Tech

The Latest Tech News in Crypto and Blockchain

Jan. 17: Unstoppable Domains, in partnership with Push Protocol, a pioneer in decentralized communication, announced the launch of a “token-gated Group Chat for Unstoppable Messaging,” according to the team. “By limiting access to specific communities based on verifiable blockchain records and tokens, Group Chat aims to eliminate the spread of misinformation and scams such as phishing, spam bots, project impersonation and social engineering-based attacks.”

Protocol Village is a regular feature of The Protocol, our weekly newsletter exploring the tech behind crypto, one block at a time. Sign up here to get it in your inbox every Wednesday. Project teams can submit updates here. For previous versions of Protocol Village, please go here. Also please check out our weekly The Protocol podcast.

Partisia Blockchain Launches Digital Asset Custody Product at Davos

Jan. 17: On stage during his keynote address at a Davos side event, Brian Gallagher, co-founder of Partisia, a layer-1 blockchain oriented around multiparty computation (MPC) and zero-knowledge proofs, introduced a custody product, according to the team: “Gallagher highlighted that unlike current custody offerings from existing providers, the new solution is decentralized, open source and available for all. ‘The industry is becoming more regulated, necessitating institutional-grade, blockchain-agnostic custody solutions.’” According to a press release, the new product is called MOCCA, for MPC On-Chain Custody Advanced solution.

Space and Time Introduces ‘Python Data Jobs’ as Coding-Free Solution

Jan. 17: Space and Time, which describes itself as “the verifiable compute layer for Web3,” has introduced “Python Data Jobs.” According to the team, the new offering “tackles Web3 limitations, offering a coding-free solution for long-running Python tasks. Building on prior achievements, it enables Python usage for data tasks, with Houston, the AI chatbot, facilitating quick data migration. The program, in beta, aims to enhance real-time security with a ZK proof for Python, streamlining database migrations and empowering DeFi calculations in Web3.”

ICP Upgrades Canisters to 400GB, Allowing Bitfinity’s Bitcoin L2 to Run Inside Smart Contract

Jan. 17: The Dfinity Foundation announced that enhancements to ICP’s canister smart contracts now allow for each canister to hold 400GB of data. According to the team: “With this upgrade, the Internet Computer is further setting itself apart as a decentralized cloud rather than another L1 blockchain. The advancement will allow Bitfinity, a Bitcoin layer-2 network based on the ICP, to run its Bitcoin L2 entirely inside of a smart contract. At only $5/year for 1GB of storage, ICP is orders of magnitude cheaper than other L1 blockchains and allows for this type of development to occur on-chain.”

Solana Foundation Releases Hacker House Dates, Starting With New York in March

Jan. 16: The Solana Foundation has announced the 2024 Hacker House schedule. According to the team: “These two-day events will serve as an opportunity for the community to gather in person to build, foster, and strengthen the diverse Solana community. The content at each Hacker House will focus on themes like DeFi, regulation, and stablecoins, designed to target specific areas of interest relevant to the current market.” The 2024 schedule:

-

Bengaluru, India: July 26-27

Gather Network to Rebrand as Hydro, Migrate Onto Sui

Jan. 17: The Gather Network announced its transformation into Hydro Online, “marking a pivotal step forward in its mission to create a dynamic ecosystem that caters to the diverse needs of its publishers. The shift is not just a change of name but a return to the platform’s core values and primary functions. These changes are designed to provide more focus, security, and efficiency in creating value for publishers and their users.” According to the team, Gather has had, and will have until the new TGE (token generation event), “its own layer 1 blockchain on which it operated. From this technical setup, we are migrating to the SUI blockchain.” (SUI)

CryoDAO, Dedicated to Cryopreservation Research, Raises $2.8M on Juicebox Platform

Jan. 17: CryoDAO, which says it aims to “solve death” through cryopreservation research, has raised about $2.8M (1,108 ETH) on the fundraising and treasury protocol Juicebox. According to the team: “CryoDAO’s objective is to contribute to cryopreservation research projects that have a high potential to increase the quality and capabilities of cryopreservation.” The project’s page on Juicebox reads: “The $CRYO token is a governance token that enables you to vote for governance proposals within CryoDAO, and is not intended to constitute securities or financial instruments in any jurisdiction.”

Metis Launches Community Testing of Proof-of-Stake Sequencer Pool

Jan. 16: Metis, an Ethereum layer-2 network, has launched “community testing for their Proof-of-Stake Sequencer Pool on the Metis Sepolia Testnet before its official launch on the mainnet later in 2024,” according to the team: “Metis Proof-of-Stake Sequencer Pool will offer 24/7 liveness, enhanced censorship resistance, enhanced security, and fee sharing. Already announced dApps include League.Tech, Tethys Finance, Midas Games, Netswap and Hummus Finance.”

