Markets

Crypto stabilizes, market expectations for second half of 2024: Market Domination Overtime

On today’s episode of Market Domination, hosts Josh Lipton and Seana Smith explore trending tickers and the afternoon’s leading market events.

US equity markets (^DJI, ^IXIC, ^GSPC) closed higher together on the first trading day of the third quarter. Jared Blikre details movements seen from Nasdaq 100 (^NDX) tech stocks. Bitcoin (BTC-USD) has stabilized following several volatile weeks since reaching an all-time price high earlier in 2024. IDX Advisors chief investment officer Ben McMillan shares his cryptocurrency outlook based on ETF inflows and speculates about which presidential candidate will be able to win over the crypto crowd. MJP Wealth Advisors chief investment officer Brian Vendig also joins the show to explain how continued confidence in slowing inflation could catalyze a catch-up in the markets.

This article was written by Gabriel Roy.

Video Transcript

And that’s the closing bell on a Wall street and now it’s market domination over time.

We’re joined by Jared Bry to get you up to speed on the action from today’s trade.

Let’s first though, check out where we are closing the day.

You’ve got the NASDAQ up just about 8/10 of a percent.

That really was the driver here in today’s action.

A lot of that out performance here in the market being driven by a lot of those larger cap tech names.

You have the dow closing up just about 50 points here and you’ve got the S and P getting closer and closer that 5500 level up just about 3/10 of a percent.

Now’s head over to Jared for a closer look at some of the today’s sector action, Jared.

Yes, I didn’t see the record highs in any individual sectors, but I did see them in the NASDAQ composite and a couple of individual issues.

But first, let’s take care of those sectors.

XLK and XL Y.

That’s those other two out performers that would be tech and consumer discretionary.

So really those are mega cap featured sectors and then also financials and energies in the green, but everything else in the red led down by materials down 1.5% and industrials down just a little over 1%.

And taking a look inside the NASDAQ, that’s where we’re seeing some of these records, I believe Microsoft.

And uh also Apple, Apple hasn’t had a record high in a couple of weeks.

Both of those up, more than 2% you can throw Amazon in there as being uh up more than 2%.

And also also seeing some action from Tesla that finally pushing above 200 dollars per share, almost closing at $210 per share.

So that’s been one of those breakout moves that I’ve been looking for personally.

And then looking at our leaders today, Bitcoin was actually the big leader G BT C up 5% as a Bitcoin proxy.

Story continues

Also seeing New York Fang and our components in the Green Arc is that disruption place?

We’ll take a look that in a second to the downside home builders and uh solar each of those down more than 2.5, at least those representative ETF S and now here’s a look at the Arc Innovation holdings.

Um I said it was a leader, a lot of that has to do with Tesla because that is the lion chair right there.

But also seeing some strength in Coinbase and Roku Josh, thank you, Jared.

We are officially in the second half of the year and markets kicking things off with modest gains.

The NASDAQ, the top performer on the day joining us now is Brian Vig M JP.

Wealth Advisors, Chief Investment Officer, Brian.

It, it is good to see you.

So we had a real strong start to the year.

Brian.

It sounds like what you’re saying is, listen, stay positive, more, good times ahead.

Well, Josh, I think all of the balance of the year.

I think that is our, our tone right now and I think it’s predicated on the fact that we’re expecting earnings to continue to expand on a sequential basis.

But as we know this first half of the year was dominated by some of those mag five mag seven names from last year continuing to lead the charge, especially if you break that down over the last three months with nine of the 11 sectors in the S and P 500 trailing um our friends in technology and communication services where most of those sectors were flat or uh uh to negative, slightly positive on an overall basis, big disparity in returns.

But I think has an opportunity to change because as earnings expand from areas outside of mega cap tech and we start to see continued confidence in that slowing inflation story with rate cuts being more and more reality from September on.

I think that’s where you have a chance for a little catch up in the markets So my question is, does today’s action maybe point to the fact that maybe some of that is at risk when you take into account, what maybe the market was pricing in today looks like it was more of a Trump presidency, some of the risks associated with that just in terms of the spending, the tax cuts and what ultimately that could do to inflation.

And then of course, the conclusion being what that means for the fed is some of that.

Are you, are you confident that this disinflation trend is going to remain intact or how much of that is at risk right now?

J that’s a great question.

Um I think in the last couple of days, the bond market is telling us that with this higher probability or near jerk reaction of, of Trump, uh coming back to the White House, we saw rates go up in the bond market with those concerns based on fiscal policy adding to inflation and the economy moving forward.

Uh But I’m looking at things from uh let’s get to the election first perspective because as we know it’s really difficult to handicap uh politics.

And so when you break that down, the consumer part of the story is what’s really been driving inflation.

Uh and, and sticking on that stickier side.

Um And so with a slowing consumer, slower spending, uh we’ve seen and we’re gonna get the jolts number tomorrow, we’ve seen less job openings, less leapfrogging with wage inflation and also housing prices um uh sticky.

Yes.

But uh with demand supply and, and uh a little bit of a freeze there because rates are still high.

We expect some of that data to change as, as uh real market data is showing up in the government inflation numbers.

So we still feel confident that over the second half of the year inflation will come down, rates will come down.

The fed has signaled that they want to cut rates, but they’re playing the wait and see game because no one really knows.

But at the end of the day, I think we’re seeing some disinflation in the system and we’re seeing uh the expectation of better earnings and that’s why our con is positive for the second half.

And Brian, do you think the market needs the fed to cut in order to keep moving higher here or, or is it just, no, the market just needs to think Jay Powell wants to cut is looking to cut that.

That’s, that’s a great point.

I mean, I think right now the market is looking for clarity of policy.

I think when you’re dealing with the uncertainty, that’s what’s really holding back on business leaders and, and some other um uh uh decisions to be made on where capital is going to be allocated.

But I think right now the market is still having a pretty high ho uh probability for at least one rate cut for in September, I think the, the the futures market there are saying around 60% and a higher probability has just ticked up in December.

