DeFi

Deciphering DeFi App Development Costs, Types & Features

The current financial system, with its inefficiencies, high fees, limited accessibility, and lack of transparency, often leaves significant portions of the global population, especially in underbanked areas, at a disadvantage. Decentralized finance (DeFi) emerges as a solution to these issues, utilizing blockchain technology to remove intermediaries, thereby reducing costs and enhancing security. This shift towards DeFi offers a more inclusive, transparent, and efficient financial ecosystem, aiming to better serve and integrate wider segments of society.

Given the transformative impact of decentralized finance (DeFi), developing a DeFi app is a strategic move for stakeholders aiming to innovate in the financial sector. The development process involves multiple stages, including ideation, technical design, coding, testing, and deployment.

The DeFi app development cost varies depending on the overall platform complexity and the specific features required. It’s crucial for FinTech businesses to understand these details so as to effectively navigate the future of finance and capitalize on DeFi’s potential to create a more inclusive and efficient system. On average, the cost of building a decentralized app can range from $40,000 to $500,000 or more.

In this blog, we will deeply delve into the factors influencing DeFi application development costs, exploring the decentralized app’s various types, features, development process, and the challenges involved.

But first let’s begin with how a decentralized finance app works!

How a DeFi App Works

A DeFi (Decentralized Finance) app uses blockchain technology and smart contracts to facilitate financial transactions without relying on traditional intermediaries. The users engage with the app through an intuitive interface, conducting transactions such as lending, borrowing, or trading digital assets. These transactions are automatically executed by smart contracts, self-executing agreements programmed in code.

Once initiated, transactions are verified by nodes on the blockchain network and permanently recorded on the blockchain, ensuring transparency and immutability. This streamlined process enhances financial operations, lowers costs, and improves accessibility.

The adoption of DeFi applications has surged due to their exponential market growth. According to a report by Grand View Research, the total value locked in the DeFi market is expected to surpass $231.19 billion by 2030.

This expansion is propelled by the rising demand for decentralized financial services, the growing use of blockchain technology, and the potential for substantial investment returns. As the DeFi ecosystem progresses and becomes more sophisticated, it is poised to become a major player in the future of finance, providing innovative solutions and challenging traditional financial systems.

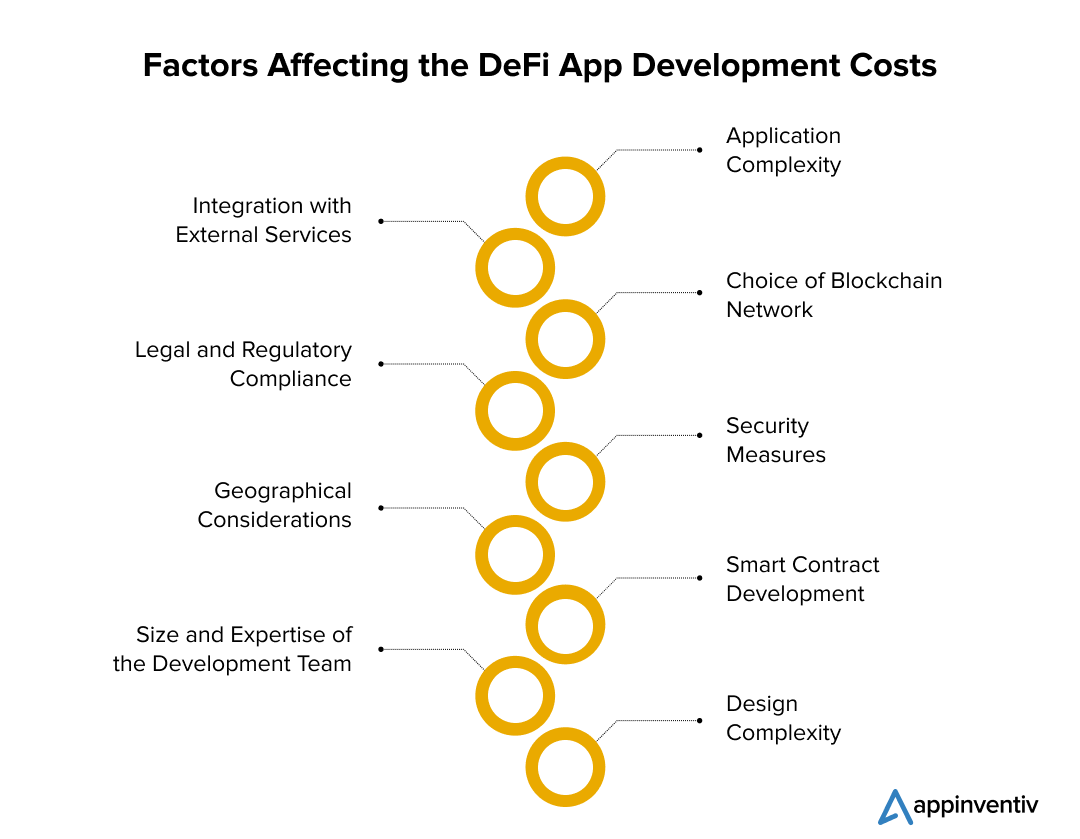

Factors Affecting Decentralized Finance App Development Costs

Developing a DeFi app involves various considerations that can impact the overall cost. These include the app’s feature set, security measures, and the selected blockchain platform. Additionally, the expertise of the development team and the need for ongoing maintenance play significant roles in determining the overall decentralized finance app development cost. Let’s have a detailed look at the factors.

