Tech

Geoff White Talks Casino Crime, Tech & Cyber Threats

In a career spanning 20 years, Geoff White has covered financial crime, money laundering, cryptocurrency, and the emergence of cybercrime as one of the primary threats to modern society.

In his book ‘The Lazarus Heist’, Geoff describes the link between cybercrime and casinos, both casino sites and land-based establishments. Now, his latest book, Rinsed, reveals how technology has changed the money laundering industry. It explores how technology is revolutionizing money laundering, from drug cartels washing their cash in Bitcoin to organized fraud gangs recruiting money mules on social media.

Casinos.com sat down with White for a wide-ranging interview on cybercrime, how it relates to the casino industry, new technologies in the space and much more.

Shedding a Spotlight on Unwanted Elements in the Industry

Here at Casinos.com we have reported on several major busts for the National Crime Agency (NCA), Interpol, and other international agencies in Europe and the USA, but there are other areas of the world—Russia, for instance—where cybercrime is rampant. White highlighted Russia as a particular area of interest, particularly in the aftermath of their invasion of Ukraine.

“It certainly is, particularly at the moment in the wake of the Russian invasion of Ukraine in 2022,” White said.

“What we’ve seen is an increase in cyber activity from both the Russian government and from Russian cybercrime groups. I think it’s fair to say the attitude in the Russian Federation is that the gloves are off for attacking Western targets.

Cybercrime as a Patriotic Endeavour

White had no doubts that cybercrime in some countries would be spreading into businesses everywhere. He continued: “The work of cybercrime groups can be seen as a sort of patriotic endeavour, part of the war effort. We’ve seen Telegram groups in which Western targets—big Western companies—are listed as legitimate targets for these groups to attack. There’s also the role of the Russian cybercrime economy in laundering money from cyberattacks and other types of crime. So, on both those levels, yeah, Russia is definitely a country that’s of great interest at the moment.”

Related Reads:

Big business is one thing, but should the ordinary man and woman in the street be concerned about the growth in cybercrime?

Unfortunately, the answer is yes, according to Geoff White, who was adamant that ordinary people were not exempt from being attacked. He said, “People should be concerned. Unfortunately, it’s affecting people at all levels of society. Obviously, big companies get targeted because they’ve got big money but organised crime groups are perfectly able to make substantial amounts of money from individuals.

Fraud Epidemic During Covid

White asserts that the Covid pandemic provided a great opportunity for cybercriminals as more people went online for business.

“We’ve seen, I think it’s fair to say, a fraud epidemic. A scam epidemic started really during the COVID era but is continuing now of people being ripped off for, in some cases, their life savings as part of romance scams in which people trick someone into thinking they’ve got a romantic interest but wanting to steal the money instead.

“Scams where people get tricked into investing in crypto and other types of financial schemes and, again, lose their life savings. It happens both on an enterprise level and a personal level.”

Geoff White highlights the aftermath of the COVID-19 pandemic, revealing a surge in online scams as people increasingly turned to digital platforms for business and connection.

‘Vipers Nest’ of Money Laundering and Cybercrime

The man in charge of regulating casino gaming in the Philippines, Alejandro Tengco, has asserted his country could soon overtake the city-state of Singapore to become the second-largest gambling market in Asia.

White has written extensively about the Philippines, where one of the biggest heists in history was attempted. In the aftermath, the criminals used casinos, amongst other means, to launder the stolen cash.

“It is interesting you mention the Philippines; obviously, this was one of the largest attempted heists in history—the attempted theft of a billion dollars from the National Bank of Bangladesh,” White said.

“Now that money or at least a chunk of it, 80 million of it was washed through casinos in the Philippines back in 2016. The casinos were largely unregulated then, but that has changed.

“What we’ve now seen is this interesting thing, which again goes back to the COVID-19 influence, where casinos were set up in the Philippines and in other countries in Southeast Asia by often Chinese conglomerates. COVID kicked in so there were no land-based casino customers, no visitors to the casinos, and no workers to work in the casinos.

“These casinos started turning into what you might call dark sites, where they shifted operations online. That became effectively a money-laundering vehicle for theft from scams I’ve talked about and also from crypto scams.

“You have this kind of Vipers nest really of illegal online casinos operating illegal online gambling exercises, but also being used for money laundering for various other types of crimes as well. The Philippines had its share of those.”

