Markets

Bitcoin Price Hits Roadblock at $67,500: What’s Next?

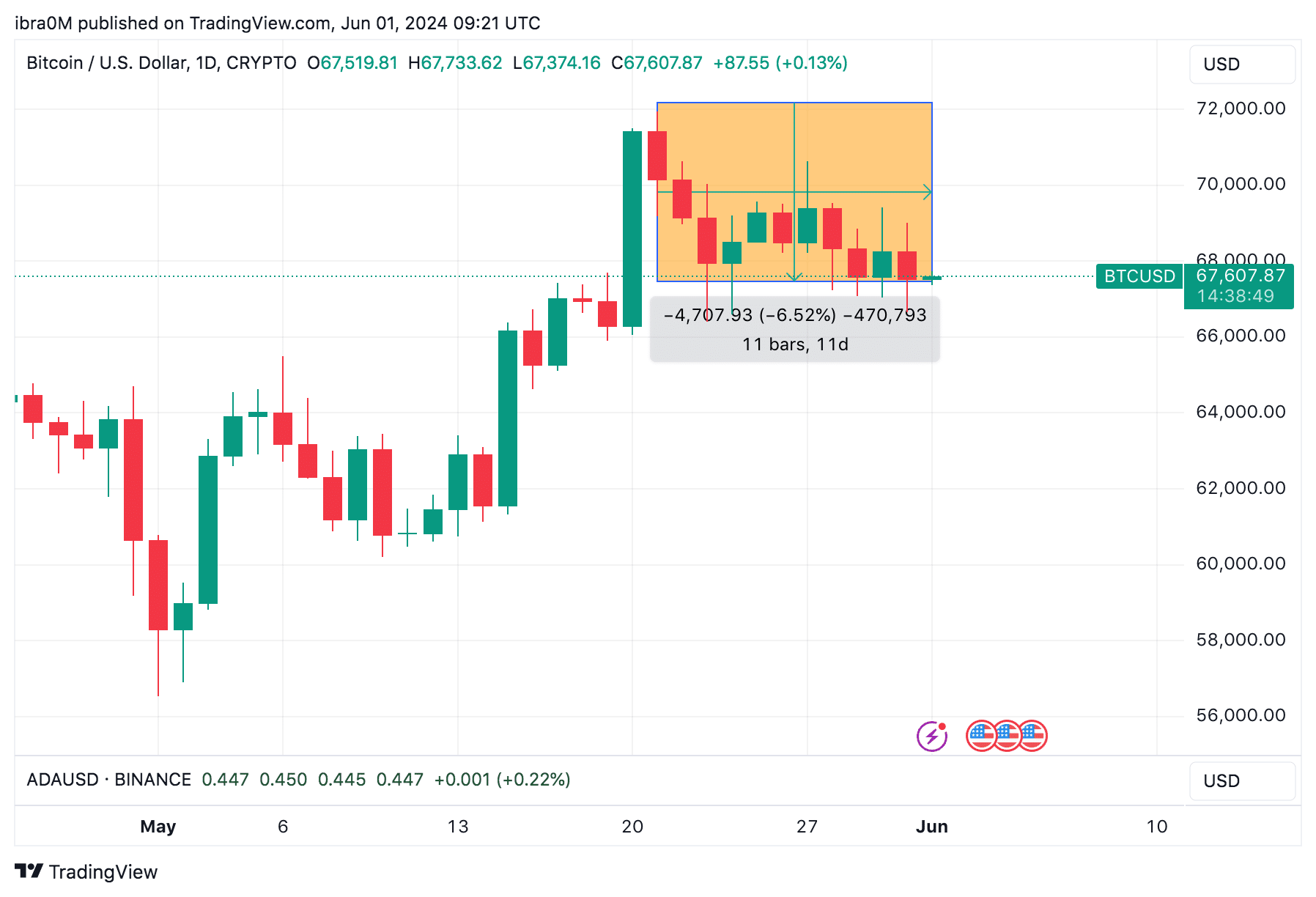

Bitcoin price remained stable at the $67,500 support level on Saturday, June 1, 2024, as the crypto market entered a consolidation phase amid delays surrounding the official launch of Ethereum ETFs.

Bitcoin price down 7% since Ethereum ETF approved

The approval of the Ethereum ETF sparked bullish sentiment and positive media coverage as it marked a milestone for the global cryptocurrency industry. However, a week later, spot ETH ETFs have yet to launch, with fund issuers still making final adjustments to their fills.

With the hiatus of ETH ETFs, crypto markets have seen significant changes in investment patterns and strategy. Notably, ETH and specific projects hosted on Etheruem, such as memecoins and DeFi protocols, have been in high demand, to the detriment of other rival blockchain networks.

Since hitting its monthly high of $71,954 on May 21, Bitcoin has now declined by 7%, falling as low as $66,657 during the daily time frame on May 31. A closer look at the daily chart shows how Bitcoin bulls immediately reacted by covering buys to recover. the support territory of $67,500.

Whale Investors Buy Bitcoin Dip

However, while retail investors appear to be looking for more profitable opportunities within the Ethereum ecosystem, on-chain data shows that whale investors have continued to double down on BTC.

IntoTheBlock’s daily large transactions chart below tracks the total number of unique BTC transactions with a value exceeding $100,000 on a given day. This provides real-time information on the level of whale demand for Bitcoin during that given period.

Bitcoin attracted 11,530 whale transactions on May 26, as seen in the chart above. But as the price correction phase intensified, rather than stopping, Bitcoin whales appear to have increased their demand.

– Advertisement –

The latest data from May 31 shows that Bitcoin reached 19,020 whale transactions, reflecting a 65% increase in whale demand, during a period of 7% price decline.

This shows that even though the price of BTC fell over the past week amid low retail confidence, whale investors took advantage of the price weakness to buy the dip.

Bitcoin Price Forecast: $70,000 Rebound Ahead

Bitcoin is trading for $67,600 at the time of writing on June 1, down 7% over the past 10 days. But given the steady increase in demand for whales, Bitcoin price is expected to see a major rebound above the $70,000 mark once market sentiment turns bullish in the coming days.

In terms of key resistance levels to watch, GIOM data from IntoTheBlock shows that BTC price could encounter a first hurdle at the $68,500 level.

As seen above, 1.24 million addresses of existing BTC holders acquired 826,790 BTC at the maximum price of $68,658. If these holders choose to exit early, the Bitcoin price could face downward pressure once it approaches its break-even point.

But if the bullish momentum is strong enough to propel Bitcoin price above the $68,700 level, an instant rebound above $70,000 could be on the cards.

On the other hand, if the $67,500 support fails to hold, Bitcoin bears could aim for a reversal towards the $65,600 zone. But with demand for whales growing, this scenario currently seems unlikely.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinions of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. Crypto Basic is not responsible for any financial losses.

-Advertisement-