News

California budget deficit: How lawmakers decide spending

In summary

State lawmakers often don’t know how well a program is working before deciding whether to cut or increase spending. Instead, they hear from advocates, interest groups and sometimes the public. Key budget hearings ramp up this week.

Lea esta historia en Español

Frustration came through loud and clear as legislators hurled question after question at the head of the state’s homelessness interagency council: Why, after years of planning and billions of dollars invested, is there so little to show for the effort?

“You come into a budget committee and there’s no numbers,” Assemblymember Phil Ting, a San Francisco Democrat, said at the May 6 Assembly committee hearing. “Why is it taking so long?”

Assemblymember Vince Fong, a Bakersfield Republican, took issue with the council saying it needed more money to compile the data. And Chris Ward, a Democrat from San Diego, said he’d been asking the same questions since 2022: “The fact that we’re still now, three years later here as a state is incredibly frustrating because that guides our decision making here as a budget.”

But even without a full picture of how well the homelessness spending is working, Gov. Gavin Newsom is proposing cuts to cover the state’s budget deficit.

That’s just one example of how the state budget gets put together, often without fully knowing if a program is paying off. Revenue dictates decisions, and voter-passed initiatives direct some spending. After that, legislators use any data that’s available, but they also negotiate with other officials and listen to their constituents.

They’re also lobbied by advocates and interest groups. (More than 650 organizations spent money lobbying on the budget, as well as other issues.)

For the 2024-25 budget now before the Legislature, Newsom released a revised plan earlier this month that calls for dipping into reserves, canceling some new spending and cutting existing programs to cover a remaining shortfall of $27.6 billion. The independent Legislative Analyst’s Office, which assesses the budget picture through different calculations, cites the deficit as $55 billion, though it generally agrees with Newsom’s overall view of the state’s finances.

- Become a CalMatters member today to stay informed, bolster our nonpartisan news and expand knowledge across California.

Today and through this week, the Assembly and Senate will conduct hearings on Newsom’s proposals. The Legislature faces a June 15 deadline to approve its version.

Jesse Gabriel, who leads the Assembly budget committee, noted that only a handful of legislators have dealt with a deep deficit before. The state had a record budget surplus as recently as two years ago, thanks to federal pandemic aid and a roaring stock market; the last lengthy recession ended in 2009.

“This is a new experience for a lot of people,” the Democrat from Encino told CalMatters. “I think we’re going to have to work really hard together to get on the same page and do the best we can in a really difficult situation.”

State bases money needs on prior year

Addressing California’s deficit is a two-part equation, where increasing revenue could help. But Newsom has ruled out increasing taxes and instead emphasized “right-sizing expenditures,” telling legislators they shouldn’t expect bills with high price tags to pass.

For Gabriel, the May 6 hearing by the revamped accountability and oversight committee hints at an appetite for culture change in the Legislature — though one that could take time.

“We want to be doing a lot more data-driven decision making about which programs and services are really delivering results for Californians,” he told CalMatters. “For us, that metric is not did the money go out the door? But was it impactful? Did it make a difference in results for the people it was intended to serve?”

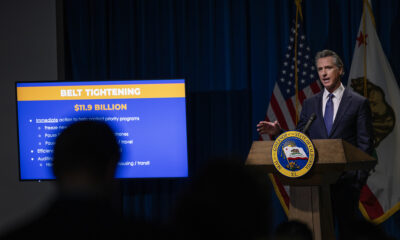

Gov. Gavin Newsom unveiled his revised 2024-25 budget proposal at the Capitol Annex Swing Space in Sacramento on May 10, 2024. Photo by Fred Greaves for CalMatters

Gov. Gavin Newsom unveiled his revised 2024-25 budget proposal at the Capitol Annex Swing Space in Sacramento on May 10, 2024. Photo by Fred Greaves for CalMatters

California currently uses “incremental budgeting:” Each department’s or program’s funding request starts with what they spent last year, updated with best estimates of what they need in the coming year. Also known as “baseline budgeting,” it’s the most common approach states take, according to the National Conference of State Legislatures.

Some public analysis of how programs are working comes from the nonpartisan Legislative Analyst’s Office and state agencies, sometimes at the request of lawmakers.

But a CalMatters analysis published in February found that 70% of the 1,118 state agency reports on how laws were working due in the past year had not been submitted to the Office of Legislative Counsel, which keeps reports. And about half of those that were filed were late.

