Tech

“We’re just scratching the surface” of cryptocurrencies and artificial intelligence – Microsoft executive – TradingView News

Microsoft believes that artificial intelligence (AI) is “the defining technology of our time” and has been at the forefront of both AI research and investment.

But that doesn’t mean the Seattle-based tech giant isn’t also paying close attention to the cryptoverse, including ways in which blockchain technology and artificial intelligence could one day support each other.

At the recent Cornell Blockchain Conference in New York, Yorke Rhodes, Microsoft’s director of digital transformation, blockchain and cloud supply chain, was asked how the company viewed this possible intersection of technologies.

“I think that as these two technologies progress, it is possible to create agents that combine the power of both. We’re just scratching the surface,” she said.

In a panel discussion titled “Crypto x AI,” Rhodes’ views were further explored by moderator Alex Lin, co-founder and general partner of Reforge, who asked: Will Microsoft have its own blockchain one day?

“There’s already a huge amount of cool stuff going on” in the cryptocurrency industry, including the open source community, Rhodes responded, so “why would we try to recreate something that [already] does he have that much investment?”

Rather, Microsoft’s focus today is more on optimizing existing technologies, such as layer 2 blockchain rollups. Rodi added:

«But we would [Microsoft] have you ever built an L1 blockchain? I do not believe.”

Cryptocurrencies are “well positioned”

Rhodes and Lin were joined on stage at the April 26 event at Cornell Tech by Neil DeSilva, chief financial officer of PayPal Digital Currencies; Matt Stephenson, head of research at Pantera; and Jasper Zhang, CEO and co-founder of Hyperbolic Labs.

Stephenson said that “cryptocurrencies are quite well positioned to be the ‘picks and shovels’ of some type of artificial intelligence,” particularly transformation and diffusion models. This is especially true given the likelihood of a “decentralized, multi-agent” AI future.

However, cryptocurrencies may have to play a secondary role to the advantage of artificial intelligence. Rhodes acknowledged that a “mass trend” like artificial intelligence tends to “suck a lot of the air out of the room” for other emerging technologies, including cryptocurrency/blockchain and Web3. Cointelegraph

“It’s a hot topic: the intersection or symbiosis between blockchain networks and artificial intelligence,” Lin commented. But it’s also susceptible to exaggerated claims, and it can sometimes be difficult to separate what’s exaggeration from what’s real.

There’s a lot of talk about decentralized graphics processing units (GPUs), for example, Lin continues, “but no one talks about latency,” the time it takes for data to transfer across a network.

Recent: Is Trump interested in cryptocurrencies? Bitcoin is the latest battleground in the US elections

Nowadays, AI requests or recommendations from a centralized network can be obtained quite quickly. However, due to “latency,” Lin said, decentralized networks will not produce these results as quickly.

However, Hyperbolic Labs’ Zhang didn’t think this would be a problem for decentralized networks like blockchains. “The inference is feasible,” he said.

Take for example a centralized network with a data center based in Texas that receives a request from a user in the UK. The data request “has to travel from the UK across the ocean to Texas and then back. So there is actually a huge delay,” Zhang said.

In comparison, with a reasonably sized decentralized network, a user could easily find a node in London to process the request locally, which would “effectively reduce communication overhead”.

In fact, Hyperbolic Labs recently launched an AI inference interface on the company’s decentralized network and achieved latency results comparable to centralized solutions, Zhang said.

A growing trend: small language models

Much of the conversation around AI these days focuses on large language models (LLMs) that require huge amounts of computing power. However, according to Rhodes, “there’s a lot going on in what you might call edge AI: getting smaller language models that actually work efficiently on phones and laptops.” This is:

“There’s a lot more compute available at the edge because models are getting smaller and smaller for specific workloads, [and] you can actually get a lot more out of it.

Microsoft has developed AI models in small languages that require less training data and computing power to develop and run, including the Phi-3 family of open models. His abilities are “really starting to come close to some of the big language models,” Rhodes said.

Regulators have artificial intelligence in their sights

Artificial intelligence is likely to come under intense scrutiny from regulators around the world in the coming years, just as cryptocurrencies have. What obstacles did the speakers foresee regarding government rules and regulations?

