Markets

Cryptocurrency Basics: Pros, Cons and How It Works

In this article we cover:

What is cryptocurrency?

Cryptocurrency (or “crypto”) is a digital currency, such as Bitcoin, that is used as an alternative payment method or speculative investment. Cryptocurrencies get their name from the cryptographic techniques that let people spend them securely without the need for a central government or bank.

-

Bitcoin was initially developed primarily to be a form of payment that isn’t controlled or distributed by a central bank. While financial institutions have traditionally been necessary to verify that a payment has been processed successfully, Bitcoin accomplishes this securely, without that central authority.

-

Ethereum uses the same underlying technology as Bitcoin, but instead of strictly peer-to-peer payments, the cryptocurrency is used to pay for transactions on the Ethereum network. This network, built on the Ethereum blockchain, enables entire financial ecosystems to operate without a central authority. To visualize this, think insurance without the insurance company, or real estate titling without the title company.

-

Scores of altcoins (broadly defined as any cryptocurrency other than Bitcoin) arose to capitalize on the various — and at times promising — use cases for blockchain technology.

Advertisement

| NerdWallet rating

NerdWallet’s ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities. 4.9 /5 |

NerdWallet rating

NerdWallet’s ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities. 5.0 /5 |

NerdWallet rating

NerdWallet’s ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities. 5.0 /5 |

|

Fees $0 per online equity trade |

Fees $0 per trade for online U.S. stocks and ETFs |

Fees $0.005 per share; as low as $0.0005 with volume discounts |

|

Promotion None no promotion available at this time |

Promotion None no promotion available at this time |

Promotion Exclusive! US resident opens a new IBKR Pro individual or joint account receives 0.25% rate reduction on margin loans. Tiers apply. |

Why do people invest in cryptocurrencies?

People invest in cryptocurrencies for the same reason anyone invests in anything. They hope its value will rise, netting them a profit.

If demand for Bitcoin grows, for example, the interplay of supply and demand could push up its value.

If people began using Bitcoin for payments on a huge scale, demand for Bitcoin would go up, and in turn, its price in dollars would increase. So, if you’d purchased one Bitcoin before that increase in demand, you could theoretically sell that one Bitcoin for more U.S. dollars than you bought it for, making a profit.

The same principles apply to Ethereum. “Ether” is the cryptocurrency of the Ethereum blockchain, where developers can build financial apps without the need for a third-party financial institution. Developers must use Ether to build and run applications on Ethereum, so theoretically, the more that is built on the Ethereum blockchain, the higher the demand for Ether.

However, it’s important to note that to some, cryptocurrencies aren’t investments at all. Bitcoin enthusiasts, for example, hail it as a much-improved monetary system over our current one and would prefer we spend and accept it as everyday payment. One common refrain — “one Bitcoin is one Bitcoin” — underscores the view that Bitcoin shouldn’t be measured in USD, but rather by the value it brings as a new monetary system.

Why is Bitcoin still popular?

Since its inception, Bitcoin has been regularly derided as dead, worthless or a scam, in part because its price is prone to meteoric rises and dramatic falls. When Bitcoin’s price rose to $60,000 in 2021 before collapsing to around $17,000 in 2022, many experts and investors said it wouldn’t recover from this burst.

But it did, hitting a series of record highs in early 2024. Those surges in price could be partially be attributed to approval by the SEC of spot Bitcoin ETFs in Jan. 2024. This gave some of the largest asset managers in the world (think Fidelity and BlackRock) a way to offer their clients exposure to Bitcoin, making it easier for those clients to hold Bitcoin in accounts such as IRAs and taxable brokerage accounts.

But Bitcoin’s 2024 price rise is also due to other factors. Every four years, something known as “Bitcoin halving” occurs. The most recent halving occurred in April 2024, cutting the mining reward from 6.25 to 3.125. The anticipation of fewer Bitcoins entering the market drives up the price.

What’s more, the surge in interest rates in 2022 that pummeled growth stocks may have had a similar influence on Bitcoin; investors tend to prefer security over volatility during times of uncertainty. But as talk of interest rate cuts in 2024 circulates, some investors may have more appetite for risky assets like Bitcoin, leading them to get back in now.

And lastly, there are still Bitcoin enthusiasts who preach that looking at Bitcoin through the lens of fiat currencies like the U.S. dollar or Great British pound is missing the point entirely, and that its true value lies in being a new monetary system.

But, if there’s anything about Bitcoin that appears to be predictable, it’s that it will continue to be volatile. In the relative short-term, both camps are likely right: Bitcoin will rise and Bitcoin will fall. But at the moment, it appears the Bitcoin bulls are winning out.

How does cryptocurrency work?

Cryptocurrencies are supported by a technology known as blockchain, which maintains a tamper-resistant record of transactions and keeps track of who owns what. The use of blockchains addressed a problem faced by previous efforts to create purely digital currencies: preventing people from making copies of their holdings and attempting to spend it twice[0].

Individual units of cryptocurrencies can be referred to as coins or tokens, depending on how they are used. Some are intended to be units of exchange for goods and services, others are stores of value, and some can be used to participate in specific software programs such as games and financial products.

How are cryptocurrencies created?

One common way cryptocurrencies are created is through a process known as mining, which is used by Bitcoin. Bitcoin mining can be an energy-intensive process in which computers solve complex puzzles in order to verify the authenticity of transactions on the network. As a reward, the owners of those computers can receive newly created cryptocurrency. Other cryptocurrencies use different methods to create and distribute tokens, and many have a significantly lighter environmental impact.

For most people, the easiest way to get cryptocurrency is to buy it, either from an exchange or another user.

Why are there so many kinds of cryptocurrency?

It’s important to remember that Bitcoin is different from cryptocurrency in general. While Bitcoin is the first and most valuable cryptocurrency, the market is large.