‘Rinsed’ Focuses on Use of Technology in Money Laundering

Regulators have been slow to act on new technologies, such as blockchain and cryptocurrency, which White chalks up to a lack of understanding. With regulations slow to commence, combined with becoming instantly ‘global’, new technologies become a playground for criminals to frequent.

“What I’ve talked about in my new book ‘Rinsed’, which you mentioned, is about how technology ends up assisting money launderers. One of the things about that is that technology, by its very nature, is international and often poorly regulated.

“You invent a new type of technology, whether it’s Bitcoin or NFT and regulators struggle to understand this stuff, let alone keep up with it and regulate it and what you end up with is this sort of Wild West-type zone.

“Obviously, criminals like playing in that particular space. But more importantly than that, as these technologies get set up, they become almost instantly global.

“You know, an NFT is transactional and tradeable everywhere. It’s attractive to criminals because if you make your criminal money in Los Angeles but you want to move it to London to evade detection or just to have it somewhere local, you can use the technology to move those funds across.

Geoff explains how emerging technologies like NFTs facilitate global money laundering. (Image: Dzmitry Kliapitski / Alamy)

“So inevitably, you get this sort of globalisation and technology and as criminals hop on the technology, so does the globalisation of crime as well.”

The Problem of North Korea

We asked Geoff about the potential problems in dealing with countries like South and North Korea and the rise of cybercrime there. Should we be concerned in the gambling casino industry over the growing tech crime in these areas?

“Yes, I think so. I find it interesting that, moving on from that 2016 case I talked about, the National Bank of Bangladesh obviously was very physical. There were literally truckloads of cash being moved out of banks in the Philippines and into the casinos. That activity has shifted largely online.

“So, it’s about online casinos and online gambling operations. Now, even if you know your readers aren’t involved in that online stuff, it’s likely they’ll be interacting with other entities in the industry who are or taking orders from people who are doing online gambling. It’s increasingly difficult, I think, to police that kind of activity around the world.

There will be criminals, criminal groups, organised crime, and gangs pushing their ill-gotten gains into online gambling; that is an absolute given.

Don’t Tar All the Casino Industry With the Same Brush

Many in the casino industry will be alert and obviously follow the laws and regulations. The net is closing in on the illegal side of gambling in different areas around the globe.

Is it fair to paint the whole casino industry with the same brush when there is a strongly regulated casino and gambling industry?

Geoff agreed that the toughening of regulations pushed people toward the black market, where the criminals often reside.

“Law enforcement does continue to do excellent work, and you know the legitimate, above-the-board respectable folks in the gambling and casino industry are doing their bit as well.

“The thing you’ve got to remember is that if you are an organised crime gang and you’re moving lots of money and we’re talking millions into the hundreds of millions, maybe even billions, yes, you can go to those underground areas, the shady kind.

“They are going to struggle to move that quantity of money. To really move that quantity of money at some stage, you need to get into the legitimate industry—legitimate banking, legitimate casinos, and so on.

“So even if you are one of the big players, well-regulated, and you work with law enforcement, you’ve always got to be aware that somewhere down the chain, the big money coming into your organisation may have come from a shadowy organisation.”

Black Market Casinos Have No Place in the Industry

In almost every industry, there are scams that target their consumers. Unfortunately, the casino industry is no exception.

White continued, “There will inevitably be in those shadowy operations casinos that frankly are not casinos; they are just scams that are trying to trick people out of their money. You are right; one of the side effects of the fact that you are so strongly regulated is that you can potentially push people into those sorts of darker places.

Strict regulations and advanced security measures protect legitimate casinos from criminal infiltration. (Image: Associated Press / Alamy)

“Just like CCTV from a physical security standpoint, security monitoring at scale and in real-time for digital assets done right should be another useful control to mitigate this risk.”

Russia, China and West Africa Among Criminal Hotspots

Geoff has traveled the world extensively and is in a great position to identify crime hotspots, and has identified some that would be the golden ground for money laundering and cybercrime.

“That is a particularly good question and it sort of depends on what kind of activity you’re looking at,” he said.

“I mean, in the book Rinsed, I look at the Russian Federation activity, which, as I say, has ramped up in the wake of the Russian invasion of Ukraine in 2022.

“China is an interesting case study because obviously gambling is illegal there. You also have a restriction on the amount of money Chinese people are allowed to take out of China, $50,000. That has inadvertently created a sort of massive market for moving money illegally, illicitly in and out of China.