So we’re still in the camp of 1 to 2 cuts assuming that disinflation story uh creeping through over the summer months into the fall.

And I think that’s gonna help the cyclical parts of the market to go back to your question.

You know, the last couple of days when the rates going up, is it a surprise that the cyclical parts of the market like industrials, basic materials take a little bit of a pause.

Why technology keeps showing their leadership?

We think not.

I think if we get a little bit more confidence that that fed policy is going to be there for cuts, that’s where we’ll see the cyclical part of the market have a chance to rebound and that might even play into the small cap market as well.

I was gonna say Brian.

So given that, what, what are you seeing in terms of the opportunity maybe within small caps and then even mid caps as well?

Given those expectations.

Yeah, Shana, I mean, that’s where this big picture value paired with growth has been our theme for uh for investors over the course of the year and staying diversified.

And I think when you break that down, you don’t have to pay 30 times plus forward pe like we’re seeing in some of these mega cap tech names to get growth.

I mean, think about industrials with this rise of infrastructure spending that’s still going to play out over the next nine years and data centers and other areas of, of, of, of making our grid smarter health care uh M and A transactions, innovation, new therapies coming out and small caps have always been uh disproportionately punished and that’s been going on since March of 23 when we had two bank failures.

And people were concerned about a recession in rates and what that, what’s gonna happen to smaller companies will.

Well, yes, they still need to play catch up.

But from a, from a reality point of view, they’re usually ones that price price the bad news first and then, uh, and knowing that that’s behind us, then they’re the ones that come out of, um, uh, uh those, those situations that actually bounce back first.

And I think we saw that in the fourth quarter last year.

And I think, uh, Chana, there’s an opportunity for that to play out when there’s more certainty around that fed policy measures on rates.

As I said before, Brian, as you look for opportunities, do you want to stay us focused or do you see any opportunities overseas as well?

That’s a great question, Josh, I think, you know, we definitely lean or, you know, we do have some exposure to international equities, but we’re leaning more in the developed part of Europe and Japan.

But our bias has been more focused domestically here in the US.

Um And that’s just because of concerns with changes in the dollar as well as just recognizing some of these political uncertainties that keep coming up with policy as we saw over the weekend with things going on in France and also a little bit of this start stop what’s going on in China.

So right now, we’re leading more domestic uh but we’re playing a close eye on where the dollar is going to move uh post election as we get a little bit more clarity on, on policy, uh both from a tariff as well as foreign policy perspective.

All right, Brian, great insight there.

Thanks so much for joining us here today.

Thank you both.

Well, the Supreme Court ruling, former President Donald Trump has some immunity from criminal charges related to his attempts to reverse the 2020 election results.

This partial backing of the former president will delay any trial on the matter.

Joining us now, from more at Yahoo finance is Rick Newman.

Rick.

It’s good to see you.

So certainly, I think a lot of people are trying to figure out exactly what this means.

Maybe what is the impact or implications here on former president Trump’s campaign for the 2024 election.

What can you tell us very hard to tell um on a bank shot basis how that this affects Trump in the 2024 election, I guess.

It means that we are not going to have this trial completed this Washington DC trial completed by the time of the election.

I think that was considered a long shot anyway, just by the fact that when the Supreme Court took up this question, it delayed those proceedings by, by several months, it looks like what is going to happen is it is going to go back to the, uh, to the judge in the Washington DC Court and she will probably get started pretty quickly.

But she has also said that once she got a ruling from the Supreme Court, she would give both sides time to prepare.

And what they now need to do is go through these, the charges in this case one at a time and see, well, given what the Supreme Court said, do the are these charges now, do these charges now no longer apply because this is something, yes, the president is immune from prosecution for and that probably will be the case.

So what’s probably gonna happen here is the prosecutors are going to have to winnow down the charges, um, to maybe just one or two charges.

It would have to clearly be stuff that happened outside of what you would consider Trump’s presidential duties.

And then once they get to that point, even then Trump can appeal it again to the Supreme Court.

So he’s going to run out the clock on this one in terms of the 2024 election.

I think it’s very hard to tell, you know, in what other way this, this might affect what’s happening in the campaign.

I mean, I think the political system is frankly on overload right now.

Democrats are still trying to figure out what to do about, uh Joe Biden’s terrible performance in the debate last Thursday.

Should he stay in the race?

Apparently, the family says he’s staying in a lot of Democrats seem to be saying, huh?

We’re not so sure about that.

What are our options here?

So that’s going to take time to play out.

And by the way, barely anybody knows today, Steve Bannon went to jail.

This was Trump’s former campaign adviser in 2016.

So yet another Trump person, somebody from Trump world headed to prison, but so far not Trump himself, Rick, what did you make if anything of the, of the 63 split on the court with his decision?

Uh, it, I mean, it was, it was very predictable because it was, uh, it was the, uh, six conservatives saying, uh that Trump president, well, not the Trump presidency.

It’s the presidency has more power than anybody really ever thought before.

At least they, uh they made that clear, it was sort of predictable.

I mean, I thought it’s not automatically obvious that just because you are a conservative judge that you think that the president should be more able rather than less to get away with something that might be criminal.

Um While, while he’s serving as president, I mean, there used to be Law and Order Republicans who were really tough on crime including crime committed by public officials, which presumably includes a president.

So um I I one thing that I think people should keep in mind is this is a finding about the powers of the president, whoever the president is and it happens to be in a case involving Trump.

But guess what?

It also applies to Joe Biden, who’s the current president?

It is possible President Trump will uh excuse me, Donald Trump will never be president again, if that’s what voters decide this year and this will not apply to anything Trump might do uh as president, but it might apply to F I mean, it clearly applies to future presidents.

So I think there’s a chance this could unravel in ways that are different from a lot of the reactions you’re seeing today.

All right, Rick, always great to have you on the show, my friend.

Thanks for joining us.

