Tech

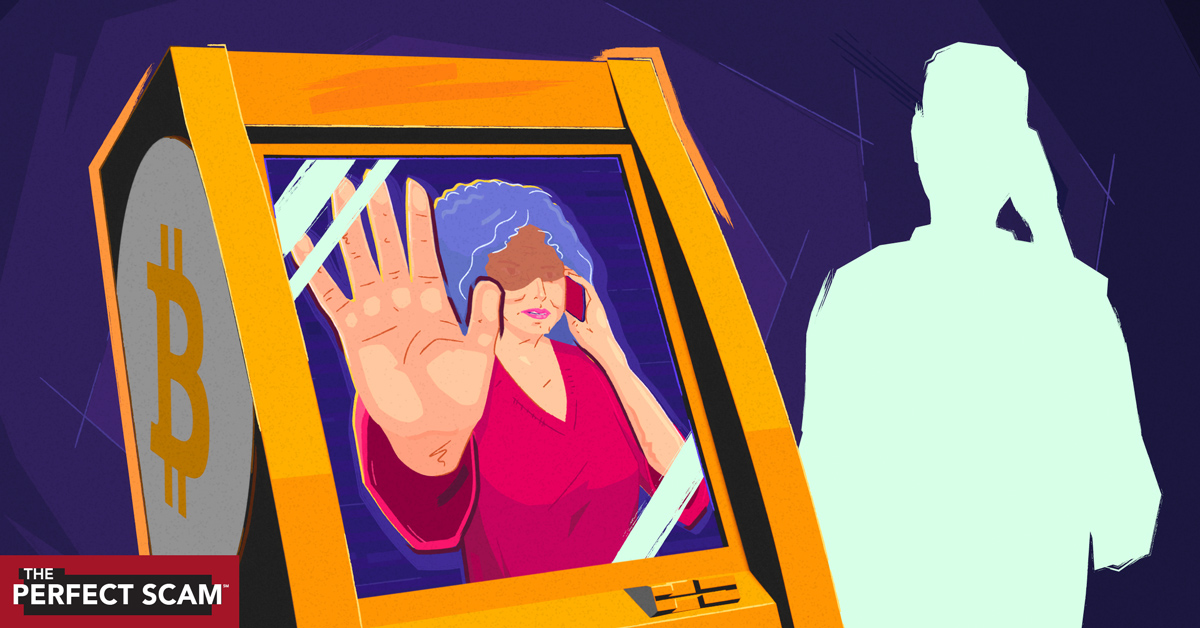

Tech Support Scam Targets Woman in Serious Pain

(MUSIC INTRO)

[00:00:01] Bob: This week on The Perfect Scam.

[00:00:04] Marlene Betesh: “Drive there right now. Do not stop and don’t talk to anybody.” Where does he want me to go? To a liquor store. “Don’t shut off the motor. Go in, you’ll see a bitcoin machine.” I push a button; I’m feeding it my 100-dollar bills and my 100-dollar bills are coming back at me. It’s spitting it out on the floor at me. I’m shaking. I don’t know what’s happening to me. My back is killing me.

(MUSIC SEGUE)

[00:00:40] Bob: Welcome back to The Perfect Scam. I’m your host, Bob Sullivan.

(MUSIC SEGUE)

[00:00:47] Bob: Right now I’m talking about scams, and you are listening to a podcast about scams so you have scams on your mind, and I hope if you’ve got a scam phone call right now, you’d just hang up. But most of our lives we’re busy thinking not about scams but about something else. Are the kids fed? Do I need to fix the roof? Is Mom sick? Why does my back hurt so much? Often, criminals are successful because us human beings are busy living our lives distracted by other things. And they catch us at just the right time when our defenses are low. That’s a big part of today’s story. Marlene Betesh was suffering from terrible back pain and getting ready for surgery in a few days just trying to get through the day when a criminal took advantage of her suffering. But before we get to that, I want you to get to know Marlene a little because for many years she had the most amazing hobby. She knitted caps for children stricken with cancer and going through chemotherapy.

[00:01:53] Marlene Betesh: I picked up some knitting needles that I hadn’t held for 18 years, and a long story short, two friends got cancer that year, and one was a beautician, and I was a knitter, I’m an avid knitter. And I said, let me try a hat.

[00:02:09] Bob: She tried one, and then another, and then dozens more, and then soon after Kozy Kaps 4 Kids was born. She was spending much of her free time knitting.

[00:02:21] Marlene Betesh: And I had about 100 hats on my dining room table, all made of Italian yarn because we didn’t have Michael’s or AC Moore in the suburbs, so I bought everything from Italy and Europe and everywhere, and the first hospital that let me in was St. Jude’s in Memphis, Tennessee. And I flew out to Memphis, Tennessee, seven times in six years.

[00:02:47] Bob: After a hand injury made her slow down a bit, she then assembled a team that she figures knitting fully 20,000 chemo caps over the years. She called it her mission in her golden years.

[00:03:00] Bob: Why is it so important for a kid suffering from cancer to have a cap that they’re proud of?

[00:03:06] Marlene Betesh: Oh my goodness. Oh my goodness. (chuckles) First of all, they lose their dignity, they lose their hair. They’re freezing, they’re cold all the time.

[00:03:18] Bob: So Marlene was doing what she could to make these kids warm and comfortable during a most uncomfortable, scary time a value she learned growing up in a suburb outside Philadelphia during the 1940s. She loved living there most of her adult life, but after a difficult divorce and some more health troubles, she moved to New Jersey where she now lives. And that’s where she was trying to manage terrible pain anxiously awaiting surgery in a few days which hopefully would give her relief when more trouble came. Much more trouble.

[00:03:52] Marlene Betesh: It’s like yesterday; I will never forget, I will never forget the pain it caused me. I was already in pain. I had, I was in bed resting, getting ready for surgery. I was working on a meeting on my Zoom, told the people I have to hang up, I don’t feel good. The minute I hung up, my computer screen started screeching black and white, black and white, on and off, on and off. I never saw my screen do that. And the screenshot says, “Suspicious activity – Bank fraud. Call Apple. 1-800-APPLE.” And it kept flickering. I sat up immediately, uh called that number, not my 1-800-APPLE, and yes, they said, “Yes, we’re Apple. How can I help you?” “Well my screen is going on and off like…” bah-bah-bah-bah. “Oh my goodness, you have a virus. We have to check it. Let us check your computer.”

[00:04:56] Bob: The person on the other end of the phone taps a few key strokes, checks Marlene’s computer, and then has something very alarming to say.

[00:05:05] Marlene Betesh: They told me that I was in big trouble. They said that I accepted a sale from Russia the morning before. I said, “Excuse me?” They said, “You accepted a sale for $11,000 in Russia. 7:03 in the morning.” I said, “Excuse me? I am nowhere near my phone; my phone is not near my bed. I only look for my cellphone with my phone.” And they said, “Well, you pushed number 2 or 3, whatever, and accepted the sale from Russia for $11,000.” I go, “What are you talking about?” He goes, “Marlene,” he knew my name, “you have to go to the bank and take out your money before Russia empties your bank account.”

[00:05:55] Bob: Take your money out of the bank before Russia empties your bank account? That’s what the man says.