Related Reads:

“You’ve got the Southeast Asian sort of dark site gambling casino industry, which obviously interfaces with scams, both perpetrating the scams and washing money from the scams.

“West Africa still has a large community, albeit a minority of the people who live there, but a significant community of scammers who perpetrate this kind of romance fraud and crypto-forward activity.”

Should Gambling Carry a Health Warning?

Cigarettes have a health warning on them. It has been suggested that gambling should follow suit and have a health warning to deter people from gambling. It’s a theory that White thinks the industry should consider seriously.

“To say to people who might recreationally use cocaine and think that that’s OK. Just take a look, do you wonder where this cocaine’s come from? Who’s suffered to get it to you and up your nose.

“It will be interesting to see if there was a way of encouraging people to use this casino because it’s well-regulated or don’t go to this casino because it’s a bit of an easier touch because you realise that this casino could be involved in all of these different activities. I think it is an interesting message to put out.”

At Casinos.com, we only recommend casino sites that pass our stringent KYC protocols. They must also have a valid licence to operate in any given area and implement all of the other safety measures necessary to ensure player protection.

Data Fraud’s New Enemy

Among White’s other successful writing ventures, he has covered fraud in the Internet industry, AI, and the Data Baby project.

“Largely speaking, AI is being used in cybercrime. A lot of this is about identity. It’s about trying to make people think their communicating with one person when they’re actually communicating with another”, White explained.

“In the Data Baby project, we actually created an entire fictional identity online. We called her Rebecca Taylor. We created an entire Internet infrastructure around her to make the Internet believe this was a real person.

“We use that to experiment with various different online scams and different kinds of online mechanisms. It was really interesting from that perspective.

“We actually gave her a job and we had a press release saying she got a job at a particular company. The whole point, the whole purpose, was to see if we could drop a barium trace.

The Data Baby project from 2013 created a fictional identity to study online scams. Today’s deepfakes are much more advanced. (Image: Screenshot of Channel 4 News Data Baby project)

“It was to try and put a barium trace into the sort of Internet and see if we could track the piles of data around the Internet. I am not sure, frankly, whether we ever did achieve that, but it was fun to do.

We asked Geoff if he was deliberately being completely relaxed by giving the scammers everything just to see where this ends up.

“Exactly that. We clicked on every accepted cookie banner that we could. We put ads on Facebook through Rebecca’s account, and we found out all about like farms on Facebook that were basically armies of people where you could buy and pay for likes. It was a really interesting experiment.”

AI for Criminals AND Crime Fighters

Geoff has looked into how criminals use AI, so we asked him if he saw any advantages to using it to fight crime and whether there would be an equitable advantage for both criminals and gamblers.

The casino industry, like any other, has had to adapt and evolve as AI becomes part and parcel of the corporate industry. There is the potential for future developments in AI-powered online casinos, such as more accurate predictive analytics and immersive VR experiences. White thinks AI will help casinos mitigate potential criminal activity, but that the technology still works both ways.

“It is interesting. I think that at the moment, my assessment on artificial intelligence is that it’s actually the defenders who are reaping the benefits of artificial intelligence. We used to call it machine learning and now we call it AI.

“There are so many viruses and spam emails out there that you just can’t spot them all, so you’re going to have to use some technology.

“I said earlier that using AI is a valuable tool in the fight against financial crime, trying to spot when money launderers are coming to your casino. We see criminals using AI, of course.

“What’s interesting is that they’re using it in sort of the same way that lots of other people are starting to experiment with it. You know, they might use it to improve their phishing emails and make them more convincing.

“We are seeing them using artificial intelligence to generate deep fakes, impersonating someone’s voice, and, in some cases, impersonating their video image to scam people.

“In the same way that you or I might think, oh, I could use AI, scammers are doing the same thing. They’re thinking, ‘Why do I bother writing my own phishing email when I could just use a chatbot to make it better?’.

“A completely new type of AI-generated crime is what we haven’t yet seen.”

Geoff White is an author, speaker, investigative journalist, and podcast creator focusing on organized crime and technology. He’s worked for the BBC, Sky News, The Sunday Times and many more.

Tech

Harvard Alumni, Tech Moguls, and Best-Selling Authors Drive Nearly $600 Million in Pre-Order Sales

BlockDAG Network’s history is one of innovation, perseverance, and a vision to push the boundaries of blockchain technology. With Harvard alumni, tech moguls, and best-selling authors at the helm, BlockDAG is rewriting the rules of the cryptocurrency game.