There are more than two million different cryptocurrencies in existence, according to CoinMarketCap.com, a market research website[0]. And while some cryptocurrencies have total market valuations in the hundreds of billions of dollars, others are obscure and essentially worthless.

If you’re thinking about getting into cryptocurrency, it can be helpful to start with one that is commonly traded and relatively well-established in the market. These coins typically have the largest market capitalizations.

Thoughtfully selecting your cryptocurrency, however, is no guarantee of success in such a volatile space. Sometimes, an issue in the deeply interconnected crypto industry can spill out and have broad implications on asset values.

For instance, in November of 2022 the market took a major hit as the cryptocurrency exchange FTX struggled to deal with liquidity issues amid a spike in withdrawals. As the fallout spread, cryptocurrencies both large and small saw their values plummet.

Are cryptocurrencies financial securities, like stocks?

Whether or not cryptocurrency is a security is a bit of a gray area right now. To back up a little, generally, a “security” in finance is anything that represents a value and can be traded. Stocks are securities because they represent ownership in a public company. Bonds are securities because they represent a debt owed to the bondholder. And both of these securities can be traded on public markets.

Regulators are increasingly starting to signal cryptocurrencies should be regulated similarly to other securities, such as stocks and bonds. But this take is receiving pushback; scholars, legal firms and some of the biggest players in the crypto industry have argued against this, claiming the rules that apply to stocks and bonds, for example, don’t apply as broadly to cryptocurrencies.

The Securities and Exchange Commission has set its sights on the sector generally. The agency has raised concerns about activities including crypto staking, and well as the operations of some large crypto companies.

Whether the SEC will treat cryptocurrencies, or specific types of cryptocurrencies, as securities will be at the forefront of crypto regulation, and could have major implications for the asset class in the near future.

Pros and cons of cryptocurrency

Cryptocurrency inspires passionate opinions across the spectrum of investors. Here are a few reasons that some people believe it is a transformational technology, while others worry it’s a fad.

Cryptocurrency pros

-

Some supporters like the fact that cryptocurrency removes central banks from managing the money supply since over time these banks tend to reduce the value of money via inflation.

-

In communities that have been underserved by the traditional financial system, some people see cryptocurrencies as a promising foothold. Pew Research Center data from 2021 found that Asian, Black and Hispanic people “are more likely than White adults to say they have ever invested in, traded or used a cryptocurrency[0].”

-

Other advocates like the blockchain technology behind cryptocurrencies, because it’s a decentralized processing and recording system and can be more secure than traditional payment systems.

-

Some cryptocurrencies offer their owners the opportunity to earn passive income through a process called staking. Crypto staking involves using your cryptocurrencies to help verify transactions on a blockchain protocol. Though staking has its risks, it can allow you to grow your crypto holdings without buying more.

Cryptocurrency cons

-

Many cryptocurrency projects are untested, and blockchain technology in general has yet to gain wide adoption. If the underlying idea behind cryptocurrency does not reach its potential, long-term investors may never see the returns they hoped for.

-

For shorter-term crypto investors, there are other risks. Its prices tend to change rapidly, and while that means that many people have made money quickly by buying in at the right time, many others have lost money by doing so just before a crypto crash.

-

Those wild shifts in value may also cut against the basic ideas behind the projects that cryptocurrencies were created to support. For example, people may be less likely to use Bitcoin as a payment system if they are not sure what it will be worth the next day.

-

The environmental impact of Bitcoin and other projects that use similar mining protocols is significant. A comparison by the University of Cambridge, for instance, said worldwide Bitcoin mining consumes more than twice as much power as all U.S. residential lighting[0]. Some cryptocurrencies use different technology that demands less energy.

-

Governments around the world have not yet fully reckoned with how to handle cryptocurrency, so regulatory changes and crackdowns have the potential to affect the market in unpredictable ways.

Track your finances all in one place

Get started by signing up and linking an account.

Cryptocurrency legal and tax issues

There’s no question that cryptocurrencies are legal in the U.S., though China has essentially banned their use, and ultimately whether they’re legal depends on each individual country.

The question of whether cryptocurrencies are legally allowed, however, is only one part of the legal question. Other things to consider include how crypto is taxed and what you can buy with cryptocurrency.

-

Legal tender: You might call them cryptocurrencies, but they differ from traditional currencies in one important way: there’s no requirement in most places that they be accepted as “legal tender.” The U.S. dollar, by contrast, must be accepted for “all debts, public and private.” Countries around the world are taking various approaches to cryptocurrency. For now, in the U.S., what you can buy with cryptocurrency depends on the preferences of the seller.

-

Crypto taxes: Again, the term “currency” is a bit of a red herring when it comes to taxes in the U.S. Cryptocurrencies are taxed as property, rather than currency. That means that when you sell them, you’ll pay tax on the capital gains, or the difference between the price of the purchase and sale. And if you’re given crypto as payment — or as a reward for an activity such as mining — you’ll be taxed on the value at the time you received them.

Your decision: Is cryptocurrency a good investment?

Cryptocurrency is a relatively risky investment, no matter which way you slice it. Generally speaking, high-risk investments should make up a small part of your overall portfolio — one common guideline is no more than 10%. You may want to look first to shore up your retirement savings, pay off debt or invest in less-volatile funds made up of stocks and bonds.

There are other ways to manage risk within your crypto portfolio, such as by diversifying the range of cryptocurrencies that you buy. Crypto assets may rise and fall at different rates, and over different time periods, so by investing in several different products you can insulate yourself — to some degree — from losses in one of your holdings.

Perhaps the most important thing when investing in anything is to do your homework. This is particularly important when it comes to cryptocurrencies, which are often linked to a specific technological product that is being developed or rolled out. When you buy a stock, it is linked to a company that is subject to well-defined financial reporting requirements, which can give you a sense of its prospects.

Cryptocurrencies, on the other hand, are more loosely regulated in the U.S., so discerning which projects are viable can be even more challenging. If you have a financial advisor who is familiar with cryptocurrency, it may be worth asking for input.