California’s budgeting approach is in contrast to two other systems: performance-based budgeting and zero-based budgeting.

Performance-based budgeting ties funding to how well programs meet their goals, and allows departments more flexibility to use any savings. The data-driven approach can create more transparency, according to research commissioned by the Assembly’s Budget Committee in 2012. But it’s difficult to implement and can be inequitable, according to the National Conference of State Legislatures — for example by linking school funding to test scores.

Under zero-based budgeting, agency budgets start each year from $0. But no state uses the system in its true form, the conference notes.

While more states are moving towards performance-based budgeting — including Minnesota, New Mexico and Utah — more comprehensive efforts to change California’s system have fizzled.

This year, Fong, who is vice chairperson of the Assembly budget committee, introduced a bill to require state agencies to use zero-based budgeting, but the measure has not been heard in committee.

In 2011, then-Gov. Jerry Brown vetoed a bill requiring state agencies to use performance-based budgeting, saying it would impose a ‘’one size fits all” budget planning process on every state agency and function.

“The politically expedient course would be to sign this bill and bask in the pretense that it is some panacea for our budget woes,” he wrote in his veto message. “But the hard truth is that this bill will mandate thousands of hours of work — at the cost of tens of millions of dollars — with little chance of actual improvement.”

Instead, Brown advocated what he described as a common sense approach to budgeting that would examine whether some programs or departments should exist at all.

Performance-based budgeting also has downsides: A program that’s underperforming may still deserve funding, said lobbyist Kristina Bas Hamilton. “That should be what the policy and budget-making process is about, is having that dialogue,” she said.

And just looking at departments or programs doesn’t show the full picture of state spending, argues Scott Graves, budget director of the California Budget & Policy Center, an advocacy and policy group. That’s because of business and other tax breaks, which are typically renewed year after year.

“Rarely do policymakers come back around and ask, ‘Do they still make sense? Are they effective? Are they achieving the goal for which they were created?’ And as a result, we end up with a lot of waste on the tax expenditure side of the budget,” he said.

“If we’re going to argue for greater scrutiny of state spending and asking what we’re getting for our money, we need to do that not just on the budget side, but we also need to do it on the tax expenditure side.”

Giving taxpayers a voice

Where data doesn’t tell the whole story of which programs are worth funding, public input can fill in some gaps.

Both Senate President Pro Tem Mike McGuire and Gabriel told CalMatters that the budget hearings from January through June are key to the decision-making.

McGuire said his office also receives thousands of comments from the public — emails, postcards, requests for meetings and more.

“It’s not just one source of feedback, but multiple sources of feedback. And by the way, that’s the way it should be,” he said in an interview with CalMatters. “It’s coming from the public, from members themselves, shaped by their lived experiences and opinions, through advocates for nonprofits.”

Various interest groups have mobilized to push back on Newsom’s proposed cuts, including rallies at the Capitol or through virtual campaigns.

Julie Baker, CEO of CA Arts Advocates, said building coalitions has helped the arts community secure funding from legislators in the past.

“They need to know what their constituents care about, and showing up and telling them that we oppose, in this case, the arts cuts — letting them know how that will impact their own communities — is critical for them to understand the decisions that they’re making.”

Greater transparency can help the public form an opinion about state spending, but getting that information isn’t easy. State Sen. Roger Niello, a Roseville Republican, introduced a bill that would have required state agencies to post their expenditures in a clear and accessible way for the public, but the Senate’s appropriations committee killed the bill in last week’s “suspense file” hearings.

Service Employees International Union California and youth advocates rallied at the state Capitol in Sacramento to protest proposed budget cuts on May 15, 2024. Photo by Renee Lopez for CalMatters

Service Employees International Union California and youth advocates rallied at the state Capitol in Sacramento to protest proposed budget cuts on May 15, 2024. Photo by Renee Lopez for CalMatters

On May 1, advocacy groups California Budget & Policy Center, Catalyst California and the Million Voters Project launched the Budget Power Project, which plans to hold workshops to understand the budget, as well as lessons on how to advocate — at cities and counties as well as the state Capitol.

The idea was conceived during the windfall of federal pandemic aid to ensure that money reached communities most in need — and out of a concern that budgets are often crafted in the shadows.