CEO Antony Turner, inspired by the successes and shortcomings of Bitcoin and Ethereum, says, “BlockDAG leverages existing technology to push the boundaries of speed, security, and decentralization.” This powerhouse team has led a staggering 1,600% price increase in 20 pre-sale rounds, raising over $63.9 million. The secret? Unparalleled expertise and a bold vision for the future of blockchain.

Let’s dive into BlockDAG’s success story and find out what the future holds for this cryptocurrency.

The Origin: Why BlockDAG Was Created

In a recent interview, BlockDAG CEO Antony Turner perfectly summed up why the market needs BlockDAG’s ongoing revolution. He said:

“The creation of BlockDAG was inspired by Bitcoin and Ethereum, their successes and their shortcomings.

If you look at almost any new technology, it is very rare that the first movers remain at the forefront forever. Later incumbents have a huge advantage in entering a market where the need has been established and the technology is no longer cutting edge.

BlockDAG has done just that: our innovation is incorporating existing technology to provide a better solution, allowing us to push the boundaries of speed, security, and decentralization.”

The Present: How Far Has BlockDAG Come?

BlockDAG’s presale is setting new benchmarks in the cryptocurrency investment landscape. With a stunning 1600% price increase over 20 presale lots, it has already raised over $63.9 million in capital, having sold over 12.43 billion BDAG coins.

This impressive performance underscores the overwhelming confidence of investors in BlockDAG’s vision and leadership. The presale attracted over 20,000 individual investors, with the BlockDAG community growing exponentially by the hour.

These monumental milestones have been achieved thanks to the unparalleled skills, experience and expertise of BlockDAG’s management team:

Antony Turner – Chief Executive Officer

Antony Turner, CEO of BlockDAG, has over 20 years of experience in the Fintech, EdTech, Travel and Crypto industries. He has held senior roles at SPIRIT Blockchain Capital and co-founded Axona-Analytics and SwissOne. Antony excels in financial modeling, business management and scaling growth companies, with expertise in trading, software, IoT, blockchain and cryptocurrency.

Director of Communications

Youssef Khaoulaj, CSO of BlockDAG, is a Smart Contract Auditor, Metaverse Expert, and Red Team Hacker. He ensures system security and disaster preparedness, and advises senior management on security issues.

advisory Committee

Steven Clarke-Martin, a technologist and consultant, excels in enterprise technology, startups, and blockchain, with a focus on DAOs and smart contracts. Maurice Herlihy, a Harvard and MIT graduate, is an award-winning computer scientist at Brown University, with experience in distributed computing and consulting roles, most notably at Algorand.

The Future: Becoming the Cryptocurrency with the Highest Market Cap in the World

Given its impressive track record and a team of geniuses working tirelessly behind the scenes, BlockDAG is quickly approaching the $600 million pre-sale milestone. This crypto powerhouse will soon enter the top 30 cryptocurrencies by market cap.

Currently trading at $0.017 per coin, BlockDAG is expected to hit $1 million in the coming months, with the potential to hit $30 per coin by 2030. Early investors have already enjoyed a 1600% ROI by batch 21, fueling a huge amount of excitement around BlockDAG’s presale. The platform is seeing significant whale buying, and demand is so high that batch 21 is almost sold out. The upcoming batch is expected to drive prices even higher.

Invest in BlockDAG Pre-Sale Now:

Pre-sale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetwork

Discord: Italian: https://discord.gg/Q7BxghMVyu

No spam, no lies, just insights. You can unsubscribe at any time.

Tech

How Karak’s Latest Tech Integration Could Make Data Breaches Obsolete

- Space and Time uses zero-knowledge proofs to ensure secure and tamper-proof data processing for smart contracts and enterprises.

- The integration facilitates faster development and deployment of Distributed Secure Services (DSS) on the Karak platform.