For beginning investors, it can also be worthwhile to examine how widely a cryptocurrency is being used. Most reputable crypto projects have publicly available metrics showing data such as how many transactions are being carried out on their platforms. If use of a cryptocurrency is growing, that may be a sign that it is establishing itself in the market. Cryptocurrencies also generally make “white papers” available to explain how they’ll work and how they intend to distribute tokens.

If you’re looking to invest in less established crypto products, here are some additional questions to consider:

-

Who’s heading the project? An identifiable and well-known leader is a positive sign.

-

Are there other major investors who are investing in it? It’s a good sign if other well-known investors want a piece of the currency.

-

Will you own a portion in the company or just currency or tokens? This distinction is important. Being a part owner means you get to participate in its earnings (you’re an owner), while buying tokens simply means you’re entitled to use them, like chips in a casino.

-

Is the currency already developed, or is the company looking to raise money to develop it? The further along the product, the less risky it is.

It can take a lot of work to comb through a prospectus; the more detail it has, the better your chances it’s legitimate. But even legitimacy doesn’t mean the currency will succeed. That’s an entirely separate question, and that requires a lot of market savvy. Be sure to consider how to protect yourself from fraudsters who see cryptocurrencies as an opportunity to bilk investors.

Frequently asked questions

How does a blockchain work?

Most cryptocurrencies are based on blockchain technology, a networking protocol through which computers can work together to keep a shared, tamper-proof record of transactions. The challenge in a blockchain network is in making sure that all participants can agree on the correct copy of the historical ledger. Without a recognized way to validate transactions, it would be difficult for people to trust that their holdings are secure. There are several ways of reaching “consensus” on a blockchain network, but the two that are most widely used are known as “proof of work” and “proof of stake.”

What does proof of work mean?

Proof of work is one way of incentivizing users to help maintain an accurate historical record of who owns what on a blockchain network. Bitcoin uses proof of work, which makes this method an important part of the crypto conversation. Blockchains rely on users to collate and submit blocks of recent transactions for inclusion in the ledger, and Bitcoin’s protocol rewards them for doing so successfully. This process is known as mining.

There is stiff competition for these rewards, so many users try to submit blocks, but only one can be selected for each new block of transactions. To decide who gets the reward, Bitcoin requires users to solve a difficult puzzle, which uses a huge amount of energy and computing power. The completion of this puzzle is the “work” in proof of work.

For lucky miners, the Bitcoin rewards are more than enough to offset the costs involved. But the huge upfront cost is also a way to discourage dishonest players. If you win the right to create a block, it might not be worth the risk of tampering with the records and having your submission thrown out — forfeiting the reward. In this instance, spending the money on energy costs in an attempt to tamper with the historical record would have resulted in significant loss.

Ultimately, the goal of proof of work is to make it more rewarding to play by the rules than to try to break them.

Proof of stake is another way of achieving consensus about the accuracy of the historical record of transactions on a blockchain. It eschews mining in favor of a process known as staking, in which people put some of their own cryptocurrency holdings at stake to vouch for the accuracy of their work in validating new transactions. Some of the cryptocurrencies that use proof of stake include Cardano, Solana and Ethereum (which is in the process of converting from proof of work).

Proof of stake systems have some similarities to proof of work protocols, in that they rely on users to collect and submit new transactions. But they have a different way of incentivizing honest behavior among those who participate in that process. Essentially, people who propose new blocks of information to be added to the record must put some cryptocurrency at stake. In many cases, your chances of landing a new block (and the associated rewards) go up as you put more at stake. People who submit inaccurate data can lose some of the money they’ve put at risk.

How do you mine cryptocurrency?

Mining cryptocurrency is generally only possible for a proof-of-stake cryptocurrency such as Bitcoin. And before you get too far, it is worth noting that the barriers to entry can be high and the probability of success relatively low without major investment.

While early Bitcoin users were able to mine the cryptocurrency using regular computers, the task has gotten more difficult as the network has grown. Now, most miners use special computers whose sole job is to run the complex calculations involved in mining all day every day. And even one of these computers isn’t going to guarantee you success. Many miners use entire warehouses full of mining equipment in their quest to collect rewards.

If you don’t have the resources to compete with the heavy hitters, one option is joining a mining pool, where users share rewards. This reduces the size of the reward you’d get for a successful block, but increases the chance that you could at least get some return on your investment.

How do you pull your money out of crypto?

Just like with buying cryptocurrencies, there are several options for converting your crypto holdings into cash. While decentralized exchanges and peer-to-peer transactions may be right for some investors, many choose to use centralized services to offload their holdings.

With a centralized exchange, the process is basically the reverse of buying. But one advantage if you own crypto is that you probably already have everything set up. Here are the steps:

-

Connect the wallet that holds the cryptocurrencies that you want to sell, and make sure the exchange you’ve chosen supports both that wallet and the asset in question.

-

Move your cryptocurrency onto the exchange.

-

Sell your cryptocurrency.

-

Transfer the proceeds back to your bank account.

Every exchange will handle such transactions differently, so you’ll want to look up the fees and processes for your specific provider. Also, remember that you may be creating crypto tax liability when you sell your digital assets.

How does a blockchain work?

Most cryptocurrencies are based on

blockchain technology

, a networking protocol through which computers can work together to keep a shared, tamper-proof record of transactions. The challenge in a blockchain network is in making sure that all participants can agree on the correct copy of the historical ledger. Without a recognized way to validate transactions, it would be difficult for people to trust that their holdings are secure. There are several ways of reaching “consensus” on a blockchain network, but the two that are most widely used are known as “proof of work” and “proof of stake.”

What does proof of work mean?