Bas Hamilton — who wrote a book on how to advocate in the Legislature — says the power of public input shouldn’t be underestimated and challenged the notion that the same people, or the loudest people, advocating is a negative.

“They might be representing voices that are marginalized, and that might be the only venue they have to get these messages across,” she said. “I would say there’s a lot of lobbyists in the Capitol, but … some of them are fighting the good fight and having them be the loudest in the room, I would say, isn’t a bad thing at all.”

Changing the budget process

Although the effort to move the state to performance-based budgeting failed, California has seen some big changes to the process — though whether they’ve helped or hurt the state’s finances depends on who you ask.

In 2010, voters passed Proposition 25, which required the Legislature to pass a budget by June 15 or lose pay and also lowered the number of votes needed for passage. While that cut down on political gridlock, Jon Coupal, president of the Howard Jarvis Taxpayers Association, said it has led to a shoddy budget that is constantly amended the rest of the year.

Because Democrats hold a two-thirds “supermajority” and don’t need Republican votes to pass the budget, there’s no longer a “Big 5” committee, where leaders of both parties negotiate with the governor. It’s now just the Democratic leaders and Newsom. There’s also no Assembly-Senate conference committee, which held public hearings.

Other efforts to change the process have failed.

In 2020, Sen. Scott Wilk introduced a bill to create a two-year budgeting process — the first year for writing the budget, and the second to focus on oversight.

“The reason for that, frankly, is our government — we look at input,” the Republican from Lancaster told CalMatters. “We never look at output. I think there’s programs we start that are no longer effective, are no longer needed, yet, we’re still spending money because everybody’s building their fiefdom.”

Learn more about legislators mentioned in this story.

A multi-year budget process could have benefits, said Chris Hoene, executive director of the California Budget & Policy Center. “One way to manage the fluctuations that are there would be to sort of admit that economic cycles don’t always adhere to an annual fiscal year.”

That could allow the state to put more money into its reserves, he said. That’s currently limited by the state constitution — another topic that comes up during every budget downturn.

The Legislature has also made some attempts at more oversight, such as splitting up the health and human services budget subcommittees to hone in on each topic, and revamping the accountability committee.

Legislators could also be more mindful of bills that add new costs — though they and the governor’s office won’t have a clear picture of added costs until measures are signed in the fall. Gabriel said he tried to send that message at a Democratic Assembly caucus retreat in January.

“We tried to be really mindful of the costs, because there may be a lot of great policy ideas that folks out there want to pursue,” he said.

Another option to rein in costs each year could be to limit the number of bills legislators introduce. But while members say the volume makes it difficult to really weigh what the financial and other impacts of each bill might be, they also say it could hamper their ability to represent constituents.

And sometimes, a pricey bill or program is worth the fight, according to some legislators.

“These draconian cuts have real life and death consequences and will push our most vulnerable children, families, and aging Californians into homelessness and starvation,” Sen. Caroline Menjivar, a Democrat from Van Nuys, said in a statement in response to Newsom’s proposal. “As legislators, we hold the power to save the most vulnerable among us … I plan to fight back with everything I have.”

“I am a CalMatters sustaining member because I want unbiased journalism that allows me to make up my own mind.”

Susan, Palos Verdes

Featured CalMatters Member

Members make our mission possible.

div{flex-basis: unset !important;flex-grow: 1 !important;}.single-post .cm-cta.cm-cta-testimonial h6{text-align: left;}.cm-cta.cm-cta-testimonial .cm-cta-center-col{align-items: center !important;gap: 12px;}.cm-cta.cm-cta-testimonial .primary-cols.wp-block-columns{gap: 40px;}.cm-cta.cm-cta-testimonial .btn-col{flex-basis: fit-content;flex-grow: 0;}.cm-cta.cm-cta-testimonial .cm-cta-center-col > div{flex-basis: auto;}.cm-cta.cm-cta-testimonial .wp-block-buttons{min-width: 98px;}@media screen and (max-width: 782px){.single .cm-cta.cm-cta-testimonial .cm-cta-center-col > div{flex-basis: min-content;}.cm-cta.cm-cta-testimonial > .wp-block-group__inner-container{grid-template-columns: auto;}.cm-cta.cm-cta-testimonial .wp-block-button.btn-light .wp-block-button__link{padding: 7px 24px;}div.cm-cta.cm-cta-testimonial{padding: 16px;}.cm-cta.cm-cta-testimonial h6{text-align: left;}.cm-cta.cm-cta-testimonial .primary-cols.wp-block-columns,.cm-cta.cm-cta-testimonial .cm-cta-center-col.is-not-stacked-on-mobile{gap: 16px;}.cm-cta.cm-cta-testimonial .btn-02-detail-05{font-size: 12px;line-height: 16px;}.cm-cta.cm-cta-testimonial .mob-p-12{padding: 12px;}}]]>

