Markets

What’s Behind the 35% LINK Rally?

Chainlink price surged to a 40-day high of $16.7 on May 18, bringing its monthly gains to 34.7%, with on-chain data suggesting increased whale activity amid recent US macroeconomic cues positive.

Chainlink Prices Rise as Big Investors Look to Looming Rate Cuts

Chainlink is a leading blockchain oracle platform that integrates real-time price feeds of offline assets into crypto products.

Over the past year, Chainlink has entered into high-profile partnerships with leading trading institutions like SWIFT, cementing its position as an industry leader in providing critical pricing oracle infrastructure to facilitate Tokenization of assets and the proliferation of real-world assets (RWA) traded on the blockchain.

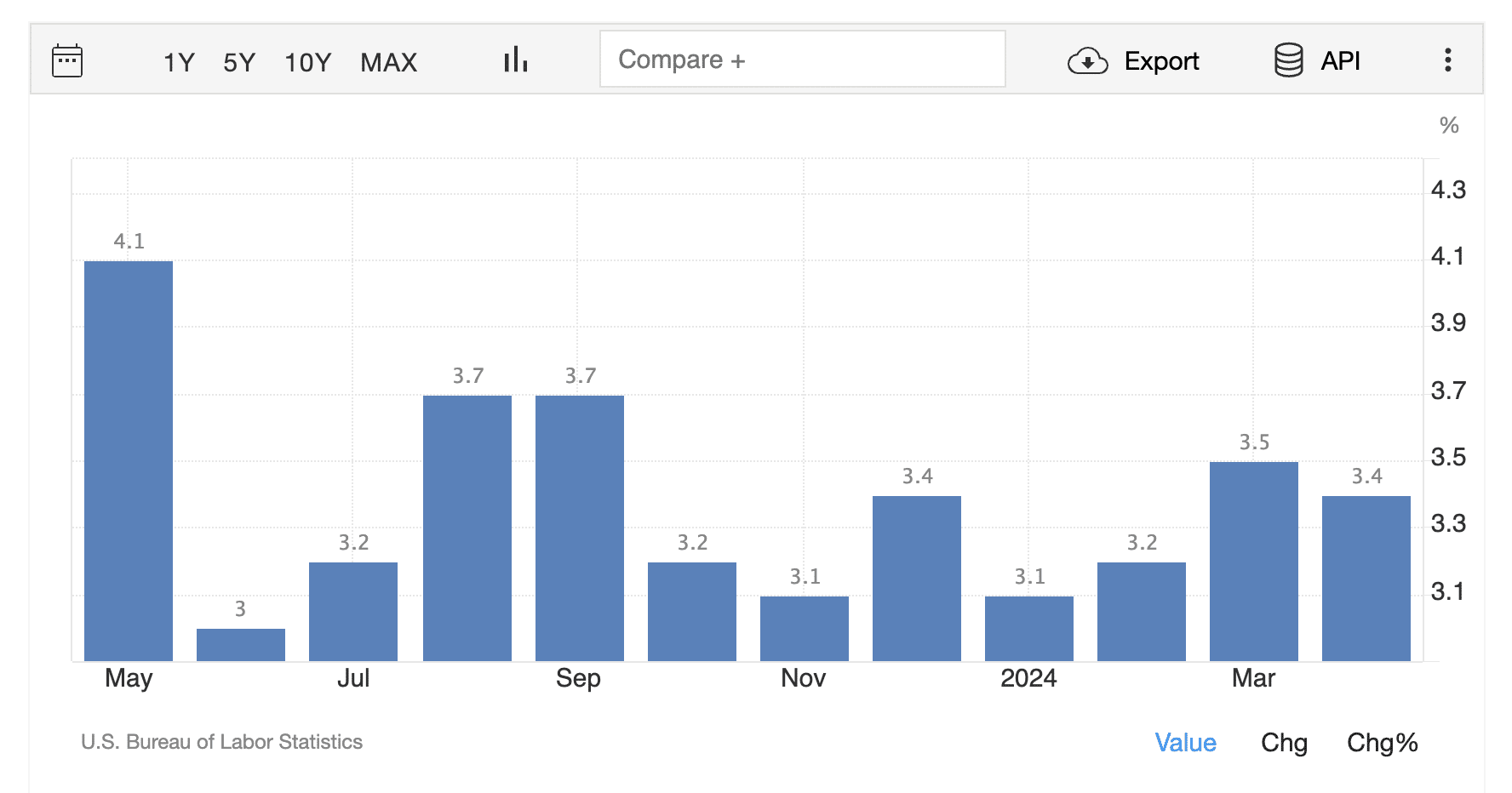

In May 2024, the US Fed announced a third consecutive pause, while the US Bureau of Statistics also reported a consumer inflation rate of 3.36%, which is cooler than the 3.48% of the last month and 4.93% last year.

These latest macroeconomic indices have increased optimism among market analysts that the US Fed could follow the European Central Bank (ECB) which has shown the first signals of rate reduction as early as June 2024.

Analysts predict that a Fed rate cut in 2024 could lead to a boom in crypto markets, particularly in nascent sectors like asset tokenization and real-world assets (RWA), where Chainlink has established its technological dominance over the past year.

23 Whales wallets buy LINK tokens in 2 weeks

Unsurprisingly, on-chain data trends show that crypto whales and large institutional investors have rushed to purchase large quantities of LINK tokens based on the potentially dovish macroeconomic cues reported in the United States this month.

– Advertisement –

The Santiment chart below represents the evolution of the number of Chainlink wallets holding balances of at least 100,000 LINK (~$1.5 million). It provides real-time information on the speed at which large institutional investors are joining (or leaving) a particular crypto ecosystem.

The chart above shows that Chainlink had 554 active whale wallets as of May 3 when the US Fed announced a rate pause. Since then, whale activity on the Chainlink network has continued to increase.