Massa Mainnet Now Live, Supports Autonomous Smart Contracts and Staking

Jan. 16: Massa Labs launched the decentralized proof-of-stake blockchain network Massa on Jan. 15, following a lengthy period of development and testing, according to the team: “This event signifies the beginning of a new state-of-the-art blockchain network that offers robust architecture and brings brand new features to decentralized finance, like Autonomous Smart Contracts and on-chain web.” From Massa’s documentation: “Instead of one chain, there are exactly 32 threads of chains running in parallel, with blocks equally spread on each thread over time, and stored inside slots that are spaced at fixed time intervals.”

Filecoin Foundation Sends IPFS to Space With Lockheed Martin-Developed Software

Jan. 16: Filecoin Foundation (FF) successfully completed a first-of-its-kind mission deploying the InterPlanetary File System (IPFS) in space, according to the team: “The recent demonstration involved sending files from Earth to orbit and back using an implementation of the IPFS protocol designed for space communications. This mission, conducted with Lockheed Martin-developed software, demonstrated how IPFS – a decentralized content distribution system – can bring the benefits of decentralized technologies to space to enable better communications across long distances and resilience in challenging environments.” (FIL)

Upshot, Decentralized AI Platform, Announces Beta Launch of ‘RoboNet’ for Vault Management

Jan. 16: Upshot, a decentralized AI platform, announced the beta launch of its AI-powered vault platform RoboNet. According to the team: “RoboNet will allow capital providers to deposit into vaults managed by AI-powered strategies. This gives people access to much more advanced DeFi strategies by leveraging AI, going beyond what was previously achievable with traditional onchain yield-generating strategies. Previously, the requirements for successful market making were complex and resource-intensive. RoboNet automates this process, predicting long-tail asset prices and driving liquidity to long-tail assets.”

Chainlink Teams Up With Circle to Allow Cross-Chain Stablecoin Transfers

Jan. 16: Chainlink’s Cross-Chain Interoperability Protocol (CCIP) has integrated Circle’s Cross-Chain Transfer Protocol (CCTP) to make it easy for users to transfer USDC across chains, according to a press release. Developers can now build cross-chain use cases via CCIP that involve cross-chain transfers of USDC, including payments and other DeFi interactions, the statement said. (LINK)

Marblex Expands Multi-Chain WARP Service to Aptos

Jan. 16: Marblex announced the expansion of its multi-chain WARP service to now include the layer-1 blockchain Aptos, according to the team: “Aptos’s breakthrough technology and programming language, Move, are designed to evolve, improve performance and strengthen user safeguards. This update establishes a connection between the ecosystems of Aptos and MBX, enabling Aptos users to seamlessly access MBX services such as games and NFTs within its own ecosystem.” (APT)

Hedera Creates MetaMask Wallet Snap, Achieving EVM Interoperability

Jan. 16: Hedera has collaborated with MetaMask to create the Hedera Wallet Snap, connecting the Hedera network with MetaMask’s 30 million monthly active users, according to the team: “The newly launched plugin will enable Hedera to achieve full EVM interoperability. Users can now send HBAR to both Hedera and EVM addresses, as well as retrieve their account information and easily view their token balances. MetaMask users can enhance the capabilities of their applications beyond the native features of MetaMask, leveraging Hedera’s wide portfolio of Web3 tools, including smart contract development and tokenization services.” (HBAR)

Bitfinex Partners With Synonym to Allow Purchases of Lightning Network Connections

Jan. 16: Bitfinex, the digital asset trading platform, “has partnered with Synonym to introduce a feature that allows customers to buy Lightning Network connections for instant deposit, withdrawals and payments,” according to the team: “Bitfinex customers can now connect directly to the nodes, eliminating the need for the previously cumbersome process of withdrawing balances, selecting peers, and manually opening channels. This feature removes the necessity to search for external Lightning Service Providers or listings on liquidity marketplaces, providing users with seamless access to substantial receiving capacity.”

Cronos Labs’ Third Web3 Accelerator Cohort Includes Lillius, Innerworks

Jan. 16: Cronos Labs announces its third Web3 Accelerator cohort, blending AI and blockchain for groundbreaking innovation. With a 57% surge in applications, five pioneering projects receive mentorship and $30,000 seed funding each. The projects are:

The program, backed by AWS, Google Cloud and more than 100 mentors, will conduct a Demo Day in April, where the projects will have the opportunity to pitch their ideas to the program’s key investment partners which include NGC, Fundamental Labs, Republic, Animoca and Delphi Digital.

WalletConnect Launches ‘Web3Inbox’ for Communication With Apps

Jan. 16: WalletConnect today announced the launch of the Web3Inbox application, “a new easy-to-use consumer product that provides both users and apps an essential communication point, flexible to the demands and needs of today’s world,” according to the team: “The platform gives users of any wallet an all-in-one inbox to subscribe and interact with updates from the apps they love, enabling a headache-free, Web3-first notification experience that keeps them in control. The app launch follows the rollout of the Notify API for Wallets and app developer toolkit, Web3Inbox SDK.”

