DeFi

XPAD Review | CoinCodex

In recent years, the decentralized finance (DeFi) industry has seen incredible growth and innovation. However, many challenges still need to be addressed that prevent widespread adoption. One of the main issues facing both investors and projects is the need to strengthen the security and quality control of launch platforms. It’s too easy for scams and attempted fraud to slip through the cracks, undermining trust in the entire ecosystem.

Enter XPADPRO, a new player aiming to completely disrupt the launch pad model and set a new benchmark in security and governance. Through its proprietary Xpad protocol and a unique DAO structure, XPADPRO seeks to eliminate the risks that have held DeFi back while opening new opportunities for investors.

In this article, we’ll take an in-depth look at what makes XPADPRO so compelling. We’ll discuss the problems they aim to solve, how their technical solutions work, and why their tokenomics offer investors strong upside potential. By the end, you’ll understand why XPADPRO might just become the premier home to launch the next generation of leading crypto projects.

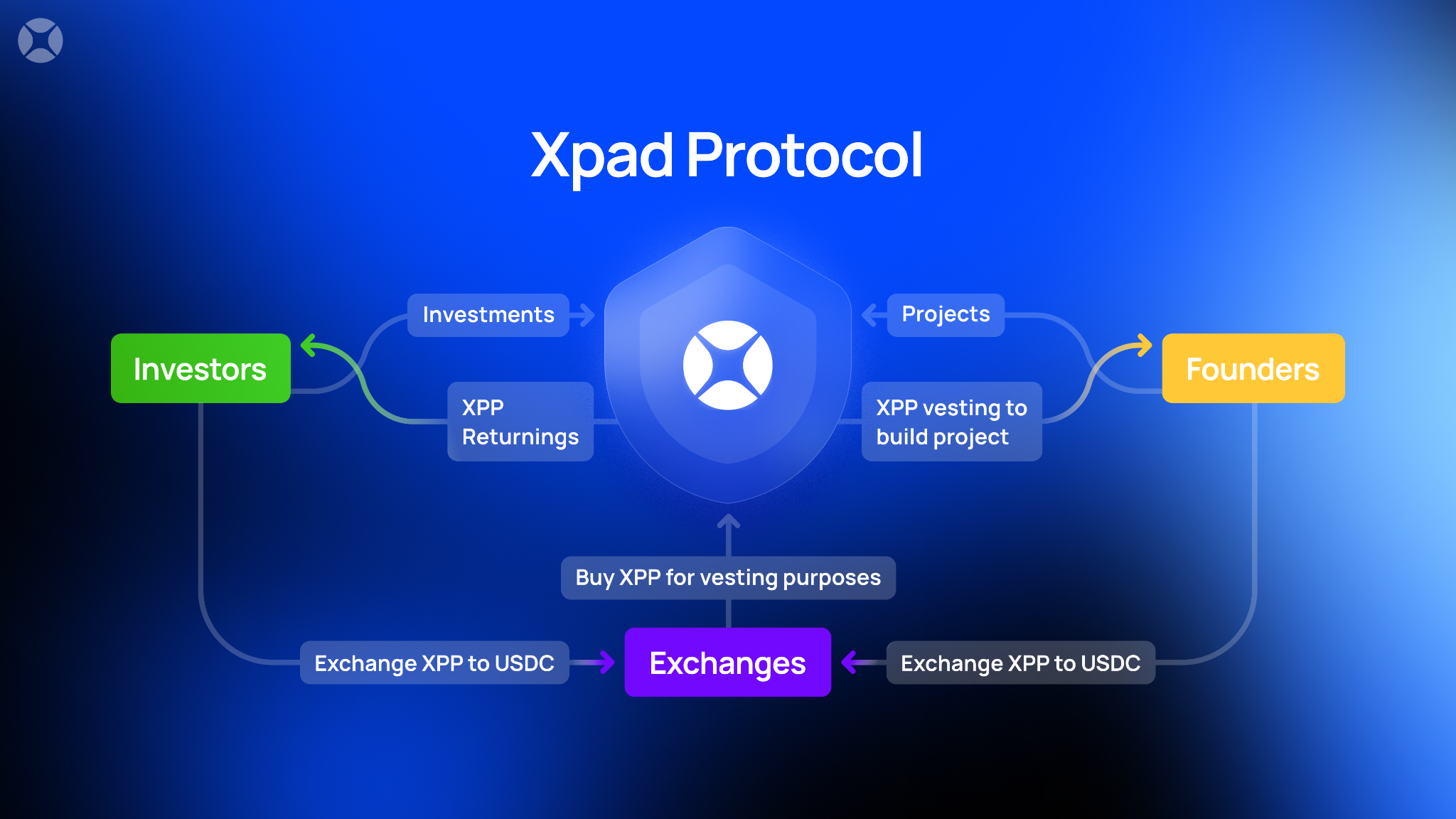

Picture: Highly Utility XPADPRO System Using $XPP Token

Solving DeFi’s Biggest Problems

As the saying goes, “one bad apple spoils everyone.” Unfortunately, in the Wild West era of DeFi, there have been more than a few “bad apples” in the form of exit scams, rug pulls, and other nefarious activities. This understandably scared many potential investors away from the entire industry.

The launch pads themselves haven’t always helped matters either. Even if the biggest names launch solid projects, they still don’t have foolproof ways to weed out potential scams during the listing process. There is also no recourse once a project draws on and steals funds.

It is this lack of accountability and quality control that XPAD aims to fundamentally solve. Their mission is to restore trust in the DeFi ecosystem by establishing the safest possible environment for projects and investors to thrive.

Using their proprietary XPad Protocol smart contracts coupled with DAO community governance, XPAD creates an “unhackable” system of checks and balances. Projects must meet strict criteria to be considered, and funds are blocked and released gradually according to predefined conditions. This eliminates the risk of projects abandoning tokens immediately after launch.

For investors, this means having the confidence that their funds will not disappear overnight if a project turns out to be a scam. XPAD essentially acts as a guarantor that the terms of any project launch will be faithfully executed. Don’t worry about being a victim of the next big headline-grabbing ‘rug pull’.

Through its next-generation security models and community monitoring, XPAD seeks to solve DeFi’s biggest persistent problem hindering its mainstream adoption. This creates the kind of trust and accountability that the space has long needed.

How the Xpad protocol works its magic

The key to XPADPRO’s value proposition is its revolutionary Xpad protocol. This proprietary smart contract system forms the backbone for the secure operation of the entire platform.

