Markets

Bitcoin sees historically low trading volume, spot trading disappears

Since February 2024, Bitcoin (BTC) is trading in a price range between $60,000 and $72,000, with two gaps. This created a rather neutral dynamic for the leader cryptocurrencynow seeing its volume of exchanges and transactions fade.

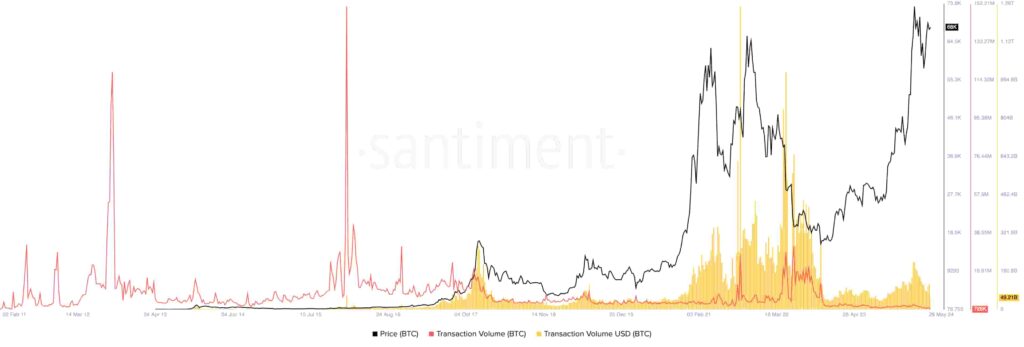

Finbold recovered data from Santiment on June 2 showing both metrics with the BTC price, currently at $68,100. Notably, the seven-day trading volume fell below $14 billion to reach the same level as in 2023, when Bitcoin traded below $30,000.

Additionally, the chart highlights a lack of interest in Bitcoin trading and on-chain transaction volumes, with the latter being remarkably low. As observed, the network only recorded 722,000 BTC moved in seven days. This contrasts with 1.79 million BTC in October 2023, with a similar trading volume and half the price.

BTC year-over-year chart: price, trading volume, trading volume. Source: Santiment/Finbold (Vini Barbosa, Sanbase Pro)

If we zoom out on the chart, Bitcoin’s current on-chain transaction volume shows its lowest value since the beginning. This highlights remarkably low network activity, which has not kept pace with the growing demand for speculative BTC over the years.

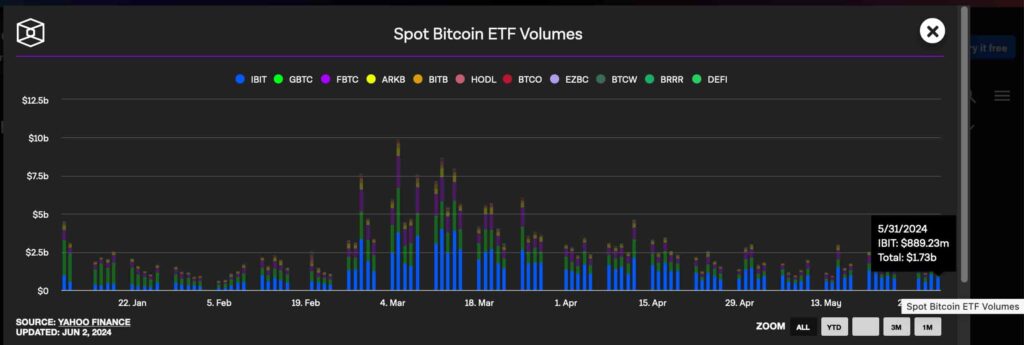

Volume of Bitcoin ETFs and derivatives

Meanwhile, this year the approval Bitcoin Spot ETF earned $1.73 billion, according to data retrieved from IntoTheBlock and Yahoo. Overall, these AND F“The last seven trading days totaled $12 billion in volume, similar to BTC spot volume on crypto exchanges.

This suggests increased interest in trading regulated and custodial securities. exchange traded funds instead of Bitcoin itself.

THE derivatives The volume also highlights the increased interest in purely speculative demand for the leading cryptocurrency. Data from CoinGlass shows daily volume above $34 billion, nearly three times the seven-day volume for spot trading.

Notably, the traded volume of futures contracts and other financial products derived from Bitcoin has remained stable after peaking in March 2024.

In conclusion, these indicators suggest higher market interest in BTC price speculation via Bitcoin ETFs and derivatives. This is opposed to acquiring Bitcoin for self-custody or long-term holding from cryptocurrency exchanges or using the blockchain without permission for true peer-to-peer transactions.

Disclaimer: The content of this site should not be considered investment advice. The investment is speculative. When you invest, your capital is at risk.