News

Modiv Industrial to release Q2 2024 financial results on August 6

RENO, Nev., August 1, 2024–(BUSINESS THREAD)–Modiv Industrial, Inc. (“Modiv” or the “Company”) (NYSE:MDV), the only public REIT focused exclusively on the acquisition of industrial real estate properties, today announced that it will release second quarter 2024 financial results for the quarter ended June 30, 2024 before the market opens on Tuesday, August 6, 2024. Management will host a conference call the same day at 7:30 a.m. Pacific Time (10:30 a.m. Eastern Time) to discuss the results.

Live conference call: 1-877-407-0789 or 1-201-689-8562 at 7:30 a.m. Pacific Time Tuesday, August 6.

Internet broadcast: To listen to the webcast, live or archived, use this link https://callme.viavid.com/viavid/?callme=true&passcode=13740174&h=true&info=company&r=true&B=6 or visit the investor relations page of the Modiv website at www.modiv.com.

About Modiv Industrial

Modiv Industrial, Inc. is an internally managed REIT focused on single-tenant net-leased industrial manufacturing real estate. The company actively acquires critical industrial manufacturing properties with long-term leases to tenants that fuel the national economy and strengthen the nation’s supply chains. For more information, visit: www.modiv.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240731628803/en/

Contacts

Investor Inquiries:

management@modiv.com

News

Volta Finance Limited – Director/PDMR Shareholding

Volta Finance Limited

Volta Finance Limited (VTA/VTAS)

Notification of transactions by directors, persons exercising managerial functions

responsibilities and people closely associated with them

NOT FOR DISCLOSURE, DISTRIBUTION OR PUBLICATION, IN WHOLE OR IN PART, IN THE UNITED STATES

*****

Guernsey, 1 August 2024

Pursuant to announcements made on 5 April 2019 and 26 June 2020 relating to changes to the payment of directors’ fees, Volta Finance Limited (the “Company” or “Volta”) purchased 3,380 no par value ordinary shares of the Company (“Ordinary Shares”) at an average price of €5.2 per share.

Each director receives 30% of his or her director’s fee for any year in the form of shares, which he or she is required to hold for a period of not less than one year from the respective date of issue.

The shares will be issued to the Directors, who for the purposes of Regulation (EU) No 596/2014 on Market Abuse (“March“) are “people who exercise managerial responsibilities” (a “PDMR“).

-

Dagmar Kershaw, Chairman and MDMR for purposes of MAR, has acquired an additional 1,040 Common Shares in the Company. Following the settlement of this transaction, Ms. Kershaw will have an interest in 12,838 Common Shares, representing 0.03% of the Company’s issued shares;

-

Stephen Le Page, a Director and a PDMR for MAR purposes, has acquired an additional 728 Ordinary Shares in the Company. Following the settlement of this transaction, Mr. Le Page will have an interest in 50,562 Ordinary Shares, representing 0.14% of the issued shares of the Company;

-

Yedau Ogoundele, Director and a PDMR for the purposes of MAR has acquired an additional 728 Ordinary Shares in the Company. Following the settlement of this transaction, Ms. Ogoundele will have an interest in 6,862 Ordinary Shares, representing 0.02% of the issued shares of the Company; and

-

Joanne Peacegood, Director and PDMR for MAR purposes has acquired an additional 884 Ordinary Shares in the Company. Following the settlement of this transaction, Ms. Peacegood will have an interest in 3,505 Ordinary Shares, representing 0.01% of the issued shares of the Company;

