Tech

El Salvador Unveils $360 Million PoR Website to Track Bitcoin Treasury

In a move that demonstrates its commitment to embracing the digital future, El Salvador has launched a revolutionary Bitcoin Treasury tracking website. The Proof of Reserve website provides real-time proof of the nation’s Bitcoin reserves using on-chain data.

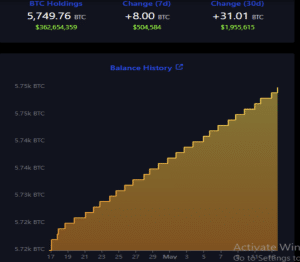

El Salvador currently holds 5,748 BTC worth approximately $360 million as of 8:20 UTC, when Bitcoin was trading above $62,700. The inauguration of this website represents an important step forward in the country’s journey towards financial transparency and global leadership cryptocurrency adoption.

El Salvador Introduces Bitcoin Treasury Tracking Website

The Central American country’s reserve testing website allows the public to track El Salvador’s Bitcoin holdings in real time. Use on-chain data to view the nation’s BTC reserves, trading activity, recent purchases and overall performance in the volatile digital asset market.

The Web site reveals that El Salvador acquired seven Bitcoin (BTC) worth $438,823 last week. Additionally, in the last month, El Salvador added 31 BTC to its treasury, worth $1.94 million. This strategic approach is in line with the government’s ambitious goal of adding 1 Bitcoin per day to its treasury.

The Government of El Salvador aims to encourage financial inclusion and innovation and promote smooth and improved efficiency of remittance payments. This is why the country adopted Bitcoin as its legal tender in 2021.

Since 2021, when the country began accumulating BTC, it has spent an average of $43,097 per BTC. Unfortunately, Bitcoin has slipped from its 2021 all-time high of $69,000, drawing much criticism for El Salvador’s move.

El Salvador suffered significant unrealized losses when BTC plummeted to $16,000 in the latest bear market.

However, this has changed, given Bitcoin’s recent rise above $73,000. With Bitcoin now trading at around $62,700, Nayib Bukele Portfolio Tracker reveals that El Salvador’s unrealized profit on its BTC holdings exceeded $57.4 million.

BTC price increase to generate further earnings

Prominent venture capitalist Tim Draper has hailed El Salvador’s Bitcoin holdings as a potential game-changer for the nation’s economic future. He declared that El Salvador could achieve financial independence if the price of Bitcoin reached $100,000.

He added that with such a price increase, it could even repay its debts to international financial institutions such as the International Monetary Fund.

Analysts have predicted that Bitcoin will surpass the coveted $100,000 mark during the next bull cycle, expected in 2024-2025. Recent research relationship Analysts at Bitfinex have suggested that Bitcoin could surpass $150,000 following the halving event scheduled for 2024.

Using regression model analysis, Bitfinex predicts a notable 160% increase in the price of Bitcoin over the next 14 months. This surge will push the value of Bitcoin between $150,000 and $169,000.

Bitfines identified the influx of institutional capital from US Bitcoin spot exchange-traded funds (ETFs) as the key factor that could drive this price movement.

After experiencing three consecutive weeks of net outflows, the tide appears to be changing, with US BTC ETFs seeing a notable increase in inflows.

Second data from Dune Analytics, BTC spot ETFs have amassed an impressive net inflow of $413 million over the past week. Meanwhile, Bitcoin stands at $62,770, reflecting a 2.73% increase over the past 24 hours.

The technical report editorial policy is focused on providing useful, accurate content that offers real value to our readers. We only work with expert writers who have specific knowledge of the topics covered, including the latest developments in technology, online privacy, cryptocurrencies, software and more. Our editorial policy ensures that each topic is researched and curated by our in-house editors. We maintain rigorous journalistic standards and every article is 100% written by real authors.