Markets

The World’s Best Crypto Exchanges And Marketplaces

After years of turbulence, including jail time for the founders of the two biggest cryptocurrency exchanges, many providers are getting serious about controls and regulation. Coinbase leads our list of the 20 most trustworthy marketplaces in an industry that still requires caution.

By Javier Paz, Forbes Staff

With the sentencing of former industry kingpins Sam Bankman-Fried and Changpeng Zhao, the cryptocurrency exchange business is by necessity moving toward a more transparent and compliant model.

The transformation has been made easier by a doubling in the price of bitcoin over the past year–it is now trading at $61,568-powered in part by the influx of about $11.8 billion into newly allowed U.S. exchange-traded funds based on the spot price of the cryptocurrency. These ETFs, offered by sponsors including BlackRock and Fidelity, are bringing new credibility to the digital-assets industry, whose reputation had been sullied by a string of bankruptcies in 2022 that culminated in the failure of Bankman-Fried’s FTX exchange. FTX was run in a criminally haphazard way, leading to the former CEO’s conviction on seven counts of fraud, money laundering and campaign-finance violations and a 25-year prison sentence.

Zhao’s Binance ran afoul of U.S. authorities and pleaded guilty to breaking anti-money laundering laws, as well as to unlicensed money transmitting and sanctions violations. The exchange had to pay $4.3 billion of restitution and Zhao himself admitted to a single charge of failing to implement an effective anti-money laundering program at Binance, for which he was fined $50 million and sentenced to four months in prison.

Binance remains the world’s largest cryptocurrency exchange by average daily trading volume, but you will not find it among the firms we ranked. We excluded Binance and Bitmex from our 2024 ranking because of their legal and regulatory infractions. Aside from its problems with the U.S., Binance was expelled from at least 17 countries in the past three years, including India, the U.K. and Japan. One of its reputational issues has to do with not having a fixed headquarters and therefore no home regulator for the majority of its business. Other large exchanges excluded from our ranking include OKX, MEXC and Kucoin due to lack of credible regulatory oversight and what we perceived to be weak internal controls.

Most of our 20 trustworthy exchanges are based in nations with significant oversight of their financial markets; the top three are all in the United States. We considered 646 exchanges and other kinds of marketplaces that allow investors to trade crypto and narrowed down the list based on nine different criteria (See full methodology at bottom).

Leading the 2024 ranking is publicly traded Coinbase, which is not only an exchange but a top cryptocurrency custodian. It has been entrusted with 13% of the world’s bitcoin and ethereum supply and 40% of all crypto assets held on exchanges, a key indicator of trustworthiness. It gets the highest possible score for regulation, although it is not without issues with government overseers. It is currently embroiled in court actions with the Securities and Exchange Commission, which considers almost all digital currencies other than bitcoin to be securities. It therefore considers Coinbase, which makes markets in no fewer than 260 tokens, to be an unlicensed broker dealer. But Coinbase’s issues are civil, not criminal, and it also gets top marks for the quality of its audits and for its acceptance among institutional investors. Coinbase also topped our 2022 list.

The runner-up is not properly a crypto exchange at all. CME Group is the largest regulated crypto marketplace and the closest thing to the arbiter of official bitcoin and ethereum prices. With roots in the old-school Chicago commodities markets, it has more than $2 trillion in U.S. Treasury futures, trillions in other asset classes, and more than $9 billion worth of regulated crypto futures contracts outstanding, the most in the world. ETF issuers such as ProShares as well as retail traders and hedge funds use the CME for hedging and speculating on future prices of bitcoin and ethereum.

In the world of cryptocurrencies, the difference between exchanges and brokers can often appear to be a matter of semantics. For most investors, cryptocurrency exchanges are indistinguishable from securities brokers. They are the middlemen you go through to buy or sell digital assets. With this in mind we have included discount stock broker Robinhood and Fidelity on our list. Robinhood’s has zero fees on crypto transactions compared to Coinbase, which charges a $6 to $17 fee per $1,000 of bitcoin purchased (price takers). Most other crypto exchanges on our list charge transaction fees, ranging up to 0.2%. Robinhood would have scored even higher but was held back by its lack of institutional traders and derivatives. Like Coinbase, it has come under scrutiny by the SEC.

The robust regulation in the U.S. stems from existing financial law supported by a legal court system, but Washington has been unable to pass any crypto-specific legislation. That is not the case in countries like Germany and Japan. Nations that have grown tired of companies asking for forgiveness rather than permission are taking steps to ban bad actors. Since the collapse of FTX, no fewer than 10 countries have passed crypto legislation seeking to identify unlicensed exchanges and create basic disclosure requirements and consumer protections. The 2023 Markets in Crypto Assets (MiCA) directive, the first piece of crypto legislation from a major economy, is going into effect this year in the European Union, with rules to ensure fair and orderly trading and objective criteria for the efficient execution of orders. Dubai launched its Virtual Assets Regulatory Authority (VARA) in 2023, administering spot and derivatives licenses that require exchanges to share information about large market exposure.

Forbes last ranked crypto exchanges in March 2022, and at the time CoinGecko indicated there were about 6,500 tokens. Today, the crypto count surpasses 13,000. Our ranking began with 646 exchanges identified by CryptoCompare, CoinMarketCap, CoinGecko and CryptoRank. We cut the list to 20 companies from 60 in 2022 with our main focus on compliance, solvency and security.

We also wanted to emphasize that market attention is primarily on bitcoin and ether, two assets that make up a combined 66% of crypto’s $2.36 trillion market capitalization. Bitcoin and ether represent roughly 76% of the $444 billion in assets held in custody by the exchanges and dealers on our list, while the remainder came from hundreds of smaller tokens. The opposite is true for many large exchanges that did not make the cut, like the unregulated MEXC and Gate.io, based in the Seychelles and Cayman Islands, respectively. For these excluded exchanges, bitcoin and ether represent just 33% of the assets they held in custody.