“I think the United States, in particular, is terrible at this [regulation]” Lin said, referring to the US Securities and Exchange Commission’s heavy-handed approach to regulating cryptocurrencies. “Now, [SEC Chair] Gensler came out and said we will regulate AI even more aggressively than blockchain digital assets.”

Fintech giant PayPal has launched its own dollar-pegged stablecoin, PayPal USD PYUSDUSDseven months ago, and so Lin asked DeSilva for his opinion on U.S. regulation.

“I don’t think the United States is terrible at regulation,” DeSilva said. “Look at all the innovation here in the United States.”

Sure, it can sometimes be frustrating dealing with government authorities, but “regulators have a mission,” he explained: “Not to harm customers.” They are trying to protect consumers and there is nothing inherently wrong with that. Or, as she said from the stage:

“If you want your technology, your innovation, to be used by millions or billions of customers, you will have to interact with regulators.”

However, other jurisdictions, including the European Union, are becoming more welcoming to stablecoin issuers, and the United States needs to be aware of this. “If the United States doesn’t move faster, this is an advantage that will go up in smoke,” DeSilva acknowledged. “The United States has struggled to achieve the right level of urgency in the country.”

Finding the right amount of regulation could be even more difficult with AI. It will be difficult for regulators to manage the potential harm to consumers given the opacity of AI decision-making – the so-called black box problem – “and I think regulators are going to have to wrestle with that,” DeSilva added.

This opacity could actually provide an opportunity for blockchain technology with its transparency, immutability, and tracking capabilities. Lin said:

“You [can] blockchains present themselves as a kind of lord and savior, saying, ‘Regulators, we have this mechanism that can clear up the opacity associated with these black boxes.’”

Why AGI?

Lin concluded the session by asking the speakers to share their visions for the future of artificial intelligence. For example, will generalized artificial intelligence (AGI) become a reality within the next five to ten years? And what might we expect in the short term?

“In the near future, AI may be powerful enough for everyone to start using it,” Zhang predicted. “Every company will be an AI company, just as every company is an Internet company today.”

“I think in five to 10 years, AGI will become possible,” Zhang continued. “Look at how quickly AI models improve now, and with the help of decentralized infrastructure we can aggregate computation,” i.e. increase the overall volume of available GPUs, which should allow even smaller players to participate.

Elsewhere, zero-knowledge proofs (ZK proofs) “will disappear within three years,” Rhodes predicted, and will be replaced by fully homomorphic encryption (FHE), a technology that achieves zero trust “by unlocking the value of data across non-domain domains.” reliable without needing to decrypt it,” according to IBM.

Reader: DeFi conflict between MakerDAO and Aave reopens due to growing risk perceived by DAI

FHE will solve many privacy issues, Rhodes said, and could be particularly useful for the healthcare industry, including clinical trials involving sensitive personal data.

Rhodes, summing up, recalled the words of Ethan Mollick of the Wharton School: “The artificial intelligence you use today will be the worst version of artificial intelligence you have ever used.” The same could be said regarding ZK proofs and fully homomorphic encryption. Overall, IT structures that protect privacy will improve a lot, he said.

DeSilva has been working in technology and finance for several decades and has seen many concrete predictions come and go. “But I find this optimism [often] wins the day,” he told the gathering, adding:

“So my prediction is you [will] getting to AGI on time and that it is beneficial for people. This will require everyone’s work.”

Tech

Harvard Alumni, Tech Moguls, and Best-Selling Authors Drive Nearly $600 Million in Pre-Order Sales

BlockDAG Network’s history is one of innovation, perseverance, and a vision to push the boundaries of blockchain technology. With Harvard alumni, tech moguls, and best-selling authors at the helm, BlockDAG is rewriting the rules of the cryptocurrency game.

CEO Antony Turner, inspired by the successes and shortcomings of Bitcoin and Ethereum, says, “BlockDAG leverages existing technology to push the boundaries of speed, security, and decentralization.” This powerhouse team has led a staggering 1,600% price increase in 20 pre-sale rounds, raising over $63.9 million. The secret? Unparalleled expertise and a bold vision for the future of blockchain.

Let’s dive into BlockDAG’s success story and find out what the future holds for this cryptocurrency.