You guys, Bitcoin down more than 9% over the past three months as spot ETF Enthusiasm Wanes.

But could the Cryptocurrency be in for a near term rebound?

More market domination over time coming right up, Bitcoin regaining some momentum to start the second half of the year with prices up just about 2% today.

Now the move higher following a down be quarter for the Cryptocurrency still off about 12% from its March high as investors excitement surrounding Bitcoin ETF had cooled.

So what can investors expect in the second half of the year here to help us answer that question and more we want to bring in Ben mcmillan, Chief Investment Officer at ID X Advisors.

Ben, it’s good to see you.

So here we are kicking off the second half of the year for crypto.

I think lots of people are, are at home questioning whether or not we are going to see this return of excitement when it comes to the crypto market, more specifically Bitcoin, what’s it going to take in order to regain some of that momentum?

Well, I mean, we do have a couple of near term catalysts to look forward to, to um you know, the first of which is being uh the presumption of Spot Ethereum ETF S um that could really cut them as early as this week.

We’ve seen a lot of excitement about that, especially as kind of adoption of the crypto market starts to broaden.

I think the spot ETF S did a really good job of kind of, you know, for lack of a better term mainstreaming the idea of Bitcoin to a broader audience that, you know, probably wouldn’t have really thought about it.

Otherwise we’ve been hearing those conversations with, you know, we’ve been hearing those in conversations with advisors and institutional investors that we talked to that once the Blackrock ETF all of a sudden came onto the marketplace, they’re starting to, you know, consider it more closely for their, you know, so called 6040 portfolios.

But I do think a lot is going to depend on the macro in Q three, you know, Bitcoin is for better or for worse, highly correlated with the NASDAQ.

It looks and feels a lot like a very, you know, high beta growth stock and, you know, to the extent that we see, you know, the emergence of a US recession, even if it’s shallow and we do start to see a rotation out of, you know, higher beta, you know, tech type stocks.

I do think that can weigh on Bitcoin, you know, but I, I also wanna get your take on a different topic.

I don’t know if you saw this but um billionaire Peter Thiel was on another network recently and he was talking about Bitcoin and it was interesting, Ben just because um he didn’t sound as enthusiastic as maybe a lot of people would imagine.

He, he’s still not listen, he, he holds some bit Bitcoin, but he said he isn’t sure the price will rise dramatically from here.

I was just curious, Ben, what if anything you made of those comments?

Um do those comments matter, Ben?

You know, I I saw that as well.

I found it interesting because it’s hard to not be kind of structurally bullish on crypto in general at this point.

In the cycle, it’s still very early from an adoption rate.

You know, it’s still very early too in terms of use cases, you know, a lot of what we’ve seen is just kind of scratching the surface in terms of, you know, what crypto can do in terms of facilitating, you know, real world outcomes.

Um you know, we saw a glimmer of it with kind of defi summer web three.

you know, the idea of, of, of kind of smart contracts and, and things like ordinals, kind of, you know, branching out to the broader world.

So, you know, it’s hard to, it’s hard to see how this is kind of the end of the run for Bitcoin.

I, I just don’t see it now, that’s not to say there’s not going to be volatility ahead and again, you know, Bitcoin, you know, Bitcoin is gonna go where the macro environment goes.

So I do think it’s important to be cautious for investors that, you know, just because the secular B story or thesis is intact doesn’t mean it’s gonna be a straight shot upwards.

But I, I’m hard pressed to believe that, you know, Bitcoin doesn’t set new highs over the next, you know, 12 to 24 months from here, Ben, you just mentioned uh that correlation a couple of times here just in terms of what we’ve seen with some of those more risk on assets and the price of Bitcoin.

We, we take a look at that correlation.

Does that make sense?

Given some of the activity that we had seen prior to the last 12 months?

And I guess drawing from that, what does that then tell us maybe about what that activity could or should maybe potentially look like here in the coming months?

Yeah, that’s an excellent question.

And it’s, it’s one where, you know, we were, we were very reticent kind of if you look at the correlation of Bitcoin.

So stocks in general or, you know, or tech stocks in particular, um it was very low kind of pre COVID.

And then after COVID, particularly after, you know, quote unquote money printing, you saw that correlation spike and that makes a ton of sense.

We think that’s here to stay now, that doesn’t necessarily mean it’s going to be as high as it has been recently forever.

You know, it’s running at kind of a, you know, 0.6 correlation, but we’re not going to go back to the days of Bitcoin being, you know, zero or even negatively correlated to risk assets.

So, you know, investors need to understand that positive correlation to risk assets of a Bitcoin is here to stay.

It’s something to, you know, it’s, it’s something to factor in when you think about it within your portfolios.

But that also doesn’t mean that it’s not at times, you know, gonna move a little bit differently or that it doesn’t have, you know, any diversification advantages.

But I do think again, we always caution investors think about Bitcoin as a very high beta, you know, high duration or long duration kind of tech play and you know, in the context of your portfolios, because that correlation, you know, is gonna ebb and flow kind of around the 0.5 0.6 mark, but it’s not gonna go back to zero, it’s certainly not gonna go back negative now with, you know, any kind of long term structural outcome.

So I think, you know, it’s, it, think of it like a, like a high beta tech stock.

Ben, are you surprised the way crypto has become an issue uh in this presidential election?

And, and do you think Ben, there’s a candidate by or Trump who’s gonna have an easier time winning over that crypto crowd?

Well, yeah, I mean, what’s been interesting to me in this election cycle is the degree to which the crypto pacs came out in force with real big money and they’ve been influencing outcomes already and, and kind of, you know, congressional races, you know, we saw the one in the Bronx, there was a big one in California and, you know, the crypto PAC, you know, fair shake.

Uh and some other ones, you know, spent real money backing crypto, you know, crypto favorable candidates.

And so I think what’s interesting there is crypto now is all of a sudden, you know, kind of a force to be reckoned with and I think, I think politicians are taking note on both sides of the aisle.