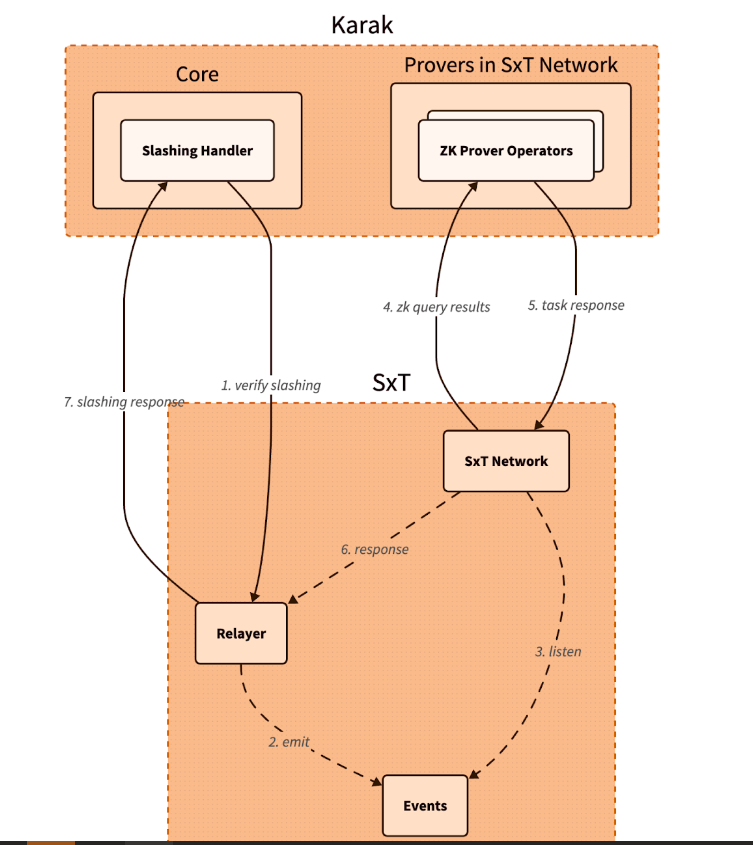

Karak, a platform known for its strong security capabilities, is enhancing its Distributed Secure Services (DSS) by integrating Space and Time as a zero-knowledge (ZK) coprocessor. This move is intended to strengthen trustless operations across its network, especially in slashing and rewards mechanisms.

Space and Time is a verifiable processing layer that uses zero-knowledge proofs to ensure that computations on decentralized data warehouses are secure and untampered with. This system enables smart contracts, large language models (LLMs), and enterprises to process data without integrity concerns.

The integration with Karak will enable the platform to use Proof of SQL, a new ZK-proof approach developed by Space and Time, to confirm that SQL query results are accurate and have not been tampered with.

One of the key features of this integration is the enhancement of DSS on Karak. DSS are decentralized services that use re-staked assets to secure the various operations they provide, from simple utilities to complex marketplaces. The addition of Space and Time technology enables faster development and deployment of these services, especially by simplifying slashing logic, which is critical to maintaining security and trust in decentralized networks.

Additionally, Space and Time is developing its own DSS for blockchain data indexing. This service will allow community members to easily participate in the network by running indexing nodes. This is especially beneficial for applications that require high security and decentralization, such as decentralized data indexing.

The integration architecture follows a detailed and secure flow. When a Karak slashing contract needs to verify a SQL query, it calls the Space and Time relayer contract with the required SQL statement. This contract then emits an event with the query details, which is detected by operators in the Space and Time network.

These operators, responsible for indexing and monitoring DSS activities, validate the event and route the work to a verification operator who runs the query and generates the necessary ZK proof.

The result, along with a cryptographic commitment on the queried data, is sent to the relayer contract, which verifies and returns the data to the Karak cutter contract. This end-to-end process ensures that the data used in decision-making, such as determining penalties within the DSS, is accurate and reliable.

Karak’s mission is to provide universal security, but it also extends the capabilities of Space and Time to support multiple DSSs with their data indexing needs. As these technologies evolve, they are set to redefine the secure, decentralized computing landscape, making it more accessible and efficient for developers and enterprises alike. This integration represents a significant step towards a more secure and verifiable digital infrastructure in the blockchain space.

Website | X (Twitter) | Discord | Telegram

No spam, no lies, just insights. You can unsubscribe at any time.

Tech

Cryptocurrency Payments: Should CFOs Consider This Ferrari-Approved Trend?

Iconic Italian luxury carmaker Ferrari has announced the expansion of its cryptocurrency payment system to its European dealer network.

The move, which follows a successful launch in North America less than a year ago, raises a crucial question for CFOs across industries: Is it time to consider accepting cryptocurrency as a form of payment for your business?

Ferrari’s move isn’t an isolated one. It’s part of a broader trend of companies embracing digital assets. As of 2024, we’re seeing a growing number of companies, from tech giants to traditional retailers, accepting cryptocurrencies.