At the same time, tokens allocated to investors and the team itself are also locked through smart contracts. They are released gradually according to a pre-established schedule agreed by all parties.

It avoids “carpet pulls” by not allowing teams immediate access to funds. The money is only released once the community voting stages have been passed.

It stops “pumping and dumping” by gradually releasing tokens over long periods of time, from six months to a year.

All activities are transparent on-chain and regulated according to the conditions programmed at launch.

Perhaps most importantly, this system is completely “unhackable” because it works entirely on-chain. No third party or centralized entity can intervene once the conditions are set.

Through the Xpad protocol, projects benefit from equity while investors benefit from unprecedented security. No other launch platform can claim such strong protections against the risks that still weigh on DeFi.

A DAO-powered launchpad

Behind the scenes, engineering XPADPRO’s innovative model is a world-class team of serial entrepreneurs, top engineers, and crypto/DeFi heavyweights. But they don’t believe their vision of security and accountability is limited to protocol alone.

That’s why XPADPRO is taking the next step by establishing itself as a DAO, or Decentralized Autonomous Organization. This creates an autonomous community which has real decision-making powers over the operation of the platform.

With a DAO structure, it is the investors and users themselves who evaluate project applications, vote on the lists, and have a say in how funds are allocated and which features are prioritized in the long term. No entity has unilateral control.

Some main ways the DAO is involved:

- Review all potential projects using objective criteria before allowing registrations.

- Can blacklist teams that violate terms or act against community interests.

- Votes on platform cash budgets and initiatives such as marketing/development.

- Elects representatives to act as board members who govern important decisions.

By decentralizing control, XPADPRO ensures that decisions will always be aligned with the interests of its community rather than those of any single company. With governance literally in the hands of users, trust is maximized that the platform will remain fair and uncensored in the long term.

Leading project pedigree

When a platform aims to list only top-notch and quality crypto projects, it is best if it has a rock-solid track record to make it happen. Fortunately, XPADPRO’s pedigree gives investors confidence that only the best of the best projects will have access.

XPADPRO’s founders include serial entrepreneurs who have successfully launched numerous technology startups. They also have extensive relationships with leading venture funds, exchanges and crypto industry influencers, who will guide valuations.

More importantly, the engineering team behind Xpad Protocol has years of experience developing other popular DeFi platforms, like decimal string, bit team, polylastic. They understand the complex requirements of creating a robust and scalable blockchain infrastructure.