Um You know, I also think the crypto community by and large is favorable to a Trump outcome.

You know, if you know Trump, I think has been strategic about trying to court the crypto community saying, you know, he’s going to do a lot of good things for crypto.

But I think even if you have heavily discount that just the fact that it’s probably at a minimum, gonna be much more laissez Faire than what we’ve seen with, you know, Biden is what’s driving a lot of the crypto enthusiasm for Trump.

But yeah, I mean, I think the bigger takeaway, at least to me has been how active and how big the kind of crypto lobby has become this election cycle.

And I think that’s here to stay as well too.

Ben, don’t tell us a little bit more just about the significance of that and the influence, maybe you see that having just more broadly here beyond the election.

Well, yeah, I mean, it’s, you know, it’s interesting because I think it’s going to force a little bit more thoughtful narrative.

And I think I have to say, I mean, I think the crypto lobby has done a very good job of, you know, being very clear that listen, this is a source of innovation for America.

And so, you know, we’re not asking for any kind of special treatment.

We’re just simply asking for, you know, uh you know, lawmakers and politicians to, you know, look at crypto as a technology as a source of it in and not just kind of cast it out as the domain of illicit, you know, criminals and, and you know, money launderers and things like that, which is kind of the early narrative or early rhetoric we heard from, you know, some, some, you know, congress people, you know, a couple of years ago.

And so I think it’s been, I think it’s come from a good place.

I think it makes a lot of sense.

Um And I think it is actually having an impact in terms of educating Congress people and politicians and also not forget it, you know, record amounts of people own crypto.

You know, if you look at the estimates, it’s upwards of 60 million people.

So it, again, it’s, it’s not a French thing anymore.

It affects a lot of Americans.

People are paying close attention, you know, especially if you look at things as, you know, federal, uh you know, federally backed CBD CS and potential privacy concerns around there.

You know, it’s, it’s starting to occupy a very real mind share for a lot of Americans.

Ben.

Great to have you on the show.

Thanks for taking the time to chat today.

Absolutely.

Thanks time now for to watch Tuesday, July 2nd, Tesla is reporting deliveries for the second quarter and also expecting the company’s deliveries to fall.

Another drop would be the first time deliveries for Tesla have dropped for two straight quarters.

It’s coming after Chinese ev rivals including Neo and Lee Auto reported better than expected deliveries on Monday.

Moving on to the fed chair, Jerome Powell is speaking at the European Central Bank for in Portugal in the morning.

This coming after a round of that commentary on Friday.

Now San Francisco fed President Mary Daly saying that recent inflation data indicates monetary policy is working, but she also says that it’s too early to tell when to cut.

And finally the monthly jolts report, that’s the job openings and labor turnover survey for May coming out in the morning economist forecasting that number to tick down to just under 8 million.

The new job data tomorrow giving us more insight into the health of the labor force and coming ahead of Friday’s full jobs report.

That’ll do it for today’s market domination over time.

Be sure to come back tomorrow at 3 p.m. Eastern time for all of your coverage leading up to and after the closing bell.

But don’t go anywhere on the other side of the break.

It’s asking for a trend.

I’ve got you covered for the next half hour with the latest and greatest market moving stories.

So you can get ahead of the themes affecting your money.

Markets

Today’s top crypto gainers and losers

Over the past 24 hours, Jupiter and JasmyCoin emerged as the top gainers among the top 100 crypto assets, while Bittensor and Mantra plunged as the top losers.

Top Winners

Jupiter

Jupiter (JUP) led the charge among the biggest gainers on July 27.

At the time of writing, the crypto asset had surged 12.6% in the past 24 hours and was trading at $1.16. JUP’s daily trading volume was hovering around $282 million, according to data from crypto.news.

JUP Hourly Price Chart, July 26-27 | Source: crypto.news

Additionally, the cryptocurrency’s market cap stood at $1.56 billion, making it the 62nd largest crypto asset, according to CoinGecko. Despite the recent price surge, the token is still down 42.6% from its all-time high of $2 reached on Jan. 31.

Jupiter functions as a decentralized exchange aggregator that allows users to trade Solana-based tokens. The platform also offers users the best routes for direct trades between multiple exchanges and liquidity pools.

In addition to being a DEX aggregator, Jupiter has expanded into a “full stack ecosystem” by launching several new projects, including a dedicated pool to support perpetual trading and plans for a stablecoin.

JasmyCoin

JasmyCoin (JASMI) has increased by 12% in the last 24 hours and is trading at $0.0328 at press time. JASMY’s daily trading volume has increased by 10% in the last 24 hours, reaching $146 million.

JASMY Hourly Price Chart, July 26-27 | Source: crypto.news

The asset’s market cap has surpassed the $1.5 billion mark, making it the 60th largest cryptocurrency at the time of reporting. However, the self-proclaimed “Bitcoin of Japan” is still down 99.3% from its all-time high of $4.79 on February 16, 2021.

JASMY is the native token of Jasmy Corporation, a Japanese Internet of Things provider. The platform seeks to merge the decentralization of blockchain technology with IoT, allowing users to convert their digital information into digital assets.

The initiative was launched by Kunitake Ando, former COO of Sony Corporation, along with Kazumasa Sato, former CEO of Sony Style.com Japan Inc., Hiroshi Harada, executive financial analyst at KPMG, and other senior executives from Japan.

