Markets

Top 5 Carbon Crypto Companies to Watch in 2024

Currently, climate change has become one of the most critical issues facing the world. It affects everyone on this planet and could have serious, long-lasting consequences for all of humanity if left untreated. This is why carbon credits are on the radar of all sectors – not just the obvious ones like energy, Agriculture and forestry. And one of these industries is blockchain technology.

The strengths of blockchain technology, such as its transparency, secure record-keeping and decentralization, constitute advantages for carbon credits.

This is why many carbon crypto companies are already in the works. There is a huge opportunity here for two of today’s biggest investment trends to develop their synergies.

With that said, let’s take a look at what some of the most promising carbon crypto companies for 2024 are.

1. ClimateDAO

At the top of our list is one of the first big players in the crypto-carbon space: ClimateDAO, also known by their play KLIMA. Its goal is to accelerate the rate at which the price of carbon emissions increases. And this by purchasing and withdrawing carbon offsets.

How do they do that ?

First, carbon offset credits are purchased from Verra’s Verified Carbon Standard registry, which guarantees their quality. These credits are withdrawn, then issued as tokens via the Toucan protocol (more on this later). These tokens are known as basic carbon tons (BCT).

- Each BCT represents a ton of carbon removed from the atmosphere.

Every KLIMA piece is backed by at least one ton of base carbon. KLIMA coin owners are incentivized to increase their share of the coin by bonding more BCT or staking their holdings to earn a yield.

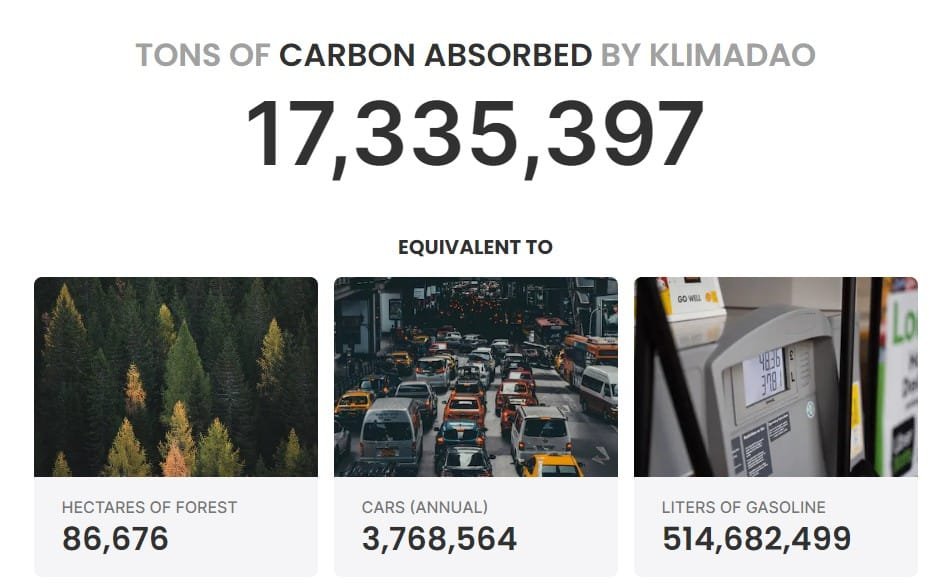

There’s a lot to unpack when it comes to KlimaDAO, but the impact it’s had so far is undeniable. Last year, KlimaDAO bought 2% from the whole voluntary carbon market. And at the time of writing this article, KlimaDAO has retired 17.3 million tonnes of carbon compensation:

This is as much as a small country like Croatia emits each year.

Even if KlimaDAO sets a floor price for voluntary carbon markets, its success will not depend on the performance of voluntary carbon markets. As with all crypto projects, the most important factor is whether people actually want to adopt it or not.

KlimaDAO is still in a growth phase, so to speak, as it looks to expand its treasury and provide a more robust supply. The coin’s developers do not expect a stable price to be reached until mid-century.

However, KLIMA has been deployed for over a year and has already caused a stir in the carbon markets. Many other carbon crypto projects are still stuck in the development phase. KlimaDAO may have an ambitious goal, but they have shown that their business model has some foundation to build on.

2. Toucan Protocol

As mentioned in our discussion on KlimaDAO earlier, the Toucan Protocol is not a coin in itself. Rather, it is the infrastructure that helps crypto-carbon projects like KlimaDAO exist.

Simply put, Toucan is a transition protocol that transforms real life carbon credits into tokens that can actually be used on a blockchain. These tokens, called Tokenized CO2 or TCO2, represent carbon offsets withdrawn but not yet claimed.

They have been removed from their source register to avoid double counting, but have not yet been declared for emissions. And so that always represents a specific amount of verified carbon offsets.

- TCO2s are semi-fungible – they are not all the same, because the information about the origin of each credit is directly encoded on-chain. However, similar credits can be split and grouped into carbon pools, where they can be traded.