With such hefty CVs involved, you can rest assured that they will only let the cream of the crop through the doors. In other words, while access will always be competitive, in the XPADPRO-curated launch pool you’ll avoid worrying about whether something is a low-quality cash grab. Only true top-notch potential will gain community approval.

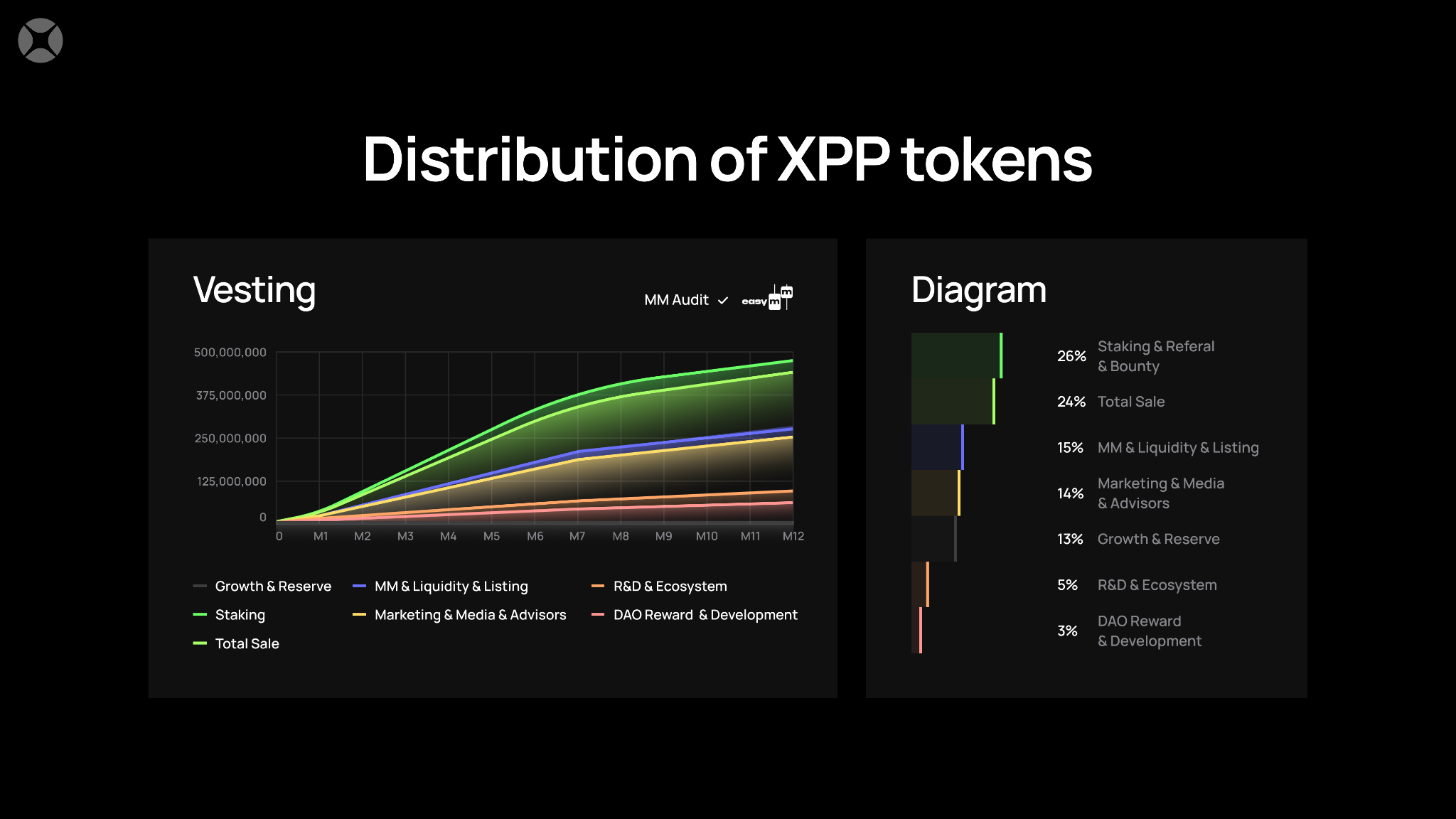

Tokenomics XPP – Benefits for Investors

Of course, no platform would be complete without a built-in utility token that powers its operation. For XPAD, the XPP token plays several important roles:

- It is used for platform fees: All service costs such as trading and governance will require XPP. This creates constant organic demand.