In an industry that is largely unregulated and unaudited and in which hacks are common, the most important job for exchanges is to keep tokens safe for investors. Our methodology reflects this goal. Each exchange had to meet a high regulatory threshold for inclusion, earning at least seven out of 10 possible points. (Note: Each category is graded on a scale from 1-10). There are seven U.S.-domiciled firms in our 20 exchange ranking, four each from Europe and Japan, two based in South Korea and one each from Singapore, Dubai and Hong Kong. The list includes firms across the board on pricing strategies and services offered. Some, such as Coinbase and Bitpanda, have relatively high transaction fees for retail traders, while others have employed low-cost strategies.

We included derivatives exchanges that specialize in trading options and futures, that give exposure to crypto assets via regulated financial contracts to reflect the growing importance of these products for bitcoin trading. We did not include decentralized exchanges, which operate without human intervention.

Forbes Crypto Exchange Rankings 2024

SCROLL RIGHT TO SEE THE FULL TABLE

The Top 20

#1. Coinbase

Among pure crypto exchanges, Coinbase is clearly the favored custodian for traditional institutions and it has benefited from the new spot bitcoin ETFs, eight of which use it to hold their crypto. At the end of the first quarter bitcoin and ether in custody rose to $219 billion. Retail fees are relatively high, averaging nearly 1.7%. Coinbase is the largest U.S. crypto exchange by trading volume and largest globally by assets held in custody.

#2. CME GROUP

Established in 1898 and formerly known as the Chicago Mercantile Exchange, the CME Group is the largest operator of financial derivative exchanges in the world. CME launched bitcoin futures in December 2017 and as of early May it had more than $8 billion worth of bitcoin futures contracts outstanding. ETF issuers such as ProShares and retail traders use the Chicago-based exchange for hedging and speculating on the future price of bitcoin and ether.

#3. Robinhood

This discount broker, famous for gamifying investing, allows its 23 million customers the ability to trade 15 cryptocurrencies. It began offering free crypto trading in 2018 in the U.S. and expanded to Europe late last year. The firm held $15 billion of cryptocurrencies in custody as of March 31.

#4. Upbit

Think of it as South Korea’s Coinbase, except that Upbit has gained dominance in trading with its low fees (5 basis points). Upbit, which is partly owned by one of Korea’s richest investors Song Chi-hyung, is the fourth-largest custodian of bitcoin among crypto marketplaces.

#5. Deribit

The world’s largest crypto options marketplace, Deribit also offers spot and perpetual-futures trading and the bitcoin equivalent of the equity market’s CBOE Volatility Index index. In the wake of the FTX debacle, the exchange moved its headquarters and operations from Panama to Dubai, which is known for its experience regulating crypto spot markets and derivatives. Deribit had $21 billion of bitcoin and ether options contracts outstanding as of May 10. Spot bitcoin trades are free but off limits to U.S. based investors.

#6. Bitstamp

This Luxembourg-based global crypto exchange was born in 2011 and unlike crypto rivals has taken a by the book approach to getting regulatory approval in every market it enters. It holds more than $3 billion in bitcoin and ether for clients.

#7. Crypto.com (tie)

This budding exchange, owned by its founders (Kris Marszalek, Rafael Melo, and Bobby Bao), spends big on marketing. In 2021, it spent $700 million for 20-year naming rights to the arena home of the Los Angeles Lakers, Clippers, Sparks and Kings. The exchange recently reported that it had 80 million clients globally, up from 10 million in 2021. Revenue was more than $1 billion in 2022, mostly from the U.S. The firm has laid off thousands of employees in the past two years.

#7. Kraken (tie)

Second-largest U.S. crypto exchange by trading volume. In 2023, the company laid off 30% of its workforce and founder Jesse Powell became chairman as part of a C-suite revamp. The SEC sued the company in November for failing to register as a securities exchange. Kraken moved to dismiss the case in February, claiming cryptocurrencies are not securities.

#7. Fidelity (tie)

Among traditional firms, the Boston asset manager with $13 trillion of assets has long been a crypto fan. Fidelity Crypto offers clients trading in bitcoin and ether at a spread of 1% (100 basis points) per trade. It also has a growing digital asset custody division. In January Fidelity began offering its Fidelity Wise Origin Bitcoin ETF (FBTC), which now has assets under management of $9.7 billion, the third-highest among the new U.S. funds.

#10. LMAX Digital

Founded in 2018, LMAX Digital is a Gibraltar-based regulated marketplace popular with hedge funds and high-frequency traders. It is one of six constituent exchanges used to generate the CME Group’s bitcoin futures prices. It operates its own custodian firm and is seeking additional licenses in the Eurozone and Singapore. Its standard fee for trading bitcoin is zero to six basis points, but it is not available to retail investors.

#11. Gemini

Created by billionaire twins Tyler and Cameron Winklevoss, this exchange has $13.9 billion in digital assets. During the last crypto runup in 2021, its Gemini Earn program became wildly popular by paying 8% interest on deposits. The program was shuttered during the crypto collapse, leaving customers in limbo. Thanks in part to rising markets, a settlement with New York State will give Gemini Earn customers back their entire $1.1 billion of investments and up to $700 million of lost earnings. Earlier this year, Gemini agreed to pay $98 million to settle civil action brought up by the SEC and New York authorities related to its Earn program.

#12. BitFlyer

The Tokyo-based exchange custodies the most crypto assets in its home market ($4 billion) and touts 0% to 0.1% trading fees. BitFlyer is regulated in Japan, the U.S, and Europe. It was founded with backing from Japanese insurance, banking, and brokerage giants like Mitsubishi UFJ Capital, SBI Investment, and Dai-ichi Life Insurance. The company re-appointed co-founder Yuzo Kano as CEO after an ownership and management spat was resolved in March 2023, and he stated plans to take the exchange public.