The largest and most well-known carbon pool using the Toucan protocol would be the Base Carbon Ton (BCT) used by KlimaDAO.

The bulk of the carbon credits filled by Toucan went to the BCT pool composed of Ethereum Request for Comment 20 (ERC-20) tokens.

These ERC-20 tokens can be directly integrated into other DeFi applications.

Toucan was the first platform to allow tokenization of carbon credits, and they have several partners in addition to KlimaDAO. They have a first mover advantage in this space and have created their own internal token, Nature Carbon Tonne (NCT) for buyers of carbon credits.

With a number of other major carbon crypto companies choosing to build on Toucan’s infrastructure instead of developing their own, there is great potential for future growth here.

3. Foam

Similar to Toucan, Mousse it’s all about the tokenization of real carbon assets.

Moss, a Brazilian company, has its own token, the MCO2 token, which is created by tokenizing verified carbon credits from sources like Verra. Each MCO2 token represents a ton of carbon offset, with a particular focus on credits generated by forest preservation projects in the the Amazon forest.

With its token, Moss aims to provide a platform for businesses and individuals wishing to offset their carbon emissions to purchase high-quality and fully transparent carbon credits.

-

Moss also has a side project Amazon Forest NFT.

Moss first purchased several plots of land in the Amazon rainforest, divided them into one-hectare lots, and then sold them as NFTs.

Funds from each NFT sale were contributed to a 30-year preservation fund that will cover the costs of activities such as patrols and satellite imagery to protect the area.

The ultimate goal of this project would be to create a “green wall” around part of the Amazon rainforest to block deforestation efforts. Moss has sold three rounds of these NFTs, and more releases are on the way.

With several Brazilian carbon credit contracts locked in for the supply of MCO2 tokens in addition to their sold-out NFT series, Moss is another of the few carbon-related crypto companies that has actually deployed a successful solution to the markets.

4. Nori

A carbon removal market that focuses on coordinating transactions between small agricultural suppliers and buyers of carbon credits, Nori has not yet launched its token. Instead, Nori naturally chose to start by making sure its business model was solid and launched a pilot program.

By partnering with U.S. farmers practicing regenerative agriculture, Nori has secured a number of domestic providers of high-quality carbon credits. Some of these providers are shown below:

The top layer of soil is actually one of Mother Nature’s largest natural carbon sinks, containing three times more carbon than the entire atmosphere.

However, human agriculture has caused carbon to be released from the soil much faster than the rate at which it is replaced.

This loss of carbon in the soil is what Nori is targeting, focusing on regenerative agriculture projects. The final objective of each project is a form of carbon sequestration known as soil carbon storage, which produces carbon credits.

-

These carbon credits constitute Nori’s main asset, the Nori Carbon Removal Tonne (NRT).

Each NRT represents one tonne of CO2 removed, stored for at least ten years and is independently verified and audited to ensure that each NRT truly represents one tonne of carbon properly sequestered.

In the future, Nori not only plans to expand its supply partnerships to international farms, but also intends to transform its NRTs into NORI tokens.

These NORI tokens will be deployed on the sustainable Polygon network. This creates an accessible secondary market for Nori’s NRTs with all the associated benefits of being on a blockchain.

Polygon is a leading layer 2 Ethereum solution and is currently the 10th largest cryptocurrency by market capitalization.

Polygon partnered with KlimaDAO early last year to go carbon negative by purchasing – these names may be familiar to you – BCT and MCO2 tokens.

Building on its business model proven through its pilot program, Nori partnered with Bayer AG. It is one of the largest pharmaceutical and agricultural companies in the world, which wants to increase its supply of NRT.

- The initial tranche of their deal, valued at $14.4 million, covers 400,000 acres of farmland.

Nori plans to roll out its token later this year. This launch, coupled with their partnership with Bayer, has made 2023 a very exciting year for Nori.