Hitachi to Create Proof-of-Concepts for Supply Chain Solutions on Hedera

Jan. 16: The Hedera Council announced its newest member, Hitachi America, Ltd. (Hitachi), which brings with it industrial solutions expertise. According to the team: “Hitachi offers a broad range of electronics, power and industrial equipment and services, energy, industrial, health care, IT, OT, mobility and IoT with operations throughout the Americas directly and through its subsidiaries. Hitachi aims to begin creating proof-of-concepts for end-to-end supply chain and sustainability solutions on Hedera in the next year.” (HBAR)

Hacken Introduces Open-Source Rust Library for Code Coverage Generation for WASM Protocols

Jan. 16: Hacken, a blockchain security auditor, has introduced an open-source Rust library for code coverage generation for WASM-based protocols, according to the team: “Code Coverage utilities are crucial for automation testing to ascertain the thoroughness of code examination. Without it, some critical components can remain untested. While it is available for Ethereum-based projects, WASM-based protocols don’t have it. Wasmcov by Hacken is already integrated into the Radix ecosystem, which enables all Radix-built projects to utilize code coverage measurement. The next protocol to get it will be NEAR. The rest can set it up manually.”

D8X, Decentralized Derivatives Exchange, Launches on Polygon zkEVM

Jan. 16: D8X, an institutional-grade DEX for derivatives, has launched on Polygon zkEVM, bringing new trading features to DeFi, according to the team. “With support from Polygon, Axelar, Swissborg and others, D8X reconceives on-chain derivatives, starting from fundamental financial engineering and extending to its novel white-label business-to-business model–a first for Polygon zkEVM. The DEX aims to attract institutional players with features such as cost-efficient hedging; linear, inverse and quanto perpetuals; and yield-bearing pools in Euro, USDC and stETH.”

Renzo, Interface for Restaking Protocol EigenLayer, Raises $3.2M

Jan. 15: Renzo, an interface for the liquid restaking protocol EigenLayer, has raised $3.2M, according to the team: “Maven11 led the Renzo seed round which also saw follow-on investments from Figment Capital, SevenX, IOSG and Paper Ventures. More than 2,000 users have deposited $20M of ETH into Renzo since its protocol was deployed in late December. Renzo uses a combination of smart contracts and operator nodes to supply automated liquid restaking strategies and enables ETH and Liquid Staking Tokens (LSTs) to be restaked and utilized as DeFi collateral to earn compounding rewards.”

Taiko Unveils ‘Katla’ Testnet with Multi-Proofs, Paving Way for Mainnet Launch

Jan. 15: Taiko, developing a so-called type-1 zkEVM to help scale the Ethereum blockchain, announced the launch of “Katla,” its alpha-6 testnet, according to a message from the team: “Katla is laying the foundation for Taiko’s mainnet launch in 2024, marking a significant step forward for the project. It will very likely be the last testnet before Taiko’s mainnet launch in 2024. It will be testing the innovative Based Contestable Rollup (BCR) design, which blends the advantages of optimistic rollups, such as simplicity and low cost, with those of ZK rollups, known for their security and shorter time-to-finality.” According to a press release: “Taiko does not have a centralized sequencer and instead relies on Ethereum block builders for transaction sequencing.”

Lagrange Labs Builds a Light Client for Mantle Network

Jan. 15: Lagrange Labs, developer of a blockchain proving system based on zero-knowledge cryptography, has integrated its light client protocol, Lagrange State Committees (LSC), for the Ethereum layer-2 network Mantle, according to the team. LSCs “are a ZK light client protocol for optimistic rollups (ORUs), designed through combining Lagrange’s ZK MapReduce Coprocessor and EigenLayer restaking. Each state committee borrows security from Ethereum by dual staking, both through EigenLayer restaking and with the rollup’s native token. Augmenting developer experience and cryptoeconomic security on Mantle Network, the LSC is deployed as a core primitive to enable trustless and efficient cross-chain access to Mantle.”

Push Protocol Says Hackathon Participant Found Way to Quantum-Proof Ethereum

Jan. 15 (PROTOCOL VILLAGE EXCLUSIVE): Push Protocol, the communication protocol of Web3, recently concluded their Billion Reasons to Build (BRB) developer tour in India, according to the team: “During the hackathon, Aditya Bisht successfully solved one of its hardest coding challenges belonging to the Ethereum Foundation – quantum proofing the Ethereum Network. Bisht’s creation of an account abstraction smart contract effectively conceals public keys, enhancing the network’s defense against quantum decryption. Building on this success, Push Protocol decided to expand their tour globally as BRB Online and offer ongoing coding challenges to developers.”

Hedera, Algorand, Swirlds Form ‘DeRec Alliance’ for ‘Decentralized Recovery’ Standards

Jan. 15: The Hedera and Algorand ecosystems have joined to Form DeRec Alliance. (DeRec stands for “decentralized recovery.”) According to the team: “Entities from across the Hedera and Algorand ecosystems including the HBAR Foundation, Algorand Foundation, Hashgraph Association, Swirlds Labs, and DLT Science Foundation, along with industry partners The Building Blocks and BankSocial, are partnering to develop a new interoperability recovery standard which will simplify the recovery & adoption of crypto and other assets. The DeRec Alliance will bring together the Web3 ecosystem to offer an open-source, industry-standard methodology making digital asset recovery painless & secure across wallets.”