#13. Bitbank

Bitbank ot bitbank.cc (not to be confused with bitbank.com) operates in the competitive Japanese market and is one of the four largest crypto exchanges. Its taker fees, charged on bids placed at market prices rather than limit transactions, are 12 basis points, which are low but higher than its large peers. Part of its success can be attributed to its offer of 38 cryptocurrencies denominated in yen, of which bitcoin yen is the largest market. The exchange is audited by Deloitte Touche Tohmatsu.

#14. GMO Japan

Part of GMO Internet group, a technology-and-finance conglomerate that runs the largest retail foreign-exchange service in the world. The exchange traded nearly $10 billion in digital assetstin April. GMO offers Japanese clients 26 cryptocurrencies in yen alongside 14 foreign currency pairs to enable investing in multiple fiat currencies and crypto at zero fees. It also provides lending and staking services.

#15. Paxos

Operates the itBit exchange, issues stablecoins, and creates crypto infrastructure that enables large clients like PayPal, Nubank and Interactive Brokers to trade crypto and offer clients custody. Paxos is regulated by New York State and has a payments firm license from the Singapore and Abu Dhabi authorities. The firm suffered in 2023 when New York asked it to terminate its Binance USD (BUSD) stablecoin due to inadequate supervision of Binance’s own version, which existed alongside the Paxos-minted tokens. In late 2023, it introduced PYUSD, a regulated stablecoin by the NY Department of Financial Services, in partnership with e-payments giant PayPal.

#16. Luno

Owned by Digital Currency Group, Luno is licensed in seven international jurisdictions (though not the United States) and offers monthly audited attestations of its holdings (attestations are less stringent than audits) . It is known for its simple wallet, or trading interface, with 26 crypto trading pairs on offer. Its transaction volume, however, is on the low side. Fees vary widely, with 10 basis points in Europe and Uganda, 21bp in Indonesia, but 60 bp in South Africa, Nigeria and Malaysia.

#17. Bithumb

Seoul-based and regulated Bithumb is the second-largest crypto exchange by volume and assets serving South Korea. It offers 288 spot coins and 297 trading pairs, mostly against the won. Bithumb is a low fee leader. It normally charges 4 basis points, but in the final months of 2023 it ran a free trading promotion. Still, Bithumb has been profitable for years. Its low cost, regulated status, and wide spot offering have generated a loyal following.

#18. HashKey Exchange

In November 2022, as crypto volatility was spiking, HashKey was securing a crypto exchange license from the Hong Kong Securities and Futures Commission, known for its rigorous standards. The digital asset exchange, which is also a full service securities brokerage, is part of the Hong Kong’s HashKey Group, a diversified financial services firm with offices in Tokyo and Singapore.

#19. Bitpanda

Vienna-based Bitpanda is regulated as a payments firm, e-money provider and virtual-asset provider in Austria and France, allowing it to offer its services to all of continental Europe. It combines crypto services with traditional brokerage of stocks, ETFs, indexes, precious metals and other commodities. It charges a stiff 1.5% in commissions or fees for entering into transactions.

#20. Coincheck

One of the top four Japanese exchanges, despite a major black eye in 2018 when thieves stole $530 million worth of NEM tokens, the fourth-biggest hack in crypto history. Dipping into its own treasury, Coincheck made its customers whole and has since rebuilt its reputation. It holds more than $3 billion in client assets today. Its current offering is limited to eight crypto assets traded against the yen, and fees are low/free depending on the pair. It plans to go public on Nasdaq via a special-purpose acquisition company transaction in 2024.

Crypto Investing: Rules To Live By

1. Don’t fall for slick websites.

The crypto exchange business has few barriers to entry. It doesn’t take much more than creating an impressive looking website, social media profile, and securing a handful of digital wallets. Assets and trading activity can be easily faked. In 2022 we published a research project showing that half of all bitcoin trading activity was likely fabricated. The risks are even higher for investors trading second and third tier tokens, which are a specialty of the lesser quality digital asset exchanges.

2. Verify, don’t trust.

Before depositing your capital at an exchange, its a good idea to investigate it with reputable data providers like Arkham and Defillama say about the assets the exchange holds in custody. If they report less than $100 million in real assets (bitcoin, ether), steer clear. Also, be very wary of any exchange-reported trading data (ie self-reported) , which is often inflated.

3. Check licenses

Crypto-specific licenses are no guarantee of safety and solvency. But more likely than not, having licenses shows that a firm is committed to transparency and complying with rules. You can also verify a license reported on an exchange’s website with the issuing authority. It is important to do so because there have been multiple false claims.

4. Don’t just accept high fees

Users paid nearly 2% in commissions or fees in 2023 to trade at Coinbase compared with near-zero fees trading crypto at Robinhood, LMAX Digital, and several Japanese exchanges. Whether its stock index fund investing or hyper-crypto trading fees eat into returns. We gave affordability has a 10% weighting in our rankings.

5. Crypto trading is more concentrated than it appears.

There may be more than 600 firms offering crypt trading, but Coinbase currently has custody of 44% of all bitcoin and ether held at exchanges. While it is a reputable company with a long audit history from Deloitte, keeping most of your assets at one service provider is never prudent. Consider spreading the wealth around.

6. Forget about fad or so called “memecoins.”

While regulators in some markets–Hong Kong, Japan and South Korea, for example–limit which tokens can be listed on their exchanges, other jurisdictions have few or no barriers. Exchanges will list nearly anything with customer demand as long as they believe that an asset is technically secure and not a security, regardless of whether a token has utility. Buying joke tokens, is not investing, it is speculating or gambling and the only thing that gives these tokens value is the existence of a fool greater than you willing to pay a higher price.

7. Don’t sweat the SEC (for now).

Given that crypto has been especially susceptible to frauds and hacks, the SEC, which is charged with investor protection, is understandably not a fan of crypto companies. In the past few years it has launched suits against Binance, Coinbase, and Kraken. Now, it has issued warnings of likely actions to Uniswap Labs (primary developer of the eponymous decentralized exchange) and Robinhood Crypto. Except for Binance, these exchanges are primarily being sued for failing to register as national securities exchanges under the Securities and Exchange Act of 1934, not for overtly deceptive practices. This is why Coinbase, Robinhood and Kraken are prominent in our rankings.