[00:06:01] Marlene Betesh: Yep, “Go to the bank. Take out the money before–, hold on a minute! Let’s see if the sale went through … Yes, it did. And they’re going to go empty your bank account so you’d better go get the money out before they take the money out.” I said, “What?” I said, “It’s almost 4 o’clock.” They said, “Well you’d better hurry up.” Well I threw on I don’t know what, and out I ran a, a little stiff, not feeling great.

[00:06:36] Bob: Marlene struggles to the car. She’s in a lot of pain. Races to the bank and gets to the bank right as the front door is about to be locked.

[00:06:45] Marlene Betesh: I get to the bank, get out of the car, he tells me, “Stay on the phone and don’t shut the motor. Don’t talk to anybody. Just go in there and get out the money.” Well, can you imagine, I run across the street; a woman is locking the door, and I’m banging on the door, “You’ve got to let me in, you’ve got to let me in!” And she looks at me, and I knock again. “You have to let me in.” And she goes, “Okay, I’ll let you in.” Just like that. She turns the key, in I go, I said, “Listen, I’m a wreck, I need to take out money, and I can’t even write anything. You have to do it.”

[00:07:28] Bob: Marlene is in such discomfort and so nervous she can’t really write out the withdrawal slip. So…

[00:07:37] Marlene Betesh: Well, they wrote out the withdrawal slip. I couldn’t even count my own mon–, I told them, “I can’t count the money. I’m a wreck. Don’t you see I’m a wreck? You count the money and give it to me.” So they counted the money and handed it to me.

[00:07:51] Bob: Now also while all this is happening, if I understand correctly, your car was running outside, right?

[00:07:56] Marlene Betesh: Running. Running.

[00:07:58] Bob: Well weren’t you afraid someone was going to steal your car, had you ever done anything like that?

[00:08:00] Marlene Betesh: I didn’t think about that at all. All I thought about is I’ve got to get my money safe, put my money in a safe place till tomorrow. They’re going to open me a new bank account. Somebody’s after me. Russia wants my money.

[00:08:14] Bob: Oh my God.

[00:08:16] Marlene Betesh: I was petrified.

[00:08:19] Bob: Marlene then takes the envelope full of bills and brings it back to her car. She’s feeling panicky and really just wants to go home and go back to bed. But she can’t.

[00:08:31] Marlene Betesh: I told them, “If you’re, if you’re scamming me, I’m going to break your face.” “No, we’re going to save your money. We’re going to protect your money till tomorrow. We’re going to open you a new bank account till tomorrow. But Charlie Miller, accept his call, he’s going to call you now.” The phone rings. It’s Charlie Miller, that’s what I see. Charlie Miller asks me, “Where are you? Do you know Cobblestones?” “Yes, I do. It’s a shopping center near my house.” “Drive there right now. Do not stop and don’t talk to anybody.” It’s after 4 now, Friday. I drive to Cobblestones. Where does he want me to go? To a liquor store. A liquor store? “Don’t shut off the motor. Go in, you’ll see a bitcoin machine.”

[00:09:22] Bob: Drive to a liquor store to a bitcoin machine with all this cash?

[00:09:29] Bob: Had you ever held that much cash before?

[00:09:32] Marlene Betesh: No. Never.

[00:09:35] Bob: Were you scared to be driving around with it?

[00:09:37] Marlene Betesh: I was petrified, I thought they were going to stop me at a corner, hold me up.

[00:09:44] Bob: Marlene parks outside the liquor store and the man on the phone starts giving her instructions.

[00:09:50] Marlene Betesh: “Just hit start.” “Just hit start?” “Just hit start and start putting your money in because we’re going to protect your money until tomorrow and open you a brand-new bank account. We’re going to protect your money.” “You’re going to protect my money. I’m going to put money in a machine and you’re going to pro–,” “Yes, that’s what we’re going to do. Just go in and don’t talk to anybody.”

[00:10:14] Bob: So she walks inside and feels terribly alone.

[00:10:19] Marlene Betesh: I see a machine. I ask the man and woman behind the counter, “Could you please help me? Could you please help me?” And they both turned their backs on me, they raised their hands up to the ceiling, “No, we can’t help you.” I see a machine, I see start, start. That’s all I saw. I didn’t see anything else but start. I push a button; I’m feeding it my 100-dollar bills and my 100-dollar bills are coming back at me. It’s spitting it out on the floor at me.

[00:10:48] Bob: Like you’re buying sn–, snacks from a vending machine and the vending machine doesn’t like your dollar bills?

[00:10:53] Marlene Betesh: Yeah, a vending machine. Okay? I’m shaking. I don’t know what’s happening to me. My back is killing me. I’m on medication.

[00:11:03] Bob: And there is another set of instructions Marlene gets from the man on the phone.

[00:11:09] Marlene Betesh: He said, “Take a picture of your license.” A picture of my license? I take out my license, I take a picture. He goes, “Turn it over.” I turn it over. I’m telling you, it’s like yesterday. I take a picture. He goes, “It’s blurry. Take it again.” Now he says, “That’s good. Take a selfie.” Take a selfie? I lift the phone to my face; I don’t even take selfies. And he goes, “Take off your glasses.” Take off my glasses? Who the flick is watching me? Where am I? I take off my glasses, I take a picture. “Stick your phone under the light in the machine.” I’m almost in tears. I don’t know what I’m doing, and I took my glasses off. “Stick the phone under the light.” Guess what, nothing happened. He sends me another scan, and I hear my money go (sound effect) … gone.

[00:12:14] Bob: Finally the man tells her she can go home. So she drives away from the liquor store, walks into her house finally able to relax and hopefully take the edge off her back pain. But something is gnawing at her. So she calls her bank.

[00:12:31] Marlene Betesh: “Hello? How do you accept the sale from Russia for $11,000 and what was it for?” And they go, “Excuse me? What are you talking about?” I go, “A sale from Russia for 11–, what did I buy for $11,000?” They said, “Nothing. You have an Apple sale for $2.99 today, and you took out a lot of money. Oh my goodness, this is fraud. You were hacked. This is fraud, hold on, we’re getting the fraud department.” I go, “What?” He said, “We’re getting the fraud department, this is fraud.”

[00:13:09] Bob: This is fraud? Marlene feels disoriented. Who was on the phone with her? In a fit, she heads back to the liquor store, back to that bitcoin ATM where her $100 bills are now stuck inside.

[00:13:24] Marlene Betesh: So I’m kicking the machine when I went back. I’m crying. “Open the machine, get me my money. I want my money.” “No, you can’t have your money, it’s not your money anymore.” “It’s my money.” I was devastated. I don’t know what state of mind I was in, like I couldn’t, the money was flying back at me, could you imagine?

[00:13:47] Bob: God.

[00:13:48] Bob: The trauma really hits Marlene hard. She contacts the police. They go back to the liquor store, but she’s really struggling. She’s bawling.