The Origin: Why BlockDAG Was Created

In a recent interview, BlockDAG CEO Antony Turner perfectly summed up why the market needs BlockDAG’s ongoing revolution. He said:

“The creation of BlockDAG was inspired by Bitcoin and Ethereum, their successes and their shortcomings.

If you look at almost any new technology, it is very rare that the first movers remain at the forefront forever. Later incumbents have a huge advantage in entering a market where the need has been established and the technology is no longer cutting edge.

BlockDAG has done just that: our innovation is incorporating existing technology to provide a better solution, allowing us to push the boundaries of speed, security, and decentralization.”

The Present: How Far Has BlockDAG Come?

BlockDAG’s presale is setting new benchmarks in the cryptocurrency investment landscape. With a stunning 1600% price increase over 20 presale lots, it has already raised over $63.9 million in capital, having sold over 12.43 billion BDAG coins.

This impressive performance underscores the overwhelming confidence of investors in BlockDAG’s vision and leadership. The presale attracted over 20,000 individual investors, with the BlockDAG community growing exponentially by the hour.

These monumental milestones have been achieved thanks to the unparalleled skills, experience and expertise of BlockDAG’s management team:

Antony Turner – Chief Executive Officer

Antony Turner, CEO of BlockDAG, has over 20 years of experience in the Fintech, EdTech, Travel and Crypto industries. He has held senior roles at SPIRIT Blockchain Capital and co-founded Axona-Analytics and SwissOne. Antony excels in financial modeling, business management and scaling growth companies, with expertise in trading, software, IoT, blockchain and cryptocurrency.

Director of Communications

Youssef Khaoulaj, CSO of BlockDAG, is a Smart Contract Auditor, Metaverse Expert, and Red Team Hacker. He ensures system security and disaster preparedness, and advises senior management on security issues.

advisory Committee

Steven Clarke-Martin, a technologist and consultant, excels in enterprise technology, startups, and blockchain, with a focus on DAOs and smart contracts. Maurice Herlihy, a Harvard and MIT graduate, is an award-winning computer scientist at Brown University, with experience in distributed computing and consulting roles, most notably at Algorand.

The Future: Becoming the Cryptocurrency with the Highest Market Cap in the World

Given its impressive track record and a team of geniuses working tirelessly behind the scenes, BlockDAG is quickly approaching the $600 million pre-sale milestone. This crypto powerhouse will soon enter the top 30 cryptocurrencies by market cap.

Currently trading at $0.017 per coin, BlockDAG is expected to hit $1 million in the coming months, with the potential to hit $30 per coin by 2030. Early investors have already enjoyed a 1600% ROI by batch 21, fueling a huge amount of excitement around BlockDAG’s presale. The platform is seeing significant whale buying, and demand is so high that batch 21 is almost sold out. The upcoming batch is expected to drive prices even higher.

Invest in BlockDAG Pre-Sale Now:

Pre-sale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetwork

Discord: Italian: https://discord.gg/Q7BxghMVyu

No spam, no lies, just insights. You can unsubscribe at any time.

Tech

How Karak’s Latest Tech Integration Could Make Data Breaches Obsolete

- Space and Time uses zero-knowledge proofs to ensure secure and tamper-proof data processing for smart contracts and enterprises.

- The integration facilitates faster development and deployment of Distributed Secure Services (DSS) on the Karak platform.

Karak, a platform known for its strong security capabilities, is enhancing its Distributed Secure Services (DSS) by integrating Space and Time as a zero-knowledge (ZK) coprocessor. This move is intended to strengthen trustless operations across its network, especially in slashing and rewards mechanisms.

Space and Time is a verifiable processing layer that uses zero-knowledge proofs to ensure that computations on decentralized data warehouses are secure and untampered with. This system enables smart contracts, large language models (LLMs), and enterprises to process data without integrity concerns.

The integration with Karak will enable the platform to use Proof of SQL, a new ZK-proof approach developed by Space and Time, to confirm that SQL query results are accurate and have not been tampered with.

One of the key features of this integration is the enhancement of DSS on Karak. DSS are decentralized services that use re-staked assets to secure the various operations they provide, from simple utilities to complex marketplaces. The addition of Space and Time technology enables faster development and deployment of these services, especially by simplifying slashing logic, which is critical to maintaining security and trust in decentralized networks.