5. DevvStream

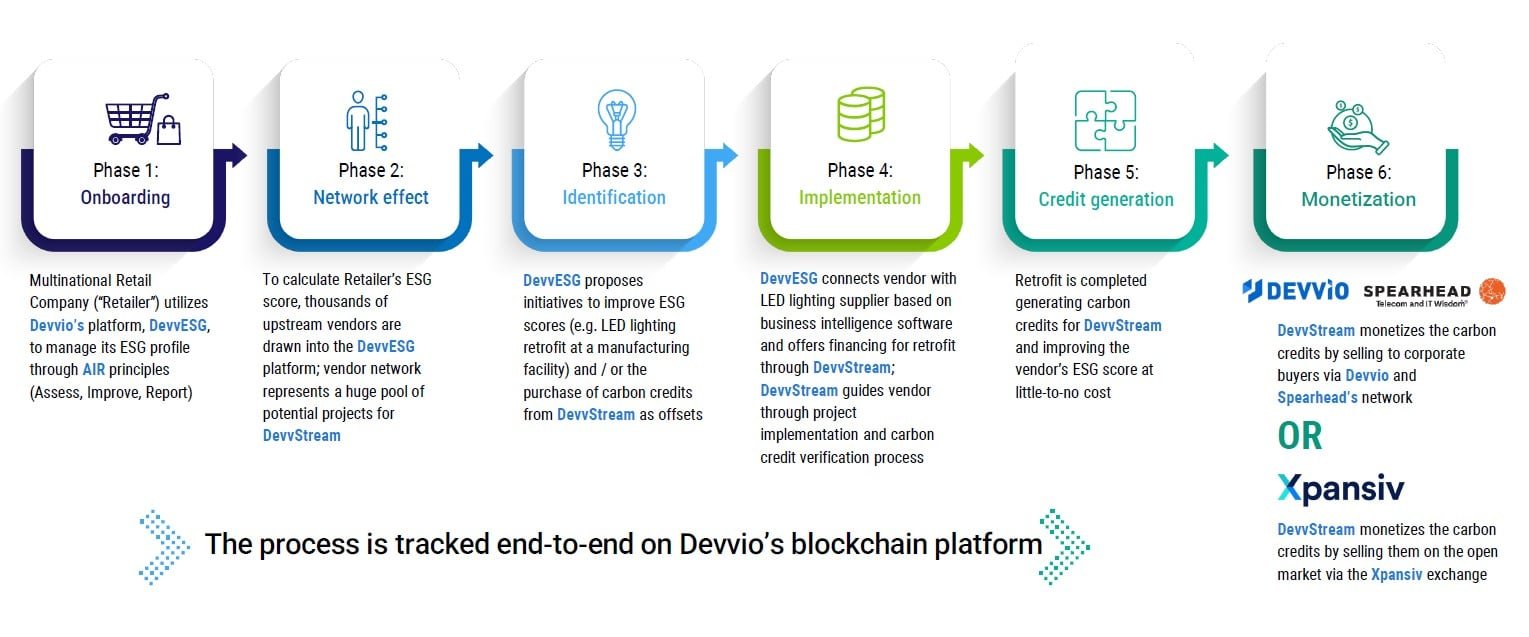

Rounding out our list of crypto-carbon companies to watch is one that is a little less heavily crypto-focused.

DevvStreamat first glance, is a carbon streaming company that provides capital for carbon credit projects in exchange for a share of subsequent production.

However, cryptocurrency comes into play through DevvStream’s relationship with its parent company, Devvio.

Devvio has a proprietary blockchain-based system ESG platform that DevvStream uses to chain the carbon credits it gets from its streaming deals.

- Once on the platform, DevvStream carbon credits benefit from many of the benefits that other carbon token projects enjoy.

In addition, DevvStream benefits from priority access to Devvio’s commercial customers who already use the latter’s ESG platform. If any of these customers are looking for carbon credits, DevvStream’s will be the first they check.

In addition to this, DevvStream has also partnered with the largest voluntary organization carbon exchange worldwide, Xpansiv. The objective is to provide additional liquidity for its carbon credits.

With its access to the ESG blockchain platform and Devvio clients, as well as The Xpansiv carbon credit exchangeDevvStream is uniquely positioned among leading carbon crypto companies to make the most of the carbon credits it puts on the blockchain.

Markets

Today’s top crypto gainers and losers

Over the past 24 hours, Jupiter and JasmyCoin emerged as the top gainers among the top 100 crypto assets, while Bittensor and Mantra plunged as the top losers.

Top Winners

Jupiter

Jupiter (JUP) led the charge among the biggest gainers on July 27.

At the time of writing, the crypto asset had surged 12.6% in the past 24 hours and was trading at $1.16. JUP’s daily trading volume was hovering around $282 million, according to data from crypto.news.

JUP Hourly Price Chart, July 26-27 | Source: crypto.news

Additionally, the cryptocurrency’s market cap stood at $1.56 billion, making it the 62nd largest crypto asset, according to CoinGecko. Despite the recent price surge, the token is still down 42.6% from its all-time high of $2 reached on Jan. 31.

Jupiter functions as a decentralized exchange aggregator that allows users to trade Solana-based tokens. The platform also offers users the best routes for direct trades between multiple exchanges and liquidity pools.

In addition to being a DEX aggregator, Jupiter has expanded into a “full stack ecosystem” by launching several new projects, including a dedicated pool to support perpetual trading and plans for a stablecoin.

JasmyCoin

JasmyCoin (JASMI) has increased by 12% in the last 24 hours and is trading at $0.0328 at press time. JASMY’s daily trading volume has increased by 10% in the last 24 hours, reaching $146 million.

JASMY Hourly Price Chart, July 26-27 | Source: crypto.news

The asset’s market cap has surpassed the $1.5 billion mark, making it the 60th largest cryptocurrency at the time of reporting. However, the self-proclaimed “Bitcoin of Japan” is still down 99.3% from its all-time high of $4.79 on February 16, 2021.

