Markets

Solana Price Eyes $200 Rally as Trading Volume Surges 300%

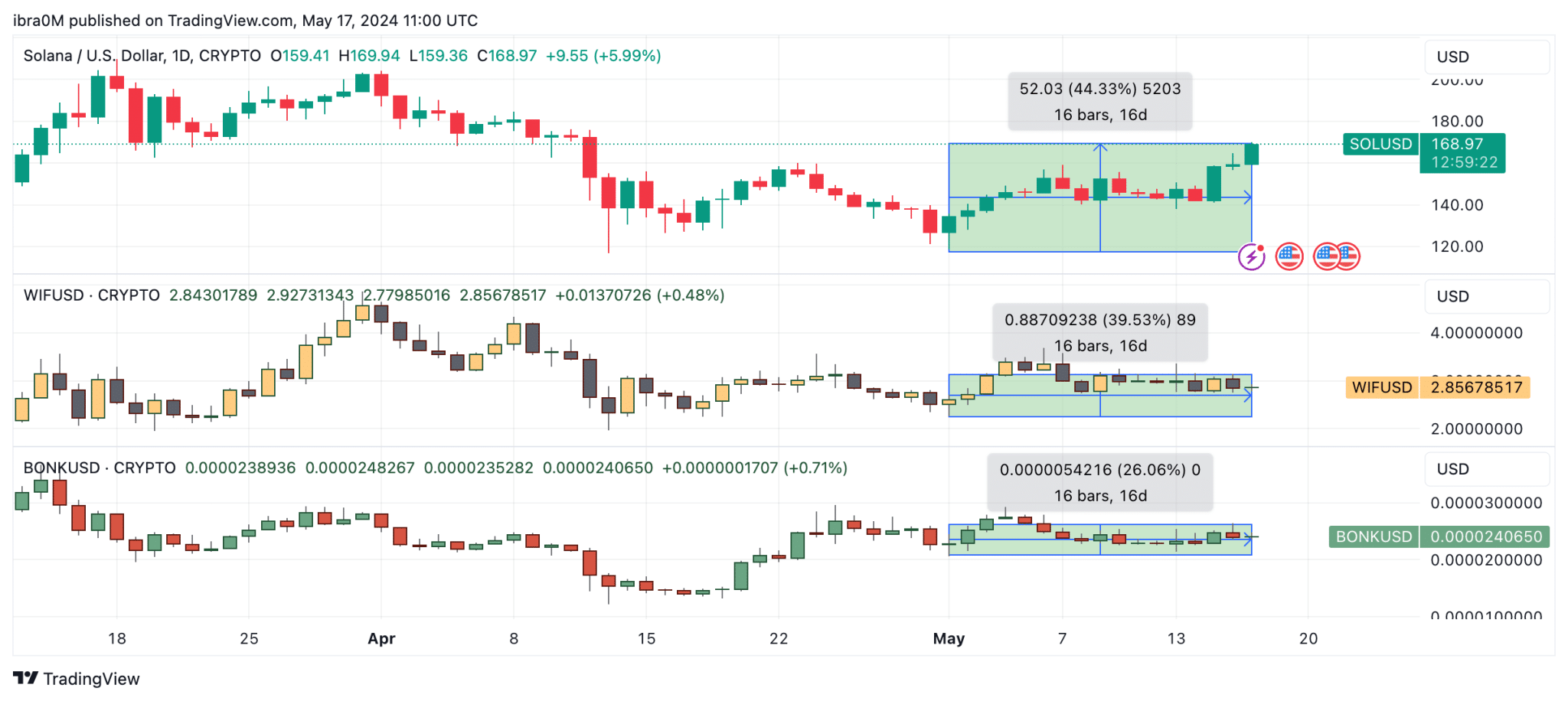

Solana price hit a 35-day high of $170 on May 17, up 44% for the month, but spikes in SOL trading activity suggest further upside could follow in the coming days.

Solana soars 22% as GameStop triggers Memecoin Mania

Solana became the best performing asset in the top 10 in the crypto market this week. As the The GameStop saga resurfaced, sparking a surge in demand for memecoin, investors rushed to scoop up prominent Solana-hosted memes like Dogwifhat (Wireless) And BONK.

This increase in native demand for memecoin has inadvertently led to an increase in demand for SOL.

Solana’s price has jumped 22% since the GameStop rally began on May 14. At the time of writing on May 17, Solana was trading for $168.9, reflecting a 44% rise for the month.

However, a closer look at the daily price charts WIF (39.5%) and BONK (+26%) shows that Solana’s two largest meme projects also saw significant double-digit gains in May 2024.

SOL Trading Volume Increases by $2.7 Billion Amid Memecoin Mania

Notably, in recent months, periods of increased memecoin demand have often triggered a sizable surge in SOL prices, as this essentially boosts Solana network activity. And this bullish phenomenon seems to have resurfaced again this week.

The Santiment trading volume chart below records the dollar value of all trades involving SOL over a 24-hour period.

– Advertisement –

As seen above, Solana trading volume reached a monthly low of 936.5 million on May 12. But since the start of the week, Solana has seen a considerable increase in business activity.

Further intensified by the GameStop-inspired memecoin rave, Solana’s trading volume has already crossed the $3.61 billion mark as of noon on May 17. This reflects a remarkable $2.7 billion increase in trading volume between May 12 and 17.

When trading activity increases during a market recovery, it often drives up prices for two main reasons. First, increased market liquidity allows early profit takers to exit without derailing the rally.

More so, increasing trading volumes are a great indicator of new capital inflows and growing investor participation. All of these factors could combine to push the price of Solana even higher in the days to come.

SOL Price Prediction: $200 Target on the Horizon

Solana price gained bullish momentum this month, climbing 44% from $126 to a 35-day high of $170 on May 17. The $2.7 billion jump in trading volume this week suggests that Solana price is now poised for another breakout towards $200 within days. in front.

However, looking at the daily price chart, the $180 area is a critical near-term resistance level to watch. As SOL has broken above the upper limit Bollinger Band indicator, the bulls appear to be firmly in control of the market momentum.

If the bulls maintain the increased trading volumes, Solana price will likely surpass $180 and head towards the $200 mark as expected.

But on the downside, the bears could regain a foothold in the market if the price falls below $140. However, as the 20-day SMA indicator shows, the bulls will likely cluster around the $146 level to avoid such a significant price reversal.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinions of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. Crypto Basic is not responsible for any financial losses.

-Advertisement-