Proof of work

is one way of incentivizing users to help maintain an accurate historical record of who owns what on a blockchain network. Bitcoin uses proof of work, which makes this method an important part of the crypto conversation. Blockchains rely on users to collate and submit blocks of recent transactions for inclusion in the ledger, and Bitcoin’s protocol rewards them for doing so successfully. This process is known as mining.

There is stiff competition for these rewards, so many users try to submit blocks, but only one can be selected for each new block of transactions. To decide who gets the reward, Bitcoin requires users to solve a difficult puzzle, which uses a huge amount of energy and computing power. The completion of this puzzle is the “work” in proof of work.

For lucky miners, the Bitcoin rewards are more than enough to offset the costs involved. But the huge upfront cost is also a way to discourage dishonest players. If you win the right to create a block, it might not be worth the risk of tampering with the records and having your submission thrown out — forfeiting the reward. In this instance, spending the money on energy costs in an attempt to tamper with the historical record would have resulted in significant loss.

Ultimately, the goal of proof of work is to make it more rewarding to play by the rules than to try to break them.

» Learn more:

How does Bitcoin work?

What is proof of stake?

Proof of stake

is another way of achieving consensus about the accuracy of the historical record of transactions on a blockchain. It eschews mining in favor of a process known as staking, in which people put some of their own cryptocurrency holdings at stake to vouch for the accuracy of their work in validating new transactions. Some of the cryptocurrencies that use proof of stake include Cardano, Solana and Ethereum (which is in the process of converting from proof of work).

Proof of stake systems have some similarities to proof of work protocols, in that they rely on users to collect and submit new transactions. But they have a different way of incentivizing honest behavior among those who participate in that process. Essentially, people who propose new blocks of information to be added to the record must put some cryptocurrency at stake. In many cases, your chances of landing a new block (and the associated rewards) go up as you put more at stake. People who submit inaccurate data can lose some of the money they’ve put at risk.

How do you mine cryptocurrency?

Mining cryptocurrency is generally only possible for a proof-of-stake cryptocurrency such as Bitcoin. And before you get too far, it is worth noting that the barriers to entry can be high and the probability of success relatively low without major investment.

While early Bitcoin users were able to mine the cryptocurrency using regular computers, the task has gotten more difficult as the network has grown. Now, most miners use special computers whose sole job is to run the complex calculations involved in mining all day every day. And even one of these computers isn’t going to guarantee you success. Many miners use entire warehouses full of mining equipment in their quest to collect rewards.

If you don’t have the resources to compete with the heavy hitters, one option is joining a mining pool, where users share rewards. This reduces the size of the reward you’d get for a successful block, but increases the chance that you could at least get some return on your investment.

How do you pull your money out of crypto?

Just like with buying cryptocurrencies, there are several options for converting your crypto holdings into cash. While decentralized exchanges and peer-to-peer transactions may be right for some investors, many choose to use centralized services to offload their holdings.

With a centralized exchange, the process is basically the reverse of buying. But one advantage if you own crypto is that you probably already have everything set up. Here are the steps:

-

Connect the wallet that holds the cryptocurrencies that you want to sell, and make sure the exchange you’ve chosen supports both that wallet and the asset in question.

-

Move your cryptocurrency onto the exchange.

-

Sell your cryptocurrency.

-

Transfer the proceeds back to your bank account.

Every exchange will handle such transactions differently, so you’ll want to look up the fees and processes for your specific provider. Also, remember that you may be creating

crypto tax

liability when you sell your digital assets.

Markets

Today’s top crypto gainers and losers

Over the past 24 hours, Jupiter and JasmyCoin emerged as the top gainers among the top 100 crypto assets, while Bittensor and Mantra plunged as the top losers.

Top Winners

Jupiter

Jupiter (JUP) led the charge among the biggest gainers on July 27.

At the time of writing, the crypto asset had surged 12.6% in the past 24 hours and was trading at $1.16. JUP’s daily trading volume was hovering around $282 million, according to data from crypto.news.

JUP Hourly Price Chart, July 26-27 | Source: crypto.news

Additionally, the cryptocurrency’s market cap stood at $1.56 billion, making it the 62nd largest crypto asset, according to CoinGecko. Despite the recent price surge, the token is still down 42.6% from its all-time high of $2 reached on Jan. 31.

Jupiter functions as a decentralized exchange aggregator that allows users to trade Solana-based tokens. The platform also offers users the best routes for direct trades between multiple exchanges and liquidity pools.

In addition to being a DEX aggregator, Jupiter has expanded into a “full stack ecosystem” by launching several new projects, including a dedicated pool to support perpetual trading and plans for a stablecoin.

JasmyCoin

JasmyCoin (JASMI) has increased by 12% in the last 24 hours and is trading at $0.0328 at press time. JASMY’s daily trading volume has increased by 10% in the last 24 hours, reaching $146 million.

JASMY Hourly Price Chart, July 26-27 | Source: crypto.news

The asset’s market cap has surpassed the $1.5 billion mark, making it the 60th largest cryptocurrency at the time of reporting. However, the self-proclaimed “Bitcoin of Japan” is still down 99.3% from its all-time high of $4.79 on February 16, 2021.

JASMY is the native token of Jasmy Corporation, a Japanese Internet of Things provider. The platform seeks to merge the decentralization of blockchain technology with IoT, allowing users to convert their digital information into digital assets.

The initiative was launched by Kunitake Ando, former COO of Sony Corporation, along with Kazumasa Sato, former CEO of Sony Style.com Japan Inc., Hiroshi Harada, executive financial analyst at KPMG, and other senior executives from Japan.