The notifications below, made in accordance with the requirements of the MAR, provide further details in relation to the above transactions:

|

a) Dagmar Kershaw |

b) Stephen LePage |

c) Yedau Ogoundele |

e) Joanne Pazgood |

|||

|

a. Position/status |

Director |

|||||

|

b. Initial Notification/Amendment |

Initial notification |

|||||

|

||||||

|

a name |

Volta Finance Limited |

|||||

|

b. LAW |

2138004N6QDNAZ2V3W80 |

|||||

|

a. Description of the financial instrument, type of instrument |

Ordinary actions |

|||||

|

b. Identification code |

GG00B1GHHH78 |

|||||

|

c. Nature of the transaction |

Acquisition and Allocation of Common Shares in Relation to Partial Payment of Directors’ Fees for the Quarter Ended July 31, 2024 |

|||||

|

d. Price(s) |

€5.2 per share |

|||||

|

e. Volume(s) |

Total: 3380 |

|||||

|

f. Transaction date |

August 1, 2024 |

|||||

|

g. Location of transaction |

At the Market – London |

|||||

|

The) |

B) |

w) |

It is) |

|||

|

Aggregate Volume: Price: |

Aggregate Volume: Price: |

Aggregate Volume: Price: |

Aggregate Volume: Price: |

|||

CONTACTS

For the investment manager

AXA Investment Managers Paris

Francois Touati

francois.touati@axa-im.com

+33 (0) 1 44 45 80 22

Olivier Pons

Olivier.pons@axa-im.com

+33 (0) 1 44 45 87 30

Company Secretary and Administrator

BNP Paribas SA, Guernsey branch

guernsey.bp2s.volta.cosec@bnpparibas.com

+44 (0) 1481 750 853

Corporate Broker

Cavendish Securities plc

Andre Worn Out

Daniel Balabanoff

+44 (0) 20 7397 8900

*****

ABOUT VOLTA FINANCE LIMITED

Volta Finance Limited is incorporated in Guernsey under the Companies (Guernsey) Law, 2008 (as amended) and listed on Euronext Amsterdam and the Main Market of the London Stock Exchange for listed securities. Volta’s home member state for the purposes of the EU Transparency Directive is the Netherlands. As such, Volta is subject to the regulation and supervision of the AFM, which is the regulator of the financial markets in the Netherlands.

Volta’s investment objectives are to preserve its capital throughout the credit cycle and to provide a stable income stream to its shareholders through dividends that it expects to distribute quarterly. The company currently seeks to achieve its investment objectives by seeking exposure predominantly to CLOs and similar asset classes. A more diversified investment strategy in structured finance assets may be pursued opportunistically. The company has appointed AXA Investment Managers Paris, an investment management firm with a division specializing in structured credit, to manage the investment portfolio of all of its assets.

*****

ABOUT AXA INVESTMENT MANAGERS

AXA Investment Managers (AXA IM) is a multi-specialist asset management firm within the AXA Group, a global leader in financial protection and wealth management. AXA IM is one of the largest European-based asset managers with 2,700 professionals and €844 billion in assets under management at the end of December 2023.

*****

This press release is issued by AXA Investment Managers Paris (“AXA IM”) in its capacity as alternative investment fund manager (within the meaning of Directive 2011/61/EU, the “AIFM Directive”) of Volta Finance Limited (“Volta Finance”), the portfolio of which is managed by AXA IM.

This press release is for information only and does not constitute an invitation or inducement to purchase shares of Volta Finance. Its circulation may be prohibited in certain jurisdictions and no recipient may circulate copies of this document in violation of such limitations or restrictions. This document is not an offer to sell the securities referred to herein in the United States or to persons who are “U.S. persons” for purposes of Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”), or otherwise in circumstances where such an offering would be restricted by applicable law. Such securities may not be sold in the United States absent registration or an exemption from registration under the Securities Act. Volta Finance does not intend to register any part of the offering of such securities in the United States or to conduct a public offering of such securities in the United States.

*****

This communication is being distributed to, and is directed only at, (i) persons who are outside the United Kingdom or (ii) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) or (iii) high net worth companies and other persons to whom it may lawfully be communicated falling within Article 49(2)(a) to (d) of the Order (all such persons together being referred to as “relevant persons”). The securities referred to herein are available only to, and any invitation, offer or agreement to subscribe for, purchase or otherwise acquire such securities will be made only to, relevant persons. Any person who is not a relevant person should not act on or rely on this document or any of its contents. Past performance should not be relied upon as a guide to future performance.

