Tech

15 Most Advanced Countries in Blockchain Technology

In this article, we will look at the 15 most advanced countries in blockchain technology. We have also discussed the global blockchain market along with key players. If you want to skip our detailed analysis, head straight to the 5 Most Advanced Countries in Blockchain Technology.

According to Fortune Business Insights, the global blockchain technology market, valued at $17.5 billion in 2023, is anticipated to witness a whopping compound annual growth rate (CAGR) of 59.9% from 2023 to 2030, reaching a valuation of $469.49 billion by the end of the forecast period. This growth trajectory is propelled by the expanding acceptance of cryptocurrencies worldwide and the increasing adoption of blockchain technology in financial and retail sectors. The market is further buoyed by services like Blockchain as a Service (BaaS), which enables small and medium-sized enterprises (SMEs) to explore blockchain applications without the complexity of in-house development.

In terms of trends, cryptocurrencies play a pivotal role, incentivizing blockchain infrastructure development and driving innovation in scalability, privacy, and interoperability. The market is witnessing an increase in diverse blockchain applications beyond cryptocurrencies, such as supply chain management, cross-border payments, lot lineage/provenance, trade finance, and identity management.

The outlook for the blockchain market remains promising, especially with North America leading in technology development and adoption. However, regulatory uncertainties pose challenges, necessitating market players to navigate complex legal frameworks. Moreover, the shortage of skilled talent in blockchain development acts as a barrier to realizing its full potential.

However, it is also worth highlighting that after a cryptocurrency downturn, which eroded over $1 trillion of investors’ wealth since 2021, renewed optimism is emerging. However, the US risks lagging behind due to its sluggish stance on crypto regulation, potentially missing out on the recovery of digital assets and blockchain technology. Data reveals a concerning trend: the share of blockchain developers in the US has declined annually since 2018, indicating a shift in the global landscape.

Despite these challenges, there are still signs of blockchain investment within the US Franklin Templeton and Walt Disney have made major moves into blockchain applications. Additionally, anticipation surrounding the approval of the first bitcoin exchange-traded fund suggests a potential resurgence in enthusiasm. However, if the US fails to retain the loyalty of blockchain innovators, it risks losing its influence over this transformative technology, potentially ceding ground to regions with more favorable regulatory environments.

Story continues

Nevertheless, the blockchain market offers vast opportunities, particularly in emerging regions like Asia-Pacific, where favorable regulatory environments and government initiatives drive market growth. As blockchain continues to evolve, stakeholders must stay abreast of market dynamics, technological advancements, and regulatory changes to capitalize on emerging opportunities and overcome existing challenges.

Let’s look at some key players in the blockchain technology and their recent developments.

Bit Digital, Inc (NASDAQ:BTBT) recently secured an agreement for 6 megawatts of additional hosting capacity for its miners. The agreement, finalized with a subsidiary of Coinmint LLC in Massena, New York, boosts Bit Digital’s total contracted hosting capacity to about 46 MW. With an initial one-year term and automatic renewals, Bit Digital, Inc (NASDAQ:BTBT) plans to deploy approximately 2,340 S19k Pro mining units purchased for $3.4 million, equating to roughly $13/TH, at the facility.

Bit Digital, Inc (NASDAQ:BTBT) aims to achieve this growth incrementally to facilitate strategic procurement decisions and enhance both scale and fleet efficiency. Bit Digital, Inc (NASDAQ:BTBT) operates bitcoin mining operations across the US, Canada, and Iceland, alongside offering infrastructure services for AI applications through its Bit Digital AI business line.

Bit Digital, Inc (NASDAQ:BTBT) is also one of the most valuable blockchain companies in the world.

On the other hand, Robinhood Markets, Inc (NASDAQ:HOOD) is a key American financial services firm renowned for its commission-free electronic trading platform. Since its inception in March 2015, the company’s mobile app has enabled users to engage in seamless trades of stocks, exchange-traded funds (ETFs), and cryptocurrencies, including individual retirement accounts. As a FINRA-regulated broker-dealer and a member of the Securities Investor Protection Corporation, Robinhood Markets, Inc (NASDAQ:HOOD) ensures compliance with US Securities and Exchange Commission standards, offering a secure trading environment.