[00:14:00] Marlene Betesh: The woman in the um, the liquor store was rocking me when I went back with the police and my friends and a detective. Rocking me. Her words were, “Oh, sweetheart, at least it’s not a kidney.” Okay, at least it’s not a kidney. The next day I showered, I bathed, I shaved, blah-blah, blah-blah. I went and bought flowers to give her, ’cause she was rocking me. I walk in the store with a bouquet of flowers, gift wrapped, and a card. I now put a ribbon and I wrapped it myself, and the woman saw me and walked away from me. And the man said, “Karen, I think she’s here for you.” And she turns around and goes, “Who would send me flowers? I don’t have a boyfriend.” And she’s staring at me. So I take another step forward towards her, she steps back. I said, “These are for you. I’m the bitcoin lady.” She goes, “You’re who?” I said, “I’m the bitcoin lady.” She goes, “No you’re not, you’re gorgeous. Look at you! That was you?” That’s the kind of wreck of a person I was that night. She didn’t recognize me.

[00:15:22] Bob: Hmm. I can see why. Al–, also, that’s incredibly kind of you to go back and bring flowers to her because she was just comforting you.

[00:15:30] Marlene Betesh: She was comforting me.

[00:15:32] Bob: So Marlene calls back her bank and fills out all the requisite forms, files a dispute, and hopes that perhaps the bank will return her money. But…

[00:15:43] Marlene Betesh: The 31st day I got a phone call. Instead of me calling them, they called me. And it was a woman, and she said, “I’m sorry, but this is not fraud and you’re not getting your money back. You took your money out.” I said, “Yes, I took my money out. I thought I was talking to you.” She said, “Well you weren’t, and that’s not our problem.” And she hung up.

[00:16:09] Bob: And at that point she realizes just how bad things have become.

[00:16:14] Marlene Betesh: That’s right. I cried for one month straight. I want you guys to know I am almost 80 years old; I live alone, I have lost the love of my life and everything else; my business, my everything. I need my money back.

[00:16:36] Bob: Marlene is trying to make ends meet with Social Security right now, but it’s a struggle. Everything feels like a struggle.

[00:16:46] Bob: One thing I really want to get at is I know you were under, under medication and you, you had a back surgery coming up. How much do you think the pain you were in uh had to do with all this?

[00:16:54] Marlene Betesh: The pain, I was in a lot of pain. I was in a lot of pain. I can take pain, but my, my back was, it was brutal. It, it was brutal. I was laying on heating pads, water bottles, um, I don’t like to take medicine. Um…

[00:17:11] Bob: And how much do you think that had to do with, with what happened?

[00:17:13] Marlene Betesh: A lot.

[00:17:14] Bob: Yeah.

[00:17:15] Marlene Betesh: And, and I was exhausted. I had just had a meeting and told the guys, I have to hang up, I can’t talk anymore. I’m exhausted. And that’s, when I moved my table over on my bed that was holding my computer, um, that’s when it happened. It started flickering right, immediately, immediately. So I was like exhausted, worn out, in pain…

[00:17:40] Bob: The um, so in, in the end it was, it was $9,500, is that right?

[00:17:45] Marlene Betesh: Yes.

[00:17:46] Bob: So that could be everything to some people, it can be almost nothing to other people. Was that a lot to you?

[00:17:53] Marlene Betesh: Everything.

[00:17:56] Bob: It was all the money you had back left in your checking account?

[00:17:59] Marlene Betesh: A couple thousand left.

[00:18:01] Bob: Wow. How are you getting by?

[00:18:04] Marlene Betesh: I’m really not.

[00:18:05] Bob: Hmm, I think people, when they listen to this, they’re going to want to know how, how you are today, so how are you?

[00:18:12] Marlene Betesh: I only get $850 Social Security because as I mentioned, I’m Middle Eastern, we’re not brought up on facts about Social Security. So my income is $850 a month.

[00:18:29] Bob: Wow.

[00:18:30] Bob: But she’s still trying to find the good in things.

[00:18:34] Marlene Betesh: I paint, I color. Um, I just enjoy life. It’s, it’s fabulous, life can be fabulous. I, I’ve had, I’ll tell you the truth, I’ve had a very hard life, a very, a very hard life. But I love children, I love people. I love life, and I love giving.

[00:18:59] Bob: And she’s talking with us today because she really wants to make something good come out of all the terrible things that have happened to her. She wants to warn others about what can happen.

[00:19:09] Marlene Betesh: The moment, the moment they hear the words, “Don’t talk to anybody, don’t trust anybody,” hang up the phone. The moment they say, “Let me check your computer. I have to see if you have a virus.” Hang up the phone. The moment anybody says, “Take a selfie,” shut your phone off. Listen to your, I’m going to say, listen to your heart. I knew something was wrong, but I couldn’t get it. I wasn’t myself that day…at all. And I just, it was like it, it wasn’t real. It was like I was in a dream.

[00:20:00] Bob: And one more critical piece of advice she has.

[00:20:05] Marlene Betesh: Take care of you.

[00:20:07] Bob: That’s…

[00:20:08] Marlene Betesh: Take care of you.

[00:20:09] Bob: …pretty solid advice right there. We all have to take care of ourselves.

[00:20:12] Marlene Betesh: And thank you. Thank you from the bottom of my heart.

[00:20:17] Bob: Marlene really wants to be heard. You can tell she feels like not enough people tried to listen to her and to help her as she went through this horrible situation. Well, in truth, she’s still going through it. We’re glad she found her way to the AARP Fraud Watch Network Helpline where she spoke to one of our amazing volunteers who listened and pointed her towards more resources, and toward The Perfect Scam too. That’s how she came to us for this episode. You can call the helpline at 877-908-3360 for help any time. Stories like Marlene’s are far too common, and we wanted to know what more could be done to stop such crimes, so we turned to Ken Palla. He’s a former bank executive who now works with financial institutions on fraud issues, and he’s got lots of suggestions about how the system could better protect people like Marlene.

[00:21:14] Ken Palla: Obviously, we, we see so many of these stories and they’re just absolutely tragic. It certainly appeared that this woman, when she went to the branch, was definitely under a much greater amount of stress than even many of the stories that I hear. And it, it’s disappointing that the uh, the branch teller wasn’t able to pick up on that. Now it did sound like one problem was this was, I guess, late at the end of the day, and they were almost closing the branch, um, and kept it open in order to do this transaction, so that probably added to some of the, you know, the difficulty uh, but it, it definitely sounds like an incredible stress situation when the woman is at the branch and this is common where they’re on the phone, they’re being directed, um, so it’s uh, it’s one I’ve heard many times, uh but it’s, it’s definitely sad each time you hear it and realize that there’s more than I think the branches and banks can do to help mitigate this for sure.

[00:22:12] Bob: Seems to be consensus that scams are increasing dramatically. Why do you think that is?

[00:22:19] Ken Palla: You know, I think when we look at it, the whole thing of scams, it’s a very organized crime process. Um, in fact, there’s been recent reports and one was from the UN talking about literally hundreds of thousands of people in scam compounds in places like Cambodia, some places in the Middle East, uh, and so there’s really a, a serious organized effort to go after people to scam them in this type of situation, in romance scams, investment scams, and we saw just in the last month you had the Federal Trade Commission came out with their report on fraud and scams, and it was showing in the US over $10 million, and then the FBI just a couple of days ago came out with their IC3 report showing it was over 12.5 million. Now remember, these are just people who report. And a lot of times the number of people that report may be only 5 or 10%. So you can take these numbers instead of being 10 billion, maybe it’s 100 billion, maybe it’s 200 billion in the US. Uh, because there isn’t much reporting on this, you don’t know, but it’s clear that it is continuing to grow and it, it catches people, like in this case, the woman was under a lot of prob–, issues, basically, um, and so because of her medical issues that were going on, she was, you know, very vulnerable for something like this.