*****

This press release contains statements that are, or may be deemed to be, “forward-looking statements”. These forward-looking statements can be identified by the use of forward-looking terminology, including the words “believes”, “anticipates”, “expects”, “intends”, “is/are expected”, “may”, “will” or “should”. They include statements about the level of the dividend, the current market environment and its impact on the long-term return on Volta Finance’s investments. By their nature, forward-looking statements involve risks and uncertainties and readers are cautioned that such forward-looking statements are not guarantees of future performance. Actual results, portfolio composition and performance of Volta Finance may differ materially from the impression created by the forward-looking statements. AXA IM undertakes no obligation to publicly update or revise forward-looking statements.

Any target information is based on certain assumptions as to future events that may not materialize. Due to the uncertainty surrounding these future events, targets are not intended to be and should not be considered to be profits or earnings or any other type of forecast. There can be no assurance that any of these targets will be achieved. Furthermore, no assurance can be given that the investment objective will be achieved.

Figures provided which relate to past months or years and past performance cannot be considered as a guide to future performance or construed as a reliable indicator as to future performance. Throughout this review, the citation of specific trades or strategies is intended to illustrate some of Volta Finance’s investment methodologies and philosophies as implemented by AXA IM. The historical success or AXA IM’s belief in the future success of any such trade or strategy is not indicative of, and has no bearing on, future results.

The valuation of financial assets may vary significantly from the prices that AXA IM could obtain if it sought to liquidate the positions on Volta Finance’s behalf due to market conditions and the general economic environment. Such valuations do not constitute a fairness or similar opinion and should not be relied upon as such.

Publisher: AXA INVESTMENT MANAGERS PARIS, a company incorporated under the laws of France, with registered office at Tour Majunga, 6, Place de la Pyramide – 92800 Puteaux. AXA IMP is authorized by Autorité des Marchés Financiers under registration number GP92008 as an alternative investment fund manager within the meaning of the AIFM Directive.

*****

News

Apple to report third-quarter earnings as Wall Street eyes China sales

Litter (AAPL) is set to report its fiscal third-quarter earnings after the market closes on Thursday, and unlike the rest of its tech peers, the main story won’t be about the rise of AI.

Instead, analysts and investors will be keeping a close eye on iPhone sales in China and whether Apple has managed to stem the tide of users switching to domestic rivals including Huawei.

For the quarter, analysts expect Apple to report earnings per share (EPS) of $1.35 on revenue of $84.4 billion, according to estimates compiled by Bloomberg. Apple saw EPS of $1.26 on revenue of $81.7 billion in the same period last year.

Apple shares are up about 18.6% year to date despite a rocky start to the year, thanks in part to the impact of the company’s Worldwide Developer Conference (WWDC) in May, where showed off its Apple Intelligence software.

But the big question on investors’ minds is whether iPhone sales have risen or fallen in China. Apple has struggled with slowing phone sales in the region, with the company noting an 8% decline in sales in the second quarter as local rivals including Huawei and Xiaomi gain market share.

Apple CEO Tim Cook delivers remarks at the start of the Apple Worldwide Developers Conference (WWDC). (Photo by Justin Sullivan/Getty Images) (Justin Sullivan via Getty Images)

And while some analysts, such as JPMorgan’s Samik Chatterjee, believe sales in Greater China, which includes mainland China, Hong Kong, Singapore and Taiwan, rose in the third quarter, others, including David Vogt of UBS Global Research, say sales likely fell about 6%.

Analysts surveyed by Bloomberg say Apple will report revenue of $15.2 billion in Greater China, down 3.1% from the same quarter last year, when Apple reported revenue of $15.7 billion in China. Overall iPhone sales are expected to reach $38.9 billion, down 1.8% year over year from the $39.6 billion Apple saw in the third quarter of 2023.

But Apple is expected to make up for those declines in other areas, including Services and iPad sales. Services revenue is expected to reach $23.9 billion in the quarter, up from $21.2 billion in the third quarter of 2023, while iPad sales are expected to reach $6.6 billion, up from the $5.7 billion the segment brought in in the same period last year. Those iPad sales projections come after Apple launched its latest iPad models this year, including a new iPad Pro lineup powered by the company’s M4 chip.

Mac revenue is also expected to grow modestly in the quarter, versus a 7.3% decline last year. Sales of wearables, which include the Apple Watch and AirPods, however, are expected to decline 5.9% year over year.