Robinhood Markets, Inc (NASDAQ:HOOD) generates revenue through various channels, including interest from customers’ cash balances, selling order information to high-frequency traders, and margin lending. With 23.4 million funded accounts and 10.9 million monthly active users as of December 2023, Robinhood Markets, Inc (NASDAQ:HOOD) has become a major player in the financial technology sector. Notably, Robinhood Markets, Inc (NASDAQ:HOOD) expanded its services by introducing a cryptocurrency wallet to over 2 million users in April 2022, further solidifying its position in the market.

15 Most Advanced Countries in Blockchain Technology

A bustling server farm, reflecting the company’s investment into cryptocurrency mining.

Our Methodology

We assessed the advancement of countries in blockchain technology using two main criteria. Firstly, we examined the number of blockchain patents granted to each country, sourced from CoinClub. Secondly, we analyzed the venture capital funding invested in blockchain technology in 2021, using data from BlockData. For investment rankings, a higher rank indicated greater investment (ranked from 1 to 20), while for patents, a rank of 1 indicated the highest number.

After ranking countries on both sets of data individually, we averaged the rankings from both metrics. We then arranged the countries in ascending order based on their average rankings. We’ve also mentioned their rankings on individual data sets mentioed above.

The choice of these metrics was made to provide a comprehensive evaluation of a country’s advancement in blockchain technology. Patents indicate innovation and development in the field, while venture capital funding reflects investor confidence and financial support for blockchain projects. By considering both metrics, we aimed to capture both the technological and economic aspects of blockchain advancement in each country.

By the way, Insider Monkey is an investing website that uses a consensus approach to identify the best stock picks of more than 900 hedge funds investing in US stocks. The website tracks the movement of corporate insiders and hedge funds. Our top 10 consensus stock picks of hedge funds outperformed the S&P 500 stock index by more than 140 percentage points over the last 10 years (see the details here). So, if you are looking for the best stock picks to buy, you can benefit from the wisdom of hedge funds and corporate insiders.

15. Mexico

Venture Capital: 12

Blockchain Patents: 27

Average Rank: 19.5

Mexico has emerged as one of the best countries for cryptocurrency, ranking 16th globally in crypto adoption. With an increase of 18% year-on-year in transactions on platforms like Bito’s exchange, boasting 8 million users worldwide, Mexico showcases promising signs of adapting to the virtual era of currencies.

To read more about crypto adoption, see 20 Countries with the Highest Cryptocurrency Adoption.

14. Philippines

Venture Capital: 15

Blockchain Patents: 22

Average Rank: 18.5

The Philippines has been as a trailblazer in blockchain technology, evident through its strategic adoption of Hyperledger Fabric for wholesale central bank digital currency trials. Leveraging blockchain’s distributed ledger technology (DLT), the Bangko Sentral ng Pilipinas (BSP) aims to enhance interbank transactions’ efficiency and accessibility.

13. Austria

Venture Capital: 6

Blockchain Patents: 29

Average Rank: 17.5

Austria is at the forefront of blockchain innovation, exemplified by the Austrian Blockchain Centre, a collaborative effort among five leading universities. This center, renowned as Austria’s largest, focuses on practical blockchain implementation and extensive research.

12. Switzerland

Venture Capital: 16

Blockchain Patents: 19

Average Rank: 17.5

Switzerland is a leader in blockchain technology owing to its progressive regulatory environment and innovative financial institutions. PostFinance, a subsidiary of SwissPost and one of Switzerland’s major banks, recently partnered with Sygnum to offer retail cryptocurrency services, becoming the first systemically important bank to do so. With generally high salaries, Switzerland is also known to be one of the best countries for blockchain developers.

11. Brazil

Venture Capital: 9

Blockchain Patents: 18

Average Rank: 13.5

Brazil is at the forefront of blockchain technology with its innovative approach to enhancing security in data management. The government’s implementation of blockchain for the new national identity card system demonstrates a commitment to combating fraud and improving efficiency. Spearheaded by the Federal Data Processing Service (Serpro), Brazil’s blockchain network, b-Cadastros, facilitates secure data sharing among governmental bodies. The new blockchain-enabled ID cards offer a digital version with enhanced authentication features, including a printed QR code.