[00:23:45] Bob: Uh, in Marlene’s story also a, a bitcoin ATM played an important role. Well can you talk about those machines or just cryptocurrency in general and how kind of the role it plays in scams.

[00:23:55] Ken Palla: Yeah, it’s unfortunate, there are just tens of thousands of these bitcoin cryptocurrency type ATMs around the country, and part of what happens is they get placed in businesses and whoever owns these crypto machines, crypto ATMs, are paying the businesses a lot of money and so it becomes a revenue generator for some, you know, small store or some 7 Eleven or whatever it might happen to be, um, to put these cryptocurrency machines in there, and it also then adds credibility when it’s in a reputable site. So when you tell somebody, oh yeah, we’ve got to do something, but you’re going to go over to, we’ll just call it store X which is well known, you tend to think, okay, well that must be okay. Um, I, I even heard that there was, they put one in a retirement center which to me made absolutely no sense.

[00:24:42] Bob: Oh God.

[00:24:43] Bob: Ken has already mentioned that he wishes the teller who Marlene worked with had done more to protect her the day of the crime. So I asked him what more he thought banks could do in general, and well, he thinks there’s a lot that can be done.

[00:24:56] Ken Palla: Let me give you some best practices, so we’ll take a moment to kind of move around the world a little bit. So the UK has had a big problem with scams uh going back. And if you look at it historically around 2007, 2008, the UK started faster payments. And we have a saying in fraud, “Faster payments equals faster fraud.” And it’s true. And so since faster payments came in in 2007, 2008, there has been a lot of scamming, especially in the last seven years. And so there, there was a lot of, you know, you know pounding on the table news stories and things like that getting a lot of attention. There was a consumer group called “Which?” which was also, you know, pounding the table saying something has to be done. And so they have gone through a number of different things, but the one thing I want to talk about is something called the banking protocol in the UK. And basically, what they’ve done there, and especially since a lot of these banks do have to reimburse these scams, unlike in the US, they’re paying more attention to it. They have a pretty good process that when someone comes into the branch and wants to withdraw money, these tellers are really trying to work with the customer and understand why they want to take this money out. And if they believe it’s a scam, they can pull their manager in, but they can also pull in the local police. And that’s called the banking protocol, which is process whereby the branch can pall-, call in the local police, and they’ll come in and also talk to this person and tell this person, it’s a scam.

[00:26:22] Bob: It was remarkable to hear you say a teller can not only get, get a manager, but also get the police in if a teller is concerned that a crime is happening. It seems to me that it makes a whole lot more sense to call in the police before the crime rather than calling the police after the crime, and the police say I’m sorry this happened, there’s nothing we can do, right?

[00:26:42] Ken Palla: Yeah.

[00:26:43] Bob: That’s right. Banks are instructed to call local police if they feel like a consumer in front of them is about to be the victim of a scam.

[00:26:51] Ken Palla: Another area, uh is Australia, and I was rec–, I recently wrote a blog about a woman in Australia. She’s in one of the states of Australia, Tasmania, which is actually an island off the coast of Australia. And there someone was coming in and they wanted to withdraw 40,000 Australian dollars because they were going to be doing an investment. And so the teller started listening to the customer and said, “You know, I don’t think this is right.” Um, and then they pulled in someone from the fraud department on a phone call. And then the fraud department had a couple suggestions, and the customer was still in doubt about this whole thing, but they wound up following up on some of those suggestions, and then came back and said, “You know, I, I want to thank you because this, this does appear to be a scam.” And so uh this woman teller in uh Tasmania in Australia, saved 40,000 Australian dollars. So it definitely happens uh where some people do it right, and then they are trained, but I think in the US we haven’t done enough about it.

[00:27:54] Bob: Ken also shared a novel legal theory with us that could help encourage banks to step in more frequently and stop fraud, and perhaps could help people like Marlene.

[00:28:05] Ken Palla: Individual states will have elder care abuse laws, and that can put responsibilities on a number of people but especially banks, to make sure that the customers are not abused. And so in this particular case, that’s one thing that struck me was, you know had someone looked at the elder abuse laws here, and I don’t know again the woman’s age, but whether that might have been relevant to possibly go back to the bank via an attorney or whomever and say, well geez, based on elder care law, you know you could see based on discovery on the bank side that this person really was incredibly stressed when this happened. And uh you know, prudent care should have been to stop this, or pull somebody to the side, or do whatever, um, but that’s one thing. And actually here in California, there are a couple lawsuits that are going on about elder care abuse on some of these investment scams saying that these people were elderly, uh maybe 75 to 80 years old, and they uh, had all these withdrawals, and the bank didn’t do anything about it, and there is a State of California elder abuse law and we believe that the bank has violated that and should reimburse the customer.

[00:29:13] Bob: Ken also believes the US government could be doing more, paying more attention to the problem of fraud.

[00:29:21] Ken Palla: Part of what I do is I, I try and find out what’s going on around the world. So I look at the UK, two other hot spots where activity’s going on is Australia and Singapore. And you know they’re, there definitely there’s, there’s more focus at the government level. I don’t see a focus at the US government level. Uh, yes you have the FCC, looks at telecommunications and robocalls and roboscams, and they’re trying to work with the telcos to, to limit that. It’s proven to be very difficult. It’s kind of a whack-a-mole thing, but when it comes to other parts of the government, I, I just don’t see that same focus as I’ve seen, as I say Australia, Singapore, and UK. Those are the three that stand out to me, where at the government level and at the regulator level. And in many cases, it’s more about controls than actual reimbursement. So that’s something to keep in mind. I mean if you put the right controls in place, you can reduce these scams, and that’s what you’re trying to do. And, and again, I, I don’t see enough of that here, and I’m, I’m in the banking world, and so I guess I’m kind of whacking myself here, but I, I, I don’t see enough of that in the US, and these numbers are so big and they’re, for the most part, for the absolute most part, they’re unreimbursed. And so it’s the banks’ customers suffering um, from this.

[00:30:41] Bob: Forcing banks to reimburse consumers who suffer fraud would certainly get their attention, Ken said.

[00:30:48] Ken Palla: Yeah so it’s, it’s a difficult thing, but I think you know if, when people get penalized, and as you can see if we go back to the UK, effective October of this year, there’s a mandatory reimbursement for scams. Now that they’re having to pay, they’re adding a lot of controls, and they take it incredibly serious in England, incredibly serious.

[00:31:10] Bob: How would the US expand regulations to require reimbursement for these kinds of scams? Well it’s not so easy.

