Markets

A warning of an impending stock market “correction” suddenly flashed red, just as the S&P 500, Dow and Nasdaq hit record highs

Updated 7/13 below. This article was originally published on July 10

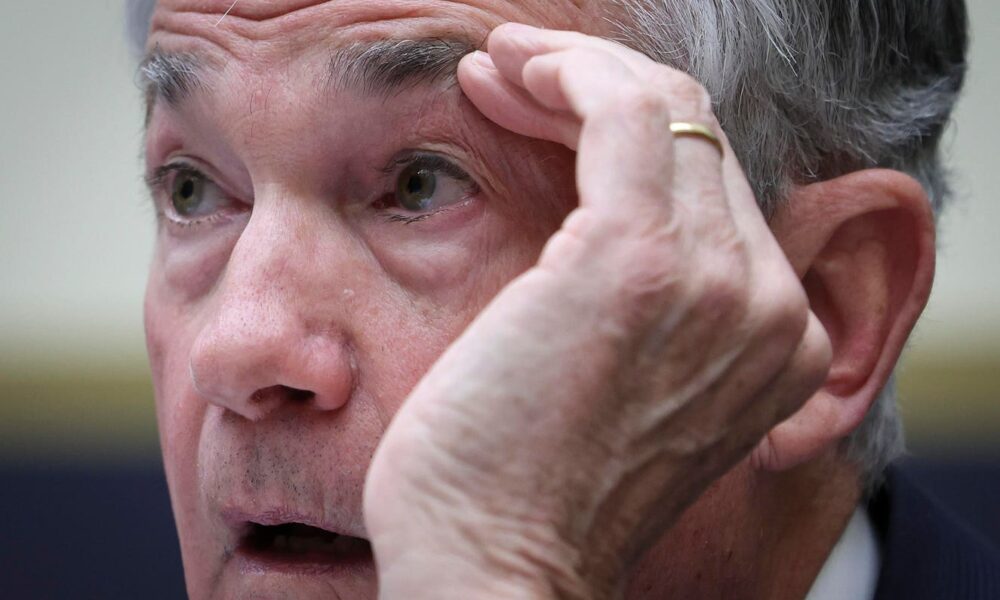

Stock markets are rising after Federal Reserve Chairman Jerome Powell fanned the flames of interest rate cut hopes in September.just after issuing a “critical” warning.

Subscribe now to Forbes Crypto Asset and Blockchain Advisor and “Discover the blockchain blockbusters poised for 1,000%+ gains” following the Bitcoin halving earthquake!

The S&P 500 and Nasdaq hit new all-time highs, following in the footsteps of the Dow, which peaked in May, despite fears of a new debt spiral that are unsettling traders.

NOW, as uncertainty hangs over the White HouseAn analyst has pointed out an unexpected warning signal in the stock market that has just started flashing red.

sign up now for free CryptoCodex—A daily five-minute newsletter for traders, investors, and the crypto-curious that will keep you up to date and ahead of the Bitcoin and cryptocurrency market bull run.

ForbesBiden’s Odds Surge As $230 Million Bet On TrumpBy

Federal Reserve Chairman Jerome Powell has helped push stock markets higher, with the S&P 500, the… [+] Nasdaq and Dow hit new all-time highs.

Getty Images

The recent crash in bitcoin and cryptocurrencies, which saw $500 billion wiped out of the combined market in just over a month, could be about to trigger “an imminent summer correction in the S&P 500,” said Barry Bannister, managing director and chief equity strategist at Stifel. said Market surveillance.

Update 7/13: Stocks rebounded Friday, with the Dow closing above 40,000 for the second time in history as second-quarter earnings season gets underway. Wall Street giants JPMorgan, Citigroup and Wells Fargo posted mixed results and ended the session lower.

Traders are hoping companies beyond tech giants will translate slowing inflation and a resilient economic backdrop into profit growth in the coming weeks.

“We just need to see an inflection in earnings growth coming from the rest of the market, and that’s something we’re going to be watching very closely over the next couple of weeks,” Zachary Hill, head of portfolio management at Horizon Investments in Charlotte, North Carolina, told Reuters.

Update 11/07: The S&P 500 and indexes fell sharply on Thursday, posting their worst performance since late April, as recent winners from tech giants including Nvidia, Apple and Tesla slumped.

The pullback came after the latest inflation data accelerated expectations for a September Federal Reserve rate cut, with interest rate futures now showing traders see a more than 90% chance the Fed will cut rates by its September meeting, up from about 74% on Wednesday, according to CME Group’s Fedwatch.

“It is clear that the continued downward trend in headline inflation will add weight to the case for a Fed rate cut, as markets largely expect in the fourth quarter of this year,” Adrian Li, managing director at corporate financial adviser Centrus, said in emailed comments.

“The exact timing of the rate cut, however, remains uncertain and may ultimately depend on the Fed’s ability to balance inflationary risks and the perceived risk of elevated rates against the continued strength of the U.S. economy. All eyes will now turn to any additional guidance on the direction of monetary policy ahead of the rate decision at the end of the month, with the next unemployment and nonfarm payrolls figures not due until early August.”

Bannister highlighted bitcoin’s correlation with stock markets, particularly the tech-heavy Nasdaq, in recent years.

“It’s the availability of cheap liquidity from the Fed that’s driving the price of bitcoin,” Bannister said. “Every accommodative pivot over the last 13 years has been a big rally in bitcoin, and bitcoin is a non-interest-bearing asset that thrives on lower interest rates and available liquidity,” much like stock markets.

On his second day of testimony before Congress this week, Fed Chairman Powell said he has “some confidence” that inflation is coming down, but is not ready to declare war on inflation.

“Bitcoin has been a good leading indicator for the Nasdaq-100 over the years,” Jonathan Krinsky, chief market technician at BTIG, wrote in a note ahead of the S&P 500, Nasdaq and Dow rally this week.

Register now for CryptoCodex—A free daily newsletter for the crypto-curious

The price of bitcoin has fallen sharply in recent weeks, fueling fears that stock markets will follow… [+] down, even as the S&P 500, Nasdaq and Dow hit record highs.

Forbes Digital Assets

For now, the momentum is on the side of stocks, as traders continue to bet on interest rate cuts from the Federal Reserve.

“Growing confidence in U.S. rate cuts has kept the mood upbeat and broad-based gains going,” Dan Coatsworth, investment analyst at brokerage AJ Bell, said in emailed comments.