BitCountry to Introduce ‘BitAvatar’ for Digital ID

Jan. 15: BitCountry, a Polkadot parachain project, launched InnoVoy Event to introduce BitAvatar before their L1 MNet Continuum, according to the team. “BitAvatar, part of MNet’s enriched layer, offers a Universal Avatar identity with NFT-bound wallet, enhancing Web3 experiences. The first 1,000 users can free-mint BitAvatar IDs, with subsequent access via invite codes. This is a significant step in digital ID evolution in blockchain, with personalized avatars and exclusive benefits for MNet’s ecosystem projects. The BitCountry Team aims to simplify blockchain accessibility and understanding through this innovative technology.” MNet is a “scaled EVM and WASM network with an Enriched Social Layer,” according to a blog post. (DOT)

Google Cloud Joins Flare Network as Validator

Jan. 15: The cloud division of tech giant Google (GOOGL) has joined the Flare blockchain as a validator and infrastructure provider. Google Cloud is one of 100 organizations adopting this combined role, both securing the network as a validator and contributing to the Flare Time Series Oracle (FTSO), according to an announcement shared with CoinDesk on Monday.

Injective ‘Volan’ Upgrade Introduces Real World Asset Module

Jan. 11: Injective, a finance-focused Web3 blockchain, launched the Volan chain upgrade, its biggest protocol update to date, which will introduce the Real World Asset (RWA) Module. According to the team: “Injective’s new RWA Module offers a groundbreaking approach to creating and managing permissioned assets with extensive customization options. This module enables both institutions and individual users to easily launch and access a variety of structured products and RWAs such as fiat pairs, treasury bills, and exclusive credit products, accessible through compliant gateways.” (INJ)

DePIN and DeWi Come to Sui Through Partnership with Karrier One

Jan. 11: Sui, a layer-1 blockchain, is getting DePIN and DeWi through a groundbreaking partnership with Karrier One, according to the team: “The deal also includes strategic investment from Sui to fuel the expansion of Karrier One’s global footprint and deployment on Sui. The technical integration will feature DePIN services powered by the Sui blockchain and the launch of a Karrier One Decentralized Wireless (DeWi) network token on Sui. In addition, contributors to and participants in the Karrier One ecosystem will be able to earn DeWi tokens for various activities such as deploying radios and mobile usage involving Karrier One phone numbers.”

Union Partners With Movement, Noble for USDC Support Across Celestia

Jan. 11: Union Labs, a sovereign interoperability layer, has partnered with modular blockchain network Movement Labs and the Cosmos-based asset-issuance appchain Noble to transport native USDC and other assets across Celestia’s modular stack. According to the team: “Union’s zero-knowledge IBC bridge facilitates a seamless flow of liquidity across Movement rollups, the broader Cosmos ecosystem and Celestia’s sovereign rollups, as well as allowing for general message passing and asset transfers on Movement.”

Open Dollar, Arbitrum Lending Protocol, Innovates ‘Non-Fungible Vaults’ or NFVs

Jan. 11: Open Dollar (OD), an Arbitrum lending protocol, will airdrop 78k+ tokens to qualifying wallets on January 17, approximately three weeks before the lending protocol goes live on Arbitrum Mainnet. According to the team: “Open Dollar is a lovechild of DeFi and NFTs, innovating a concept called Non-Fungible Vaults (NFVs) which enables tradable loans as NFTs, with a focus on liquid staking tokens and Arbitrum native assets, so users earn their staking rewards while they trade. Three percent of the total token supply, 300,000 Open Dollar Governance tokens, will be airdropped to qualifying users.”

Bitfinity Has Secured $7M From Backers Including Polychain, ParaFi

Jan. 11: Bitfinity Network, a Web3 infrastructure firm, on Thursday announced it has successfully secured over $7 million in funding from notable backers, including Polychain Capital and ParaFi Capital, advancing its mission to establish off-chain infrastructure for Bitcoin and Ordinals. According to the team: “The raise coincides with the development of the Bitfinity Ethereum Virtual Machine (EVM) – a Bitcoin sidechain integrated into the Internet Computer blockchain that enables solidity developers and existing EVM-compatible services to build Bitcoin-enabled decentralized apps (dApps).”

Ethereum’s Vitalik Buterin Proposes Gas Limit Increase

Jan. 11: Ethereum co-founder Vitalik Buterin suggested raising the network’s gas limit by 33% on Wednesday – a move that would raise the network’s transaction capacity and could reduce fees for end-users, but could increase operational costs for validators.

Mobile Gaming Studio AOFverse Gets Grant from Arbitrum Foundation

Jan. 11: AOFverse, a prominent mobile gaming studio, secured a “significant” grant from Arbitrum Foundation, according to the team: AOFverse plans to innovate mobile gaming with blockchain tech, emphasizing Web3 integration and user education. Their game Army of Tactics is gaining popularity with over 4 million TikTok followers. The AFG token enhances community engagement. This partnership aims to create a blockchain-powered metaverse, setting new gaming industry standards.”