Additionally, Space and Time is developing its own DSS for blockchain data indexing. This service will allow community members to easily participate in the network by running indexing nodes. This is especially beneficial for applications that require high security and decentralization, such as decentralized data indexing.

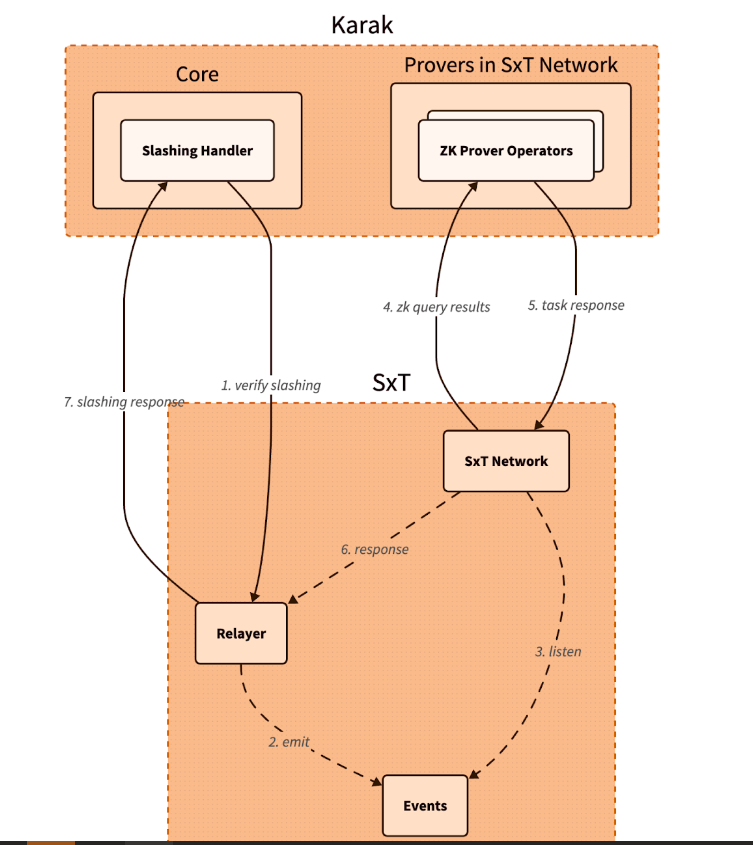

The integration architecture follows a detailed and secure flow. When a Karak slashing contract needs to verify a SQL query, it calls the Space and Time relayer contract with the required SQL statement. This contract then emits an event with the query details, which is detected by operators in the Space and Time network.

These operators, responsible for indexing and monitoring DSS activities, validate the event and route the work to a verification operator who runs the query and generates the necessary ZK proof.

The result, along with a cryptographic commitment on the queried data, is sent to the relayer contract, which verifies and returns the data to the Karak cutter contract. This end-to-end process ensures that the data used in decision-making, such as determining penalties within the DSS, is accurate and reliable.

Karak’s mission is to provide universal security, but it also extends the capabilities of Space and Time to support multiple DSSs with their data indexing needs. As these technologies evolve, they are set to redefine the secure, decentralized computing landscape, making it more accessible and efficient for developers and enterprises alike. This integration represents a significant step towards a more secure and verifiable digital infrastructure in the blockchain space.

Website | X (Twitter) | Discord | Telegram

No spam, no lies, just insights. You can unsubscribe at any time.

Tech

Cryptocurrency Payments: Should CFOs Consider This Ferrari-Approved Trend?

Iconic Italian luxury carmaker Ferrari has announced the expansion of its cryptocurrency payment system to its European dealer network.

The move, which follows a successful launch in North America less than a year ago, raises a crucial question for CFOs across industries: Is it time to consider accepting cryptocurrency as a form of payment for your business?

Ferrari’s move isn’t an isolated one. It’s part of a broader trend of companies embracing digital assets. As of 2024, we’re seeing a growing number of companies, from tech giants to traditional retailers, accepting cryptocurrencies.

