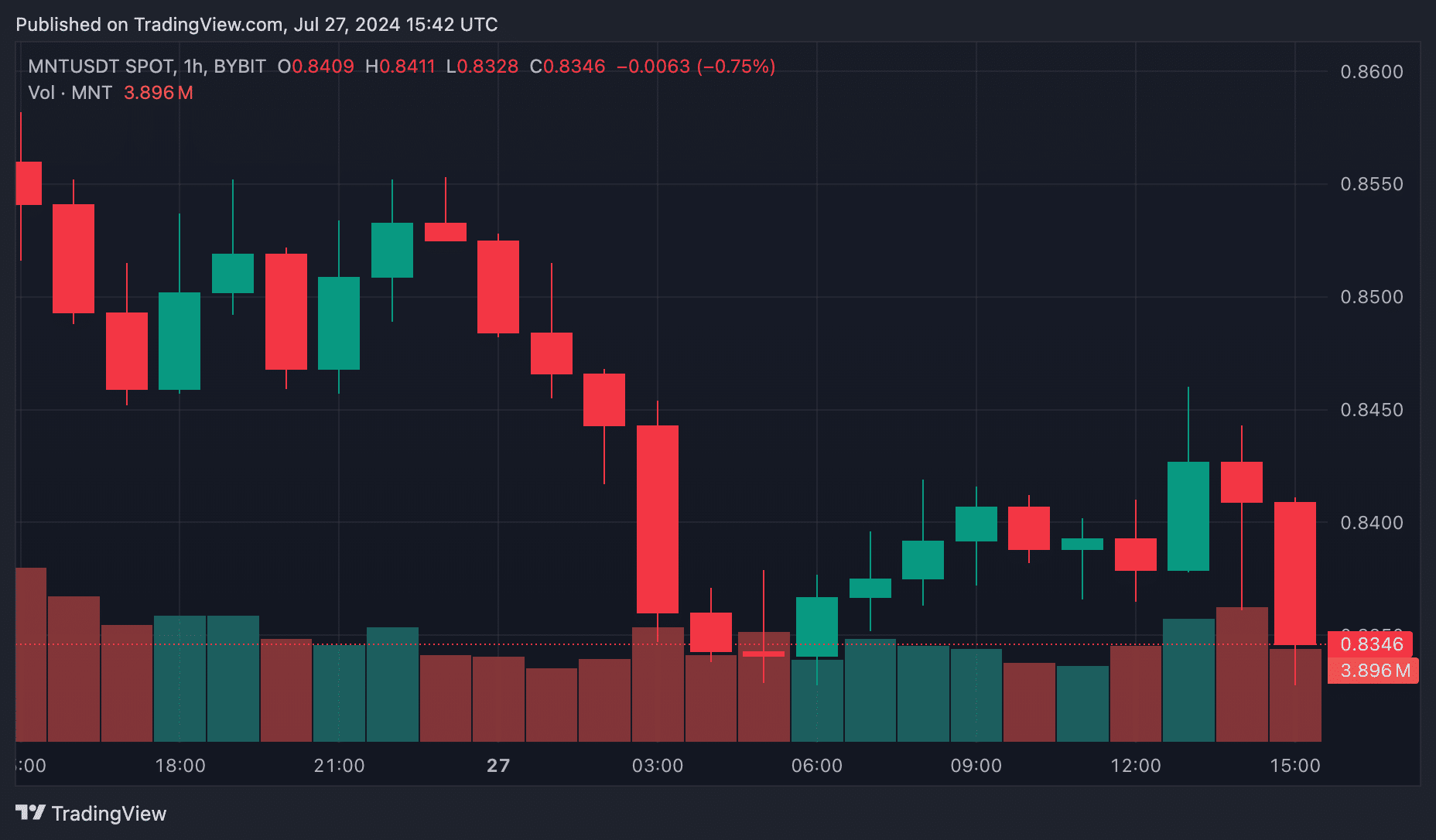

Coat (MNT) also saw a 2.4% drop in price, now trading at $0.8413. Currently, Mantle has a market cap of around $2.75 billion, which ranks 36th in the global cryptocurrency rankings by market cap, according to price data from crypto.news.