- Unlocks access to private sales: To participate in private project token rounds, users will need XPP holdings. Very exclusive privileges for early risers.

- Powers Staking Rewards: For those who stake their XPP long-term, lucrative yield incentives will be earned through the protocol’s revenue streams.

- Supports referral rewards: Invite new users or projects and earn a share of the transaction volume they generate by transacting on XPAD.

- Enables governance: As a DAO platform, XPP holders can vote on treasure allocation and feature priorities.

Now here’s why tokenomics themselves make XPP an inherently valuable investment proposition beyond just using the platform:

Limited total offer: Only 1.9 billion will ever exist, creating a severe shortage over time.

Deflationary burn: A portion of the fee is destroyed forever, continually reducing the circulating supply.

Strong use case benefits: As XPAD expands its user base and project listings, the demand for the various utilities provided by XPP will also increase.

With this combination of utility functions, limited emissions, and high long-term user retention rates, it is easy to predict that XPP will gain significant value as the platform expands globally . For patient investors and those willing to invest for the long term, this represents a very interesting opportunity.

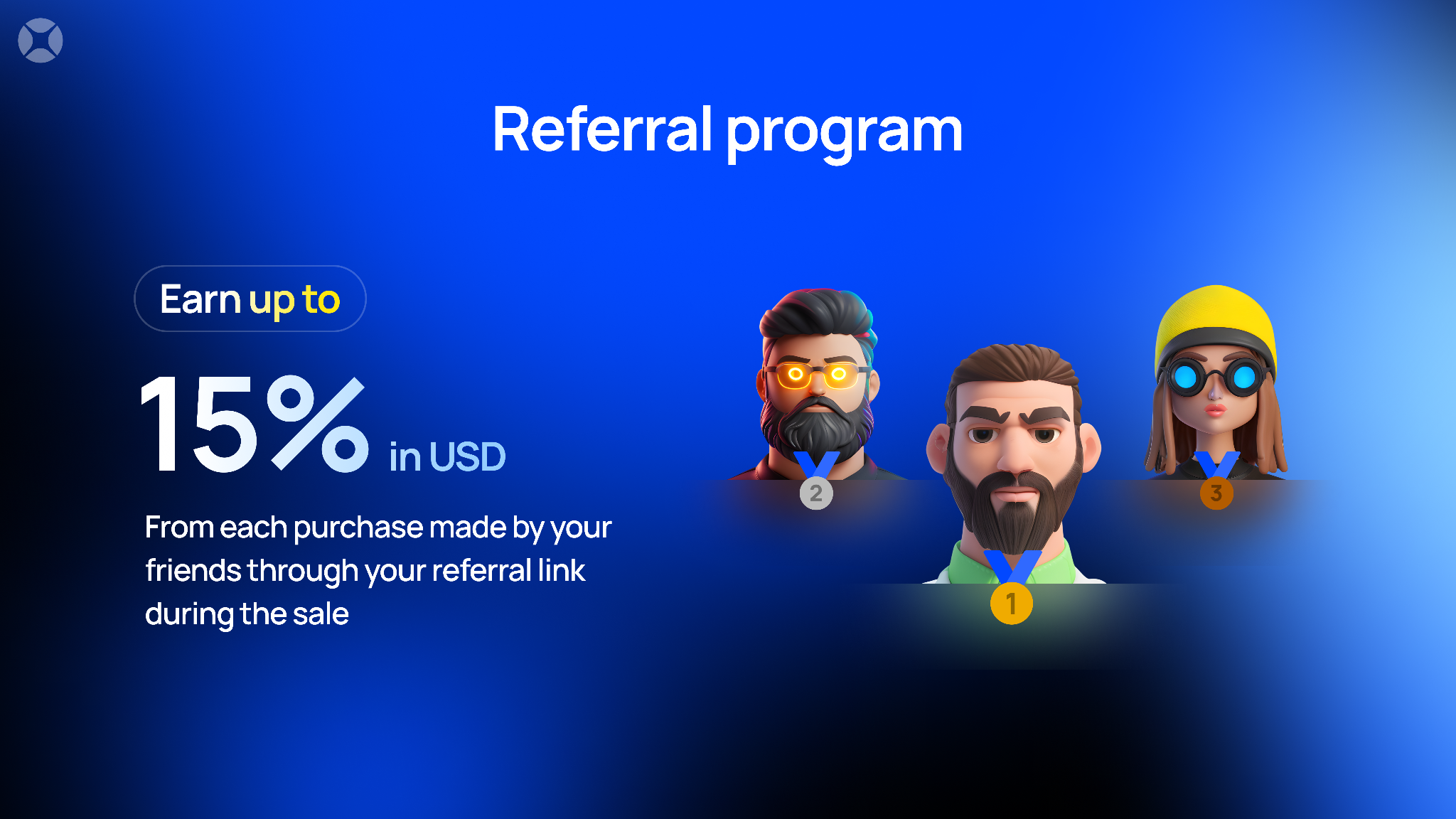

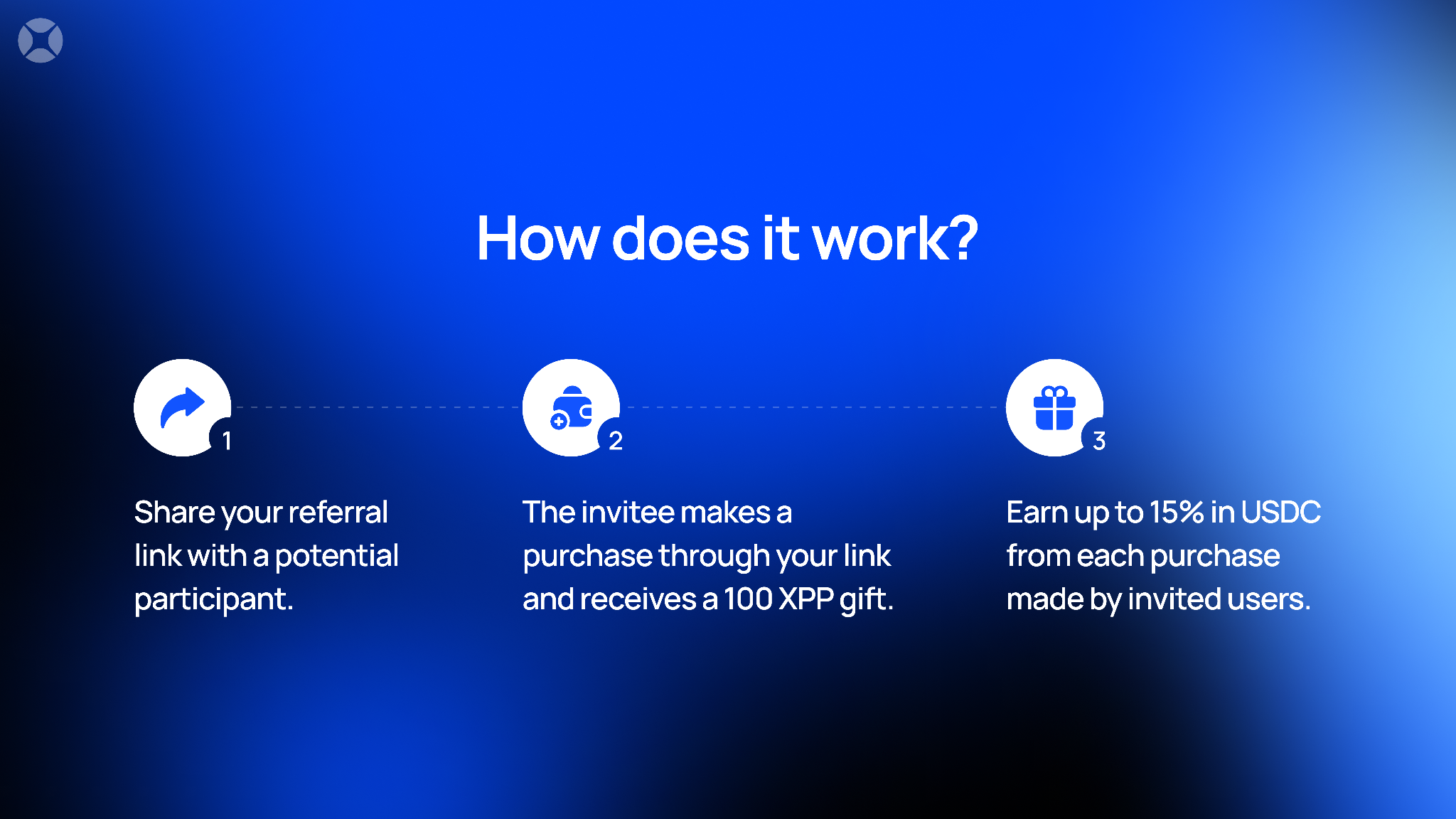

Arrive early – Referral bonus

For ambitious users willing to do a little work, XPAD wants to reward them handsomely through its generous referral program structure.

