DeFi

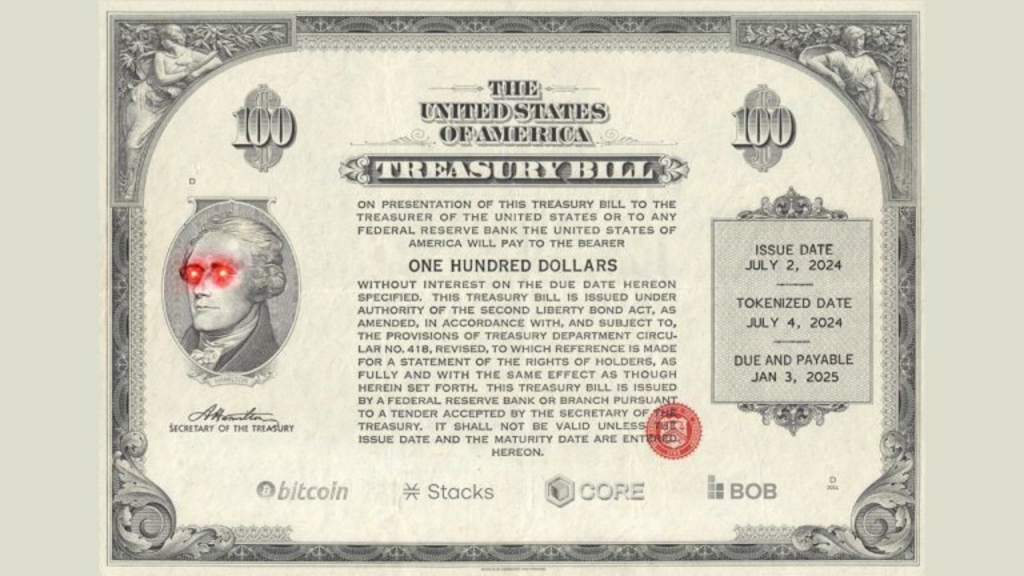

Hamilton Brings US Treasuries to Bitcoin L2 Solutions

.

Hamilton, a pioneering real-world asset (RWA) tokenization startup, has announced a major breakthrough: the tokenization of U.S. Treasuries on Bitcoin Layer 2 (L2) solutions, including Stacks, Core, and BoB. This breakthrough marks a significant step forward in integrating traditional finance into the Bitcoin ecosystem, improving the accessibility and tradability of government-backed stable assets within decentralized finance (DeFi) networks.

Hamilton’s inaugural transaction, made on American Independence Day, symbolizes a new era for financial instruments. By making Treasuries more accessible and tradable within Bitcoin’s DeFi ecosystems, Hamilton aims to bridge the gap between traditional finance and the burgeoning world of cryptocurrencies.

“Combining U.S. Treasuries with the security and transparency of Bitcoin marks a historic step toward financial independence, providing critical exposure to emerging markets,” said Kasstawi, CEO and co-founder of Hamilton.

Hamilton’s tokenized Treasuries will be available on three leading Bitcoin L2 solutions: Stacks, Core, and BoB. These platforms are known for improving the scalability and functionality of Bitcoin, making it easier and more affordable to create digital tokens representing real-world assets. With Bitcoin’s robust security framework, these tokenized Treasuries are expected to become a prominent asset on Hamilton’s platform.

The move comes amid growing interest in RWA tokenization from both cryptocurrency companies and traditional financial institutions. The Boston Consulting Group (BCG) predicts that the RWA market will reach a staggering $16 trillion by 2030, highlighting the immense potential of such innovations.

The latest data from RWA.xyz highlights the rapid growth of the tokenized Treasury market. As of July 4, the total value of tokenized Treasury bonds stood at $1.79 billion, an increase of 215.88% from $566.67 million a year earlier. This increase in value reflects the growing demand and potential for RWA tokenization within the financial sector.

Hamilton’s move to tokenize US Treasuries on Bitcoin’s L2 solutions not only shows the potential for traditional assets to be integrated into the cryptocurrency space, but also highlights the growing sophistication and maturity of the DeFi market. This move is poised to attract more institutional interest, fostering a deeper connection between traditional financial markets and the innovative world of blockchain technology.

The tokenization of U.S. Treasuries on Bitcoin’s L2 solutions is a critical development for several reasons. By tokenizing Treasuries, Hamilton is making these stable, government-backed assets more accessible to a broader range of investors in the DeFi space. This democratizes access to traditionally proprietary financial instruments. Tokenized assets can be traded more easily and quickly than their traditional counterparts, improving liquidity in financial markets. This is particularly beneficial for assets like Treasuries, which are typically considered highly stable but not easily tradable.

This initiative represents an important step towards integrating traditional financial assets with the decentralized and transparent nature of blockchain technology. It bridges the gap between the old and new financial systems, offering the benefits of both worlds. Leveraging Bitcoin’s renowned security and transparency ensures that tokenized assets maintain high standards of integrity and trust. This is essential to attract institutional investors who require strong guarantees for their investments.

The RWA market’s projected growth to $16 trillion by 2030 and the current surge in tokenized Treasuries indicate a significant shift in the way financial assets are viewed and traded. Hamilton’s early entry into this market positions it as a leader in the space, with substantial growth potential.

Hamilton’s successful tokenization of US Treasuries on Bitcoin L2 Solutions sets a precedent for other financial instruments. As the RWA tokenization space continues to evolve, we can expect to see more traditional assets integrated into the blockchain ecosystem, further blurring the lines between conventional finance and the innovative world of cryptocurrencies. This initiative is not just about making financial instruments more accessible; it’s about redefining the future of finance. By harnessing the power of Bitcoin L2 Solutions, Hamilton is paving the way for a more inclusive, transparent, and efficient financial system.