MNT Hourly Price Chart, July 26-27 | Source: crypto.news

Over the past 24 hours, MNT trading volume also fell by 6%, reaching $240 million.

Mantle, formerly known as BitDAO, is an investment DAO closely associated with Bybit. The MNT token is essential for governance, paying gas fees on the Mantle network, and staking on various platforms.

Built on the Ethereum network, Mantle provides a platform for decentralized application developers to launch their projects. It has become particularly popular for GameFi applications, leading to the formation of an internal Web3 gaming team.

Markets

Bitcoin Price Drops to $67,000 Despite Trump’s Pro-Crypto Comments, Further Correction Ahead?

Pioneer cryptocurrency Bitcoin has registered a 1.13% decline in the past 24 hours to trade at $67,400. Despite a strong pro-crypto stance from US presidential candidate Donald Trump at the Bitcoin 2024 conference, this massive selloff has raised concerns in the market about the asset’s sustainability at a higher price. However, given the recent three-week rally, a slight pullback this weekend is justifiable and necessary to regain the depleted bullish momentum.

Bitcoin Price Flag Formation Hints at Opportunity to Break Beyond $80,000

The medium-term trend Bitcoin Price remains a sideways trend amidst the formation of a bullish flag pattern. This chart pattern is defined by two descending lines that are currently shaping the price trajectory by providing dynamic resistance and support.

On July 5, BTC saw a bullish reversal from the flag pattern at $53,485, increasing its asset by 29.75% to a high of $69,400. This recent spike followed the market’s positive sentiment towards the Donald Trump speech at the Bitcoin 2024 conference in Nashville on Saturday afternoon.

Bitcoin Price | Tradingview

In his speech, Trump outlined several pro-crypto initiatives: he promised to replace SEC Chairman Gary Gensler on his first day in office, to establish a Strategic National Reserve of Bitcoin if elected, to ensure that the U.S. government holds all of its assets. Bitcoin assets and block any attempt to create a central bank digital currency (CBDC) during his presidency.

He also claimed that under his leadership, Bitcoin and cryptocurrencies will skyrocket like never before.

Despite Donald Trump’s optimistic promises, the BTC price failed to reach $70,000 and is currently trading at $67,400. As a result, Bitcoin’s market cap has dipped slightly to hover at $1.335 trillion.

However, this pullback is justified, as Bitcoin price has recently seen significant growth over the past three weeks, which has significantly improved market sentiment. Thus, price action over the weekend could replenish the depleted bullish momentum, potentially strengthening an attempt to break out from the flag pattern at $70,130.

A successful breakout will signal the continuation of the uptrend and extend the Bitcoin price forecast target at $78,000, followed by $84,000.

On the other hand, if the supply pressure on the upper trendline persists, the asset price could trigger further corrections for a few weeks or months.

Technical indicator:

- Pivot levels: The traditional pivot indicator suggests that the price pullback could see immediate support at $64,400, followed by a correction floor at $56,700.

- Moving average convergence-divergence: A bullish crossover state between the MACD (blue) and the signal (orange) ensure that the recovery dynamics are intact.

Related Articles

Frequently Asked Questions

A CBDC is a digital form of fiat currency issued and regulated by a country’s central bank. It aims to provide a digital alternative to traditional banknotes.

The proposal for a strategic national Bitcoin reserve is a major confirmation of Bitcoin’s legitimacy and potential as a reserve asset. Such a move could position Bitcoin in a similar way to gold, potentially stabilizing its price and encouraging other countries to adopt similar strategies.

Conferences like Bitcoin 2024 serve as essential platforms for networking, knowledge sharing, and showcasing new technologies within the cryptocurrency industry.

Markets

Swiss crypto bank Sygnum reports profitability after surge in first-half trading volumes – DL News

- Sygnum says it has reached profitability after increasing transaction volumes.

- The Swiss crypto bank does not disclose specific profit figures.

Sygnum, a Swiss global crypto banking group with approximately $4.5 billion in client assets, announced that it has achieved profitability after a strong first half, with key metrics showing year-to-date growth.