Earn 15% of their purchases after they sign up. The invited person receives a gift of 100 XPP when they purchase through your link.

With uncapped compensation paid in perpetuity as long as your sponsorship remains active, the potential to generate significant recurring rewards is real. It allows ambitious community members to earn like marketers and affiliates without having to put in much effort.

The Bottom Line: A Deep Dive into XPADPRO’s Vision and Game Plan

XPAD has all the assets to truly change the game in launchpad ecosystems. Its unique Xpad protocol establishes unprecedented security, while benefits like pre-purchase unlock premium access for the general public. With a limited and highly demanded XPP token feeder platform utility and passive income, you have as compelling an investment proposition as possible.

Keep your eyes peeled for their innovative roadmap and roster of top-tier partners like I have a bit. This is undoubtedly one of the most promising projects to emerge in the crowded launch pad space.

DeFi

Pump.Fun is revolutionizing the Ethereum blockchain in terms of daily revenue

The memecoin launchpad saw the largest daily revenue in all of DeFi over the past 24 hours.

Memecoin launchpad Pump.Fun has recorded the highest gross revenue in all of decentralized finance (DeFi) in the last 24 hours, surpassing even Ethereum.

The platform has raised $867,429 in the past 24 hours, compared to $844,276 for Ethereum, according to DeFiLlama. Solana-based Telegram trading bot Trojan was the third-highest revenue generator of the day, as memecoin infrastructure continues to dominate in DeFi.

Pump.Fun generates $315 million in annualized revenue according to DeFiLlama, and has averaged $906,160 per day over the past week.

Income Ranking – Source: DeFiLlama

The memecoin frenzy of the past few months is behind Pump.fun’s dominance. Solana-based memecoins have been the main drug of choice for on-chain degenerates.

The app allows non-technical users to launch their own tokens in minutes. Users can spend as little as $2 to launch their token and are not required to provide liquidity up front. Pump.Fun allows new tokens to trade along a bonding curve until they reach a set market cap of around $75,000, after which the bonding curve will then be burned on Raydium to create a safe liquidity pool.

Pump.Fun generates revenue through accrued fees. The platform charges a 1% fee on transactions that take place on the platform. Once a token is bonded and burned on Raydium, Pump.fun is no longer able to charge the 1% fee.

Ethereum is the blockchain of the second-largest cryptocurrency, Ether, with a market cap of $395 billion. It powers hundreds of applications and thousands of digital assets, and backs over $60 billion in value in smart contracts.

Ethereum generates revenue when users pay fees, called gas and denominated in ETH, to execute transactions and smart contracts.

DeFi

DeFi technologies will improve trading desk with zero-knowledge proofs

DeFi Technologies, a Canadian company financial technology companyis set to enhance its trading infrastructure through a new partnership with Zero Computing, according to a July 30 statement shared with CryptoSlate.

The collaboration aims to integrate zero-knowledge proof tools to boost operations on the Solana And Ethereum blockchains by optimizing its ability to identify and execute arbitrage opportunities.

Additionally, it will improve the performance of its DeFi Alpha trading desk by enhancing its use of ZK-enabled maximum extractable value (MEV Strategies).

Zero knowledge Proof of concept (ZKP) technology provides an additional layer of encryption to ensure transaction confidentiality and has recently been widely adopted in cryptographic applications.

Optimization of trading strategies

DeFi Technologies plans to use these tools to refine DeFi Alpha’s ability to spot low-risk arbitrage opportunities. The trading desk has already generated nearly $100 million in revenue this year, and this new partnership is expected to further enhance its algorithmic strategies and market analysis capabilities.

Zero Computing technology will integrate ZKP’s advanced features into DeFi Alpha’s infrastructure. This upgrade will streamline trading processes, improve transaction privacy, and increase operational efficiency.

According to DeFi Technologies, these improvements will increase the security and sophistication of DeFi Alpha’s trading strategies.

The collaboration will also advance commercial approaches for ZK-enabled MEVs, a new concept in Motor vehicles which focuses on maximizing value through transaction fees and arbitrage opportunities within block production.

Additionally, DeFi Technologies plans to leverage Zero Computing technology to develop new financial products, such as zero-knowledge index exchange-traded products (ETPs).