Application Complexity

The DeFi app development cost increases with the complexity of its features and functionalities. Complications can arise from adopting complex smart contracts, combining several blockchain networks, or creating intricate financial tools. Furthermore, the application’s complexity may rise if sophisticated tokenomics and decentralized governance methods are included.

These intricacies frequently necessitate more involved testing, development, and auditing procedures, which drives up expenses. Moreover, additional work may be involved in integrating with current DeFi protocols or ecosystems since it could be necessary to ensure smooth compatibility and conform to current standards.

Choice of Blockchain Network

The selection of a blockchain network, such as Ethereum, Binance Smart Chain, or Polkadot, may impact the DeFi application development cost. Certain blockchain networks might incur higher costs or require more extensive labor for integration services. Additionally, factors such as scalability, security, and community support of the blockchain network significantly impact the development cost.

For example, Ethereum’s popularity can result in increased fees and resource competition, while emerging networks like Polkadot might offer more affordable alternatives but demand more integration time. Thus, the chosen network’s ecosystem and the available development tools also play a vital role in determining the overall decentralized finance app development costs.

Security Measures

Security is crucial in DeFi applications but thorough security controls, audits, and testing usually increase the decentralized finance app development cost. Furthermore, the protection of user assets and data depends on implementing sophisticated security mechanisms like multi-signature wallets, secure coding techniques, and frequent security audits by third-parties.

Also, adding decentralized governance systems and integrating with decentralized identification solutions might improve security but may also raise the DeFi application development costs. Furthermore, the development process may become more complicated and expensive to ensure adherence to legal standards and security best practices.

Also Read: How Blockchain is Revolutionizing Mobile App Security

Smart Contract Development

Smart contracts are the foundation of DeFi apps. The complexity and number of smart contracts needed for the app will impact costs. Furthermore, as well-written contracts can lower transaction fees and enhance overall performance, the effectiveness and optimization of smart contracts might also impact the DeFi app development cost.

Integration with pre-existing smart contracts or protocols can also affect the development budget because it might need to be modified or customized to meet the unique needs of the DeFi app. Furthermore, it is important to ensure the security and reliability of smart contracts by conducting thorough testing and auditing procedures, which may raise the cost to build a DeFi app.

Also Read: How to Create Cardano Smart Contracts?

Design Complexity

DeFi apps require a well-thought-out and intuitive interface. UI/UX design expenditures may raise the overall DeFi platform development costs. Moreover, adding interactive components, user-friendly navigation, and flexible design might improve user engagement, but they might also need more time and money for development.

Additionally, while conducting usability testing and user research to enhance the UI/UX design may be costly, however, the investment will lead to more successful and user-friendly DeFi software.

Integration with External Services

The decentralized finance app development costs may rise due to the need for integration with external services, such as decentralized oracles for external data feeds. Furthermore, the DeFi development process may become more complex and expensive if external payment gateways or decentralized identity solutions like safe user authentication or fiat onramps are included.

Furthermore, the DeFi app’s functionality can be improved by integrating with external services for features like automated trading, asset management, or lending protocols, but doing so might involve more work and resources in the development process.

In addition, it is imperative to ensure the reliability and safety of external service integrations using comprehensive testing and auditing procedures. Although these are essential, they can still lead to elevated development expenses.

Legal and Regulatory Compliance

Ensuring the DeFi development process complies with all applicable rules and regulations, including KYC/AML standards, can be more challenging and costly. Moreover, adding a layer of complexity to assure compliance with data protection rules by implementing privacy-enhancing technology, including zero-knowledge proofs, may raise the DeFi app development costs.

Post-development costs may also rise due to ongoing monitoring and adjustments needed to comply with evolving regulatory requirements. The total cost of creating a DeFi app also includes legal advice and documentation needed to guarantee adherence to global compliances and standards.

Geographical Considerations

When considering the cost of developing a DeFi app, it’s essential to note that hiring developers from nations like the US or the UK can incur higher labor costs. In contrast, opting for developers from countries like India can offer cost optimization without compromising on quality. India has a big talent pool of skilled DeFi developers proficient in blockchain technology and smart contract development.

By tapping and hiring this skilled talent pool, businesses can ensure high-quality work while managing development costs. This approach optimizes expenses and provides access to a skilled workforce capable of delivering advanced DeFi solutions.

Size and Expertise of the Development Team

The development team’s size and expertise can greatly affect the cost of building a decentralized app. Highly experienced DeFi developers with expertise in multiple blockchain technologies may demand higher fees.

Furthermore, sophisticated projects could require a larger development team, which raises costs. Typically, a DeFi app development team includes blockchain developers, smart contract developers, front-end and back-end developers, UI/UX designers, and quality assurance testers. A skilled and experienced team, however, can ensure a faster development cycle and superior results, often justifying the additional costs through enhanced efficiency and quality.

Also Read: How to Hire a Dedicated Development Team?