The company said in a Press release Compared to the same period last year, cryptocurrency spot trading volumes doubled, cryptocurrency derivatives trading increased by 500%, and lending volumes increased by 360%. The exact figures for the first half of the year were not disclosed.

Sygnum said its staking service has also grown, with the percentage of Ethereum staked by customers increasing to 42%. For institutional clients, staking Ethereum has a benefit that goes beyond the limitations of the ETF framework, which excludes staking returns, Sygnum noted.

“The approval and launch of Bitcoin and Ethereum ETFs was a turning point for the crypto industry this year, leading to a major increase in demand for trusted, regulated exposure to digital assets,” said Martin Burgherr, Chief Client Officer of Sygnum.

He added: “This is also reflected in Sygnum’s own growth, with our core business segments recording significant year-to-date growth in the first half of the year.”

Sygnum, which has also been licensed in Luxembourg since 2022, plans to expand into European and Asian markets, the statement said.

Markets

Former White House official Anthony Scaramucci says cryptocurrency bull market could be sparked by regulatory clarity

Anthony Scaramucci, founder of Skybridge Capital, says the next cryptocurrency bull market could be sparked by a new wave of clear cryptocurrency regulations.

In a new interview On CNBC’s Squawk Box, the former White House communications director said he and two other prominent industry figures traveled to Washington, D.C. to speak to officials about the dangers of Sen. Elizabeth Warren and U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler’s hardline approach to cryptocurrency regulation.

“Mark Cuban, myself, and Michael Novogratz were in Washington a few weeks ago to speak with White House officials and explain the dangers of Gary Gensler and Elizabeth Warren’s anti-crypto approach. I hope that message gets through…

“Overall, if we can get regulatory policy around Bitcoin and crypto assets in sync, we will have a bull market next year for these assets.”

Scaramucci then compares crypto assets to ride-hailing company Uber, saying regulators were initially wary of the service but eventually decided to adopt clear guidelines due to public demand.

“Remember Uber: Nobody wanted Uber. A lot of regulators didn’t want it. Mayors and deputy mayors didn’t want it, but citizens wanted Uber and eventually accepted the idea of regulating it fairly. I think we’re there now.”

The CEO also says young Democratic voters believe their leaders are making the wrong choices when it comes to digital assets.

“I think President Trump’s move toward Bitcoin and crypto assets has shaken Democrats to their core, and I think very smart, younger Democrats are recognizing that they are completely off base with their positions, completely off base with these SEC lawsuits and regulation by law enforcement, and now they need to get back to the center.”

Don’t miss a thing – Subscribe to receive email alerts directly to your inbox

Check Price action

follow us on X, Facebook And Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed on The Daily Hodl are not investment advice. Investors should do their own due diligence before making any high-risk investments in Bitcoin, cryptocurrencies or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Image generated: Midjourney

-

Videos4 weeks ago

Videos4 weeks agoAbsolutely massive: the next higher Bitcoin leg will shatter all expectations – Tom Lee

-

News12 months ago

News12 months agoVolta Finance Limited – Director/PDMR Shareholding

-

News12 months ago

News12 months agoModiv Industrial to release Q2 2024 financial results on August 6

-

News12 months ago

News12 months agoApple to report third-quarter earnings as Wall Street eyes China sales

-

News12 months ago

News12 months agoNumber of Americans filing for unemployment benefits hits highest level in a year

-

News1 year ago

News1 year agoInventiva reports 2024 First Quarter Financial Information¹ and provides a corporate update

-

News1 year ago

News1 year agoLeeds hospitals trust says finances are “critical” amid £110m deficit

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Hit $100 Billion in 2024, Fueling Insane Investor Optimism ⋆ ZyCrypto

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Videos1 year ago

Videos1 year ago$1,000,000 worth of BTC in 2025! Get ready for an UNPRECEDENTED PRICE EXPLOSION – Jack Mallers

-

Videos1 year ago

Videos1 year agoABSOLUTELY HUGE: Bitcoin is poised for unabated exponential growth – Mark Yusko and Willy Woo

-

Tech1 year ago

Tech1 year agoBlockDAG ⭐⭐⭐⭐⭐ Review: Is It the Next Big Thing in Cryptocurrency? 5 questions answered