This change is determined by several factors:

- Growing mainstream adoption of cryptocurrencies

- Growing demand from tech-savvy and affluent consumers

- Potential for faster and cheaper international transactions

- Desire to project an innovative brand image

Ferrari’s approach is particularly noteworthy. They have partnered with BitPay, a leading cryptocurrency payment processor, to allow customers to purchase vehicles using Bitcoin, Ethereum, and USDC. This satisfies their tech-savvy and affluent customer base, many of whom have large digital asset holdings.

Navigating Opportunities and Challenges

Ferrari’s adoption of cryptocurrency payments illustrates several key opportunities for companies considering this move. First, it opens the door to new customer segments. By accepting cryptocurrency, Ferrari is targeting a younger, tech-savvy demographic—people who have embraced digital assets and see them as a legitimate form of value exchange. This strategy allows the company to connect with a new generation of affluent customers who may prefer to conduct high-value transactions in cryptocurrency.

Second, cryptocurrency adoption increases global reach. International payments, which can be complex and time-consuming with traditional methods, become significantly easier with cryptocurrency transactions. This can be especially beneficial for businesses that operate in multiple countries or deal with international customers, as it potentially reduces friction in cross-border transactions.

Third, accepting cryptocurrency positions a company as innovative and forward-thinking. In today’s fast-paced business environment, being seen as an early adopter of emerging technologies can significantly boost a brand’s image. Ferrari’s move sends a clear message that they are at the forefront of financial innovation, which can appeal to customers who value cutting-edge approaches.

Finally, there is the potential for cost savings. Traditional payment methods, especially for international transactions, often incur substantial fees. Cryptocurrency transactions, on the other hand, can offer lower transaction costs. For high-value purchases, such as luxury cars, these savings could be significant for both the business and the customer.

While the opportunities are enticing, accepting cryptocurrency payments also presents significant challenges that businesses must address. The most notable of these is volatility. Cryptocurrency values can fluctuate dramatically, sometimes within hours, posing potential risk to businesses that accept them as payment. Ferrari addressed this challenge by implementing a system that instantly converts cryptocurrency received into traditional fiat currencies, effectively mitigating the risk of value fluctuations.

Regulatory uncertainty is another major concern. The legal landscape surrounding cryptocurrencies is still evolving in many jurisdictions around the world. This lack of clear and consistent regulations can create compliance challenges for companies, especially those operating internationally. Companies must remain vigilant and adaptable as new laws and regulations emerge, which can be a resource-intensive process.

Implementation costs are also a significant obstacle. Integrating cryptocurrency payment systems often requires substantial investment in new technology infrastructure and extensive staff training. This can be especially challenging for small businesses or those with limited IT resources. The costs are not just financial; a significant investment of time is also required to ensure smooth implementation and operation.

Finally, security concerns loom large in the world of cryptocurrency transactions. While blockchain technology offers some security benefits, cryptocurrency transactions still require robust cybersecurity measures to protect against fraud, hacks, and other malicious activity. Businesses must invest in robust security protocols and stay up-to-date on the latest threats and protections, adding another layer of complexity and potential costs to accepting cryptocurrency payments.

Strategic Considerations for CFOs

If you’re thinking of following in Ferrari’s footsteps, here are the key factors to consider:

- Risk Assessment: Carefully evaluate potential risks to your business, including financial, regulatory, and reputational risks.

- Market Analysis: Evaluate whether your customer base is significantly interested in using cryptocurrencies for payments.

- Technology Infrastructure: Determine the costs and complexities of implementing a cryptographic payment system that integrates with existing financial processes.

- Regulatory Compliance: Ensure that cryptocurrency acceptance is in line with local regulations in all markets you operate in. Ferrari’s gradual rollout demonstrates the importance of this consideration.

- Financial Impact: Analyze how accepting cryptocurrency could impact your cash flow, accounting practices, and financial reporting.

- Partnership Evaluation: Consider partnering with established crypto payment processors to reduce risk and simplify implementation.

- Employee Training: Plan comprehensive training to ensure your team is equipped to handle cryptocurrency transactions and answer customer questions.

While Ferrari’s adoption of cryptocurrency payments is exciting, it’s important to consider this trend carefully.