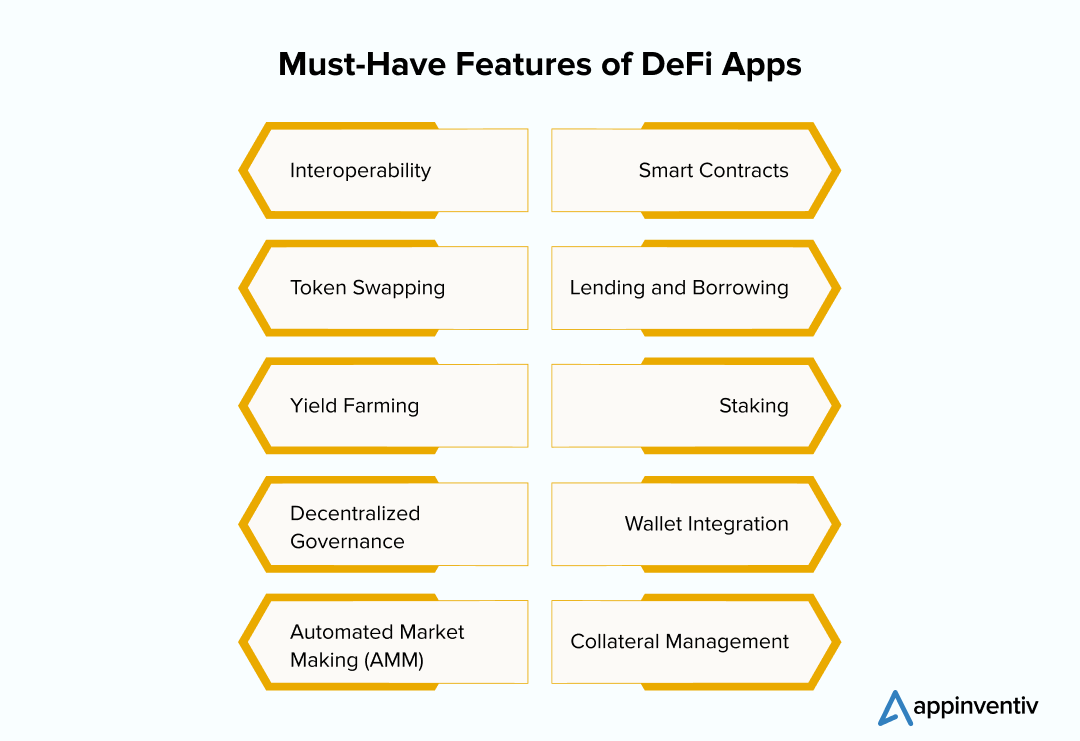

Core Characteristic Features of DeFi Apps

DeFi applications have various features that distinguish them in the FinTech world. These features of DeFi app improve functionality, security, and user experience, making them essential tools for decentralized finance. Let’s look at some of the top DeFi features.

- Interoperability: Integration with various DeFi platforms and blockchains for seamless functionality.

- Smart Contracts: Executes automated transactions based on predefined conditions without human intervention.

- Token Swapping: Facilitates direct exchanges between different cryptocurrencies.

- Lending and Borrowing: Users can leverage automated, decentralized processes to lend or borrow digital assets.

- Yield Farming: Provides rewards to users who supply liquidity to DeFi protocols.

- Staking: Enables users to lock up their assets to support network operations and earn returns.

- Decentralized Governance: Empowers users to participate in platform decision-making through voting mechanisms.

- Wallet Integration: Connects seamlessly with various crypto wallets for easy asset management and transactions.

- Automated Market Making (AMM): Utilizes algorithms to provide liquidity and set trading prices in decentralized pools.

- Collateral Management: Monitors and manages collateral assets for securing loans and other financial activities.

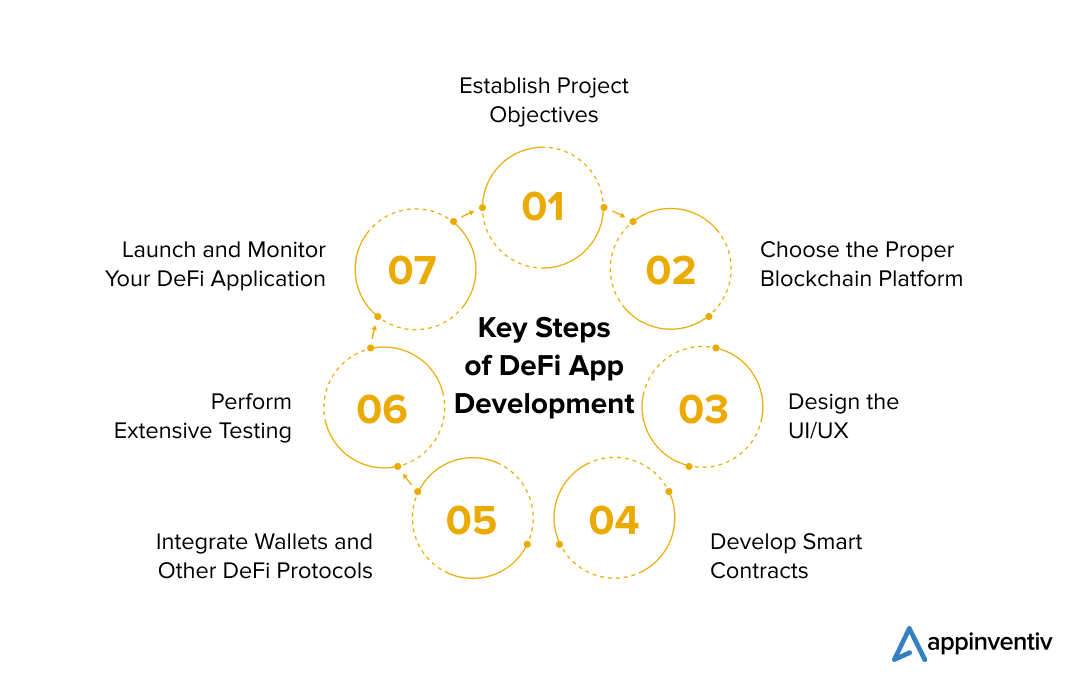

Essential Stages of DeFi App Development

DeFi app development involves several essential steps, including setting clear project goals, choosing an appropriate blockchain platform, designing a user-friendly interface, and developing secure smart contracts. This structured approach ensures the development of a reliable and effective application that caters to user needs. Let’s have a look at the key steps involved in the DeFi development process in detail below.