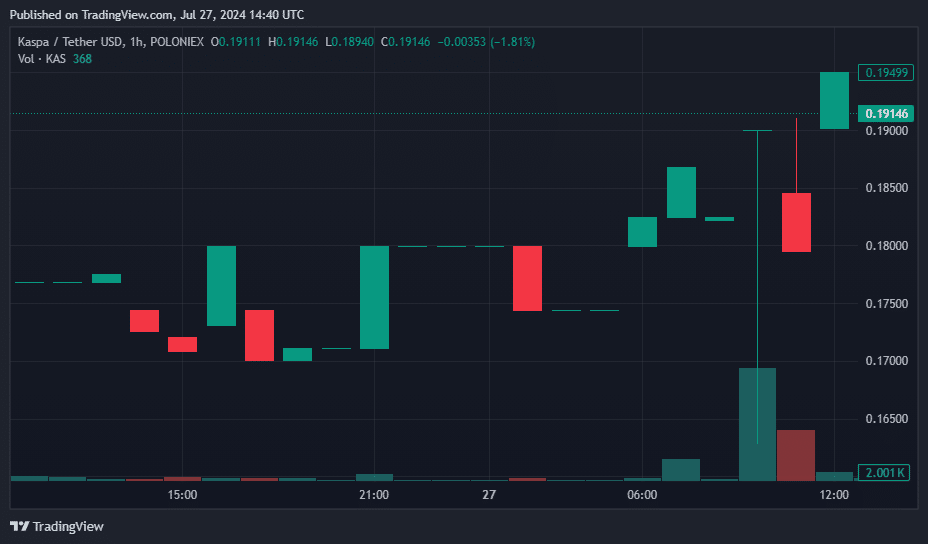

Kaspa

Kaspa (KAS) saw a 100% increase in trading volume and an 8% increase in price over the past 24 hours, trading at $0.19 at the time of publication.

KAS Hourly Price Chart, July 26-27 | Source: crypto.news

According to data from CoinGecko, Kaspa now ranks 27th in the global cryptocurrency list, with a circulating supply of approximately 24.29 billion KAS tokens and a market capitalization of $4.59 billion.

Kaspa is a cryptocurrency designed to deliver a high-performance, scalable, and secure blockchain platform. Its unique Layer-1 protocol includes the GhostDAG protocol, a proof-of-work (PoW) consensus mechanism that enables faster block times and higher transaction throughput compared to standard blockchains.

Unlike Bitcoin, GhostDAG allows multiple blocks to be created simultaneously, speeding up transactions and increasing block rewards for miners.

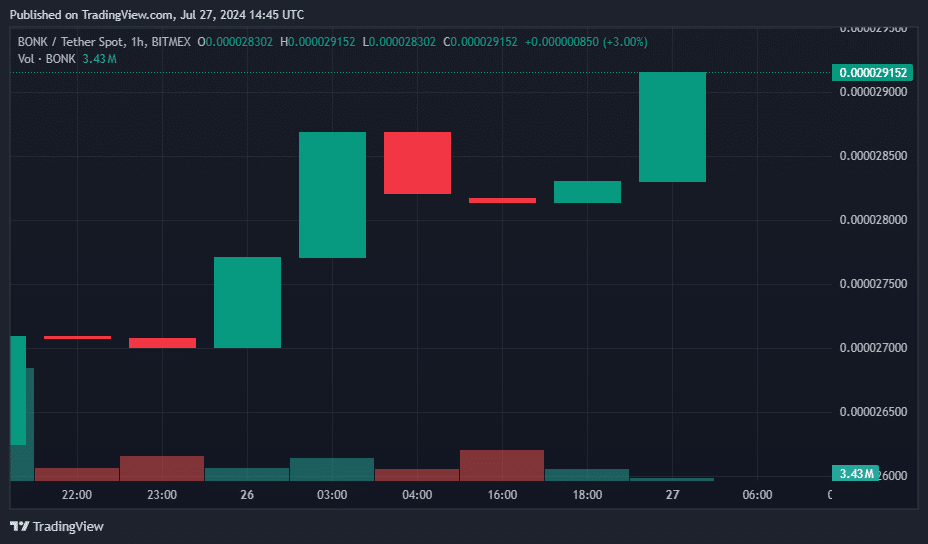

Bonk

Bonk (BONK) is the only one coin meme which made it to this list of biggest gainers and jumped 8.6% in the last 24 hours. Trading at $0.000030, the Solana-based meme coin’s market cap has surpassed $2.1 billion, surpassing Floki (FLOKI), another competing dog-themed coin with a market cap of $1.78 billion.

BONK Hourly Price Chart, July 26-27 | Source: crypto.news

BONK’s daily trading volume hovered around $285 million. However, BONK is still down 33.5% from its all-time high of $0.000045, reached on March 4.

Bonk, a meme coin that rose to prominence in 2023, has contributed significantly to Solana’s value increase amid the meme coin frenzy.

Bonk started out as a simple dog-themed coin. It has since expanded its features to include integration with decentralized finance. The project also partners with cross-chain communication protocols, NFT marketplaces, and various other cryptocurrency ecosystems.

BONK trading pairs are now listed on major exchanges including Binance, Coinbase, OKX, and Bitstamp.