10. Australia

Venture Capital: 17

Blockchain Patents: 7

Average Rank: 12

Australia is considered a blockchain leader due to its proactive approach to regulatory frameworks, showcased by Ripple’s recent policy summit in Sydney. Attended by global policymakers and industry leaders, discussions revolved around Australia’s proposed regulations for digital assets, aiming to integrate them into existing financial frameworks overseen by ASIC.

Australia is also one of the most advanced countries in space exploration.

9. Japan

Venture Capital: 18

Blockchain Patents: 4

Average Rank: 11

Japan is one of the countries with the best blockchain technology. With the cabinet’s approval of a bill enabling venture capital firms to invest in crypto assets, Japan paves the way for burgeoning Web3 startups. This legislation, if ratified, promises to invigorate Japan’s blockchain and decentralized finance sectors. Despite challenges, such as profitability concerns for stablecoin issuers, Japan’s regulatory clarity positions it as a global leader in blockchain governance, setting a precedent for others to follow.

8. Germany

Venture Capital: 13

Blockchain Patents: 8

Average Rank: 10.5

Germany is one of the top 10 most advanced countries in blockchain technology, evidenced by initiatives like Union Investment’s launch of a blockchain fund. With €455 billion ($493 billion) in assets under management, Union Investment is a major investor in tokenized assets, including digital bonds from the European Investment Bank and Siemens. The UniThemen Blockchain fund reflects Germany’s commitment, allocating up to 15% of its assets to crypto tokens and the majority to blockchain-related stocks and assets.

On a side note, Germany is also one of the highest paying countries for bankers.

7. Singapore

Venture Capital: 7

Blockchain Patents: 12

Average Rank: 9.5

In Singapore, blockchain technology has garnered huge traction, especially among financially savvy individuals, with over half owning cryptocurrencies. Staking has emerged as a prominent use case, with 55% utilizing centralized exchanges and 38% engaging with decentralized finance (DeFi) apps for staking activities. These numbers confirm that Singapore is one of the most popular countries in blockchain technology in 2024.

6. Hong Kong

Venture Capital: 3

Blockchain Patents: 15

Average Rank: 9

Hong Kong is a vanguard in blockchain technology, evident through its stringent regulatory measures and proactive approach. The Securities and Futures Commission (SFC) of Hong Kong has been vigilant against fraudulent crypto exchanges, exemplified by its recent warning against HKCEXP for falsely claiming SFC registration.

Click here to see the 5 Most Advanced Countries in Blockchain Technology.

Suggested Articles:

Disclosure: None. 15 Most Advanced Countries in Blockchain Technology is originally published on Insider Monkey.

Tech

Harvard Alumni, Tech Moguls, and Best-Selling Authors Drive Nearly $600 Million in Pre-Order Sales

BlockDAG Network’s history is one of innovation, perseverance, and a vision to push the boundaries of blockchain technology. With Harvard alumni, tech moguls, and best-selling authors at the helm, BlockDAG is rewriting the rules of the cryptocurrency game.

CEO Antony Turner, inspired by the successes and shortcomings of Bitcoin and Ethereum, says, “BlockDAG leverages existing technology to push the boundaries of speed, security, and decentralization.” This powerhouse team has led a staggering 1,600% price increase in 20 pre-sale rounds, raising over $63.9 million. The secret? Unparalleled expertise and a bold vision for the future of blockchain.

Let’s dive into BlockDAG’s success story and find out what the future holds for this cryptocurrency.

The Origin: Why BlockDAG Was Created

In a recent interview, BlockDAG CEO Antony Turner perfectly summed up why the market needs BlockDAG’s ongoing revolution. He said:

“The creation of BlockDAG was inspired by Bitcoin and Ethereum, their successes and their shortcomings.

If you look at almost any new technology, it is very rare that the first movers remain at the forefront forever. Later incumbents have a huge advantage in entering a market where the need has been established and the technology is no longer cutting edge.

BlockDAG has done just that: our innovation is incorporating existing technology to provide a better solution, allowing us to push the boundaries of speed, security, and decentralization.”