JASMY is the native token of Jasmy Corporation, a Japanese Internet of Things provider. The platform seeks to merge the decentralization of blockchain technology with IoT, allowing users to convert their digital information into digital assets.

The initiative was launched by Kunitake Ando, former COO of Sony Corporation, along with Kazumasa Sato, former CEO of Sony Style.com Japan Inc., Hiroshi Harada, executive financial analyst at KPMG, and other senior executives from Japan.

Kaspa

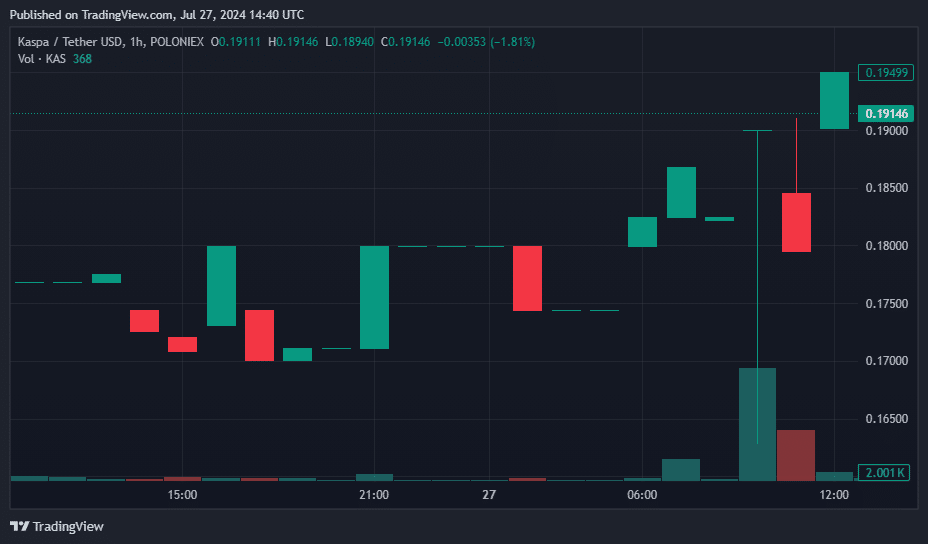

Kaspa (KAS) saw a 100% increase in trading volume and an 8% increase in price over the past 24 hours, trading at $0.19 at the time of publication.

KAS Hourly Price Chart, July 26-27 | Source: crypto.news

According to data from CoinGecko, Kaspa now ranks 27th in the global cryptocurrency list, with a circulating supply of approximately 24.29 billion KAS tokens and a market capitalization of $4.59 billion.

Kaspa is a cryptocurrency designed to deliver a high-performance, scalable, and secure blockchain platform. Its unique Layer-1 protocol includes the GhostDAG protocol, a proof-of-work (PoW) consensus mechanism that enables faster block times and higher transaction throughput compared to standard blockchains.

Unlike Bitcoin, GhostDAG allows multiple blocks to be created simultaneously, speeding up transactions and increasing block rewards for miners.

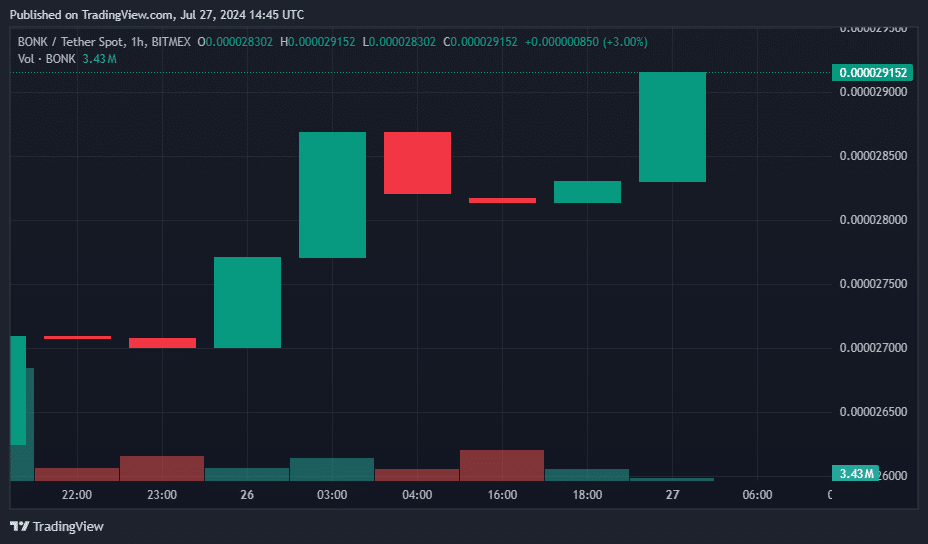

Bonk

Bonk (BONK) is the only one coin meme which made it to this list of biggest gainers and jumped 8.6% in the last 24 hours. Trading at $0.000030, the Solana-based meme coin’s market cap has surpassed $2.1 billion, surpassing Floki (FLOKI), another competing dog-themed coin with a market cap of $1.78 billion.