Establish Project Objectives

First, ensure your DeFi app’s goal and the features are well established. This could entail yield farming, lending, borrowing, or decentralized exchanges. Conduct in-depth market research to determine your target market and the app’s distinct value proposition.

Create a thorough project roadmap that outlines the stages of development and includes reasonable deadlines. Before the DeFi development process starts, interact with potential users to get their feedback and improve the concept of your app.

Choose a Proper Blockchain Platform

Decide on a blockchain platform that complements your project’s objectives. Ethereum, Binance Smart Chain, and Polkadot are well-liked options. When making your choice, take into account elements like developer community support, scalability, security, and transaction speed.

Analyze the transaction costs as well as the tools and libraries available to make development on the selected platform easier. In addition, consider the blockchain platform’s governance structure and long-term viability to ensure it can support your project’s growth.

Design the UI/UX

Develop a user-friendly interface, emphasizing intuitive design, seamless interaction, and accessibility. Utilize wireframes to visualize the user journey and gather feedback prior to development.

Incorporate user feedback and perform usability testing to enhance the UI/UX, ensuring it meets user expectations and addresses any challenges. Iterate on the design feedback to create an engaging and user-centric experience.

Develop Smart Contracts

In the development stage, you need to clearly define the contract’s terms & conditions and then implement them using blockchain programming languages like Solidity. Include strong error handling and security measures to protect against vulnerabilities. Conduct comprehensive testing, such as unit, integration, and real-world scenario tests.

Have security professionals audit the smart contracts to identify and address any issues. After successful testing and auditing, deploy the smart contracts to the blockchain to ensure they are secure and fully functional.

Integrate Wallets and Other DeFi Protocols

Ensure your application is compatible with well-known cryptocurrency wallets such as Coinbase Wallet, Trust Wallet, and MetaMask. To improve your app’s functionality, you can integrate different DeFi protocols, including liquidity pools or Oracle services, for real-time data.

To safeguard user wallets and data, utilize secure authentication and encryption techniques. Perform extensive testing to guarantee smooth integration and functionality with different wallets and protocols.

Perform Extensive Testing

Conduct thorough testing to verify and confirm the functionality of your DeFi app. Begin with unit testing to ensure individual components work correctly, followed by integration testing to verify the interactions between these components. Perform regular security audits to detect and address vulnerabilities, ensuring your app is secure. Promptly address any issues to guarantee a smooth launch and a seamless user experience.

Launch and Monitor Your DeFi Application

After completing testing, it’s time to launch your DeFi app on the selected blockchain platform. Consider launching a beta version to gather feedback and make any necessary final adjustments. Provide consistent updates and support to address issues and improve functionality over time. Monitor user feedback and app performance to ensure ongoing success. Establish channels for community engagement to gather feedback, enhance user experience, and cultivate a loyal user base over time.

Additionally, it’s crucial to consider app maintenance, as it can significantly impact the overall DeFi app development cost. Maintenance costs typically include hosting fees, ongoing development work for updates and enhancements, and customer support expenses.

Also Read: What is the Cost of Maintaining an App in 2024?

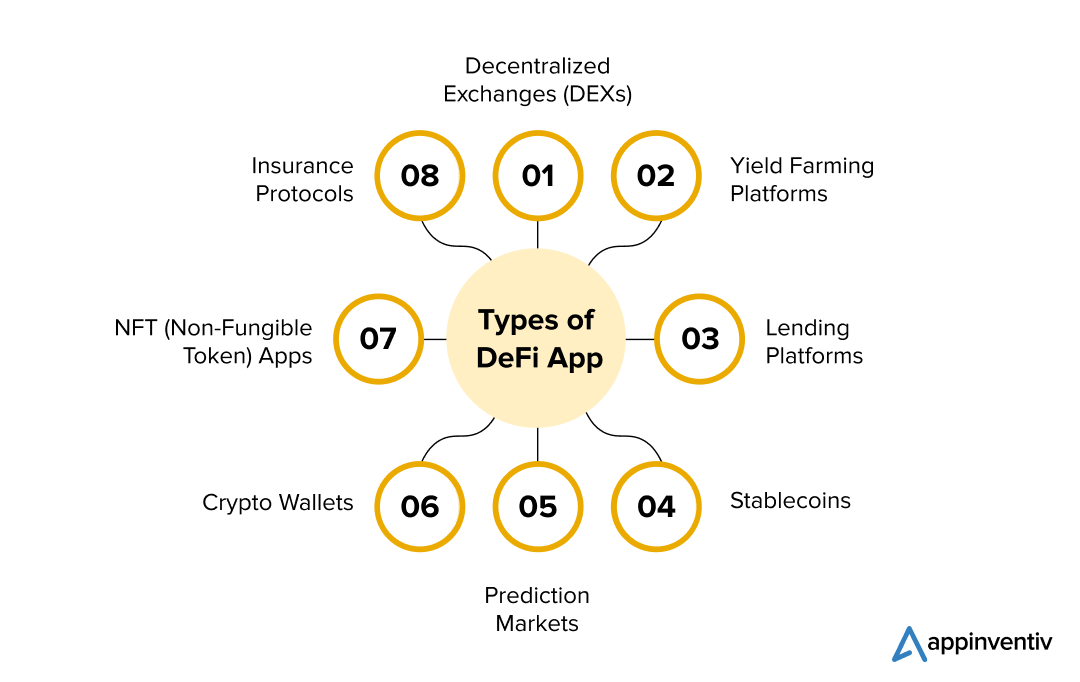

A Brief Overview on the Types of DeFi Apps You Can Consider Building

DeFi applications are transforming the financial sector by providing decentralized solutions that boost accessibility, transparency, and security. These decentralized finance applications offer cutting-edge financial services, enabling users to manage their assets and transactions independently. Let’s check out some of the top DeFi app types.