Following the latest conciliatory IPC data released on May 13, the number of Chainlink whale wallets has now skyrocketed to 567 at the time of writing on May 17.

This essentially implies that 23 additional whale wallets have been active on the Chainlink network over the past two weeks, with each of them purchasing at least $1.5 million worth of LINK tokens.

When there is a significant number of whale investors on a blockchain network, as observed on Chainlink this week, strategic investors may view it as a major bullish signal for two main reasons.

First, increased whale activity often indicates growing confidence among large investors in the asset’s future prospects. Whales are generally well-informed and have access to sophisticated analytical tools, so their actions can be a strong indicator of positive future performance.

Second, the accumulation of large quantities of LINK tokens by new whale wallets may create a supply squeeze, leading to upward pressure on prices. As whales often wait for longer-term investment goals, reducing the supply available on the open market can drive up prices.

Even more so, the timing of this increase in Chainlink whale activity suggests that large investors are taking strategic steps to anticipate potential gains from an imminent U.S. Fed rate cut.

Chainlink Price Forecast: Bulls Target Retest of $20 After $2.3 Billion Increase in LINK Market Cap

Chainlink’s price is hovering around $16.40 at the time of writing on May 18, having added over $2.3 billion to its market cap since the release of US CPI data. Increasing whale activity, following dovish economic signals, suggests that LINK price could be poised for another surge towards $20 in the coming days.

Looking at key technical indicators, LINK price has now surpassed critical resistance at $15.97 highlighted by the upper boundary Bollinger band. This alignment suggests that bulls are now firmly in control of Chainlink market dynamics in the near term.

If more whales join the buying frenzy, Chainlink’s price will likely surpass $20, as expected. But in case of a correction phase, LINK bullish traders must defend the support price level of $14.12 to avoid losing the bullish momentum.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinions of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. Crypto Basic is not responsible for any financial losses.

-Advertisement-