The big losers

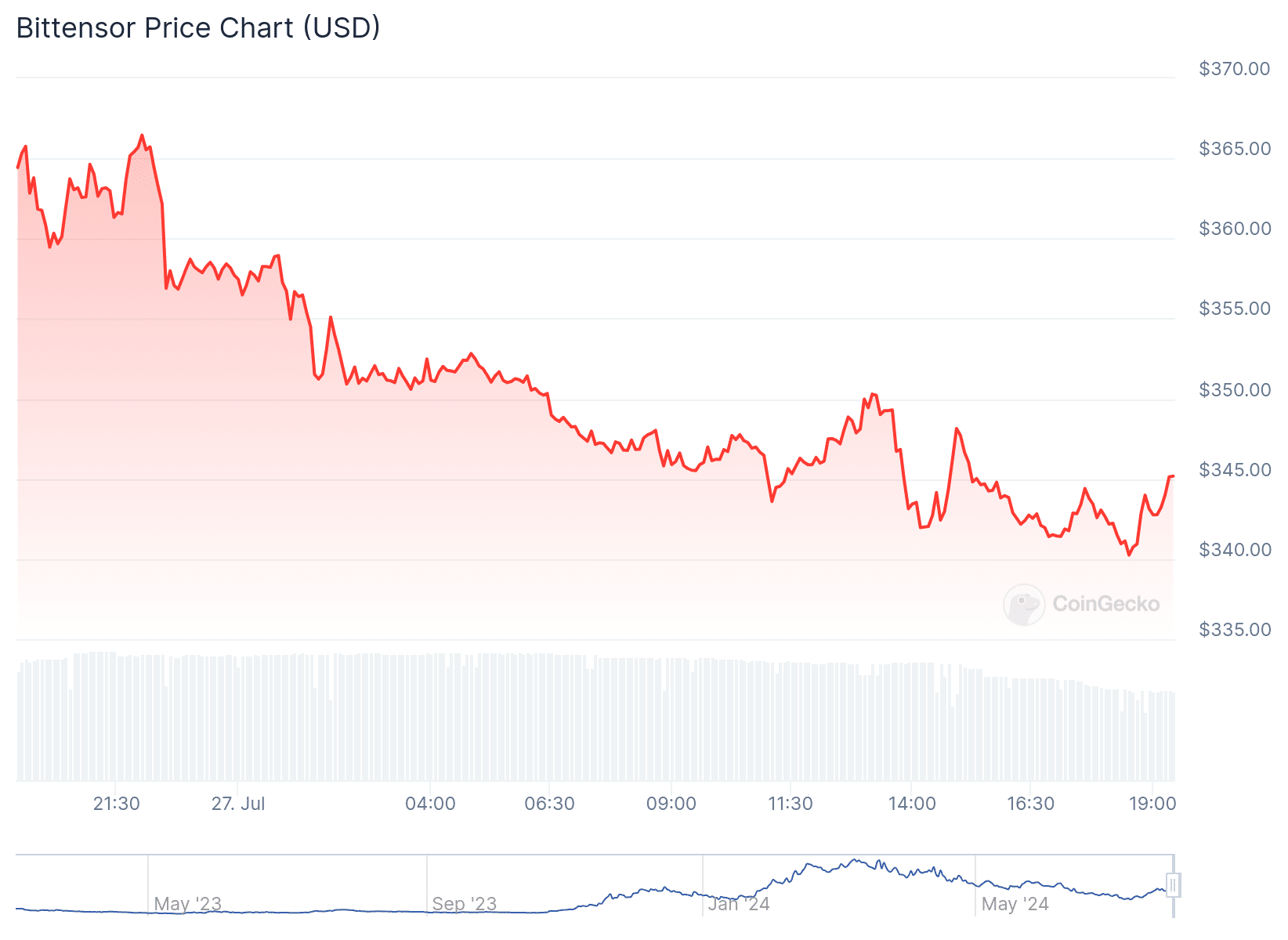

Bittensor

Bittensor (TAO) was the biggest loser among the 100 largest crypto assets, according to data from CoinGecko.

At the time of writing, TAO, the native token of decentralized AI project Bittensor, was down 5%, trading around $344. The crypto asset had a daily trading volume of $59 million and a market cap of $2.43 billion.

TAO 24 Hour Price Chart | Source: CoinGecko

Bittensor, created in 2019 by AI researchers Ala Shaabana and Jacob Steeves, initially operated as a parachain on Polkadot before transitioning to its own layer-1 blockchain in March 2023.

Mantra

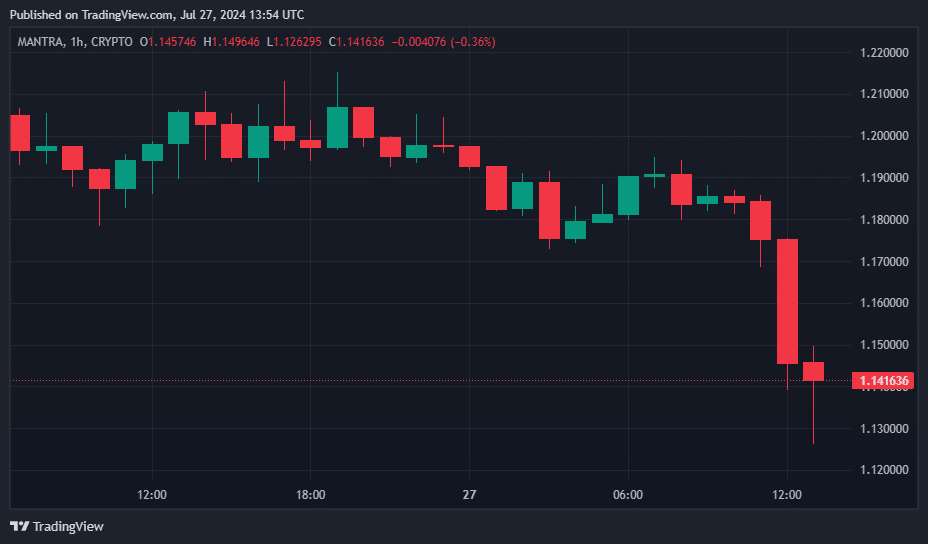

Mantra (OM) fell 6%, trading at $1.13 at press time. The digital currency’s market cap fell to $938 million. Additionally, the 82nd largest crypto asset has a daily trading volume of $26 million.

OM Price Hourly Chart, July 26-27 | Source: crypto.news

Mantra is a modular blockchain network comprising two chains, Manta Pacific and Manta Atlantic, specialized in zero-knowledge applications.