Decentralized Exchanges (DEXs)

Unlike centralized exchanges, decentralized exchanges (DEXs) give customers more control and privacy over their money while enabling them to trade cryptocurrencies straight from their wallets. They accomplish this by using smart contracts, which make trade easier and eliminate the need for a reliable third party.

Yield Farming Platforms

Yield farming platforms encourage users to contribute liquidity to DeFi protocols by offering them more tokens or interest. These sites allow users to generate passive income from their cryptocurrency holdings. For instance, Curve Finance focuses on stablecoin trading and liquidity provision, with low slippage and costs, whereas Yearn Finance is recognized for optimizing yield farming tactics across many protocols.

Lending Platforms

DeFi lending platforms enable users to earn interest on their cryptocurrency holdings by lending them to borrowers, who can utilize the funds for diverse purposes. These platforms leverage smart contracts to directly automate the lending and borrowing processes, removing the necessity for conventional financial intermediaries.

Aave, Compound, and MakerDAO are prominent examples, each offering unique features such as a diverse range of lending assets, algorithmic interest rates, and stablecoin issuance through collateralized debt positions (CDPs).

Stablecoins

Stablecoins are digital currencies that are intended to reduce price volatility by maintaining a fixed value and being correlated with a stable asset, usually the US dollar. While USDC is a controlled stablecoin produced by a consortium that includes Coinbase and Circle, both of which are extensively utilized for lending and trading in the DeFi ecosystem, DAI is a decentralized stablecoin issued by MakerDAO.

Prediction Markets

Prediction markets are online platforms that leverage blockchain technology to let users wager on the results of future events such as financial markets, sporting events, and elections. Notable instances of decentralized prediction markets are Augur and Gnosis, which allow users to purchase and sell shares in the results of events, with the market price indicating the likelihood of event occurrence.

Crypto Wallets

Crypto wallets are digital tools that securely store, manage, and facilitate cryptocurrency transactions. They support various cryptocurrencies and often provide functions for token transfers and conversions. Trust Wallet, for example, is Binance’s official exchange wallet, allowing users to buy and stake cryptocurrencies, store NFT tokens, and use a dApp browser for decentralized exchange transactions.

Also Read: How to Build an App Like Exodus Cryptocurrency Wallet?

NFT (Non-Fungible Token) Apps

Blockchain-based applications like NFT (Non-Fungible Token) let users generate, purchase, sell, and exchange NFTs. These apps help digital artists, musicians, game developers, and other creators establish ownership in the digital space by tokenizing their creations. NBA Top Shot, Rarible, and OpenSea are well-known NFT marketplaces.

Insurance Protocols

Insurance protocols such as Cover Protocol, Nexus Mutual, and Unslashed Finance offer decentralized solutions for risks like smart contract failures and hacks in blockchain and cryptocurrency settings. These platforms use blockchain technology and smart contracts to provide transparent, automated, and community-governed insurance coverage, enhancing security and trust within the DeFi insurance ecosystem.

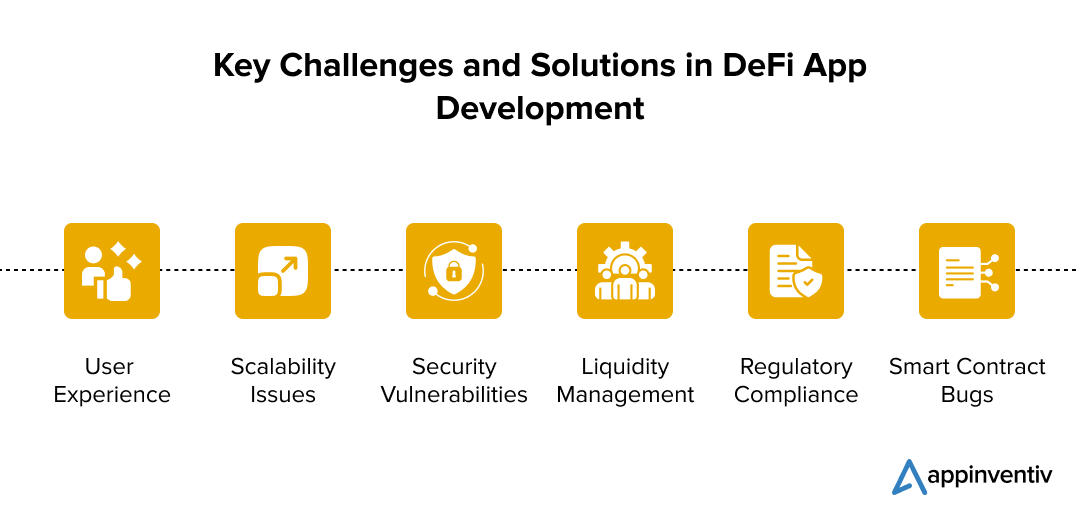

DeFi App Development: Common Challenges and Solutions

Developing DeFi applications involves overcoming various obstacles to ensure a successful launch and adoption. By implementing effective DeFi development strategies, businesses can address these challenges and create robust, user-friendly apps.