A CFO’s decision to adopt cryptocurrency as a means of payment should be based on a thorough analysis of your company’s specific needs, risk tolerance, and strategic goals. Cryptocurrency payments may not be right for every business, but for some, they could provide a competitive advantage in an increasingly digital marketplace.

Remember that the landscape is rapidly evolving. Stay informed about regulatory changes, technological advancements, and changing consumer preferences. Whether you decide to accelerate your crypto engines now or wait in the pit, keeping this payment option on your radar is critical to navigating the future of business transactions.

Was this article helpful?

Yes No

Sign up to receive your daily business insights

Tech

Bitcoin Tumbles as Crypto Market Selloff Mirrors Tech Stocks’ Plunge

The world’s largest cryptocurrency, Bitcoin (BTC), suffered a significant price decline on Wednesday, falling below $65,000. The decline coincides with a broader market sell-off that has hit technology stocks hard.

Cryptocurrency Liquidations Hit Hard

CoinGlass data reveals a surge in long liquidations in the cryptocurrency market over the past 24 hours. These liquidations, totaling $220.7 million, represent forced selling of positions that had bet on price increases. Bitcoin itself accounted for $14.8 million in long liquidations.

Ethereum leads the decline

Ethereal (ETH), the second-largest cryptocurrency, has seen a steeper decline than Bitcoin, falling nearly 8% to trade around $3,177. This decline mirrors Bitcoin’s price action, suggesting a broader market correction.

Cryptocurrency market crash mirrors tech sector crash

The cryptocurrency market decline appears to be linked to the significant losses seen in the U.S. stock market on Wednesday. Stock market listing The index, heavily weighted toward technology stocks, posted its sharpest decline since October 2022, falling 3.65%.

Analysts cite multiple factors

Several factors may have contributed to the cryptocurrency market crash:

- Tech earnings are underwhelming: Earnings reports from tech giants like Alphabet are disappointing (Google(the parent company of), on Tuesday, triggered a sell-off in technology stocks with higher-than-expected capital expenditures that could have repercussions on the cryptocurrency market.

- Changing Political Landscape: The potential impact of the upcoming US elections and changes in Washington’s policy stance towards cryptocurrencies could influence investor sentiment.

- Ethereal ETF Hopes on the line: While bullish sentiment around a potential U.S. Ethereum ETF initially boosted the market, delays or rejections could dampen enthusiasm.

Analysts’ opinions differ

Despite the short-term losses, some analysts remain optimistic about Bitcoin’s long-term prospects. Singapore-based cryptocurrency trading firm QCP Capital believes Bitcoin could follow a similar trajectory to its post-ETF launch all-time high, with Ethereum potentially converging with its previous highs on sustained institutional interest.

Rich Dad Poor Dad Author’s Prediction

Robert Kiyosaki, author of the best-selling Rich Dad Poor Dad, predicts a potential surge in the price of Bitcoin if Donald Trump is re-elected as US president. He predicts a surge to $105,000 per coin by August 2025, fueled by a weaker dollar that is set to boost US exports.

BTC/USD Technical Outlook

Bitcoin price is currently trading below key support levels, including the $65,500 level and the 100 hourly moving average. A break below the $64,000 level could lead to further declines towards the $63,200 support zone. However, a recovery above the $65,500 level could trigger another increase in the coming sessions.

-

News10 months ago

News10 months agoVolta Finance Limited – Director/PDMR Shareholding

-

News10 months ago

News10 months agoModiv Industrial to release Q2 2024 financial results on August 6

-

News10 months ago

News10 months agoApple to report third-quarter earnings as Wall Street eyes China sales

-

News10 months ago

News10 months agoNumber of Americans filing for unemployment benefits hits highest level in a year

-

News1 year ago

News1 year agoInventiva reports 2024 First Quarter Financial Information¹ and provides a corporate update

-

News1 year ago

News1 year agoLeeds hospitals trust says finances are “critical” amid £110m deficit

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Tech1 year ago

Tech1 year agoBitcoin’s Correlation With Tech Stocks Is At Its Highest Since August 2023: Bloomberg ⋆ ZyCrypto

-

Tech1 year ago

Tech1 year agoEverything you need to know

-

Markets12 months ago

Markets12 months ago20 Top Crypto Trading Platforms to Know

-

News10 months ago

News10 months agoStocks wobble as Fed delivers and Meta bounces

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Hit $100 Billion in 2024, Fueling Insane Investor Optimism ⋆ ZyCrypto