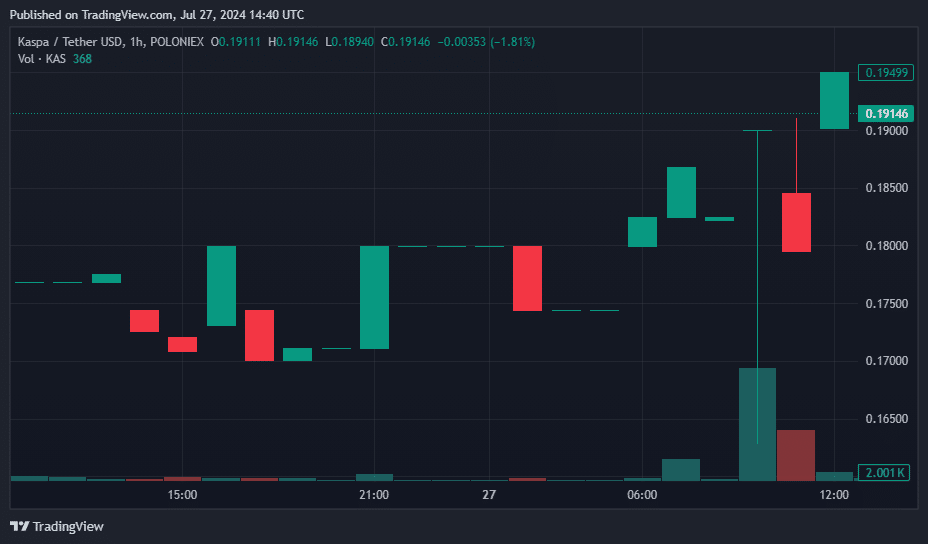

Kaspa

Kaspa (KAS) saw a 100% increase in trading volume and an 8% increase in price over the past 24 hours, trading at $0.19 at the time of publication.

KAS Hourly Price Chart, July 26-27 | Source: crypto.news

According to data from CoinGecko, Kaspa now ranks 27th in the global cryptocurrency list, with a circulating supply of approximately 24.29 billion KAS tokens and a market capitalization of $4.59 billion.

Kaspa is a cryptocurrency designed to deliver a high-performance, scalable, and secure blockchain platform. Its unique Layer-1 protocol includes the GhostDAG protocol, a proof-of-work (PoW) consensus mechanism that enables faster block times and higher transaction throughput compared to standard blockchains.

Unlike Bitcoin, GhostDAG allows multiple blocks to be created simultaneously, speeding up transactions and increasing block rewards for miners.

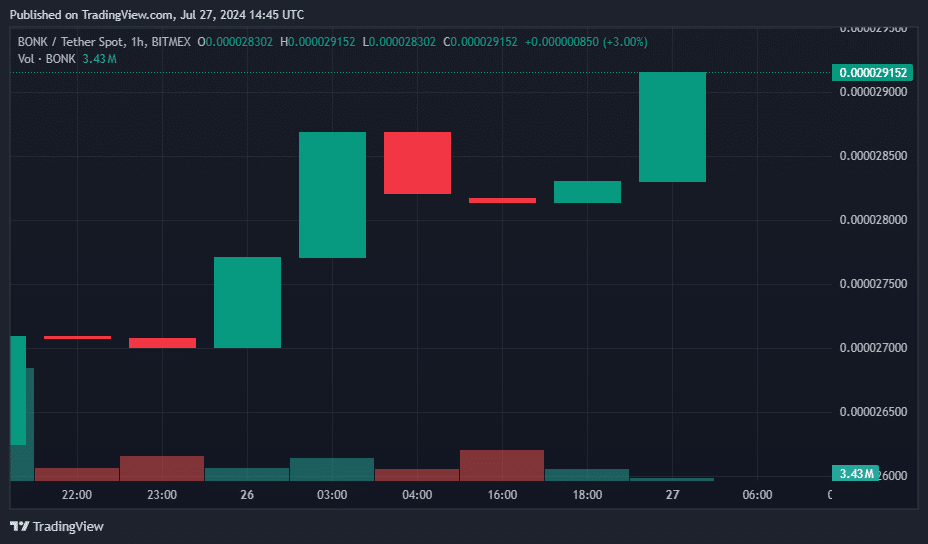

Bonk

Bonk (BONK) is the only one coin meme which made it to this list of biggest gainers and jumped 8.6% in the last 24 hours. Trading at $0.000030, the Solana-based meme coin’s market cap has surpassed $2.1 billion, surpassing Floki (FLOKI), another competing dog-themed coin with a market cap of $1.78 billion.

BONK Hourly Price Chart, July 26-27 | Source: crypto.news

BONK’s daily trading volume hovered around $285 million. However, BONK is still down 33.5% from its all-time high of $0.000045, reached on March 4.

Bonk, a meme coin that rose to prominence in 2023, has contributed significantly to Solana’s value increase amid the meme coin frenzy.

Bonk started out as a simple dog-themed coin. It has since expanded its features to include integration with decentralized finance. The project also partners with cross-chain communication protocols, NFT marketplaces, and various other cryptocurrency ecosystems.

BONK trading pairs are now listed on major exchanges including Binance, Coinbase, OKX, and Bitstamp.