User Experience

DeFi apps can be complex and intimidating for new users, characterized by technical terminology, intricate interfaces, and the need to grasp complex concepts such as liquidity pools, yield farming, and securing digital wallets.

Focus on intuitive UI/UX design, provide clear instructions, and offer customer support to guide users through the app. Simplifying the onboarding process can enhance user experience.

Scalability Issues

High transaction volumes can often lead to complex network congestion and increased transaction fees.

Opt for scalable blockchain solutions or layer-2 scaling technologies such as sidechains or state channels. Exploring platforms with higher throughput can also mitigate scalability problems.

Security Vulnerabilities

DeFi apps are prime targets for cyberattacks due to the significant value they manage.

Conduct rigorous security audits, employ robust encryption techniques, and continuously monitor for vulnerabilities. Engaging third-party security tools can bolster the app’s security.

Also Read: How Does Blockchain Resolve Data Privacy and Security Issues for Businesses?

Liquidity Management

Ensuring sufficient liquidity for user transactions can be challenging, especially in the initial stages.

Attract liquidity providers through incentives and partnerships. Implementing automated market makers (AMMs) can help maintain liquidity.

Regulatory Compliance

Navigating the complex and ever-transforming intricate regulatory landscape can be challenging.

Stay informed about relevant regulations and work with legal experts to ensure compliance. Implementing compliance features within the app can help users adhere to local laws.

Smart Contract Bugs

Errors in smart contract code can lead to significant financial losses.

Implement thorough testing procedures, including unit tests and integration tests. Regular code reviews and third-party audits can help identify and fix potential issues before deployment.

Innovate in DeFi and Develop Your App with Appinventiv’s Expertise

Decentralized Finance applications are revolutionizing the traditional financial landscape, offering innovative solutions that are more accessible, transparent, and efficient. These apps have streamlined lending, borrowing, trading, and asset management, eliminating the need for traditional intermediaries.

The future of DeFi is promising, with anticipated expansion in decentralized exchanges, yield farming, and stablecoins. As the ecosystem matures, innovations such as cross-chain interoperability and enhanced security measures will likely drive further adoption and trust in decentralized financial solutions.

Appinventiv stands at the forefront of DeFi app development, offering expertise and experience in creating advanced solutions. With an elaborate understanding of blockchain technology and a solid record of developing secure and scalable DeFi applications, we are well-positioned to help you realize your DeFi app vision.

As a trusted blockchain software development company, we have established a great reputation for delivering exceptional results. Our extensive portfolio boasts over a thousand successful applications, including notable names such as Nova and Empire. Our remarkable 95% client satisfaction rating is a proof of our constant dedication to innovation and excellence in the DeFi app development process.

Are you prepared to transform your DeFi experience? Together, we can develop a state-of-the-art application that surpasses your expectations and caters to your particular demands.

Partner with us to tap into the potential of DeFi and shape the future of finance.

FAQs

Q. How much does it cost to develop a DeFi app?

A. The DeFi app development cost varies depending on a number of criteria, making it a potentially large investment. The intricacy of the application, encompassing its features and functionalities, is vital.

The cost of building a decentralized app with basic features can fall between $40,000 and $100,000. However, more complicated applications with additional features, such as decentralized exchanges or intricate lending protocols, can cost up to $500,000 or more. Connect with the best DeFi developers now to get the complete cost estimation.

Q. What are some of the top DeFi trends?

A. Some of the top DeFi trends include:

- Rise of Decentralized Exchanges (DEXs)

- Growth of decentralized lending platforms

- Emergence of yield farming and liquidity mining

- Development of decentralized stablecoins

- Integration of Non-Fungible Tokens (NFTs) into DeFi applications

Give this blog a quick read to learn more about the top DeFi trends of 2024.

Q. Which essential technology stack is utilized in the DeFi app development process?

A. DeFi technology stack usually comprises blockchain platforms like Ethereum, Binance Smart Chain, or Polkadot, which provide smart contract capabilities. Businesses can utilize languages such as Solidity for smart contract coding, web3.js for blockchain interaction, and frameworks like Truffle or Hardhat for smart contract testing and deployment.

Check out this blog to learn more about the fundamentals of blockchain programming languages.

Q. What is DeFi dApp development?

A. DeFi dApp development involves crafting decentralized applications (dApps) that provide financial services like lending, borrowing, trading, and asset management, all without relying on traditional intermediaries. These dApps are constructed on blockchain platforms and leverage smart contracts to automate operations, ensuring both security and transparency.

![]()

THE AUTHOR

chirag

Blockchain Evangelist

Fuente

DeFi

Pump.Fun is revolutionizing the Ethereum blockchain in terms of daily revenue

The memecoin launchpad saw the largest daily revenue in all of DeFi over the past 24 hours.

Memecoin launchpad Pump.Fun has recorded the highest gross revenue in all of decentralized finance (DeFi) in the last 24 hours, surpassing even Ethereum.

The platform has raised $867,429 in the past 24 hours, compared to $844,276 for Ethereum, according to DeFiLlama. Solana-based Telegram trading bot Trojan was the third-highest revenue generator of the day, as memecoin infrastructure continues to dominate in DeFi.

Pump.Fun generates $315 million in annualized revenue according to DeFiLlama, and has averaged $906,160 per day over the past week.

Income Ranking – Source: DeFiLlama

The memecoin frenzy of the past few months is behind Pump.fun’s dominance. Solana-based memecoins have been the main drug of choice for on-chain degenerates.