BONK Hourly Price Chart, July 26-27 | Source: crypto.news

BONK’s daily trading volume hovered around $285 million. However, BONK is still down 33.5% from its all-time high of $0.000045, reached on March 4.

Bonk, a meme coin that rose to prominence in 2023, has contributed significantly to Solana’s value increase amid the meme coin frenzy.

Bonk started out as a simple dog-themed coin. It has since expanded its features to include integration with decentralized finance. The project also partners with cross-chain communication protocols, NFT marketplaces, and various other cryptocurrency ecosystems.

BONK trading pairs are now listed on major exchanges including Binance, Coinbase, OKX, and Bitstamp.

The big losers

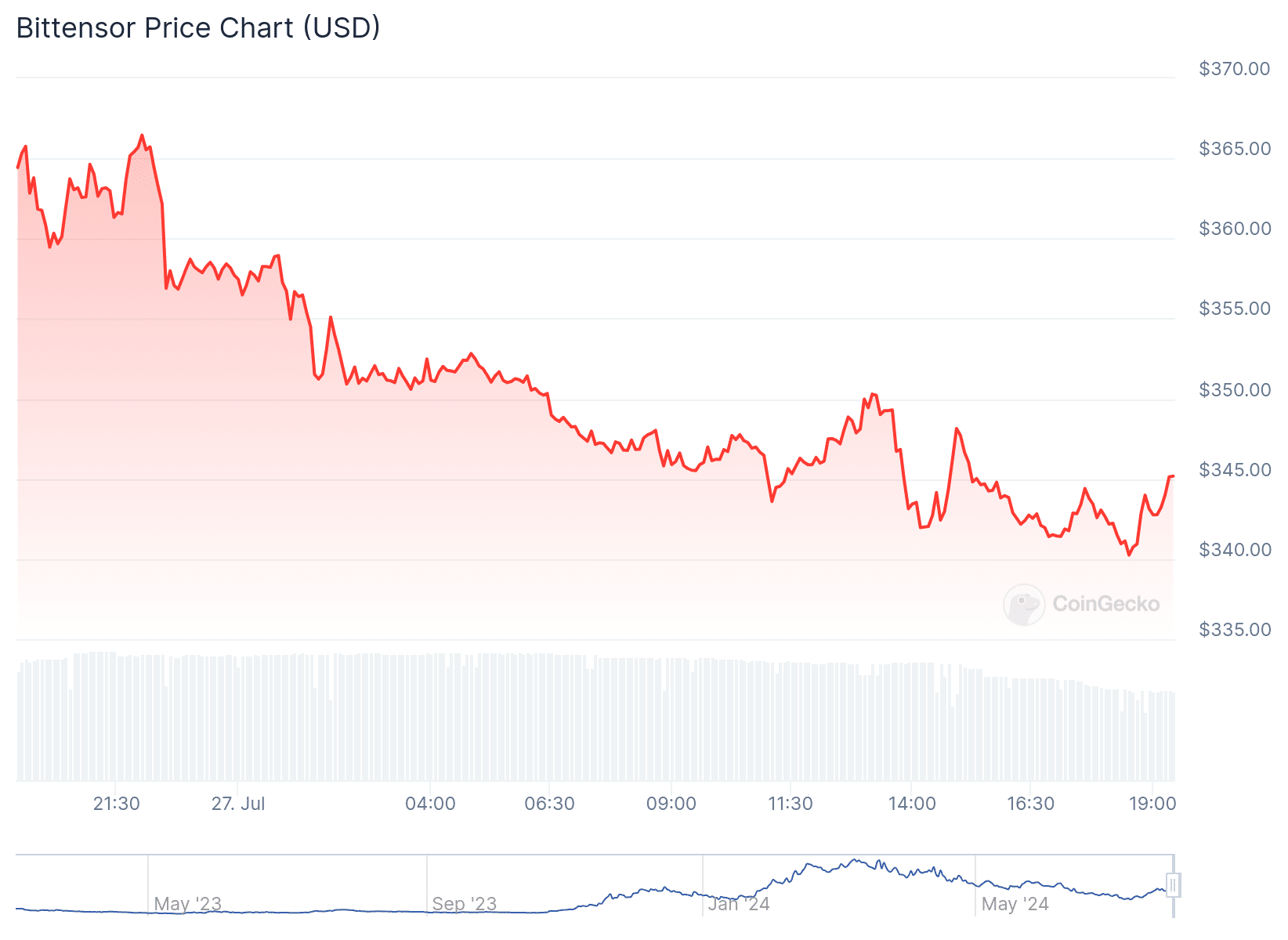

Bittensor

Bittensor (TAO) was the biggest loser among the 100 largest crypto assets, according to data from CoinGecko.

At the time of writing, TAO, the native token of decentralized AI project Bittensor, was down 5%, trading around $344. The crypto asset had a daily trading volume of $59 million and a market cap of $2.43 billion.