Coat

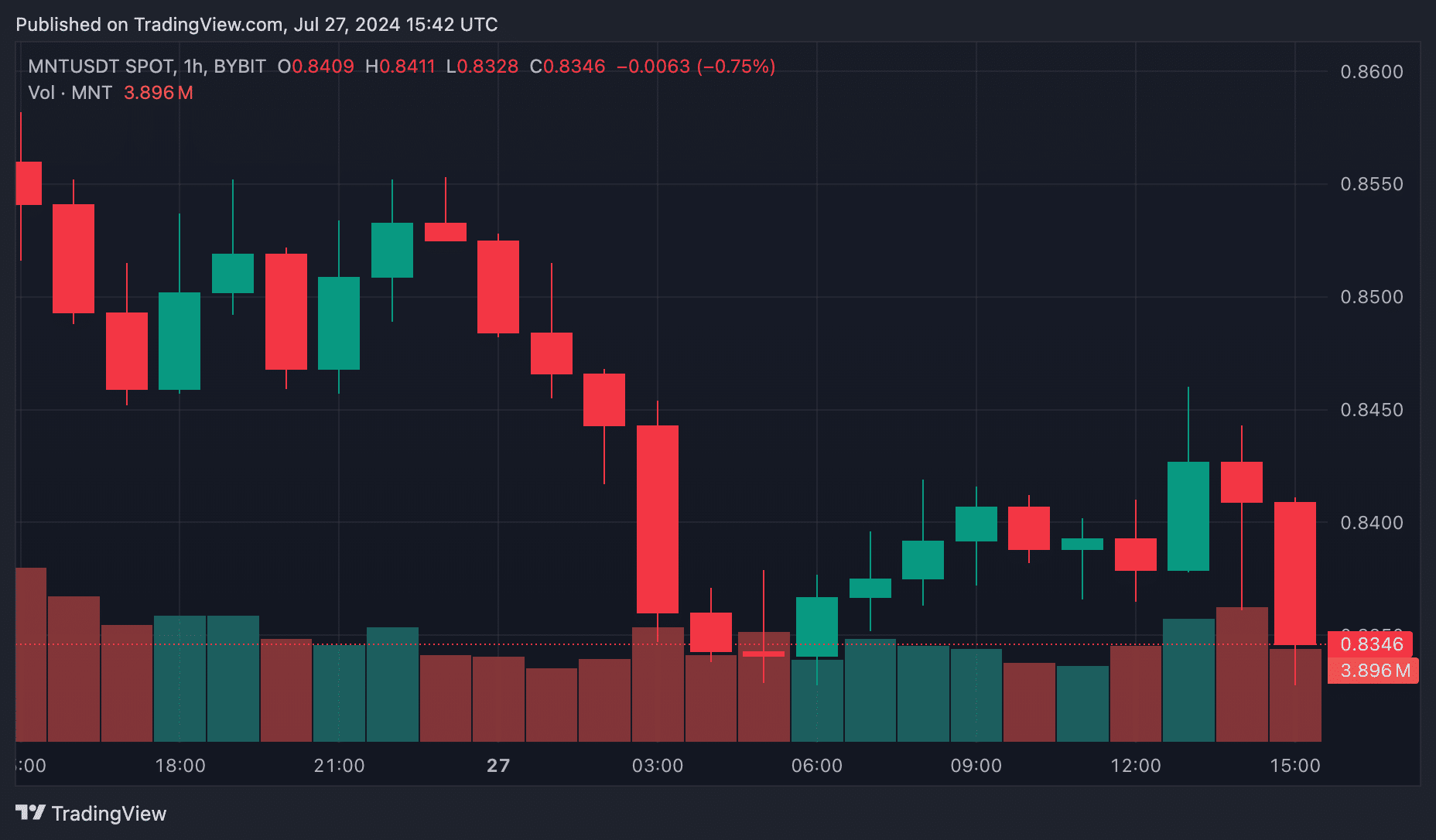

Coat (MNT) also saw a 2.4% drop in price, now trading at $0.8413. Currently, Mantle has a market cap of around $2.75 billion, which ranks 36th in the global cryptocurrency rankings by market cap, according to price data from crypto.news.

MNT Hourly Price Chart, July 26-27 | Source: crypto.news

Over the past 24 hours, MNT trading volume also fell by 6%, reaching $240 million.

Mantle, formerly known as BitDAO, is an investment DAO closely associated with Bybit. The MNT token is essential for governance, paying gas fees on the Mantle network, and staking on various platforms.

Built on the Ethereum network, Mantle provides a platform for decentralized application developers to launch their projects. It has become particularly popular for GameFi applications, leading to the formation of an internal Web3 gaming team.

Markets

Bitcoin Price Drops to $67,000 Despite Trump’s Pro-Crypto Comments, Further Correction Ahead?

Pioneer cryptocurrency Bitcoin has registered a 1.13% decline in the past 24 hours to trade at $67,400. Despite a strong pro-crypto stance from US presidential candidate Donald Trump at the Bitcoin 2024 conference, this massive selloff has raised concerns in the market about the asset’s sustainability at a higher price. However, given the recent three-week rally, a slight pullback this weekend is justifiable and necessary to regain the depleted bullish momentum.

Bitcoin Price Flag Formation Hints at Opportunity to Break Beyond $80,000

The medium-term trend Bitcoin Price remains a sideways trend amidst the formation of a bullish flag pattern. This chart pattern is defined by two descending lines that are currently shaping the price trajectory by providing dynamic resistance and support.

On July 5, BTC saw a bullish reversal from the flag pattern at $53,485, increasing its asset by 29.75% to a high of $69,400. This recent spike followed the market’s positive sentiment towards the Donald Trump speech at the Bitcoin 2024 conference in Nashville on Saturday afternoon.

Bitcoin Price | Tradingview

In his speech, Trump outlined several pro-crypto initiatives: he promised to replace SEC Chairman Gary Gensler on his first day in office, to establish a Strategic National Reserve of Bitcoin if elected, to ensure that the U.S. government holds all of its assets. Bitcoin assets and block any attempt to create a central bank digital currency (CBDC) during his presidency.

He also claimed that under his leadership, Bitcoin and cryptocurrencies will skyrocket like never before.

Despite Donald Trump’s optimistic promises, the BTC price failed to reach $70,000 and is currently trading at $67,400. As a result, Bitcoin’s market cap has dipped slightly to hover at $1.335 trillion.