This change is determined by several factors:

- Growing mainstream adoption of cryptocurrencies

- Growing demand from tech-savvy and affluent consumers

- Potential for faster and cheaper international transactions

- Desire to project an innovative brand image

Ferrari’s approach is particularly noteworthy. They have partnered with BitPay, a leading cryptocurrency payment processor, to allow customers to purchase vehicles using Bitcoin, Ethereum, and USDC. This satisfies their tech-savvy and affluent customer base, many of whom have large digital asset holdings.

Navigating Opportunities and Challenges

Ferrari’s adoption of cryptocurrency payments illustrates several key opportunities for companies considering this move. First, it opens the door to new customer segments. By accepting cryptocurrency, Ferrari is targeting a younger, tech-savvy demographic—people who have embraced digital assets and see them as a legitimate form of value exchange. This strategy allows the company to connect with a new generation of affluent customers who may prefer to conduct high-value transactions in cryptocurrency.

Second, cryptocurrency adoption increases global reach. International payments, which can be complex and time-consuming with traditional methods, become significantly easier with cryptocurrency transactions. This can be especially beneficial for businesses that operate in multiple countries or deal with international customers, as it potentially reduces friction in cross-border transactions.

Third, accepting cryptocurrency positions a company as innovative and forward-thinking. In today’s fast-paced business environment, being seen as an early adopter of emerging technologies can significantly boost a brand’s image. Ferrari’s move sends a clear message that they are at the forefront of financial innovation, which can appeal to customers who value cutting-edge approaches.

Finally, there is the potential for cost savings. Traditional payment methods, especially for international transactions, often incur substantial fees. Cryptocurrency transactions, on the other hand, can offer lower transaction costs. For high-value purchases, such as luxury cars, these savings could be significant for both the business and the customer.

While the opportunities are enticing, accepting cryptocurrency payments also presents significant challenges that businesses must address. The most notable of these is volatility. Cryptocurrency values can fluctuate dramatically, sometimes within hours, posing potential risk to businesses that accept them as payment. Ferrari addressed this challenge by implementing a system that instantly converts cryptocurrency received into traditional fiat currencies, effectively mitigating the risk of value fluctuations.

Regulatory uncertainty is another major concern. The legal landscape surrounding cryptocurrencies is still evolving in many jurisdictions around the world. This lack of clear and consistent regulations can create compliance challenges for companies, especially those operating internationally. Companies must remain vigilant and adaptable as new laws and regulations emerge, which can be a resource-intensive process.

Implementation costs are also a significant obstacle. Integrating cryptocurrency payment systems often requires substantial investment in new technology infrastructure and extensive staff training. This can be especially challenging for small businesses or those with limited IT resources. The costs are not just financial; a significant investment of time is also required to ensure smooth implementation and operation.

Finally, security concerns loom large in the world of cryptocurrency transactions. While blockchain technology offers some security benefits, cryptocurrency transactions still require robust cybersecurity measures to protect against fraud, hacks, and other malicious activity. Businesses must invest in robust security protocols and stay up-to-date on the latest threats and protections, adding another layer of complexity and potential costs to accepting cryptocurrency payments.

Strategic Considerations for CFOs

If you’re thinking of following in Ferrari’s footsteps, here are the key factors to consider:

- Risk Assessment: Carefully evaluate potential risks to your business, including financial, regulatory, and reputational risks.

- Market Analysis: Evaluate whether your customer base is significantly interested in using cryptocurrencies for payments.

- Technology Infrastructure: Determine the costs and complexities of implementing a cryptographic payment system that integrates with existing financial processes.

- Regulatory Compliance: Ensure that cryptocurrency acceptance is in line with local regulations in all markets you operate in. Ferrari’s gradual rollout demonstrates the importance of this consideration.

- Financial Impact: Analyze how accepting cryptocurrency could impact your cash flow, accounting practices, and financial reporting.

- Partnership Evaluation: Consider partnering with established crypto payment processors to reduce risk and simplify implementation.

- Employee Training: Plan comprehensive training to ensure your team is equipped to handle cryptocurrency transactions and answer customer questions.

While Ferrari’s adoption of cryptocurrency payments is exciting, it’s important to consider this trend carefully.

A CFO’s decision to adopt cryptocurrency as a means of payment should be based on a thorough analysis of your company’s specific needs, risk tolerance, and strategic goals. Cryptocurrency payments may not be right for every business, but for some, they could provide a competitive advantage in an increasingly digital marketplace.