TAO 24 Hour Price Chart | Source: CoinGecko

Bittensor, created in 2019 by AI researchers Ala Shaabana and Jacob Steeves, initially operated as a parachain on Polkadot before transitioning to its own layer-1 blockchain in March 2023.

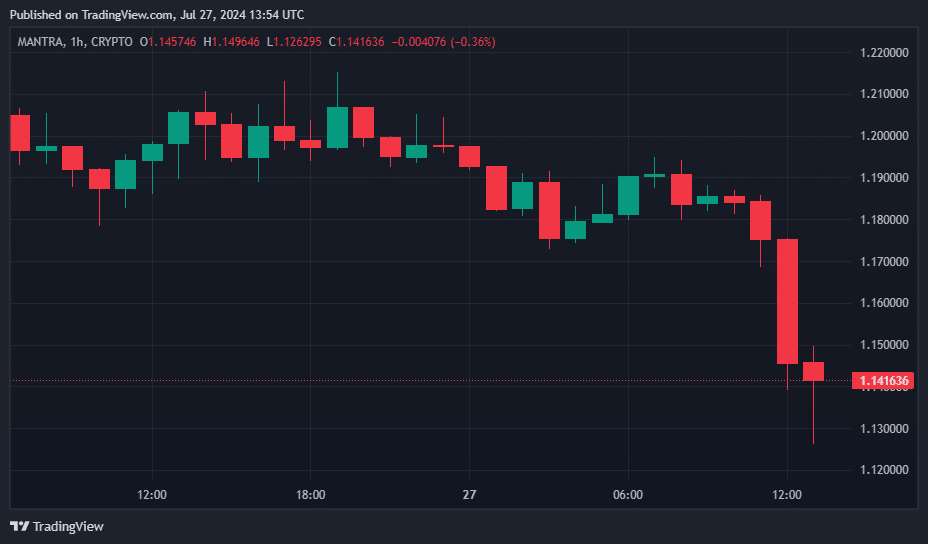

Mantra

Mantra (OM) fell 6%, trading at $1.13 at press time. The digital currency’s market cap fell to $938 million. Additionally, the 82nd largest crypto asset has a daily trading volume of $26 million.

OM Price Hourly Chart, July 26-27 | Source: crypto.news

Mantra is a modular blockchain network comprising two chains, Manta Pacific and Manta Atlantic, specialized in zero-knowledge applications.