The app allows non-technical users to launch their own tokens in minutes. Users can spend as little as $2 to launch their token and are not required to provide liquidity up front. Pump.Fun allows new tokens to trade along a bonding curve until they reach a set market cap of around $75,000, after which the bonding curve will then be burned on Raydium to create a safe liquidity pool.

Pump.Fun generates revenue through accrued fees. The platform charges a 1% fee on transactions that take place on the platform. Once a token is bonded and burned on Raydium, Pump.fun is no longer able to charge the 1% fee.

Ethereum is the blockchain of the second-largest cryptocurrency, Ether, with a market cap of $395 billion. It powers hundreds of applications and thousands of digital assets, and backs over $60 billion in value in smart contracts.

Ethereum generates revenue when users pay fees, called gas and denominated in ETH, to execute transactions and smart contracts.

DeFi

DeFi technologies will improve trading desk with zero-knowledge proofs

DeFi Technologies, a Canadian company financial technology companyis set to enhance its trading infrastructure through a new partnership with Zero Computing, according to a July 30 statement shared with CryptoSlate.

The collaboration aims to integrate zero-knowledge proof tools to boost operations on the Solana And Ethereum blockchains by optimizing its ability to identify and execute arbitrage opportunities.

Additionally, it will improve the performance of its DeFi Alpha trading desk by enhancing its use of ZK-enabled maximum extractable value (MEV Strategies).

Zero knowledge Proof of concept (ZKP) technology provides an additional layer of encryption to ensure transaction confidentiality and has recently been widely adopted in cryptographic applications.

Optimization of trading strategies

DeFi Technologies plans to use these tools to refine DeFi Alpha’s ability to spot low-risk arbitrage opportunities. The trading desk has already generated nearly $100 million in revenue this year, and this new partnership is expected to further enhance its algorithmic strategies and market analysis capabilities.

Zero Computing technology will integrate ZKP’s advanced features into DeFi Alpha’s infrastructure. This upgrade will streamline trading processes, improve transaction privacy, and increase operational efficiency.

According to DeFi Technologies, these improvements will increase the security and sophistication of DeFi Alpha’s trading strategies.

The collaboration will also advance commercial approaches for ZK-enabled MEVs, a new concept in Motor vehicles which focuses on maximizing value through transaction fees and arbitrage opportunities within block production.

Additionally, DeFi Technologies plans to leverage Zero Computing technology to develop new financial products, such as zero-knowledge index exchange-traded products (ETPs).

Olivier Roussy Newton, CEO of DeFi Technologies, said:

“By integrating their cutting-edge zero-knowledge technology, we not only improve the efficiency and privacy of our transactions, but we also pave the way for innovative trading strategies.”

Extending Verifiable Computing to Solana

According to the release, Zero Computing has created a versatile, chain-agnostic platform for generating zero-knowledge proofs. The platform currently supports Ethereum and Solana, and the company plans to expand compatibility with other blockchains in the future.

The company added that it is at the forefront of introducing verifiable computation to the Solana blockchain, enabling complex computations to be executed off-chain with on-chain verification. This development represents a significant step in the expansion of ZKPs across various blockchain ecosystems.

Mentioned in this article

Latest Alpha Market Report

DeFi

Elastos’ BeL2 Secures Starknet Grant to Advance Native Bitcoin Lending and DeFi Solutions

Singapore, Asia, July 29, 2024, Chainwire

- Elastos BeL2 to Partner with StarkWare to Integrate Starknet’s ZKPs and Cairo Programming Language with BeL2 for Native DeFi Applications

- Starknet integration allows BeL2 to provide smart contracts and dapps without moving Bitcoin assets off the mainnet

- Starknet Exchange Validates the Strength of BeL2’s Innovation and Leadership in the Native Bitcoin Ecosystem

Elastos BeL2 (Bitcoin Elastos Layer2) has secured a $25,000 grant from Starknet, a technology leader in the field of zero-knowledge proofs (ZKPs). This significant approval highlights the Elastos BeL2 infrastructure and its critical role in advancing Bitcoin-native DeFi, particularly Bitcoin-native lending. By integrating Starknet’s ZKPs and the Cairo programming language, Elastos’ BeL2 will enhance its ability to deliver smart contracts and decentralized applications (dapps) without moving Bitcoin (BTC) assets off the mainnet. This strategic partnership with Starknet demonstrates the growing acceptance and maturity of the BeL2 infrastructure, reinforcing Elastos’ commitment to market leadership in the evolving Bitcoin DeFi market.

Starknet, developed by StarkWare, is known for its advancements in ZKP technology, which improves the privacy and security of blockchain transactions. ZKPs allow one party to prove to another that a statement is true without revealing any information beyond the validity of the statement itself. This technology is fundamental to the evolution of blockchain networks, which will improve BeL2’s ability to integrate complex smart contracts while preserving the integrity and security of Bitcoin.

“We are thrilled to receive this grant from Starknet and announce our partnership to build tighter integrations with its ZKP technology and the Cairo programming language,” said Sasha Mitchell, Head of Bitcoin Layer 2 at Elastos. “This is a major milestone for BeL2 and a true recognition of the maturity and capabilities of our core technology. This support will allow us to further develop our innovation in native Bitcoin lending as we look to capitalize on the growing acceptance of Bitcoin as a viable alternative financial system.”