The big losers

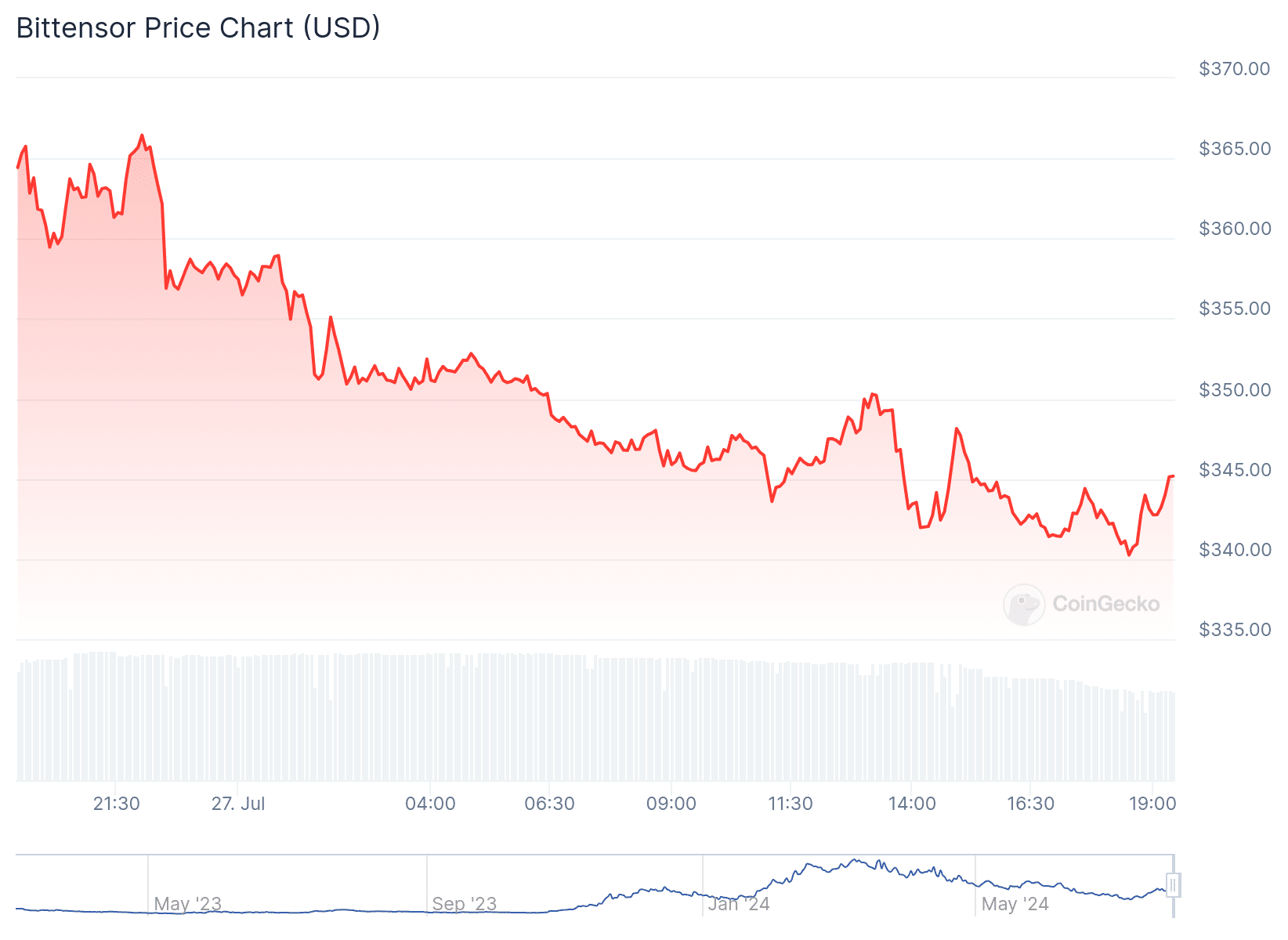

Bittensor

Bittensor (TAO) was the biggest loser among the 100 largest crypto assets, according to data from CoinGecko.

At the time of writing, TAO, the native token of decentralized AI project Bittensor, was down 5%, trading around $344. The crypto asset had a daily trading volume of $59 million and a market cap of $2.43 billion.

TAO 24 Hour Price Chart | Source: CoinGecko

Bittensor, created in 2019 by AI researchers Ala Shaabana and Jacob Steeves, initially operated as a parachain on Polkadot before transitioning to its own layer-1 blockchain in March 2023.

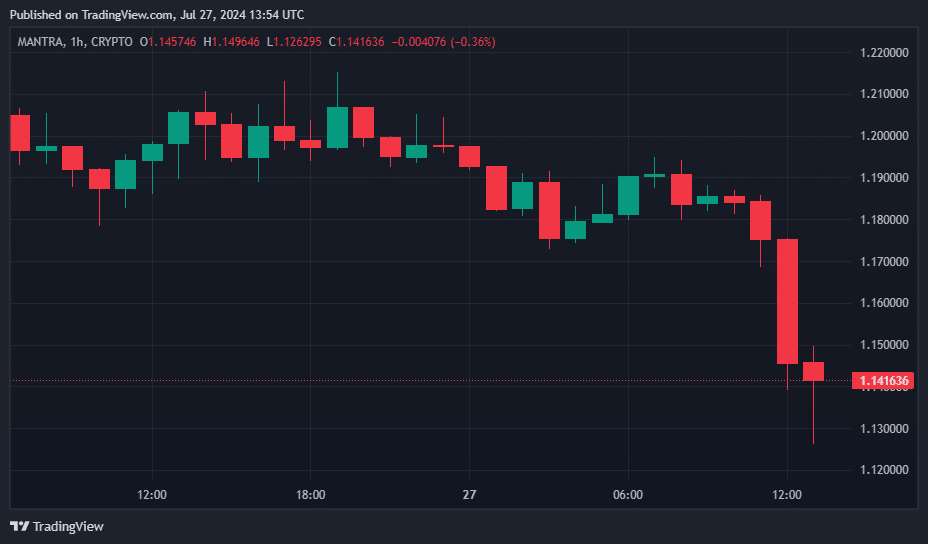

Mantra

Mantra (OM) fell 6%, trading at $1.13 at press time. The digital currency’s market cap fell to $938 million. Additionally, the 82nd largest crypto asset has a daily trading volume of $26 million.

OM Price Hourly Chart, July 26-27 | Source: crypto.news

Mantra is a modular blockchain network comprising two chains, Manta Pacific and Manta Atlantic, specialized in zero-knowledge applications.