[00:31:19] Ken Palla: Well, and what you have in the US is you have Reg E, and it basically talks in general about reimbursing for unauthorized payment transactions, which is typically when your account is taken over, where it’s a fraud. So in, in the example of an account takeover, uh, you get a phishing email and you click the link and you think you’re going to your bank, and you enter your credentials in, and instead it’s just a fraudster grabbing them. And then the fraudster logs into your account and does a transaction. That’s an unauthorized transaction. And generally, those are reimbursed. But Reg E was written well before the internet even came about. And so it’s really back quite a ways. There’s been some talks about trying to expand it, but I’m not aware of anything that’s serious or meaningful at this point. Um, I know the Consumer Financial Protection Bureau, I think would like to, in effect, expand Reg E, but the question is legally what can you do, uh without going to Congress if you’re going to do some type of reimbursement thing. My own view is, I think you can put more requirements on the, on the banks and other financial institutions to have controls to help limit scams, and it’s easy to add controls. I don’t think it takes any, any vote of Congress. And I think that would be one way to do it is to have more controls around scams, more controls around the money mule accounts, because that’s where when you talk about transferring from one bank to another, it goes to a money mule account. And that’s one thing that I think could be done that doesn’t take, you know, the political, Republicans and Democrats and everybody having to get together. It’s just a regulation of saying here’s more controls that we have to have. And so far, I haven’t seen that. I’m not one to say we have to regulate the heck out of everything, but at the same time, if you have regulation and if you have penalties, people pay more attention to it. And I think in this whole scam thing, it’s just grown so fast and again, we don’t even know what the numbers are in the United States, and uh, but we have to do something about it.

[00:33:23] Bob: Um, if you could wave a magic wand and fix this today, what would you do?

[00:33:27] Ken Palla: Well I think from my own standpoint, I would put more requirements on the, on the financial institutions for controls, um, because that’s something people won’t disagree with. If I was the FFIEC, if I was the Consumer Financial Protection Bureau, I would come out with controls around scams and around, well what I call the receiving bank side of this because of the money mules. So tight controls around online account opening, tight controls around looking for money mules, anomaly detection on inbound transactions coming into accounts, especially of high dollar ones on new accounts that have been opened. Um, and I’d focus on the control side, and then I would have penalties if the controls aren’t being done well. That’s probably the first thing I would do because I know that’s doable, it’s realistic, and it doesn’t have any political impercussions or you know wow, we’ve got to wait, we’re going to have, no one’s going to agree–, you just write it so it will become a government requirement. Uh, and I think that’s, that’s almost what you have to do because this stuff’s insidious, and you’ve got to get these entities to be serious about mitigating it, and sometimes penalties is the way to create the wakeup call and say, oh, I guess I’ve got to do this. But in the meantime, individuals are just losing so much, and it’s almost like people don’t care about those individuals and the losses that they incur, uh even though they may be a customer. And so I think you just have to get around that, and just here are the new requirements. This is what you have to do.

[00:35:00] Bob: There’s also a change he’d like to see when deciding which bank would have liability for scam losses. This gets a little technical, but it’s very important.

[00:35:10] Ken Palla: Uh, where we’ve seen kind a liability shift, if you will, has been involving the receiving bank. So when we talk about banking, we have a sending bank and a receiving bank. So if I’m doing a wire transaction and I’m a customer, I go to my bank and I ask my bank to send a wire. So that’s the sending bank. And then they send the wire to the other bank. That’s the receiving bank. Typically when we’ve been looking about any kinds of reimbursement, it’s been the sending bank, the bank that sent the wire, the bank that did the transaction. What we’ve started to see in the last 24 months is a focus on the receiving bank participating in some of this reimbursement. So in the UK, it’s a 50/50 split between the sending and the receiving bank when they reimburse the customer. In the case of Zelle for these limited impersonation scam reimbursements, it’s 100% the receiving bank. One hundred percent the receiving bank. And now somebody say, well why do you involve the receiving bank? Well the reality is, that’s where the money mule account is, and that’s where the receiving bank has weak controls on online account opening, and weak controls in, in doing anomaly detection on the transactions coming into these new accounts or other accounts. Because again, I mean money mules could be a brand-new account, it could be an existing customer looking for money, and so it could be a 10-year-old account. Or it could be a romance scam victim who’s been kind of conned into becoming a money mule. So a lot of definition when you really get into money mule accounts. But that’s a, that is a new trend is shifting whatever liability there might be, shifting more of it to the receiving bank.

[00:36:54] Bob: That’s really interesting.

[00:36:56] Ken Palla: Again…

[00:36:57] Bob: I’m sorry to, to interrupt, but what’s interesting to me about that is the receiving bank is the one who touches the criminal, right?

[00:37:03] Ken Palla: Hm-hmm, yes.

[00:37:05] Bob: So you’re saying you are responsible for knowing that this is a criminal.

[00:37:09] Ken Palla: Yeah, it’s like, well it’s like know your customer basically, which is a basic banking law, and obviously what’s happening in these banks, they’re not doing a good enough KYC job on online account opening because a whole bunch of fraudsters are getting in.

[00:37:22] Bob: But one thing Ken is adamant about is training human beings, tellers, who interact with consumers like Marlene.

[00:37:32] Ken Palla: And I think one of the things that’s most obvious is that when you walk into a branch, there you have the human, the teller, or, or customer service in the branch, that’s a point that there should be incredible training, that’s there, because that, that cash withdrawal, I’m withdrawing $20,000, that’s a lot of furniture I’m buying, which is typical a thing. And to be fair, the fraudsters are teaching the, the victim how to lie when they go to the branch. They say, “Look, I need this money,” and whatever the scenario is, they define the scenario, and they say, “Look, they’re going to challenge you about this, so what you do is you, you tell them, it’s because you’re buying furniture. You tell them.” And so they’re conditioning the victim when they go into the branch to basically lie to the teller and that’s part of what makes it work because they’ll be convincing because they’ve been told they have to be really convincing because of whatever the particular scam is. You know, there’s, there’s fraud in the branch and we’ve got to get your money out because you’re going to lose it, or whatever it happens to be. So that’s part of the problem. You know, I mean I hope that as people who listen to this, especially banks that listen to this, to realize how important it is to really educate the tellers, the people in the branch about these types of scams and have some type of, you know, escalation procedure because maybe the teller isn’t going to be the best expert on how to deal with one of these scams, because they’re dealing with a victim who’s being coached by an expert scammer. But what you want to do in that case is give the teller the ability to have that uh that lifeline call, where they can call someone in the fraud department, they know that number, and it’s a planned procedure. So it’s the next best thing to bringing the police in, being able to call someone from the fraud department who’s very experienced in this, who can then help the teller. And so, if anything, I would really love to see the banks become much more aggressive in the training for the tellers and giving them the backup support that can help and you know, break the spell isn’t the term that you know the people who help these victims want to call it, but if you’re, if you’re a teller and you say, okay this person seems to be in a problem state, how do I break them out of that? Sometimes they need help, but that’s what I would like to see because that’s something that, that can be done. It doesn’t cost money, it’s just training. Training and phone calls. There’s no software development, it’s not a million-dollar project, it’s just giving the branch tellers the appropriate training and a lifeline capability to call their fraud department.

[00:40:10] Bob: You know we’ve all seen on TV and in movies the bank teller pushing the red button under the desk when the bank robbers come into the bank, right?

[00:40:17] Ken Palla: (chuckles) Yeah.

[00:40:18] Bob: I’m picturing a metaphorical red button right now when there’s a consumer under a distress in front of the teller.