The Present: How Far Has BlockDAG Come?

BlockDAG’s presale is setting new benchmarks in the cryptocurrency investment landscape. With a stunning 1600% price increase over 20 presale lots, it has already raised over $63.9 million in capital, having sold over 12.43 billion BDAG coins.

This impressive performance underscores the overwhelming confidence of investors in BlockDAG’s vision and leadership. The presale attracted over 20,000 individual investors, with the BlockDAG community growing exponentially by the hour.

These monumental milestones have been achieved thanks to the unparalleled skills, experience and expertise of BlockDAG’s management team:

Antony Turner – Chief Executive Officer

Antony Turner, CEO of BlockDAG, has over 20 years of experience in the Fintech, EdTech, Travel and Crypto industries. He has held senior roles at SPIRIT Blockchain Capital and co-founded Axona-Analytics and SwissOne. Antony excels in financial modeling, business management and scaling growth companies, with expertise in trading, software, IoT, blockchain and cryptocurrency.

Director of Communications

Youssef Khaoulaj, CSO of BlockDAG, is a Smart Contract Auditor, Metaverse Expert, and Red Team Hacker. He ensures system security and disaster preparedness, and advises senior management on security issues.

advisory Committee

Steven Clarke-Martin, a technologist and consultant, excels in enterprise technology, startups, and blockchain, with a focus on DAOs and smart contracts. Maurice Herlihy, a Harvard and MIT graduate, is an award-winning computer scientist at Brown University, with experience in distributed computing and consulting roles, most notably at Algorand.

The Future: Becoming the Cryptocurrency with the Highest Market Cap in the World

Given its impressive track record and a team of geniuses working tirelessly behind the scenes, BlockDAG is quickly approaching the $600 million pre-sale milestone. This crypto powerhouse will soon enter the top 30 cryptocurrencies by market cap.

Currently trading at $0.017 per coin, BlockDAG is expected to hit $1 million in the coming months, with the potential to hit $30 per coin by 2030. Early investors have already enjoyed a 1600% ROI by batch 21, fueling a huge amount of excitement around BlockDAG’s presale. The platform is seeing significant whale buying, and demand is so high that batch 21 is almost sold out. The upcoming batch is expected to drive prices even higher.

Invest in BlockDAG Pre-Sale Now:

Pre-sale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetwork

Discord: Italian: https://discord.gg/Q7BxghMVyu

No spam, no lies, just insights. You can unsubscribe at any time.

Tech

How Karak’s Latest Tech Integration Could Make Data Breaches Obsolete

- Space and Time uses zero-knowledge proofs to ensure secure and tamper-proof data processing for smart contracts and enterprises.

- The integration facilitates faster development and deployment of Distributed Secure Services (DSS) on the Karak platform.

