Markets

Bitcoin ready to reach a new high? US trading volumes reach 2-year high

- Bitcoin volumes in the United States surged and reached 2022 levels.

- Holder profitability has increased with the speed of BTC.

Bitcoin [BTC] has seen a massive price rally over the past few days, causing a spike in optimism for BTC during this period. Due to this price surge, BTC volume has also increased significantly.

Increasing volumes

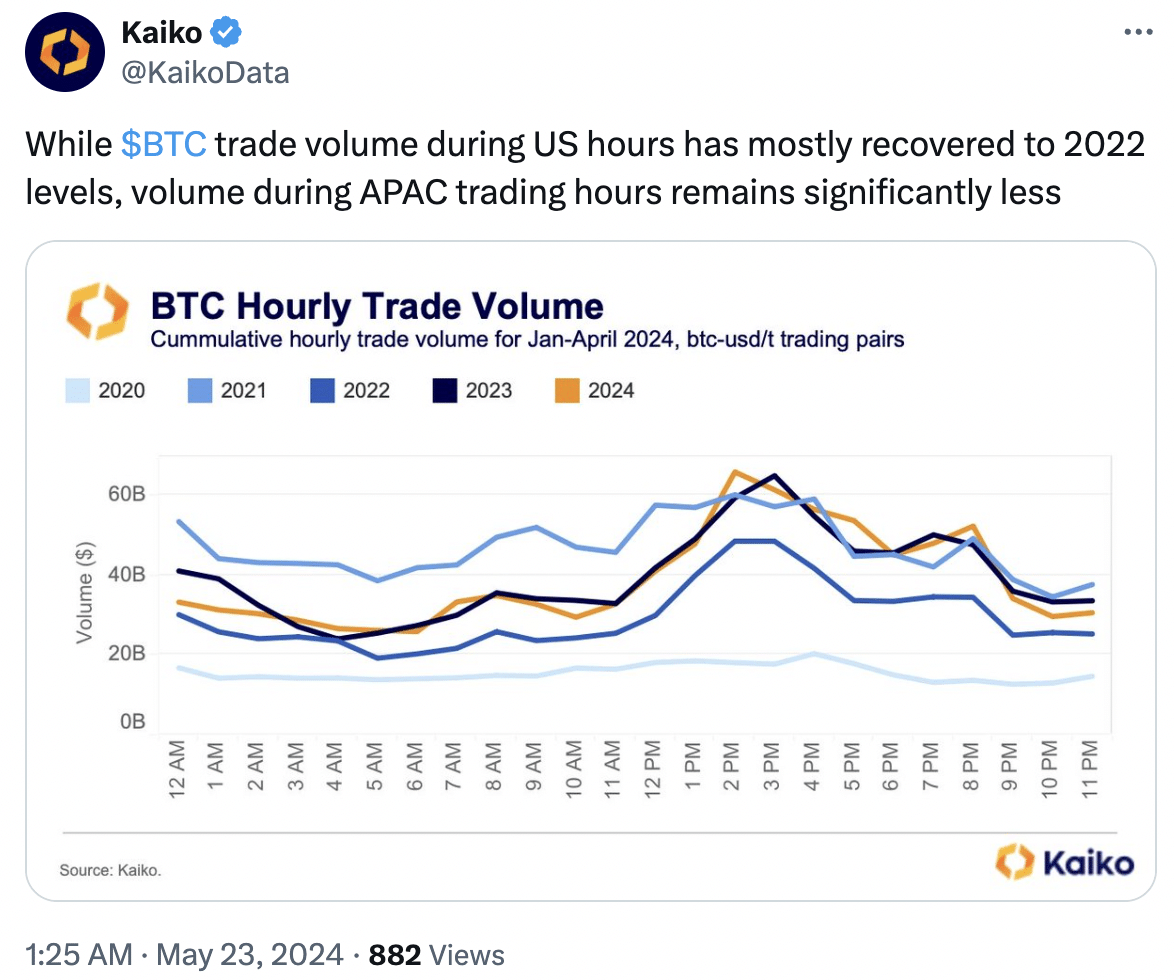

According to new data, BTC trading volume during US hours had returned to 2022 levels. The high BTC trading volume in America indicates that the US market is showing massive interest in BTC and may even have reached saturation.

However, on the APAC (Asia-Pacific) front, this was not the case. Volume during APAC trading hours was significantly lower. This meant that there was a large cohort of people who still had not interacted with BTC.

As the popularity of BTC increases, traders operating during APAC trading hours could soon invest and trade BTC, which could push the price of BTC to new highs.

Source:

As BTC began to reach its previously established all-time highs, many former holders were observed moving their holdings. Recently, an on-chain movement of Bitcoin more than 10 years old was recorded.

A transaction involving 2,000 BTC was sent to block 844625, marking a significant change in long-term held assets.

The whales are moving

This whale behavior could cause an increase in FUD among holders and traders, and could negatively impact the price of BTC.

At press time, BTC was trading at $69,750.53 and its price increased by 0.04% in the last 24 hours.

Additionally, the speed at which BTC trades has increased, implying that the frequency at which BTC trades has also increased.

Along with this, the MVRV ratio for BTC has also increased significantly, implying that most addresses were profitable at the time of writing. While this is positive for holders, it could spell trouble for the BTC price.

As profitability increases, so does the incentive to sell. If holders start taking profits, the price of BTC could be negatively impacted. One factor that can determine the likelihood of an address selling its BTC is the Long/Short ratio.

Read Bitcoin [BTC] Price prediction 2024-25

The Long/Short ratio shows the number of long-term holders versus short-term holders on the network.

At press time, this ratio was declining, indicating a predominance of short-term holders who are more likely to sell their holdings.

Source: Santiment