In addition to Apple’s revenue numbers, analysts and investors will be listening closely for any commentary on the company’s software launches. Apple Intelligence beta for developers earlier this week.

The story continues

The software, which is powered by Apple’s generative AI technology, is expected to arrive on iPhones, iPads and Macs later this fall, though according to Bloomberg’s Marc GurmanIt won’t arrive alongside the new iPhone in September. Instead, it’s expected to arrive on Apple devices sometime in October.

Analysts are divided on the potential impact of Apple Intelligence on iPhone sales next year, with some saying the software will kick off a new iPhone sales supercycle and others offering more pessimistic expectations about the technology’s effect on Apple’s profits.

It’s important to note that Apple Intelligence is only compatible with the iPhone 15 Pro and newer phones, ensuring that all users desperate to get their hands on the tech will have to upgrade to a newer, more powerful phone as soon as it is available.

Either way, if Apple wants to make Apple Intelligence a success, it will need to ensure it has the features that will make customers excited to take advantage of the offering.

Subscribe to the Yahoo Finance Tech Newsletter. (Yahoo Finance)

Email Daniel Howley at dhowley@yahoofinance.com. Follow him on Twitter at @DanielHowley.

Read the latest financial and business news from Yahoo Finance

News

Number of Americans filing for unemployment benefits hits highest level in a year

The number of Americans filing for unemployment benefits hit its highest level in a year last week, even as the job market remains surprisingly healthy in an era of high interest rates.

Jobless claims for the week ending July 27 rose 14,000 to 249,000 from 235,000 the previous week, the Labor Department said Thursday. It’s the highest number since the first week of August last year and the 10th straight week that claims have been above 220,000. Before that period, claims had remained below that level in all but three weeks this year.

Weekly jobless claims are widely considered representative of layoffs, and while they have been slightly higher in recent months, they remain at historically healthy levels.

Strong consumer demand and a resilient labor market helped avert a recession that many economists predicted during the Federal Reserve’s prolonged wave of rate hikes that began in March 2022.

As inflation continues to declinethe Fed’s goal of a soft landing — reducing inflation without causing a recession and mass layoffs — appears to be within reach.

On Wednesday, the Fed left your reference rate aloneBut officials have strongly suggested a cut could come in September if the data stays on its recent trajectory. And recent labor market data suggests some weakening.

The unemployment rate rose to 4.1% in June, despite the fact that American employers added 206,000 jobs. U.S. job openings also fell slightly last month. Add that to the rise in layoffs, and the Fed could be poised to cut interest rates next month, as most analysts expect.

The four-week average of claims, which smooths out some of the weekly ups and downs, rose by 2,500 to 238,000.

The total number of Americans receiving unemployment benefits in the week of July 20 jumped by 33,000 to 1.88 million. The four-week average for continuing claims rose to 1,857,000, the highest since December 2021.

Continuing claims have been rising in recent months, suggesting that some Americans receiving unemployment benefits are finding it harder to get jobs.

There have been job cuts across a range of sectors this year, from agricultural manufacturing Deerefor media such as CNNIt is in another place.

-

News11 months ago

News11 months agoVolta Finance Limited – Director/PDMR Shareholding

-

News11 months ago

News11 months agoModiv Industrial to release Q2 2024 financial results on August 6

-

News11 months ago

News11 months agoApple to report third-quarter earnings as Wall Street eyes China sales

-

News11 months ago

News11 months agoNumber of Americans filing for unemployment benefits hits highest level in a year

-

News1 year ago

News1 year agoInventiva reports 2024 First Quarter Financial Information¹ and provides a corporate update

-

News1 year ago

News1 year agoLeeds hospitals trust says finances are “critical” amid £110m deficit

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Hit $100 Billion in 2024, Fueling Insane Investor Optimism ⋆ ZyCrypto

-

Tech1 year ago

Tech1 year agoBitcoin’s Correlation With Tech Stocks Is At Its Highest Since August 2023: Bloomberg ⋆ ZyCrypto

-

Tech1 year ago

Tech1 year agoEverything you need to know

-

News11 months ago

News11 months agoStocks wobble as Fed delivers and Meta bounces

-

Markets1 year ago

Markets1 year agoCrazy $3 Trillion XRP Market Cap Course Charted as Ripple CEO Calls XRP ETF “Inevitable” ⋆ ZyCrypto