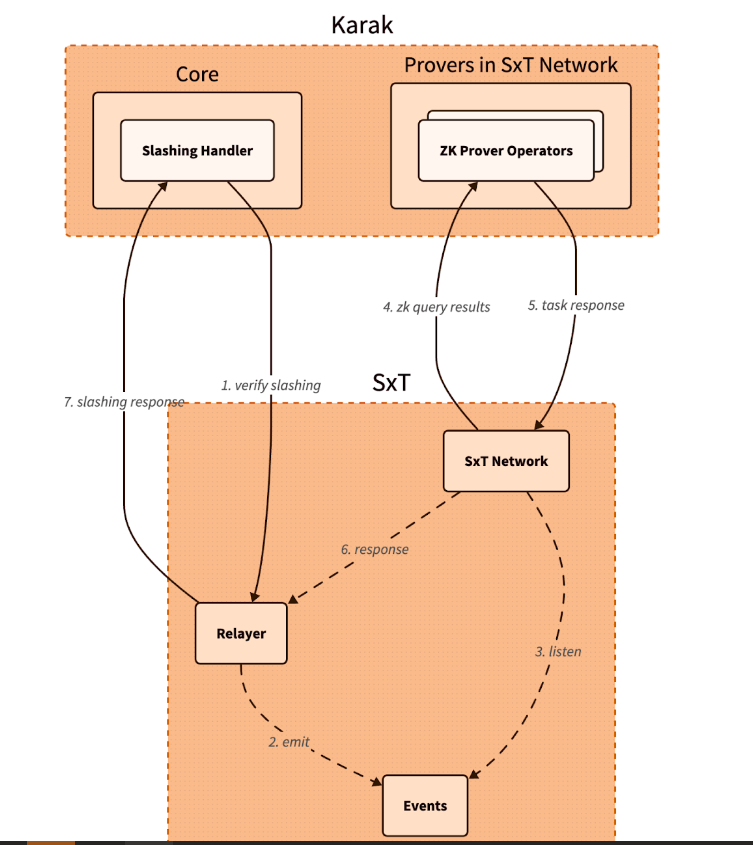

Karak, a platform known for its strong security capabilities, is enhancing its Distributed Secure Services (DSS) by integrating Space and Time as a zero-knowledge (ZK) coprocessor. This move is intended to strengthen trustless operations across its network, especially in slashing and rewards mechanisms.

Space and Time is a verifiable processing layer that uses zero-knowledge proofs to ensure that computations on decentralized data warehouses are secure and untampered with. This system enables smart contracts, large language models (LLMs), and enterprises to process data without integrity concerns.

The integration with Karak will enable the platform to use Proof of SQL, a new ZK-proof approach developed by Space and Time, to confirm that SQL query results are accurate and have not been tampered with.

One of the key features of this integration is the enhancement of DSS on Karak. DSS are decentralized services that use re-staked assets to secure the various operations they provide, from simple utilities to complex marketplaces. The addition of Space and Time technology enables faster development and deployment of these services, especially by simplifying slashing logic, which is critical to maintaining security and trust in decentralized networks.

Additionally, Space and Time is developing its own DSS for blockchain data indexing. This service will allow community members to easily participate in the network by running indexing nodes. This is especially beneficial for applications that require high security and decentralization, such as decentralized data indexing.

The integration architecture follows a detailed and secure flow. When a Karak slashing contract needs to verify a SQL query, it calls the Space and Time relayer contract with the required SQL statement. This contract then emits an event with the query details, which is detected by operators in the Space and Time network.

These operators, responsible for indexing and monitoring DSS activities, validate the event and route the work to a verification operator who runs the query and generates the necessary ZK proof.

The result, along with a cryptographic commitment on the queried data, is sent to the relayer contract, which verifies and returns the data to the Karak cutter contract. This end-to-end process ensures that the data used in decision-making, such as determining penalties within the DSS, is accurate and reliable.

Karak’s mission is to provide universal security, but it also extends the capabilities of Space and Time to support multiple DSSs with their data indexing needs. As these technologies evolve, they are set to redefine the secure, decentralized computing landscape, making it more accessible and efficient for developers and enterprises alike. This integration represents a significant step towards a more secure and verifiable digital infrastructure in the blockchain space.

Website | X (Twitter) | Discord | Telegram

No spam, no lies, just insights. You can unsubscribe at any time.

Tech

Cryptocurrency Payments: Should CFOs Consider This Ferrari-Approved Trend?

Iconic Italian luxury carmaker Ferrari has announced the expansion of its cryptocurrency payment system to its European dealer network.

The move, which follows a successful launch in North America less than a year ago, raises a crucial question for CFOs across industries: Is it time to consider accepting cryptocurrency as a form of payment for your business?

Ferrari’s move isn’t an isolated one. It’s part of a broader trend of companies embracing digital assets. As of 2024, we’re seeing a growing number of companies, from tech giants to traditional retailers, accepting cryptocurrencies.

This change is determined by several factors:

- Growing mainstream adoption of cryptocurrencies

- Growing demand from tech-savvy and affluent consumers

- Potential for faster and cheaper international transactions

- Desire to project an innovative brand image

Ferrari’s approach is particularly noteworthy. They have partnered with BitPay, a leading cryptocurrency payment processor, to allow customers to purchase vehicles using Bitcoin, Ethereum, and USDC. This satisfies their tech-savvy and affluent customer base, many of whom have large digital asset holdings.