Methodology

The 2024 Forbes list began with a multi-month study of 646 crypto exchanges listed by sources including CoinMarketCap and CryptoCompare. We concluded that 74% of them lacked sufficient assets under custody to be considered for our list, using data from analytics specialists like Arkham and Defillama. Additional checks for those vetted more thoroughly included products offered on their websites, trading volume, traffic volume and regulatory history, if any. Forbes then evaluated each firm on the list in nine categories on a scale from 1 to 10. The scores were then tallied and weighted by the percentages in the second row of the ranking table above to obtain a composite final score.

BTC+ETH

Represents total holdings of bitcoin and ether. For derivatives exchanges like Deribit and CME, we are counting open interest.

10: $50+ Billion

8: $10B–$49B

6: $5–$9.9 billion

4: $1B–$4.9B

2: $0.5B–$0.9B

1: $0.1B–$0.49B

TRANSPARENCY

Forbes sent a survey to pre-selected firms. Transparency points were earned based on the number of successful responses to questions.

10: 25-28

8: 20-24

6: 15-19

4: 10-14

2: 5-9

0: 0 response

REGULATION

Points earned based on quantity and type of license, combined with reputation of home regulator.

7: Designated Contract Market

2: Virtual asset service provider

3: Payments firm

2: Money transmitter firm

3: Broker dealer

3: Crypto exchange

COST

Points were awarded based on lowest cost entry point for retail investors. Cost is measured in ‘basis points.’ Each basis point is equal to one hundredth of one percent.

10: 0-5bp

8: 6-10bp

6: 11-20bp

4: 20-30bp

2: 31-50bp

0: More than 50bp

AUDIT STRENGTH

Firms evaluated based on auditor quality and years under audit.

10: 5+ years, Big 4 (Deloitte, E&Y, PWC, KPMG)

7: 1-4yrs Big-4

3: Non big-4 audit

2: Pending first audit

0: No audit

INSTITUTIONAL CLIENTS

Top points earned for serving as a reference rate provider to the CME for pricing derivatives clients. Large institutional client base earned a half-score.

10: CME Constituent exchange

5: Has institutional clients

0: Retail only

SPOT VOLUME

Points earned based on average daily spot volume (ADV).

10: $1+Billion ADV

8: $500M-$999M ADV

6: $250M-$499M ADV

4: $100M-$249M ADV

2: $50M-$99M ADV

0: Less than $50M ADV

CRYPTO PRODUCTS

Points given based on variety of product offerings.

2: Crypto futures/options

1: Crypto perpetuals

2: Crypto stocks

2: Crypto ETFs

3: Spot crypto

1: Lending / Staking

DERIVATIVES VOLUME

Points given based on average daily derivatives volume (ADV).

10: $5+B ADV

8: $1B-$4.9B ADV

6: $500M-$999M ADV

4: $250M-$499M ADV

2: $50M-$249M ADV

0: Less than $50M ADV

MORE FROM FORBES

ForbesDubai Unlocked: Inside The Secret Billionaire HideawaysBy Giacomo TogniniForbesHow Much Is Stormy Daniels Making Off Donald Trump?By Zach EversonForbesMeet The Greek Shipping Billionaires Getting Rich Off Russian OilBy Giacomo TogniniForbesBuffett’s 2024 Investment Wisdom: Psychology Matters As Much As FinancialsBy John DoboszForbesThis Pandemic Boom Town Is Also A Surprisingly Wonderful Place To RetireBy Emily Mason

Fuente

Markets

Today’s top crypto gainers and losers

Over the past 24 hours, Jupiter and JasmyCoin emerged as the top gainers among the top 100 crypto assets, while Bittensor and Mantra plunged as the top losers.

Top Winners

Jupiter

Jupiter (JUP) led the charge among the biggest gainers on July 27.

At the time of writing, the crypto asset had surged 12.6% in the past 24 hours and was trading at $1.16. JUP’s daily trading volume was hovering around $282 million, according to data from crypto.news.

JUP Hourly Price Chart, July 26-27 | Source: crypto.news

Additionally, the cryptocurrency’s market cap stood at $1.56 billion, making it the 62nd largest crypto asset, according to CoinGecko. Despite the recent price surge, the token is still down 42.6% from its all-time high of $2 reached on Jan. 31.

Jupiter functions as a decentralized exchange aggregator that allows users to trade Solana-based tokens. The platform also offers users the best routes for direct trades between multiple exchanges and liquidity pools.

In addition to being a DEX aggregator, Jupiter has expanded into a “full stack ecosystem” by launching several new projects, including a dedicated pool to support perpetual trading and plans for a stablecoin.

JasmyCoin

JasmyCoin (JASMI) has increased by 12% in the last 24 hours and is trading at $0.0328 at press time. JASMY’s daily trading volume has increased by 10% in the last 24 hours, reaching $146 million.

JASMY Hourly Price Chart, July 26-27 | Source: crypto.news

The asset’s market cap has surpassed the $1.5 billion mark, making it the 60th largest cryptocurrency at the time of reporting. However, the self-proclaimed “Bitcoin of Japan” is still down 99.3% from its all-time high of $4.79 on February 16, 2021.

JASMY is the native token of Jasmy Corporation, a Japanese Internet of Things provider. The platform seeks to merge the decentralization of blockchain technology with IoT, allowing users to convert their digital information into digital assets.

The initiative was launched by Kunitake Ando, former COO of Sony Corporation, along with Kazumasa Sato, former CEO of Sony Style.com Japan Inc., Hiroshi Harada, executive financial analyst at KPMG, and other senior executives from Japan.

