Tech

Ethereum (ETH) Rises $3,500 Ahead of ETF Expiration: Could ETF Approval Trigger a Massive Rise?

Heightened speculation over the spot approval of the ETH ETF has triggered a rally in several cryptocurrencies. Being at the center of the ETF frenzy, Ethereum ($ETH) has made great strides, with its price rising more than 29% in the past week.

Ethereum ($ETH) is trading at $3,860, marking a rise of 3.88% in the last 24 hours. Given the ongoing momentum, can ETH break above $4,000 soon?

Ethereum Buying Frenzy Heats Up as ETF Approval Nears; 30% rally on the horizon?

In a recent report, QCP Capital, a Singapore-based firm, said that Ethereum could rise significantly if the US SEC approves applications for spot Ether ETFs. QCP Capital noted that Ethereum price could rise 31% to 5,000 in the coming months.

The forecast depends on the market reaction when Spot Bitcoin ETF they were approved earlier this year. Shortly after the ETFs went public in January, Bitcoin skyrocketed from around $42,000 to over $73,000 in just two weeks.

Hence, QCP Capital believes that the approval of a spot ether ETF could have a similar, if not more explosive, impact on the market price of ETH. The firm is particularly bullish on the VanEck ETF, which is already listed on DTCC.

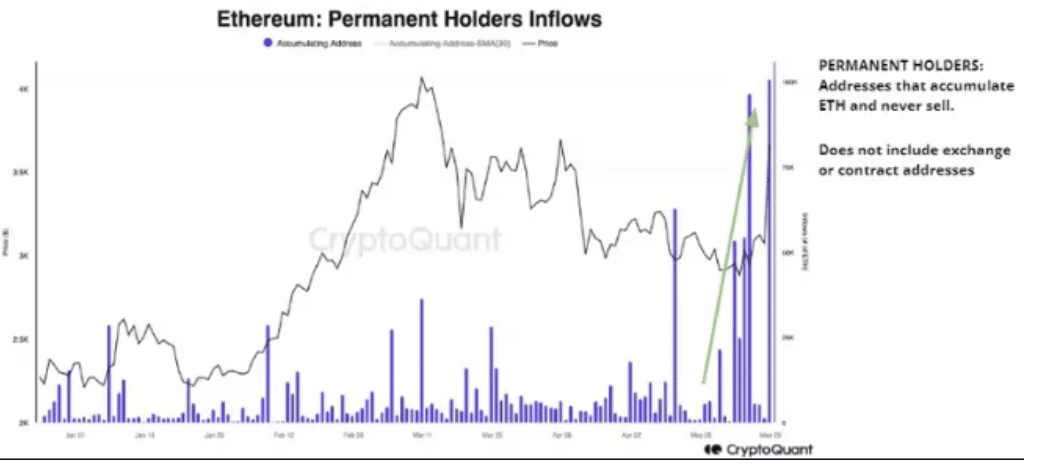

According to QCP Capital, the approval of this ETF is very likely and trading could begin as early as next week. Furthermore, on-chain data from CryptoQuant reveals that ether purchasing activity has increased, both on centralized exchanges and blockchain-based platforms.

Whales raised over 100,000 ETH in spot markets, the highest daily level since September 2023. However, while ETH ETF approval could send prices soaring, a rejection could lead to a sharp decline.

ETH Price Analysis: ETH price broke out of bearish channel following speculation on spot ETF approval

Ethereum price has taken an exciting turn breaking free from a declining channel pattern. Over the course of a day, ETH rallied significantly, marking a reversal from its negative trend since mid-March.

The ETH/USDT chart shows that ETH has witnessed its most significant upward leap in the last 36 months. This massive price surge signals a robust uptrend.

With increasing buying sentiment, Ethereum has crossed the $3,800 mark following the recent price surge. And if the bulls manage to put in more effort, ETH could surge to $4,000 or even $5,000.

Technical indicators paint a highly bullish picture for ETH. Currently, ETH is trading above the 50-day SMA (yellow line) and 200-day SMA indicators (red line). This positioning above these crucial levels indicates a solid upward trend in the coin’s price movement.

Furthermore, the Relative Strength Index (RSI) is 73, indicating that ETH is already overbought. This suggests that the buying pressure for ETH is extremely high, and if the momentum is sustained, more gains could be expected.

However, although the indicators show buy signals, remember that cryptocurrency markets are volatile and unexpected market events or changes in sentiment can always occur.

While a potential spot ETH ETF remains in the pipeline, investors can consider alternatives with notable growth potential, such as WienerAI ($WAI). While still on pre-sale, WienerAI gained considerable popularity.

The WienerAI token raised over $2.7 million in a pre-sale event

The WienerAI token, an AI-powered crypto project, has raised over $2.7 in just a few weeks since the presale began. The WienerAI presale follows a traditional multi-phase format, each lasting 48 hours.

Early buyers got the best deals, with WAI tokens priced at just $0.00071 each. The pre-sale phase is almost over; the next phase will begin in a few hours.

Users who stake their WienerAI tokens can earn up to 372% APY. With 20% of the total token supply earmarked for staking, over 2.7 billion have already been staked. This staking program allows investors to earn annual returns by holding their WAI tokens.

According to WienerAI White paper, the token will be launched on decentralized exchanges (DEX), but no specific names are mentioned yet. However, with pre-sales selling out quickly, WienerAI may soon debut on exchanges. This is expected to drive its price to higher levels, offering early investors massive returns.

Since Uniswap is the largest Ethereum-based DEX, it is the most likely option. WAI’s debut on Uniswap will introduce it to a larger user base, positively impacting its price.

WienerAI AI Trading Bot: Get intelligent investment insights and execute trades on DEX

WienerAI is much more than just a meme coin that takes advantage of hype and sentiment. This innovative project offers real utility and promises to become an essential tool for cryptocurrency traders around the world.

WienerAI uses an advanced AI-powered trading bot to identify promising investment opportunities. It offers users a personalized trading experience, allowing them to choose their risk tolerance and objective.

This bot also allows users to quickly scan the cryptocurrency market and look for opportunities, allowing traders to make informed decisions quickly and confidently.

But that is not all; Wiener AI It has an easy to use interface. Users can execute trades on multiple decentralized exchanges (DEXs) with just a few clicks.

Surprisingly, this powerful trading companion comes without the burden of hidden fees that often eat away at your hard-earned profits. Additionally, WienerAI’s trading bot offers real-time MEV (Maximal Extractable Value) protection.

With this in mind, interested investors should now rush to the presale siteee buy the token with USDT, ETH or a bank card.

The technical report editorial policy is focused on providing useful, accurate content that offers real value to our readers. We only work with expert writers who have specific knowledge of the topics covered, including the latest developments in technology, online privacy, cryptocurrencies, software and more. Our editorial policy ensures that each topic is researched and curated by our in-house editors. We maintain rigorous journalistic standards and every article is 100% written by real authors.