Navigating Opportunities and Challenges

Ferrari’s adoption of cryptocurrency payments illustrates several key opportunities for companies considering this move. First, it opens the door to new customer segments. By accepting cryptocurrency, Ferrari is targeting a younger, tech-savvy demographic—people who have embraced digital assets and see them as a legitimate form of value exchange. This strategy allows the company to connect with a new generation of affluent customers who may prefer to conduct high-value transactions in cryptocurrency.

Second, cryptocurrency adoption increases global reach. International payments, which can be complex and time-consuming with traditional methods, become significantly easier with cryptocurrency transactions. This can be especially beneficial for businesses that operate in multiple countries or deal with international customers, as it potentially reduces friction in cross-border transactions.

Third, accepting cryptocurrency positions a company as innovative and forward-thinking. In today’s fast-paced business environment, being seen as an early adopter of emerging technologies can significantly boost a brand’s image. Ferrari’s move sends a clear message that they are at the forefront of financial innovation, which can appeal to customers who value cutting-edge approaches.

Finally, there is the potential for cost savings. Traditional payment methods, especially for international transactions, often incur substantial fees. Cryptocurrency transactions, on the other hand, can offer lower transaction costs. For high-value purchases, such as luxury cars, these savings could be significant for both the business and the customer.

While the opportunities are enticing, accepting cryptocurrency payments also presents significant challenges that businesses must address. The most notable of these is volatility. Cryptocurrency values can fluctuate dramatically, sometimes within hours, posing potential risk to businesses that accept them as payment. Ferrari addressed this challenge by implementing a system that instantly converts cryptocurrency received into traditional fiat currencies, effectively mitigating the risk of value fluctuations.

Regulatory uncertainty is another major concern. The legal landscape surrounding cryptocurrencies is still evolving in many jurisdictions around the world. This lack of clear and consistent regulations can create compliance challenges for companies, especially those operating internationally. Companies must remain vigilant and adaptable as new laws and regulations emerge, which can be a resource-intensive process.

Implementation costs are also a significant obstacle. Integrating cryptocurrency payment systems often requires substantial investment in new technology infrastructure and extensive staff training. This can be especially challenging for small businesses or those with limited IT resources. The costs are not just financial; a significant investment of time is also required to ensure smooth implementation and operation.

Finally, security concerns loom large in the world of cryptocurrency transactions. While blockchain technology offers some security benefits, cryptocurrency transactions still require robust cybersecurity measures to protect against fraud, hacks, and other malicious activity. Businesses must invest in robust security protocols and stay up-to-date on the latest threats and protections, adding another layer of complexity and potential costs to accepting cryptocurrency payments.

Strategic Considerations for CFOs

If you’re thinking of following in Ferrari’s footsteps, here are the key factors to consider:

- Risk Assessment: Carefully evaluate potential risks to your business, including financial, regulatory, and reputational risks.

- Market Analysis: Evaluate whether your customer base is significantly interested in using cryptocurrencies for payments.

- Technology Infrastructure: Determine the costs and complexities of implementing a cryptographic payment system that integrates with existing financial processes.

- Regulatory Compliance: Ensure that cryptocurrency acceptance is in line with local regulations in all markets you operate in. Ferrari’s gradual rollout demonstrates the importance of this consideration.

- Financial Impact: Analyze how accepting cryptocurrency could impact your cash flow, accounting practices, and financial reporting.

- Partnership Evaluation: Consider partnering with established crypto payment processors to reduce risk and simplify implementation.

- Employee Training: Plan comprehensive training to ensure your team is equipped to handle cryptocurrency transactions and answer customer questions.

While Ferrari’s adoption of cryptocurrency payments is exciting, it’s important to consider this trend carefully.

A CFO’s decision to adopt cryptocurrency as a means of payment should be based on a thorough analysis of your company’s specific needs, risk tolerance, and strategic goals. Cryptocurrency payments may not be right for every business, but for some, they could provide a competitive advantage in an increasingly digital marketplace.

Remember that the landscape is rapidly evolving. Stay informed about regulatory changes, technological advancements, and changing consumer preferences. Whether you decide to accelerate your crypto engines now or wait in the pit, keeping this payment option on your radar is critical to navigating the future of business transactions.

Was this article helpful?