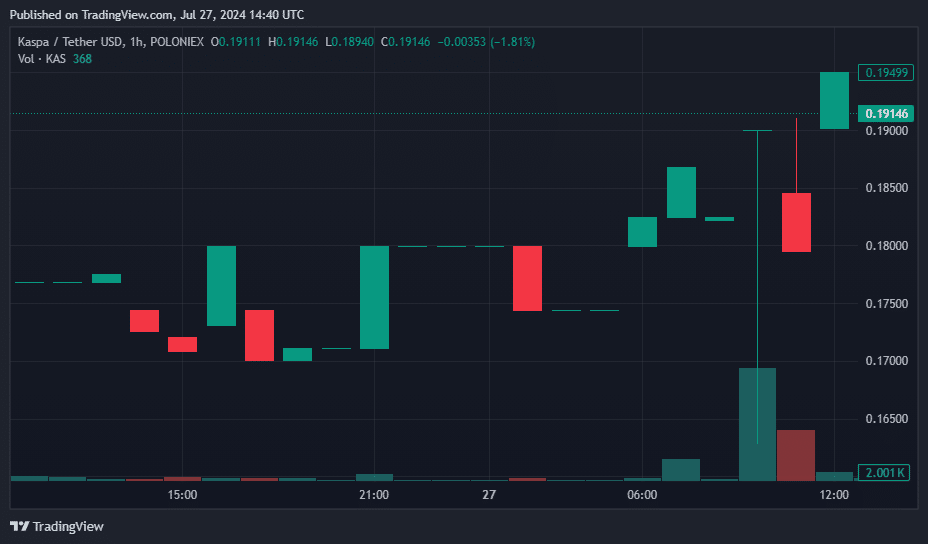

Kaspa

Kaspa (KAS) saw a 100% increase in trading volume and an 8% increase in price over the past 24 hours, trading at $0.19 at the time of publication.

KAS Hourly Price Chart, July 26-27 | Source: crypto.news

According to data from CoinGecko, Kaspa now ranks 27th in the global cryptocurrency list, with a circulating supply of approximately 24.29 billion KAS tokens and a market capitalization of $4.59 billion.

Kaspa is a cryptocurrency designed to deliver a high-performance, scalable, and secure blockchain platform. Its unique Layer-1 protocol includes the GhostDAG protocol, a proof-of-work (PoW) consensus mechanism that enables faster block times and higher transaction throughput compared to standard blockchains.

Unlike Bitcoin, GhostDAG allows multiple blocks to be created simultaneously, speeding up transactions and increasing block rewards for miners.

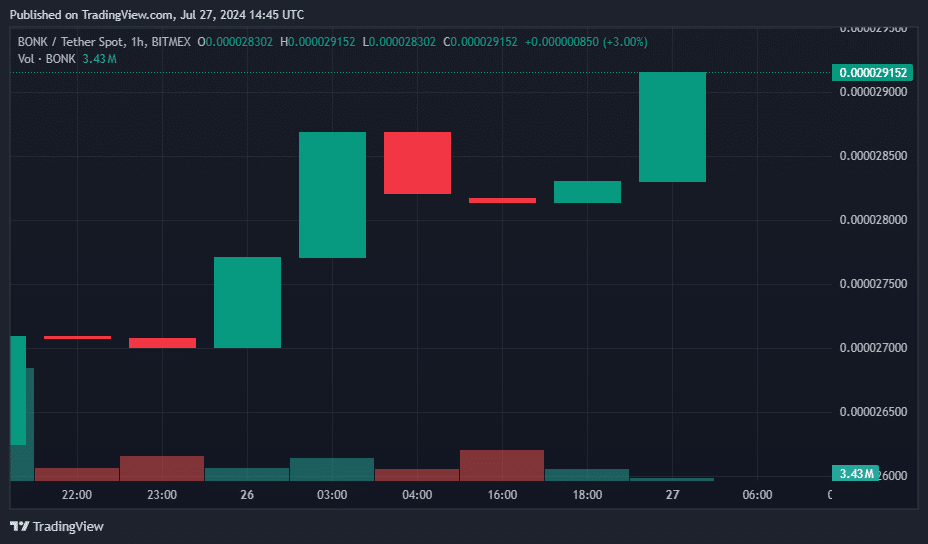

Bonk

Bonk (BONK) is the only one coin meme which made it to this list of biggest gainers and jumped 8.6% in the last 24 hours. Trading at $0.000030, the Solana-based meme coin’s market cap has surpassed $2.1 billion, surpassing Floki (FLOKI), another competing dog-themed coin with a market cap of $1.78 billion.

BONK Hourly Price Chart, July 26-27 | Source: crypto.news

BONK’s daily trading volume hovered around $285 million. However, BONK is still down 33.5% from its all-time high of $0.000045, reached on March 4.

Bonk, a meme coin that rose to prominence in 2023, has contributed significantly to Solana’s value increase amid the meme coin frenzy.

Bonk started out as a simple dog-themed coin. It has since expanded its features to include integration with decentralized finance. The project also partners with cross-chain communication protocols, NFT marketplaces, and various other cryptocurrency ecosystems.

BONK trading pairs are now listed on major exchanges including Binance, Coinbase, OKX, and Bitstamp.