[00:40:24] Ken Palla: That’s it, that’s exactly what it is. I mean if someone has a gun in front of you, you know what to do. Well this person is about to lose $40,000 which is more than you’d give up in a bank robbery. You know you rob a bank, maybe you get 5, $10,000. This person’s being robbed, and they lose $40,000 or $20,000, whatever it is. And you have to have that same mindset of there’s a gun in, there’s a gun in play and how do I deal with it? I mean something very serious. That, that’s what it, that’s what it takes.

[00:40:55] Bob: I, I love that metaphor, and it’s, it’s more than a metaphor, but I think you’re, you’re right. There’s a loaded gun, there’s a procedure for that. It’s remarkable to think that in these crimes, that more money is stolen than in a traditional bank robbery.

[00:41:08] Ken Palla: Oh, without a doubt, without a doubt. I mean I think bank robberies have become passé. I mean a lot of the street gangs are going into check theft and things like that where they can make so much more money.

[00:41:19] Bob: We talk a lot here on The Perfect Scam about how big the scam problem is and how it doesn’t get enough attention. But Ken right there really makes the case. Bank robberies are now passé, he just told us, because scams are so profitable for criminals.

[00:41:35] Bob: So what do you want people who listen to this podcast mo-, most of them will be regular banking consumers, what do want them to know? What kind of um, tips do you have for them to protect themselves?

[00:41:46] Ken Palla: Well, I’ll tell you, there’s, there’s probably two simple things I will tell people in, in general when it comes to scams, and one of them is never respond to a text message from someone you do not know. Never, never, never. What the fraudsters are trying to do is send something like, “Hey, thanks for last weekend. I’m looking forward to this weekend.” And you want to be nice, and you want to go, “Hey, I just want to let you know, you missent that text message.” And that’s all the scammer wants is to get a hook into you and start a dialog. And 1 out of 100 or whatever with that dialog it will lead to a scam and a loss. So never ever respond to a text message from someone you don’t know. The second thing is as far as phone calls go, if you get a phone call coming in, if you don’t recognize the number ’cause it’s not in your contact list, do not answer it. Let it go to voicemail. What the scammers try to do is get you in a sense of urgency. And so if you pick up the phone and they go, “This is Bob from the FBI,” or “Bob from your bank branch and we have a real serious problem,” you go, “Oh my God! What do I do?” So if you listen to a voicemail, you don’t have that same emotional attachment. And, and the third thing is, you know the, always call the bank back, go to the website, go to the back of the credit card, and, and do it. Never, never take a phone number off of an email you get. You know, go to a known source where you have a number. Um, I mean those are probably some things that are really simple that, that can help people, um, you know it’s doesn’t cover everything, but certainly it covers some of the things that go on.

[00:43:26] Bob: Well we try to cover as many things that are going on in the scam space as possible here at The Perfect Scam. If you ever read or see or hear about something you want us to cover, please send an email to theperfectscampodcast@aarp.org. We love hearing from listeners. For The Perfect Scam, I’m Bob Sullivan.

(MUSIC SEGUE)

[00:43:54] Bob: If you have been targeted by a scam or fraud, you are not alone. Call the AARP Fraud Watch Network Helpline at 877-908-3360. Their trained fraud specialists can provide you with free support and guidance on what to do next. Our email address at The Perfect Scam is: theperfectscampodcast@aarp.org, and we want to hear from you. If you’ve been the victim of a scam or you know someone who has, and you’d like us to tell their story, write to us. That address again is: theperfectscampodcast@aarp.org. Thank you to our team of scambusters; Associate Producer, Annalea Embree; Researcher, Becky Dodson; Executive Producer, Julie Getz; and our Audio Engineer and Sound Designer, Julio Gonzalez. Be sure to find us on Apple Podcasts, Spotify, or wherever you listen to podcasts. For AARP’s The Perfect Scam, I’m Bob Sullivan.

(MUSIC OUTRO)

END OF TRANSCRIPT

Tech

Harvard Alumni, Tech Moguls, and Best-Selling Authors Drive Nearly $600 Million in Pre-Order Sales

BlockDAG Network’s history is one of innovation, perseverance, and a vision to push the boundaries of blockchain technology. With Harvard alumni, tech moguls, and best-selling authors at the helm, BlockDAG is rewriting the rules of the cryptocurrency game.

CEO Antony Turner, inspired by the successes and shortcomings of Bitcoin and Ethereum, says, “BlockDAG leverages existing technology to push the boundaries of speed, security, and decentralization.” This powerhouse team has led a staggering 1,600% price increase in 20 pre-sale rounds, raising over $63.9 million. The secret? Unparalleled expertise and a bold vision for the future of blockchain.

Let’s dive into BlockDAG’s success story and find out what the future holds for this cryptocurrency.

The Origin: Why BlockDAG Was Created

In a recent interview, BlockDAG CEO Antony Turner perfectly summed up why the market needs BlockDAG’s ongoing revolution. He said:

“The creation of BlockDAG was inspired by Bitcoin and Ethereum, their successes and their shortcomings.

If you look at almost any new technology, it is very rare that the first movers remain at the forefront forever. Later incumbents have a huge advantage in entering a market where the need has been established and the technology is no longer cutting edge.

BlockDAG has done just that: our innovation is incorporating existing technology to provide a better solution, allowing us to push the boundaries of speed, security, and decentralization.”

The Present: How Far Has BlockDAG Come?

BlockDAG’s presale is setting new benchmarks in the cryptocurrency investment landscape. With a stunning 1600% price increase over 20 presale lots, it has already raised over $63.9 million in capital, having sold over 12.43 billion BDAG coins.

This impressive performance underscores the overwhelming confidence of investors in BlockDAG’s vision and leadership. The presale attracted over 20,000 individual investors, with the BlockDAG community growing exponentially by the hour.

These monumental milestones have been achieved thanks to the unparalleled skills, experience and expertise of BlockDAG’s management team:

Antony Turner – Chief Executive Officer

Antony Turner, CEO of BlockDAG, has over 20 years of experience in the Fintech, EdTech, Travel and Crypto industries. He has held senior roles at SPIRIT Blockchain Capital and co-founded Axona-Analytics and SwissOne. Antony excels in financial modeling, business management and scaling growth companies, with expertise in trading, software, IoT, blockchain and cryptocurrency.

Director of Communications

Youssef Khaoulaj, CSO of BlockDAG, is a Smart Contract Auditor, Metaverse Expert, and Red Team Hacker. He ensures system security and disaster preparedness, and advises senior management on security issues.

advisory Committee

Steven Clarke-Martin, a technologist and consultant, excels in enterprise technology, startups, and blockchain, with a focus on DAOs and smart contracts. Maurice Herlihy, a Harvard and MIT graduate, is an award-winning computer scientist at Brown University, with experience in distributed computing and consulting roles, most notably at Algorand.

The Future: Becoming the Cryptocurrency with the Highest Market Cap in the World

Given its impressive track record and a team of geniuses working tirelessly behind the scenes, BlockDAG is quickly approaching the $600 million pre-sale milestone. This crypto powerhouse will soon enter the top 30 cryptocurrencies by market cap.