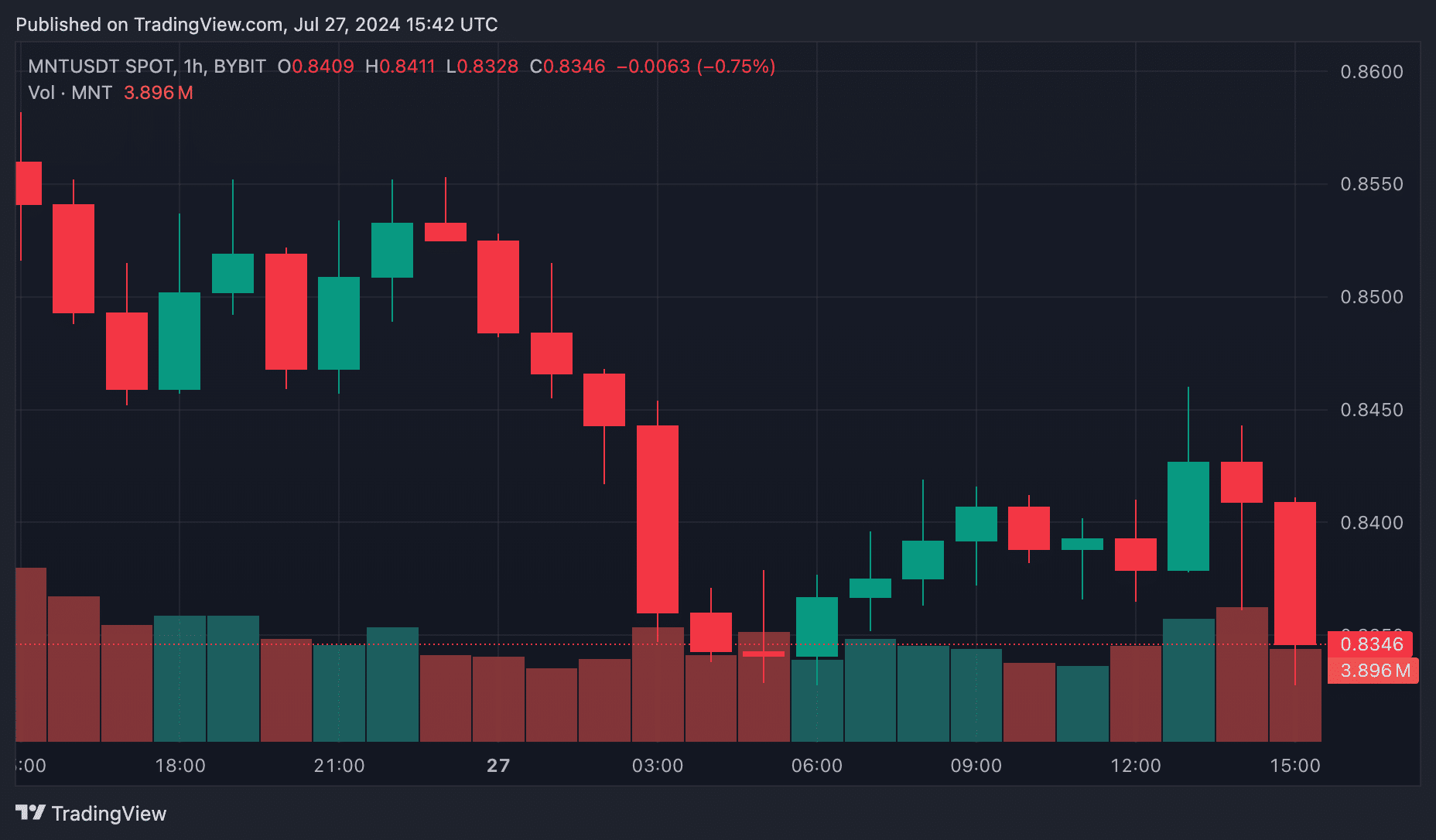

Coat

Coat (MNT) also saw a 2.4% drop in price, now trading at $0.8413. Currently, Mantle has a market cap of around $2.75 billion, which ranks 36th in the global cryptocurrency rankings by market cap, according to price data from crypto.news.

MNT Hourly Price Chart, July 26-27 | Source: crypto.news

Over the past 24 hours, MNT trading volume also fell by 6%, reaching $240 million.

Mantle, formerly known as BitDAO, is an investment DAO closely associated with Bybit. The MNT token is essential for governance, paying gas fees on the Mantle network, and staking on various platforms.

Built on the Ethereum network, Mantle provides a platform for decentralized application developers to launch their projects. It has become particularly popular for GameFi applications, leading to the formation of an internal Web3 gaming team.

Markets

Bitcoin Price Drops to $67,000 Despite Trump’s Pro-Crypto Comments, Further Correction Ahead?

Pioneer cryptocurrency Bitcoin has registered a 1.13% decline in the past 24 hours to trade at $67,400. Despite a strong pro-crypto stance from US presidential candidate Donald Trump at the Bitcoin 2024 conference, this massive selloff has raised concerns in the market about the asset’s sustainability at a higher price. However, given the recent three-week rally, a slight pullback this weekend is justifiable and necessary to regain the depleted bullish momentum.

Bitcoin Price Flag Formation Hints at Opportunity to Break Beyond $80,000

The medium-term trend Bitcoin Price remains a sideways trend amidst the formation of a bullish flag pattern. This chart pattern is defined by two descending lines that are currently shaping the price trajectory by providing dynamic resistance and support.

On July 5, BTC saw a bullish reversal from the flag pattern at $53,485, increasing its asset by 29.75% to a high of $69,400. This recent spike followed the market’s positive sentiment towards the Donald Trump speech at the Bitcoin 2024 conference in Nashville on Saturday afternoon.

Bitcoin Price | Tradingview

In his speech, Trump outlined several pro-crypto initiatives: he promised to replace SEC Chairman Gary Gensler on his first day in office, to establish a Strategic National Reserve of Bitcoin if elected, to ensure that the U.S. government holds all of its assets. Bitcoin assets and block any attempt to create a central bank digital currency (CBDC) during his presidency.

He also claimed that under his leadership, Bitcoin and cryptocurrencies will skyrocket like never before.

Despite Donald Trump’s optimistic promises, the BTC price failed to reach $70,000 and is currently trading at $67,400. As a result, Bitcoin’s market cap has dipped slightly to hover at $1.335 trillion.

However, this pullback is justified, as Bitcoin price has recently seen significant growth over the past three weeks, which has significantly improved market sentiment. Thus, price action over the weekend could replenish the depleted bullish momentum, potentially strengthening an attempt to break out from the flag pattern at $70,130.

A successful breakout will signal the continuation of the uptrend and extend the Bitcoin price forecast target at $78,000, followed by $84,000.

On the other hand, if the supply pressure on the upper trendline persists, the asset price could trigger further corrections for a few weeks or months.

Technical indicator:

- Pivot levels: The traditional pivot indicator suggests that the price pullback could see immediate support at $64,400, followed by a correction floor at $56,700.

- Moving average convergence-divergence: A bullish crossover state between the MACD (blue) and the signal (orange) ensure that the recovery dynamics are intact.

Related Articles

Frequently Asked Questions

A CBDC is a digital form of fiat currency issued and regulated by a country’s central bank. It aims to provide a digital alternative to traditional banknotes.