Coat

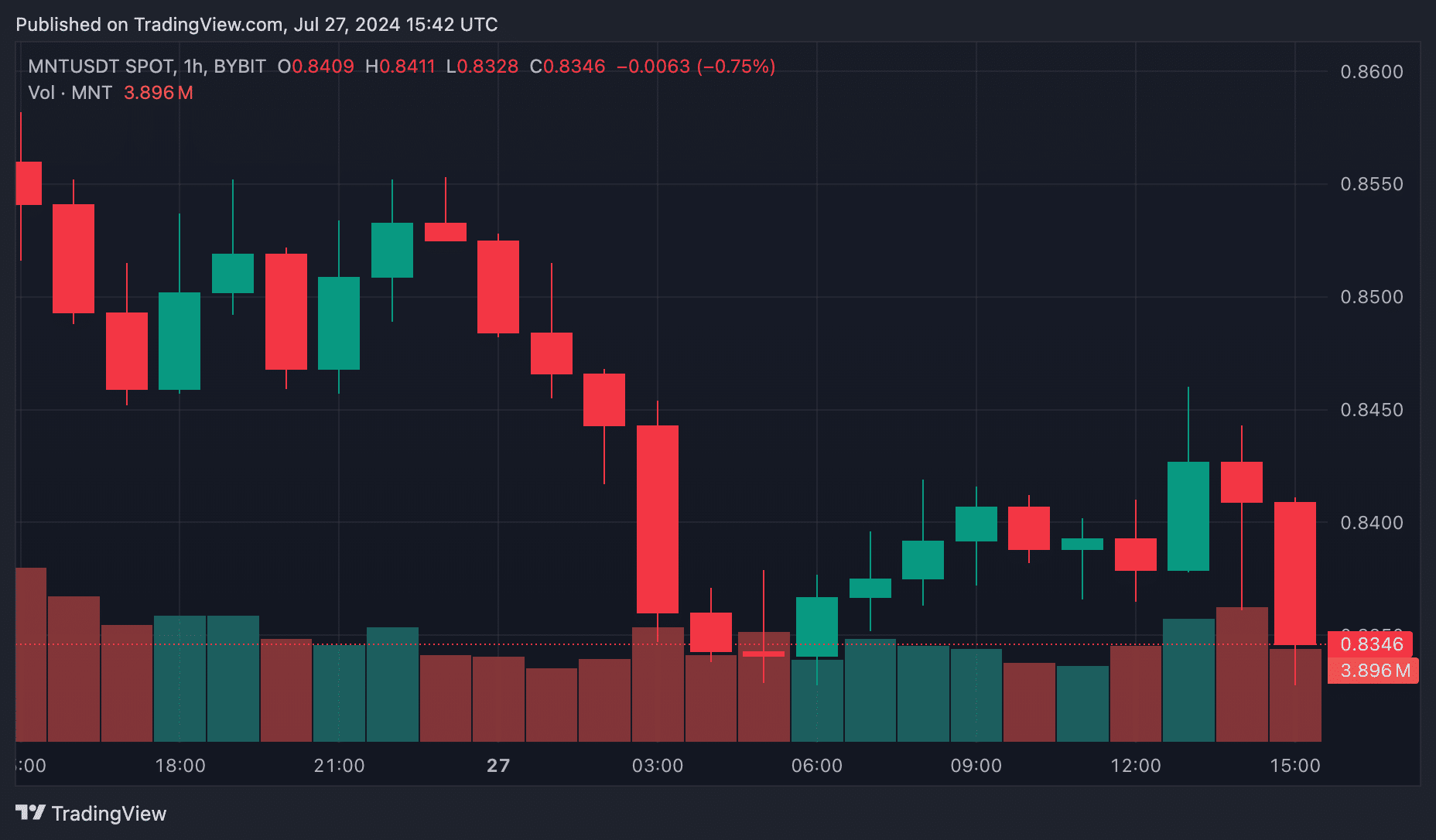

Coat (MNT) also saw a 2.4% drop in price, now trading at $0.8413. Currently, Mantle has a market cap of around $2.75 billion, which ranks 36th in the global cryptocurrency rankings by market cap, according to price data from crypto.news.

MNT Hourly Price Chart, July 26-27 | Source: crypto.news

Over the past 24 hours, MNT trading volume also fell by 6%, reaching $240 million.

Mantle, formerly known as BitDAO, is an investment DAO closely associated with Bybit. The MNT token is essential for governance, paying gas fees on the Mantle network, and staking on various platforms.

Built on the Ethereum network, Mantle provides a platform for decentralized application developers to launch their projects. It has become particularly popular for GameFi applications, leading to the formation of an internal Web3 gaming team.

Markets

Bitcoin Price Drops to $67,000 Despite Trump’s Pro-Crypto Comments, Further Correction Ahead?

Pioneer cryptocurrency Bitcoin has registered a 1.13% decline in the past 24 hours to trade at $67,400. Despite a strong pro-crypto stance from US presidential candidate Donald Trump at the Bitcoin 2024 conference, this massive selloff has raised concerns in the market about the asset’s sustainability at a higher price. However, given the recent three-week rally, a slight pullback this weekend is justifiable and necessary to regain the depleted bullish momentum.

Bitcoin Price Flag Formation Hints at Opportunity to Break Beyond $80,000

The medium-term trend Bitcoin Price remains a sideways trend amidst the formation of a bullish flag pattern. This chart pattern is defined by two descending lines that are currently shaping the price trajectory by providing dynamic resistance and support.

On July 5, BTC saw a bullish reversal from the flag pattern at $53,485, increasing its asset by 29.75% to a high of $69,400. This recent spike followed the market’s positive sentiment towards the Donald Trump speech at the Bitcoin 2024 conference in Nashville on Saturday afternoon.

Bitcoin Price | Tradingview

In his speech, Trump outlined several pro-crypto initiatives: he promised to replace SEC Chairman Gary Gensler on his first day in office, to establish a Strategic National Reserve of Bitcoin if elected, to ensure that the U.S. government holds all of its assets. Bitcoin assets and block any attempt to create a central bank digital currency (CBDC) during his presidency.

He also claimed that under his leadership, Bitcoin and cryptocurrencies will skyrocket like never before.