Currently trading at $0.017 per coin, BlockDAG is expected to hit $1 million in the coming months, with the potential to hit $30 per coin by 2030. Early investors have already enjoyed a 1600% ROI by batch 21, fueling a huge amount of excitement around BlockDAG’s presale. The platform is seeing significant whale buying, and demand is so high that batch 21 is almost sold out. The upcoming batch is expected to drive prices even higher.

Invest in BlockDAG Pre-Sale Now:

Pre-sale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetwork

Discord: Italian: https://discord.gg/Q7BxghMVyu

No spam, no lies, just insights. You can unsubscribe at any time.

Tech

How Karak’s Latest Tech Integration Could Make Data Breaches Obsolete

- Space and Time uses zero-knowledge proofs to ensure secure and tamper-proof data processing for smart contracts and enterprises.

- The integration facilitates faster development and deployment of Distributed Secure Services (DSS) on the Karak platform.

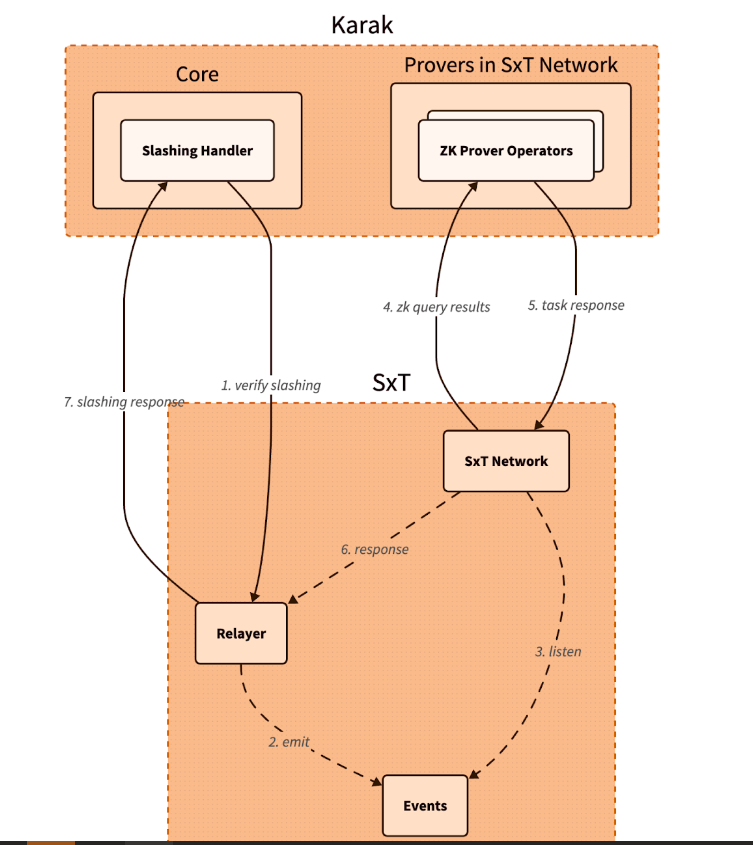

Karak, a platform known for its strong security capabilities, is enhancing its Distributed Secure Services (DSS) by integrating Space and Time as a zero-knowledge (ZK) coprocessor. This move is intended to strengthen trustless operations across its network, especially in slashing and rewards mechanisms.

Space and Time is a verifiable processing layer that uses zero-knowledge proofs to ensure that computations on decentralized data warehouses are secure and untampered with. This system enables smart contracts, large language models (LLMs), and enterprises to process data without integrity concerns.

The integration with Karak will enable the platform to use Proof of SQL, a new ZK-proof approach developed by Space and Time, to confirm that SQL query results are accurate and have not been tampered with.

One of the key features of this integration is the enhancement of DSS on Karak. DSS are decentralized services that use re-staked assets to secure the various operations they provide, from simple utilities to complex marketplaces. The addition of Space and Time technology enables faster development and deployment of these services, especially by simplifying slashing logic, which is critical to maintaining security and trust in decentralized networks.

Additionally, Space and Time is developing its own DSS for blockchain data indexing. This service will allow community members to easily participate in the network by running indexing nodes. This is especially beneficial for applications that require high security and decentralization, such as decentralized data indexing.

The integration architecture follows a detailed and secure flow. When a Karak slashing contract needs to verify a SQL query, it calls the Space and Time relayer contract with the required SQL statement. This contract then emits an event with the query details, which is detected by operators in the Space and Time network.

These operators, responsible for indexing and monitoring DSS activities, validate the event and route the work to a verification operator who runs the query and generates the necessary ZK proof.

The result, along with a cryptographic commitment on the queried data, is sent to the relayer contract, which verifies and returns the data to the Karak cutter contract. This end-to-end process ensures that the data used in decision-making, such as determining penalties within the DSS, is accurate and reliable.

Karak’s mission is to provide universal security, but it also extends the capabilities of Space and Time to support multiple DSSs with their data indexing needs. As these technologies evolve, they are set to redefine the secure, decentralized computing landscape, making it more accessible and efficient for developers and enterprises alike. This integration represents a significant step towards a more secure and verifiable digital infrastructure in the blockchain space.

Website | X (Twitter) | Discord | Telegram

No spam, no lies, just insights. You can unsubscribe at any time.

Tech

Cryptocurrency Payments: Should CFOs Consider This Ferrari-Approved Trend?

Iconic Italian luxury carmaker Ferrari has announced the expansion of its cryptocurrency payment system to its European dealer network.

The move, which follows a successful launch in North America less than a year ago, raises a crucial question for CFOs across industries: Is it time to consider accepting cryptocurrency as a form of payment for your business?

Ferrari’s move isn’t an isolated one. It’s part of a broader trend of companies embracing digital assets. As of 2024, we’re seeing a growing number of companies, from tech giants to traditional retailers, accepting cryptocurrencies.

This change is determined by several factors:

- Growing mainstream adoption of cryptocurrencies

- Growing demand from tech-savvy and affluent consumers

- Potential for faster and cheaper international transactions

- Desire to project an innovative brand image

Ferrari’s approach is particularly noteworthy. They have partnered with BitPay, a leading cryptocurrency payment processor, to allow customers to purchase vehicles using Bitcoin, Ethereum, and USDC. This satisfies their tech-savvy and affluent customer base, many of whom have large digital asset holdings.

Navigating Opportunities and Challenges

Ferrari’s adoption of cryptocurrency payments illustrates several key opportunities for companies considering this move. First, it opens the door to new customer segments. By accepting cryptocurrency, Ferrari is targeting a younger, tech-savvy demographic—people who have embraced digital assets and see them as a legitimate form of value exchange. This strategy allows the company to connect with a new generation of affluent customers who may prefer to conduct high-value transactions in cryptocurrency.

Second, cryptocurrency adoption increases global reach. International payments, which can be complex and time-consuming with traditional methods, become significantly easier with cryptocurrency transactions. This can be especially beneficial for businesses that operate in multiple countries or deal with international customers, as it potentially reduces friction in cross-border transactions.

Third, accepting cryptocurrency positions a company as innovative and forward-thinking. In today’s fast-paced business environment, being seen as an early adopter of emerging technologies can significantly boost a brand’s image. Ferrari’s move sends a clear message that they are at the forefront of financial innovation, which can appeal to customers who value cutting-edge approaches.