StarkWare CEO Uri Kolodny Steps Down Due to Family Health Issue

Jan. 11: Uri Kolodny, the CEO of Ethereum scaling and privacy technology StarkWare, is stepping down due to a family health issue. StarkWare president Eli Ben-Sasson will become CEO, and Kolodny will continue to serve on the StarkWare board of directors, the company said on Thursday.

Liquidity-Focused Berachain Opens Layer-1 Testnet to Public

Jan. 11: Upcoming layer 1 blockchain Berachain opened its testnet to the public Thursday, a debut for its “proof of liquidity” consensus mechanism that garnered $42 million in funding last year. Berachain is a meme-fueled project built in the Cosmos ecosystem. Its creators are largely pseudonymous crypto developers who identify themselves online with pictures of cartoon bears – some smoking weed.

Aave Community Votes To Integrate PayPal’s Stablecoin

Jan. 11: Aave, the decentralized non-custodial lending and borrowing protocol, is voting to onboard PayPal’s PYUSD stablecoin issued by Paxos Trust Company. In an ongoing governance vote, 99.98% of the participating AAVE token holders favor integrating PYUSD into AAVE’s Ethereum-based pool. The voting on the proposal, termed temperature check, floated by Trident Digital on Dec. 18, will end later Thursday. The vote follows decentralized exchange Curve’s December decision to host PYUSD.

Ryder, Hardware Wallet, to Become Signer for Stacks Nakamoto Upgrade

Jan. 11: Ryder, a hardware crypto wallet, announced it will become a signer for the upcoming Stacks Nakamoto upgrade as well as operate the FAST pool. According to the team: “The FAST Pool is one of the first and currently one of the largest stacking services in the Stacks ecosystem, boasting a total TVL of 43 million STX. Ryder’s participation in helping to decentralize the Bitcoin movement on Stacks’ Layer 2, will strengthen the security of the network and enable the next generation of scalable Bitcoin applications.”

Tech

Harvard Alumni, Tech Moguls, and Best-Selling Authors Drive Nearly $600 Million in Pre-Order Sales

BlockDAG Network’s history is one of innovation, perseverance, and a vision to push the boundaries of blockchain technology. With Harvard alumni, tech moguls, and best-selling authors at the helm, BlockDAG is rewriting the rules of the cryptocurrency game.

CEO Antony Turner, inspired by the successes and shortcomings of Bitcoin and Ethereum, says, “BlockDAG leverages existing technology to push the boundaries of speed, security, and decentralization.” This powerhouse team has led a staggering 1,600% price increase in 20 pre-sale rounds, raising over $63.9 million. The secret? Unparalleled expertise and a bold vision for the future of blockchain.

Let’s dive into BlockDAG’s success story and find out what the future holds for this cryptocurrency.

The Origin: Why BlockDAG Was Created

In a recent interview, BlockDAG CEO Antony Turner perfectly summed up why the market needs BlockDAG’s ongoing revolution. He said:

“The creation of BlockDAG was inspired by Bitcoin and Ethereum, their successes and their shortcomings.

If you look at almost any new technology, it is very rare that the first movers remain at the forefront forever. Later incumbents have a huge advantage in entering a market where the need has been established and the technology is no longer cutting edge.

BlockDAG has done just that: our innovation is incorporating existing technology to provide a better solution, allowing us to push the boundaries of speed, security, and decentralization.”

The Present: How Far Has BlockDAG Come?

BlockDAG’s presale is setting new benchmarks in the cryptocurrency investment landscape. With a stunning 1600% price increase over 20 presale lots, it has already raised over $63.9 million in capital, having sold over 12.43 billion BDAG coins.

This impressive performance underscores the overwhelming confidence of investors in BlockDAG’s vision and leadership. The presale attracted over 20,000 individual investors, with the BlockDAG community growing exponentially by the hour.

These monumental milestones have been achieved thanks to the unparalleled skills, experience and expertise of BlockDAG’s management team:

Antony Turner – Chief Executive Officer

Antony Turner, CEO of BlockDAG, has over 20 years of experience in the Fintech, EdTech, Travel and Crypto industries. He has held senior roles at SPIRIT Blockchain Capital and co-founded Axona-Analytics and SwissOne. Antony excels in financial modeling, business management and scaling growth companies, with expertise in trading, software, IoT, blockchain and cryptocurrency.

Director of Communications

Youssef Khaoulaj, CSO of BlockDAG, is a Smart Contract Auditor, Metaverse Expert, and Red Team Hacker. He ensures system security and disaster preparedness, and advises senior management on security issues.

advisory Committee

Steven Clarke-Martin, a technologist and consultant, excels in enterprise technology, startups, and blockchain, with a focus on DAOs and smart contracts. Maurice Herlihy, a Harvard and MIT graduate, is an award-winning computer scientist at Brown University, with experience in distributed computing and consulting roles, most notably at Algorand.