The big losers

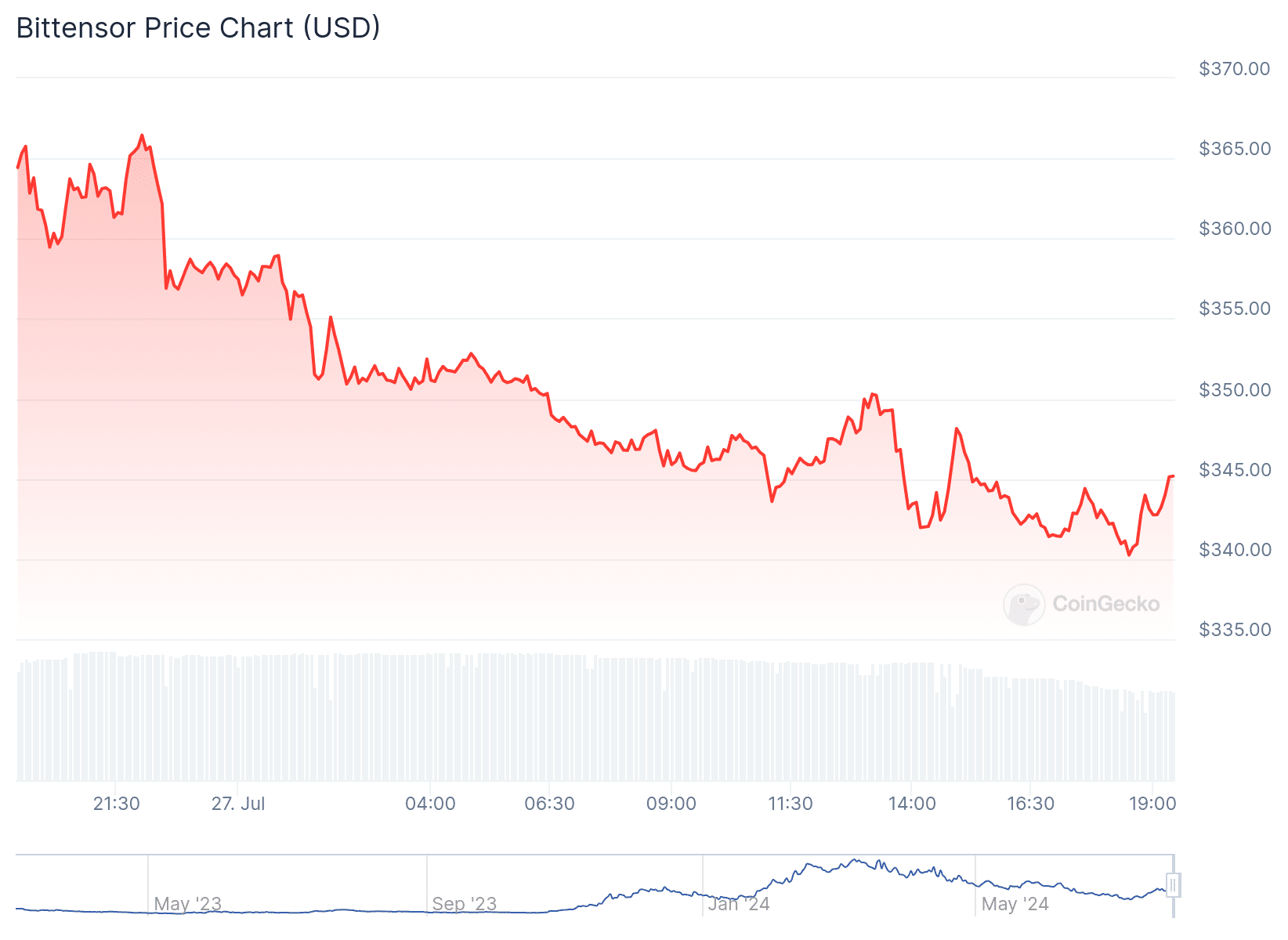

Bittensor

Bittensor (TAO) was the biggest loser among the 100 largest crypto assets, according to data from CoinGecko.

At the time of writing, TAO, the native token of decentralized AI project Bittensor, was down 5%, trading around $344. The crypto asset had a daily trading volume of $59 million and a market cap of $2.43 billion.

TAO 24 Hour Price Chart | Source: CoinGecko

Bittensor, created in 2019 by AI researchers Ala Shaabana and Jacob Steeves, initially operated as a parachain on Polkadot before transitioning to its own layer-1 blockchain in March 2023.

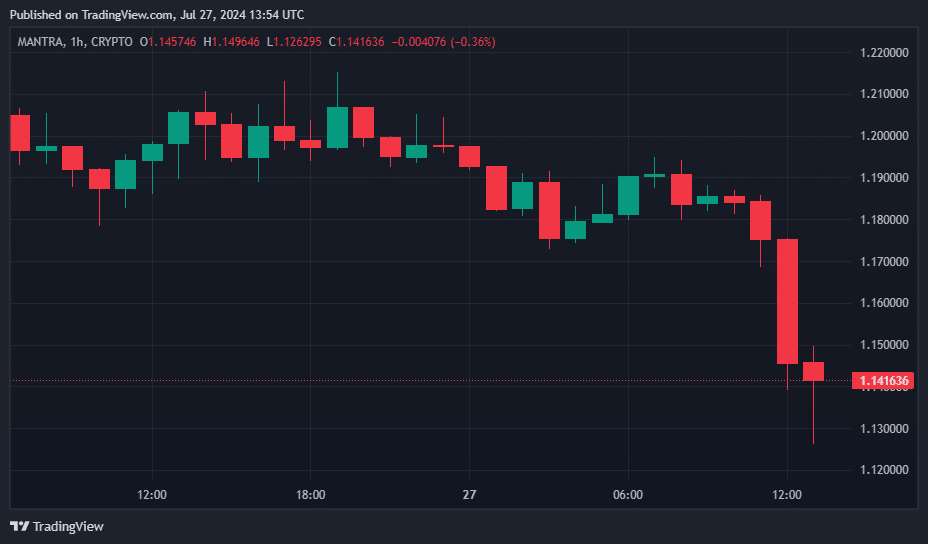

Mantra

Mantra (OM) fell 6%, trading at $1.13 at press time. The digital currency’s market cap fell to $938 million. Additionally, the 82nd largest crypto asset has a daily trading volume of $26 million.

OM Price Hourly Chart, July 26-27 | Source: crypto.news

Mantra is a modular blockchain network comprising two chains, Manta Pacific and Manta Atlantic, specialized in zero-knowledge applications.

