News

3 Indian stocks estimated below fair value

The Indian market has risen 2.5% in the past 7 days, driven by gains across the board, and has risen 45% in the past year. In this booming environment, where earnings are forecast to grow 16% annually, identifying undervalued stocks can provide significant opportunities for investors looking to capitalize on potential growth.

Top 10 Undervalued Stocks Based on Cash Flows in India

|

Name |

Current price |

Fair Value (Est) |

Discount (Est) |

|

Shyam Metalics and Energy (NSEI:SHYAMMETL) |

₹716.85 |

₹1041.17 |

31.1% |

|

HEG (NSEI:HEG) |

₹2195.85 |

₹3310.12 |

33.7% |

|

Update Services (NSEI:UDS) |

₹317.55 |

₹537.05 |

40.9% |

|

Venus Pipes & Tubes (NSEI:VENUSPIPES) |

₹2250.85 |

₹3598.27 |

37.4% |

|

Vedanta (NSEI:VEDL) |

₹447.20 |

₹722.69 |

38.1% |

|

Rajesh Exports (NSEI:RAJESHEXPO) |

₹315.70 |

₹508.03 |

37.9% |

|

Mahindra Logistics (NSEI: MAHLOG) |

₹524.00 |

₹854.67 |

38.7% |

|

Piramal Pharma (NSEI:PPLPHARMA) |

₹173.82 |

₹246.83 |

29.6% |

|

Delivery (NSEI:DELHIVERY) |

₹406.15 |

₹751.07 |

45.9% |

|

Godrej Properties (NSEI:GODREJPROP) |

₹3181.05 |

₹5542.84 |

42.6% |

Let’s discover some gems from our specialized tracker.

Overview: Fusion Finance Limited, a non-banking financial company with a market capitalization of ₹43.42 billion, provides microfinance lending services to women entrepreneurs in rural and semi-urban areas in India.

Operations: Revenue from microfinance activities amounts to ₹12.57 billion.

Estimated discount to fair value: 12.5%

Fusion Finance, trading at ₹431.55, is undervalued compared to its estimated fair value of ₹493.46 and industry peers. Despite recent regulatory challenges including income tax and GST show cause notices, the company’s earnings have grown 41.6% annually over the past five years and are forecast to grow 18.23% annually going forward. With revenue expected to grow 24.8% annually, Fusion Finance demonstrates strong cash flow potential amid market uncertainties.

NSEI:FUSION Discounted Cash Flow July 2024

Overview: Mahindra Logistics Limited provides integrated logistics and mobility solutions in India and internationally, with a market capitalization of ₹37.75 billion.

Operations: The company’s revenue from operations is primarily derived from Supply Chain Management contributing ₹53.04 billion and Enterprise Mobility Services adding ₹3.29 billion.

Estimated discount to fair value: 38.7%

Mahindra Logistics, trading at ₹524, is significantly undervalued with a fair value estimate of ₹854.67. The company is projected to grow revenue by 12% annually and become profitable within three years. Despite recent losses and regulatory penalties, its earnings are expected to grow by 65.06% annually. However, interest payments are not well covered by earnings, and the dividend yield of 0.48% is unsustainable based on current earnings.

The story continues

NSEI:MAHLOG Discounted cash flow in July 2024

Overview: Vedanta Limited, with a market capitalization of ₹1.75 trillion, is a diversified natural resources company engaged in the exploration, extraction and processing of minerals, oil and gas in India and internationally.

Operations: Vedanta Limited’s revenue segments include Energy (₹61.53 billion), Copper (₹197.30 billion), Iron Ore (₹90.69 billion), Aluminium (₹483.71 billion), Oil & Gas (₹178.37 billion), Zinc – India (₹279.25 billion) and Zinc – International (₹35.56 billion).

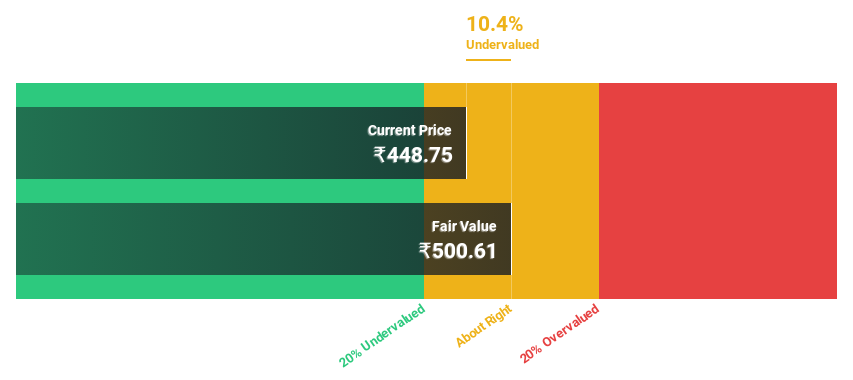

Estimated discount to fair value: 38.1%

Vedanta, trading at ₹447.2, is significantly undervalued with a fair value estimate of ₹722.69. Despite a high debt level and recent regulatory challenges, its earnings are forecast to grow 43.25% annually over the next three years, outpacing the Indian market growth rate of 16.2%. However, its dividend yield of 4.92% is not well covered by earnings, and shareholders faced dilution last year due to share offerings totaling ₹85 billion.

NSEI:VEDL Discounted cash flow in July 2024

Next steps

Curious about other options?

This Simply Wall St article is general in nature. We provide commentary based on historical data and analyst forecasts using only an unbiased methodology and our articles are not intended to be financial advice. They do not constitute a recommendation to buy or sell any stock and do not take into account your objectives or financial situation. Our goal is to bring you long-term focused analysis, driven by fundamental data. Please note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:FUSION, NSEI:MAHLOG, and NSEI:VEDL.

Have feedback on this article? Concerned about the content? Get in touch directly with us. Alternatively, send an email editorial-team@simplywallst.com