Finally, there is the potential for cost savings. Traditional payment methods, especially for international transactions, often incur substantial fees. Cryptocurrency transactions, on the other hand, can offer lower transaction costs. For high-value purchases, such as luxury cars, these savings could be significant for both the business and the customer.

While the opportunities are enticing, accepting cryptocurrency payments also presents significant challenges that businesses must address. The most notable of these is volatility. Cryptocurrency values can fluctuate dramatically, sometimes within hours, posing potential risk to businesses that accept them as payment. Ferrari addressed this challenge by implementing a system that instantly converts cryptocurrency received into traditional fiat currencies, effectively mitigating the risk of value fluctuations.

Regulatory uncertainty is another major concern. The legal landscape surrounding cryptocurrencies is still evolving in many jurisdictions around the world. This lack of clear and consistent regulations can create compliance challenges for companies, especially those operating internationally. Companies must remain vigilant and adaptable as new laws and regulations emerge, which can be a resource-intensive process.

Implementation costs are also a significant obstacle. Integrating cryptocurrency payment systems often requires substantial investment in new technology infrastructure and extensive staff training. This can be especially challenging for small businesses or those with limited IT resources. The costs are not just financial; a significant investment of time is also required to ensure smooth implementation and operation.

Finally, security concerns loom large in the world of cryptocurrency transactions. While blockchain technology offers some security benefits, cryptocurrency transactions still require robust cybersecurity measures to protect against fraud, hacks, and other malicious activity. Businesses must invest in robust security protocols and stay up-to-date on the latest threats and protections, adding another layer of complexity and potential costs to accepting cryptocurrency payments.

Strategic Considerations for CFOs

If you’re thinking of following in Ferrari’s footsteps, here are the key factors to consider:

- Risk Assessment: Carefully evaluate potential risks to your business, including financial, regulatory, and reputational risks.

- Market Analysis: Evaluate whether your customer base is significantly interested in using cryptocurrencies for payments.

- Technology Infrastructure: Determine the costs and complexities of implementing a cryptographic payment system that integrates with existing financial processes.

- Regulatory Compliance: Ensure that cryptocurrency acceptance is in line with local regulations in all markets you operate in. Ferrari’s gradual rollout demonstrates the importance of this consideration.

- Financial Impact: Analyze how accepting cryptocurrency could impact your cash flow, accounting practices, and financial reporting.

- Partnership Evaluation: Consider partnering with established crypto payment processors to reduce risk and simplify implementation.

- Employee Training: Plan comprehensive training to ensure your team is equipped to handle cryptocurrency transactions and answer customer questions.

While Ferrari’s adoption of cryptocurrency payments is exciting, it’s important to consider this trend carefully.

A CFO’s decision to adopt cryptocurrency as a means of payment should be based on a thorough analysis of your company’s specific needs, risk tolerance, and strategic goals. Cryptocurrency payments may not be right for every business, but for some, they could provide a competitive advantage in an increasingly digital marketplace.

Remember that the landscape is rapidly evolving. Stay informed about regulatory changes, technological advancements, and changing consumer preferences. Whether you decide to accelerate your crypto engines now or wait in the pit, keeping this payment option on your radar is critical to navigating the future of business transactions.

Was this article helpful?

Yes No

Sign up to receive your daily business insights

Tech

Bitcoin Tumbles as Crypto Market Selloff Mirrors Tech Stocks’ Plunge

The world’s largest cryptocurrency, Bitcoin (BTC), suffered a significant price decline on Wednesday, falling below $65,000. The decline coincides with a broader market sell-off that has hit technology stocks hard.

Cryptocurrency Liquidations Hit Hard

CoinGlass data reveals a surge in long liquidations in the cryptocurrency market over the past 24 hours. These liquidations, totaling $220.7 million, represent forced selling of positions that had bet on price increases. Bitcoin itself accounted for $14.8 million in long liquidations.

Ethereum leads the decline

Ethereal (ETH), the second-largest cryptocurrency, has seen a steeper decline than Bitcoin, falling nearly 8% to trade around $3,177. This decline mirrors Bitcoin’s price action, suggesting a broader market correction.

Cryptocurrency market crash mirrors tech sector crash

The cryptocurrency market decline appears to be linked to the significant losses seen in the U.S. stock market on Wednesday. Stock market listing The index, heavily weighted toward technology stocks, posted its sharpest decline since October 2022, falling 3.65%.

Analysts cite multiple factors

Several factors may have contributed to the cryptocurrency market crash:

- Tech earnings are underwhelming: Earnings reports from tech giants like Alphabet are disappointing (Google(the parent company of), on Tuesday, triggered a sell-off in technology stocks with higher-than-expected capital expenditures that could have repercussions on the cryptocurrency market.

- Changing Political Landscape: The potential impact of the upcoming US elections and changes in Washington’s policy stance towards cryptocurrencies could influence investor sentiment.

- Ethereal ETF Hopes on the line: While bullish sentiment around a potential U.S. Ethereum ETF initially boosted the market, delays or rejections could dampen enthusiasm.

Analysts’ opinions differ

Despite the short-term losses, some analysts remain optimistic about Bitcoin’s long-term prospects. Singapore-based cryptocurrency trading firm QCP Capital believes Bitcoin could follow a similar trajectory to its post-ETF launch all-time high, with Ethereum potentially converging with its previous highs on sustained institutional interest.

Rich Dad Poor Dad Author’s Prediction

Robert Kiyosaki, author of the best-selling Rich Dad Poor Dad, predicts a potential surge in the price of Bitcoin if Donald Trump is re-elected as US president. He predicts a surge to $105,000 per coin by August 2025, fueled by a weaker dollar that is set to boost US exports.

BTC/USD Technical Outlook

Bitcoin price is currently trading below key support levels, including the $65,500 level and the 100 hourly moving average. A break below the $64,000 level could lead to further declines towards the $63,200 support zone. However, a recovery above the $65,500 level could trigger another increase in the coming sessions.

-

Videos4 weeks ago

Videos4 weeks agoAbsolutely massive: the next higher Bitcoin leg will shatter all expectations – Tom Lee

-

News12 months ago

News12 months agoVolta Finance Limited – Director/PDMR Shareholding

-

News12 months ago

News12 months agoModiv Industrial to release Q2 2024 financial results on August 6

-

News12 months ago

News12 months agoApple to report third-quarter earnings as Wall Street eyes China sales

-

News12 months ago

News12 months agoNumber of Americans filing for unemployment benefits hits highest level in a year

-

News1 year ago

News1 year agoInventiva reports 2024 First Quarter Financial Information¹ and provides a corporate update

-

News1 year ago

News1 year agoLeeds hospitals trust says finances are “critical” amid £110m deficit

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Hit $100 Billion in 2024, Fueling Insane Investor Optimism ⋆ ZyCrypto

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Videos1 year ago

Videos1 year ago$1,000,000 worth of BTC in 2025! Get ready for an UNPRECEDENTED PRICE EXPLOSION – Jack Mallers

-

Videos1 year ago

Videos1 year agoABSOLUTELY HUGE: Bitcoin is poised for unabated exponential growth – Mark Yusko and Willy Woo

-

Tech1 year ago

Tech1 year agoBlockDAG ⭐⭐⭐⭐⭐ Review: Is It the Next Big Thing in Cryptocurrency? 5 questions answered