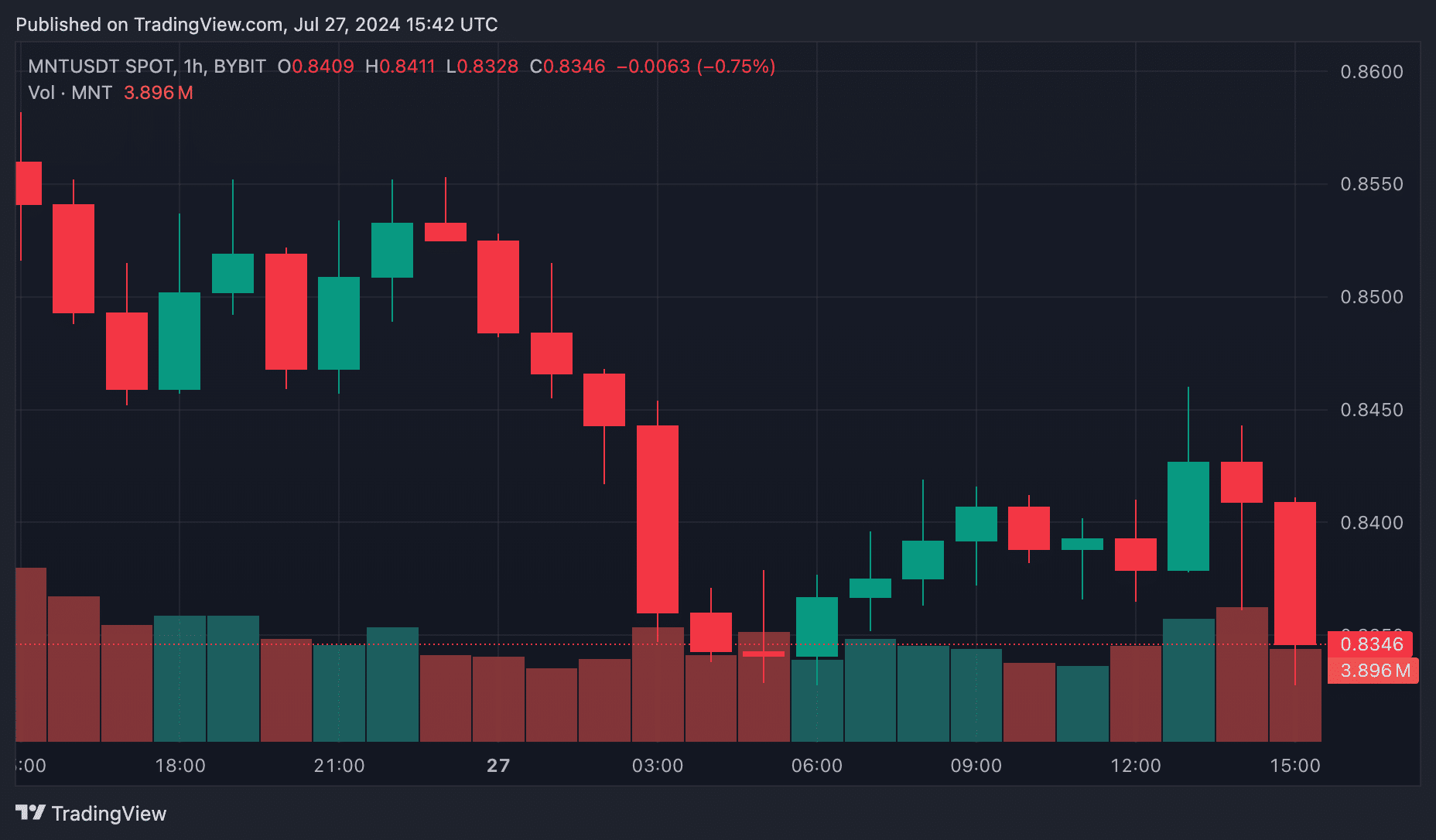

Coat

Coat (MNT) also saw a 2.4% drop in price, now trading at $0.8413. Currently, Mantle has a market cap of around $2.75 billion, which ranks 36th in the global cryptocurrency rankings by market cap, according to price data from crypto.news.

MNT Hourly Price Chart, July 26-27 | Source: crypto.news

Over the past 24 hours, MNT trading volume also fell by 6%, reaching $240 million.

Mantle, formerly known as BitDAO, is an investment DAO closely associated with Bybit. The MNT token is essential for governance, paying gas fees on the Mantle network, and staking on various platforms.

Built on the Ethereum network, Mantle provides a platform for decentralized application developers to launch their projects. It has become particularly popular for GameFi applications, leading to the formation of an internal Web3 gaming team.

Markets

Bitcoin Price Drops to $67,000 Despite Trump’s Pro-Crypto Comments, Further Correction Ahead?

Pioneer cryptocurrency Bitcoin has registered a 1.13% decline in the past 24 hours to trade at $67,400. Despite a strong pro-crypto stance from US presidential candidate Donald Trump at the Bitcoin 2024 conference, this massive selloff has raised concerns in the market about the asset’s sustainability at a higher price. However, given the recent three-week rally, a slight pullback this weekend is justifiable and necessary to regain the depleted bullish momentum.

Bitcoin Price Flag Formation Hints at Opportunity to Break Beyond $80,000

The medium-term trend Bitcoin Price remains a sideways trend amidst the formation of a bullish flag pattern. This chart pattern is defined by two descending lines that are currently shaping the price trajectory by providing dynamic resistance and support.

On July 5, BTC saw a bullish reversal from the flag pattern at $53,485, increasing its asset by 29.75% to a high of $69,400. This recent spike followed the market’s positive sentiment towards the Donald Trump speech at the Bitcoin 2024 conference in Nashville on Saturday afternoon.

Bitcoin Price | Tradingview

In his speech, Trump outlined several pro-crypto initiatives: he promised to replace SEC Chairman Gary Gensler on his first day in office, to establish a Strategic National Reserve of Bitcoin if elected, to ensure that the U.S. government holds all of its assets. Bitcoin assets and block any attempt to create a central bank digital currency (CBDC) during his presidency.

He also claimed that under his leadership, Bitcoin and cryptocurrencies will skyrocket like never before.

Despite Donald Trump’s optimistic promises, the BTC price failed to reach $70,000 and is currently trading at $67,400. As a result, Bitcoin’s market cap has dipped slightly to hover at $1.335 trillion.