A closer integration with Cairo will allow BeL2 to leverage this powerful programming language to enhance Bitcoin’s capabilities and deliver secure, efficient, and scalable decentralized finance (DeFi) applications. Specifically, the relationship with Cairo reinforces BeL2’s core technical innovations, including:

- ZKPs ensure secure and private verification of transactions

- Decentralized Arbitrage Using Collateralized Nodes to Supervise and Enforce Fairness in Native Bitcoin DeFi

- BTC Oracle (NYSE:) facilitates cross-chain interactions where information, not assets, is exchanged while Bitcoin remains on the main infrastructure

BeL2’s vision goes beyond technical innovation and aims to innovate by creating a new financial system. The goal is to build a Bitcoin-backed Bretton Woods system, address global debt crises, and strengthen Bitcoin’s role as a global hard currency. This new system will be anchored in the integrity and security of Bitcoin, providing a stable foundation for decentralized financial applications.

As integration with Starknet and the Cairo programming language continues, BeL2 will deliver further advancements in smart contract capabilities, decentralized arbitration, and innovative financial products. At Token 2049, BeL2 will showcase further innovations in its core technologies, including arbitrators, that will underscore Elastos’ vision for a fairer decentralized financial system rooted in Bitcoin.

About Elastos

Elastos is a public blockchain project that integrates blockchain technology with a suite of redesigned platform components to produce a modern Internet infrastructure that provides intrinsic privacy and ownership protection for digital assets. The mission is to create open source services that are accessible to the world, so developers can create an Internet where individuals own and control their data.

The Elastos SmartWeb platform enables organizations to recalibrate how the Internet operates to better control their own data.

https://www.linkedin.com/company/elastosinfo/

ContactPublic Relations ManagerRoger DarashahElastosroger.darashah@elastoselavation.org

DeFi

Compound Agrees to Distribute 30% of Reserves to COMP Shareholders to End Alleged Attack on Its Governance

Compound will introduce the staking program in exchange for Humpy, a notorious whale accused of launching a governance attack on the protocol, negating a recently adopted governance proposal.

Compound is launching a new staking program for COMP holders as a compromise with Humpy, a notorious DeFi whale accused of launching a governance attack against the veteran DeFi protocol.

On July 29, Bryan Colligan, head of business development at Compound, published a governance proposal outlining plans for a new compound participation product that would pay 30% of the project’s current and future reserves to COMP participants.

Colligan noted that the program was requested by Humpy in exchange for his agreement Proposition 289 — which sought to invest 499,000 COMP worth approximately $24 million into a DeFi vault controlled by Humpy, and which appears to have been forced by Humpy and his associates over the weekend.

“We propose the following staking product that meets Humpy’s stated interests as a recent new delegate and holder of COMP in exchange for the repeal of Proposition 289 due to the governance risks it poses to the protocol,” Colligan said. “The Compound Growth Program…will execute the above commitments, given the immediate repeal of Proposition 289.”

Colligan added that the proposal would expire at 11:59 p.m. EST on July 29. Had Humpy not rescinded Proposition 289, Compound would move forward with it. Proposition 290 — block Humpy using the Compound team’s multi-sig to deploy a new governor contract removing the delegate’s governance power behind Proposition 289.

Hunchback tweeted that Proposition 289 had been repealed a few hours ago. “Glad to have brought Compound Finance back into the spotlight,” they said. added. “StakedComp… finally becomes a yield-generating asset!

Markets reacted favorably to the resolution, with the price of COMP increasing by 6.2% over the past 24 hours, according to CoinGecko.

Attack on governance

Proposition 289 proposed investing 499,000 COMP from the Compound treasury into goldCOMP, a yield-generating vault of the Humpy-linked Golden Boys team.

The proposal passed with nearly 52 percent of the vote on July 28, despite two previous iterations of the proposal being defeated by strong opposition. Can And JulyThe proposals notably asked for only 92,000 COMP, with security researchers warning that any deposit of tokens into the goldCOMP vault would cede their governance power.

In May, Michael Lewellen of Web3 security firm OpenZeppelin, note The first proposal was submitted by a new governance delegate who was suddenly awarded 228,000 COMP by five wallets that got their tokens from the Bybit exchange. Combined with his own tokens, the delegate got 325,333 COMP, which is over 81% of the 400,000 tokens required for a governance proposal to reach quorum.

“We have been alerting the community to the risk that these delegates could support a potential attack on governance,” Lewellen said. “The timing of the new proposal and these recent delegations are suspect.”

Read more: Compound community accuses famous whale of attacking engineering governance

-

News11 months ago

News11 months agoVolta Finance Limited – Director/PDMR Shareholding

-

News11 months ago

News11 months agoModiv Industrial to release Q2 2024 financial results on August 6

-

News11 months ago

News11 months agoApple to report third-quarter earnings as Wall Street eyes China sales

-

News11 months ago

News11 months agoNumber of Americans filing for unemployment benefits hits highest level in a year

-

News1 year ago

News1 year agoInventiva reports 2024 First Quarter Financial Information¹ and provides a corporate update

-

News1 year ago

News1 year agoLeeds hospitals trust says finances are “critical” amid £110m deficit

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Tech1 year ago

Tech1 year agoBitcoin’s Correlation With Tech Stocks Is At Its Highest Since August 2023: Bloomberg ⋆ ZyCrypto

-

Tech1 year ago

Tech1 year agoEverything you need to know

-

Markets1 year ago

Markets1 year ago20 Top Crypto Trading Platforms to Know

-

News11 months ago

News11 months agoStocks wobble as Fed delivers and Meta bounces

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Hit $100 Billion in 2024, Fueling Insane Investor Optimism ⋆ ZyCrypto