Tech

XRP remains among the top five crypto assets with high profitability despite challenges, data reveals

Ripple (XRP)’s lackluster performance has left many investors disappointed. However, the data from the analytics platform Most Holy shows that the asset remains among the top five cryptocurrencies with the highest profitability.

This report comes as XRP has faced significant resistance around the $0.5 price level in recent weeks.

Santiment data shows the most profitable crypto assets

XRP has failed to break out of $0.5 after slipping from the $0.6 mark on April 12. However, the asset held the $0.5 support, reflecting its resilience amidst the difficulties. Santiment data shows that the majority of XRP’s circulating supply is trading at a profit despite price stagnation.

Santiment came to this conclusion after evaluating the XRP offering in terms of profit data. In context, the profit bid is calculated by comparing the current value of a token to its initial value at the time of creation.

The report reveals that Bitcoin leads the Supply in Profit chart, with 98.3% of its supply trading at profit. Ethereum follows closely with a 95.1% profit offering. This is followed by Chainlink at 86.8%, Dogecoin at 82.2% and XRP at 78.8%, while Cardano holds a profitability ratio of 53.5%.

Bitcoin likely holds the top spot because it is trading near its all-time high value. Meanwhile, although XRP has underperformed compared to others cryptographic resources in the list it still emerges in fifth place. Despite its lackluster performance, the Ripple token maintains a profitability ratio of 78.8%.

Why is XRP on the supply profitability list?

XRP’s high profitability may be due to the fact that most of its circulating supply was released when its price was very low.

Ripple Labs releases approximately 200 million XRP tokens from escrow each month, for a total of approximately 2.4 billion each year. If the monthly escrow release coincides with a drop in prices, this could support the profitability of the offering.

For example, 500 million XRP tokens they were released from escrow on May 1st. This release occurred when XRP was trading at $0.50. Therefore, these tokens are currently profitable as XRP has risen to trade above $0.52.

What’s next?

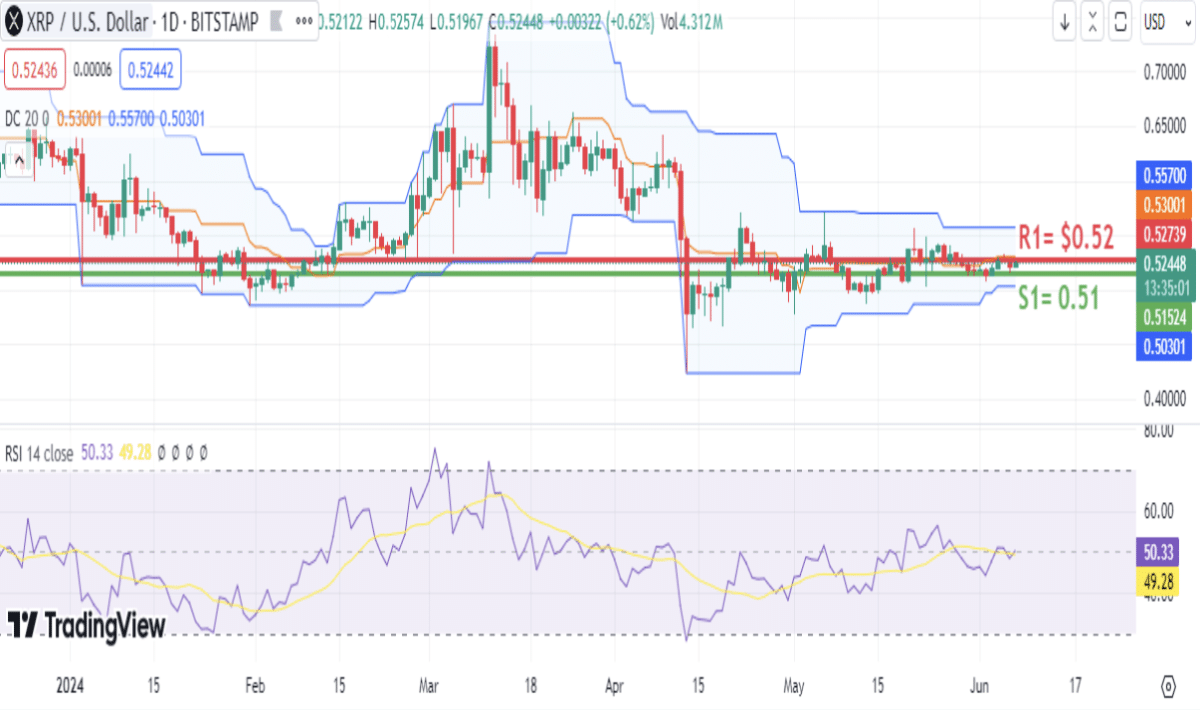

XRP price has remained in a sideways trend for the past few weeks as traders continue to show indecisiveness. However, XRP has remained above $0.51 since May 20 despite seller pressure. The strong support zone at $0.50 prevented further decline even during overall market retracements.

XRP is facing resistance at the $0.52 price level and rejection at this level will likely force a decline to $0.50. Furthermore, it is trading below the mid-band of the Donchian Channel (DC), confirming the sideways trend.

This implies that buyers and sellers are equally matched in the market and that the price remains relatively stable. The RSI indicator confirms the neutral sentiment with a value of 50.33. However, the RSI is rising, suggesting a possible recovery ahead.

Therefore, if the RSI rises to 60, buyers have regained control of the market. If the $0.51 support holds, XRP will likely remain in the $0.51-0.52 price range for the next few days.

The technical report editorial policy is focused on providing useful, accurate content that offers real value to our readers. We only work with expert writers who have specific knowledge of the topics covered, including the latest developments in technology, online privacy, cryptocurrencies, software and more. Our editorial policy ensures that each topic is researched and curated by our in-house editors. We maintain rigorous journalistic standards and every article is 100% written by real authors.