Remember that the landscape is rapidly evolving. Stay informed about regulatory changes, technological advancements, and changing consumer preferences. Whether you decide to accelerate your crypto engines now or wait in the pit, keeping this payment option on your radar is critical to navigating the future of business transactions.

Was this article helpful?

Yes No

Sign up to receive your daily business insights

Tech

Bitcoin Tumbles as Crypto Market Selloff Mirrors Tech Stocks’ Plunge

The world’s largest cryptocurrency, Bitcoin (BTC), suffered a significant price decline on Wednesday, falling below $65,000. The decline coincides with a broader market sell-off that has hit technology stocks hard.

Cryptocurrency Liquidations Hit Hard

CoinGlass data reveals a surge in long liquidations in the cryptocurrency market over the past 24 hours. These liquidations, totaling $220.7 million, represent forced selling of positions that had bet on price increases. Bitcoin itself accounted for $14.8 million in long liquidations.

Ethereum leads the decline

Ethereal (ETH), the second-largest cryptocurrency, has seen a steeper decline than Bitcoin, falling nearly 8% to trade around $3,177. This decline mirrors Bitcoin’s price action, suggesting a broader market correction.

Cryptocurrency market crash mirrors tech sector crash

The cryptocurrency market decline appears to be linked to the significant losses seen in the U.S. stock market on Wednesday. Stock market listing The index, heavily weighted toward technology stocks, posted its sharpest decline since October 2022, falling 3.65%.

Analysts cite multiple factors

Several factors may have contributed to the cryptocurrency market crash:

- Tech earnings are underwhelming: Earnings reports from tech giants like Alphabet are disappointing (Google(the parent company of), on Tuesday, triggered a sell-off in technology stocks with higher-than-expected capital expenditures that could have repercussions on the cryptocurrency market.

- Changing Political Landscape: The potential impact of the upcoming US elections and changes in Washington’s policy stance towards cryptocurrencies could influence investor sentiment.

- Ethereal ETF Hopes on the line: While bullish sentiment around a potential U.S. Ethereum ETF initially boosted the market, delays or rejections could dampen enthusiasm.

Analysts’ opinions differ

Despite the short-term losses, some analysts remain optimistic about Bitcoin’s long-term prospects. Singapore-based cryptocurrency trading firm QCP Capital believes Bitcoin could follow a similar trajectory to its post-ETF launch all-time high, with Ethereum potentially converging with its previous highs on sustained institutional interest.

Rich Dad Poor Dad Author’s Prediction

Robert Kiyosaki, author of the best-selling Rich Dad Poor Dad, predicts a potential surge in the price of Bitcoin if Donald Trump is re-elected as US president. He predicts a surge to $105,000 per coin by August 2025, fueled by a weaker dollar that is set to boost US exports.

BTC/USD Technical Outlook

Bitcoin price is currently trading below key support levels, including the $65,500 level and the 100 hourly moving average. A break below the $64,000 level could lead to further declines towards the $63,200 support zone. However, a recovery above the $65,500 level could trigger another increase in the coming sessions.

-

News10 months ago

News10 months agoVolta Finance Limited – Director/PDMR Shareholding

-

News10 months ago

News10 months agoModiv Industrial to release Q2 2024 financial results on August 6

-

News10 months ago

News10 months agoApple to report third-quarter earnings as Wall Street eyes China sales

-

News10 months ago

News10 months agoNumber of Americans filing for unemployment benefits hits highest level in a year

-

News1 year ago

News1 year agoInventiva reports 2024 First Quarter Financial Information¹ and provides a corporate update

-

News1 year ago

News1 year agoLeeds hospitals trust says finances are “critical” amid £110m deficit

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Tech1 year ago

Tech1 year agoBitcoin’s Correlation With Tech Stocks Is At Its Highest Since August 2023: Bloomberg ⋆ ZyCrypto

-

Tech1 year ago

Tech1 year agoEverything you need to know

-

Markets12 months ago

Markets12 months ago20 Top Crypto Trading Platforms to Know

-

News10 months ago

News10 months agoStocks wobble as Fed delivers and Meta bounces

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Hit $100 Billion in 2024, Fueling Insane Investor Optimism ⋆ ZyCrypto