Olivier Roussy Newton, CEO of DeFi Technologies, said:

“By integrating their cutting-edge zero-knowledge technology, we not only improve the efficiency and privacy of our transactions, but we also pave the way for innovative trading strategies.”

Extending Verifiable Computing to Solana

According to the release, Zero Computing has created a versatile, chain-agnostic platform for generating zero-knowledge proofs. The platform currently supports Ethereum and Solana, and the company plans to expand compatibility with other blockchains in the future.

The company added that it is at the forefront of introducing verifiable computation to the Solana blockchain, enabling complex computations to be executed off-chain with on-chain verification. This development represents a significant step in the expansion of ZKPs across various blockchain ecosystems.

Mentioned in this article

Latest Alpha Market Report

DeFi

Elastos’ BeL2 Secures Starknet Grant to Advance Native Bitcoin Lending and DeFi Solutions

Singapore, Asia, July 29, 2024, Chainwire

- Elastos BeL2 to Partner with StarkWare to Integrate Starknet’s ZKPs and Cairo Programming Language with BeL2 for Native DeFi Applications

- Starknet integration allows BeL2 to provide smart contracts and dapps without moving Bitcoin assets off the mainnet

- Starknet Exchange Validates the Strength of BeL2’s Innovation and Leadership in the Native Bitcoin Ecosystem

Elastos BeL2 (Bitcoin Elastos Layer2) has secured a $25,000 grant from Starknet, a technology leader in the field of zero-knowledge proofs (ZKPs). This significant approval highlights the Elastos BeL2 infrastructure and its critical role in advancing Bitcoin-native DeFi, particularly Bitcoin-native lending. By integrating Starknet’s ZKPs and the Cairo programming language, Elastos’ BeL2 will enhance its ability to deliver smart contracts and decentralized applications (dapps) without moving Bitcoin (BTC) assets off the mainnet. This strategic partnership with Starknet demonstrates the growing acceptance and maturity of the BeL2 infrastructure, reinforcing Elastos’ commitment to market leadership in the evolving Bitcoin DeFi market.

Starknet, developed by StarkWare, is known for its advancements in ZKP technology, which improves the privacy and security of blockchain transactions. ZKPs allow one party to prove to another that a statement is true without revealing any information beyond the validity of the statement itself. This technology is fundamental to the evolution of blockchain networks, which will improve BeL2’s ability to integrate complex smart contracts while preserving the integrity and security of Bitcoin.

“We are thrilled to receive this grant from Starknet and announce our partnership to build tighter integrations with its ZKP technology and the Cairo programming language,” said Sasha Mitchell, Head of Bitcoin Layer 2 at Elastos. “This is a major milestone for BeL2 and a true recognition of the maturity and capabilities of our core technology. This support will allow us to further develop our innovation in native Bitcoin lending as we look to capitalize on the growing acceptance of Bitcoin as a viable alternative financial system.”

A closer integration with Cairo will allow BeL2 to leverage this powerful programming language to enhance Bitcoin’s capabilities and deliver secure, efficient, and scalable decentralized finance (DeFi) applications. Specifically, the relationship with Cairo reinforces BeL2’s core technical innovations, including:

- ZKPs ensure secure and private verification of transactions

- Decentralized Arbitrage Using Collateralized Nodes to Supervise and Enforce Fairness in Native Bitcoin DeFi

- BTC Oracle (NYSE:) facilitates cross-chain interactions where information, not assets, is exchanged while Bitcoin remains on the main infrastructure

BeL2’s vision goes beyond technical innovation and aims to innovate by creating a new financial system. The goal is to build a Bitcoin-backed Bretton Woods system, address global debt crises, and strengthen Bitcoin’s role as a global hard currency. This new system will be anchored in the integrity and security of Bitcoin, providing a stable foundation for decentralized financial applications.

As integration with Starknet and the Cairo programming language continues, BeL2 will deliver further advancements in smart contract capabilities, decentralized arbitration, and innovative financial products. At Token 2049, BeL2 will showcase further innovations in its core technologies, including arbitrators, that will underscore Elastos’ vision for a fairer decentralized financial system rooted in Bitcoin.

About Elastos

Elastos is a public blockchain project that integrates blockchain technology with a suite of redesigned platform components to produce a modern Internet infrastructure that provides intrinsic privacy and ownership protection for digital assets. The mission is to create open source services that are accessible to the world, so developers can create an Internet where individuals own and control their data.