Yes No

Sign up to receive your daily business insights

Tech

Bitcoin Tumbles as Crypto Market Selloff Mirrors Tech Stocks’ Plunge

The world’s largest cryptocurrency, Bitcoin (BTC), suffered a significant price decline on Wednesday, falling below $65,000. The decline coincides with a broader market sell-off that has hit technology stocks hard.

Cryptocurrency Liquidations Hit Hard

CoinGlass data reveals a surge in long liquidations in the cryptocurrency market over the past 24 hours. These liquidations, totaling $220.7 million, represent forced selling of positions that had bet on price increases. Bitcoin itself accounted for $14.8 million in long liquidations.

Ethereum leads the decline

Ethereal (ETH), the second-largest cryptocurrency, has seen a steeper decline than Bitcoin, falling nearly 8% to trade around $3,177. This decline mirrors Bitcoin’s price action, suggesting a broader market correction.

Cryptocurrency market crash mirrors tech sector crash

The cryptocurrency market decline appears to be linked to the significant losses seen in the U.S. stock market on Wednesday. Stock market listing The index, heavily weighted toward technology stocks, posted its sharpest decline since October 2022, falling 3.65%.

Analysts cite multiple factors

Several factors may have contributed to the cryptocurrency market crash:

- Tech earnings are underwhelming: Earnings reports from tech giants like Alphabet are disappointing (Google(the parent company of), on Tuesday, triggered a sell-off in technology stocks with higher-than-expected capital expenditures that could have repercussions on the cryptocurrency market.

- Changing Political Landscape: The potential impact of the upcoming US elections and changes in Washington’s policy stance towards cryptocurrencies could influence investor sentiment.

- Ethereal ETF Hopes on the line: While bullish sentiment around a potential U.S. Ethereum ETF initially boosted the market, delays or rejections could dampen enthusiasm.

Analysts’ opinions differ

Despite the short-term losses, some analysts remain optimistic about Bitcoin’s long-term prospects. Singapore-based cryptocurrency trading firm QCP Capital believes Bitcoin could follow a similar trajectory to its post-ETF launch all-time high, with Ethereum potentially converging with its previous highs on sustained institutional interest.

Rich Dad Poor Dad Author’s Prediction

Robert Kiyosaki, author of the best-selling Rich Dad Poor Dad, predicts a potential surge in the price of Bitcoin if Donald Trump is re-elected as US president. He predicts a surge to $105,000 per coin by August 2025, fueled by a weaker dollar that is set to boost US exports.

BTC/USD Technical Outlook

Bitcoin price is currently trading below key support levels, including the $65,500 level and the 100 hourly moving average. A break below the $64,000 level could lead to further declines towards the $63,200 support zone. However, a recovery above the $65,500 level could trigger another increase in the coming sessions.

-

Videos4 weeks ago

Videos4 weeks agoAbsolutely massive: the next higher Bitcoin leg will shatter all expectations – Tom Lee

-

News12 months ago

News12 months agoVolta Finance Limited – Director/PDMR Shareholding

-

News12 months ago

News12 months agoModiv Industrial to release Q2 2024 financial results on August 6

-

News12 months ago

News12 months agoApple to report third-quarter earnings as Wall Street eyes China sales

-

News12 months ago

News12 months agoNumber of Americans filing for unemployment benefits hits highest level in a year

-

News1 year ago

News1 year agoInventiva reports 2024 First Quarter Financial Information¹ and provides a corporate update

-

News1 year ago

News1 year agoLeeds hospitals trust says finances are “critical” amid £110m deficit

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Hit $100 Billion in 2024, Fueling Insane Investor Optimism ⋆ ZyCrypto

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Videos1 year ago

Videos1 year ago$1,000,000 worth of BTC in 2025! Get ready for an UNPRECEDENTED PRICE EXPLOSION – Jack Mallers

-

Videos1 year ago

Videos1 year agoABSOLUTELY HUGE: Bitcoin is poised for unabated exponential growth – Mark Yusko and Willy Woo

-

Tech1 year ago

Tech1 year agoBlockDAG ⭐⭐⭐⭐⭐ Review: Is It the Next Big Thing in Cryptocurrency? 5 questions answered