However, this pullback is justified, as Bitcoin price has recently seen significant growth over the past three weeks, which has significantly improved market sentiment. Thus, price action over the weekend could replenish the depleted bullish momentum, potentially strengthening an attempt to break out from the flag pattern at $70,130.

A successful breakout will signal the continuation of the uptrend and extend the Bitcoin price forecast target at $78,000, followed by $84,000.

On the other hand, if the supply pressure on the upper trendline persists, the asset price could trigger further corrections for a few weeks or months.

Technical indicator:

- Pivot levels: The traditional pivot indicator suggests that the price pullback could see immediate support at $64,400, followed by a correction floor at $56,700.

- Moving average convergence-divergence: A bullish crossover state between the MACD (blue) and the signal (orange) ensure that the recovery dynamics are intact.

Related Articles

Frequently Asked Questions

A CBDC is a digital form of fiat currency issued and regulated by a country’s central bank. It aims to provide a digital alternative to traditional banknotes.

The proposal for a strategic national Bitcoin reserve is a major confirmation of Bitcoin’s legitimacy and potential as a reserve asset. Such a move could position Bitcoin in a similar way to gold, potentially stabilizing its price and encouraging other countries to adopt similar strategies.

Conferences like Bitcoin 2024 serve as essential platforms for networking, knowledge sharing, and showcasing new technologies within the cryptocurrency industry.

Markets

Swiss crypto bank Sygnum reports profitability after surge in first-half trading volumes – DL News

- Sygnum says it has reached profitability after increasing transaction volumes.

- The Swiss crypto bank does not disclose specific profit figures.

Sygnum, a Swiss global crypto banking group with approximately $4.5 billion in client assets, announced that it has achieved profitability after a strong first half, with key metrics showing year-to-date growth.

The company said in a Press release Compared to the same period last year, cryptocurrency spot trading volumes doubled, cryptocurrency derivatives trading increased by 500%, and lending volumes increased by 360%. The exact figures for the first half of the year were not disclosed.

Sygnum said its staking service has also grown, with the percentage of Ethereum staked by customers increasing to 42%. For institutional clients, staking Ethereum has a benefit that goes beyond the limitations of the ETF framework, which excludes staking returns, Sygnum noted.

“The approval and launch of Bitcoin and Ethereum ETFs was a turning point for the crypto industry this year, leading to a major increase in demand for trusted, regulated exposure to digital assets,” said Martin Burgherr, Chief Client Officer of Sygnum.

He added: “This is also reflected in Sygnum’s own growth, with our core business segments recording significant year-to-date growth in the first half of the year.”

Sygnum, which has also been licensed in Luxembourg since 2022, plans to expand into European and Asian markets, the statement said.

Markets

Former White House official Anthony Scaramucci says cryptocurrency bull market could be sparked by regulatory clarity

Anthony Scaramucci, founder of Skybridge Capital, says the next cryptocurrency bull market could be sparked by a new wave of clear cryptocurrency regulations.

In a new interview On CNBC’s Squawk Box, the former White House communications director said he and two other prominent industry figures traveled to Washington, D.C. to speak to officials about the dangers of Sen. Elizabeth Warren and U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler’s hardline approach to cryptocurrency regulation.

“Mark Cuban, myself, and Michael Novogratz were in Washington a few weeks ago to speak with White House officials and explain the dangers of Gary Gensler and Elizabeth Warren’s anti-crypto approach. I hope that message gets through…

“Overall, if we can get regulatory policy around Bitcoin and crypto assets in sync, we will have a bull market next year for these assets.”

Scaramucci then compares crypto assets to ride-hailing company Uber, saying regulators were initially wary of the service but eventually decided to adopt clear guidelines due to public demand.

“Remember Uber: Nobody wanted Uber. A lot of regulators didn’t want it. Mayors and deputy mayors didn’t want it, but citizens wanted Uber and eventually accepted the idea of regulating it fairly. I think we’re there now.”

The CEO also says young Democratic voters believe their leaders are making the wrong choices when it comes to digital assets.

“I think President Trump’s move toward Bitcoin and crypto assets has shaken Democrats to their core, and I think very smart, younger Democrats are recognizing that they are completely off base with their positions, completely off base with these SEC lawsuits and regulation by law enforcement, and now they need to get back to the center.”

Don’t miss a thing – Subscribe to receive email alerts directly to your inbox

Check Price action

follow us on X, Facebook And Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed on The Daily Hodl are not investment advice. Investors should do their own due diligence before making any high-risk investments in Bitcoin, cryptocurrencies or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Image generated: Midjourney

-

Videos4 weeks ago

Videos4 weeks agoAbsolutely massive: the next higher Bitcoin leg will shatter all expectations – Tom Lee

-

News12 months ago

News12 months agoVolta Finance Limited – Director/PDMR Shareholding

-

News12 months ago

News12 months agoModiv Industrial to release Q2 2024 financial results on August 6

-

News12 months ago

News12 months agoApple to report third-quarter earnings as Wall Street eyes China sales

-

News12 months ago

News12 months agoNumber of Americans filing for unemployment benefits hits highest level in a year

-

News1 year ago

News1 year agoInventiva reports 2024 First Quarter Financial Information¹ and provides a corporate update

-

News1 year ago

News1 year agoLeeds hospitals trust says finances are “critical” amid £110m deficit

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Hit $100 Billion in 2024, Fueling Insane Investor Optimism ⋆ ZyCrypto

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Videos1 year ago

Videos1 year ago$1,000,000 worth of BTC in 2025! Get ready for an UNPRECEDENTED PRICE EXPLOSION – Jack Mallers

-

Videos1 year ago

Videos1 year agoABSOLUTELY HUGE: Bitcoin is poised for unabated exponential growth – Mark Yusko and Willy Woo

-

Tech1 year ago

Tech1 year agoBlockDAG ⭐⭐⭐⭐⭐ Review: Is It the Next Big Thing in Cryptocurrency? 5 questions answered