The Elastos SmartWeb platform enables organizations to recalibrate how the Internet operates to better control their own data.

https://www.linkedin.com/company/elastosinfo/

ContactPublic Relations ManagerRoger DarashahElastosroger.darashah@elastoselavation.org

DeFi

Compound Agrees to Distribute 30% of Reserves to COMP Shareholders to End Alleged Attack on Its Governance

Compound will introduce the staking program in exchange for Humpy, a notorious whale accused of launching a governance attack on the protocol, negating a recently adopted governance proposal.

Compound is launching a new staking program for COMP holders as a compromise with Humpy, a notorious DeFi whale accused of launching a governance attack against the veteran DeFi protocol.

On July 29, Bryan Colligan, head of business development at Compound, published a governance proposal outlining plans for a new compound participation product that would pay 30% of the project’s current and future reserves to COMP participants.

Colligan noted that the program was requested by Humpy in exchange for his agreement Proposition 289 — which sought to invest 499,000 COMP worth approximately $24 million into a DeFi vault controlled by Humpy, and which appears to have been forced by Humpy and his associates over the weekend.

“We propose the following staking product that meets Humpy’s stated interests as a recent new delegate and holder of COMP in exchange for the repeal of Proposition 289 due to the governance risks it poses to the protocol,” Colligan said. “The Compound Growth Program…will execute the above commitments, given the immediate repeal of Proposition 289.”

Colligan added that the proposal would expire at 11:59 p.m. EST on July 29. Had Humpy not rescinded Proposition 289, Compound would move forward with it. Proposition 290 — block Humpy using the Compound team’s multi-sig to deploy a new governor contract removing the delegate’s governance power behind Proposition 289.

Hunchback tweeted that Proposition 289 had been repealed a few hours ago. “Glad to have brought Compound Finance back into the spotlight,” they said. added. “StakedComp… finally becomes a yield-generating asset!

Markets reacted favorably to the resolution, with the price of COMP increasing by 6.2% over the past 24 hours, according to CoinGecko.

Attack on governance

Proposition 289 proposed investing 499,000 COMP from the Compound treasury into goldCOMP, a yield-generating vault of the Humpy-linked Golden Boys team.

The proposal passed with nearly 52 percent of the vote on July 28, despite two previous iterations of the proposal being defeated by strong opposition. Can And JulyThe proposals notably asked for only 92,000 COMP, with security researchers warning that any deposit of tokens into the goldCOMP vault would cede their governance power.

In May, Michael Lewellen of Web3 security firm OpenZeppelin, note The first proposal was submitted by a new governance delegate who was suddenly awarded 228,000 COMP by five wallets that got their tokens from the Bybit exchange. Combined with his own tokens, the delegate got 325,333 COMP, which is over 81% of the 400,000 tokens required for a governance proposal to reach quorum.

“We have been alerting the community to the risk that these delegates could support a potential attack on governance,” Lewellen said. “The timing of the new proposal and these recent delegations are suspect.”

Read more: Compound community accuses famous whale of attacking engineering governance

-

Videos2 weeks ago

Videos2 weeks agoAbsolutely massive: the next higher Bitcoin leg will shatter all expectations – Tom Lee

-

News11 months ago

News11 months agoVolta Finance Limited – Director/PDMR Shareholding

-

News11 months ago

News11 months agoModiv Industrial to release Q2 2024 financial results on August 6

-

News11 months ago

News11 months agoApple to report third-quarter earnings as Wall Street eyes China sales

-

News11 months ago

News11 months agoNumber of Americans filing for unemployment benefits hits highest level in a year

-

News1 year ago

News1 year agoInventiva reports 2024 First Quarter Financial Information¹ and provides a corporate update

-

News1 year ago

News1 year agoLeeds hospitals trust says finances are “critical” amid £110m deficit

-

DeFi1 year ago

DeFi1 year ago🏴☠️ Pump.Fun operated by Insider Exploit

-

Markets1 year ago

Markets1 year agoWhale Investments in Bitcoin Hit $100 Billion in 2024, Fueling Insane Investor Optimism ⋆ ZyCrypto

-

Tech1 year ago

Tech1 year agoBitcoin’s Correlation With Tech Stocks Is At Its Highest Since August 2023: Bloomberg ⋆ ZyCrypto

-

News11 months ago

News11 months agoStocks wobble as Fed delivers and Meta bounces

-

Markets1 year ago

Markets1 year agoCrazy $3 Trillion XRP Market Cap Course Charted as Ripple CEO Calls XRP ETF “Inevitable” ⋆ ZyCrypto