Despite Donald Trump’s optimistic promises, the BTC price failed to reach $70,000 and is currently trading at $67,400. As a result, Bitcoin’s market cap has dipped slightly to hover at $1.335 trillion.

However, this pullback is justified, as Bitcoin price has recently seen significant growth over the past three weeks, which has significantly improved market sentiment. Thus, price action over the weekend could replenish the depleted bullish momentum, potentially strengthening an attempt to break out from the flag pattern at $70,130.

A successful breakout will signal the continuation of the uptrend and extend the Bitcoin price forecast target at $78,000, followed by $84,000.

On the other hand, if the supply pressure on the upper trendline persists, the asset price could trigger further corrections for a few weeks or months.

Technical indicator:

- Pivot levels: The traditional pivot indicator suggests that the price pullback could see immediate support at $64,400, followed by a correction floor at $56,700.

- Moving average convergence-divergence: A bullish crossover state between the MACD (blue) and the signal (orange) ensure that the recovery dynamics are intact.

Related Articles

Frequently Asked Questions

A CBDC is a digital form of fiat currency issued and regulated by a country’s central bank. It aims to provide a digital alternative to traditional banknotes.

The proposal for a strategic national Bitcoin reserve is a major confirmation of Bitcoin’s legitimacy and potential as a reserve asset. Such a move could position Bitcoin in a similar way to gold, potentially stabilizing its price and encouraging other countries to adopt similar strategies.

Conferences like Bitcoin 2024 serve as essential platforms for networking, knowledge sharing, and showcasing new technologies within the cryptocurrency industry.

Markets

Swiss crypto bank Sygnum reports profitability after surge in first-half trading volumes – DL News

- Sygnum says it has reached profitability after increasing transaction volumes.

- The Swiss crypto bank does not disclose specific profit figures.

Sygnum, a Swiss global crypto banking group with approximately $4.5 billion in client assets, announced that it has achieved profitability after a strong first half, with key metrics showing year-to-date growth.

The company said in a Press release Compared to the same period last year, cryptocurrency spot trading volumes doubled, cryptocurrency derivatives trading increased by 500%, and lending volumes increased by 360%. The exact figures for the first half of the year were not disclosed.

Sygnum said its staking service has also grown, with the percentage of Ethereum staked by customers increasing to 42%. For institutional clients, staking Ethereum has a benefit that goes beyond the limitations of the ETF framework, which excludes staking returns, Sygnum noted.

“The approval and launch of Bitcoin and Ethereum ETFs was a turning point for the crypto industry this year, leading to a major increase in demand for trusted, regulated exposure to digital assets,” said Martin Burgherr, Chief Client Officer of Sygnum.

He added: “This is also reflected in Sygnum’s own growth, with our core business segments recording significant year-to-date growth in the first half of the year.”

Sygnum, which has also been licensed in Luxembourg since 2022, plans to expand into European and Asian markets, the statement said.

Markets

Former White House official Anthony Scaramucci says cryptocurrency bull market could be sparked by regulatory clarity

Anthony Scaramucci, founder of Skybridge Capital, says the next cryptocurrency bull market could be sparked by a new wave of clear cryptocurrency regulations.

In a new interview On CNBC’s Squawk Box, the former White House communications director said he and two other prominent industry figures traveled to Washington, D.C. to speak to officials about the dangers of Sen. Elizabeth Warren and U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler’s hardline approach to cryptocurrency regulation.

“Mark Cuban, myself, and Michael Novogratz were in Washington a few weeks ago to speak with White House officials and explain the dangers of Gary Gensler and Elizabeth Warren’s anti-crypto approach. I hope that message gets through…

“Overall, if we can get regulatory policy around Bitcoin and crypto assets in sync, we will have a bull market next year for these assets.”

Scaramucci then compares crypto assets to ride-hailing company Uber, saying regulators were initially wary of the service but eventually decided to adopt clear guidelines due to public demand.

“Remember Uber: Nobody wanted Uber. A lot of regulators didn’t want it. Mayors and deputy mayors didn’t want it, but citizens wanted Uber and eventually accepted the idea of regulating it fairly. I think we’re there now.”

The CEO also says young Democratic voters believe their leaders are making the wrong choices when it comes to digital assets.

“I think President Trump’s move toward Bitcoin and crypto assets has shaken Democrats to their core, and I think very smart, younger Democrats are recognizing that they are completely off base with their positions, completely off base with these SEC lawsuits and regulation by law enforcement, and now they need to get back to the center.”

Don’t miss a thing – Subscribe to receive email alerts directly to your inbox

Check Price action

follow us on X, Facebook And Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed on The Daily Hodl are not investment advice. Investors should do their own due diligence before making any high-risk investments in Bitcoin, cryptocurrencies or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Image generated: Midjourney

-

News11 months ago

News11 months agoVolta Finance Limited – Director/PDMR Shareholding

-

News11 months ago

News11 months agoModiv Industrial to release Q2 2024 financial results on August 6

-

News11 months ago

News11 months agoApple to report third-quarter earnings as Wall Street eyes China sales

-

News11 months ago

News11 months agoNumber of Americans filing for unemployment benefits hits highest level in a year

-

News1 year ago

News1 year agoInventiva reports 2024 First Quarter Financial Information¹ and provides a corporate update

-

News1 year ago

News1 year agoLeeds hospitals trust says finances are “critical” amid £110m deficit

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Hit $100 Billion in 2024, Fueling Insane Investor Optimism ⋆ ZyCrypto

-

Tech1 year ago

Tech1 year agoBitcoin’s Correlation With Tech Stocks Is At Its Highest Since August 2023: Bloomberg ⋆ ZyCrypto

-

Tech1 year ago

Tech1 year agoEverything you need to know

-

News11 months ago

News11 months agoStocks wobble as Fed delivers and Meta bounces

-

News11 months ago

News11 months agoHutchinson House and Senate Candidates Report Finances Ahead of Election