The Future: Becoming the Cryptocurrency with the Highest Market Cap in the World

Given its impressive track record and a team of geniuses working tirelessly behind the scenes, BlockDAG is quickly approaching the $600 million pre-sale milestone. This crypto powerhouse will soon enter the top 30 cryptocurrencies by market cap.

Currently trading at $0.017 per coin, BlockDAG is expected to hit $1 million in the coming months, with the potential to hit $30 per coin by 2030. Early investors have already enjoyed a 1600% ROI by batch 21, fueling a huge amount of excitement around BlockDAG’s presale. The platform is seeing significant whale buying, and demand is so high that batch 21 is almost sold out. The upcoming batch is expected to drive prices even higher.

Invest in BlockDAG Pre-Sale Now:

Pre-sale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetwork

Discord: Italian: https://discord.gg/Q7BxghMVyu

No spam, no lies, just insights. You can unsubscribe at any time.

Tech

How Karak’s Latest Tech Integration Could Make Data Breaches Obsolete

- Space and Time uses zero-knowledge proofs to ensure secure and tamper-proof data processing for smart contracts and enterprises.

- The integration facilitates faster development and deployment of Distributed Secure Services (DSS) on the Karak platform.

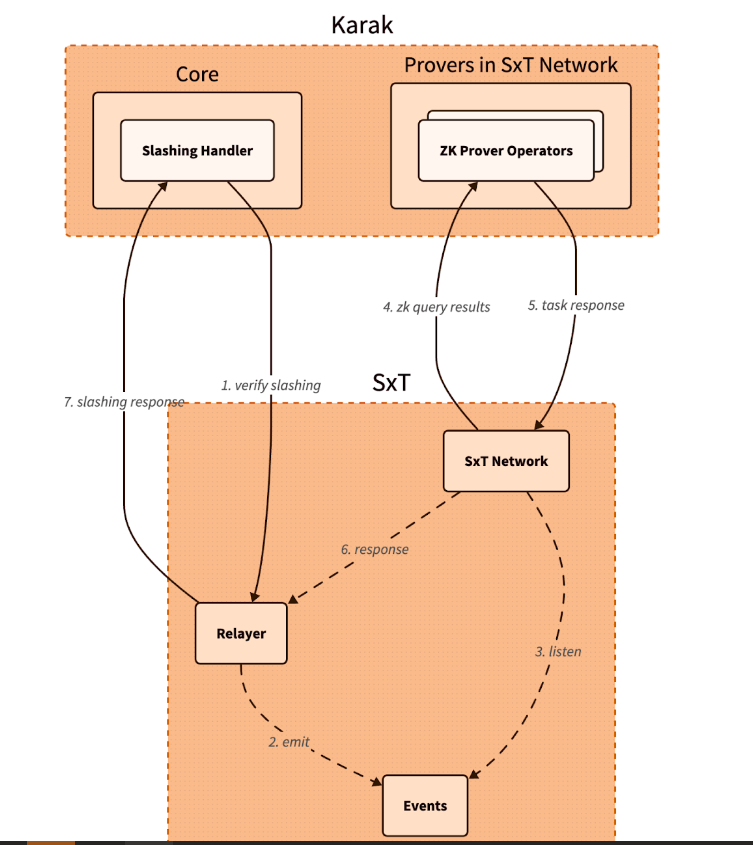

Karak, a platform known for its strong security capabilities, is enhancing its Distributed Secure Services (DSS) by integrating Space and Time as a zero-knowledge (ZK) coprocessor. This move is intended to strengthen trustless operations across its network, especially in slashing and rewards mechanisms.

Space and Time is a verifiable processing layer that uses zero-knowledge proofs to ensure that computations on decentralized data warehouses are secure and untampered with. This system enables smart contracts, large language models (LLMs), and enterprises to process data without integrity concerns.

The integration with Karak will enable the platform to use Proof of SQL, a new ZK-proof approach developed by Space and Time, to confirm that SQL query results are accurate and have not been tampered with.

One of the key features of this integration is the enhancement of DSS on Karak. DSS are decentralized services that use re-staked assets to secure the various operations they provide, from simple utilities to complex marketplaces. The addition of Space and Time technology enables faster development and deployment of these services, especially by simplifying slashing logic, which is critical to maintaining security and trust in decentralized networks.

Additionally, Space and Time is developing its own DSS for blockchain data indexing. This service will allow community members to easily participate in the network by running indexing nodes. This is especially beneficial for applications that require high security and decentralization, such as decentralized data indexing.

The integration architecture follows a detailed and secure flow. When a Karak slashing contract needs to verify a SQL query, it calls the Space and Time relayer contract with the required SQL statement. This contract then emits an event with the query details, which is detected by operators in the Space and Time network.

These operators, responsible for indexing and monitoring DSS activities, validate the event and route the work to a verification operator who runs the query and generates the necessary ZK proof.

The result, along with a cryptographic commitment on the queried data, is sent to the relayer contract, which verifies and returns the data to the Karak cutter contract. This end-to-end process ensures that the data used in decision-making, such as determining penalties within the DSS, is accurate and reliable.

