Markets

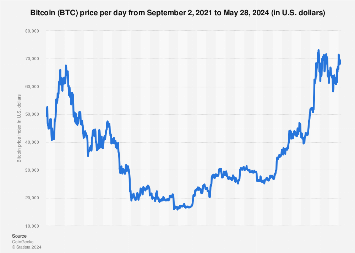

Bitcoin Price History May 28, 2024

The price of Bitcoin (BTC) reached an all-time high again in 2024, with values surpassing $73,000 in March 2024. This particular price rise was linked to the approval of Bitcoin ETFs in the United States, as previous increases in 2021 were due to events involving Tesla and Coinbase, respectively. Tesla’s March 2021 announcement that it had acquired US$1.5 billion worth of digital coins, for example, as well as the IPO of the largest crypto exchange in the United States aroused the interest of the masses. However, the market was noticeably different at the end of 2022, with Bitcoin prices reaching around 68,296.22 on May 28, 2024 after another crypto exchange, FTX, filed for bankruptcy.

Is the world running out of Bitcoin?

Unlike fiat currencies like the US dollar – as the Federal Reserve can simply decide to print more banknotes – Bitcoin’s supply is limited: BTC has a maximum supply built into its design, of which approximately 89% was achieved as of April 2021. It is estimated that Bitcoin will be exhausted by 2040, despite more powerful mining equipment. This is because mining becomes exponentially more difficult and energy-intensive every four years, which is part of Bitcoin’s original design. Because of that, a Bitcoin mining transaction could equal the energy consumption of a small country in 2021.

Bitcoin Price Outlook: A Potential Bubble?

Cryptocurrencies have few metrics by which to make predictions, if only because it is rumored that only a few cryptocurrency holders own much of the available supply. These large holders – called “whales” – would represent 2% of anonymous ownership accounts, while holding around 92% of BTC. In addition to this, most people who use cryptocurrency-related services around the world are retail customers rather than institutional investors. This means that it is difficult to gauge the prospects for Bitcoin price decline or growth, as the movements of a large whale are already having a significant impact on this market.

Fuente