Markets

Analysis of the relationship between SHIB prices and Bitcoin and Ethereum

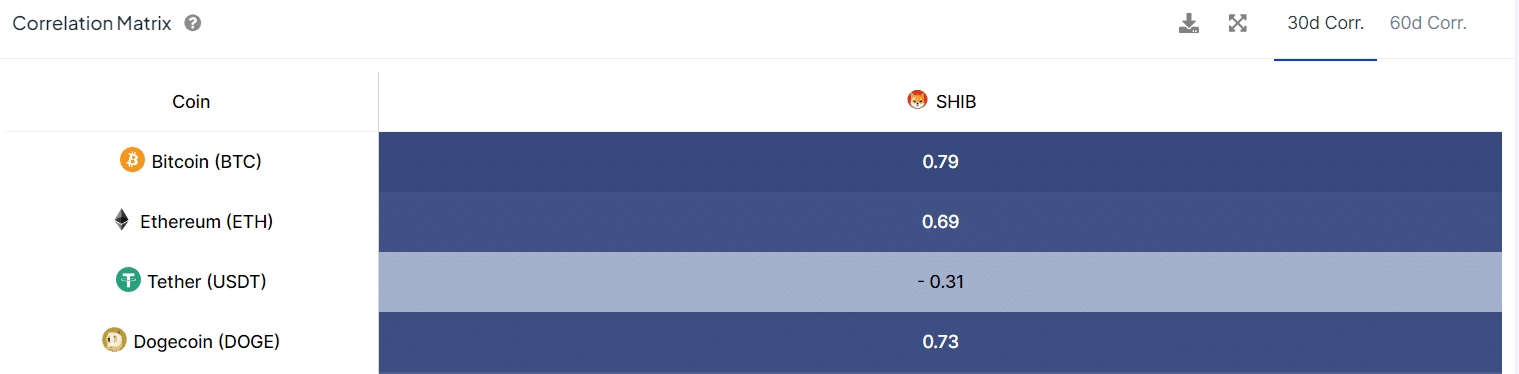

Data shows that Shiba Inu price has closely followed Bitcoin price movements more than any other asset, with SHIB and BTC showing the highest price correlation matrix over the past 30 days.

Shiba Inu (SHIB) has been a beneficiary and victim of broader market trends depending on their direction. When the market shows an upward trend, the Shiba Inu usually sees price increases. However, during a market downtrend, SHIB experiences substantial declines.

Shiba Inu follows Bitcoin

This trend has prevailed throughout this year, with a notable impact at the end of April. Bitcoin fell 15%, from a high of $66,000 on April 23 to a low of $56,000 on May 1. This value represented the lowest price of Bitcoin in three months.

Interestingly, Shiba Inu followed a similar trajectory, crashing from $0.00002689 on April 23 to a low of $0.00002057 on May 1. This represents a 23.5% decline over the same period that Bitcoin saw similar downward pressure. The price decline seen by Shiba Inu and Bitcoin is a product of their strong correlation.

Shiba Inu Price Correlation with BTC

Walk data from IntoTheBlock shows that Shiba Inu has a 79% correlation with Bitcoin over the last 30 days. This indicates that Shiba Inu price movements have had a strong positive correlation with Bitcoin price movements. On the other hand, Cardano (ADA) has only a 62% correlation with Bitcoin during this period.

While this trend may be positive for Shiba Inu, it also paints a worrying picture. For example, if Bitcoin faces turbulence due to market headwinds, SHIB is unlikely to buck the overall market trend. This is observed in recent price action, where Shiba Inu has now fallen alongside BTC.

Bitcoin faced major resistance at the $70,000 level yesterday, leading to a decline towards $68,000. This decline impacted the Shiba Inu price, compounding the existing downward pressure it is already facing. SHIB has recorded six consecutive days of loss since May 30, down 6.17% this month.

– Advertisement –

The basis of cryptography confirmed earlier that Shiba Inu has a habit of recording losses in June. Notably, Bitcoin has not seen as many losses as Shiba Inu during the current downturn due to its greater resilience. SHIB generally has higher volatility. As a result, during market declines, it faces steeper declines.

However, this also means that Shiba Inu experiences higher price increases during an uptrend. For example, SHIB climbed 370% between late February and early March to reach $0.000045. Meanwhile, Bitcoin only saw a 33% increase during this period.

Shiba Inu price ready to follow BTC upsurge

SHIB’s strong correlation with BTC is a generally positive sign, especially with Bitcoin poised to reach greater highs. As a result, analysts who predicted high BTC prices for this market cycle also believe that Shiba Inu would see bigger rallies. Armando Pantoja, market expert waits SHIB will reach $0.001 when BTC reaches $100,000 to $250,000.

Meanwhile, Shiba Inu only has a 69% price correlation with Ethereum (ETH) and 73% with Dogecoin (DOGE). SHIB is currently trading at $0.00002383, with its accumulation/distribution measure indicating a sharp decline in investor holdings, having collapsed from 28 trillion SHIB on May 28 to the current figure of 12.6 trillion.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinions of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. Crypto Basic is not responsible for any financial losses.

-Advertisement-