Karak’s mission is to provide universal security, but it also extends the capabilities of Space and Time to support multiple DSSs with their data indexing needs. As these technologies evolve, they are set to redefine the secure, decentralized computing landscape, making it more accessible and efficient for developers and enterprises alike. This integration represents a significant step towards a more secure and verifiable digital infrastructure in the blockchain space.

Website | X (Twitter) | Discord | Telegram

No spam, no lies, just insights. You can unsubscribe at any time.

Tech

Cryptocurrency Payments: Should CFOs Consider This Ferrari-Approved Trend?

Iconic Italian luxury carmaker Ferrari has announced the expansion of its cryptocurrency payment system to its European dealer network.

The move, which follows a successful launch in North America less than a year ago, raises a crucial question for CFOs across industries: Is it time to consider accepting cryptocurrency as a form of payment for your business?

Ferrari’s move isn’t an isolated one. It’s part of a broader trend of companies embracing digital assets. As of 2024, we’re seeing a growing number of companies, from tech giants to traditional retailers, accepting cryptocurrencies.

This change is determined by several factors:

- Growing mainstream adoption of cryptocurrencies

- Growing demand from tech-savvy and affluent consumers

- Potential for faster and cheaper international transactions

- Desire to project an innovative brand image

Ferrari’s approach is particularly noteworthy. They have partnered with BitPay, a leading cryptocurrency payment processor, to allow customers to purchase vehicles using Bitcoin, Ethereum, and USDC. This satisfies their tech-savvy and affluent customer base, many of whom have large digital asset holdings.

Navigating Opportunities and Challenges

Ferrari’s adoption of cryptocurrency payments illustrates several key opportunities for companies considering this move. First, it opens the door to new customer segments. By accepting cryptocurrency, Ferrari is targeting a younger, tech-savvy demographic—people who have embraced digital assets and see them as a legitimate form of value exchange. This strategy allows the company to connect with a new generation of affluent customers who may prefer to conduct high-value transactions in cryptocurrency.

Second, cryptocurrency adoption increases global reach. International payments, which can be complex and time-consuming with traditional methods, become significantly easier with cryptocurrency transactions. This can be especially beneficial for businesses that operate in multiple countries or deal with international customers, as it potentially reduces friction in cross-border transactions.

Third, accepting cryptocurrency positions a company as innovative and forward-thinking. In today’s fast-paced business environment, being seen as an early adopter of emerging technologies can significantly boost a brand’s image. Ferrari’s move sends a clear message that they are at the forefront of financial innovation, which can appeal to customers who value cutting-edge approaches.

Finally, there is the potential for cost savings. Traditional payment methods, especially for international transactions, often incur substantial fees. Cryptocurrency transactions, on the other hand, can offer lower transaction costs. For high-value purchases, such as luxury cars, these savings could be significant for both the business and the customer.

While the opportunities are enticing, accepting cryptocurrency payments also presents significant challenges that businesses must address. The most notable of these is volatility. Cryptocurrency values can fluctuate dramatically, sometimes within hours, posing potential risk to businesses that accept them as payment. Ferrari addressed this challenge by implementing a system that instantly converts cryptocurrency received into traditional fiat currencies, effectively mitigating the risk of value fluctuations.

Regulatory uncertainty is another major concern. The legal landscape surrounding cryptocurrencies is still evolving in many jurisdictions around the world. This lack of clear and consistent regulations can create compliance challenges for companies, especially those operating internationally. Companies must remain vigilant and adaptable as new laws and regulations emerge, which can be a resource-intensive process.

Implementation costs are also a significant obstacle. Integrating cryptocurrency payment systems often requires substantial investment in new technology infrastructure and extensive staff training. This can be especially challenging for small businesses or those with limited IT resources. The costs are not just financial; a significant investment of time is also required to ensure smooth implementation and operation.

Finally, security concerns loom large in the world of cryptocurrency transactions. While blockchain technology offers some security benefits, cryptocurrency transactions still require robust cybersecurity measures to protect against fraud, hacks, and other malicious activity. Businesses must invest in robust security protocols and stay up-to-date on the latest threats and protections, adding another layer of complexity and potential costs to accepting cryptocurrency payments.

Strategic Considerations for CFOs

If you’re thinking of following in Ferrari’s footsteps, here are the key factors to consider:

- Risk Assessment: Carefully evaluate potential risks to your business, including financial, regulatory, and reputational risks.

- Market Analysis: Evaluate whether your customer base is significantly interested in using cryptocurrencies for payments.

- Technology Infrastructure: Determine the costs and complexities of implementing a cryptographic payment system that integrates with existing financial processes.

- Regulatory Compliance: Ensure that cryptocurrency acceptance is in line with local regulations in all markets you operate in. Ferrari’s gradual rollout demonstrates the importance of this consideration.

- Financial Impact: Analyze how accepting cryptocurrency could impact your cash flow, accounting practices, and financial reporting.