The proposal for a strategic national Bitcoin reserve is a major confirmation of Bitcoin’s legitimacy and potential as a reserve asset. Such a move could position Bitcoin in a similar way to gold, potentially stabilizing its price and encouraging other countries to adopt similar strategies.

Conferences like Bitcoin 2024 serve as essential platforms for networking, knowledge sharing, and showcasing new technologies within the cryptocurrency industry.

Markets

Swiss crypto bank Sygnum reports profitability after surge in first-half trading volumes – DL News

- Sygnum says it has reached profitability after increasing transaction volumes.

- The Swiss crypto bank does not disclose specific profit figures.

Sygnum, a Swiss global crypto banking group with approximately $4.5 billion in client assets, announced that it has achieved profitability after a strong first half, with key metrics showing year-to-date growth.

The company said in a Press release Compared to the same period last year, cryptocurrency spot trading volumes doubled, cryptocurrency derivatives trading increased by 500%, and lending volumes increased by 360%. The exact figures for the first half of the year were not disclosed.

Sygnum said its staking service has also grown, with the percentage of Ethereum staked by customers increasing to 42%. For institutional clients, staking Ethereum has a benefit that goes beyond the limitations of the ETF framework, which excludes staking returns, Sygnum noted.

“The approval and launch of Bitcoin and Ethereum ETFs was a turning point for the crypto industry this year, leading to a major increase in demand for trusted, regulated exposure to digital assets,” said Martin Burgherr, Chief Client Officer of Sygnum.

He added: “This is also reflected in Sygnum’s own growth, with our core business segments recording significant year-to-date growth in the first half of the year.”

Sygnum, which has also been licensed in Luxembourg since 2022, plans to expand into European and Asian markets, the statement said.

Markets

Former White House official Anthony Scaramucci says cryptocurrency bull market could be sparked by regulatory clarity

Anthony Scaramucci, founder of Skybridge Capital, says the next cryptocurrency bull market could be sparked by a new wave of clear cryptocurrency regulations.

In a new interview On CNBC’s Squawk Box, the former White House communications director said he and two other prominent industry figures traveled to Washington, D.C. to speak to officials about the dangers of Sen. Elizabeth Warren and U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler’s hardline approach to cryptocurrency regulation.

“Mark Cuban, myself, and Michael Novogratz were in Washington a few weeks ago to speak with White House officials and explain the dangers of Gary Gensler and Elizabeth Warren’s anti-crypto approach. I hope that message gets through…

“Overall, if we can get regulatory policy around Bitcoin and crypto assets in sync, we will have a bull market next year for these assets.”

Scaramucci then compares crypto assets to ride-hailing company Uber, saying regulators were initially wary of the service but eventually decided to adopt clear guidelines due to public demand.

“Remember Uber: Nobody wanted Uber. A lot of regulators didn’t want it. Mayors and deputy mayors didn’t want it, but citizens wanted Uber and eventually accepted the idea of regulating it fairly. I think we’re there now.”

The CEO also says young Democratic voters believe their leaders are making the wrong choices when it comes to digital assets.

“I think President Trump’s move toward Bitcoin and crypto assets has shaken Democrats to their core, and I think very smart, younger Democrats are recognizing that they are completely off base with their positions, completely off base with these SEC lawsuits and regulation by law enforcement, and now they need to get back to the center.”

Don’t miss a thing – Subscribe to receive email alerts directly to your inbox

Check Price action

follow us on X, Facebook And Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed on The Daily Hodl are not investment advice. Investors should do their own due diligence before making any high-risk investments in Bitcoin, cryptocurrencies or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Image generated: Midjourney

-

News11 months ago

News11 months agoVolta Finance Limited – Director/PDMR Shareholding

-

News11 months ago

News11 months agoModiv Industrial to release Q2 2024 financial results on August 6

-

News11 months ago

News11 months agoApple to report third-quarter earnings as Wall Street eyes China sales

-

News11 months ago

News11 months agoNumber of Americans filing for unemployment benefits hits highest level in a year

-

News1 year ago

News1 year agoInventiva reports 2024 First Quarter Financial Information¹ and provides a corporate update

-

News1 year ago

News1 year agoLeeds hospitals trust says finances are “critical” amid £110m deficit

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Hit $100 Billion in 2024, Fueling Insane Investor Optimism ⋆ ZyCrypto

-

Tech1 year ago

Tech1 year agoBitcoin’s Correlation With Tech Stocks Is At Its Highest Since August 2023: Bloomberg ⋆ ZyCrypto

-

Tech1 year ago

Tech1 year agoEverything you need to know

-

News11 months ago

News11 months agoStocks wobble as Fed delivers and Meta bounces

-

Markets1 year ago

Markets1 year agoCrazy $3 Trillion XRP Market Cap Course Charted as Ripple CEO Calls XRP ETF “Inevitable” ⋆ ZyCrypto