However, this pullback is justified, as Bitcoin price has recently seen significant growth over the past three weeks, which has significantly improved market sentiment. Thus, price action over the weekend could replenish the depleted bullish momentum, potentially strengthening an attempt to break out from the flag pattern at $70,130.

A successful breakout will signal the continuation of the uptrend and extend the Bitcoin price forecast target at $78,000, followed by $84,000.

On the other hand, if the supply pressure on the upper trendline persists, the asset price could trigger further corrections for a few weeks or months.

Technical indicator:

- Pivot levels: The traditional pivot indicator suggests that the price pullback could see immediate support at $64,400, followed by a correction floor at $56,700.

- Moving average convergence-divergence: A bullish crossover state between the MACD (blue) and the signal (orange) ensure that the recovery dynamics are intact.

Related Articles

Frequently Asked Questions

A CBDC is a digital form of fiat currency issued and regulated by a country’s central bank. It aims to provide a digital alternative to traditional banknotes.

The proposal for a strategic national Bitcoin reserve is a major confirmation of Bitcoin’s legitimacy and potential as a reserve asset. Such a move could position Bitcoin in a similar way to gold, potentially stabilizing its price and encouraging other countries to adopt similar strategies.

Conferences like Bitcoin 2024 serve as essential platforms for networking, knowledge sharing, and showcasing new technologies within the cryptocurrency industry.

Markets

Swiss crypto bank Sygnum reports profitability after surge in first-half trading volumes – DL News

- Sygnum says it has reached profitability after increasing transaction volumes.

- The Swiss crypto bank does not disclose specific profit figures.

Sygnum, a Swiss global crypto banking group with approximately $4.5 billion in client assets, announced that it has achieved profitability after a strong first half, with key metrics showing year-to-date growth.

The company said in a Press release Compared to the same period last year, cryptocurrency spot trading volumes doubled, cryptocurrency derivatives trading increased by 500%, and lending volumes increased by 360%. The exact figures for the first half of the year were not disclosed.

Sygnum said its staking service has also grown, with the percentage of Ethereum staked by customers increasing to 42%. For institutional clients, staking Ethereum has a benefit that goes beyond the limitations of the ETF framework, which excludes staking returns, Sygnum noted.

“The approval and launch of Bitcoin and Ethereum ETFs was a turning point for the crypto industry this year, leading to a major increase in demand for trusted, regulated exposure to digital assets,” said Martin Burgherr, Chief Client Officer of Sygnum.

He added: “This is also reflected in Sygnum’s own growth, with our core business segments recording significant year-to-date growth in the first half of the year.”

Sygnum, which has also been licensed in Luxembourg since 2022, plans to expand into European and Asian markets, the statement said.

Markets

Former White House official Anthony Scaramucci says cryptocurrency bull market could be sparked by regulatory clarity

Anthony Scaramucci, founder of Skybridge Capital, says the next cryptocurrency bull market could be sparked by a new wave of clear cryptocurrency regulations.

In a new interview On CNBC’s Squawk Box, the former White House communications director said he and two other prominent industry figures traveled to Washington, D.C. to speak to officials about the dangers of Sen. Elizabeth Warren and U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler’s hardline approach to cryptocurrency regulation.

“Mark Cuban, myself, and Michael Novogratz were in Washington a few weeks ago to speak with White House officials and explain the dangers of Gary Gensler and Elizabeth Warren’s anti-crypto approach. I hope that message gets through…

“Overall, if we can get regulatory policy around Bitcoin and crypto assets in sync, we will have a bull market next year for these assets.”

Scaramucci then compares crypto assets to ride-hailing company Uber, saying regulators were initially wary of the service but eventually decided to adopt clear guidelines due to public demand.

“Remember Uber: Nobody wanted Uber. A lot of regulators didn’t want it. Mayors and deputy mayors didn’t want it, but citizens wanted Uber and eventually accepted the idea of regulating it fairly. I think we’re there now.”

The CEO also says young Democratic voters believe their leaders are making the wrong choices when it comes to digital assets.

“I think President Trump’s move toward Bitcoin and crypto assets has shaken Democrats to their core, and I think very smart, younger Democrats are recognizing that they are completely off base with their positions, completely off base with these SEC lawsuits and regulation by law enforcement, and now they need to get back to the center.”

Don’t miss a thing – Subscribe to receive email alerts directly to your inbox

Check Price action

follow us on X, Facebook And Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed on The Daily Hodl are not investment advice. Investors should do their own due diligence before making any high-risk investments in Bitcoin, cryptocurrencies or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Image generated: Midjourney

-

Videos4 weeks ago

Videos4 weeks agoAbsolutely massive: the next higher Bitcoin leg will shatter all expectations – Tom Lee

-

News12 months ago

News12 months agoVolta Finance Limited – Director/PDMR Shareholding

-

News12 months ago

News12 months agoModiv Industrial to release Q2 2024 financial results on August 6

-

News12 months ago

News12 months agoApple to report third-quarter earnings as Wall Street eyes China sales

-

News12 months ago

News12 months agoNumber of Americans filing for unemployment benefits hits highest level in a year

-

News1 year ago

News1 year agoInventiva reports 2024 First Quarter Financial Information¹ and provides a corporate update

-

News1 year ago

News1 year agoLeeds hospitals trust says finances are “critical” amid £110m deficit

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Hit $100 Billion in 2024, Fueling Insane Investor Optimism ⋆ ZyCrypto

-

Videos1 year ago

Videos1 year ago$1,000,000 worth of BTC in 2025! Get ready for an UNPRECEDENTED PRICE EXPLOSION – Jack Mallers

-

Videos1 year ago

Videos1 year agoABSOLUTELY HUGE: Bitcoin is poised for unabated exponential growth – Mark Yusko and Willy Woo

-

Tech1 year ago

Tech1 year agoBlockDAG ⭐⭐⭐⭐⭐ Review: Is It the Next Big Thing in Cryptocurrency? 5 questions answered