- Partnership Evaluation: Consider partnering with established crypto payment processors to reduce risk and simplify implementation.

- Employee Training: Plan comprehensive training to ensure your team is equipped to handle cryptocurrency transactions and answer customer questions.

While Ferrari’s adoption of cryptocurrency payments is exciting, it’s important to consider this trend carefully.

A CFO’s decision to adopt cryptocurrency as a means of payment should be based on a thorough analysis of your company’s specific needs, risk tolerance, and strategic goals. Cryptocurrency payments may not be right for every business, but for some, they could provide a competitive advantage in an increasingly digital marketplace.

Remember that the landscape is rapidly evolving. Stay informed about regulatory changes, technological advancements, and changing consumer preferences. Whether you decide to accelerate your crypto engines now or wait in the pit, keeping this payment option on your radar is critical to navigating the future of business transactions.

Was this article helpful?

Yes No

Sign up to receive your daily business insights

Tech

Bitcoin Tumbles as Crypto Market Selloff Mirrors Tech Stocks’ Plunge

The world’s largest cryptocurrency, Bitcoin (BTC), suffered a significant price decline on Wednesday, falling below $65,000. The decline coincides with a broader market sell-off that has hit technology stocks hard.

Cryptocurrency Liquidations Hit Hard

CoinGlass data reveals a surge in long liquidations in the cryptocurrency market over the past 24 hours. These liquidations, totaling $220.7 million, represent forced selling of positions that had bet on price increases. Bitcoin itself accounted for $14.8 million in long liquidations.

Ethereum leads the decline

Ethereal (ETH), the second-largest cryptocurrency, has seen a steeper decline than Bitcoin, falling nearly 8% to trade around $3,177. This decline mirrors Bitcoin’s price action, suggesting a broader market correction.

Cryptocurrency market crash mirrors tech sector crash

The cryptocurrency market decline appears to be linked to the significant losses seen in the U.S. stock market on Wednesday. Stock market listing The index, heavily weighted toward technology stocks, posted its sharpest decline since October 2022, falling 3.65%.

Analysts cite multiple factors

Several factors may have contributed to the cryptocurrency market crash:

- Tech earnings are underwhelming: Earnings reports from tech giants like Alphabet are disappointing (Google(the parent company of), on Tuesday, triggered a sell-off in technology stocks with higher-than-expected capital expenditures that could have repercussions on the cryptocurrency market.

- Changing Political Landscape: The potential impact of the upcoming US elections and changes in Washington’s policy stance towards cryptocurrencies could influence investor sentiment.

- Ethereal ETF Hopes on the line: While bullish sentiment around a potential U.S. Ethereum ETF initially boosted the market, delays or rejections could dampen enthusiasm.

Analysts’ opinions differ

Despite the short-term losses, some analysts remain optimistic about Bitcoin’s long-term prospects. Singapore-based cryptocurrency trading firm QCP Capital believes Bitcoin could follow a similar trajectory to its post-ETF launch all-time high, with Ethereum potentially converging with its previous highs on sustained institutional interest.

Rich Dad Poor Dad Author’s Prediction

Robert Kiyosaki, author of the best-selling Rich Dad Poor Dad, predicts a potential surge in the price of Bitcoin if Donald Trump is re-elected as US president. He predicts a surge to $105,000 per coin by August 2025, fueled by a weaker dollar that is set to boost US exports.

BTC/USD Technical Outlook

Bitcoin price is currently trading below key support levels, including the $65,500 level and the 100 hourly moving average. A break below the $64,000 level could lead to further declines towards the $63,200 support zone. However, a recovery above the $65,500 level could trigger another increase in the coming sessions.

-

Videos4 weeks ago

Videos4 weeks agoAbsolutely massive: the next higher Bitcoin leg will shatter all expectations – Tom Lee

-

News12 months ago

News12 months agoVolta Finance Limited – Director/PDMR Shareholding

-

News12 months ago

News12 months agoModiv Industrial to release Q2 2024 financial results on August 6

-

News12 months ago

News12 months agoApple to report third-quarter earnings as Wall Street eyes China sales

-

News12 months ago

News12 months agoNumber of Americans filing for unemployment benefits hits highest level in a year

-

News1 year ago

News1 year agoInventiva reports 2024 First Quarter Financial Information¹ and provides a corporate update

-

News1 year ago

News1 year agoLeeds hospitals trust says finances are “critical” amid £110m deficit

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Hit $100 Billion in 2024, Fueling Insane Investor Optimism ⋆ ZyCrypto

-

Videos1 year ago

Videos1 year ago$1,000,000 worth of BTC in 2025! Get ready for an UNPRECEDENTED PRICE EXPLOSION – Jack Mallers

-

Videos1 year ago

Videos1 year agoABSOLUTELY HUGE: Bitcoin is poised for unabated exponential growth – Mark Yusko and Willy Woo

-

Tech1 year ago

Tech1 year agoBlockDAG ⭐⭐⭐⭐⭐ Review: Is It the Next Big Thing in Cryptocurrency? 5 questions answered